- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Enjoy a More Cost - effective Cross - border Remittance Experience through Remitly's New Customer Offer

Image Source: unsplash

After registering for Remitly’s new customer promotion, your first remittance can be exempt from transaction fees and enjoy an exclusive exchange rate. The process is simple, and the fees are transparent. The table below shows the savings compared to other platforms:

| Platform | Transaction Fee (USD) | Exchange Rate |

|---|---|---|

| Remitly | 3.99 (waived for new customers’ first transfer) | Promotional Rate |

| Wise | Starting from 0.48% | Mid-Market Rate |

Key Points

- After registering as a new Remitly customer, your first transfer can be fee-free and benefit from an exclusive exchange rate, saving on remittance costs.

- The activation process is simple, ensuring you complete your first transfer during the promotional period to receive the offer.

- Remitly offers multiple payment methods and fast delivery options to meet various user needs.

Claiming Remitly’s New Customer Promotion

Image Source: unsplash

Registration and Eligibility

To enjoy Remitly’s new customer promotion, you first need to meet a few basic conditions. Remitly offers a one-time fee waiver and exclusive exchange rate for first-time users. You can claim this limited-time benefit by completing your first transfer.

Remitly’s new customer promotion is only available to first-time customers, with each customer limited to one claim. You need to use the official notification link or enter an exclusive promo code on the “Redeem Offer” page. The promotion is activated only upon successfully completing the first transfer during the promotional period. If you cancel the order or have insufficient funds, you will not qualify for this benefit.

You can refer to the eligibility requirements below to ensure you qualify:

- Only first-time customers are eligible, with a limit of one claim per customer.

- You must use the notification link or enter the promo code on the “Redeem Offer” page.

- The first transfer must be successfully completed to claim the offer.

- The transfer must be completed within the specified promotional period.

- Cancellation or insufficient funds will disqualify you from the offer.

You should also note that Remitly’s new customer promotion cannot be combined with other offers. Each customer can only claim it once and cannot redeem it repeatedly.

Activation Process

After registering, activating Remitly’s new customer promotion is very straightforward. Simply follow these steps:

- Register a new account on the Remitly website or app and fill in your personal information.

- Go to the “Redeem Offer” page, enter the exclusive promo code received, or activate via the official notification link.

- Select the remittance country and recipient method, and fill in the recipient’s information.

- Enter the remittance amount, and the system will automatically display the fee waiver and exclusive exchange rate.

- Complete the first transfer within the promotional period and wait for system confirmation.

- Once the transfer is successful, you can enjoy the cost savings from Remitly’s new customer promotion.

You also need to pay attention to the remittance amount limits. Remitly sets different transfer limits based on account tiers. The table below shows the transfer limits for each account tier (in USD):

| Account Tier | 24-Hour Limit | 30-Day Limit | 180-Day Limit |

|---|---|---|---|

| Tier 1 | $2,999 | $10,000 | $18,000 |

| Tier 2 | $6,000 | $20,000 | $36,000 |

| Tier 3 | $10,000 | $30,000 | $60,000 |

You can choose the appropriate account tier based on your needs.

Tip: When activating and using Remitly’s new customer promotion, it’s recommended to confirm the promotion’s validity period and transfer amount limits in advance to avoid missing out due to ineligibility or operational errors.

Applicable Scope

Remittance Countries and Currencies

With Remitly’s new customer promotion, you can transfer funds from the US or Canada to multiple countries and regions worldwide. The platform supports various mainstream currencies, covering the Americas, Asia, Africa, and more. The table below lists some common sending and receiving countries:

| Sending Country | Receiving Countries |

|---|---|

| United States | Antigua and Barbuda, Argentina, Bahamas, Barbados, Belize, Bolivia, Cayman Islands, Chile, Colombia, Costa Rica, Dominica, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, St. Kitts and Nevis, St. Lucia, Suriname, Trinidad and Tobago, Turks and Caicos Islands, Uruguay |

| Canada | Antigua and Barbuda, Argentina, Bahamas, Bolivia, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, St. Kitts and Nevis, Suriname, Trinidad and Tobago, Uruguay |

You can choose different currencies during remittance to meet diverse cross-border needs. The actual supported countries and currencies may vary based on policy and market changes, so it’s recommended to visit the Remitly website for the latest information before proceeding.

Supported Payment Methods

Remitly offers multiple convenient payment methods. You can choose from the following methods to complete your transfer:

- Bank Transfer

- Alipay

- WeChat Pay

- Debit Card

- Credit Card

- Cash Pickup

- Bank Account

- Mobile Wallet

You can select the most suitable payment method based on your situation. Some payment methods may vary depending on the receiving country. You can check the platform’s page for detailed information before use.

Tip: The applicable scope and supported methods for Remitly’s new customer promotion may change periodically. You should regularly check the Remitly website to stay updated on the latest service information and promotional policies.

