- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Convert US Dollars in a GCash Account to Philippine Pesos and Enjoy a Fast and Economical Remittance Experience

Image Source: pexels

You can directly convert USD to Philippine Pesos from the USD balance page in your GCash account using the app’s exchange feature. GCash allows you to perform this operation without needing a bank account, with a simple process, transparent fees, and no hidden charges.

Many users choose GCash for international remittances for the following reasons:

- You can receive overseas funds through various methods, such as direct transfers and fund requests

- User-friendly interface and convenient operation

- Quick registration process with low entry barriers

Key Points

- Converting USD to PHP in GCash is simple, requires no bank account, and offers transparent fees.

- Ensure you complete account verification by uploading valid identification to secure your funds.

- Check real-time exchange rate information to choose the best conversion timing and avoid hidden fees.

- Select an appropriate withdrawal method, as GCash supports multiple channels for easy fund access.

- Stay updated on GCash promotions to take advantage of zero transfer fees and promo codes to save more.

Preparation for Conversion

Before converting USD to PHP in your GCash account, you need to complete several important steps. This ensures a smooth conversion process and secure funds.

Account Verification

You must complete GCash account verification. GCash requires you to upload a valid Philippine government-issued ID, such as a passport, driver’s license, or UMID. You need to be at least 18 years old and possess a physical ID. GCash does not accept scanned copies or photocopies. The table below summarizes the official verification requirements:

| ID Type | Requirements |

|---|---|

| Validity | ID must be within its validity period and not expired |

| Condition | ID must be clear and in good condition |

| Physical ID | A physical ID is required; scanned copies or photocopies are not accepted |

As a digital currency platform, GCash must comply with the regulations of the Bangko Sentral ng Pilipinas (BSP) and the Anti-Money Laundering Act (AMLA). The platform implements strict Know Your Customer (KYC) and Customer Due Diligence (CDD) processes to ensure your account’s security.

Binding Method

You need to bind a valid international phone number. GCash supports phone numbers from multiple regions, as long as you reside in a GCash-supported area. You also need to ensure your account is fully verified to use the currency conversion feature. GCash requires you to provide accurate information to ensure compliant fund flows. The platform periodically submits reports to regulatory authorities to ensure transparency and accountability.

Tip: If you are using GCash in Mainland China, confirm in advance whether your phone number supports GCash services.

Balance Check

Before converting, you can directly check the USD balance in your GCash account. GCash has no minimum balance requirement, allowing you to convert based on your actual needs.

- You don’t need to worry about balance restrictions.

- As long as your account has a USD balance, you can initiate a conversion at any time.

The USD conversion feature in GCash is highly convenient for users with frequent international remittances. You can flexibly manage funds without complicated operations.

USD to PHP Conversion Process in GCash

Image Source: unsplash

In-App Conversion

You can complete the USD to PHP conversion directly within the GCash app. The process is straightforward and does not require a bank account. Simply follow these steps:

- Select the USD amount you want to convert.

- Enter the recipient’s GCash account details, including name, account number, address, and phone number.

- Choose the payment method, verify the information, and complete the conversion.

The USD conversion feature in GCash allows you to manage funds anytime without cumbersome procedures. You can easily operate from Mainland China or other GCash-supported regions. The platform’s interface is clear, with straightforward guidance suitable for all users.

Tip: You can preview fees and the amount received before converting to ensure every transaction is clear and transparent.

Exchange Rate Confirmation

GCash displays the real-time USD to PHP exchange rate during the conversion process. You can view the latest rate directly in the app, helping you choose the optimal conversion timing. The platform regularly updates exchange rates to ensure you get the most accurate conversion price.

| Evidence Content | Description |

|---|---|

| GCash provides real-time updated exchange rates | You can access the latest rate information during the transaction, ensuring transparent pricing. |

| GCash regularly updates its conversion rates | Rates reflect the latest market changes, maximizing the value of your funds during conversion. |

| GCash offers real-time rate information | You can flexibly decide conversion timing based on rate fluctuations, improving fund management efficiency. |

You don’t need to worry about delayed rates or hidden fees. The USD to PHP conversion process in GCash remains open and transparent, with all fees and rates displayed in USD.

Conversion Completion

After completing the conversion, GCash immediately deposits the Philippine Pesos into the designated account. The process requires no bank review or additional intermediaries. You can check the transaction history in the app to confirm the funds’ arrival.

