- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring PayPal Remittance Fees: How to Avoid High Costs and Exchange Rate Losses

Image Source: pexels

When you make cross-border payments or transfer money to overseas friends, you often find that PayPal remittance fees, exchange rate losses, and withdrawal fees significantly increase costs. For example, when you use PayPal to convert one currency to another, the currency conversion fee can be as high as 4%. If you choose instant transfers, PayPal charges a 1.50% withdrawal fee. The table below clearly shows the fees for different scenarios:

| Transaction Type | PayPal Currency Conversion Fee |

|---|---|

| Purchasing goods or services, paying with a currency not in your PayPal account | 4% |

| Receiving or converting non-USD currencies | 3% |

If you want to reduce these costs, you need to understand the specific sources and differences of each fee.

Key Takeaways

- Understand PayPal’s fee structure to avoid unnecessary costs. Fees typically range from 3% to 5%, with currency conversion fees up to 4%.

- Choose the appropriate payment method, using PayPal balance or bank account transfers to avoid additional fees from credit card payments.

- Before remitting, compare PayPal’s exchange rates and fees with those of licensed Hong Kong banks to choose a more cost-effective channel and reduce costs.

- Optimize the remittance process by informing clients of fee details in advance to avoid misunderstandings and enhance transaction transparency.

- Regularly monitor fee and exchange rate changes, flexibly adjust remittance strategies to ensure fund security and achieve cost-saving goals.

PayPal Remittance Fees and Exchange Rate Losses

Image Source: unsplash

PayPal Remittance Fee Standards

When you use PayPal for international remittances, you first encounter various types of fees. PayPal’s remittance fee structure is relatively complex, with fee standards varying by transaction type and region. You can refer to the table below to understand common fee components:

| Transaction Type | Fee Description |

|---|---|

| Sending | Usually free, but may include currency conversion fees. |

| Receiving | Additional 1.5% (on top of the base rate in China/Mainland China). Typically 2.99% + 1.5% = 4.4% + fixed fee (depending on currency). |

| Currency Conversion | Transaction exchange rate + currency conversion spread. Ranges from 3%-4% depending on transaction type. |

| Sending between friends and family (P2P) | P2P in China/Mainland China via PayPal balance/bank is usually free. International P2P fees are 5%, with a minimum of $0.99 and a maximum of $4.99 (for USD transactions). |

