- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Complete Online Money Transfers via MoneyGram: Understanding Services, Fees, and Transfer Methods

Image Source: unsplash

You only need five steps to complete a MoneyGram online transfer: register an account, complete identity verification, fill in recipient information, choose payment and receiving methods, and finally confirm the transfer. Globally, over 15 million users have chosen this service, with the number of users growing year by year:

| Year | Number of Users (Million) | Penetration Rate (%) |

|---|---|---|

| 2018 | 6.37 | 0.09 |

| 2019 | 7.72 | 0.10 |

| 2020 | 9.30 | 0.13 |

| 2021 | 11.02 | 0.15 |

| 2022 | 12.73 | 0.17 |

| 2023 | 14.33 | 0.19 |

| 2024 | 15.75 | 0.21 |

Many users are most concerned about the following issues:

- Cybersecurity

- Service interruptions

- Insufficient communication

Key Points

- Registering a MoneyGram account and completing identity verification is the first step for online transfers, ensuring accurate personal information and valid identification documents are provided.

- Choosing the appropriate payment and receiving methods can improve transfer efficiency, with MoneyGram supporting various payment options such as credit cards, bank accounts, and cash pickup.

- Before confirming the transfer, carefully review all information, including the recipient’s name, amount, and fees, to ensure accuracy and avoid delays.

- Using MoneyGram’s fee calculator can help you estimate transfer fees and understand real-time exchange rates, ensuring the recipient receives the expected amount.

- MoneyGram provides multiple security measures to ensure the safety of personal information and funds, and users should remain vigilant against online scams and verify the recipient’s identity.

MoneyGram Online Transfer Process

Image Source: unsplash

Registration and Identity Verification

You need to first register an account on the MoneyGram online transfer platform. During registration, the system will require you to fill in some basic information, including your full name, residential address (not a P.O. box), phone number, date of birth, and Social Security Number or Individual Taxpayer Identification Number. After completing registration, you will also need to undergo identity verification. You can choose to upload a valid government-issued ID, such as a U.S. driver’s license, passport, state ID, U.S. military ID, or foreign resident ID.

Tip: Ensure the uploaded ID is within its validity period and the information is clear and visible. If identity verification fails, the system will prompt you to re-upload the documents.

Filling in Recipient Information

After registering and passing identity verification, you can proceed to the transfer process. You need to fill in the recipient’s detailed information, including the recipient’s full name, contact information, and receiving country. You also need to choose the method by which the recipient wishes to receive the funds.

- Ensure the recipient’s name is spelled accurately and matches their ID.

- If the recipient chooses bank account receipt, you need to provide their bank account information.

- If choosing cash pickup, you need to specify the city of the agent location where the recipient can collect the funds.

Choosing Payment Method

MoneyGram online transfers support multiple payment methods. You can choose the appropriate payment method based on your situation.

| Payment Method | Description |

|---|---|

| Credit/Debit Card | Supports online transfer payments using Visa and MasterCard. |

| Bank Account Payment | Allows direct transfers from U.S. checking or savings accounts. |

| Other Online Payment Options | Depending on the country, other online payment options may be available. |

Note: If you choose bank account payment, ensure the account has sufficient funds to avoid transfer failure due to insufficient balance.

Choosing Receiving Method

You can choose from multiple receiving methods for the recipient. Common receiving methods include:

- Direct deposit to a bank account

- Cash pickup (the recipient can collect cash at a local agent location)

- Transfer to a debit card (supported in some countries)

- Transfer to a mobile wallet account (supported in some countries)

- Cash home delivery (supported in some countries)

You need to select the most suitable method based on the recipient’s actual needs and country. Some methods may only be available in specific countries or regions.

Confirming the Transfer

After filling in all the information, the system will display the details of the MoneyGram online transfer, including the transfer amount, fees, real-time exchange rate, and estimated arrival time. You need to carefully review all information to ensure accuracy.

- Check the recipient’s name, receiving method, and amount.

- Confirm the payment method and fees.

- The system will generate a reference number or confirmation number; please keep it safe. The recipient will need to provide this number and a valid photo ID matching the transfer information when collecting the funds.

