- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money to Colombia: Understanding Remittance Currency, Methods, and Amount Limits

Image Source: pexels

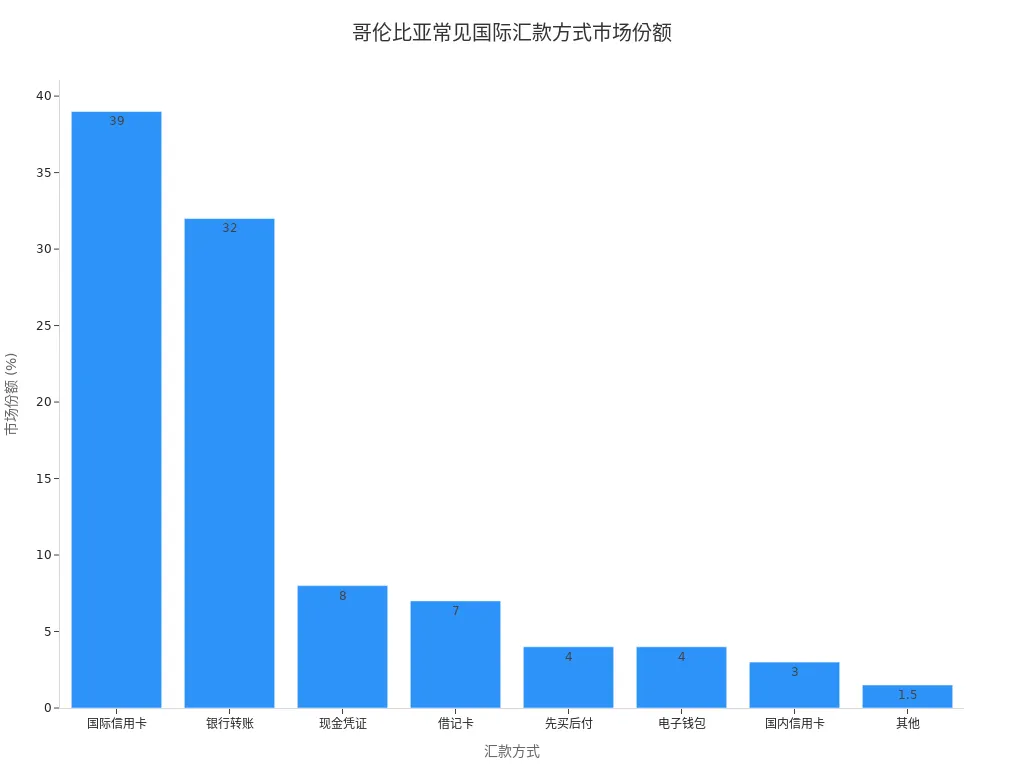

When you want to send money to Colombia via remittance, common options include international credit cards, bank transfers, cash vouchers, debit cards, and digital wallets. You can complete the operation using U.S. dollars, Colombian pesos, or other major currencies. The actual process is simple, with a focus on choosing the right channel, preparing documents, and adhering to amount limits. You need to ensure security, compliance, and cost-effectiveness. The chart below shows the market share of major remittance methods:

Key Points

- When choosing a remittance channel, consider security, fees, and transfer speed. Common channels include bank transfers, online platforms, and cash remittance services.

- Before sending money, confirm the recipient’s information and required documents to ensure they are accurate and complete, avoiding transfer failures due to errors.

- When selecting a currency for remittance, Colombian pesos are suitable for local spending, while U.S. dollars offer greater flexibility and lower fees.

- Understand the amount limits of different channels to plan your remittance amount reasonably, avoiding legal risks due to exceeding limits.

- Pay attention to exchange rate fluctuations and choose the right time to send money, utilizing exchange rate lock services to minimize losses.

Process for Sending Money to Colombia

Remittance Channels

You can send money to Colombia through various channels. Common channels include bank transfers, wire transfers, online platforms, and cash remittance services. Bank transfers are suitable for users who prioritize high security, especially when processed through licensed banks in Hong Kong for international remittances. Online platforms offer faster transfer times and lower service fees, ideal for frequent small-amount transfers. Cash remittance services are suitable for recipients without bank accounts. In the U.S. market, many users choose online platforms for cross-border transfers due to their convenience and transparent fees. When choosing a channel, you should make decisions based on the recipient’s actual needs and your own convenience.