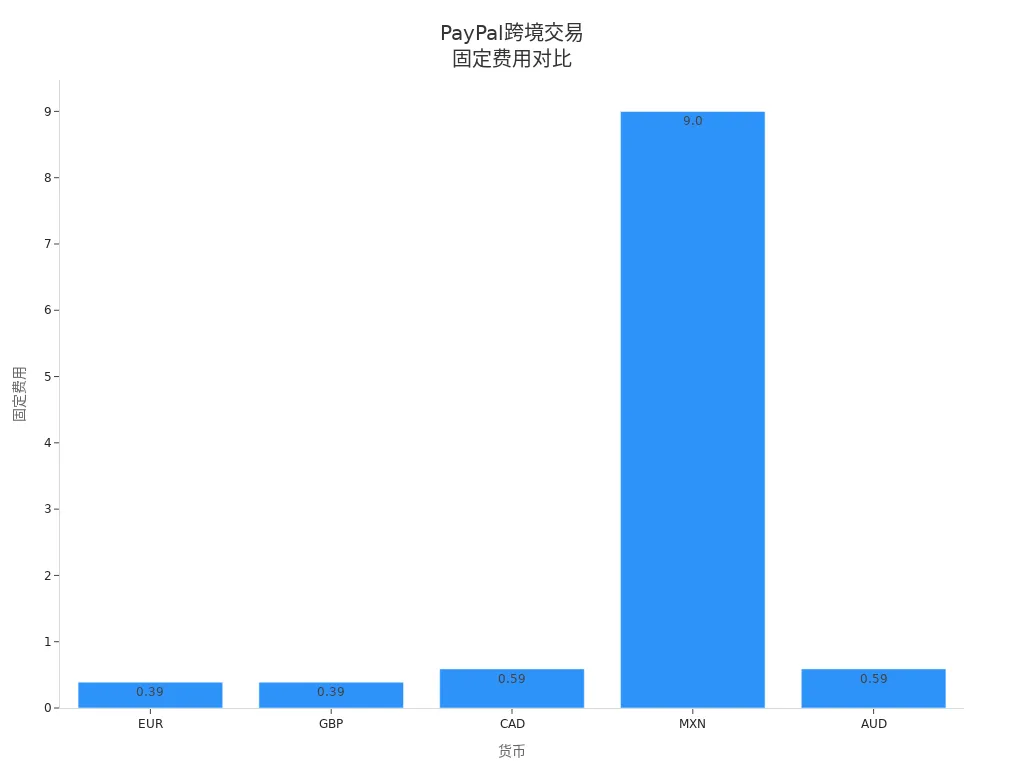

If you choose to pay with a credit card, PayPal also charges a 2.9% fee plus a fixed fee (e.g., $0.30). When withdrawing to a licensed Hong Kong bank account, PayPal may charge a withdrawal fee of up to $35. In cross-border transactions, in addition to standard fees, you need to bear currency conversion fees and fixed fees. For example, when receiving payments in the UK, PayPal adds a fixed fee of 0.39 GBP; for Canada, it’s 0.59 CAD; for Australia, it’s 0.59 AUD. You can review the fixed fee distribution for different currencies in the chart below:

PayPal remittance fees are relatively high in the international remittance field. When you make international transfers from China/Mainland China using PayPal balance or a bank account, you typically need to pay a 5% fee (minimum $0.99). If you choose card payment, the fees are higher, reaching 2.9% plus a fixed fee plus 5%. These fees are significantly higher than many licensed Hong Kong banks’ international wire transfer services, which typically charge $0-$25 for incoming wires and $0-$50 for outgoing wires.

Exchange Rate Losses and Currency Conversion Fees

When you make cross-border remittances with PayPal, in addition to direct PayPal remittance fees, you need to watch out for exchange rate losses. PayPal’s currency conversion typically adds a 2.5% to 3% spread on top of the mid-market exchange rate. For every $1000 you convert, you may lose $30 or more due to this. The table below shows the difference between PayPal’s exchange rate and the mid-market rate:

| PayPal Exchange Rate | Mid-Market Exchange Rate | Difference |

|---|---|---|

| 2.5% - 3% | 100% | 2.5% - 3% |

In practice, PayPal does not separately list the currency conversion fee but includes it in the overall transaction cost. For each international transaction, you need to bear standard fees, cross-border fees, and additional fixed fees simultaneously. If you choose international wire transfers through licensed Hong Kong banks, you typically only bear a 1%-3% foreign exchange transaction fee, with a currency conversion spread of about 1%. In comparison, PayPal’s currency conversion fee rate is significantly higher.

Tip: For large remittances, exchange rate spreads result in more noticeable losses. It’s recommended that you compare PayPal’s real-time exchange rates and fees with those of licensed Hong Kong banks before remitting to choose a more cost-effective method.

You can refer to the table below to directly compare PayPal’s main fees with those of banks:

| Type | Fee |

|---|---|

| PayPal Balance or Bank Account Transfer - International | 5% (minimum fee: $0.99) |

| Card Payment - International | 2.90% + fixed fee ($0.30) + 5% |

| Currency Conversion | 3% to 4% currency conversion spread |

| Licensed Hong Kong Bank Forex Transaction Fee | Typically 1% to 3% |

| Licensed Hong Kong Bank Currency Conversion | Typically about 1% |

| Incoming Wire Fees | $0-$25 |

| Outgoing Wire Fees | $0-$50 |

You can see that PayPal remittance fees and currency conversion fees are relatively high for international remittances. If you frequently conduct cross-border transactions, it’s recommended that you pay attention to the details of each fee and choose the remittance channel wisely to avoid unnecessary cost losses.

