- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understand how to track Ria money transfers and monitor the movement of your funds.

Image Source: pexels

You are most concerned about whether your funds safely reach the recipient. When tracking Ria’s remittance status, you can obtain real-time progress through the online system at any time. After entering the correct PIN code, the system will display the latest status. You need to ensure all information is accurate to avoid delays in fund delivery due to data errors. Stay vigilant and promptly verify each step of the operation.

Key Points

- Use Ria’s online system to track remittances, ensuring the correct PIN code is entered to obtain real-time progress.

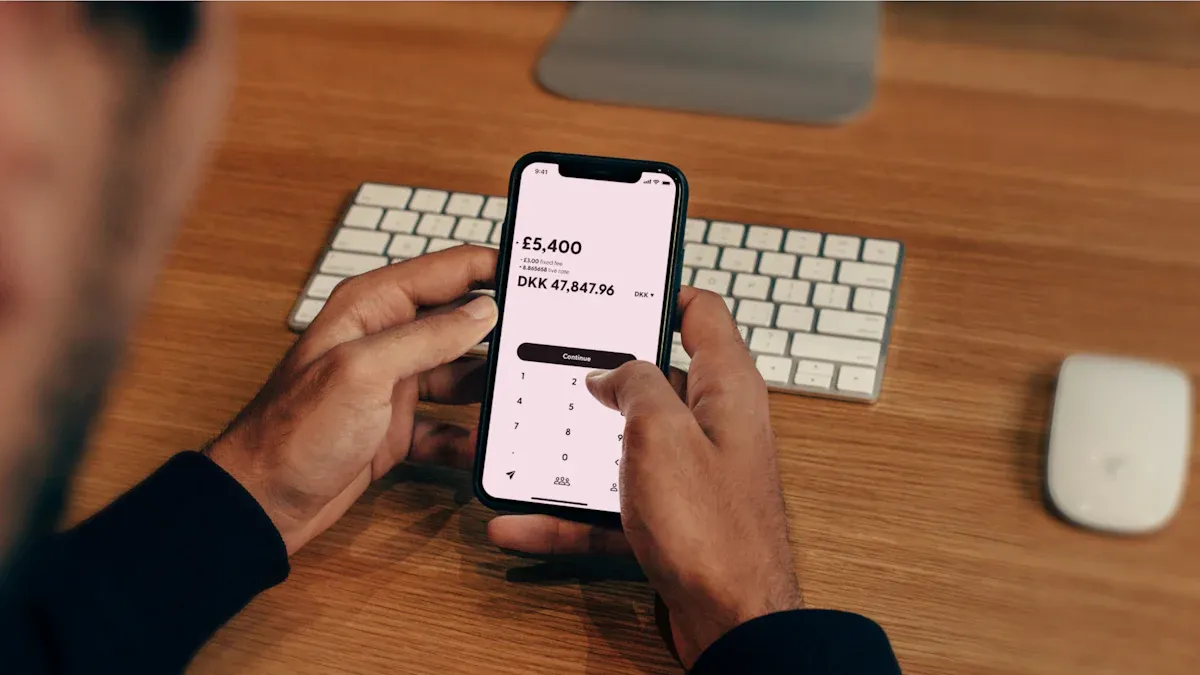

- Choose a suitable tracking method; Ria offers multiple channels such as the website and mobile app, making it convenient for users to check anytime.

- Understand the transfer times for different payment methods; credit card payments typically take 15 minutes to 3 hours, while bank transfers may take up to 4 business days.

- During tracking, ensure all information is accurate to avoid delays due to errors.

- If you encounter issues, promptly contact Ria customer service for assistance to ensure fund safety.

Tracking Ria Remittance Status

Image Source: unsplash

Online Tracking Portal

You can track Ria’s remittance status through various official channels. Ria provides the website, mobile app, and online portal for users. As long as you have an internet connection, you can check the fund status anytime, anywhere. Whether you are in mainland China or the United States, the operation is straightforward.

