- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring the Fastest Ways to Send Money: A Comparison of PayPal, Venmo, and Western Union

Image Source: unsplash

When you’re looking for the fastest way to transfer money, you’ll often find that PayPal can achieve near-instant transfers within the same platform. The transfer speed is influenced by multiple factors, such as platform type, receipt method, technology, and regulatory processes. Pay attention to speed, fees, security, and convenience: in different scenarios, such as transfers to China/Mainland China, international remittances, or urgent transfers, your best choice may vary.

The table below shows the main factors affecting transfer speed:

| Influencing Factor | Description |

|---|---|

| Technical Factors | Outdated systems can slow down processing times. |

| Regulatory Factors | Strict verification processes may cause delays. |

| Operational Factors | International transfers and manual approvals can slow progress. |

| Geopolitical Factors | Changes in the political environment can also affect international payment speeds. |

Key Points

- When choosing a transfer method, speed is a primary consideration. PayPal’s platform-internal transfers are nearly instant, ideal for urgent remittances.

- Venmo is suitable for small domestic transfers in the US, typically completed within 30 minutes, but it does not support international transfers.

- Western Union excels in international remittances and cash pickups, with some transfers completed in minutes.

- Compare the fee structures of each platform and choose a transparent service that suits your needs to avoid high handling fees.

- Ensure the chosen transfer platform has security measures, such as encryption and identity verification, to protect your funds.

Fastest Way to Transfer Money

Image Source: pexels

When choosing the fastest way to transfer money, you should first focus on transfer speed. Different platforms, receipt methods, and countries/regions directly affect the time it takes for funds to reach the recipient’s account. Below, we will detail the performance of PayPal, Venmo, and Western Union in terms of speed and combine real-world scenarios to help you make a choice.

PayPal Speed

PayPal offers you multiple transfer methods. You can choose instant transfers or standard bank transfers. Instant transfers are typically completed within minutes, though in rare cases, they may take up to 30 minutes. Standard bank transfers require 1 to 3 business days. When using PayPal in China/Mainland China or the US market, if both parties have PayPal accounts and choose instant transfers, funds can arrive almost in real-time.

| Transfer Method | Completion Time |

|---|---|

| Instant Transfer | Typically completed within minutes, but may take up to 30 minutes in rare cases |

| Standard Bank Transfer | Typically requires 1 to 3 business days |

PayPal’s speed advantage lies primarily in platform-internal transfers. For international remittances, PayPal can also achieve relatively fast delivery, especially suitable for freelancers and marketplace sellers. When choosing PayPal as the fastest way to transfer money, consider the following factors:

- Convenient payment and authorization methods make it easier for you to complete transfers.

- Advancements in digital services enhance user experience and settlement speed.

- New payment channel connections allow you to access funds more quickly.

When using PayPal in China/Mainland China or the US market, choosing instant transfers is often one of the fastest ways to transfer money.

Venmo Speed

Venmo primarily serves the US market and is suitable for small domestic transfers. You can choose standard bank transfers or instant transfers. Standard bank transfers take 1 to 3 business days, while instant transfers are typically completed within 30 minutes. If you initiate a transfer after 7 PM, on weekends, or during holidays, processing will be deferred to the next business day.

| Transfer Method | Speed | Fees |

|---|---|---|

| Instant Transfer | Typically completed within 30 minutes | 1.75% fee (minimum $0.25, maximum $25) |

| Standard Transfer | Typically requires 1 to 3 business days | No fee |

When choosing Venmo as the fastest way to transfer money, it’s suitable for daily spending and transfers between friends in the US market. If you need to transfer money between China/Mainland China and the US, Venmo does not support international transfers.

Western Union Speed

Western Union is suitable for international remittances, especially when the recipient does not have a PayPal account or needs cash pickup. For major bank-to-bank transfers between developed countries during normal banking hours, transfers can be completed in as little as a few hours. In most cases, Western Union’s transfer time is within 24 hours. When using Western Union in China/Mainland China or the US market, speed is affected by the following factors:

- Banking infrastructure and regulations in different countries affect delivery time.

- The payment method you choose (cash, debit card, credit card, or bank account) impacts fund availability speed.

- Bank closures on weekends or holidays can cause delays.

- Currency conversion increases processing time.

- International transfers typically take 1-5 business days, depending on the destination country and the banks involved.

In urgent situations requiring international remittances, Western Union can be one of the fastest ways to transfer money, especially for cash pickups and cross-border emergency transfers.

