- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use MoneyGram Bank Transfer: A Comprehensive Analysis of Fast and Secure Remittance Services

Image Source: unsplash

Do you want to quickly send money to China or Mainland China? MoneyGram bank transfer can help you achieve secure and convenient fund transfers. You can choose from various receipt methods, such as bank accounts, mobile wallets, or cash pickup at branches. The system uses strict identity verification to ensure every transfer is protected by financial regulations. You can use it with peace of mind, without worrying about fund security or delivery speed.

Key Points

- MoneyGram bank transfer supports multiple receipt methods, including bank accounts, cash pickup, and mobile wallets, catering to diverse needs.

- Remittance delivery is fast, with cash pickup available within 10 minutes and bank account deposits typically arriving within 1 hour.

- When using MoneyGram bank transfer, pay attention to remittance limits and transaction fees, and choose the most suitable payment method to reduce costs.

- The system employs strict identity verification and multiple security measures to ensure fund safety and prevent fraud.

- Before sending money, confirm the recipient’s information and locally supported service types to increase the success rate of the transfer.

Advantages and Scenarios

MoneyGram Bank Transfer Advantages

When choosing an international remittance service, MoneyGram bank transfer offers many unique advantages. You can enjoy the following conveniences:

- MoneyGram bank transfer covers over 200 countries and regions worldwide, with an extensive service range.

- You can receive funds at over 350,000 agent locations, making it easy to access money even in remote areas.

- You can choose multiple receipt methods, including bank account deposits, mobile wallets, cash pickup, and home delivery in some regions.

- Cash pickup is typically available within minutes, meeting your need for fast transfers.

You can complete remittances using different payment methods, as detailed below:

| Payment Method | Description |

|---|---|

| Bank Account Payment | You can send funds directly from a US checking or savings account without using a debit or credit card. |

| Credit/Debit Card Payment | You can transfer funds using a credit or debit card, with simple operations and fast delivery. |

MoneyGram bank transfer offers flexible options, allowing you to find a suitable receipt method no matter where you are.

Applicable Scenarios

You may need to use MoneyGram bank transfer in various situations. Here are some typical scenarios:

- When facing emergencies, such as paying medical bills, 44% of users choose MoneyGram bank transfer to address urgent needs.

- You need to continuously support family members in China/Mainland China for essentials like food and housing, with 42% of users using it for daily necessities.

- You want to help people affected by global events, with 27% of users using MoneyGram bank transfer for international aid.

You can flexibly choose MoneyGram bank transfer services based on your actual needs, ensuring a secure and fast experience for both urgent remittances and regular support.

MoneyGram Bank Transfer Process

Image Source: unsplash

Online Process

You can complete online remittances through the MoneyGram bank transfer website or mobile app. The process is straightforward, suitable for operations at home or in the office. Here are the standard steps:

- Log in or register for a MoneyGram bank transfer account.

- Enter the recipient’s information, including name, receipt method, and receiving country (e.g., China/Mainland China).

- Enter the amount you wish to send (in USD).

- Choose a payment method, such as a credit or debit card.

- Review the information and submit the remittance request.

Tip: The MoneyGram bank transfer online process uses multiple security protocols to protect your funds and personal information. You’ll encounter identity verification and multi-factor authentication during the process to ensure account security. The table below outlines key security measures:

| Security Protocol | Description |

|---|---|

| Data Protection | Encryption technology is used to protect your information and prevent data breaches. |

| Identity Verification | You are required to provide valid identification to prevent identity theft. |

| Fraud Prevention | The system automatically monitors transactions and alerts you to any anomalies. |

| Multi-Factor Authentication (MFA) | You need to verify through a phone or email code, enhancing account security. |

In most cases, online remittances arrive in real-time, with a maximum of 2 business days. You can check the remittance progress in your account at any time.

Offline Process

If you prefer in-person services, you can opt for MoneyGram bank transfer’s offline process. Visit a nearby agent location and follow these steps:

- Log in to your MoneyGram bank transfer profile to pre-fill remittance information.

- Inform the staff of the recipient’s details and the remittance amount (in USD).

- Choose cash payment and confirm the receipt method.

- Within 24 hours, visit the designated location and present identification documents (e.g., passport or Hong Kong ID).

- Complete the payment, and the staff will process the remittance for you.

Note: You must bring valid identification, as all countries and regions require ID verification, whether you’re a member or not. Licensed banks in Hong Kong follow the same regulations to ensure compliant and secure transactions.

