- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Best Way to Remit Money to El Salvador: Comparing Costs, Speed, and Security

Image Source: unsplash

If you need to remit to El Salvador, Wise is often the best choice due to its low fees and fast transfers. Western Union and MoneyGram are suitable for recipients needing cash pickup. Remitly and Paysend are also practical in specific scenarios. You should focus on fees, speed, and security to help choose the best method. Data shows that in 2023, El Salvador received remittances totaling 8.182 billion USD:

| Year | Remittance Amount (USD) |

|---|---|

| 2023 | 8.182 billion |

Key Points

- Choosing Wise for remittances typically offers low fees and fast transfers, ideal for cost-conscious users.

- Western Union and MoneyGram are suitable for cash pickup scenarios but have relatively higher fees.

- Using third-party platforms like Remitly and Paysend provides transparent fees and fast transfers, suitable for frequent remittances.

- Cryptocurrency remittances are fast but require attention to high costs and security risks, ideal for users prioritizing speed.

- When choosing a remittance method, always consider fees, speed, and security to ensure the service best meets your needs.

Fee Comparison

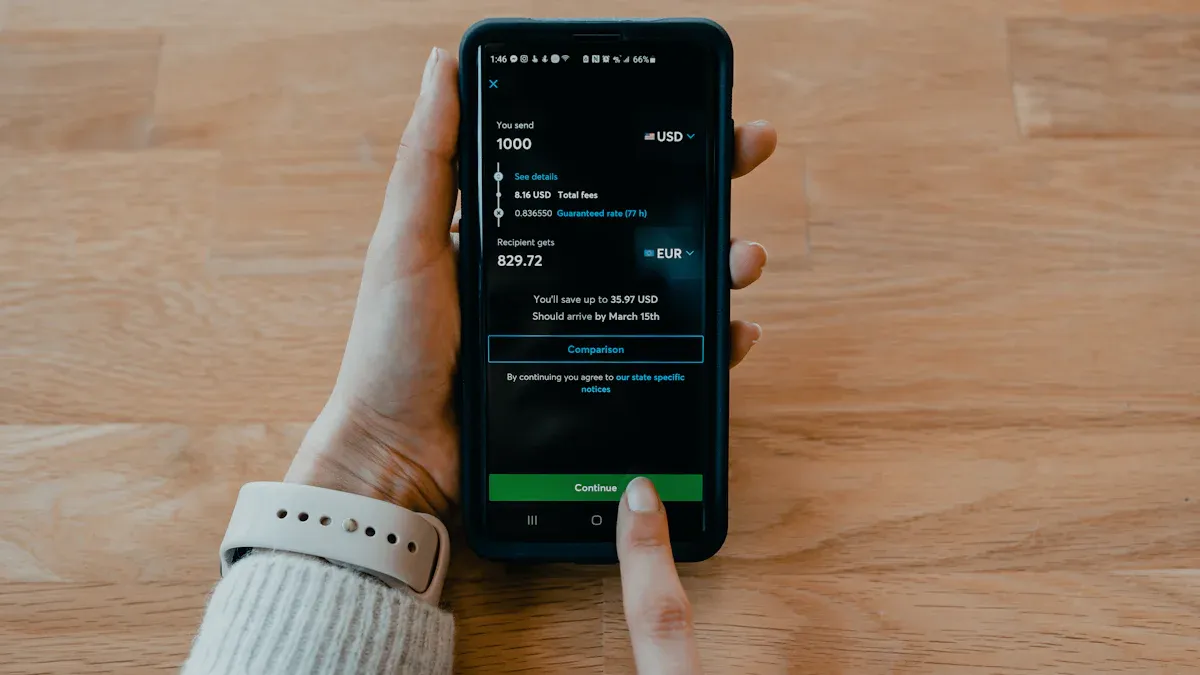

Image Source: pexels

Bank Transfer Fees

If you choose to remit to El Salvador through a bank, you will typically face high service fees and non-transparent exchange rates. Licensed Hong Kong banks often add a markup to the mid-market exchange rate, reducing the amount received by the recipient. You can refer to the table below to understand the exchange rate differences across services:

| Bank/Service | Exchange Rate Type | Notes |

|---|---|---|

| Licensed Hong Kong Banks | May be higher than mid-market rate | Traditional banks often add a markup, reducing the amount received by the recipient. |

| Dedicated Remittance Services | Closer to mid-market rate | Offer more competitive rates, potentially benefiting the recipient. |

Banks also charge fixed fees, typically between 15-30 USD. If the remittance amount is small, the fee proportion will be higher. Bank transfers are suitable for large amounts with high security requirements, but the fees are not cost-friendly.