Practical Benefits

Fee Reduction

When using Remitly’s new customer promotion, you can significantly reduce remittance costs. The platform offers fee waivers or extremely low fees for first-time users. You can understand the actual benefits of fee reduction through the following points:

- Remitly provides introductory rates for first-time users, with fees typically ranging from $0 to a small fixed amount.

- Transfers made via bank account or debit card usually incur lower fees.

- Instant transfers paid by credit card may incur higher fees, sometimes exceeding $3 or more.

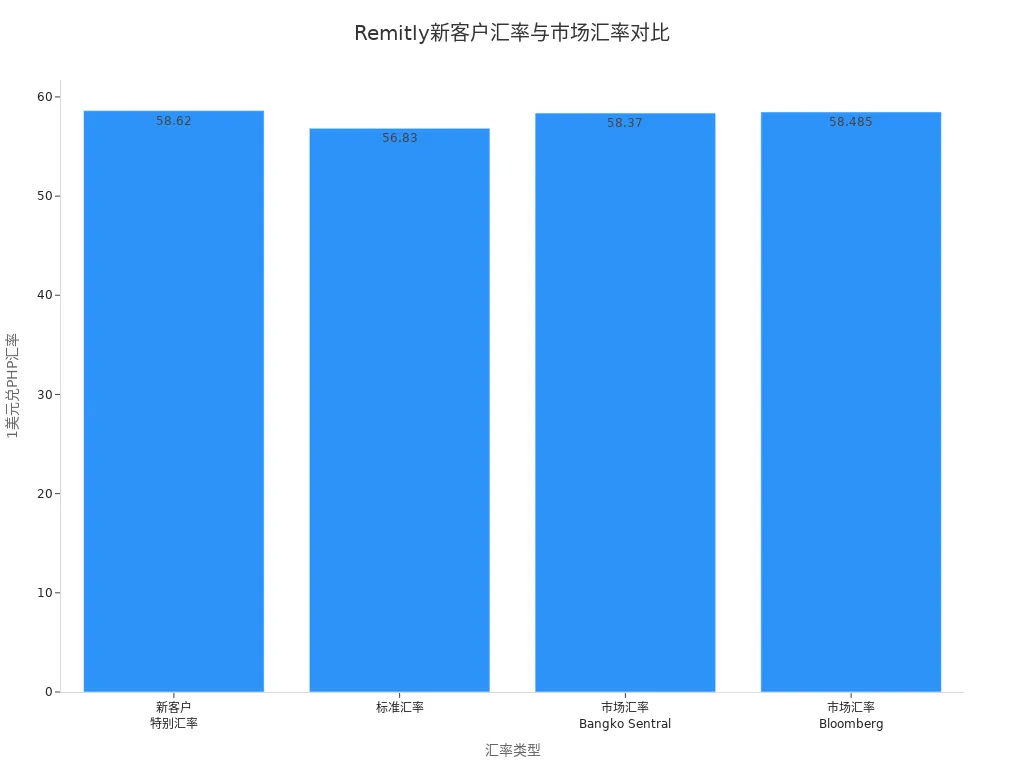

You can not only enjoy fee waivers but also benefit from better exchange rates. The table below compares the new customer special rate, standard rate, and mainstream market rates:

| Rate Type | Exchange Rate |

|---|---|

| New Customer Special Rate | 1 USD = 58.62 PHP |

| Standard Rate | 1 USD = 56.83 PHP |

| Market Rate (Bangko Sentral ng Pilipinas) | 1 USD = 58.370 PHP |

| Market Rate (Bloomberg Markets Data) | 1 USD = 58.4850 PHP |

You can see that Remitly’s new customer promotion rate is close to or even better than mainstream market rates, allowing you to get more local currency during remittance.

Tip: Before transferring, you can view all fees and exchange rates directly on the Remitly page. The platform does not charge hidden fees, and the fee structure is highly transparent.

Transfer Speed

When using Remitly for cross-border remittances, you can choose different transfer speeds based on your needs. The platform offers two main options: “Express Transfer” and “Economy Transfer”:

| Transfer Type | Processing Time |

|---|---|

| Express Transfer | Usually completed within minutes |

| Economy Transfer | Takes 3-5 business days |

If you choose Express Transfer, funds typically arrive within minutes, ideal for urgent needs. Economy Transfer is suitable for scenarios where time is less critical, and you want to save more on fees.

You may be interested in comparing Remitly’s transfer speeds with other major international remittance services. The table below shows transfer speeds of different platforms:

| Service | Transfer Option | Transfer Speed |

|---|---|---|

| Remitly | Express | Within minutes |

| Economy | 1 to 5 days | |

| WorldRemit | Instant | 70% of transfers are instant |

| Cash Pickup | Almost always instant | |

| Western Union | Cash Pickup | Usually instant |

| Bank Transfers | 1 to 3 business days |

When using Remitly, you can track transfer progress in real-time via email. The system will automatically notify you of any changes in fund status, ensuring you stay informed about your remittance.

Tip: Different transfer methods and payment channels may affect delivery speed. It’s recommended to choose the most suitable service based on your actual needs before transferring.

