- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use Remitly for Remittance: Understanding Its Exchange Rates, Fee Structure, and Remittance Process

Image Source: unsplash

When you choose Remitly for remittances, you can enjoy promotional offers on your first remittance and transparent fees, easily checking real-time exchange rates. Data shows that Remitly processed $16.2 billion in remittances in Q2 2025, with a user base of 8 million. Compared to Western Union, it has higher transaction volume and growth rates. Remitly offers excellent value for money in remittances.

Key Points

- When using Remitly for remittances, real-time exchange rates and transparent fees allow you to clearly understand the cost of each transaction, avoiding unexpected expenses.

- New users can enjoy zero fees and better exchange rates on their first remittance; be sure to check the promotional page to confirm eligibility and save more.

- Choosing the right payment and delivery methods can reduce fees; use the fee calculator to understand the total cost of each remittance in advance, ensuring safe and timely fund delivery.

Remitly Remittance Exchange Rates

Exchange Rate Calculation

When you use Remitly for remittances, you can view real-time exchange rates directly on the website or app. Remitly automatically displays the current applicable rate based on the remittance country and currency you select. You don’t need to calculate manually; the system will automatically convert the remittance amount to the actual amount the recipient will receive after you input it.

Remitly’s exchange rate structure is highly transparent. You can clearly see the exchange rate and final received amount for each transaction before sending. This allows you to assess cost-effectiveness in advance and avoid losses due to exchange rate fluctuations.

If you choose to send USD to China/Mainland China, Remitly will display the real-time USD to CNY exchange rate. You can refresh the page at any time to get the latest data.

Market Rate Comparison

You may be concerned about the difference between Remitly’s rates and the mid-market rate. The mid-market rate, typically provided by financial data services like XE or OANDA, is considered the closest to the true market rate.

- Remitly’s exchange rates are typically lower than the mid-market rates provided by XE and OANDA.

- Remitly’s rates include a margin to cover operational costs.

- XE and OANDA’s mid-market rates are more favorable, closer to the true market value.

When choosing Remitly for remittances, it’s advisable to compare its real-time rates with the mid-market rate. This helps you gauge the actual cost. If you prioritize the best possible rate, compare multiple platforms. However, Remitly’s strengths lie in its user-friendly process, fast delivery, and transparent fees.

Promotional Rates

Remitly offers highly attractive promotional rates for new users. When you use Remitly for your first remittance, you can typically enjoy zero fees and better exchange rates. The specific promotional terms are as follows:

| Term Type | Details |

|---|---|

| Zero-Fee Transfer Conditions | Zero-fee transfers will be applied directly to your first three (3) successful transactions during the promotional period. Zero-fee transfers do not apply to transactions made with a credit card. |

| Special Exchange Rate Conditions | The special exchange rate will be applied directly to your first eligible transfer, with a maximum limit as specified on the promotional page. For UAE customers, the special rate will be applied by a partner bank authorized by the UAE Central Bank. |

| Promotional Period | The promotion starts on July 31, 2025, at 12:00 PM (PST/PDT) and ends on September 22, 2025, at 11:59 PM (PST/PDT). |

| Eligibility Restrictions | Remitly reserves the right to limit the number of individuals per household eligible for this promotion and may cancel any transfers deemed to circumvent promotional rules. |

| Other Terms | Participating in this promotion will make you ineligible for other Remitly promotions. Cancellations or insufficient funds will disqualify you from this promotion. |

During the promotional period, you can enjoy the following benefits:

- New users can receive special offers on their first transfer.

- Zero fees or reduced rates may be available during the promotional period.

By using Remitly for remittances, you not only benefit from transparent rates but also gain tangible fee reductions on your first transfer. For users looking to save costs, this promotion is highly attractive. Before sending, check the promotional page to confirm your eligibility.

Remitly Remittance Fees

Image Source: unsplash

Fee Types

When using Remitly for remittances, you’ll notice that fees vary depending on the remittance and delivery methods. Remitly charges different fees based on your chosen payment method, delivery method, and destination country. You can refer to the table below to understand common fee types:

| Transfer Method | Fee Description |

|---|---|

| Online Transfer | Fees vary based on the amount sent, payment method, and delivery option. |

| Bank Account Transfer | Visit the pricing page to view current fees. |

| Mobile Wallet Transfer | Visit the pricing page to view current fees. |

Fees vary depending on your chosen payment method. For example, using a debit or credit card typically incurs higher fees than bank account transfers. The delivery method also affects fees, such as bank deposits, cash pickups, or mobile wallets.

