- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Ways to Remit Money to Mexico: Efficient and Secure Transfers via Apps

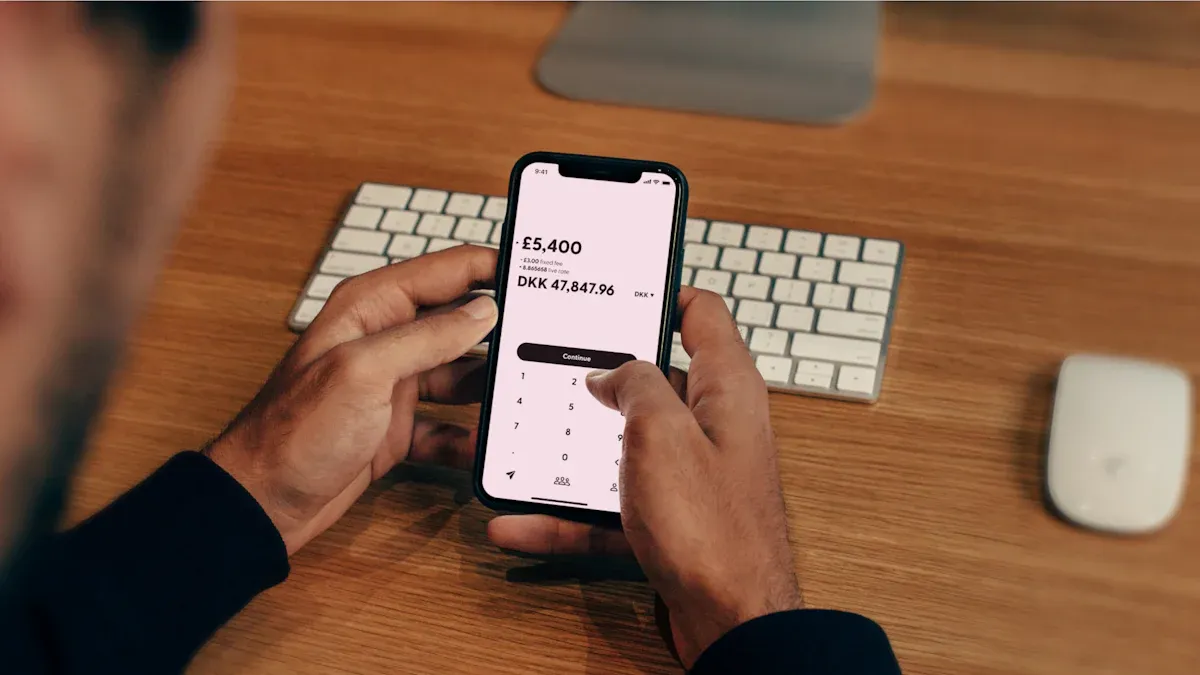

Image Source: unsplash

Are you looking for the best remittance method? Now, using apps like PayPal, Xoom, and Remitly, you can easily send funds to Mexico securely and efficiently. With just a few steps, funds can arrive in as little as a few minutes, with transparent fees and reasonable exchange rates. The table below compares the fees and delivery speeds of different apps for a clear overview:

| Service | PayPal | Xoom | Remitly |

|---|---|---|---|

| International Transfer Fees | Up to $4.99 + currency conversion fee | Varies by amount | Typically below $4.99 |

| Processing Time | Instant | A few minutes | Express: a few minutes, Economy: 3-5 days |

You can choose the most suitable remittance tool based on your needs, enjoying the convenience and security of mobile payments.

Key Points

- Using mobile apps like PayPal, Xoom, and Remitly, you can quickly and securely send funds to Mexico, typically arriving within minutes.

- Mobile app fees are generally lower than traditional banks, allowing more funds to reach the recipient by choosing the right app.

- Apps offer better exchange rates, ensuring each dollar converts to more Mexican pesos, increasing the recipient’s actual amount.

- Choosing trusted remittance apps ensures fund safety, with apps employing advanced encryption and identity verification mechanisms.

- Select the appropriate delivery method based on the recipient’s needs, flexibly addressing different remittance scenarios to enhance the experience.

Recommended Best Remittance Methods

Image Source: pexels

Advantages of App-Based Remittances

When choosing the best remittance method, mobile apps offer many unique advantages. You can complete transfers anytime, anywhere via your phone, without needing to visit a bank or remittance point. Mobile apps allow you to operate easily from home, work, or even while traveling. You don’t have to worry about business hours or waiting in line.

