- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Simple Ways to Remit Money to Someone in the United States: How to Choose the Right Method

Image Source: pexels

Have you ever needed to send money within the U.S. but didn’t know which method is most convenient? In daily life, you may need to transfer money to friends, family, or colleagues. You’ll find that methods like Zelle, PayPal, and Venmo each have unique features. You need to consider fees, transfer speed, and whether the recipient has a suitable account. Choosing the right remittance method can save you time and money.

Before sending money, understand the security and operational procedures of different methods to complete transfers with peace of mind.

Key Points

- Choosing the right remittance method can help you save time and money; common options include Zelle, PayPal, and ACH.

- Zelle is ideal for fast transfers, typically arriving in minutes, and most banks offer it for free.

- ACH transfers are suitable for recurring payments, with low fees and a processing time of 1-3 business days, ideal for large amounts.

- Wire transfers are suitable for urgent or large remittances, though fees are higher, with funds typically arriving the same day.

- Before transferring, always verify recipient information to ensure security and avoid losses due to incorrect details.

Domestic Remittance Methods in the U.S.

Image Source: pexels

In the U.S. market, there are several mainstream methods for domestic remittances. You can choose the appropriate channel based on your needs. The table below shows the market share of major remittance methods:

| Remittance Method | Market Share |

|---|---|

| Traditional Money Transfer Operators (MTOs) | Approx. 15% |

| Digital-First Services | Approx. 10% |

| Banks | Approx. 25% |

| Mobile Network Operators | Significant in some regions |

Zelle

You can use Zelle to transfer money directly using a phone number or email address. Zelle connects to your bank account, with funds typically arriving in minutes. Zelle is ideal for splitting bills, paying rent, and small business payments, offering simple operation and fast speed.

- Splitting Bills: Friends commonly use Zelle to split dining costs.

- Paying Rent: Tenants can pay rent directly via Zelle.

- Small Business Payments: Some small businesses and freelancers accept Zelle.

ACH

ACH (Automated Clearing House) is suitable for recurring transfers, such as payroll or utility bill payments. You can initiate ACH transfers through your bank, with funds typically arriving in 1-3 business days. ACH has low fees, making it suitable for large or recurring remittances.

Wire Transfer

Wire Transfer is ideal for large or urgent remittances. You can process it through a bank branch or online banking, with funds typically arriving the same day. Wire transfers have higher fees but offer guaranteed security and speed.

Check

You can issue a check and mail it to the recipient. Checks are suitable for non-urgent scenarios, such as paying rent or tuition. Checks are a traditional method, still preferred by some.

PayPal

PayPal offers convenient online remittance services. You can use a debit card, credit card, or bank account to transfer money, track progress in real-time, and enjoy transparent fee structures. PayPal is widely accepted, highly secure, and trusted by users.

- Fast and convenient online remittances

- Supports multiple payment methods

- Advanced security features

Venmo

Venmo is known for social payments, ideal for peer-to-peer transfers and group activities. You can use Venmo to split costs for dining out or event tickets. Venmo has a user-friendly interface and is popular among younger users.

Cash App

Cash App allows you to transfer money easily using your phone. You can link a bank card to complete domestic remittances quickly. Cash App is suitable for daily small payments, with a simple and convenient interface.

Paysend

Paysend is a digital-first remittance service. You can use Paysend for low-fee domestic transfers in the U.S., ideal for users needing cross-platform transfers. Paysend supports multiple bank cards and offers fast delivery.

Operations and Fees

Image Source: unsplash

Zelle

You can use Zelle for domestic remittances with a simple process:

- Log into your bank account and select the Zelle service.

- Enter the recipient’s email or phone number.

- Enter the amount, confirm the details, and click send.

Zelle transfers typically arrive in minutes. If the recipient hasn’t registered with Zelle, the transfer may take 1-3 business days. You don’t need to pay any fees, as most banks offer Zelle for free.