Common issues and solutions are shown in the table below:

| Issue Type | Possible Cause/Solution |

|---|---|

| Online Bank Transfer Failure | Insufficient account balance, transfer amount exceeds limit, bank network issues |

| Identity Re-verification | Log in to the account and upload new identity proof |

| Expired Identity Proof | Log in to the account and upload new identity proof |

| System Error | Log in to the account and create a new single transfer |

Reminder: After each step, it’s recommended to take screenshots or save relevant information for future reference and follow-up.

Receiving Methods and Service Types

MoneyGram online transfers offer multiple receiving methods and service types to meet the needs of users in different countries and regions. You can choose the most suitable method based on the recipient’s situation. The table below summarizes the main service types and their features:

| Service Type | Description |

|---|---|

| Online Transfer | Send funds through the MoneyGram website or app. |

| Cash Payment | Send funds in cash at agent locations. |

| Bank Account Transfer | Send funds directly to the recipient’s bank account. |

| Mobile Wallet | Send funds to the recipient’s mobile wallet. |

| Bill Payment | Use MoneyGram to pay bills in the U.S. |

| Prison Transfer | Send funds to inmates in prisons. |

| Agent Location Pickup | Recipients can collect cash at approximately 400,000 MoneyGram agent locations worldwide. |

Cash Pickup

You can choose to let the recipient collect funds in cash at agent locations worldwide. MoneyGram has approximately 400,000 agent locations globally, offering wide coverage. The recipient only needs to bring a valid ID and the transfer reference number to the designated location to collect the cash.

Tip: Remind the recipient to verify the spelling of their name to ensure it matches their ID; otherwise, they may not be able to collect the funds smoothly.

Cash pickup is suitable for recipients without bank accounts or those needing quick access to cash. You can send funds from the U.S., and the recipient can collect them at designated locations in mainland China, Hong Kong, and other areas.

Bank Account Receipt

You can also choose to transfer funds directly to the recipient’s bank account. This method is secure and convenient, suitable for recipients with bank accounts. You only need to provide the recipient’s bank account information, including the account number and the bank’s name.

- In mainland China and Hong Kong, some licensed banks support this service.

- Funds typically arrive within 1-2 business days, depending on the bank’s processing speed.

Bank account receipt is suitable for larger amounts or scenarios where funds need to be deposited directly into an account. You can track the transfer progress on the platform at any time.

Mobile Wallet Receipt

If the recipient uses a mobile wallet, you can choose to transfer funds directly to their mobile wallet account. Mobile wallet receipt is available in some countries and regions, suitable for users who frequently use mobile payments.

- The recipient only needs to provide their phone number and wallet account information.

- After the funds arrive, the recipient can manage and use the funds directly through the mobile app.

The table below shows the main receiving methods and their brief descriptions:

| Receiving Method | Description |

|---|---|

| Cash Pickup | Funds can be collected in cash at designated locations. |

| Bank Account Deposit | Funds are deposited directly into a bank account. |

| Debit Card Deposit | Funds are deposited into an account via a debit card. |

| Mobile Wallet | Funds are deposited into a mobile wallet in specific countries. |

Reminder: When choosing a receiving method, consider the recipient’s actual needs and the available services in their region.

MoneyGram Online Transfer Fees

Fee Composition

When using MoneyGram online transfers, you will encounter various fee types. The main fees include transfer fees, exchange rate margins, and possible compliance or government taxes. The fee ranges for different transaction types are as follows:

| Transaction Type | Fee Range | Notes |

|---|---|---|

| Debit Card Transfer | $1.99 to $15 | Fees vary based on destination and transfer amount |

| Sending to Businesses | Fees may be higher | Depends on destination, payment method, and transfer amount |

| Additional Fees | May vary by region | Includes compliance fees or government taxes, etc. |

You can view the real-time fees and exchange rates displayed by the system before transferring. MoneyGram’s online transfer fee structure is relatively transparent, and the system will list all fee details before confirming the transfer.

Reminder: You should carefully review each fee to ensure you understand the actual payment amount and the amount the recipient will receive.

You may be interested in comparing MoneyGram’s fees with other major transfer service providers. The table below shows the fee types of major providers:

| Service Provider | Fee Type | Notes |

|---|---|---|

| MoneyGram | Competitive | May be higher for small transfers or currency conversions |

| PayPal | Lower | For transfers to certain countries |

| Other Services | May be lower | Consider exchange rates and delivery speed |

You can compare services based on your needs and actual fees.