Receipt Methods

MoneyGram bank transfer offers multiple receipt methods to meet various needs. You can choose the most suitable method based on the recipient’s situation:

- Cash Pickup: Recipients can collect cash at over 440,000 MoneyGram bank transfer agent locations worldwide, covering China/Mainland China and other regions.

- Bank Account Transfer: Funds are directly deposited into the recipient’s bank account, suitable for licensed banks in Hong Kong or China/Mainland China.

- Debit Card Deposit: Some regions support direct transfers to the recipient’s debit card.

- Mobile Wallet: In specific countries and regions, you can transfer funds to the recipient’s mobile wallet for convenience.

Tip: When choosing a receipt method, confirm the service types supported in the recipient’s region in advance. Cash pickup is ideal for urgent needs, while bank accounts and mobile wallets are better for daily support.

You can flexibly utilize MoneyGram bank transfer’s diverse services, whether online or offline, to enjoy a secure and fast remittance experience.

Fees and Exchange Rates

Transaction Fees

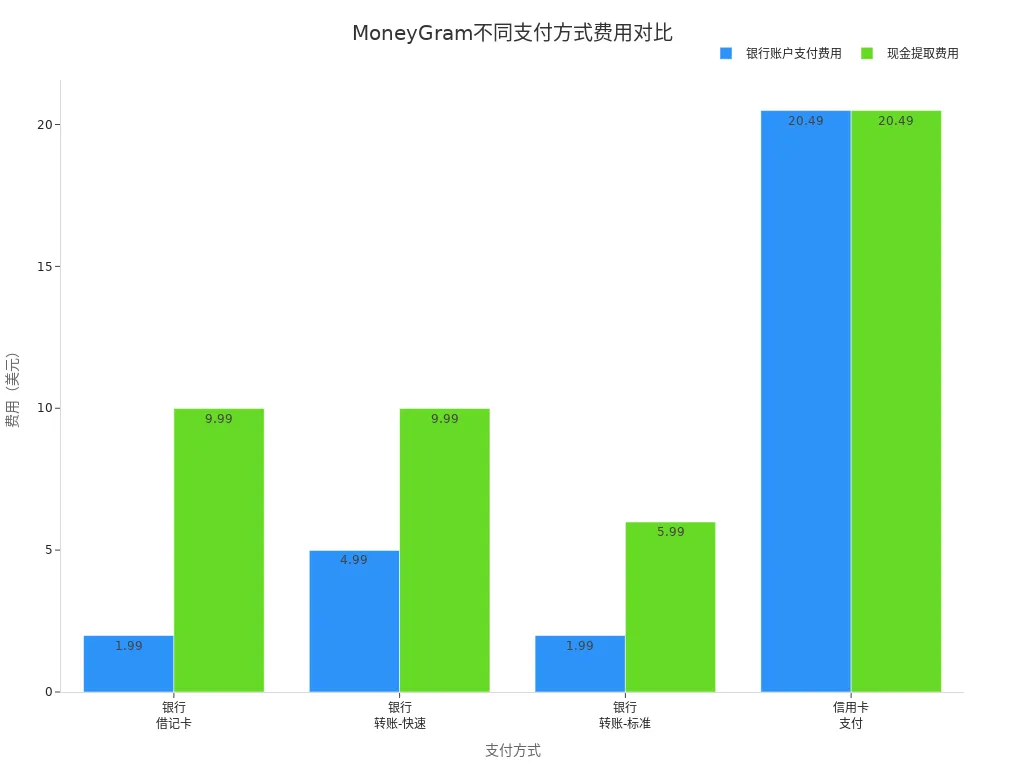

When using MoneyGram bank transfer, transaction fees vary based on the payment and receipt methods. Refer to the table below for typical fees when sending $500 to a Euro account:

| Payment Method | Bank Account Payment Fee | Cash Pickup Fee |

|---|---|---|

| Bank Debit Card Payment | $1.99 | $9.99 |

| Bank Transfer - Fast | $4.99 | $9.99 |

| Bank Transfer - Standard | $1.99 | $5.99 |

| Credit Card Payment | $20.49 | $20.49 |

| Cash Payment | Varies by sending location | Varies by sending location |

You can choose the payment method that best suits your needs. Fees are transparent, allowing you to budget remittance costs in advance.

You can see that bank account payments generally have lower fees, while credit card payments are more expensive. Choose based on your specific needs.