ACH

ACH is suitable for recurring or large remittances. You can initiate an ACH transfer through your bank with the following process:

- Submit a transfer request.

- The bank processes and sends the batch transfer to the clearinghouse.

- Financial institutions settle the funds.

- The recipient’s account receives the funds.

Processing typically takes 1-3 business days. Individual users usually pay no fees, while businesses incur $0.20-$1.50 per transaction. Some banks charge extra for expedited ACH transfers.

| Fee Type | ACH Transfer (Individual) | ACH Transfer (Business) |

|---|---|---|

| Standard Fee | Free | $0.20-$1.50 |

| Expedited Fee | Varies by bank | Varies by bank |

Wire Transfer

Wire Transfer is ideal for urgent or large domestic remittances. You can initiate a wire transfer through a bank branch or online banking. Funds typically arrive within 24 hours, with some intra-bank transfers completing in minutes. Fees are higher, typically $15-$35 per transfer. Cut-off times vary by bank, so confirm in advance.

| Bank | Cut-off Time (ET) | Fees (USD) |

|---|---|---|

| Bank of America | 8 pm | $15-$35 |

| Citibank | 6 pm | $15-$35 |

| JPMorgan Chase | 4 pm | $15-$35 |

Wire Transfers are fast and secure but have higher fees, making them suitable for large remittance scenarios.

Check

You can issue a check and mail it to the recipient. The recipient deposits the check, and funds typically arrive in 2-5 business days. Checks have no handling fees, but some banks may charge a small fee for check deposits. Checks are suitable for non-urgent scenarios.

PayPal

PayPal supports multiple payment methods. You can log into your PayPal account, go to the wallet, select “Transfer Funds,” enter the amount, and confirm. Standard bank transfers are free, taking 1-3 business days. Instant transfers arrive in up to 30 minutes, with a fee of 1.75% of the amount, minimum $0.25, maximum $25. Peer-to-peer transfers are usually free, but using a credit or debit card incurs a 2.90% fee plus a fixed fee.

| Transaction Type | Fees | Processing Time |

|---|---|---|

| PayPal Balance/Bank | Free | 1-3 business days |

| Instant Transfer | 1.75% ($0.25-$25) | Up to 30 minutes |

| Card Payment | 2.90% + fixed fee | 1-3 business days |

Venmo

You can use Venmo for peer-to-peer remittances. Sending money to a Venmo account is instant and free. Transfers to a bank account take 1-3 business days and are free. Instant transfers take up to 30 minutes, with a fee of 1% (minimum $0.25, maximum $10).

| Step | Processing Time | Fees |

|---|---|---|

| Send to Venmo | Instant | Free |

| Transfer to Bank | 1-3 business days | Free |

| Instant Transfer | Up to 30 minutes | 1% ($0.25-$10) |

Cash App

You can link a bank card to Cash App, enter recipient details and amount, and click send. Standard transfers are free, taking 1-3 business days. Instant transfers arrive in minutes, with fees of 0.5%-1.75% of the amount, minimum $0.25.

Paysend

Paysend is suitable for users seeking low fees and fast delivery. You need to register an account, add funds, select the recipient, enter the amount, and confirm after review. Funds typically arrive in minutes, with some cases taking up to three days. Each transfer costs $2.

| Operation Step | Fees | Processing Time |

|---|---|---|

| Register Account | N/A | N/A |

| Add Funds | N/A | N/A |

| Enter Amount | $2 | Minutes to three days |

If you want to save fees and ensure fast delivery for domestic remittances, prioritize Zelle and Paysend.

Scenarios, Advantages, and Disadvantages

Zelle

You often use Zelle in daily life to split dinner bills, pay utility bills to roommates, or transfer money to friends. Zelle is ideal for scenarios requiring fast delivery. Most banks offer Zelle for free, with funds arriving in minutes.

| Advantages | Disadvantages |

|---|---|

| Ideal for daily transactions | Does not support international transfers |

| Fast fund delivery | No purchase protection |

| Free to use | Fraud risks exist |

If both you and the recipient have Zelle-supported bank accounts, Zelle is an ideal choice for daily small domestic remittances.