The USD conversion process in GCash supports real-time transfers, typically completing within minutes. You can withdraw funds or use them for local spending, with efficient and convenient fund flows. The platform does not charge hidden fees, and all service fees are clearly displayed before the transaction.

Friendly Reminder: After completing the conversion, check your account balance and transaction details promptly to ensure fund security.

Partner Service Conversion

Service Selection

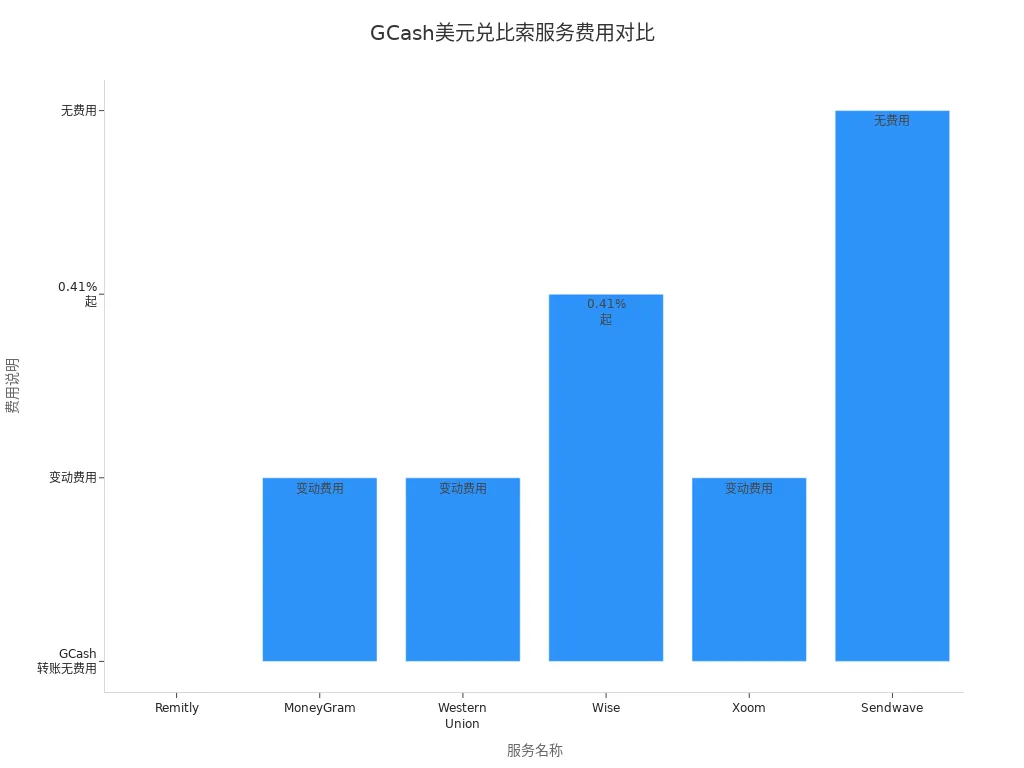

You can use the USD in your GCash account to convert through multiple international partner services. Each service provider offers different fees, exchange rates, and delivery speeds. The table below summarizes the features of mainstream partner services to help you compare quickly:

| Service Name | Fees | Exchange Rate | Delivery Speed |

|---|---|---|---|

| Remitly | Variable - No fees for GCash transfers | Rate includes markup | Depends on express or economy transfer |

| MoneyGram | Variable fees based on selected service | Rate includes variable markup | Depends on selected service |

| Western Union | Variable fees based on selected service | Rate includes variable markup | Depends on selected service |

| Wise | Low transfer fees starting at 0.41% | Mid-market rate | Transfers can be fast or instant |

| Xoom | Variable fees based on payment method | Rate includes markup | Payments may arrive in minutes |

| Sendwave | No fees for transfers to the Philippines | Rate includes markup | GCash payments arrive in minutes |

You can choose a service provider based on your needs, prioritizing low fees, fast delivery, or better exchange rates. It’s recommended to compare real-time information from each service before converting.