Tip: When selecting a channel, it’s advisable to understand the service fees and exchange rates in advance, with all amount information based on USD, to avoid losses due to exchange rate fluctuations.

Operation Steps

When sending money to Colombia, you need to follow these steps:

- Choose a transfer method: You can select a bank, wire transfer, online platform, or cash remittance service.

- Confirm recipient information: Carefully verify the recipient’s name, contact details, and account information.

- Understand fees and exchange rates: Fees and exchange rates vary significantly across channels, so it’s recommended to compare and choose the most suitable option.

- Execute the transfer: Follow the selected channel’s instructions to complete the remittance operation.

- Track funds: Keep transfer records for future reference and fund tracking.

When processing the transfer, you typically need to prepare the following documents:

- Identity proof: Such as a passport, national ID, or driver’s license.

- Address proof: Such as utility bills or bank statements from the past two months, showing your name and address.

- Recipient’s identity proof: Such as a copy of the recipient’s valid photo ID.

- Proof of source of funds for large transfers: Such as bank statements or other documents.

Throughout the process, you must ensure the documents are accurate and complete to avoid transfer failures due to incorrect information. When sending money to Colombia, it’s recommended to communicate with the recipient in advance to confirm the required currency and receiving method to increase the success rate of the transfer.

Currency Options for Remittance

Image Source: unsplash

Colombian Peso

When sending money to Colombia, choosing Colombian pesos (COP) as the remittance currency has clear advantages. The peso is Colombia’s official currency, and recipients can use it directly for local spending and payments. You don’t need to perform additional conversions, reducing operational steps.

However, you should note that peso transfers may incur conversion fees and unfavorable exchange rates, especially when converting from USD or other foreign currencies. Some providers may hide fees in the exchange rate, reducing the amount the recipient actually receives. The table below shows the impact of exchange rates and fees on the received amount:

| Fee Type | Amount |

|---|---|

| Exchange Rate | 3835.959000 |

| Transfer Fee | $0 |

| Amount Received | $3,835,959.00 |

When choosing pesos, it’s recommended to compare exchange rates and fees across different channels to ensure the recipient receives the maximum amount.

U.S. Dollar

The U.S. dollar is one of the commonly used currencies for international remittances. When you choose USD for transfers, you can usually enjoy lower fees and more stable exchange rates. Online platforms and bank services in the U.S. market support USD transfers with fast delivery times. After receiving USD, the recipient can exchange it for pesos at a local bank, offering high flexibility.

You need to note that some Colombian banks or merchants may not directly accept USD, and the recipient may need to exchange it themselves, potentially incurring additional fees. Before sending money, you should confirm with the recipient whether they can easily exchange and use USD.

Other Currencies

In addition to pesos and USD, you can also choose major currencies such as EUR, GBP, or CAD for remittances. When selecting other currencies, you need to consider the following factors:

- Transparency of the mid-market exchange rate

- Whether the remittance channel supports the currency

- Whether the recipient can easily exchange and use the currency

Planning the remittance currency in advance helps secure better exchange rates. Using ATMs typically offers better exchange prices, while exchanging at airports or hotels may involve high fees. Before sending money, you must verify the receiving currency with the recipient to avoid delays or issues due to currency mismatches.