ACH

You can use ACH for recurring payments, such as subscriptions, loan repayments, rent, or payroll. ACH is suitable for businesses and individuals handling large or recurring remittances.

- Advantages:

- Low cost, affordable transaction fees.

- Automated processing reduces manual effort.

- High security, low fraud risk.

- Environmentally friendly, reduces paper usage.

- Disadvantages:

- Slower processing, typically 1-3 business days.

- Transaction limits exist.

- Non-business days may delay delivery.

Wire Transfer

You can choose Wire Transfer for urgent or large remittances. Funds typically arrive the same day, ideal for high-value payments requiring quick completion.

- Advantages:

- Fast delivery, suitable for time-sensitive scenarios.

- High security, direct bank account transfers.

- Strong confidentiality.

- Disadvantages:

- High fees, $25-$50 per transfer.

- Difficult to reverse erroneous transfers.

- Complex process with extensive information required.

Check

You can use checks to pay rent, tuition, or other non-urgent expenses. Checks are suitable for those accustomed to traditional payment methods.

- Advantages:

- Suitable for non-urgent scenarios.

- No need for an electronic account.

- Disadvantages:

- Slow delivery, typically 2-5 business days.

- Risk of loss or forgery.

- Mailing required, cumbersome process.

PayPal

You can use PayPal for online shopping, peer-to-peer transfers, or small business payments. PayPal has a user-friendly interface and high security.

| Advantages | Disadvantages |

|---|---|

| Fast fund transfers | Complex fee structure |

| Globally available | High international fees |

| User-friendly interface | Recipient needs a PayPal account |

| Strong security measures | Possible service restrictions |

PayPal is ideal for users needing online payments and fund protection, but both you and the recipient need registered accounts.

Venmo

You often use Venmo for group outings, bill splitting, or family transfers. Venmo’s simple interface is popular among U.S. users.

| Advantages | Disadvantages |

|---|---|

| Free to use, no annual fee | Privacy and security concerns |

| Fast transfers | U.S.-only |

| Easy to operate | Not suitable for large transactions |

- Ideal for small daily payments and social scenarios.

Cash App

You can use Cash App for daily small payments or peer-to-peer transfers. Cash App is convenient and fast.

- Advantages:

- Simple mobile operation.

- Standard transfers are free.

- Instant delivery option.

- Disadvantages:

- Instant transfers incur fees.

- Account security requires attention.

- U.S.-only.

Paysend

You can choose Paysend for low fees and fast delivery. Paysend supports multiple bank cards and account types.

| Advantage | Description |

|---|---|

| Low Fees | $2 per transfer, transparent fees |

| Fast Delivery | Most complete in minutes |

| Flexible Methods | Transfer to bank accounts, cards, or mobile wallets |

Paysend is ideal for users seeking flexible transfer methods and cost savings, especially for cross-platform payments.