Exchange Rates

When using MoneyGram bank transfer, exchange rates affect the final amount received. MoneyGram adopts a dynamic exchange rate policy influenced by global markets and local factors. You can view the exchange rate in real-time during the transaction to understand the value of your remittance.

- Exchange rate types include fixed and floating rates.

- Floating rates are influenced by market supply and demand, currency strength, and other factors.

- MoneyGram bank transfer’s exchange rate policy is transparent, with details available at any time.

During the process, the system displays reference and actual exchange rates, with typically minimal differences. For example:

| Reference Rate | Actual Rate | Rate Difference (%) |

|---|---|---|

| 1.00 | 1.00 | 0.00 |

You can rest assured that MoneyGram bank transfer does not charge hidden exchange rate markups.

Inquiry and Comparison

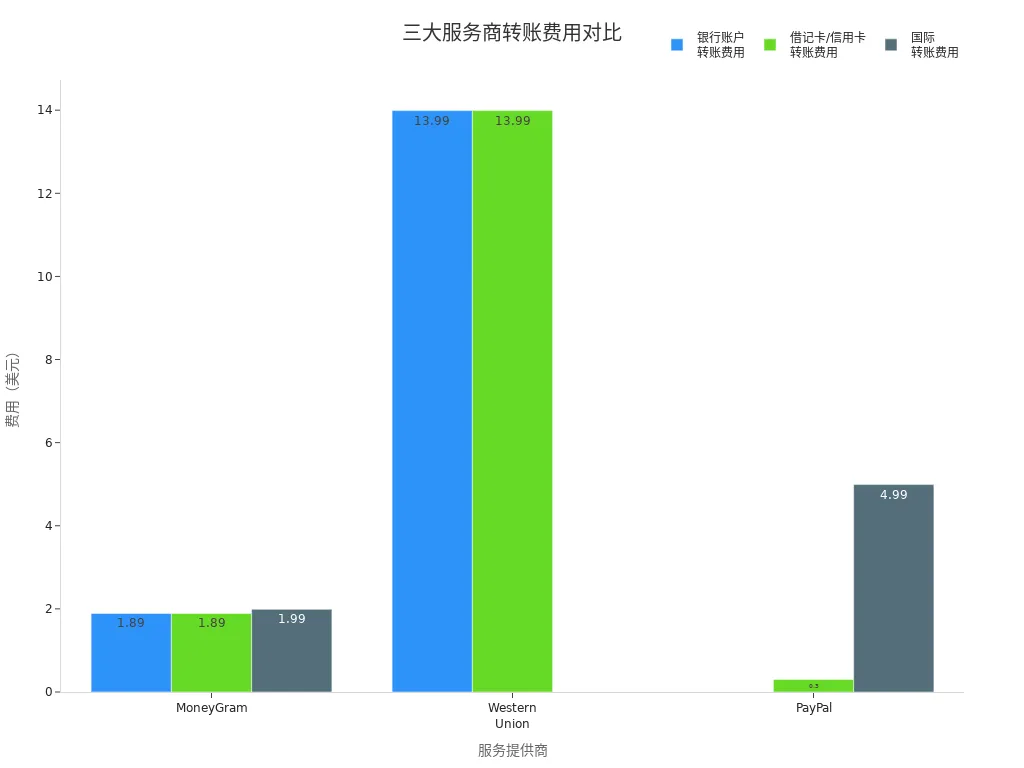

You can use online tools to check MoneyGram bank transfer’s fees and exchange rates and compare them with other providers. The table below shows typical fees for MoneyGram, Western Union, and PayPal:

| Service Provider | Bank Account Transfer Fee | Debit/Credit Card Transfer Fee | International Transfer Fee |

|---|---|---|---|

| MoneyGram | $1.89 | $1.89 (up to $6.49) | $1.99 (first transaction may be free) |

| Western Union | $13.99 | $13.99 (debit card) | N/A |

| PayPal | No fee | 2.9% + $0.30 | $4.99 (minimum $0.99) |

You can quickly compare fees and exchange rates across providers to choose the most suitable remittance method. It’s recommended to check rates before sending to ensure the best exchange rate and lowest fees.

