- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money from the US to Pakistan: Comparing the Costs and Efficiency of Different Remittance Methods

Image Source: unsplash

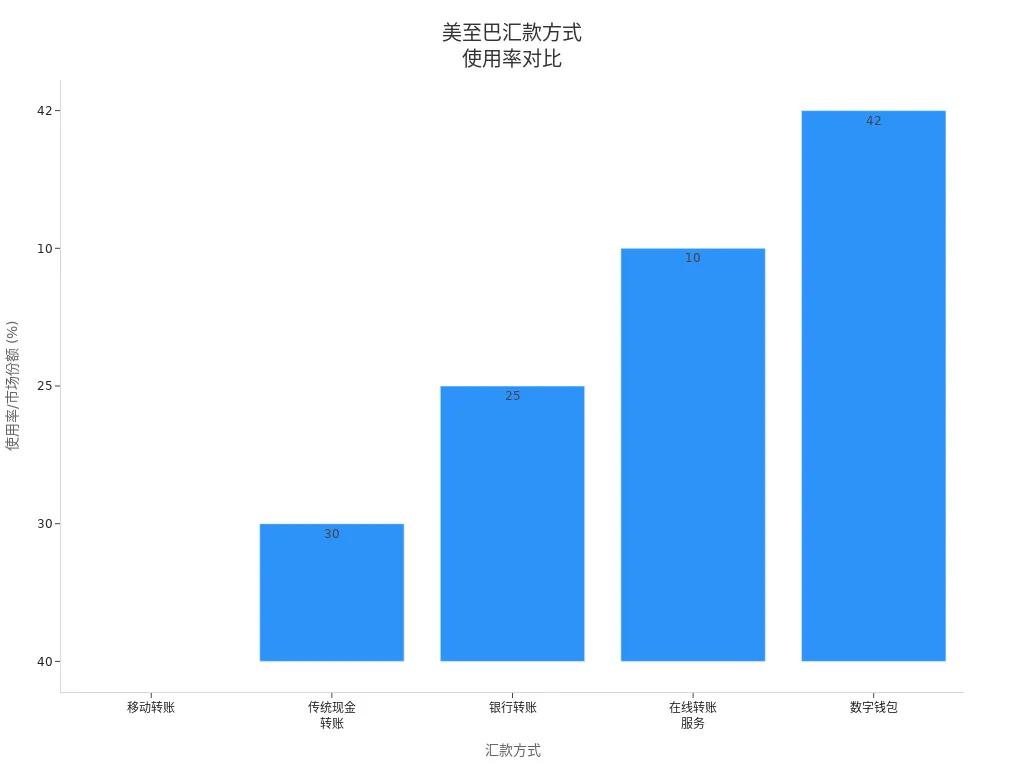

When choosing a channel to send money from the USA to Pakistan, digital remittance services offer the lowest costs, with average fees of only 5%, and faster delivery times. Compared to traditional methods, mobile operators and money transfer operators have fees of 4.4% and 5.5%, respectively, but digital channels generally have an advantage. The table below shows that monthly remittance volumes from the USA to Pakistan fluctuate significantly, reaching a high of 4053.60 million USD. You need to consider fees, delivery times, and hidden costs, selecting the most suitable method based on your needs.

| Actual | Previous | Highest | Lowest |

|---|---|---|---|

| 3100.00 | 3200.00 | 4053.60 | 906.00 |

| 2002 - 2025 | Million USD | Monthly | Non-seasonally adjusted |

Key Points

- Digital remittance services typically have the lowest fees and fast delivery, suitable for most users’ needs.

- Online remittance services like Wise and Remitly offer transparent fees and exchange rates, ideal for frequent transfers.

- Peer-to-peer services are convenient for small and urgent transfers but come with security risks.

- Digital wallets and cryptocurrency transfers are nearly instant with low fees, suitable for users prioritizing speed.

- When choosing a remittance method, focus on fees, delivery time, and security to ensure safe transactions.