Factors Affecting Fees

During the MoneyGram online transfer process, fees are influenced by several factors. The main factors include:

- Transfer Amount: The higher the transfer amount, the higher the fees usually are.

- Destination Country: Fees and exchange rates vary by country, which may affect the total cost.

- Payment Method: Using a credit or debit card usually incurs higher fees than bank account payments.

- Delivery Speed: Choosing faster delivery services will increase fees.

You can flexibly choose payment and receiving methods based on your needs to reasonably control fees.

Fee Estimation Method

Before transferring, you can use the fee calculator on MoneyGram’s official website or mobile app. This tool helps you quickly estimate transfer fees and real-time exchange rates. Simply enter the destination country, currency, and amount, and the system will automatically display all fee details and the estimated amount received.

- MoneyGram provides a fee calculator on its website and app.

- After entering transfer details, the system will instantly display fees and exchange rates.

- You can decide whether to proceed with the transfer or adjust the amount based on the estimation results.

It’s recommended to use the fee calculator before each transfer to ensure a clear understanding of all fees and avoid discrepancies in the actual received amount due to fee or exchange rate changes.

Throughout the MoneyGram online transfer process, you can always check fee details and exchange rates through official channels. This helps you make more informed transfer decisions.

Transfer Limits and Arrival Times

Transfer Limits

When using MoneyGram online transfers, you need to be aware of the limits for each transaction. MoneyGram sets maximum limits for different types of transfers to help you plan fund flows reasonably. The table below shows the limits for major transfer types:

| Type | Maximum Limit | Minimum Limit |

|---|---|---|

| Mainland China Transfer | 15,000 USD | N/A |

| International Transfer | 10,000 USD | N/A |

| 30-Day Total Limit | 10,000 USD | N/A |

Each time you transfer, the system will automatically prompt you if the limit is exceeded. If you need to send larger amounts, you can split the transfer or contact MoneyGram customer service for assistance.

Arrival Speed

After transferring funds on the MoneyGram platform, the arrival speed depends on the transfer method. The table below summarizes the processing times for common transfer methods:

| Transfer Method | Processing Time |

|---|---|

| Online Bank Transfer | Usually instant, up to 2 business days |

| Transfer to Bank Account or Mobile Wallet | Usually completed within a few hours |

| Transfers Between MoneyGram Accounts | Usually completed within a few minutes |

The arrival time varies depending on the receiving method chosen. If you want funds to arrive quickly, prioritize transfers between MoneyGram accounts or mobile wallet receipts.

Factors Affecting Arrival Time

During the actual transfer process, the arrival time may be affected by various external factors. Common factors affecting arrival speed include:

- Different destination countries result in varying arrival speeds.

- The payment amount and type affect delivery speed.

- The chosen payment method may cause delays.

- International transfers typically take longer, possibly between 3 to 5 days to complete.

- If the transfer amount is unusual, the bank may need to verify the transfer purpose, which could delay arrival.

Reminder: You can check the estimated arrival time on the MoneyGram platform before transferring. If there’s a delay, it’s recommended to contact MoneyGram customer service or the recipient’s bank (e.g., licensed banks in Hong Kong) promptly for verification.

Security Measures

Image Source: pexels

Information Protection

When conducting online transfers on the MoneyGram platform, the system employs multiple data protection measures to ensure the safety of your personal information and funds.

- MoneyGram uses robust data protection protocols, with all sensitive information encrypted to prevent leaks.

- The platform does not store your credit or debit card information, reducing the risk of data theft.

- Each transfer requires valid identity proof, helping to prevent identity theft and fraud.

- MoneyGram employs advanced encryption technology to secure data during transmission.

- The website continuously monitors and regularly updates its security systems to prevent unauthorized access and cyber threats.

Reminder: When uploading ID documents, ensure the information is accurate and valid to avoid transfer issues due to mismatched information.

Transaction Security

Each transfer initiated on the MoneyGram platform undergoes multiple verifications. The platform requires you to input detailed recipient information and review all transfer details.

- MoneyGram verifies your identity to ensure only you can operate the account.

