- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Easily Track Remittance Status and Understand Its Fees and Security by Logging into Remitly

Image Source: unsplash

By logging in to Remitly, you can keep track of your remittance progress at any time. The system clearly displays the status and related fees for each transaction. You can also learn about the multiple security measures the platform takes to ensure the safety of your funds. This way, managing your remittance process becomes more efficient and reassuring.

Key Points

- After logging in to Remitly, you can track the status of each remittance in real-time, ensuring the safety and transparency of your funds.

- Use Remitly’s price calculator to understand transaction fees and exchange rates in advance, avoiding hidden costs.

- The platform provides multiple security measures, including identity verification and data encryption, to protect your personal information and funds.

Logging in to Remitly and Tracking Remittances

Image Source: unsplash

Login Steps

You can log in to your Remitly account via the Remitly website or mobile app. First, open the official Remitly website or download the official app. Enter your registered email and password. If you forget your password, you can click the “Forgot Password” option and follow the prompts to reset it. Ensure the information you enter is accurate. Maintain a stable internet connection to log in smoothly. If your account is locked or inaccessible, it’s recommended to contact Remitly’s customer service promptly.

Common login issues include:

- Forgotten password

- Restricted account access

- Security lock

- Unstable network

- Using an outdated app or website

You can resolve most issues by updating the app, checking your network, or resetting your password.

Remittance Status Inquiry

After logging in to Remitly, you’ll access your personal dashboard. Here, you can view all remittance records and current transaction statuses. Each remittance has a unique tracking number. You can use this number to monitor the progress of your funds in real-time. The dashboard displays detailed statuses for each transaction, such as “Processing,” “Sent,” or “Received.” If you have multiple remittances, Remitly supports simultaneous tracking, making it convenient to manage multiple transfers.

Remitly’s dashboard is designed intuitively. You can easily find historical records and current transactions. For users frequently sending money to licensed banks in Hong Kong or other regions, this multi-transaction management feature is highly practical. Simply click on a transaction to view detailed progress and related information.

Reference Number and Notifications

Each remittance generates a unique reference number. Both you and the recipient can use this number to track the transaction status. The reference number not only ensures the uniqueness of each transfer but also enhances fund security. Different transfer methods have distinct reference numbers, making it easier to differentiate and manage them.

| Evidence Point | Description |

|---|---|

| Uniqueness | Remitly’s reference number is unique for each transaction, ensuring the individuality of each transfer. |

| Tracking Function | The reference number is used to track transfers, helping senders and recipients confirm transaction status. |

| Security | Each transfer method has a specific reference number, increasing security and convenience. |

You’ll also receive various notifications to keep you updated on remittance progress. Remitly sends notifications via email and SMS, covering key milestones like transfer initiation, funds in transit, and recipient receipt. This way, you can stay informed about your funds’ status without frequently logging in to Remitly.

Tip: If you don’t receive notifications, check your email spam folder or SMS blocking settings to ensure smooth communication.

Fee Types

Transaction Fees

When using Remitly for remittances, you’ll encounter different transaction fees. Fees vary based on the transfer corridor, receipt method, and payment method. The table below shows the common fee structure for transfers from the US to the Philippines:

| Transfer Corridor | Fee Type | Fee Amount (USD) |

|---|---|---|

| US to Philippines (USD to USD) | Bank/Debit Card Deposit | $17.99 (0.75% + $2.99) |

| US to Philippines (USD to PHP) | Bank/Debit Card Deposit | $1.99 |

| US to Philippines (USD to PHP) | Cash Pickup/Home Delivery | $4.99 |

| US to Philippines (USD to PHP) | Cash Pickup | 1.25% |

| US to Philippines (USD to PHP) | Mobile Wallet | No additional fees |

You’ll notice that fees vary depending on the receipt method. Remitly’s fee structure is more transparent than Western Union’s, and Wise’s fees are also relatively clear. The table below compares the fee structures of three major remittance services:

| Service | Transfer Fee Structure | Exchange Rate Markup |

|---|---|---|

| Remitly | Transparent fee structure based on transfer amount, location, receipt method, and payment method | 1-2% |

| Western Union | Complex and opaque fee structure, depending on transfer method and destination | 2-4% |

| Wise | Clear and easy-to-understand fee structure | 0.5% - 3.0% |

Exchange Rates

When sending money, you need to consider exchange rates in addition to transaction fees. Remitly’s exchange rates are typically 1% to 3% higher than the mid-market rate.

- Remitly’s average exchange rate markup is usually between 1% and 3%.