Third-Party Platform Fees

Third-party platforms like Wise, Paysend, and Remitly have more transparent fee structures. You can see all fees and exchange rates before remitting. The main fee characteristics of these platforms are:

- Fee structures vary depending on the transfer method and service provider.

- Competition helps lower costs.

- Actual fees depend on the payment method and how funds are received (e.g., bank deposit or cash pickup).

- Sending 200 USD to Latin America and the Caribbean costs about 3.5%, but paying in USD can reduce it to 3% or lower.

- Exchange rate differences exist between companies but are generally close to major financial institutions’ rates.

- Market competition and transparency are driving an overall decline in fees.

If you prioritize low fees and transparency, third-party platforms are one of the best options.

Cryptocurrency Costs

Cryptocurrency remittances may seem convenient, but the actual costs are not low. When using cryptocurrencies like Bitcoin for remittances, fees are affected by network congestion and platform choice:

| Influencing Factor | Description |

|---|---|

| Network Congestion | During high transaction volumes, network congestion leads to delays and increased transaction fees. |

| Platform Choice | Different platforms have varying fee structures and processing speeds, affecting the final remittance cost. |

- Network fees fluctuate based on network congestion.

- Different platforms’ fee structures can lead to variations in remittance costs.

In El Salvador, using Bitcoin ATMs incurs up to 5% sales fees, with overall costs nearly double those of traditional methods. When considering cryptocurrencies, you need to weigh their flexibility against high costs.

Other Method Fees

Cash pickup services like Western Union and MoneyGram have flexible fees but are typically higher than digital transfers. You can refer to the table below for fee information across services:

| Service Provider | Fee Information |

|---|---|

| Western Union | Fees depend on the specific amount, payment method, delivery method, and pickup location. |

| MoneyGram | Fees vary based on transaction details and may include currency exchange rates. |