Fees and Security

Image Source: pexels

Fee Structure

When using Remitly for remittances, you can clearly see all fees and exchange rates. The platform displays the total transfer cost before you confirm, helping you make informed decisions. Remitly’s fee structure is highly transparent, as reflected in the following aspects:

- You can view the total cost of each transfer directly on the Remitly website or app.

- Fees are automatically calculated based on your transfer amount, payment method, and recipient method.

- Remitly offers competitive exchange rates and low fees, with all fees clearly displayed before the transfer.

Tip: Before confirming the transfer, make sure to review all fees and exchange rates displayed on the page. The platform does not charge any hidden fees.

Security Measures

Remitly places a high priority on the security of your funds and personal information. The platform employs multiple industry-leading security technologies to ensure every transfer is safe and reliable. You can refer to the table below for Remitly’s main security measures:

| Security Technology | Description |

|---|---|

| Encryption Protocols | Uses advanced encryption protocols (e.g., TLS, AES256, 2048-bit RSA) to protect data and transactions. |

| Verification Process | Implements strict account verification procedures to ensure user identity authenticity. |

| Monitoring Suspicious Activity | Monitors accounts 24/7 to detect and prevent suspicious activity, fraud, and hacking attempts. |

Remitly also has a robust fraud detection system and a team of security experts continuously monitoring all transactions. The platform complies with international standards such as the UK Financial Conduct Authority (FCA) and strictly enforces anti-money laundering policies. You’ll also use two-factor authentication (2FA) when logging in and operating your account, further enhancing security.

If you encounter any issues during the remittance process, you can contact Remitly’s official customer service channels for immediate assistance.

Latest Promotion Information

Official Channels

To get the latest Remitly new customer promotions and offers, you can check the following official channels:

- Visit Remitly News for the latest customer promotions and official announcements.

- Use the Remitly Help Center for 24/7 customer support and FAQs.

You can regularly browse these pages to stay updated on the latest activities and service changes, ensuring you don’t miss any limited-time offers or new benefits.

Event Updates

Remitly periodically launches exclusive promotions for new customers based on seasons and market demands. You can refer to the table below for promotion frequency and influencing factors:

| Promotion Type | Average Time Interval |

|---|---|

| New Offer Release Frequency | Approximately 30 days or more |

| Influencing Factors | Seasonal promotions, etc. |

Recent activities include first-time user offers, seasonal discounts, and referral rewards. For example:

- New users who register and transfer $100 or more can receive a $20 transfer discount.

- During specific holidays, Remitly offers transfer fee discounts or exclusive exchange rates.

- Referring new users to register earns both the referrer and referee a $20 reward.

You can share referral links via email or social media to invite friends to use Remitly. Each successful referral earns additional rewards. It’s recommended to check the latest event details before transferring to plan your remittance timing and amount for maximum savings.

By choosing Remitly’s new customer promotion, you can enjoy lower fees, fast transfers, and multi-layered security protections.

- After registering, your first transfer comes with more competitive fees.

- The Flex Plus plan enables instant transfers.

- Multiple security measures protect your funds.

| Feature | Remitly | Other Services |

|---|---|---|

| New User Promotion | Fee waiver or high exchange rate | Promotions vary |

| Fee Transparency | Clear structure | May lack transparency |

| Satisfaction Rating | 4.5/5 (2024) | - |

You should follow official channels to stay updated on the latest promotions, provide accurate information during registration, and enable two-factor authentication to ensure secure remittances.

FAQ

Is Remitly’s new customer promotion available to users in mainland China?

You can receive funds in mainland China, but you need to confirm whether the sending country and recipient method are supported. It’s recommended to check the latest information on the Remitly website in advance.

What recipient methods are available for remittances?

You can choose bank accounts, Alipay, WeChat Pay, and other methods. Supported recipient methods may vary by country, so please verify before placing your order.

Are there limits on remittance amounts?

Your first transfer has amount limits. Different account tiers have varying limits, up to $10,000 (24 hours). You can check details in your account settings.

After reviewing Remitly’s new customer promo activation, you might still grapple with hidden fees, rate volatility, or account limits (like $10,000 per 24 hours), which often drive up cross-border transfer costs and hinder family support. BiyaPay, an innovative global finance platform, empowers you to overcome these hurdles for a more affordable remittance journey!

BiyaPay enables real-time exchange rate queries, with the current USD/PHP rate around 58.62, allowing instant locking of optimal moments to evade market dips. Fees as low as 0.5%, zero for contract orders, far below Remitly’s $3.99 starting fee; seamless fiat-to-digital swaps for agile asset handling.

Quick signup unlocks remittances to most countries worldwide, same-day delivery spanning Remitly’s 170+ destinations. Uniquely, BiyaPay integrates US and Hong Kong stock trading on one platform, no overseas accounts needed, merging transfers with investing effortlessly. Secured by AES-256 encryption and FCA compliance, it prioritizes fund protection.

Sign up at BiyaPay today, join millions of users, and embrace low-rate, clear-exchange global freedom, surpassing Remitly promo boundaries!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.