Limits and Delivery Times

Remittance Limits

When using MoneyGram bank transfer, you need to be aware of per-transaction limits. Different countries and regions have specific maximum transfer amount regulations. Refer to the table below for limits in key regions:

| Country/Region | Maximum Transfer Limit (USD) | Minimum Transfer Limit (USD) |

|---|---|---|

| Most Countries | 10,000 | N/A |

| United States | 15,000 | N/A |

| Chile | 5,000 | N/A |

When sending to China/Mainland China or licensed banks in Hong Kong, the typical single-transaction limit is $10,000. For larger amounts, you can split the transfer into multiple transactions. Confirm the destination country’s specific limits before proceeding.

Delivery Speed

You may be concerned about when funds will arrive. MoneyGram bank transfer’s delivery speed depends on the receipt method and region. Refer to the table below for average delivery times for different methods:

| Delivery Method | Transfer Time |

|---|---|

| Cash Pickup | As little as 10 minutes (subject to agent operating hours) |

| Bank Account Deposit | Up to 1 hour; same-day or next-day in some countries |

| Direct to Debit Card | Within minutes |

| Mobile Wallet | Within minutes |

When choosing cash pickup in China/Mainland China, funds can be collected in as little as 10 minutes. Bank account deposits typically arrive within 1 hour, though some countries may take same-day or next-day delivery. Transfers to licensed banks in Hong Kong are also very fast, ideal for urgent needs.

Tip: Remittances during holidays or non-business hours may experience delays. It’s recommended to send money during business days and agent operating hours to improve delivery efficiency.

Influencing Factors

During the remittance process, you’ll find that delivery speed is affected by multiple factors. These include:

- Transfer type

- Amount sent

- Currency type

- Time of day

- Weekends and holidays

- Destination country

- Intermediary banks

- Transfer provider

When choosing same-day service, funds arrive within minutes. Next-day service takes about one business day. Standard service may take a few days. It’s recommended to select the service type based on the recipient’s needs and local banking policies.

Security Measures

Image Source: pexels

Identity Verification

When using MoneyGram bank transfer, the system requires strict identity verification. This step effectively prevents fraud and illegal activities. You need to provide your full name, date of birth, and address, and sometimes a valid government-issued ID. You can complete verification online or at MoneyGram bank transfer agent locations. For first-time remittances, the system may require additional information to ensure the authenticity of both you and the recipient.

| Method | Description |

|---|---|

| Mobile Verify | MoneyGram bank transfer integrates Mitek’s Mobile Verify technology, effectively reducing fraud and account theft risks. |

| Identity Verification Requirements | You need to provide detailed personal information, including full name, date of birth, and address, and in some cases, upload identification documents. |

| Verification Effectiveness | Since adopting Mobile Verify, payment fraud losses have decreased by 20%, and account theft cases have dropped by 80%. |

For larger amounts or when using credit/debit cards, identity verification is more stringent. MoneyGram bank transfer uses these measures to protect your personal and financial security.

Fund Security

During the remittance process, the system employs multiple security measures to protect your funds. MoneyGram bank transfer is committed to preventing the system from being used for illegal activities. With each operation, the platform automatically monitors transactions to prevent money laundering, fraud, and terrorist financing. You can rest assured that the platform strictly complies with relevant laws and internal policies, with all transactions supervised by financial regulatory authorities.

When using MoneyGram bank transfer at licensed banks in Hong Kong, banks follow local and international anti-money laundering standards. The platform continuously monitors all activities to prevent misuse by malicious actors. If an unusual transaction is detected, the system will promptly freeze funds and notify you.

After each remittance, you’ll receive a reference number. You can use this number to check the fund status at any time, ensuring safe delivery to the recipient’s account.

Risk Prevention

When sending money, be cautious of common fraud risks. Scammers often target trusting users, tricking you into sending money to strangers. Once funds are sent, they are as difficult to recover as cash. Pay special attention to these common risks:

- Don’t send money to people you don’t know.

- If someone claims to be a friend or relative in an emergency, verify their identity first.

- Be cautious of online shopping or investment requests requiring MoneyGram bank transfer payments.

- Scammers may request confirmation codes or Money Transfer Control Numbers (MTCN)—never share these.

You can take the following measures to protect yourself:

- Send money only to trusted individuals.

- Avoid sharing personal information on unknown websites or social platforms.

- If you receive suspicious messages, contact MoneyGram bank transfer customer service or licensed banks in Hong Kong for verification.

- Safeguard your reference number and account information, and don’t share them casually.

Tip: When sending money in the US market or other countries, follow the same security principles. If you encounter any anomalies, stop the operation immediately and seek help.