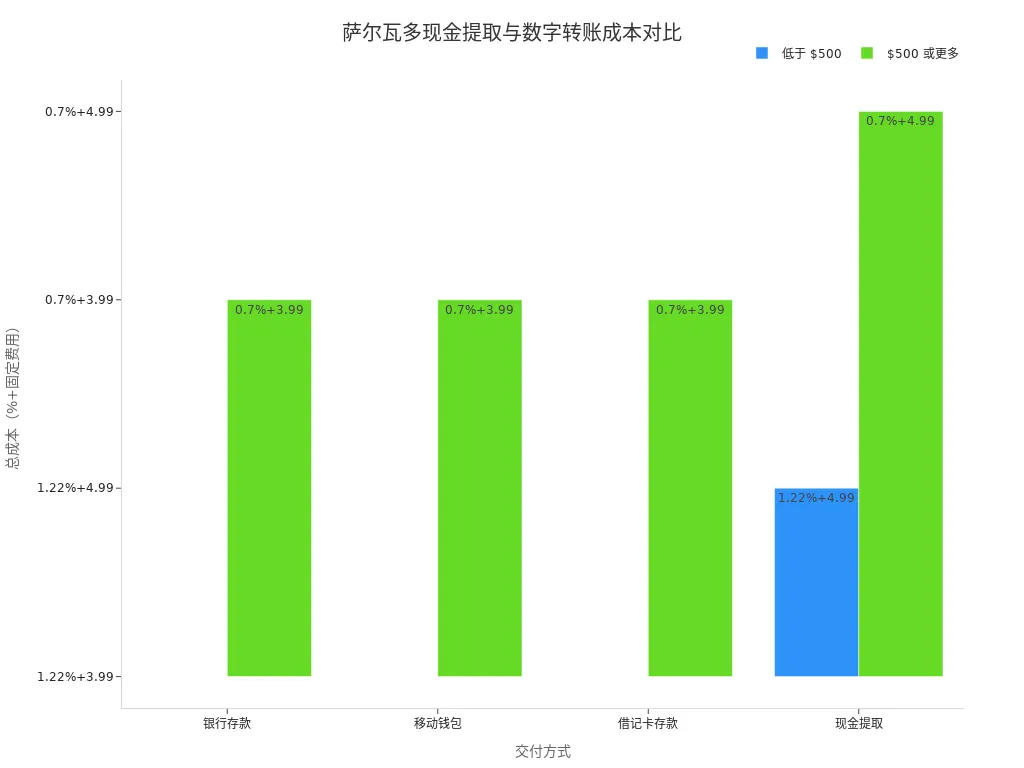

The total costs for cash pickup services are shown in the table below:

| Delivery Method | Below $500 | $500 or More |

|---|---|---|

| Bank Deposit | 1.22% of the amount + $3.99 | 0.7% of the amount + $3.99 |

| Mobile Wallet | 1.22% of the amount + $3.99 | 0.7% of the amount + $3.99 |

| Debit Card Deposit | 1.22% of the amount + $3.99 | 0.7% of the amount + $3.99 |

| Cash Pickup | 1.22% of the amount + $4.99 | 0.7% of the amount + $4.99 |

If the recipient needs cash, Western Union and MoneyGram are common choices, but fees are slightly higher. You can choose the best method based on your needs, considering fees, delivery method, and convenience.

Speed Comparison

Image Source: unsplash

Bank Transfer Speed

If you remit to El Salvador through licensed Hong Kong banks, the transfer speed is typically slower. Bank systems require multiple reviews and international clearing processes. Generally, the processing time is 0-1 banking business day. You can refer to the table below for specific transfer times:

| Country | Currency | Processing Time |

|---|---|---|

| El Salvador | USD | 0-1 banking business day |

Bank transfers are suitable for high-security, large-amount scenarios. If you need funds to arrive quickly, bank channels may not be the best choice.

Third-Party Platform Speed

Third-party platforms like Wise and Paysend excel in transfer speed. You can complete remittances in minutes to 15 minutes, far faster than traditional banks. The table below shows the delivery times of major platforms:

| Platform | Delivery Time |

|---|---|

| Paysend | Typically arrives within minutes |

| Wise | Fastest transfers in as little as 15 minutes |

Western Union and MoneyGram are also suitable for cash pickup, typically available the same day. Remitly offers multiple receiving methods, allowing you to flexibly choose transfer speed based on the recipient’s needs. If you need fast transfers, third-party platforms are one of the best options.

Cryptocurrency Speed

Cryptocurrency remittances are extremely fast. You can use blockchain technology for peer-to-peer transfers without intermediaries, significantly reducing processing time. The transfer speeds for different cryptocurrencies are shown below:

| Cryptocurrency Type | Remittance Speed | Traditional Bank Transfer Speed |

|---|---|---|

| General Cryptocurrency | A few minutes | 1 to 5 business days |

| Ethereum | Average less than 5 minutes | - |

| Bitcoin Lightning Network | Millisecond-level micropayments | - |

| Latin American Users | 65% report cryptocurrency is faster | - |

| Southeast Asian Users | 76% prefer cryptocurrency speed | - |

- Cryptocurrency transactions have no intermediaries, resulting in faster processing times.

- Blockchain technology enables efficient transfers, with costs as low as 0.01% to 0.10% of the total amount.

If you prioritize extreme speed, you can consider cryptocurrencies, but you need to pay attention to platform choice and security.

Factors Affecting Transfer Speed

Transfer speed depends not only on the remittance method but also on various factors:

- Local bank operating hours, holidays, or weekends can cause delays.

- The payment method you choose affects transfer speed.

- Some platforms, like Ria, may require additional information for security reviews, leading to delays.

When choosing the best method, you need to combine transfer speed with your actual needs and flexibly adjust remittance channels.

Security Comparison

Bank Transfer Security

If you choose licensed Hong Kong banks for international remittances, security is typically high. Banks use multiple identity verification and anti-money laundering measures to ensure funds are transferred legally. Bank systems have strict risk control mechanisms to effectively prevent account theft. When submitting a remittance application, banks require clear identity documents and proof of address. You can prepare your passport and recent bills in advance to ensure smooth verification. Although the bank’s review process is rigorous, it maximizes the security of your funds.

