- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What You Should Know Before Remitting Money to Dubai: Remittance Amount Limits, Fees, Remittance Methods, and Tracking Services

Image Source: unsplash

When you remit money to Dubai, you often encounter four issues: remittance amount limits, fees, transfer methods, and tracking services. Many people mistakenly believe that amount limits are very high, but according to the latest policies, the limits for common currencies are as follows:

| Currency Type | Annual Limit |

|---|---|

| AED | 40,000 AED |

| Foreign Currency | 50,000 USD |

You can use bank wire transfers, third-party platforms, or remittance company services. Businesses and individuals need to consider applicable scenarios when choosing a channel to avoid risks from exceeding limits.

Key Points

- Understand the UAE’s remittance amount policies; there is no annual cap for individuals or businesses, but banks may set single-transaction or daily limits.

- When remitting from China/mainland China to Dubai, individuals can purchase and send up to $50,000 annually, requiring relevant documents to ensure a smooth transfer.

- When selecting a remittance channel, compare fees and exchange rates of different services to choose the most suitable method and reduce costs.

- Before remitting, verify all information to avoid transaction failures or delays due to errors.

- Use tracking numbers and online tools to monitor remittance progress in real time, ensuring funds arrive securely and on time.

Remittance Amount Limit Regulations

UAE Amount Regulations

When you send money to Dubai, you first need to understand the UAE’s amount policies. The UAE Central Bank currently does not impose a clear annual limit on remittance amounts for individuals or businesses. Whether you choose AED or USD, there is no official annual restriction. You can refer to the table below:

| Currency Type | Remittance Limit |

|---|---|

| AED | No limit |

| USD | No limit |

Although the UAE does not have a unified annual remittance amount limit, in practice, banks and remittance companies set single-transaction or daily limits based on their risk control policies. When choosing a channel, you need to consult the relevant institution in advance to avoid rejections due to exceeding limits.

Tip: UAE financial institutions will review large remittances based on anti-money laundering regulations. You should prepare relevant proof documents to ensure a smooth remittance.

China Foreign Exchange Requirements

When you send money from China/mainland China to Dubai, you must comply with the regulations of the State Administration of Foreign Exchange of China. China/mainland China sets a clear annual cap on foreign exchange purchases for individuals. Each person can purchase and send up to the equivalent of $50,000 annually. Specific regulations are as follows:

| Transaction Type | Maximum Amount |

|---|---|

| Per Transaction | N/A |

| Annual Limit | $50,000 |

You need to prepare the following documents:

- Submit an outbound remittance application form and payment order.

- The bank verifies the documents and sends the remittance instruction.

- The overseas bank makes the payment based on the instruction.

For business users, additional conditions must be met. For example, businesses must be legally registered with a valid business license, have import/export trade qualifications, and maintain a settlement account with the Bank of China. Businesses also need to pass the annual business license inspection and have a loan card and credit line. Specific requirements are shown in the table below:

| Required Documents | Eligibility Criteria |

|---|---|

| 1. Submit an outbound remittance application form, foreign exchange account payment order, and RMB check. | 1. The applicant must be legally registered and hold a valid business license. |

| 2. Provide valid documents as per foreign exchange regulations, such as foreign exchange usage approval documents. | 2. The applicant must hold a loan card. |

| 3. The applicant must have a settlement account with the Bank of China. | 3. The applicant must have import/export trade qualifications. |

| 4. The applicant must have a credit line with the Bank of China. | 4. The applicant must have a business license that has passed the annual inspection. |

When processing remittances, you must prepare all documents in advance to avoid delays due to incomplete materials.

Channel and Currency Limits

Different remittance channels and currencies have varying requirements for amount limits. You can choose banks, remittance companies, or online platforms for operations. The amount limits for each channel are as follows:

- Limits for remittance service providers vary by channel, including banks and online platforms.

- Some services set daily, monthly, or per-transaction limits based on anti-money laundering laws.