- Extremely fast. When you send money via apps, funds typically arrive in seconds or minutes. Compared to traditional banks or remittance offices that take days, this method is ideal for urgent needs.

- Low fees. Mobile app transaction costs are significantly lower than traditional banks. You can save substantial intermediary fees, ensuring more funds reach the recipient.

- Better exchange rates. Apps generally offer better rates than traditional remittance services, meaning each dollar you send converts to more Mexican pesos.

- High flexibility. You can send money anytime, anywhere, whether you’re in mainland China, Hong Kong, or the US, as long as you have an internet connection.

- Data security. Apps use advanced encryption to protect your personal information and funds.

- Wide applicability. Even recipients in remote areas of Mexico can receive funds via mobile wallets or local bank accounts.

By choosing apps as the best remittance method, you can avoid the cumbersome procedures and high intermediary fees of traditional banks. You don’t need to fill out complex forms or wait for lengthy reviews. Mobile apps enable both you and the recipient to complete fund transfers faster and more securely.

Tip: Xoom offers a Spanish-language interface, making it convenient for Mexican recipients. PayPal enables instant transfers, ideal for urgent scenarios. Remitly’s simple registration process suits first-time users.

Fees and Exchange Rates

When considering the best remittance method, fees and exchange rates are among the most critical factors. Mobile apps excel in this area. The table below compares the fees of major apps and traditional banks:

| Service | Fees |

|---|---|

| PayPal | 4.4% + fixed fee |

| Xoom | $3.99 (bank account transfer) |

| Remitly | Fixed fee around $3.99 |

| Paysend | $2 (from the US) |

| Traditional Banks | Varies by bank, typically higher |

You can see that Paysend and Remitly offer lower fixed fees, and Xoom provides reasonable pricing for bank account transfers. PayPal, despite its transaction fees, offers fast delivery, suitable for users prioritizing speed. In contrast, traditional banks generally charge higher fees and offer less favorable exchange rates.

Mobile apps not only save you on fees but also provide better exchange rates. Each transfer ensures the recipient receives more actual funds, which is why more users are choosing apps as the best remittance method.

Security and Efficiency

Image Source: pexels

Fund Safety Assurance

When choosing the best remittance method, fund safety is a top consideration. Mobile apps implement multiple security measures to ensure your funds and personal information remain protected.

- Xoom uses 128-bit data security encryption to safeguard all your information during the transfer process. Even when you’re not logged in, all pages are provided through encrypted secure pages.

- Xoom stores user information on servers protected by physical and electronic safeguards, located behind firewalls and not directly connected to the internet.

- Xoom regularly reviews its security policies to ensure your personal data is always protected. All employees undergo financial and criminal background checks before onboarding.

- As a service of PayPal, Inc., Xoom is subject to strict regulation by U.S. federal and state governments.

- Apps like Remitly and Paysend also use similar encryption and identity verification mechanisms to ensure your funds’ safety.

- During transfers, apps require different levels of identity verification based on the amount. For example, amounts exceeding $1,000 require basic customer information; amounts over $5,000 trigger a full customer due diligence process.

| Fund Transfer Amount | Identity Verification Requirements |

|---|---|

| Over $1,000 | Basic customer information |

| Over $5,000 | Full customer due diligence process |

When verifying your identity, you may need to provide a CURP card (Mexican population registration card) or use Mastercard’s biometric technology and one-time passwords. Some apps also employ Alviere’s compliance and risk management measures, strictly adhering to anti-money laundering standards to ensure transaction safety.

Tip: Choosing trusted remittance apps effectively prevents fraud and information leaks. The apps’ multi-layered encryption and identity verification mechanisms allow you to transfer funds with confidence.

Delivery Speed

When sending money, delivery speed directly impacts the recipient’s experience. Mobile apps perform exceptionally in this regard.

- Xoom typically completes transactions within minutes, ideal for urgent fund needs.