Account Linking

You need to link an external account to GCash to complete conversions smoothly. The linking process is simple; follow these steps:

- In the GCash app, click “Cash In”

- Select “Global Banks and Partners”

- Choose “USA” from the international bank list

- Read the instructions and click “Cash In”

- Enter your U.S. phone number and verify

- Enter the 6-digit verification code received

- Input the USD amount to deposit and proceed

- Fill in personal information

- Enter your full address and postal code

- Review transaction details and link the bank account

After linking, you can directly use the USD in your GCash account for conversions without additional procedures.

Fund Withdrawal

After conversion, funds are automatically transferred to your GCash Peso account. You can choose to withdraw to a local bank account or use them for local spending in the Philippines. Most partner services support arrivals within minutes, greatly improving fund flow efficiency. You don’t need to wait for bank reviews or worry about hidden fees. GCash displays all transaction details in the app, allowing you to check anytime.

Fees and Exchange Rates

Image Source: unsplash

Transparent Fees

When using GCash for conversions, you can clearly see all fees and exchange rate information. GCash displays the applicable rate and service fees before you confirm the transaction. You can preview the exact amount the recipient will receive, avoiding any misunderstandings.

You don’t need to worry about unexpected additional fees. GCash maintains fee transparency, with all amounts displayed in USD.

You can enjoy the same transparent experience in Mainland China or other GCash-supported regions.

Exchange Rate Advantage

GCash provides real-time updated USD to PHP exchange rates. You can view the latest rates on the conversion page at any time, allowing you to choose the best conversion timing.

- Rate information is displayed directly, making it easy to compare conversion values at different times.

- USD in your GCash account can be converted flexibly without waiting for bank reviews.

USD received from the U.S. market can be quickly converted to PHP, ensuring efficient fund flows.

| Rate Display Method | Advantage Description |

|---|---|

| Real-Time Rates | You get the latest prices |

| Transparent Display | Conversion amounts are clear at a glance |

Avoiding Hidden Fees

GCash does not charge any hidden fees. You can see all fee details before each transaction.

- You can convert with confidence, without worrying about subsequent deductions.

- GCash clearly lists all service fees and exchange rates in the app, ensuring your fund security.

When withdrawing to licensed Hong Kong banks, you can enjoy the same transparent policy. GCash makes international remittances simple and reliable.

Fund Arrival

Withdrawal Methods

After converting USD to PHP in your GCash account, you can choose from multiple withdrawal methods. GCash offers flexible fund withdrawal channels, allowing you to access funds based on your needs. The table below summarizes common withdrawal methods and their descriptions:

| Withdrawal Method | Description |

|---|---|

| Partner Outlets | You can generate a cash-out barcode in the app and withdraw cash at GCash partner outlets (e.g., Palawan Pawnshop, Villarica Pawnshop). |

| ATM Withdrawal | With a GCash Mastercard, you can withdraw cash directly at Mastercard-supported ATMs. |

| Linked Bank Account | You can transfer GCash balance to a linked bank account and withdraw via bank ATM or counter. |

You can choose the most suitable withdrawal method based on your situation. If you’re in Mainland China or other GCash-supported regions, consider linking a licensed Hong Kong bank account for fund transfers to enhance flexibility and security.

Friendly Reminder: Each withdrawal method may have different fees and limits; carefully read the relevant instructions in the GCash app before proceeding.

Arrival Speed

The arrival speed varies depending on the withdrawal method chosen. GCash partner outlets typically support cash arrivals within minutes, ideal for urgent cash needs. Using a GCash Mastercard for ATM withdrawals results in real-time fund access, which is convenient and fast. Transfers to linked bank accounts depend on the bank’s processing speed, typically completing within 1 business day for licensed Hong Kong bank accounts.

- Partner Outlets: Arrives within minutes, suitable for urgent withdrawals.

- ATM Withdrawal: Real-time arrival, convenient and quick.

- Linked Bank Account: Typically arrives within 1 business day, ideal for large-amount fund management.

You can track withdrawal progress and history in the GCash app to ensure fund security. Choose withdrawal channels based on your fund needs and arrival speed to optimize efficiency.

Conversion Advantages and Tips

Channel Selection

When choosing GCash to convert USD to PHP, you can enjoy multiple unique advantages. GCash provides a convenient and secure currency conversion method, eliminating the need to visit physical exchange points. You can complete the process directly on your phone, saving significant time. GCash’s exchange rates are generally more competitive than traditional banks, helping you achieve higher conversion value. Low transaction fees allow you to save more funds. You can also flexibly withdraw cash at over 20,000 partner outlets, greatly enhancing convenience. GCash employs high-level security and anti-fraud measures to ensure your fund safety.