Third-Party Platform Security

If you use third-party platforms like Wise, Remitly, or Western Union, security is equally reliable. These platforms have robust risk control systems and user protection mechanisms. They monitor transactions in real-time and freeze accounts promptly upon detecting anomalies. During registration and remittance, platforms require verification of all information to ensure identity authenticity. You can speed up verification by clearly photographing identity documents. Platforms also retain transaction records for easy future inquiries and dispute resolution.

Cryptocurrency Security

If you consider cryptocurrency remittances, you need to pay special attention to security risks. While cryptocurrencies offer fast transfers, they face issues like market volatility, regulatory challenges, and high-risk fraud. You may encounter complex deposit and withdrawal processes, high fees, and incomplete KYC policies. The table below summarizes the main risks:

| Risk Type | Description |

|---|---|

| Market Volatility | Cryptocurrency prices fluctuate sharply, potentially leading to fund losses. |

| Regulatory Challenges | Lack of regulation may affect financial stability. |

| Price Stability Risk | Default or debt repayment issues may impact price stability. |

You can enhance remittance security by following AML/KYC policies, customer due diligence, and real-time transaction monitoring. Platforms should use encryption technology and incident response plans to ensure the safety of digital assets.

Preventing Remittance Scams

When choosing the best method, you must stay vigilant against various remittance scams. Common scam types include:

- Romance Scams: Scammers build fake relationships on social platforms to extort money or information.

- Fake Customer Service Scams: Impersonating remittance service customer support to obtain personal or payment details.

- Transfer Scams: Asking you to receive and forward funds, potentially involving illegal activities.

- Prepayment Scams: Requiring a small upfront fee to unlock a larger amount.

- Phishing Scams: Stealing login credentials or payment information through fake websites.

You can take the following measures to verify platform legitimacy:

- Use a passport as identity proof to speed up verification.

- Ensure documents are clear and readable when photographed.

- Verify all information matches your documents when filling out forms.

- Prepare proof of address, such as a recent bill.

- Wait patiently for verification results after submission.

By combining security measures and platform verification processes, you can effectively reduce remittance risks and ensure fund safety.

Recommendations for Choosing the Best Method

Prioritizing Low Fees

If you want to minimize remittance costs, you can prioritize Paysend and Chivo Wallet. Paysend charges only 1.99 USD for remittances from the U.S. to El Salvador, with the first transfer often fee-free. Chivo Wallet, launched by the El Salvador government, supports near-zero-fee international transfers, with funds arriving almost instantly. You can send funds directly to a Chivo Wallet account, avoiding high fees and exchange rate losses.

Tip: When choosing the best method, always check the platform’s latest fee policies in advance to ensure actual costs meet expectations.

- Paysend is suitable for frequent small remittances, with low fees and fast transfers.

- Chivo Wallet is ideal if the recipient has a local account, with nearly no fees.

- For small remittance amounts, third-party platforms are generally more cost-effective than licensed Hong Kong banks.

Prioritizing Speed

If you urgently need funds to arrive, you can choose Remitly, Paysend, or cash pickup services. Remitly offers flexible payment methods, including debit and credit cards, with total fees and delivery times clearly displayed before remitting. Paysend typically delivers the same day, while cash pickup services like BOSS Money and ACE Money Transfer allow withdrawals within minutes, ideal for recipients without bank accounts.

The table below compares the speed and pros/cons of common remittance methods:

| Remittance Option | Advantages | Disadvantages |

|---|---|---|

| Remitly | Fast, cost-effective, secure | Fees and delivery times vary by payment method |

| Paysend | Same-day delivery, low fees | Requires recipient to have a bank account |

| BOSS Money | Cash available in minutes | Fee information needs prior checking |

| ACE Money Transfer | Convenient cash pickup | Suitable for recipients without bank accounts |

If you prioritize transfer speed, cash pickup services or Remitly are ideal. When choosing the best method, you need to balance speed and fees.