Remitly’s fees also vary by destination country. Remittances to the Philippines or India generally have lower fees, while transfers to Europe or Africa may be higher. Choosing economy or express delivery options also impacts the final fee.

Tip: When selecting payment and delivery methods, compare different combinations to find the most cost-effective option for you.

Fee Calculator

On Remitly’s website or app, you can use the fee calculator to estimate the total cost of each remittance in advance. The fee calculator accounts for the following variables:

- Transfer Fees: Depend on the delivery method (e.g., bank deposit, cash pickup, or mobile wallet) and transfer speed (express or economy).

- Exchange Rate Margin: Remitly adds a small margin to the exchange rate, especially when converting USD to other currencies.

- Payment Method: Using a debit or credit card incurs higher fees than bank account transfers.

You simply input the remittance amount, select the payment and delivery methods, and the system will automatically display all related fees and the actual amount the recipient will receive. This allows you to know all costs upfront, avoiding unexpected expenses.

Fee Transparency

Remitly emphasizes fee transparency. Before confirming a transfer, the system clearly displays all fees and real-time exchange rates, ensuring no surprises. Remitly is characterized by clear upfront pricing and no hidden fees, allowing you to know exactly what you’ll pay before sending funds.

You can also check real-time updated exchange rates to ensure competitive conversions. While Remitly strives for transparency, some users note that fees can increase significantly when using credit cards. After the promotional period, exchange rate margins may range from 1% to 3%, potentially resulting in recipients receiving less than expected.

When choosing a payment method, prioritize bank account transfers to effectively reduce fees. You can also compare different payment and delivery methods to find the most cost-effective combination.

Note: Remitly does not charge hidden fees, but some banks (e.g., licensed Hong Kong banks) may impose additional fees for international remittances. Before sending, consult the recipient’s bank to understand all possible fees.

Transfer Limits

Single Transaction Limit

When using Remitly for remittances, note that each transfer has a maximum amount limit. Remitly sets different single transaction limits for different countries. For example, when sending from the U.S., the maximum per transfer can reach $100,000. Limits for other countries vary depending on the sending country and delivery method.

In some cases, transfer limits may also be affected by exchange rate fluctuations. Before proceeding, you can check the current applicable limits on Remitly’s website or app to avoid transfer failures due to exceeding limits.

| Sending Country | Maximum Single Transaction Limit |

|---|---|

| United States | $100,000 |

| Other Countries | May vary |

Friendly Reminder: For large transfers, consult the recipient’s bank (e.g., licensed Hong Kong banks) in advance to confirm any additional restrictions or fees.

Daily Limit

Remitly also has clear regulations on daily transfer totals. You can send up to $2,999 per day through Remitly. This limit is moderate compared to other major remittance platforms. For example, Western Union’s daily limit is $5,000, while MoneyGram ranges from $1,000 to $2,999.

If you have higher remittance needs, you can split transfers across multiple days. Remitly may adjust your limit based on your account verification level and transaction history. You can check your current limit in your account settings at any time.

| Platform | Daily Transfer Limit |

|---|---|

| Remitly | Up to $2,999 |

| Western Union | Up to $5,000 |

| MoneyGram | $1,000 to $2,999 |

Tip: When planning large remittances, schedule transfers over time to complete fund transfers more efficiently.

Delivery Time

Influencing Factors

When using Remitly for remittances, delivery times are not always fixed. Multiple factors affect how quickly funds reach the recipient. You can refer to the table below for key factors affecting delivery time:

| Influencing Factor | Description |

|---|---|

| Delivery Method | Choosing bank deposit, cash pickup, or mobile wallet results in different delivery speeds. Some methods arrive in minutes, while others take one to three days. |

| Recipient Bank | Licensed Hong Kong banks have varying processing speeds; some process instantly, while others may take days. |

| Transfer Option | Remitly offers express and economy transfer speeds; express transfers typically arrive in minutes or hours, while economy takes longer. |

| Information Accuracy | Ensure recipient information is accurate and complete to avoid delays. |

| Compliance Checks | Remitly complies with anti-money laundering regulations, and compliance reviews may cause delays. |

| Payment Method Issues | Using debit cards, credit cards, or bank accounts with insufficient funds or authorization issues can affect delivery speed. |

Before sending, choose the appropriate delivery method and transfer option based on your needs. Double-check information to avoid delays due to errors. You can also consult the recipient’s bank to understand processing times.