Mobile wallet channels are increasingly popular for remittances in the Philippines. As a leading mobile wallet, GCash is the preferred choice for many users due to its speed, convenience, and low fees. You can refer to the table below to understand the advantages and disadvantages of different channels:

| Method | Advantages | Disadvantages |

|---|---|---|

| Remittance Services | No cash-in fees, suitable for overseas users sending funds | May take time to arrive |

| Traditional Bank Transfer | Convenient, widely used | Higher fees, less favorable rates |

| Other Cash-In Methods | May have free options | May incur fees |

Before converting, you can compare GCash and traditional bank exchange rates. GCash typically offers better rates, especially in reducing indirect costs. Since exchange rates fluctuate daily, confirm the latest rate information before transacting.

Promotions

GCash frequently collaborates with international remittance services to offer various promotions. When using GCash as a receiving wallet during specific periods, you may enjoy zero transfer fees or earn additional points. For example, sending funds to GCash via #BCRemit offers zero transfer fees. Some partners also provide promo codes to further reduce costs. These promotions are typically aimed at users in the UK and Canada and have time restrictions. Check the latest promotion details in the GCash app before converting to seize savings opportunities.

Friendly Reminder: When participating in promotions, carefully read the rules to ensure eligibility and avoid missing out due to regional or time restrictions.

Common Issues

When using GCash to convert USD to PHP, you may encounter some common issues. Account verification issues are common, so prepare valid identification in advance. Disputes or refund requests may occasionally arise during transactions. Delays may occur during cash-in or cash-out operations. Technical glitches or app errors may also affect your experience.

You can minimize issues by:

- Confirming your account is fully verified

- Checking balance and rates before transacting

- Keeping transaction records for future reference

- Contacting customer service promptly for technical issues

With proper preparation, you can smoothly complete conversions and enjoy GCash’s efficient experience.

When converting USD to PHP in your GCash account, you can enjoy convenient operations, real-time rates, and no hidden fees. Pay attention to account security and follow these suggestions:

- Use a non-jailbroken or non-rooted device to access the GCash app

- Disable “unknown sources” installations to prevent malware

- Turn off developer options to reduce risks

You should also note:

- Current conversions have no additional fees, with amounts directly converted

- Exchange rates fluctuate with the market, so regularly check the latest information in the GCash app

| Update Content | Date |

|---|---|

| GCash Conversion Policy Adjustment | November 7, 2023 |

Choosing the right conversion method allows you to enjoy an efficient and cost-effective remittance experience.

FAQ

How do I confirm my GCash account is fully verified?

You can check your account status in the GCash app. If it shows “Fully Verified,” your account is fully verified. You need to upload a valid ID, and the system will automatically review it.

What fees does GCash charge for USD conversions?

You can see all service fees and rate information before converting. GCash does not charge hidden fees. All amounts are displayed in USD, with transparent fees.

How long does it take for funds to arrive after conversion?

After completing the conversion, funds typically arrive within minutes. You can check transaction records in the GCash app to confirm the Peso balance change.

Can I withdraw converted Pesos to a licensed Hong Kong bank?

You can transfer GCash Peso balance to a linked licensed Hong Kong bank account. Arrival time is generally 1 business day, depending on the bank’s processing speed.

What should I do if I encounter technical issues during conversion?

You can first restart the GCash app. If the issue persists, contact GCash customer service with transaction records and account details for assistance.

While GCash offers a convenient way to convert USD to PHP, partner providers’ exchange markups and variable fees (like Remitly’s hidden spreads) can reduce received amounts, especially with the Philippines’ projected $41.21 billion remittances in 2025, where high costs and delays frustrate users. For a faster, more cost-effective solution, choose BiyaPay. With transfer fees as low as 0.5%, BiyaPay outperforms traditional options, ensuring recipients get maximum value with full transparency.

BiyaPay covers most countries, including the Philippines, with quick registration and same-day transfers, no complex verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, with zero fees on contract orders. Sign up now and use the real-time exchange rate tool to track USD/PHP (around 57.5 today), transforming your cross-border remittances into a secure, efficient experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.