US Remittance Methods

Image Source: unsplash

When sending money from the USA to Pakistan, you can consider multiple channels. Each method varies in fees, delivery speed, and convenience. Below is a detailed introduction to four mainstream remittance methods:

Bank Transfers

Bank transfers are the most traditional way to send money from the USA. You can use local US banks or licensed Hong Kong banks for international wire transfers. Banks typically charge a fixed fee, such as approximately USD $1.99 per transfer. For larger amounts (e.g., 58,000 PKR or more), some banks may waive fees. Bank transfers remain common in high-income regions but have higher overall costs and longer delivery times.

| Country | Transfer Fees |

|---|---|

| USA | USD $1.99 |

| Canada | CAD $0.99 / $2.99 |

| Australia | AUD $0.99 / $2.99 |

| UK | GBP £0.99 / £2.99 |

| 58,000 PKR and above | $0 fees |

Online Remittance Services

Online remittance services (e.g., Wise, Remitly, Paysend) have become increasingly popular. You can operate these platforms online with transparent fees and exchange rates. For example, Wise’s transfer fee is USD $6.82, while Paysend charges USD $2. Online services offer fast delivery, typically within 1-2 days, ideal for users needing quick transfers.

| Service Provider | Transfer Fees | Exchange Rate | Amount Received |

|---|---|---|---|

| Wise | $6.82 USD | 0.907350 | €901.16 EUR |

| Paysend | $2 USD | 1.1188 | $892.00 EUR |

Tip: Online remittance services often outperform traditional banks in fees and delivery time, suitable for most US remittance needs.

Peer-to-Peer Services

Peer-to-peer services (e.g., PayPal, Revolut) allow you to transfer funds directly to the recipient’s account. These platforms have low fees and competitive exchange rates. Note that each platform has different daily or monthly transfer limits. Peer-to-peer services in the USA exceed $200 million in daily transactions, growing rapidly, and are suitable for small, frequent remittances.

- Many platforms have daily or monthly limits

- Fees are typically lower than traditional banks

- Exchange rates are relatively favorable

Digital Wallets and Cryptocurrency

Digital wallets (e.g., Apple Pay, Google Pay) and cryptocurrencies (e.g., Bitcoin, Ethereum) offer new options for US remittances. Digital wallets have low fees, transparent rates, and fast delivery. Cryptocurrencies enable near-instant transfers, avoiding high fees and long waits of traditional channels. Acceptance of digital currencies in Pakistan is growing, making receiving funds more convenient.