Remittance Methods

Image Source: unsplash

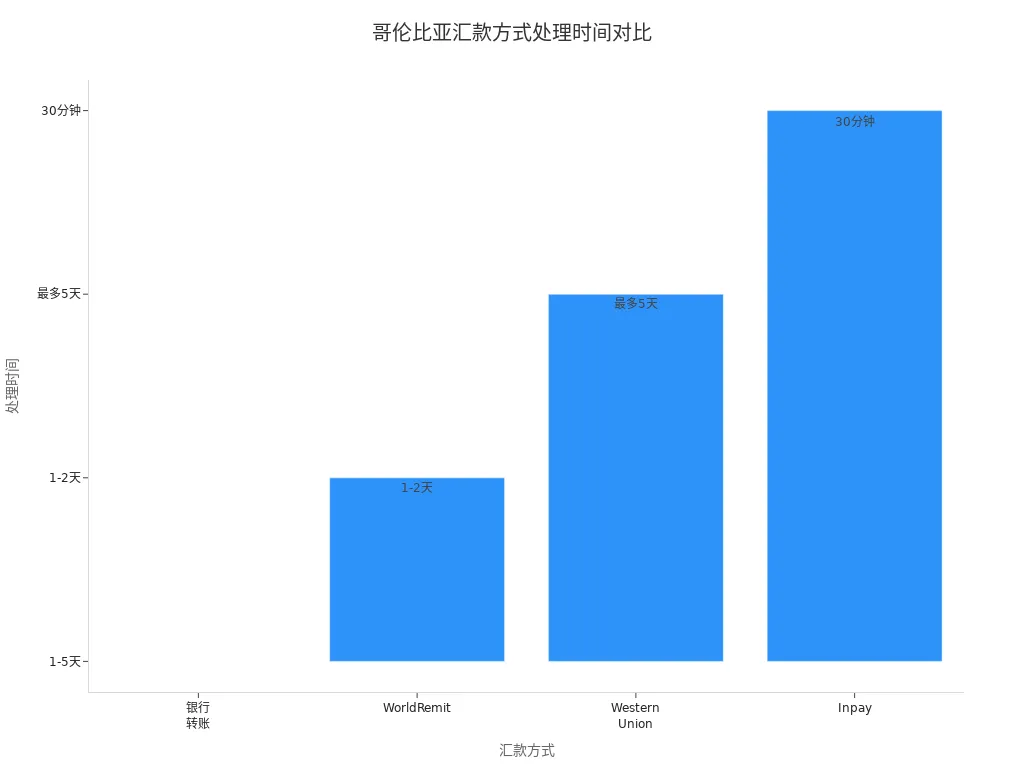

When choosing a method to send money to Colombia, you can select from several mainstream channels based on your needs and the recipient’s situation. Each method has its own advantages in terms of delivery speed, fees, security, and convenience. The table below compares the average fees and transaction speeds of different remittance methods to help you quickly understand their characteristics:

| Remittance Method | Average Fee | Transaction Speed |

|---|---|---|

| Traditional Remittance Operators | 5.5% | Up to five business days |

| Stablecoins (e.g., USDC) | Can reduce by 50% | Completed in minutes |

Bank Transfer

Bank transfers are suitable for those seeking high security and large-amount transfers. You can process international remittances through licensed banks in mainland China or Hong Kong, with funds directly deposited into the recipient’s bank account in Colombia. The advantage of bank transfers lies in their strong compliance, making them ideal for business or family large-amount transfers.

You need to note that bank transfers take longer, typically 1-5 business days, depending on factors like bank reviews and international clearing. Fee-wise, banks usually charge fixed fees, and some may also charge intermediary bank fees.

The table below compares processing times across different channels:

| Transfer Method | Processing Time | Notes |

|---|---|---|

| Bank Transfer | 1-5 business days | Affected by multiple factors |

| WorldRemit | 1-2 business days | |

| Western Union | Up to 5 days for first transfer | Subsequent transfers can be same-day |

| Inpay | Average 30 minutes | Uses real-time payment systems |

When processing bank transfers, you need to prepare identity proof and proof of funds source in advance. Bank transfers are suitable for users with high requirements for fund security and compliance.

Online Platforms

Online platforms provide a more convenient option for sending money to Colombia. You can quickly complete cross-border transfers using mainstream online services in the U.S. market. Online platforms typically support multiple currency options, with fast delivery times, and some can achieve transfers within 1-2 business days.

When using online platforms, you can enjoy lower service fees and transparent exchange rates. Some platforms also support real-time exchange rate locking to help you avoid exchange rate fluctuation risks.