Comparison of Transfer Speeds Across the Three Platforms

| Service | Transactions in China/Mainland China | International Transactions | Transaction Completion Time |

|---|---|---|---|

| Venmo | No | No | N/A |

| PayPal | Yes | Yes | Instant transfers available |

| Western Union | No | Yes | Typically arrives within a few hours at the fastest |

When choosing the fastest way to transfer money, consider your specific needs, receipt method, and country/region. PayPal is suitable for platform-internal and international fast transfers, Venmo is ideal for instant small transfers in the US market, and Western Union excels in cross-border cash pickups and urgent international remittances.

Fee Comparison

When choosing a transfer platform, the fee structure is a critical consideration. Fees vary significantly across platforms, especially for international transfers and different receipt methods. Below, we detail the main fee structures for PayPal, Venmo, and Western Union to help you make an informed choice.

PayPal Fees

PayPal’s fee structure is relatively complex. When using PayPal in China/Mainland China or the US market, fees vary based on the transfer type and payment method.

- International transfers: 4.4% + fixed fee (e.g., $0.49 per transaction), with an additional 5% (minimum $0.99, maximum $4.99) for bank card or credit card payments.

- Transfers within China/Mainland China: 2.99% + fixed fee.

- PayPal also charges currency conversion fees and withdrawal fees, which are hidden costs you might overlook.

| Type | Fees |

|---|---|

| Transfers within China/Mainland China | 2.99% + $0.49 |

| International Transfers | 4.4% + $0.49 |

| Card/Bank Account | 5% ($0.99-$4.99) |

PayPal’s international transactions also incur exchange rate markups, which may result in a lower actual received amount than expected.

Venmo Fees

Venmo primarily serves the US market with a relatively simple fee structure. When using Venmo in the US, standard transfers are free, while instant transfers incur a 1.75% fee (minimum $0.25, maximum $25). Credit card transfers have a 3% fee.

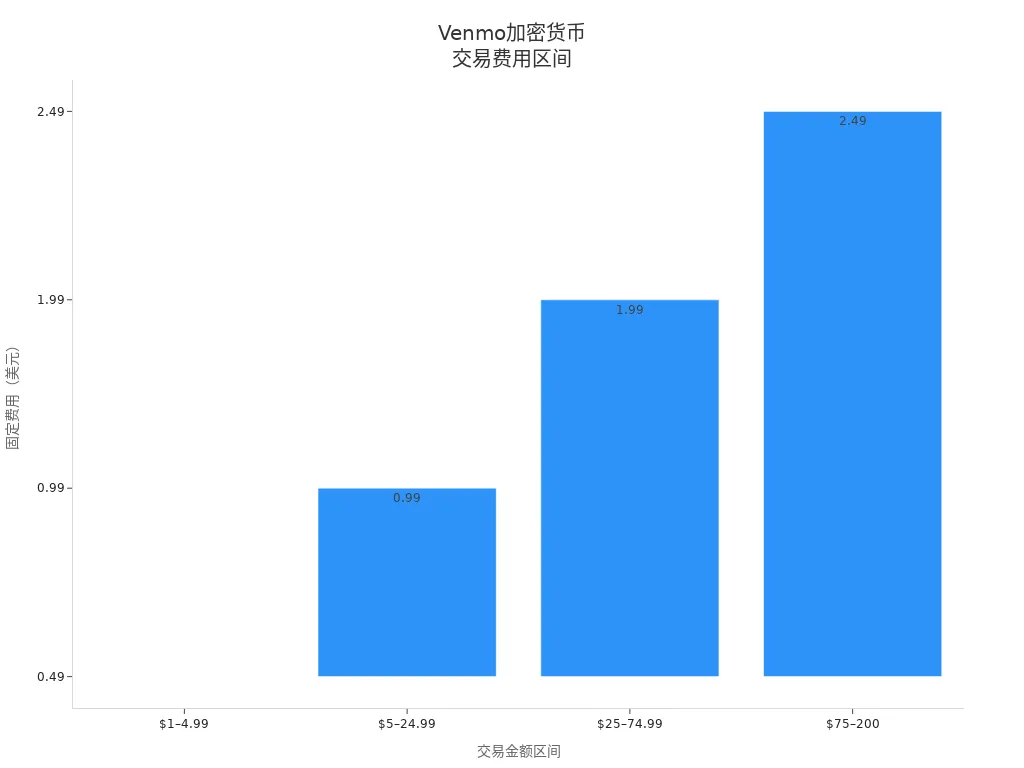

For cryptocurrency transactions, Venmo charges different fees based on the amount range.

| Transaction Type | Fees |

|---|---|

| Instant Transfer | 1.75% ($0.25-$25) |

| Credit Card Transfer | 3% |

| Standard Electronic Withdrawal | Free |

When using Venmo for daily spending or transfers between friends in the US market, its fee advantage is clear.