- Digital wallets have low fees and fast delivery

- Cryptocurrency transfers are nearly instant

- Suitable for users prioritizing speed and low costs

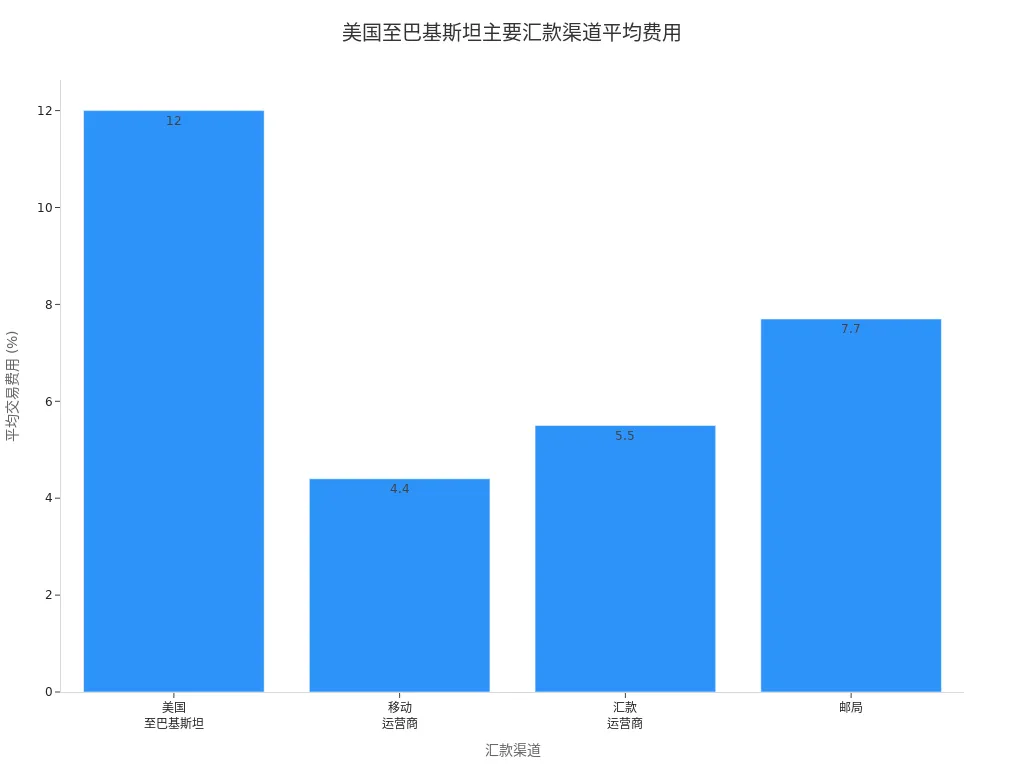

You can refer to the table below for the market share of different remittance methods:

| Remittance Method | Usage Rate/Market Share | Notes |

|---|---|---|

| Mobile Transfers | 40% | Popular in developing countries with limited banking infrastructure. |

| Traditional Cash Transfers | 30% | Decreasing by 2-3% annually, with digital alternatives growing. |

| Bank Transfers | 25% | Common in high-income regions but with higher fees. |

| Online Transfer Services | 10% | E.g., Wise and Revolut, popular for low fees and transparency. |

| Peer-to-Peer Apps | N/A | Over $200 million in daily US transactions, rapidly growing. |

| Digital Wallets | 42% | Preferred for international transactions by US consumers. |

US Remittance Cost Analysis

Image Source: pexels

When choosing a remittance channel from the USA to Pakistan, the cost structure is key to determining the final expense. Fees, exchange rate markups, and amount limits affect the total cost. Below is a detailed analysis of cost factors to help you make an informed choice.

Fees

When using different remittance channels, fee differences are significant. Traditional banks typically charge higher international transfer fees due to high operational costs and longer processing times. Money transfer operators (e.g., Western Union, MoneyGram) offer competitive rates and faster services. Online transfer platforms (e.g., Wise, Remitly, Paysend) have lower fees, though some may charge extra based on payment methods.

Tip: Compare fees across platforms to choose the most suitable option. Online services typically charge between USD $2 and $7, while bank transfer fees may be higher, with some Hong Kong-licensed banks offering fee waivers for large transfers.

Here’s a comparison of fees across channels:

| Channel Type | Typical Fee Range (USD) | Notes |

|---|---|---|

| Traditional Banks | $1.99 - $30 | Long processing times, some large transfers fee-free |

| Online Remittance Services | $2 - $7 | Wise, Paysend, Remitly, etc. |

| Money Transfer Operators | $4 - $10 | Western Union, MoneyGram |

| Peer-to-Peer Services | $0 - $5 | PayPal, Revolut, etc. |

| Digital Wallets/Cryptocurrency | $0 - $3 | Apple Pay, Google Pay, etc. |

Online remittance services and digital wallets have lower fees, ideal for frequent or small transfers.

Exchange Rates and Hidden Fees

When sending money, besides visible fees, you should watch for exchange rate markups and hidden costs. Some platforms add a markup to the exchange rate, reducing the amount received. According to recent data, hidden exchange rate markups significantly impact US remittance costs, increasing by 41% from 2018 to 2023. Remittance fees are also rising, with 94% of users paying fees, nearly half exceeding $50 per transaction.

| Fee Type | Impact Amount (USD) | Trend |

|---|---|---|

| Hidden Exchange Rate Markup | 1.54 billion | Increased 41% from 2018-2023 |

| Remittance Fees | 1.31 billion (8% increase 2022-2023) | 94% of users pay, nearly half over $50 |

- Traditional banks have higher exchange rate markups and hidden fees, reducing actual received amounts.