- The recipient’s financial institution in Dubai may have specific receiving limits.

- Verified accounts or repeat customers may enjoy higher remittance limits.

When choosing a channel, you need to pay attention to the annual limits for currencies. For example, some banks and platforms set the following annual limits for AED and USD:

| Currency Type | Annual Limit |

|---|---|

| AED | AED 40,000 |

| USD | $50,000 |

You should choose the currency and channel reasonably based on your needs and the recipient’s requirements to ensure compliance with remittance amount limits.

Risks of Exceeding Limits

If you exceed the remittance amount limits, you may face various risks. Banks and remittance companies have the right to refuse processing over-limit remittances and may even freeze related accounts. China/mainland China’s foreign exchange authorities will investigate over-limit activities, and in severe cases, it may affect your credit record.

Before remitting, you must verify all relevant regulations and allocate your annual quota reasonably. For business users, it’s advisable to split large remittances to avoid exceeding limits at once. Individual users should avoid splitting remittances across multiple accounts, as this may be considered an attempt to bypass regulations, leading to legal risks.

Note: In case of over-limit or abnormal transactions, banks and regulatory authorities will require you to provide additional documents or explain the source of funds. You should maintain transparency in fund flows and ensure each remittance has a legitimate purpose and documentation.

Remittance Fee Analysis

Bank Fees

When choosing a bank for remittance, you first need to pay attention to the fee structures of different banks. Bank fees typically include transfer fees and possible intermediary bank fees. Different banks have varying fee standards for remittance amounts. You can refer to the table below for the fee ranges of some banks:

| Bank Name | Transfer Fee Range (USD) | Notes |

|---|---|---|

| Licensed Hong Kong Bank A | $0 - $27 | Suitable for large-amount transfers |

| Licensed Hong Kong Bank B | $10 - $20 | Suitable for large-amount transfers |

| Licensed Hong Kong Bank C | $5 - $15 | Suitable for small-amount transfers, cost-effective for individuals |

Tip: Transfer fees vary based on the bank, remittance amount, and whether intermediary banks are involved. You should consult the bank in advance to avoid increased costs due to unclear fees.

Wire Transfer and Platform Fees

You can also choose wire transfers or third-party remittance platforms. Wire transfers are typically operated by banks and have higher fees. Third-party platforms charge fees as a percentage, suitable for varying amount needs. The table below shows the fee ranges for common service types:

| Service Type | Fee Range (USD) | Notes |

|---|---|---|

| Bank Wire Transfer | $0 - $27 | Excluding VAT, generally more expensive |

| Third-Party Platform | 1.28% - 1.94% | Fees vary by destination and amount |

| Exchange Rate Difference | May be higher than market rates | Compare exchange rates and fees across services |

When choosing, you should consider your needs and remittance amount limits, balancing fees and delivery speed.

Exchange Rates and Hidden Costs

When remitting, in addition to visible fees, you need to pay attention to exchange rates and hidden costs. Exchange rate fluctuations directly affect the amount the recipient actually receives.

- Favorable exchange rates allow you to send more funds with the same amount, increasing value.

- Unfavorable exchange rates result in the recipient receiving less money, especially impacting families reliant on remittances.

- Hidden costs, such as service fees, exchange rate markups, and receiving bank fees, further reduce the amount received.

- Some platforms have low visible fees but high exchange rate markups, increasing actual costs.

- For international transfers, intermediary banks may deduct small fees before the funds arrive.

You should carefully compare exchange rates and fees across services to avoid losses due to hidden costs.

Fee Calculation

When calculating the total remittance cost, you can follow these methods:

- Compare fee structures, exchange rates, and additional fees across providers to find the most cost-effective option.

- Check the difference between the provider’s exchange rate and the market rate, as small differences can impact the amount received.

- Read all terms carefully to understand potential additional fees, such as processing or handling fees.