- The markup varies depending on the transfer method and destination country.

- In some cases, the markup may reach 2% to 3%.

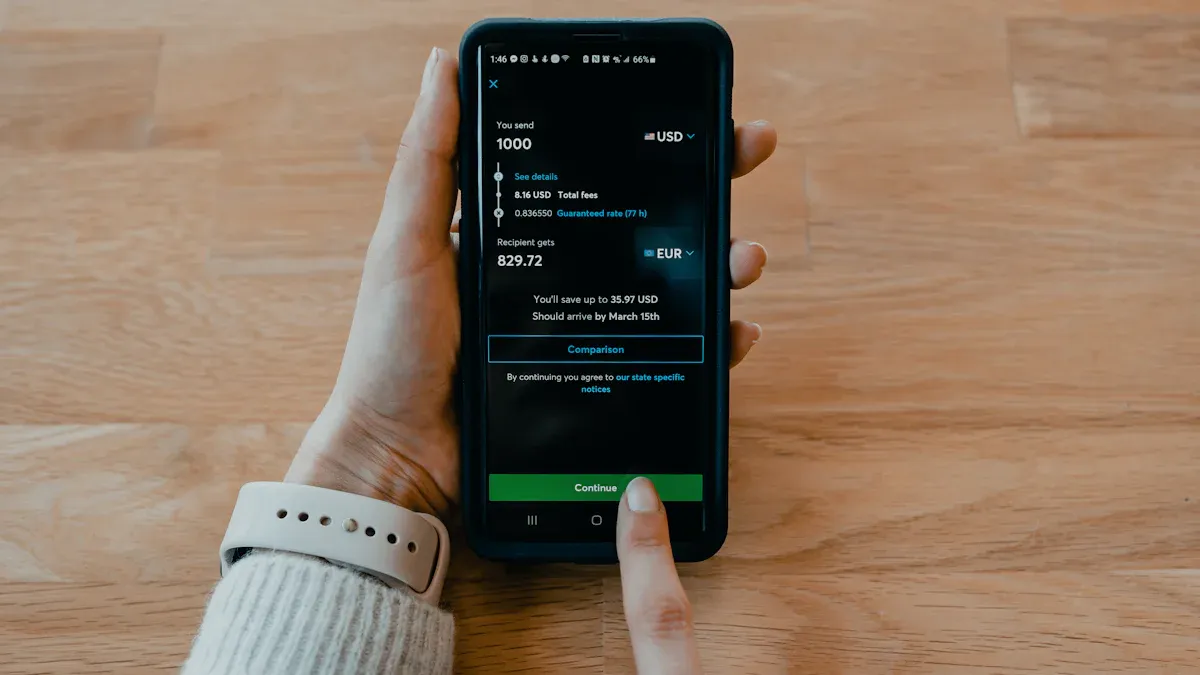

You can use Remitly’s price calculator before sending money to preview estimated exchange rates and fees.

Other Fees

In addition to transaction fees and exchange rate markups, you may encounter other fees. Some receiving banks (such as licensed banks in Hong Kong) may charge additional incoming fees or currency conversion fees. The table below lists common additional fee types:

| Fee Type | Description |

|---|---|

| Hidden Fees | Remitly’s main fees are embedded in its exchange rates, which may increase transfer costs. |

| Bank Fees | Some banks charge exchange rate spreads during currency conversion, contributing to transfer costs. |

| Exchange Rate Markup | Remitly’s exchange rates may include a markup on the mid-market rate. |

You can consult the receiving bank before sending money to confirm any additional fees.

Fee Details Inquiry

You can clearly view all fee details in your Remitly account.

- Before confirming a transfer, Remitly displays a detailed breakdown of all fees and costs.

- You can verify each fee to ensure accuracy.

- Remitly focuses on overall pricing to help you get the most value.

- The platform provides a transparent fee structure with no hidden costs.

By carefully reviewing the fee details on the transfer page, you can understand all costs, ensuring a transparent and reliable remittance process.

Remitly Login Security Measures

Image Source: unsplash

Identity Verification

When registering and logging in to your Remitly account, the system requires you to complete a strict identity verification process. This effectively prevents unauthorized access, ensuring the safety of your funds.

Common identity verification methods include:

- Submitting a government-issued photo ID, such as a passport, national ID, or driver’s license.

- Uploading proof of address, such as a utility bill or bank statement, especially for large remittances.

- Providing personal information, including name, date of birth, and contact details.

- The system verifies your identity through reliable data sources and uses advanced technology to analyze transaction risks and detect suspicious activity.