- Remitly offers Express and Economy delivery options. In Express mode, funds arrive in minutes; in Economy mode, funds arrive within 3-5 days, suitable for scenarios where cost savings are prioritized.

| Service | Average Delivery Time |

|---|---|

| Xoom | Transactions completed in minutes |

| Remitly | Express: minutes; Economy: 3-5 days |

You can choose different delivery methods based on the recipient’s needs. Xoom has an extensive network of pickup locations in Mexico, supporting bank deposits and cash pickups. Western Union also offers cash access services, suitable for recipients without bank accounts. When sending money, you only need to fill in the recipient’s information, select the delivery method (e.g., cash pickup or bank deposit), and funds will arrive quickly. Mobile apps also provide better currency exchange rates and diverse pickup options, allowing recipients to choose the most suitable method.

Tip: Relying on trusted remittance providers ensures a smoother transaction experience and better exchange rates. Multiple delivery options provide greater convenience for both you and the recipient.

App Comparison

Applicable Scenarios

When choosing a remittance app, you need to consider your specific needs. PayPal is ideal for scenarios requiring instant delivery and flexible recipient methods. Xoom supports multiple recipient channels, suitable for recipients who need to collect funds quickly at Mexican banks or cash pickup points. Remitly is great for large transfers or scenarios with varying delivery speed requirements. Paysend suits users prioritizing low fees and high security.

If your recipient needs Spanish-language services, Xoom and Remitly offer multilingual customer support, helping them complete transactions smoothly. The table below shows the language support of major apps:

| App Name | Multilingual Support | Customer Service Channels |

|---|---|---|

| Xoom | Supported | Online/Phone |

| Remitly | Supported | Online/Phone |

| PayPal | Supported | Online/Phone |

| Paysend | Supported | Online |

You can flexibly choose the most suitable remittance tool based on the recipient’s language needs and delivery method.

Pros and Cons Analysis

When comparing apps, you can refer to their unique strengths and limitations. The table below summarizes the key features of Paysend and Remitly:

| Service Provider | Advantages | Limitations |

|---|---|---|

| Paysend | Offers instant transfer services, high security, certified by Visa and Mastercard | Transfers may take up to 3 business days, lower sending limits |

| Remitly | Allows single transactions up to $25,000, high security | Transfer fees and exchange rates may be higher, limits vary by destination and delivery method |

PayPal’s strength lies in its fast delivery, ideal for urgent fund needs. Xoom has an extensive pickup network in Mexico, supporting bank accounts and cash pickups. When using these apps, you can choose the best option based on fees, exchange rates, delivery speed, and language support.

If you need large transfers, prioritize Remitly. If you focus on fees and security, Paysend is a good choice. Each app has unique advantages, allowing you to choose flexibly based on your situation.

Operational Process

Registration and Verification

When using apps for remittances, you first need to complete registration and identity verification. The process is simple and straightforward, suitable for users in mainland China.

- Download your chosen remittance app, such as PayPal, Xoom, Remitly, or Paysend.

- Create a free account, filling in your personal contact information. No social security number is required during registration, but for larger amounts, you’ll need to upload government-issued ID and proof of address.

- Provide the recipient’s name, address, and other basic information.

- Complete identity verification as required by the app. Some platforms may ask for a CURP card or biometric verification.

- After registration, you can start sending money anytime without visiting a bank branch.

Tip: During registration, use accurate information and securely store your account password to avoid transfer failures due to incorrect details.

Remittance Steps

After registering, you can follow these steps to send money:

- Log into your app account.

- Select Mexico as the remittance destination.

- Enter the amount you wish to send (in USD).

- Choose the delivery method, such as bank deposit or cash pickup. Some apps support Mexican local bank accounts or mobile wallets.

- Provide the recipient’s bank account number or phone number.

- Select your payment method, such as PayPal balance, credit card, debit card, or a licensed Hong Kong bank account.

- Confirm all information is correct and submit the transfer request.

- Wait for the app to complete currency conversion and fund transfer; the recipient can receive funds in minutes to days.

Tip: Before sending, check the real-time exchange rate and fees to select the best remittance method for you.

Notes

You may encounter common issues and risks during the remittance process.

- The recipient needs an account on the same platform, which may be a barrier for Mexican recipients unfamiliar with technology.

- Some apps operate in specific countries or regions, so confirm in advance whether the Mexican recipient can receive funds smoothly.

- Exchange rate fluctuations may affect the actual amount received, so monitor rate changes before transferring.

- Fraud risks exist; always download apps from official sources and verify recipient information.