The table below lists Ria’s commonly used online tracking portals:

| Type | Link |

|---|---|

| Track Transfer | Track Transfer |

| Location Finder | Locations |

| Help Center | Help |

| Mobile App | Download Mobile App |

| Send Money | Send Money |

You can choose the method that suits you best. If you prefer using a phone, you can download the Ria mobile app. If you are more comfortable with a computer, you can directly visit the Ria website. Simply enter the unique identification number (PIN code), and the system will automatically display your remittance progress.

Tip: It’s recommended to securely save the PIN code and related information after each transfer. This allows you to track Ria’s remittance status at any time and avoid issues due to lost information.

Real-Time Status Updates

When tracking Ria’s remittance status, your primary concern is when the funds will arrive. The Ria system updates the remittance status in real-time based on different payment methods. You can view the latest progress, including the estimated arrival time and current processing stage, on the website or app.

The table below shows the average transfer times for different payment methods:

| Payment Method | Transfer Time |

|---|---|

| Credit/Debit Card | 15 minutes to 3 hours |

| Cash Pickup | Usually available the same day |

| Bank Transfer | Up to 4 business days |

| Security Review Delays | May result in longer processing times |

After entering the PIN code, the system will display detailed progress information. For example, if you choose credit card payment, funds typically arrive within 15 minutes to 3 hours. If you opt for a bank transfer, it may take longer. In case of a security review, processing time may be extended.

You can refresh the page at any time to get the latest status. Ria adjusts the estimated arrival time dynamically based on actual processing progress. This way, you can stay informed about your funds’ movement and ensure every transfer is under control.

Reminder: If you notice the status hasn’t updated for a long time, it’s recommended to contact Ria’s official customer service promptly for further assistance.

Operation Steps

When tracking Ria’s remittance status, you need to follow the steps below. Whether you use the Ria website or mobile app, the process is very clear. Each step requires careful verification of information to ensure a smooth query.

Log In to Your Account

You can log in to your account via the Ria website or app. During login, the system uses multiple security measures to protect your account information.

- The system generates a random session ID (token) for each login instead of directly using your username and password.

- The server verifies this token with each request to ensure only you can access the account.

- Ria also manages your login status through encrypted cookies, with each operation requiring verification.

These measures effectively prevent others from misusing your account. When logging in, it’s recommended to use a secure network environment and avoid entering account information in public places.

Tip: If you’re using Ria in mainland China or the United States, it’s advisable to change your password regularly to enhance account security.

Enter PIN Code

After logging in, you need to navigate to the “Track” or “Track Transfer” function page. The system will prompt you to enter the remittance’s unique identification number (PIN code).

You can proceed in one of two ways:

- If you have registered and logged into a Ria account, select “Track” or “Track Transfer” and enter the PIN code to query.

- If you don’t have a Ria account, you can directly enter the PIN code on the “Track Transfer” page without logging in. This allows both senders and recipients to track Ria’s remittance status at any time.

When entering the PIN code, ensure every digit is correct to avoid query failures due to input errors.

Note: The PIN code is your only credential for tracking remittance progress. Keep it secure and do not share it with others.

View Progress

After successfully entering the PIN code, the system will immediately display your remittance progress. You can view the following information:

- Current remittance status (e.g., processing, sent, received)

- Estimated arrival time

- Transfer amount (displayed in USD)

- Transfer method (e.g., bank transfer, cash pickup)

- Order number or reference number

You can refresh the page at any time to get the latest status. If the status hasn’t updated for a long time, it’s recommended to contact Ria customer service promptly.

Reminder: After each query, verify all information again to ensure accuracy. This helps avoid delays due to incorrect information.

Required Information

When tracking Ria remittances, you need to prepare the necessary information in advance. Only accurate information allows the system to successfully retrieve your remittance progress. Refer to the following to ensure all details are complete and correct.

Remittance Reference Number

You must provide the remittance reference number. This is a unique identification code generated by the Ria system for each transfer. You can find it in the transfer receipt, email, or SMS notification. The system requires this number for every query.

Reminder: Securely store the remittance reference number. Losing it can make tracking progress very difficult.