- Remitly also conducts manual reviews, with compliance experts carefully checking transaction details to ensure each remittance meets security standards.

After completing these steps, you can successfully log in to Remitly and start sending money. Multi-factor authentication and secure encryption further enhance account security.

Tip: If you encounter issues during identity verification, you can contact the Remitly customer service team for assistance.

Data Encryption

When logging in to Remitly and making remittances, all data is encrypted. Remitly uses industry-standard encryption protocols to convert your sensitive information into secure code. This ensures that your personal and financial data cannot be accessed by unauthorized third parties.

Encryption technology protects not only your login information but also every transaction during the remittance process. You can confidently enter account details and transaction amounts, as the system automatically encrypts all data, enhancing overall security.

- Remitly uses advanced encryption technology, covering login, transactions, and account management.

- Encryption protocols meet international financial industry standards, boosting user trust.

- During data transmission, the system monitors security status in real-time to prevent information leaks.

When using Remitly, you don’t need to worry about data security. The platform continuously upgrades its encryption technology to keep your information protected.

Compliance Measures

Remitly places great emphasis on compliance management, strictly adhering to international data privacy regulations. All data on the platform is managed and stored in accordance with GDPR and CCPA.

The table below outlines Remitly’s main compliance measures:

| Compliance Measure | Related Laws |

|---|---|

| Data Management and Storage Practices | GDPR, CCPA |

When receiving funds in China/Mainland China or Hong Kong licensed banks, Remitly operates in compliance with local regulations. The platform continuously monitors and reports suspicious transactions, ensuring every remittance meets anti-money laundering (AML) and know-your-customer (KYC) requirements.

Compliance measures not only protect your personal privacy but also enhance fund security. You can confidently use Remitly for cross-border remittances without worrying about legal risks.

Handling Security Issues

If you notice abnormal or suspicious activity in your Remitly account, you can report and resolve security issues promptly through the following methods:

- Log in to your Remitly account via the mobile app or official website.

- Go to the “Help” or “Contact Us” section to submit a report directly to the customer support team.

- Provide detailed information, including transaction ID, amount, date, and a description of the suspicious activity.

- Contact 24/7 customer support via live chat, phone, or email for professional assistance.

Remitly typically responds to security reports within 24 hours, demonstrating a strong commitment to customer safety. You can track the progress of your issue to ensure timely resolution.

Suggestion: Regularly check your account security settings and update your password promptly to prevent information leaks. If you have any security concerns, contact Remitly’s official customer service first and avoid sharing personal information with third parties.

By choosing to log in to Remitly, you can easily track remittance progress with a clear and transparent fee structure. The platform supports multiple transfer methods, offering speed and high security. You can stay informed about every fee and manage your funds with confidence.

Remitly provides a convenient and secure cross-border remittance service.

FAQ

How do I check remittance progress on Remitly?

You can log in to your account, click “Transaction History,” and view the real-time status and reference number for each remittance.

How are Remitly’s transaction fees and exchange rates calculated?

You can use the platform’s calculator to estimate all fees before sending money. Transaction fees and exchange rates are displayed in USD, with a transparent fee structure.

What should I do if I encounter account security issues?

You can contact customer service via the app or website. After providing transaction details, Remitly will assist you in resolving the issue within 24 hours.

As we’ve explored, whether it’s using GCash for seamless local transfers or leveraging Remitly to track cross-border remittances, modern digital financial services are fundamentally addressing users’ core needs: speed, cost-efficiency, and security. Platforms like GCash excel with low fees and near-instant domestic transfers, while Remitly builds trust through transparent pricing, real-time tracking, and robust identity verification and data encryption.

Yet, for users in North America and beyond who regularly send money to the Philippines, is there a solution that more seamlessly integrates low cost, high speed, and expanded functionality?

BiyaPay was built precisely for this purpose. We understand that every remittance carries not just funds, but care and support for loved ones. That’s why we go beyond offering a competitive service—featuring real-time currency conversion, fees as low as 0.5%, and fast, secure same-day transfers—and empower you to take the next step: global wealth building.

Imagine completing family remittances and instantly investing in U.S. or Hong Kong stocks—all on one platform, without the hassle of opening overseas accounts. This “remittance + investment” integrated model ensures your money not only reaches your family on time but also grows proactively, unlocking greater future possibilities.

This isn’t just technological integration—it’s an evolution in how we think about cross-border finance. Choosing BiyaPay means embracing a smarter, more comprehensive approach to managing your global finances.

Start your journey today at BiyaPay and unlock a new era of global financial empowerment.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.