Western Union Fees

Western Union is suitable for international remittances, with fees varying significantly based on the destination country, payment method, and transfer speed.

- Sending fees typically range from $4.99-$15.

- Exchange rate markups range from 1%-6%, with actual fees determined after entering transfer details.

- Fees vary depending on whether you choose cash, debit card, or credit card payments.

| Fee Range | Destination Country | Payment Method |

|---|---|---|

| $4.99-$15 | Various Countries | Cash/Debit Card/Credit Card |

Western Union’s fees are more competitive in countries with strong business coverage, making it suitable for cross-border cash pickups or urgent remittances.

Operational Process

Image Source: unsplash

PayPal Process

When using PayPal for transfers, the operational process is very intuitive. You can complete a transfer with the following steps:

- Log in to your PayPal account.

- Go to “Wallet,” and if you need to add a bank account, select “Link Bank,” enter the details of a licensed Hong Kong bank account, and complete verification.

- Select “Send and Request.”

- Enter the recipient’s name, PayPal username, email, or phone number, and click “Next.”

- Enter the transfer amount (in USD), select the currency, and add an optional note.

- Choose “Pay for Goods or Services” or “Send to Friends.”

- Select the payment method and click “Next.”

- Review all information and select “Send Payment Now” if correct.

PayPal’s user interface is intuitive and supports multiple payment methods. You only need the recipient’s email and bank account details.

Venmo Process

When using Venmo in the US market, the process is more socially oriented, ideal for small transfers between friends:

- Open the Venmo app and log in to your account.

- Select “Send and Request.”

- Enter the recipient’s name, phone number, or Venmo username.

- Enter the amount (in USD) and add an optional note.

- Choose the payment type (“Friends and Family” or “Goods and Services”).

- Review the details and click “Send.”

Venmo’s interface is simple, emphasizing social interaction. You only need the recipient’s phone number or bank account information.

Western Union Process

When using Western Union for international remittances in China/Mainland China or the US market, the process is as follows:

- Visit the Western Union website or a physical service point.

- Fill in the recipient’s information, including name, country, and transfer amount (in USD).

- Choose the payment method (cash, debit card, credit card, or bank account).

- Review all information and submit the transfer if correct.

- Receive a Money Transfer Control Number (MTCN) and notify the recipient to collect the funds.

Western Union’s interface is more traditional, emphasizing international remittance functions. You need to prepare the recipient’s detailed information and transfer amount.

The table below compares the user interfaces and required information for the three platforms:

| Platform | User Interface Features | Required Information |

|---|---|---|

| PayPal | Intuitive and user-friendly, supports multiple payment methods | Email, bank account information |

| Venmo | Social-oriented interface, ideal for friend transfers | Phone number, bank account information |

| Western Union | Traditional interface, emphasizes international remittances | Recipient information, transfer amount |

Security

PayPal Security

When using PayPal, you can feel the platform’s strong emphasis on security. PayPal uses end-to-end encryption technology to protect your account and transaction information from being leaked. Every payment undergoes the latest identity verification processes, and the system monitors transactions in real-time to detect and block suspicious activity promptly. PayPal also provides fraud risk tools and real-time alerts to help you stay informed about account risks immediately.

PayPal offers buyer protection for goods and services payments. If you purchase goods in China/Mainland China or the US market via PayPal and encounter issues like non-delivery or items not matching the description, the platform will assist you in resolving disputes. However, personal transfers are not covered by this protection. When making personal remittances, you should take extra care to verify the recipient’s identity.

The table below summarizes PayPal’s main security measures and user protection policies:

| Security Measures | User Protection Policy |

|---|---|

| Strong encryption, identity verification, real-time monitoring | Protection for goods and services payments, no protection for personal transfers |

Venmo Security

When using Venmo in the US market, the platform also employs strong encryption technology to ensure your funds’ safety. Venmo conducts multi-factor identity verification to prevent unauthorized access. The platform monitors unusual transactions and alerts you to potential risks promptly.

However, Venmo’s user protection policy is relatively limited. If you transfer funds to the wrong account, the platform cannot reverse the transaction. You should carefully verify recipient information before transferring to avoid losses due to errors. The platform recommends transferring money only to people you know to reduce risks.