Prioritizing Security

If you prioritize fund security, you can choose licensed Hong Kong banks or government-supported platforms. Licensed Hong Kong banks use multiple identity verification and anti-money laundering measures to ensure fund safety. Chivo Wallet and Transfer365, modern payment systems, also offer high security, providing 24/7 instant remittances and various interbank transfer types.

Note: When choosing the best method, prioritize registered, regulated remittance providers to avoid fund loss risks.

- Licensed Hong Kong banks are suitable for large remittances and scenarios with high security requirements.

- Chivo Wallet relies on fiat currency, reducing conversion barriers and offering high security.

- Transfer365 automates clearing, enhancing transaction transparency and security.

You can further enhance remittance security by understanding the platform’s regulatory information and user protection measures.

Scenario-Based Choices

You can flexibly choose the best method for different scenarios:

- Large Remittances: Licensed Hong Kong banks and Transfer365 are more secure, suitable for one-time large transfers.

- Frequent Remittances: Paysend offers low fees and fast transfers, ideal for regular transfers.

- Cash Pickup: Western Union, MoneyGram, BOSS Money, and ACE Money Transfer support cash withdrawals, suitable for recipients without bank accounts.

- Government-Supported Scenarios: Chivo Wallet has nearly no fees, ideal for recipients with local accounts.

The table below summarizes recommended remittance methods for different scenarios:

| Scenario | Recommended Method | Main Advantages |

|---|---|---|

| Large Remittances | Licensed Hong Kong Banks, Transfer365 | High security |

| Frequent Remittances | Paysend | Low fees, fast transfers |

| Cash Pickup | Western Union, MoneyGram, BOSS Money, ACE Money Transfer | Convenient withdrawals |

| Government-Supported | Chivo Wallet | Zero fees, instant transfers |

You can choose the best method based on your actual needs, considering fees, speed, and security. Before each remittance, it’s recommended to recheck platform policies and recipient needs to ensure fund safety and timely delivery.

When choosing a remittance method to El Salvador, you can follow these steps:

- Clarify your needs, determining whether fees, speed, or security is most important.

- Compare fees and delivery times across platforms.

- Verify platform credentials to ensure fund safety.

- Pay attention to the accuracy of entered information to prevent remittance risks.

You can flexibly choose based on your situation to enhance remittance efficiency and security.

FAQ

How to Choose the Most Suitable Platform for Remitting to El Salvador?

You should first identify your needs, such as fees, transfer speed, or security. Then compare fees and delivery times across platforms. It’s recommended to prioritize regulated, legitimate platforms.

What Basic Documents Are Needed for Remitting to El Salvador?

You typically need to provide valid identification (e.g., passport) and recipient information. Some platforms may also require proof of address. Preparing these documents in advance can speed up verification.

Are There Limits on Remittance Amounts?

Most platforms impose caps on single or daily remittance amounts. You can check specific limits on the platform’s official website. For large remittances, licensed Hong Kong banks offer higher security.

How Long Does It Take for a Remittance to Arrive?

Delivery time depends on the platform and payment method. Wise and Paysend can deliver in minutes, while bank channels typically take 0-1 business day. Cash pickup services are usually available the same day.

How to Prevent Remittance Scams?

You should verify platform credentials and avoid operating through unfamiliar links. Do not disclose personal information casually. If you encounter suspicious situations, promptly contact platform customer service or relevant regulatory authorities.

When remitting to El Salvador, Wise stands out for low fees and swift delivery, but Western Union and MoneyGram’s cash pickup ease comes with 3-5% exchange markups and costs like 1.22% plus fixed fees, particularly as El Salvador’s remittances are projected to exceed $8.2 billion in 2025, where traditional channels’ hidden losses and verification delays heighten frustrations. For a more affordable, secure cross-border option, opt for BiyaPay. With transfer fees as low as 0.5%, BiyaPay undercuts market averages, delivering maximum value to recipients with full transparency and no hidden charges.

BiyaPay serves most countries and regions, including El Salvador, with registration in minutes and same-day processing, skipping cumbersome checks. Plus, invest in stocks across US and Hong Kong markets without an overseas account, enjoying zero fees on contract orders. Sign up today and harness the real-time exchange rate tool to secure USD/SVC (around 8.75 now), elevating your remittances to a streamlined, trustworthy global finance solution.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.