- All transaction information is encrypted to prevent third-party theft.

- The platform monitors abnormal transaction behavior to promptly detect suspicious activities.

- Before each transfer, you can view detailed fee and arrival information to ensure transparent fund flows.

It’s recommended to keep the transfer reference number and related documents safe during the process for future reference.

Risk Prevention

When using MoneyGram online transfers, you need to proactively identify and prevent various fraud risks. Common online scam types include:

- Online shopping scams: Scammers lure you to transfer money with low-priced goods.

- Family impersonation scams: Someone pretends to be a family member urgently requesting money.

- Loan, fake check, romance, elderly, IRS extortion, refund, disaster relief, lottery, and other scams.

- Fake buyers or sellers defrauding funds through false advertisements.

You can take the following measures to reduce risks:

- Before sending funds, always verify the recipient’s identity and avoid transferring to strangers.

- Don’t trust claims of winning prizes, refunds, or urgent transfer requests.

- MoneyGram helps prevent fraud through identity verification and transaction monitoring.

If you encounter suspicious situations, immediately contact MoneyGram customer service or the relevant bank to protect your financial security.

Notes

Exchange Rates and Fees

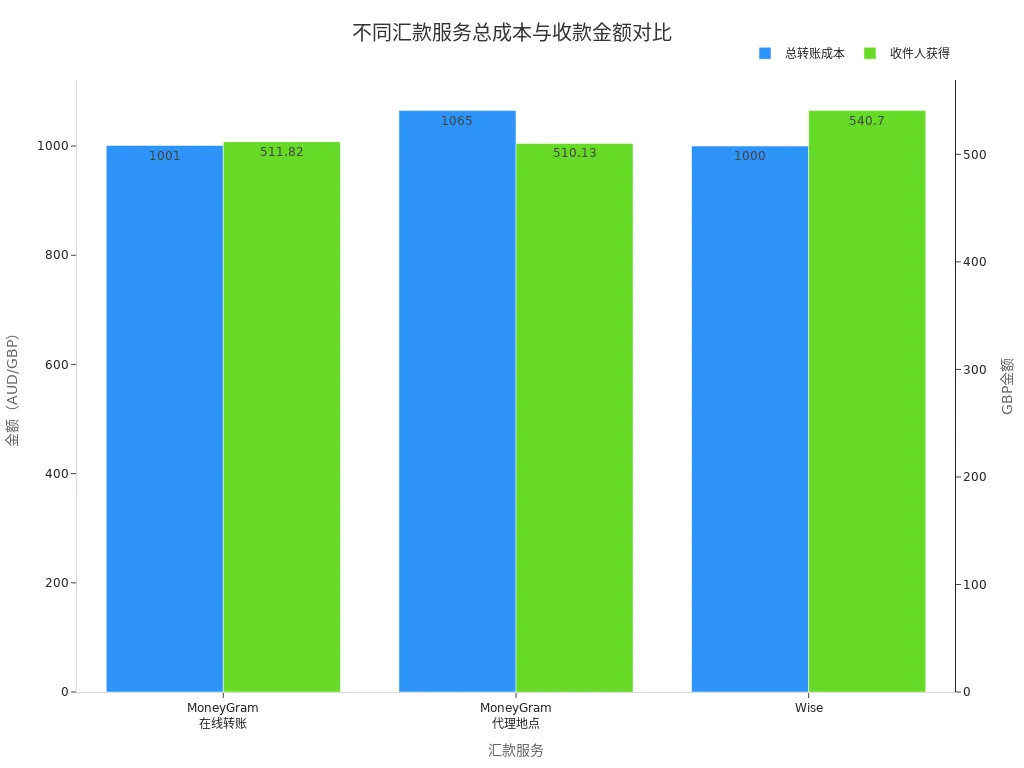

When using MoneyGram online transfers, exchange rates and fees directly affect the total cost and the amount the recipient actually receives. Different service providers have noticeable differences in exchange rates and fees. The table below shows a comparison of exchange rates, fees, and amounts received for three major transfer services (in USD):

| Service | Exchange Rate Used | Fees and Total Transaction Cost | Amount Received |

|---|---|---|---|

| MoneyGram Online Transfer | 1USD=GBP0.51 | USD1 fee, total cost USD1,001 | GBP511.82 |

| MoneyGram Agent Location Transfer | 1USD=GBP0.51 | USD65, total cost USD1,065 | GBP510.13 |

| Wise | 1USD=GBP0.54 | USD5.22, total cost USD1,000 | GBP540.70 |

You can visually compare the total costs and amounts received for different services through the chart below:

Reminder: Before transferring, carefully review real-time exchange rates and fees to ensure the amount received meets expectations.