In terms of security, mainstream online platforms use end-to-end encryption, multi-factor authentication, and data masking to ensure the safety of your funds and personal information. The table below lists common security measures:

| Security Measure | Description |

|---|---|

| End-to-End Encryption (E2EE) | Uses complex encryption algorithms to protect sensitive data, making it incomprehensible if intercepted. |

| Multi-Factor Authentication (MFA) | Enhances account access security by requiring multiple credentials, preventing unauthorized access. |

| Tokenization and Data Masking | Replaces real data with dummy data to protect sensitive information, ensuring hackers cannot exploit real data. |

| Secure APIs and Zero Trust Framework | Implements multi-layer security measures in API gateways, monitoring and addressing abnormal activities in real time. |

| AI and Machine Learning Advanced Threat Detection | Uses AI and machine learning algorithms to assess and respond to cyber threats in real time, enhancing platform security. |

If you prioritize delivery speed and fee transparency, online platforms are an ideal choice. They are suitable for frequent small-amount transfers or users needing flexible currency options.

Digital Wallets

Digital wallets offer a more flexible remittance experience. You can achieve near-instant fund transfers through digital wallets, especially suitable for recipients without bank accounts. The advantages of digital wallets include low barriers, low fees, and operational convenience.

When using digital wallets, you can enjoy the following benefits:

- Digital wallets provide fast, low-barrier international remittance options for Colombia, particularly for the unbanked population.

- You can achieve near-instant fund transfers, reducing transaction costs and enhancing financial inclusion for small and medium-sized enterprises.

You also need to be aware of the limitations of digital wallets. They rely on internet access, and some users may need to adapt to digital platform operations. In terms of security, some digital wallet platforms carry potential risks, so it’s recommended to choose providers with a good reputation and strong security measures.

Cash Remittance

Cash remittance is suitable when you or the recipient lack a bank account or digital wallet. You can send cash directly from offline stores or partner locations in the U.S. market, and the recipient can collect cash at designated locations in Colombia.

The advantages of cash remittance include simple operations and wide coverage, making it suitable for remote areas or temporary needs. You need to note that cash remittances typically have higher fees, with some operators charging around 5.5%, and delivery can take up to five business days.

When choosing cash remittance, it’s recommended to check the distribution of service locations and the pickup process in advance to ensure the recipient can collect funds smoothly.

Tip: When choosing a remittance method, consider delivery speed, fees, security, and recipient convenience comprehensively. Bank transfers are better for large-amount, high-compliance transfers. Online platforms and digital wallets are more advantageous for small-amount, frequent, or speed-focused transfers. Cash remittances are suitable for special scenarios or urgent needs.

Amount Limits

When sending money to Colombia, you must understand the amount limits of different channels and services. Planning the remittance amount reasonably helps enhance fund security and avoid legal risks due to exceeding limits. Amount limits are mainly divided into minimum limits, maximum limits, and periodic limits.

Minimum Limit

When choosing a remittance channel, you often encounter minimum transfer amount requirements. Most banks and online platforms set minimum limits to ensure each transaction is cost-effective. The minimum limit is generally $25 USD. If you only need to send small amounts, prioritize online platforms or digital wallets, as these channels are more friendly for small transfers. Bank channels are more suitable for large-amount fund transfers.

Tip: Before sending money, carefully check the platform’s minimum limit to avoid transaction failures due to insufficient amounts.