Fast Delivery Methods

If you want funds to reach the recipient quickly, choose Remitly’s express delivery options. Delivery times for different methods are as follows:

| Transfer Method | Average Time |

|---|---|

| Bank Transfer | 3-5 business days |

| Credit/Debit Card Transfer | 1-3 business days |

| Cash Pickup | Within minutes |

| Mobile Wallet | 1-3 business days |

When choosing cash pickup, recipients can receive funds within minutes. Credit or debit card transfers typically take 1-3 business days. Bank transfers and mobile wallet deliveries take slightly longer, averaging 1-5 business days. When sending from the U.S. market to China/Mainland China, prioritize cash pickup or express transfer options to significantly reduce waiting time.

Tip: When sending, select “Express transfer” for faster delivery. If time is not urgent, choose the “Economy option” for lower fees but longer delivery times.

When operating, combine your needs and the recipient’s situation to choose the most suitable delivery method, ensuring funds arrive safely and on time.

Remittance Process

Image Source: unsplash

Registration and Verification

You can easily register an account on Remitly’s website or app. During registration, the system will require you to upload identity verification documents. Common documents include government-issued photo IDs, such as passports, national IDs, or driver’s licenses. For large transfers, the system may also request utility bills or bank statements to verify your address. The process is straightforward, helping you quickly activate your account.

Entering Information

When sending a remittance, you need to provide the recipient’s detailed information, including their name, bank account or mobile wallet details, and specific address in China/Mainland China. When selecting a licensed Hong Kong bank as the recipient bank, ensure the information is accurate. The system automatically matches the remittance country and currency based on your input, supporting 145 countries worldwide and over 100 currencies to meet your diverse needs.

Choosing Methods

You can select different remittance methods based on your needs. Remitly supports bank deposits, cash pickups, and mobile wallets. You can also choose economy or express delivery options. Economy options have lower fees but longer delivery times, while express is ideal for urgent needs. When sending from the U.S. market to China/Mainland China, choose the most suitable method flexibly, with the system displaying fees and rates in real time.

Status Tracking

After completing the remittance, you can track the fund status anytime on the app or website. Each transaction has a unique tracking number, allowing you to monitor progress in real time. The system notifies you of each stage via email or SMS, ensuring you stay informed about fund movements. Remitly uses encryption to protect your data and conducts 24/7 transaction monitoring to prevent fraud. You can also enable two-factor authentication to further enhance account security.

Precautions

Reasons for Remittance Failure

When using Remitly, you may encounter transfer failures. Common reasons include incorrect recipient information, exceeding transfer limits, payment method authorization failures, or delays by the recipient bank (e.g., licensed Hong Kong banks). If account information is inaccurate, the system will automatically reject the transaction. Before sending, double-check all information, including recipient name, bank account, and address. Monitor daily and single transaction limits to avoid failures due to excessive amounts.

Security Precautions

Protecting personal information and fund security is critical during remittances. You can take the following measures to prevent fraud:

- Identify fraud warning signs, such as unknown recipients or requests for upfront payments.

- Verify all Remitly-related communications and transaction details to ensure authenticity.

- Regularly update software and use strong passwords to enhance account security.

- Use fraud detection software and identity verification tools to improve protection.

If you encounter suspicious activity, stop the operation immediately and contact Remitly customer service. Enable two-factor authentication to further secure your account.

Promotions

When using Remitly, you can enjoy various promotional offers. The table below outlines common promotion types and details:

| Promotion Type | Details |

|---|---|

| Discount Code | Use a discount code for a $25 order discount |

| First Order | $10 discount on orders above $100 |

| New Customer Offer | $10 discount on first transfer |

| Referral Program | Earn $20 for referring friends, who also receive $20 |

As a new customer, you can use notification links or enter promo codes on the redemption page. After completing your first transfer, you’ll receive the corresponding discount. Referring friends who register and complete transactions earns rewards for both parties. Before sending, check the latest promotions to utilize offers and reduce costs.