By following these recommendations, you can significantly reduce remittance risks and ensure funds safely reach China/Mainland China or other destinations.

Common Issues and Recommendations

Reasons for Remittance Failure

When using MoneyGram bank transfer, you may encounter remittance failures. Based on customer support data, common reasons include:

- Insufficient funds in the bank account, preventing the transfer from completing.

- The transfer amount exceeds the bank’s daily sending limit.

- Bank network issues affecting transaction processing.

If your remittance fails, check your account balance and ensure the transfer amount complies with regulations, then verify the bank system’s functionality.

Methods for Successful Delivery

You can take the following steps to improve remittance success rates and ensure smooth fund delivery:

- Log in to your MoneyGram bank transfer account, re-verify your identity, and upload valid identification. Update expired IDs promptly.

- If you encounter system errors, try initiating a new transfer. The system will automatically resume recurring transactions.

- If the mobile app has issues, close and restart it or update to the latest version. You can also access the MoneyGram bank transfer website via desktop or mobile.

- For technical issues, fill out a contact form, describe the problem in detail, and attach screenshots for faster customer service assistance.

During the process, ensure your personal and recipient information is accurate to reduce the risk of failure.

Precautions

When using MoneyGram bank transfer services, avoid these common mistakes:

| Error Type | Description |

|---|---|

| Failure to Deliver Funds on Time | MoneyGram bank transfer fails to deliver funds on time, affecting your ability to use them promptly. |

| Delayed Error Handling | The platform fails to resolve your issues quickly, impacting the overall experience. |

| Inaccurate Information Provided | Inaccurate platform information may lead to misunderstandings about the service process or fees. |

Also, note the following:

- Don’t send money to strangers to avoid scams.

- Verify the identity of anyone requesting a transfer to prevent fraud.

- Be cautious of checks, especially if the amount exceeds the actual purchase amount.

- Scammers may request confirmation codes or MTCN—never provide them.

When using MoneyGram bank transfer at licensed banks in Hong Kong, verify all information in advance to ensure fund security and smooth delivery.

By choosing MoneyGram bank transfer, you can experience fast delivery, robust security, and transparent fees. When sending money, you can choose bank accounts, cash, or mobile wallets based on your needs. Pay attention to remittance limits and the accuracy of recipient information to enhance your experience. The table below shows user satisfaction with the service:

| Statistic | Rating | Evaluation |

|---|---|---|

| Customer Feedback and Satisfaction | 4.1 | Excellent |

| Customer Support | 3.9 | Very Good |

| Pricing Transparency | 4.4 | Excellent |

FAQ

What receipt methods does MoneyGram bank transfer support?

You can choose bank accounts, cash pickup, or mobile wallets. Bank account receipt is common in licensed banks in Hong Kong. Select based on the recipient’s region.

How long does it take to send money to China/Mainland China?

Cash pickup can arrive in as little as 10 minutes. Bank account receipts typically complete within 1 hour. Mobile wallet receipts are also fast, arriving within minutes.

What should I do if a remittance fails?

Check your account balance and remittance limits. Re-verify your identity or update information. For technical issues, contact MoneyGram bank transfer customer service for assistance.

How do I check the status of a remittance?

Log in to the MoneyGram bank transfer website or app and enter the reference number to check progress. You can also consult staff at licensed banks in Hong Kong for the latest status.

How are remittance fees and exchange rates calculated?

You can check fees and exchange rates in real-time on the MoneyGram bank transfer website. Fees vary by payment method, with all amounts displayed in USD. Plan your remittance by reviewing fees in advance.

MoneyGram stands out as a key player in international money transfer, offering a vast global network, diverse payout options (including bank deposits, cash pickup, and mobile wallets), and fast delivery—cash pickup can be as quick as 10 minutes. Its strict KYC verification and multi-layered security provide reliable protection for your funds.

When choosing a remittance service, speed and reach are crucial, but so are cost efficiency and post-arrival utility. BiyaPay presents a cost-effective alternative: Fees as low as 0.5% with same-day transfers—send and receive on the same day. Users can check exact costs in advance using the real-time exchange rate calculator. Furthermore, once funds arrive, they can be directly used to invest in stocks, enabling integrated remittance and wealth growth without the need for separate overseas accounts.

For users aiming to optimize cross-border cash flow and seeking transparency and multifunctionality, integrated platforms like this are worth considering. Learn more at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.