Comparison and Selection for Domestic Remittances

Fee Comparison

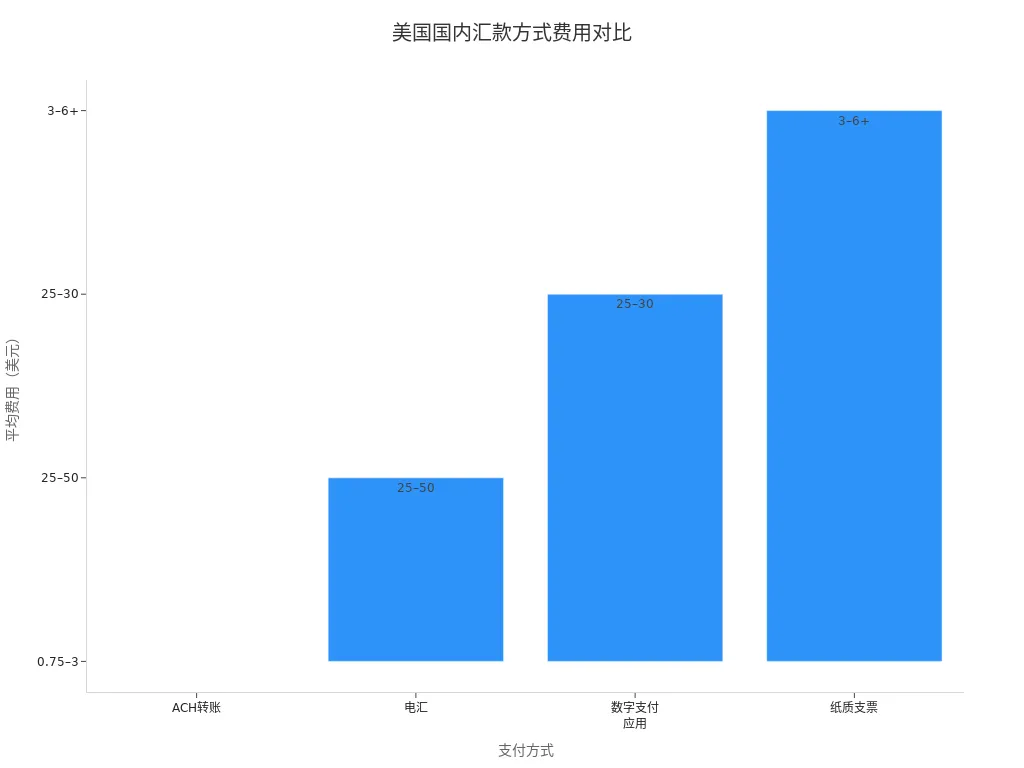

When choosing a domestic remittance method, fees are a key consideration. Fee structures vary significantly. The table below shows the average fees and processing times for a $1,000 transfer:

| Payment Method | Typical Fee Structure | Average Fee ($1,000 Transfer) | Processing Time |

|---|---|---|---|

| ACH Transfer | Fixed fee ($0.20–$1.50) | $0.75–$3 | 1–3 business days |

| Wire Transfer | Fixed fee ($25–$50) | $25–$50 | Same day |

| Digital Payment Apps | 2.5%–3% (business) | $25–$30 | Instant to 1–3 days |

| Paper Check | Total cost $3–$6+ | $3–$6+ | 5–7 business days |

You can see that ACH transfers have the lowest fees, ideal for large and recurring remittances. Wire transfers have the highest fees but offer the fastest delivery. Digital payment apps like PayPal, Venmo, and Cash App have lower fees for individuals but charge businesses 2.5%-3%. Checks have moderate fees but slow delivery.

The chart below visually compares the average fees for each method:

Speed Comparison

Delivery speed directly affects your fund arrangements. You can choose based on urgency:

- Zelle, Venmo, Cash App, Paysend: Most transfers arrive in minutes, ideal for daily and urgent transfers.

- Wire Transfer: Same-day delivery, suitable for large and urgent scenarios.

- ACH Transfer: 1-3 business days, suitable for non-urgent recurring payments.

- PayPal: Instant to PayPal accounts, bank withdrawals take 1-3 days. Instant withdrawals incur additional fees.

- Check: Slowest, typically 5-7 business days.

You can flexibly choose a method based on the urgency of your funding needs.