When using Remitly for remittances, you can enjoy an intuitive interface, transparent fees, and multiple delivery options. The table below summarizes key advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| User-friendly operation | Transfer limits apply |

| Competitive rates | Issues may arise with cancellations |

| Multiple delivery methods | Available only in select countries |

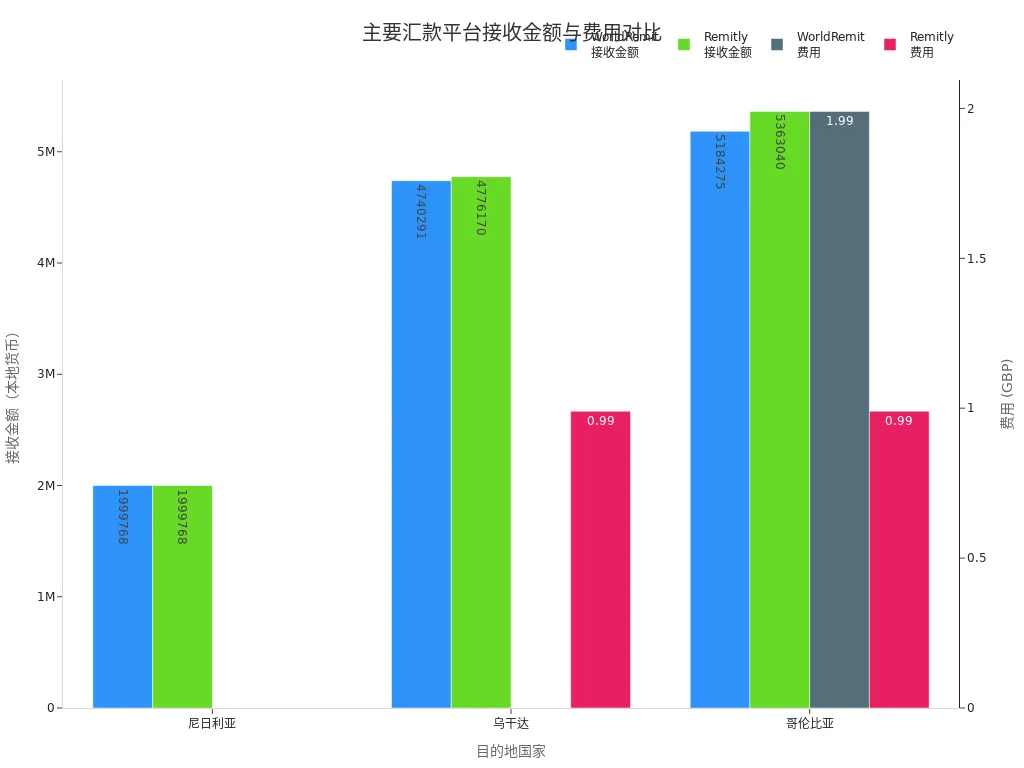

If you’re part of an international NGO or e-commerce platform, Remitly is ideal for efficient cross-border transfers. Focus on fees, rates, and delivery times. The chart below compares received amounts and fees across major platforms in different countries:

Choose the most suitable remittance method based on your needs to ensure funds arrive safely and on time.

FAQ

What delivery methods does Remitly support?

You can choose bank deposits, cash pickups, or mobile wallets. Licensed Hong Kong banks support bank deposits, and cash pickups are available in some regions.

Tip: Check all available methods displayed in the app before sending.

How long does it take for funds to arrive after a remittance?

With express delivery, funds can arrive within minutes. Economy options take longer, typically 1-5 business days.

| Method | Average Delivery Time |

|---|---|

| Express Delivery | Within minutes |

| Economy Delivery | 1-5 business days |

What should I do if a remittance fails?

First, verify the recipient information and remittance amount. If issues persist, contact Remitly customer service or the recipient’s licensed Hong Kong bank to investigate the cause.

Remitly offers transparent fees and swift delivery (Express mode in minutes), but its 0.5%-3% exchange markup, fees starting at $3.99, and per-transfer limits up to $100,000-$300,000 (depending on country) can inflate costs in the projected $80+ trillion global remittance market of 2025, where non-promotional rates and verification delays often erode received amounts. For a more affordable, dependable cross-border option, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay outperforms Remitly, maximizing recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day processing, no lengthy checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current USD rates (e.g., USD/CNY around 7.1), optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.