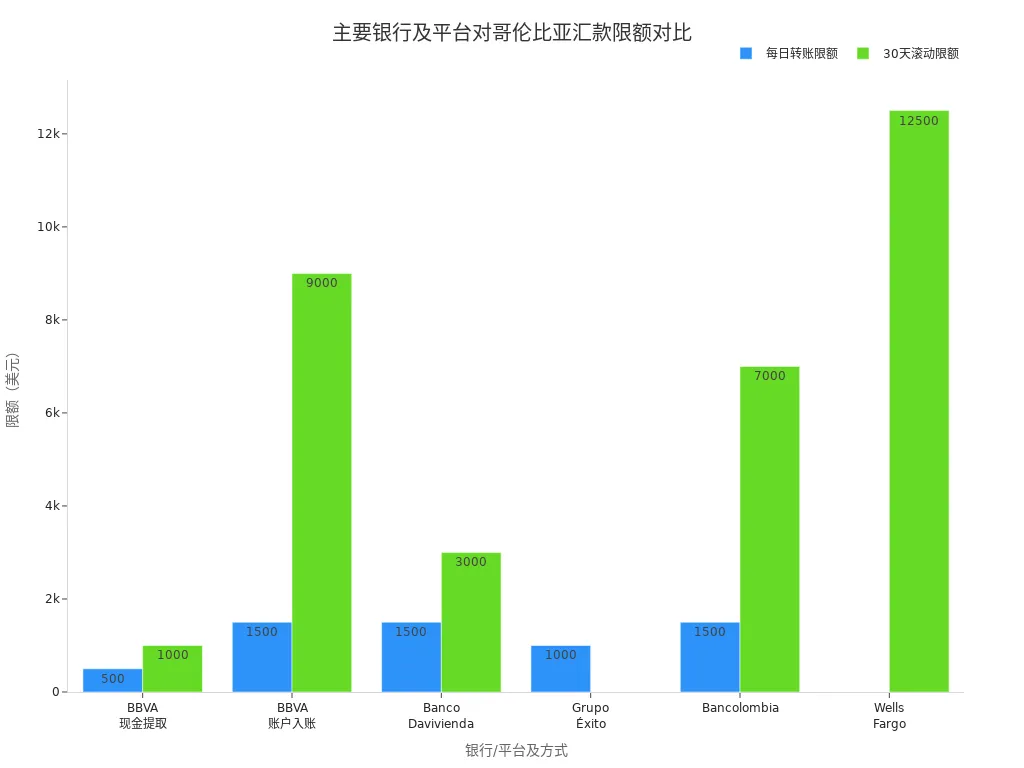

Maximum Limit

The maximum limit is a key factor you must focus on when sending money. Different banks and platforms have clear regulations for single, daily, and periodic remittances. The table below shows the daily and 30-day rolling transfer limits for major banks and platforms in the U.S. market:

| Bank/Platform | Daily Transfer Limit (USD) | 30-Day Rolling Transfer Limit (USD) |

|---|---|---|

| BBVA | $500 cash pickup / $1,500 account deposit | $1,000 cash pickup / $9,000 account deposit |

| Banco Davivienda | $1,500 cash pickup or account deposit | $3,000 cash pickup or account deposit |

| Grupo Éxito | $1,000 (cash pickup only) | - |

| Bancolombia | $1,500 cash pickup or account deposit | $7,000 cash pickup or account deposit |

| Wells Fargo ExpressSend | $5,000 (daily) | $12,500 (30 days) |

When using licensed banks in Hong Kong for international remittances, you typically encounter similar limit regulations. Some banks set different caps for account deposits and cash pickups. If you need to send large amounts, it’s recommended to communicate with the bank or platform in advance to understand specific policies.

You also need to note that Colombian local regulations have different requirements based on the recipient’s nationality. The table below shows the maximum remittance limits for recipients of different nationalities:

| Recipient Nationality | Maximum Remittance Limit (USD) |

|---|---|

| Colombian | 5,000 |

| Foreigner | 7,500 |

If you send money to a Colombian, the single transfer amount must not exceed $5,000 USD. For foreigners, the maximum can reach $7,500 USD. Some financial institutions may set lower limits based on internal risk controls.

Note: Colombian law does not set a universal maximum limit for family remittances, but individual financial institutions set internal limits based on their policies. You should consult in advance to ensure the remittance amount is compliant.

Periodic Limits

Periodic limits are a factor you must consider when planning remittance frequency. Most banks and platforms regulate the cumulative remittance amount within 24 hours, 30 days, or 180 days. For example, Wells Fargo ExpressSend allows you to send up to $5,000 daily to all beneficiaries, with a maximum total of $12,500 over 30 days. Some banks also set separate periodic limits for account deposits and cash pickups.

When using online platforms, periodic limits are generally more flexible but still subject to platform regulations. Periodic limits help prevent money laundering and illegal fund flows, ensuring financial security.

Tip: When making multiple remittances, you should distribute amounts reasonably to avoid large transfers in a short period. Periodic limits vary by region and service, so it’s recommended to understand and plan your remittance schedule in advance.