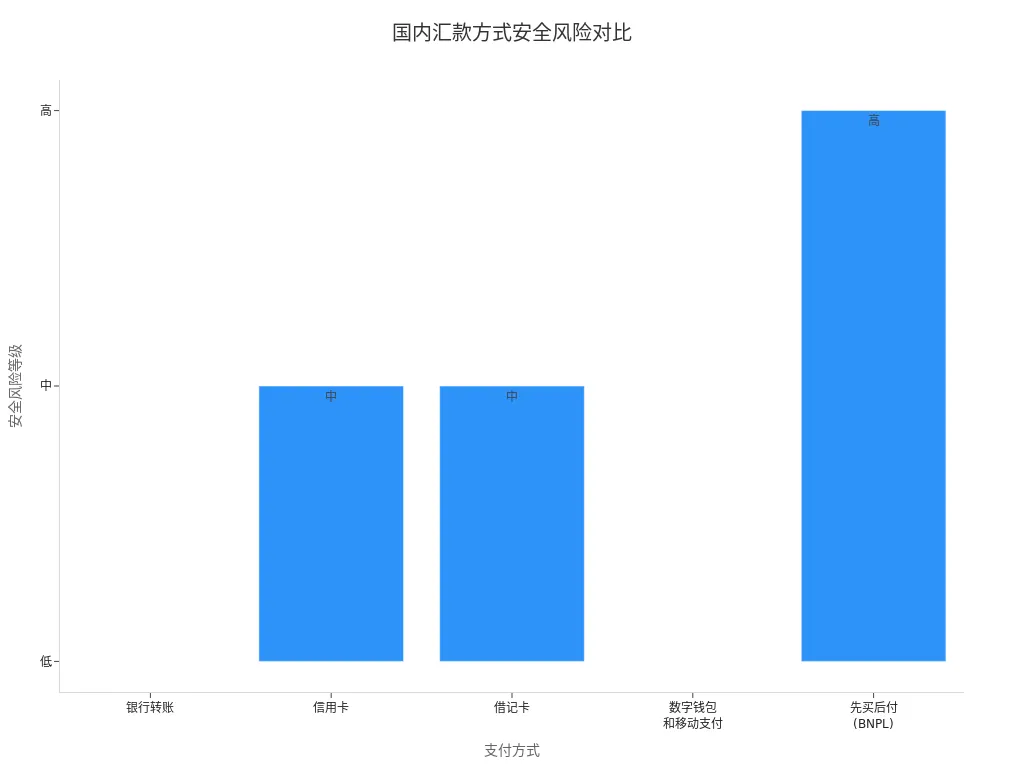

Security Comparison

Security is a critical focus when sending money. Different methods have varying risks and convenience levels. The table below compares the security risk and customer convenience levels:

| Payment Method | Security Risk Level | Customer Convenience Level |

|---|---|---|

| Bank Transfer (ACH/Wire) | Low | Low |

| Digital Wallet/Mobile Payment | Low | High |

| Credit/Debit Card | Medium | High |

| Paper Check | Medium | Low |

You’ll notice that bank transfers and digital wallets have lower security risks. Digital wallets and mobile payments offer higher convenience, ideal for daily use. Checks have risks of loss and forgery, with lower security and convenience.

The chart below illustrates the security risk levels of different methods:

Tip: Always verify recipient information when using any method to avoid losses due to errors.

Selection Tips

When making a choice, consider these common needs:

- Prioritizing Low Fees

You can prioritize ACH transfers or Zelle. Most banks offer Zelle for free, and ACH fees are minimal, ideal for large and recurring remittances. - Needing Fast Delivery

You can choose Zelle, Venmo, Cash App, or Paysend, which deliver in minutes, ideal for urgent or daily small payments. Wire transfers also offer same-day delivery for large urgent remittances. - Emphasizing Security

You can prioritize bank transfers (ACH, Wire) and mainstream digital wallets (e.g., PayPal, Venmo). These methods have robust security measures and low risks. - Recipient Has Limited Conditions

If the recipient lacks a bank account, you can use digital payment apps (e.g., PayPal, Venmo, Cash App), requiring only an email or phone number. Checks are also suitable for recipients without electronic accounts but are slow. - Business or Large Payments

You can choose ACH for recurring large payments or Wire Transfer for one-time large and urgent remittances.