- Consult the receiving bank and intermediary banks about possible additional fees, as some may not be disclosed upfront.

- Choose providers with transparent fees to ensure all costs are clear before the transaction.

Recommendation: Before officially remitting, verify all fees, exchange rates, and amount limits to avoid unnecessary expenses due to overlooked details.

Remittance Method Options

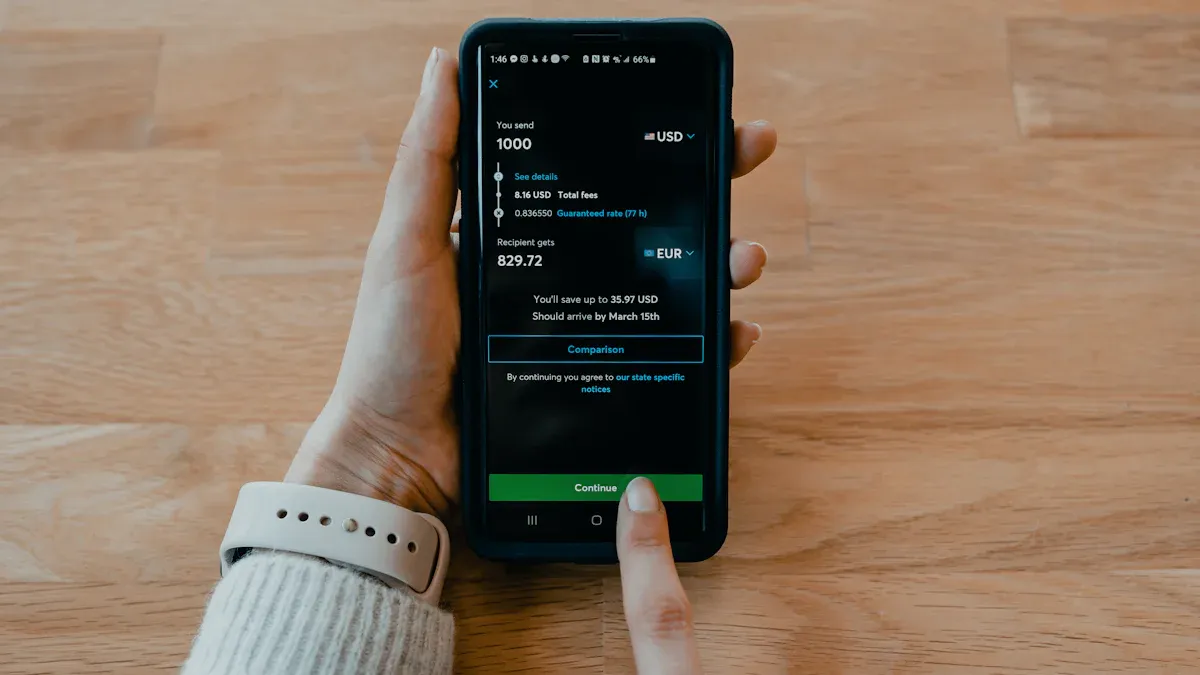

Image Source: unsplash

Bank Wire Transfer

You can choose bank wire transfers as the primary method for sending money to Dubai. Bank wire transfers are generally considered secure and reliable, suitable for large-amount fund transfers. Licensed Hong Kong banks offer stable exchange rates and high delivery assurance. You need a bank account and must submit relevant documents during processing. Bank wire transfers have higher fees, with processing times typically ranging from 1-3 business days. Some banks also charge intermediary bank fees, making this method suitable for users with high requirements for delivery speed and security.

Remittance Company Services

If you don’t have a bank account, you can use remittance company services to complete transfers. Many remittance companies support real-time transfers, offering customized exchange rates and multi-platform operations. You can easily manage remittances on mobile devices or computers. Remittance companies typically have compliant management and multi-currency support, meeting various needs. You can also receive funds via digital wallets, with real-time notifications and secure authentication. Remittance companies are suitable for users needing flexible, fast services.