Compliance Operations and Risk Prevention

When sending money to Colombia, you must comply with local laws and financial institution regulations. Exceeding limits may not only lead to transaction failures but also trigger legal liabilities. The table below lists potential legal consequences of exceeding limits:

| Penalty Type | Amount Range |

|---|---|

| Non-Disclosure Penalty | $10,000 - $50,000 |

| Additional Penalties | $10,000 per 30 days |

| Possible Criminal Consequences | Imprisonment, etc. |

If you fail to declare the source of funds or exceed remittance limits, you may face high fines or even criminal penalties. Before sending money, you should prepare proof of funds source to ensure all documents are accurate and complete.

Recommendation: Always follow the principles of security, compliance, and cost-effectiveness, plan remittance amounts reasonably, and avoid exceeding limits. Communicating with the recipient and financial institution in advance helps improve the success rate of transfers and ensures fund security.

Selection Factors

Fees

When choosing a remittance method, fees are the most direct consideration. Differences in service fees and exchange rates across channels affect the amount the recipient actually receives. You can reduce costs through the following methods:

- Compare exchange rates and total fees across platforms to avoid focusing only on low fees while ignoring exchange rate losses.

- If not urgent, choose standard delivery services, which typically have lower fees.

- Use bank account transfers, as many online platforms support direct bank account links, offering more cost-effective fees.

- Look for zero-fee first transfers, loyalty programs, or seasonal promotions to significantly reduce costs.

Before sending money, you should choose the most suitable provider based on the amount sent, timing, and destination country. In the U.S. market, commercial banks, credit unions, remittance services, and online platforms can meet various needs.

Speed

Delivery speed determines when the recipient can access the funds. If you need urgent transfers, you can choose express services, which typically deliver within minutes to hours. Standard services are suitable for non-urgent funds, offering lower fees. When choosing, balance speed and cost to ensure funds arrive safely and on time.

Reminder: Some online platforms and digital wallets support real-time delivery, but higher speeds may come with higher fees. Choose flexibly based on your actual needs.

Security

Security is a critical factor you cannot overlook when sending money. You should choose platforms with compliance qualifications and security protocols. The table below shows common security measures for international remittances:

| Security Protocol/Compliance Measure | Description |

|---|---|

| Anti-Money Laundering (AML) | Complies with regulations to prevent illegal fund flows |

| Know Your Customer (KYC) | Verifies customer identity to ensure legitimacy |

| Ongoing Transaction Monitoring | Monitors transactions in real time to identify suspicious activities |

| Enhanced Due Diligence for High-Risk Customers | Conducts in-depth reviews of high-risk customers to reduce risks |

| Employee Training | Regular training to enhance compliance and security awareness |

| Clear Escalation Protocols | Establishes processes for reporting suspicious transactions |

If you choose non-compliant platforms, you may face high fines or legal liabilities. In 2023, Colombia imposed fines exceeding $10 million for AML violations. You should ensure all transactions report suspicious activities promptly to safeguard funds.

Exchange Rates

Exchange rates directly affect the actual amount received by the recipient. Before sending money, you should compare exchange rates across platforms and choose the best option. Some platforms support exchange rate locking to help you mitigate fluctuation risks. You should avoid exchanging at airports or hotels, which often charge high fees. Choosing exchange rates and channels wisely helps maximize fund value.

Recommendation: When sending money, consider fees, speed, security, and exchange rates comprehensively to select the appropriate provider and channel. Planning in advance can effectively reduce costs and ensure fund security.

Common Issues

Transfer Failures

When sending money to Colombia, you may encounter transaction failures. Common reasons include:

- Incorrect information input. If you enter the wrong recipient name or account number, the bank will reject the transfer.

- Bank rejection of the transaction. Some banks may refuse certain international transfers due to compliance or risk control reasons.

- Bank technical issues. System upgrades or network failures may cause delays or transfer failures.

- Contact the remittance platform to resolve issues. You can proactively contact platform customer service for professional assistance.

When facing transfer failures, it’s recommended to verify all information immediately and communicate with the provider to resolve the issue promptly.

Fund Tracking

If your transfer does not arrive on time, you can take the following steps to track and recover funds:

- Carefully check transfer details. You need to review all transfer information, including account numbers and recipient names, to ensure accuracy.

- Contact your bank. You can consult licensed banks in Hong Kong or U.S. market banks to check the transfer status.