When choosing a domestic remittance method, combine fees, speed, security, and the recipient’s situation to make a flexible choice. This ensures efficient and secure fund transfers.

Precautions

Information Verification

You must carefully verify recipient information before sending money. Confirm the recipient’s name, bank account number, email, or phone number to ensure accuracy.

It’s recommended to double-check information after entering, especially for bank or digital payment app transfers.

If using a licensed Hong Kong bank for remittances, ensure the recipient’s account details match the bank’s records. Incorrect information may delay delivery or result in unrecoverable funds.

Security Precautions

You need to guard against fraud and information leaks when sending money. Avoid clicking links from strangers or sharing account details with unknown individuals.

You can take these measures to enhance security:

- Operate only through official channels or trusted bank apps.

- Set strong passwords and change them regularly.

- Enable two-factor authentication for your account.

- Regularly review transaction records and contact the bank immediately if anomalies are detected.

If you notice suspicious transactions, contact bank customer service immediately to freeze the account and minimize losses.

Avoiding High Fees

You should pay attention to handling and hidden fees when choosing a remittance method. Fee structures vary significantly.

| Remittance Method | Typical Fees (USD) | Applicable Scenarios |

|---|---|---|

| Zelle | Free | Daily small transfers |

| ACH | $0.20-$1.50 | Large or recurring remittances |

| Wire Transfer | $25-$50 | Urgent or large remittances |

| Paysend | $2 | Cross-platform fast transfers |

You can prioritize low-fee, fast-delivery methods. Understanding fees in advance helps you plan funds and avoid unnecessary expenses.

When choosing a domestic remittance method, first consider your actual needs. Focus on the amount, delivery speed, fees, and recipient account type. Each method has its advantages. You can combine them based on the scenario. Always verify information and protect fund security. For questions, consult your bank or official customer service.

FAQ

How Long Does a Zelle Transfer Take?

You typically receive Zelle transfers in minutes. If the recipient hasn’t registered with Zelle, delivery may take 1-3 business days.

What Are the Fees for Sending Money to the U.S. via a Licensed Hong Kong Bank?

You can expect fees of $25-$50 for ACH or Wire Transfers through licensed Hong Kong banks. Confirm specific amounts with bank customer service.

What Methods Can Be Used If the Recipient Has No Bank Account?

You can choose PayPal, Venmo, or Cash App. The recipient only needs an email or phone number, no bank account required.

How to Ensure Remittance Security?

You should verify recipient information and use official channels. Enable two-factor authentication, regularly check transaction records, and contact the bank immediately if anomalies occur.

Navigating the options for sending money within the US highlights the strengths of tools like Zelle for quick, free small transfers, but also the drawbacks of high fees and delays with ACH or wire transfers for larger sums. For frequent or cross-border transactions, steep costs, slow processing, or account limitations can be frustrating. BiyaPay offers a seamless solution, with transfer fees as low as 0.5% and same-day send-and-receive capabilities across the US and most global regions. Whether splitting bills or handling business payments, BiyaPay enables real-time fiat-to-crypto conversions and zero-fee contract orders, ensuring transparent, cost-effective fund flows.

What sets BiyaPay apart is its all-in-one versatility: a quick signup takes minutes, giving you access to real-time exchange rate tools to sidestep currency fluctuations. Even better, you can trade US and Hong Kong stocks on the same platform without needing an overseas account, blending payments with investment opportunities. Compared to PayPal’s complex fees or wire transfers’ high costs, BiyaPay delivers affordability and flexibility while prioritizing security and compliance.

Take control of your transfers today—sign up at BiyaPay for a streamlined domestic and global payment experience. Use the Real-Time Exchange Rate Query to secure optimal rates and enhance your financial strategy. Dive into Stocks to integrate trading with transfers, maximizing every dollar. With BiyaPay, sending money becomes effortless and empowering!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.