Third-Party Platforms

Third-party platforms offer a more cost-effective option. You can enjoy lower transfer fees and competitive exchange rates. Modern platforms support delivery within minutes and allow real-time progress tracking. Legitimate platforms use encryption technology to ensure fund security. Third-party platforms are suitable for frequent small-amount remittances and users focused on cost control.

Exchange Offices and Cash

You can also choose exchange offices or cash remittances. Exchange offices do not require a local bank account, making them suitable for users without accounts. You can enjoy fixed transaction fees and multiple options, but exchange rates may not be ideal. Cash remittances carry risks of money laundering and smuggling, and financial institutions must comply with strict anti-money laundering regulations. You should prioritize compliance and fund security when choosing this method.

Method Comparison

| Method | Advantages | Disadvantages | Applicable Scenarios |

|---|---|---|---|

| Bank Wire Transfer | Secure, stable exchange rates, suitable for large amounts | High fees, requires bank account, average speed | Business or large-amount remittances |

| Remittance Company | Real-time delivery, flexible, no account needed | Exchange rate fluctuations, some services have high fees | No account or urgent remittances |

| Third-Party Platform | Low fees, fast, easy to track | Requires identity verification, some platforms don’t support large amounts | Frequent small-amount personal remittances |

| Exchange Office/Cash | No account needed, multiple options | High risks, poor exchange rates, strict compliance requirements | Special or cash-based scenarios |

Recommendation: Choose the most suitable remittance method based on your needs, amount size, and delivery speed to ensure funds are secure and compliant.

Progress Tracking Services

Image Source: unsplash

Tracking Number Acquisition

When you send money to Dubai, you typically receive a tracking number. This number is the key to checking the remittance progress. Bank wire transfers and third-party platforms automatically generate this number after the transaction is completed. You can find the number in the remittance receipt, SMS notification, or email. It’s recommended to save the number for easy access to check the remittance status. If you don’t receive the number, you can contact the provider’s customer service to verify transaction details.

Reminder: The tracking number is your only credential for communicating with banks or platforms. When querying or handling issues, you must provide the accurate number.

Bank and Platform Tools

You can use online tools provided by banks and third-party platforms to monitor remittance progress in real time. Many licensed Hong Kong banks and international platforms support 24/7 online queries. The table below shows tracking services for some banks and platforms:

| Bank/Platform | Tracking Service | Details |

|---|---|---|

| HSBC | International Payment Tracker | Allows users to check foreign currency payment status 24/7, supports queries for payments from the past 60 days, displaying payment date, recipient name, payment amount, and other details. |

You only need to log into online banking or the platform account, enter the tracking number, and check whether the funds have arrived. Some platforms also send progress notifications, keeping you updated on fund movements.

Common Query Issues

When tracking remittance progress, you may encounter common issues. The following suggestions can help you resolve them smoothly:

- Understand UAE Central Bank regulations to avoid legal risks.

- Choose the appropriate payment method based on transaction amount and recipient location.

- Monitor exchange rates regularly to select the best timing for remittances.

- Use reputable foreign exchange providers to save on international payment fees.

- Utilize automated payment tools to simplify the management process.

You can prepare in advance to reduce obstacles during queries and operations.

Handling Anomalies

If you notice abnormal remittance progress, such as delayed arrivals or mismatched information, you can take the following steps. First, verify the tracking number and recipient information for accuracy. Then, contact the bank or platform’s customer service to explain the issue. You can provide transaction receipts and related documents to help customer service quickly identify the problem. Some banks may require additional documents or re-verification of identity. You should maintain open communication and follow up on progress promptly. For complex cases, you can consult professionals to ensure fund security.

Security and Refunds

Fraud Prevention Tips

When sending money to Dubai, you must prioritize fund security. Financial regulatory authorities recommend the following measures to prevent fraud:

- Use fraud protection tools to identify suspicious transactions promptly.