- Money transfer operators often offer better rates, but some still have hidden fees.

- Online platforms like Wise and Paysend have transparent rates and clear fee structures, ideal for cost-conscious users.

Advice: Check the platform’s exchange rates and fee details before transferring to avoid unexpected costs.

Amount Limits

When choosing a remittance channel, you need to consider minimum and maximum transfer limits. Different platforms have varying rules for single, daily, or monthly transfer amounts. Most online services have minimums of USD $1 to $50, with maximums depending on platform policies. Bank transfer limits are set by financial institutions and regulations, with some Hong Kong-licensed banks offering higher limits for large transfers. Money transfer operators like Western Union also have specific limits.

| Transfer Type | Minimum Transfer Amount (USD) | Maximum Transfer Amount (USD) |

|---|---|---|

| Most Transfer Services | $1 - $50 | Depends on provider |

| Bank Transfers | Depends on institution | Depends on policy |

| Western Union, etc. | Depends on platform | Depends on platform |

Before transferring, choose a platform with suitable amount limits based on your needs. For large transfers, prioritize bank channels, especially Hong Kong-licensed banks. For small or frequent transfers, online services and digital wallets are more flexible.

Tip: Contact platform customer service in advance to confirm amount limits and policies to avoid transfer failures.

US Remittance Efficiency Comparison

Delivery Time

When choosing a remittance channel, delivery time directly impacts your experience. Different methods vary significantly in speed. Digital channels (e.g., Wise, Remitly, Paysend) often enable same-day or instant delivery. Traditional international wire transfers may take several days, suitable for non-urgent scenarios. Refer to the table below for a quick overview of delivery times:

| Transfer Method | Transfer Time |

|---|---|

| Digital Remittance Channels | Same day or instant |

| Traditional International Wire Transfers | May take several days |

When using digital channels, fees are lower, averaging about 5%. You can see rates and fees upfront, with high platform transparency. You can also track transfer status in real-time, reducing uncertainty. Platforms like Remitly and Paysend support same-day delivery, ideal for users needing quick receipt.

Tip: Prioritize delivery time when choosing a channel, especially for urgent remittances or living expense transfers, where digital channels excel.

Process Complexity

When performing US remittances, process complexity directly affects your experience. Personal remittances are usually simple, requiring only the recipient’s name and bank account details, completed in a few steps. Digital remittance services and peer-to-peer platforms have user-friendly interfaces, suitable for first-time users. Commercial remittances are more complex, requiring additional documentation and stricter compliance with regulations, with higher security standards. Larger commercial transactions make exchange rates, processing time, and transparency critical factors.

- Personal remittances: Simple steps, focusing on speed, low fees, and convenience.

- Commercial remittances: Complex processes, requiring compliance documents and higher security standards.

- Digital channels and peer-to-peer platforms: Intuitive interfaces, convenient for frequent small transfers.

Choose a method based on your needs and transfer amount for the most suitable process.

Security

When sending money from the USA, fund security is a top concern. Major remittance providers (e.g., Western Union, MoneyGram, PayPal, Wise) use encryption and two-factor authentication to protect your financial information. Choose licensed, regulated platforms that follow strict financial oversight for high security standards. Before transacting, check for SSL certificates to ensure secure data transmission. Avoid sharing personal information with unverified sources and confirm recipient details before transferring.

- Choose reputable remittance services with encryption and two-factor authentication.

- Verify platform compliance, as licensed providers have high security standards.

- Check for SSL certificates to ensure data security.

- Avoid sharing personal information with unknown sources and confirm recipient details.

Prioritize high-security platforms to ensure safe remittances from the USA to Pakistan.

Advantages and Disadvantages

Bank Transfer Pros and Cons

When choosing bank transfers, you benefit from high security and reliability. Bank systems have global coverage, supporting multi-country remittances, especially through reputable Hong Kong-licensed banks. You can trust fund security, suitable for large and critical transactions.