Reasons for High Fees

Fee Structure

When you use PayPal for international remittances, you’ll find its fee structure quite complex. PayPal remittance fees mainly consist of two parts: a percentage-based fee on the transaction amount and a fixed fee per transaction. You can refer to the table below to understand the fee components for different payment methods:

| PayPal Balance or Linked Bank Account | Credit or Debit Card | |

|---|---|---|

| Cross-Border Transaction Fees | 5% (minimum fee $0.99, maximum fee $4.99) | 5% (minimum fee $0.99, maximum fee $4.99) + 2.9% + currency-based fixed fee |

| Exchange Rate | 3%-4% markup on wholesale rate | 3%-4% markup on wholesale rate |

If you choose credit card payment, you also bear an additional 2.9% fee and a $0.30 fixed fee per transaction. For international transactions in different countries and regions, PayPal charges different fixed fees based on the currency type. For example, international transactions in the US, UK, Canada, Australia, etc., have a standard fee rate of 4.4% plus a fixed fee. In contrast, licensed Hong Kong banks’ international wire transfer fees are generally more transparent, with incoming fees ranging from $0-$25 and outgoing fees from $0-$50.

Tip: When choosing a payment method, it’s recommended that you prioritize PayPal balance or bank account to avoid additional fees from credit card payments.

Exchange Rate Spread Mechanism

PayPal adds a 3%-4% spread on the wholesale exchange rate during currency conversion. When you make cross-border remittances, the amount received is reduced due to this exchange rate markup. Although PayPal displays the exchange rate before the transaction, you need to note that this rate already includes the markup. You can refer to the table below to understand the exchange rate markup differences between PayPal and other international remittance platforms:

| Service Provider | Exchange Rate Markup |

|---|---|

| PayPal | Up to 4% |

| Other Mainstream Platforms | 0.5%-3% |

For every $1000 you remit, the recipient’s actual received amount is reduced by $30-$40 due to the exchange rate spread. In contrast, licensed Hong Kong banks’ currency conversion spread is typically around 1%. PayPal supports over 25 currencies, facilitating international payments, but the high exchange rate spread significantly increases your remittance costs.

How to Reduce PayPal Remittance Fees

Optimizing the Remittance Process

You can effectively reduce PayPal remittance fees and exchange rate losses by optimizing the remittance process. Here are some practical suggestions:

- Include standard 3% and “invoice fees” in project estimates or contracts in advance. This ensures clients clearly understand the fee structure, avoiding subsequent misunderstandings.

- Transfer directly to a bank account through PayPal to avoid additional transfer fees. You should opt for standard bank transfers to avoid paying an extra 1% fee.

- If you frequently receive small payments, you can apply to enable dynamic micropayments. This can significantly reduce fees for small transactions, especially for payments between $1 and $10. You only need to log into your PayPal account, confirm it’s a business account (upgrade if necessary), contact support through the message center, apply for dynamic micropayments, and follow the instructions.

- Increasing monthly transaction volume can also help reduce overall fees. PayPal offers customized rates and interchange-plus pricing for high-volume merchants. If you have a large monthly transaction volume, you can proactively contact PayPal to request more favorable rates.

Tip: When communicating with clients, it’s recommended to clarify all fee details in advance to avoid issues affecting the partnership due to fees.

Account Settings and Currency Selection

Proper account setup and currency selection can further reduce your remittance costs. You can refer to the following methods:

- Check and upgrade your account type. Business accounts typically offer more discounts and features, suitable for users with frequent international transactions.

- Choose the appropriate receiving currency. When receiving payments, it’s recommended to prioritize the same currency as the client’s payment to reduce currency conversion frequency and avoid 3%-4% exchange rate spreads.

- Choose the conversion party at checkout. You can select your issuing bank to handle currency conversion at PayPal’s checkout page instead of PayPal. Some licensed Hong Kong banks offer better rates, with conversion spreads around 1%, much lower than PayPal’s 3%-4%.

- Avoid using credit cards for remittances. Credit card payments incur an additional 2.9% fee plus a fixed fee. You should prioritize PayPal balance or bank account payments.

- Choose withdrawal methods wisely. When withdrawing to a bank account, if the account currency matches the PayPal balance (e.g., AUD), there are usually no additional fees. Withdrawing to a different currency account incurs a currency conversion fee. Withdrawing to a USD bank account incurs a 2.5% transfer fee, while withdrawing to a debit card incurs a 2% fee, with a minimum of $0.25 and a maximum of $10. You should select the optimal withdrawal method based on your needs.