- Request SWIFT tracking (for international transfers). Banks can help you track the flow of funds in the international system to identify issues.

- File a complaint. If the bank cannot locate the lost transfer, you can submit a formal complaint to the relevant regulatory authority.

During the fund tracking process, you need to prepare transaction details such as date, amount, and recipient information. Following the bank’s dispute resolution process can improve the success rate of recovery.

Exchange Rate Fluctuations

Exchange rate changes directly affect the actual value of your remittance. When you send money at different times, the amount the recipient receives may vary due to exchange rate fluctuations. The table below shows the impact of exchange rate fluctuations on remittances to different regions in Colombia and remittance inflows:

| Evidence Type | Content |

|---|---|

| Impact | In regions like Valle del Cauca, Coffee Region, and Caribbean Coast, remittances can buffer fluctuations in inflation, interest rates, or USD value. |

| Monetary Policy Impact | Monetary tightening reduces remittance inflows, and the relationship between exchange rates and remittance inflows is influenced by external economic policies. |

| Exchange Rate Response | Real exchange rate changes significantly affect remittance inflows, with notable impacts from monetary policy shocks. |

Before sending money, you can monitor exchange rate trends and choose a favorable time to remit. Planning the remittance timing wisely helps increase the amount the recipient receives.

When sending money to Colombia, you should choose the most suitable method and currency based on your needs. You can optimize costs by comparing multiple providers, monitoring exchange rates, batching transfers, and seeking promotional offers. You need to stay updated on policy changes, such as new U.S. legislation imposing a 3.5% tax on some immigrants or Colombia’s DIAN new foreign exchange information transmission rules. You should retain transaction documents to ensure compliance and use regulated fintech companies or banks. The table below summarizes key compliance points:

| Item | Description |

|---|---|

| Document Retention | Residents must retain documents proving amounts and conditions |

| Submission Requirements | Submit relevant documents when required by foreign exchange regulators |

| Retention Period | Document retention period aligns with penalty statute of limitations |

It’s recommended to set automatic reminders for reporting deadlines, maintain digital records, and join industry associations for the latest information. Focus on fees, speed, and security, plan remittances wisely, and avoid common risks.

FAQ

What should I do if a transfer fails?

When you encounter a transfer failure, it’s recommended to first verify recipient information. You can contact the remittance platform’s customer service for assistance. You need to retain transaction records for future reference.

How can I track fund progress?

You can log in to the remittance platform’s account to check the transfer status. You can also contact licensed Hong Kong bank customer service for detailed progress. You need to prepare the transaction number and recipient information.

Do exchange rate fluctuations affect the amount received?

When you send money, exchange rate changes directly affect the USD amount the recipient receives. You can choose exchange rate locking services to reduce losses. It’s recommended to compare exchange rates across platforms in advance.

Will incomplete documents lead to transfer rejection?

If you submit incomplete documents, the bank or platform will reject the transfer. You need to provide complete identity proof and proof of funds source. It’s recommended to prepare all necessary documents in advance.

How are periodic limits calculated?

You can check the platform’s announcements to understand 24-hour or 30-day cumulative limits. You need to distribute each remittance amount reasonably to avoid exceeding limits. It’s recommended to plan remittance frequency in advance.

Remitting to Colombia involves various currency options (like USD or COP), methods (such as bank transfers or online platforms), and amount limits (e.g., up to $5,000-$7,500 per transaction based on recipient nationality), but traditional channels often charge up to 5.5% fees with 1-5 day delivery, and exchange volatility can cut received amounts by over 8%, amid Colombia’s projected $11+ billion remittances in 2025 where costs and caps frustrate users. For a more versatile, low-fee option, discover BiyaPay. At just 0.5% transfer fees, BiyaPay supports seamless USD/COP swaps, dodging rate pitfalls to deliver maximum value to recipients.

BiyaPay spans most countries and regions, including Colombia, with registration in minutes and same-day transfers, free from rigid limits. Plus, trade stocks in US and Hong Kong markets without an overseas account, with zero fees on contract orders. Sign up today and use the real-time exchange rate tool to track USD/COP (around 3836 now), empowering your cross-border remittances with secure, efficient global finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.