- Advantages:

- High security, with funds protected by financial institutions.

- Strong reliability with complete transaction records.

- Supports remittances to multiple countries, ideal for cross-border needs.

- Disadvantages:

- Higher fees, typically USD $1.99 to $30 per transfer.

- Unfavorable exchange rates, potentially reducing received amounts.

- Processing times may be delayed, usually 1-3 working days.

Bank transfers are ideal for safety and stability, but for lower costs and faster delivery, consider other channels.

Online Remittance Pros and Cons

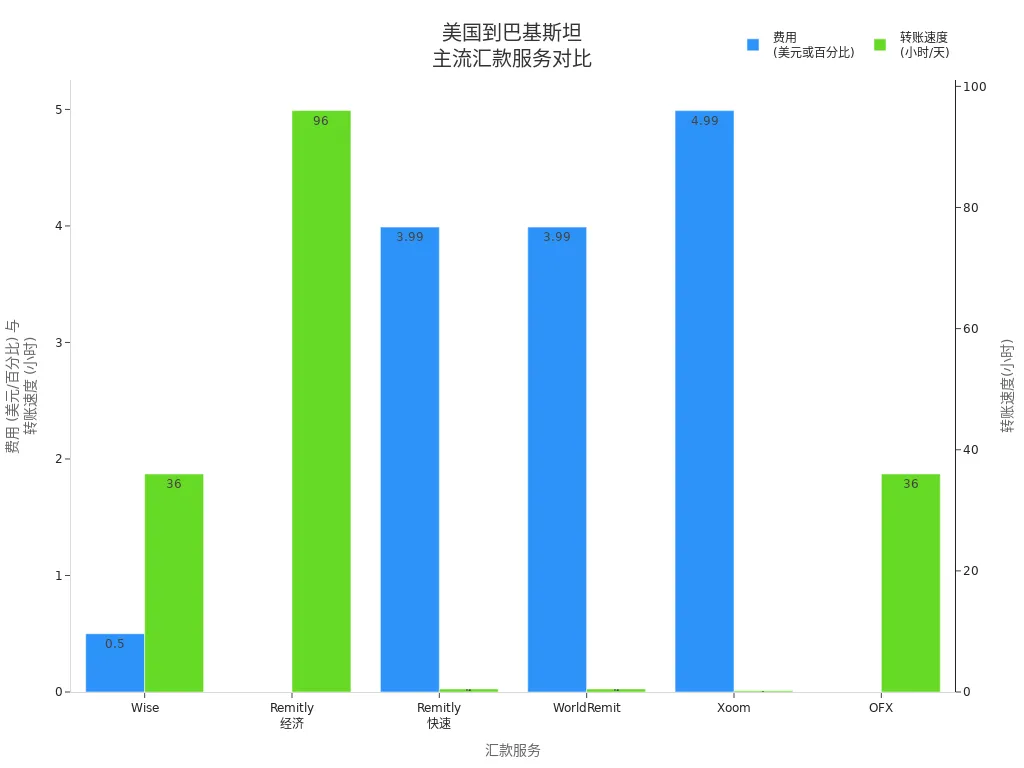

When using online remittance services, you enjoy low fees and high transparency. Platforms like Wise, Remitly, WorldRemit, Xoom, and OFX offer diverse options. The table below shows fees, speed, and pros and cons of major services:

| Service | Fees | Exchange Rate | Transfer Speed | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Wise | 0.5-1% | Mid-market rate | 1-2 working days | Low fees, favorable rates, user-friendly | Requires bank account, not instant |

| Remitly | $0-$3.99 | Slightly below mid-market rate | Instant or 3-5 working days | Low-cost economy transfers, fast delivery | Exchange rate markup |

| WorldRemit | $3.99 | Competitive rate | Same day or instant | Multiple delivery options, fast transfers | Higher fees for small transfers |

| Xoom | $4.99 | Competitive rate with markup | Minutes | Fast transfers, PayPal integration | High fees for card payments |

| OFX | $0 | Competitive for large transfers | 1-2 working days | No fees, ideal for large transfers | Not suitable for small transfers, requires account setup |

Choose a platform based on transfer amount and speed. Online services are ideal for cost-conscious and efficient users.