The table below compares fees for different withdrawal methods:

| Withdrawal Method | Fee Description |

|---|---|

| Bank Account (USD) | 2.5% transfer fee, possibly with currency conversion fees. |

| Bank Account (Non-USD) | Currency conversion fees apply. |

| Debit Card | 2% withdrawal fee, minimum $0.25, maximum $10. |

| Foreign Currency Withdrawal to USD | 3% exchange rate markup applies. |

If you can flexibly apply the above methods and combine them with your transaction habits and client needs, you can effectively reduce PayPal remittance fees and improve cross-border payment efficiency.

Alternative Solutions Comparison

Image Source: unsplash

International Remittance Platforms

When you choose an international remittance platform, you can focus on fees, speed, and exchange rate transparency. Many platforms like Skrill, Payoneer, Xoom, NETELLER, Stripe, and Wise offer different fee structures and service experiences. You can refer to the table below to compare the main fees of these platforms:

| Platform | Fee Description |

|---|---|

| Skrill | 3.99% fee for currency conversion transactions. |

| Payoneer | Fees vary by currency and transfer method, up to 3% for transfers to non-Payoneer customers. |

| Xoom | Profits from remittance exchange rates and transaction fees, depending on the remittance amount. |

| NETELLER | Up to 4.99% additional fee for currency conversion, with forex fees up to 3.99%. |

| Stripe | 2.9% + $0.30 for domestic card payments, additional 1.5% for international cards. 1% extra for transactions involving two or more currencies. |

| Wise | Uses mid-market rates for transfers, with transparent and relatively low fees. |

If you prioritize delivery speed, you can refer to the table below:

| Platform | Transaction Speed |

|---|---|

| Western Union | Cash pickups are usually completed within minutes, but bank transfers may take days. |

| PayPal | Almost instant transfers with PayPal balance or card, but bank withdrawals may take 3-5 days. |

Platforms like Wise offer transparent fees and mid-market rates, ideal for users seeking low costs and rate transparency. You can weigh fees and delivery speed based on your needs when choosing.

Cross-Border Payment Tools

If you’re a cross-border e-commerce seller, commonly used payment tools typically feature multi-currency processing, local payment method integration, and compliance assurance. You can refer to the following features:

- Multi-currency processing: Allows clients to pay in their local currency, reducing exchange rate losses.

- Integration with local payment methods: Supports regional payment preferences, enhancing customer experience.

- Compliance with regional regulations: Ensures cross-border transaction compliance, reducing legal risks.

- Anti-fraud tools: Provide security to minimize fraud losses.

- Local and foreign currency settlement: Simplifies financial management and facilitates fund transfers.

In terms of fees, these tools typically charge a base fee of 2.9% + $0.30, with an additional 1% for cross-border transactions and 1% for currency conversion. Refund fees are around $15. Compared to PayPal, some platforms like Wise use mid-market rates and small fixed fees, making overall costs lower. When choosing, you can prioritize platforms with transparent fees, multi-currency support, and local settlement options.

Bank Wire Transfers

You can also choose bank wire transfers for international remittances. Licensed Hong Kong banks typically offer relatively transparent fee structures. You can refer to the table below:

| Bank Type | Fee Range | Processing Time |

|---|---|---|

| US Banks | $30-$50 | 1-5 days |

| Eurozone Banks | $5-$7 + 0.1%-1% | Usually 2 days, up to 5 days |

| Large US Retail Banks | $40-$65 | N/A |

International wire transfers generally take 1 to 5 days to arrive. US banks’ fees typically range from $30 to $50, with some receiving banks charging $10 to $20. Eurozone bank transfer fees are $5 to $7, plus 0.1% to 1% of the amount. For large remittances, bank wire transfers are more suitable, especially for scenarios with less stringent delivery speed requirements.

When choosing alternatives, you can consider fees, delivery speed, exchange rate transparency, and platform usability to find the most suitable cross-border remittance method.