- Venmo emphasizes the impact of user behavior on security. You can take the following measures to enhance account security:

- Keep your account balance low

- Enable all available security features

- Avoid transferring to strangers

| Encryption Security Features | User Protection Policy |

|---|---|

| Strong encryption | Cannot reverse transfers to incorrect accounts |

Western Union Security

When using Western Union for international remittances in China/Mainland China or the US market, the platform encrypts your transaction information using Secure Sockets Layer (SSL) technology. Western Union also employs Strong Customer Authentication (SCA) to ensure only you can operate your account. The platform provides secure transfer advice, reminding you to verify the recipient’s credibility.

Western Union’s user protection relies heavily on your behavior. The platform lacks additional fund protection measures. If you accidentally send funds to an untrustworthy person, recovery is difficult. You should thoroughly verify recipient information before transferring to ensure accuracy.

The security of payment apps largely depends on your operational habits. You should develop good account management habits, regularly check transaction records, and avoid transferring to strangers.

| Security Measures | User Protection Policy |

|---|---|

| SSL encryption, strong authentication | Relies primarily on user behavior |

Comparison Table

When choosing a transfer platform, you often focus on transfer speed, fees, applicable scenarios, and receipt methods. The table below helps you quickly understand the main features of PayPal, Venmo, and Western Union:

| Service | Speed | Fees (USD) | Applicable Scenarios | Receipt Method |

|---|---|---|---|---|

| PayPal | Platform-internal transfers are nearly instant; bank withdrawals take 1-3 business days | International transfers 4.4% + fixed fee; bank card/credit card 5% | Global service, suitable for personal and commercial remittances | PayPal account, bank account |

| Venmo | Instant transfers within 30 minutes; standard withdrawals 1-3 business days | Instant transfers 1.75% ($0.25-$25); credit card 3% | US market, suitable for small transfers between friends | Venmo balance, bank account |

| Western Union | Cash pickups in minutes; bank transfers 1-5 business days | $4.99-$15 + exchange rate markup 1%-6% | Supports 200+ countries, suitable for international cash and urgent remittances | Cash, bank account |

You can see that PayPal supports platform-internal instant transfers globally, ideal for scenarios requiring fast delivery. Venmo serves the US market, suitable for small transfers between friends. Western Union excels in international cash pickups and urgent remittances, especially when you need quick cash withdrawals in China/Mainland China or other countries.

When using PayPal in China/Mainland China, choosing platform-internal instant transfers can achieve near-real-time delivery. In the US market, Venmo’s instant transfers are also convenient. For cross-border remittances or urgent cash pickups, Western Union allows cash withdrawals in minutes in some countries and regions. You can choose the most suitable platform based on your needs, considering speed, fees, and receipt methods.

Scenario Recommendations

International Remittances

When making international remittances, speed, fees, and security are the most important factors. Different methods perform differently. You can refer to the table below to quickly understand the pros and cons of common international remittance methods:

| Remittance Method | Speed | Fees | Security |

|---|---|---|---|

| Bank Wire Transfer | 1-5 business days | Average 7.34% | Highly secure, regulated |

| Online Remittance Services | Same day or next day | Lower, some free | Strict security measures |

| Mobile Payment Apps | Minutes | Higher exchange rate markups | Follow strong security measures |

| Cash Transfer Services | Minutes | Fees and exchange rates vary | Verify provider security |

If you prioritize speed, choose online remittance services like PayPal or Western Union cash transfers. If security is your focus, bank wire transfers remain a reliable choice. When using PayPal for international transfers in China/Mainland China, it balances speed and security but be mindful of fees and exchange rate markups. In the US market, Venmo does not support international transfers.

Domestic Transfers

When making domestic transfers in China/Mainland China or the US market, speed and fees are typically the primary considerations. You can choose from various mobile payment apps or bank services. Here are common options:

- Zelle offers extremely fast transfer speeds, ideal for domestic transfers in the US market.

- PayPal is suitable for scenarios requiring global transactions and comprehensive financial management.

- Venmo and Cash App are ideal for social interactions and small transfers in the US market.

When using PayPal in China/Mainland China, platform-internal transfers can achieve near-real-time delivery. In the US market, Venmo is convenient for transfers between friends. If you need advanced fund management capabilities, consider comprehensive platforms like PayPal.

Urgent Remittances

In urgent situations, transfer speed is the most critical factor. You can choose the following methods:

- Western Union cash transfer services can be completed in minutes, suitable for scenarios requiring quick cash withdrawals in China/Mainland China or the US market.

- PayPal instant transfers are ideal for platform-internal urgent transfers.

- If you need to ensure funds arrive as soon as possible, choose trackable overnight mailing methods to enhance security and control.

For urgent remittances, prioritize trackable, fast-delivery platforms and verify recipient information to ensure fund safety.