Peer-to-Peer Service Pros and Cons

When using peer-to-peer services, you enjoy high convenience and instant delivery. You can operate via digital platforms, avoiding complex processes. These services support various payment scenarios, ideal for small and urgent transfers.

- Benefits:

- High convenience with simple operations.

- Fast delivery with instant fund transfers.

- High flexibility, linking multiple bank accounts and supporting cross-currency transactions.

- Risks:

- High risk of fraud and scams, with funds potentially moved quickly by fraudsters.

- Data breach concerns, as platforms store significant personal information.

- Transaction errors are hard to reverse, with mistakes potentially leading to fund loss.

- Limited legal protection, making refunds challenging after authorized payments.

- Evolving regulatory environment may affect fund access.

When using peer-to-peer services, verify recipient details and protect personal data to avoid losses from errors or security breaches.

Digital Wallet/Cryptocurrency Pros and Cons

When choosing digital wallets or cryptocurrency for remittances, you experience fast delivery and low fees. Digital wallets like Apple Pay and Google Pay are user-friendly, while cryptocurrency platforms support global transfers with near-instant delivery. Pakistan’s government is promoting a crypto ecosystem, establishing a crypto committee to enhance regulation and infrastructure.

| Type | Advantages | Disadvantages |

|---|---|---|

| Digital Wallet | Low fees, fast delivery, simple operation | Requires both parties to have wallet accounts, limited in some regions |

| Cryptocurrency | Global transfers, near-instant delivery, very low fees | High exchange rate volatility, regulatory changes, security risks |

Monitor policy changes and platform security when using digital wallets and cryptocurrencies. Pakistan’s growing digital finance ecosystem will further improve these services.

Comparison Table

Method Comparison

You can quickly compare major US-to-Pakistan remittance methods using the table below. It covers fees, exchange rate transparency, delivery speed, amount limits, and security, helping you choose the best channel based on your needs.

| Remittance Method | Fees (USD) | Exchange Rate Transparency | Delivery Speed | Amount Limits | Security |

|---|---|---|---|---|---|

| Bank Transfer | $1.99-$30 | Average | 1-3 days | High | Very High |

| Online Remittance Services | $2-$7 | High | Instant-2 days | Medium | High |

| Peer-to-Peer Services | $0-$5 | High | Minutes-1 day | Low-Medium | Medium |

| Digital Wallet/Cryptocurrency | $0-$3 | Very High | Seconds-1 day | Low-High | Platform-dependent |

Online services and digital wallets excel in fees and delivery speed. Bank transfers suit large, high-security needs. Peer-to-peer services are ideal for small, urgent transfers, but you must manage security risks.

Key Metrics Checklist

When choosing a remittance method, focus on these key metrics:

- Fees: Prioritize platforms with low fees, especially for frequent transfers.

- Exchange Rate Transparency: Verify if platforms disclose rates to avoid hidden markups.

- Delivery Speed: Choose instant or same-day channels based on urgency.

- Amount Limits: Confirm the platform’s minimum and maximum transfer amounts to avoid failures.

- Security: Select licensed, regulated platforms to ensure fund safety.

Before transferring, use the platform’s fee calculator to simulate results, ensuring you know the exact amount the recipient will receive and avoiding hidden fees or exchange rate losses.

Selection Advice

Selection Criteria

When choosing a method to send money from the USA to Pakistan, refer to these criteria:

| Criterion | Description |

|---|---|

| Exchange Rate | Focus on channels with better exchange rates for higher value. |

| Transfer Speed | Consider how quickly funds need to arrive, prioritizing faster methods for urgent needs. |

| Transfer Fees | Compare platform fees to choose the lowest total cost. |

| Security | Ensure the method is secure and reliable to avoid risks. |

Consider your specific needs:

- For urgent transfers, choose fastest delivery digital channels.