Solution Selection Suggestions

Fees and Speed

When choosing a cross-border remittance solution, fees and delivery speed are the most important factors. Different platforms have distinct fee structures and delivery times. You can refer to the table below to quickly understand the fees and speed of common solutions:

| Solution Type | Main Fees (USD) | Delivery Speed |

|---|---|---|

| PayPal | 3%-5% fees + 3%-4% exchange rate spread | Instant or 1-3 days |

| Licensed Hong Kong Bank Wire | $0-$50 fees + ~1% exchange rate spread | 1-5 days |

| International Remittance Platforms | 1%-4% fees + 0.5%-3% exchange rate spread | Minutes to 2 days |

If you want to save on fees, you can choose batch payments, combining multiple small transactions into one large transaction to reduce the impact of fixed fees per transaction. You can also use local payment channels like ACH or SEPA to lower transfer costs. You should regularly monitor fee changes for PayPal and other platforms and choose the optimal payment method. Avoid using credit card payments; direct transfers using PayPal balance or bank accounts typically reduce additional fees. At checkout, try to pay in the recipient’s currency and decline dynamic currency conversion to further reduce costs.

Security and Applicable Scenarios

When making cross-border remittances, security is equally important. Different platforms have varying security measures. You can refer to the table below to understand the security features of mainstream platforms:

| Platform | Security Features |

|---|---|

| PayPal | Strong encryption, fraud detection, purchase protection, two-factor authentication |

| MoneyGram | Photo ID verification, adding an extra layer of security |

| Lightspark | Decentralized wallet, user-hosted funds |

PayPal offers two-factor authentication, login alerts, and automated fraud detection to ensure account security. You can remove linked cards at any time to reduce risks. For freelancers and e-commerce sellers, Payoneer supports cross-border payments in over 200 countries, suitable for multi-currency collections. For family remittances, Remitly offers multiple payment options and fast delivery, with Express transfers completing in minutes and transparent fees. You should choose a solution based on your needs:

- If you prioritize delivery speed and convenience, PayPal and international remittance platforms are more suitable.

- If you value fund security and large remittances, licensed Hong Kong bank wire transfers are more reliable.

- If you need multi-currency collections or family remittances, you can choose specialized cross-border payment tools or platforms like Remitly.

In practice, it’s recommended that you combine fees, speed, and security to flexibly choose the most suitable cross-border remittance solution.

You can effectively reduce PayPal fees and exchange rate losses by optimizing the remittance process and account settings. You should choose the most suitable remittance method based on your needs.

- Continuously monitor fee and exchange rate changes, adjusting remittance strategies promptly.

- Compare fees of licensed Hong Kong banks and international remittance platforms to arrange fund transfers wisely.

It’s recommended that you carefully calculate all fees before each remittance to ensure fund security and achieve cost-saving goals.

FAQ

What are the main fees for PayPal international remittances?

When you use PayPal for international remittances, you need to pay 3%-5% fees and bear a 3%-4% exchange rate spread. When withdrawing to a bank account, PayPal may charge up to $35 in fees.

How can you avoid PayPal’s high currency conversion fees?

You can settle in the same currency as the client to reduce conversion frequency. You can also choose your issuing bank for conversion at checkout, as licensed Hong Kong banks typically offer better rates.

How long does it take to withdraw from PayPal to a licensed Hong Kong bank account?

You typically need to wait 1 to 5 business days. Delivery time depends on the bank’s processing speed. Some banks may complete transfers faster.

Is PayPal or licensed Hong Kong bank wire transfers more cost-effective?

For large remittances, licensed Hong Kong bank wire transfers typically have lower fees, with exchange rate spreads around 1%. PayPal is suitable for small, instant transfers but has higher overall costs.

What happens to funds if a PayPal account is frozen?

If your account is frozen, PayPal will notify you of the specific reason. You can follow the instructions to submit materials. Once approved, PayPal will unfreeze the account or arrange fund withdrawals.

PayPal’s convenience for remittances comes at a cost, with 3%-5% transaction fees and up to 4% currency conversion charges inflating expenses, especially as global cross-border payments are projected to hit $190 trillion in 2025, where high fees and exchange losses deter users. For a cost-effective, secure alternative, choose BiyaPay. With transfer fees as low as 0.5% and transparent rates free of hidden markups, BiyaPay ensures recipients receive maximum value.

BiyaPay covers most countries and regions, with registration in minutes and same-day transfers, no complex verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, enjoying zero fees on contract orders. Sign up now and use the real-time exchange rate tool to secure optimal rates, transforming your cross-border remittances into an efficient, budget-friendly solution.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.