Choosing the Fastest Way to Transfer Money

When choosing the fastest way to transfer money, you need to consider the performance of different platforms in real-world scenarios. PayPal achieves near-instant transfers within the platform, suitable for personal or commercial remittances in China/Mainland China or the US market. Venmo primarily serves the US market, ideal for small transfers between friends with fast speeds. Western Union excels in international cash pickups and urgent remittances, with cash withdrawals completed in minutes in some countries and regions.

When making a decision, don’t focus solely on speed. You should also consider fees, security, and service transparency. The table below helps you quickly identify key factors to focus on when choosing:

| Key Factor | Description |

|---|---|

| Security | Choose providers offering encryption, two-factor authentication, and regulatory compliance to ensure secure financial transactions. |

| Speed | Look for systems offering fast transfers to meet personal and business needs. |

| Cost-Effectiveness | Compare transfer fees across platforms and choose the cheapest option. |

| Customer Reviews | Check user ratings and reviews to understand each platform’s reliability and user satisfaction. |

You can follow these steps to scientifically choose the transfer method that suits you:

- Compare transfer fees and exchange rates across platforms, prioritizing platforms with transparent fees.

- Based on your actual needs, focus on transfer speed and choose a service that meets your time requirements.

- Check if the platform has security measures like encryption and two-factor authentication to protect your funds.

You should also pay attention to service transparency and compliance. Choose platforms that clearly disclose all fees and exchange rates and ensure the provider holds necessary financial licenses. This can effectively reduce risks.

When using remittance services in China/Mainland China or the US market, combine speed, fees, and security to flexibly choose the platform that best suits you. Don’t blindly pursue the fastest way to transfer money while ignoring fund safety and costs.

When choosing the fastest way to transfer money, you can see that Western Union is the fastest for cash pickups, while PayPal (Xoom) and Venmo also meet different scenarios. The table below helps you quickly compare:

| Service | Transfer Speed | Notes |

|---|---|---|

| Western Union | Transfers completed in minutes | Cash pickups are typically available immediately |

| Venmo | Fast domestic transfers | Plans to support more international transfers in 2025 |

| PayPal (Xoom) | Some transactions completed in minutes | Covers 130+ countries |

You should combine speed, fees, security, and convenience, referring to the comparison table and recommendations, to choose the platform that best suits your needs. Don’t focus solely on speed; your actual needs are key.

FAQ

Which is better for users in China/Mainland China: PayPal, Venmo, or Western Union?

PayPal is more convenient for use in China/Mainland China. Venmo is limited to the US market. Western Union is suitable for international cash remittances. Choose based on your needs.

How can I avoid high handling fees during transfers?

You can compare platform fees in advance. Choosing standard transfers or bank account payments is usually cheaper. Pay attention to exchange rate markups.

How long does it take to withdraw funds after a transfer arrives?

After receiving funds on PayPal or Venmo, you can use them immediately within the platform. Withdrawals to bank accounts typically take 1-3 business days. Western Union cash pickups are available instantly.

What should I do if I encounter issues during a transfer?

You can contact the platform’s customer service. PayPal and Venmo have online help centers. Western Union offers phone and physical location support. Keep transaction records.

Can I recover funds if I enter incorrect transfer information?

You should contact the platform’s customer service immediately. PayPal and Western Union have some recovery mechanisms. Venmo transfers are generally non-reversible. Verify information carefully before transferring.

When weighing PayPal, Venmo, and Western Union for the fastest remittance options, you’ve likely noticed their trade-offs: PayPal’s instant transfers come with steep fees (up to 4.4% plus fixed costs), Venmo is confined to the US, and Western Union’s swift cross-border cash pickups carry exchange rate markups (1%-6%). For users seeking rapid, low-cost, and globally accessible transfers—especially between China/mainland China and the US—BiyaPay delivers a superior alternative: fees as low as 0.5%, same-day send-and-receive across most countries, ensuring fast, secure fund flows.

BiyaPay stands out with real-time exchange rate queries to capture optimal conversion moments and seamless fiat-to-crypto swaps with zero-fee contract orders, maximizing cost efficiency. Its quick signup takes just minutes, granting access to a platform where you can trade US and Hong Kong stocks without an overseas account, blending remittances with investment opportunities. Unlike traditional platforms’ high fees and regional limits, BiyaPay prioritizes transparency and compliance to safeguard your funds.

Start today by signing up at BiyaPay for a frictionless global transfer experience. Leverage the Real-Time Exchange Rate Query to minimize currency fluctuation risks and preserve value. Dive into Stocks to integrate transfers with trading, unlocking new growth potential. With BiyaPay, remittances become simple, efficient, and a gateway to financial empowerment!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.