- For frequent transfers, prioritize low-fee, transparent-rate platforms.

- For large transfers, opt for Hong Kong-licensed banks for fund security.

Studies show most users prioritize delivery speed, followed by cost, exchange rates, and convenience. Female users focus more on exchange rates and transfer more frequently.

Cost-Saving Tips

You can reduce remittance costs with these methods:

- Compare fees and exchange rates across platforms to select the lowest total cost.

- Avoid transferring during high exchange rate volatility, choosing favorable rate periods.

- Use Hong Kong-licensed banks offering fee waivers for large transfers.

- Use platform fee calculators to know the exact amount received.

- Prioritize transparent-rate, no-hidden-fee digital channels.

Monitor platform promotions, as some offer fee waivers during holidays or for new users.

Precautions

When transferring, avoid common issues to prevent losses:

- Avoid unauthorized or unreliable channels, which carry high fraud risks and are hard to trace.

- Don’t focus only on transfer fees; check exchange rates and hidden costs.

- Verify recipient details carefully, ensuring bank account numbers and names are correct.

- Keep transfer receipts for future inquiries or disputes.

Choosing regulated, compliant platforms maximizes fund safety and delivery efficiency.

When selecting a method to send money from the USA to Pakistan, adjust based on your needs. Different channels offer unique advantages in cost, speed, and security. Refer to the table below, considering transaction costs, financial literacy, remittance service competition, and ICT development, to make a better decision:

| Key Factor | Description |

|---|---|

| Transaction Costs | High costs may push users toward informal channels; lower costs favor formal ones. |

| Financial Literacy | Better financial knowledge helps you understand processes and choose suitable methods. |

| Competitive Remittance Services | Intense market competition reduces cost sensitivity, offering better value options. |

| ICT Development | Technological advancements lower costs and improve efficiency, enabling faster transfers. |

Monitor these trends to enhance your remittance experience:

- New technologies lower costs, but AML measures may increase fees.

- Mobile payment platforms drive transaction growth, offering greater convenience.

- Global regulatory changes may increase compliance costs for some providers.

Before transferring, compare fees, delivery times, and security. Choose the optimal channel based on transfer amount and urgency, avoiding single-criterion decisions. Make rational choices to ensure fund safety and delivery efficiency.

FAQ

How Fast Can Money Be Sent from the USA to Pakistan?

When using digital remittance services, funds can arrive in minutes. Bank transfers typically take 1-3 working days. Delivery speed varies by channel.

What Information Is Needed for a Transfer?

You need to provide the recipient’s name, bank account number, and bank details. Some platforms also require the recipient’s address. Verify information carefully to avoid errors.

Are There Amount Limits for Transfers?

Minimum transfer amounts typically range from USD $1 to $50 across platforms. Maximum limits depend on platform policies. Contact customer service to confirm specific limits.

How to Ensure Fund Safety During Transfers?

Choose licensed, regulated platforms. Verify website security certificates and protect personal information. Avoid clicking unknown links to prevent data leaks.

How to Check Transfer Fees and Exchange Rates?

Check fees and rates directly on the platform’s website or app. Use fee calculators to know the exact amount the recipient will receive.

Are you tired of high fees and opaque exchange rate markups when sending money from the USA to Pakistan? BiyaPay offers a more efficient, transparent, and cost-effective alternative. We support seamless conversion between 30+ fiat currencies and 200+ cryptocurrencies, with fees as low as 0.5% and absolutely no hidden charges. Use our real-time exchange rate tool to instantly lock in the best available rate, avoiding losses from intermediary markups. Whether you’re sending money for family living expenses, tuition fees, or business payments, BiyaPay enables same-day sending and same-day delivery to major banks in Pakistan. We strictly adhere to global compliance standards, ensuring every transaction is secure and legally sound. Visit BiyaPay today to learn more, and complete your registration in just a few minutes—experience a faster, cheaper, and more reliable cross-border money transfer today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.