- Data security is critical; while apps use encryption, you should still protect your personal information.

- Transaction fees vary by provider, so compare platforms’ fee structures to choose the best option.

- Mexico’s regulatory environment and economic conditions may affect delivery speed and convenience.

Recommendation: Prioritize regulated, reputable apps and regularly check account security settings to ensure fund safety.

Practical Tips

Selection Guide

When choosing a remittance app, consider the following factors:

- Security: Prioritize services with strong encryption and fraud protection. Check if the app has multi-factor authentication and compliance certifications.

- Delivery Speed: For urgent needs, choose apps offering delivery in minutes. Some services provide Express mode for emergencies.

- Fees and Exchange Rates: Compare fees and real-time rates across platforms. Many apps display detailed fees before transactions, helping you make informed choices.

- Delivery Methods: Choose bank accounts, cash pickups, or digital wallets based on the recipient’s situation. Platforms like Bitso support users without bank accounts, enhancing convenience.

- Language Support and Customer Service: Prioritize apps with Spanish-language support and multi-channel customer service to assist recipients.

Recommendation: Before sending, create a table to record each platform’s fees and delivery times, then choose the best tool based on the recipient’s needs.

Remittance Tips

You can follow these methods to reduce fees and optimize exchange rates:

- Combine multiple small transfers into one larger transaction, as many services charge lower fees for larger amounts.

- Explore fee-free options; some platforms offer loyalty programs or promotional activities for frequent users.

- Contact providers to negotiate better rates, especially for frequent or large transfers.

- Choose optimal transfer times to avoid peak periods, which may offer lower fees.

- Use only reputable apps to avoid transactions through unverified channels, ensuring fund safety.

- Compare exchange rates and fees across services to maximize the Mexican pesos received per dollar.

- For recipients without bank accounts, consider digital wallets or crypto platforms like Bitso, using USDC stablecoins for stable, fast transfers.

Tip: When sending money, verify recipient information and regularly check account security settings to avoid losses due to negligence.

You can use the table below to quickly compare the speed, fees, and exchange rate features of major apps, selecting the best remittance method for your needs:

| Service | Speed | Fees | Exchange Rate Features |

|---|---|---|---|

| PayPal | A few hours | $3 for transfers under $299.98 | More expensive rates |

| Xoom | A few minutes | $3 for transfers under $299.98 | Many pickup points, fast delivery |

| Wise | 2-5 days | Below $1, about 1% of amount | Mid-market rate |

| Skrill | A few minutes | Free | Competitive rates |

When sending money, focus on delivery speed, fees, and security. Choose regulated providers, enable two-factor authentication, and monitor transactions regularly. Plan transfers in advance and save frequent recipient information to make remittances more efficient and secure.

FAQ

Are remittance apps safe?

When using mainstream remittance apps, encryption and multi-factor authentication protect your funds and personal information. You can confidently send cross-border transfers.

How long does it take for funds to arrive?

With Express mode, funds typically arrive in minutes. In Economy mode, recipients receive USD within 3-5 days. Delivery speed depends on the provider and recipient method.

What identity verification materials are required?

During registration, you only need basic personal information. For transfers exceeding $1,000 USD, you’ll need to upload ID and proof of address. Some platforms may require a CURP card or biometric verification.

What if the recipient doesn’t have a bank account?

You can choose cash pickup or digital wallet delivery. Some apps allow recipients to collect cash at local Mexican points. Crypto platforms can also be used without a bank account.

How are remittance fees and exchange rates calculated?

Before submitting a transfer, you can view real-time fees and rates. Each platform displays a detailed fee structure. Compare services to select the best USD rate and lowest fees.

Remitting to Mexico via apps like PayPal, Xoom, and Remitly offers speed and convenience, but fees up to $4.99 and exchange rate volatility can erode the amount your recipient receives. For a more cost-effective and streamlined experience, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay outperforms traditional apps, and its real-time exchange rate tool lets you secure the best USD-to-MXN rates, ensuring recipients get maximum value.

BiyaPay supports seamless fiat-to-crypto conversions across numerous countries, including Mexico, with quick registration and same-day transfers. Plus, you can trade stocks in US and Hong Kong markets without an overseas account, with zero fees on contract orders. Sign up for BiyaPay today to unlock secure, affordable global remittances and investments, making your cross-border financial management smarter and more efficient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.