- Complete identity verification to ensure account security.

- Monitor transactions and address abnormalities immediately.

- Comply with regulatory requirements and choose compliant remittance channels.

When processing remittances, you must adhere to anti-money laundering laws. Remittance companies typically require valid identity and address proof to ensure the transaction’s security and legality. You should avoid transferring through unknown channels and choose regulated providers to ensure fund safety.

Tip: Regularly update your account password and avoid operating remittances on public networks to prevent personal information leaks.

Failures and Delays

During the remittance process, you may encounter failures or delays. Common reasons include:

- Inaccurate information, such as incorrect recipient name, bank account number, or branch code.

- Ignoring exchange rate changes, leading to lower-than-expected received amounts.

- Not understanding all fees and hidden costs, reducing the amount received.

- Choosing unverified or less reputable providers, increasing fund risks.

- Not considering delivery speed, selecting methods unsuitable for urgent needs.

- Ignoring provider transfer limits, leading to transaction rejections.

- Failing to track transfer status promptly, missing important notifications or issue resolutions.

Before remitting, you should carefully verify all information, choose transparent and compliant providers, and continuously monitor transfer progress.

Refund Process

If your remittance fails or is delayed, you can usually apply for a refund. You need to keep the remittance receipt and tracking number and contact the provider’s customer service promptly. The general process is as follows:

- Submit a refund request, explaining the reason and providing relevant proof.

- The provider verifies the transaction status to confirm non-delivery or return.

- Complete identity verification to ensure refund security.

- Wait for the provider to process, typically taking 3-7 business days, depending on the provider’s regulations.

You should actively communicate with the provider to track refund progress. In special cases, you can consult licensed Hong Kong bank customer service for further assistance.

Before sending money to Dubai, you must verify remittance amount limits and all fees.

- Compare fees and exchange rates across channels and choose official channels to ensure fund safety.

- Prepare valid identity proof, proof of funds source, and recipient information to avoid legal risks.

- Monitor exchange rate fluctuations and plan remittance methods and amounts reasonably.

- Use digital payments and mobile solutions to enhance convenience and tracking efficiency.

By planning the remittance process carefully, you can effectively avoid losses and risks, ensuring funds arrive smoothly.

FAQ

What basic documents are needed for remittances to Dubai?

You need to prepare valid identity proof, proof of funds source, and recipient information. Licensed Hong Kong banks typically require you to fill out a remittance application form and verify related documents.

How long does it take for a remittance to arrive?

When you choose bank wire transfers, funds typically arrive within 1-3 business days. Third-party platforms and remittance companies may be faster, depending on the provider and amount.

Can I apply for a refund if the remittance fails?

You can apply for a refund. Keep the remittance receipt and tracking number and contact the provider’s customer service promptly. The provider will verify the transaction status and process the refund within 3-7 business days.

What are the consequences of exceeding remittance limits?

Banks and remittance companies may reject your remittance application. China/mainland China’s foreign exchange authorities will investigate over-limit activities, and in severe cases, it may affect your credit record.

How can I check remittance progress?

You can use online tools provided by banks or third-party platforms to check the remittance status in real time by entering the tracking number. Some providers also send progress notifications, making it easy to track fund movements.

Remitting to Dubai involves UAE’s no annual caps but bank per-transfer limits (e.g., Western Union $50,000 USD) and China’s $50,000 yearly forex quota, plus bank fees of $0-50 and 1-5 day wire delays, especially amid 2025’s $80+ trillion global remittance market, where markups and tracking hassles erode received amounts. For a cheaper, faster solution, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay outperforms traditional banks, maximizing recipient value with full transparency.

BiyaPay serves most countries and regions, including Dubai, with registration in minutes and same-day processing, no lengthy reviews needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current USD/AED rates (e.g., USD/AED around 3.67), optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.