Pickup Process

After receiving a MoneyGram online transfer, you can follow these steps to complete the pickup:

- Log in to your PayPal account and find the “Withdraw” option.

- Select the bank account or card to withdraw funds to and enter the transfer amount.

- Review and confirm the transaction fees and details, then click “Continue.”

- In the MoneyGram account, link PayPal, select “PayPal” as the payment method, and enter the PayPal email address.

- Verify your identity by providing personal identification information.

- Wait for the funds to transfer from PayPal to MoneyGram, which typically takes a few minutes to a few days.

It’s recommended to confirm in advance that the bank supports MoneyGram services when receiving funds in a licensed Hong Kong bank account and verify the recipient information to avoid delays due to mismatched details.

Customer Support

If you encounter any issues during the MoneyGram online transfer process, you can seek help through the following channels:

| Customer Support Channel | Description |

|---|---|

| Online Chat | You can communicate directly with a customer service representative on the MoneyGram website, suitable for quick resolutions. |

| Email Support | You can contact the support team via email, typically receiving a response within a reasonable time. |

If you encounter issues with transfer delays, identity verification, or account problems, it’s recommended to use online chat for immediate assistance. For detailed issue descriptions, you can submit materials via email.

MoneyGram online transfers offer several advantages. You can complete transfers anytime, anywhere via computer or smartphone, saving time and suiting those needing contactless transactions. Recipients typically receive funds quickly, and the service is available 24/7, meeting urgent cross-time-zone transfer needs.

| Advantage | Description |

|---|---|

| Convenience | You can operate online anytime, anywhere, saving time. |

| Speed | Funds arrive quickly, suitable for urgent needs. |

| Accessibility | Service available 24/7, supporting multiple regions globally. |

Before transferring, you should pay attention to the following:

- Fees vary based on transfer amount, payment method, and receiving method.

- Fund arrival times are affected by the destination country, bank operating hours, and compliance requirements.

- You should carefully compare fees and exchange rates and choose the receiving method reasonably.

- MoneyGram does not store your credit or debit card information, and all sensitive information is encrypted for security.

You can flexibly use MoneyGram services based on your needs. It’s recommended to regularly check the latest official policies and tips to ensure a smooth transfer experience.

FAQ

What receiving methods does MoneyGram online transfer support?

You can choose bank account receipt, cash pickup, or mobile wallet receipt. Some countries also support debit card receipt. Please select the appropriate method based on the recipient’s region.

How does the recipient collect funds after the transfer arrives?

The recipient needs to bring a valid ID and the transfer reference number to a designated agent location or licensed Hong Kong bank to collect the funds. The bank will verify the information before releasing the funds.

What should I do if the transfer fails?

You can first check the account balance and recipient information. If the issue persists, contact MoneyGram customer service or the recipient’s bank for assistance.

How can I track the transfer progress?

You can log in to the MoneyGram website or app, enter the reference number to check the transfer status. The system will display the fund processing progress and estimated arrival time.

How can I ensure information security during a transfer?

When you input information on the MoneyGram platform, the system automatically encrypts the data. Please keep your account and reference number secure and avoid sharing them with strangers.

As global remittance needs grow, MoneyGram offers convenience and security, yet high fees and exchange rate concerns often frustrate users. For a more cost-effective and reliable solution, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay significantly cuts costs compared to traditional platforms. Check real-time exchange rates to ensure transparency and maximize your funds’ value. Supporting fiat-to-crypto conversions and covering most countries and regions worldwide, BiyaPay offers fast registration and same-day transfers. Even better, you can trade US and Hong Kong stocks without needing an overseas account, with zero fees on contract orders. Sign up for BiyaPay today to streamline your cross-border transactions and unlock a smarter way to manage global finances.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.