Personal Information

You also need to provide your personal information. Ria typically requires your name, contact details, and proof of identity. When using Ria in mainland China or the United States, it’s recommended to use the same name spelling as during the transfer to avoid query failures due to mismatched information.

If you transfer through a licensed bank in Hong Kong, the bank will also require relevant proof of identity. Ensure all information is valid and accurate.

- Name (consistent with the transfer)

- Contact details (e.g., phone number or email)

- Proof of identity (e.g., ID card or passport number)

Recipient Information

You also need to provide key recipient information. The Ria system uses this to verify transfer records. Refer to the list below to prepare the necessary details:

- Reference number

- Sender’s last name

This information helps the system quickly locate your transfer. Verify each detail carefully during input to ensure accuracy. Only then can you smoothly track the latest status of your funds.

Issue Resolution

Transfer Delays

When using Ria for remittances, you may encounter delays in fund delivery. Understanding the reasons for delays helps you quickly identify issues.

Common causes of transfer delays include:

- Incomplete or incorrect recipient information, such as errors in name, address, or phone number.

- Compliance checks, where the system may require additional review, extending processing time.

- Bank operating hours and holidays, as transfers initiated on weekends or public holidays may be delayed.

- Technical issues or system maintenance, which may temporarily disrupt the transfer process.

First, check if your information is accurate. If there are holidays or system maintenance, be patient. During compliance reviews, Ria will proactively contact you for additional documents.

Reminder: When filling out recipient information, carefully verify each detail to reduce delays caused by errors.

Status Anomalies

When tracking remittances, you may notice status anomalies, such as “processing” for too long or unauthorized transactions. In such cases, take immediate action.

To address status anomalies, you can:

- If you detect unauthorized or incorrectly executed transactions, notify Ria immediately.

- You must notify Ria within 13 months from the date the transaction is received or paid to the beneficiary.

- After confirming an anomaly, Ria will refund you by the next business day.

- If a transaction is defective, Ria will promptly restore your account status or issue a refund.

When noticing anomalies, contact Ria customer service immediately to protect your funds and avoid losses.

Suggestion: Provide feedback through Ria’s website, app, or customer service phone, and keep records of all communications for future reference.

Non-Delivered Funds

If your transfer hasn’t arrived for a long time, seek help through official channels. Ria offers multiple support options to resolve non-delivery issues.

You can choose from the following methods:

- Call Ria’s 24-hour customer service hotline for urgent matters or issues needing immediate attention.

- Send an email for less urgent issues, allowing communication at your convenience.

- Check Ria’s website FAQ for information on international transfers, payment options, and security features.

- Use the built-in support feature in the Ria mobile app to manage transfers and get help directly on your device.

When contacting support, prepare your remittance reference number and personal information to help customer service quickly locate your order.

Tip: Prioritize the hotline or in-app support for faster responses. For complex issues, keep all communication records for follow-up.

Fund Safety

Image Source: unsplash

Security Measures

When using Ria for remittances, the system provides multiple protections for your funds and personal information. Ria uses advanced encryption technologies, such as SSL and TLS protocols, to ensure secure data transmission over the internet. The company strictly complies with global regulations, including anti-money laundering (AML) and know-your-customer (KYC) policies.

The table below outlines Ria’s main security measures:

| Security Measure | Description |

|---|---|

| Encryption Technology | Ria uses advanced encryption to protect sensitive data during transactions. |

| Compliance Regulations | Adheres to AML and KYC policies to ensure every transfer is legal and compliant. |

| Regular Audits and Updates | The company conducts regular security audits and updates protocols to address new threats and vulnerabilities. |

You can rest assured that Ria tracks every transfer in real-time, promptly identifying anomalies. The company also regularly reviews its systems to ensure security protocols remain industry-leading.

User Recommendations

You can take additional steps to enhance remittance security. Ria advises protecting personal information during transfers. All data is stored securely, protected by firewalls and complex security mechanisms. Only limited administrators can access your data, and all handlers must comply with privacy policies.

Refer to the following recommendations:

- Use strong passwords and change them regularly to prevent leaks.

- Avoid logging in or entering sensitive information on public networks.

- Securely store PIN codes and reference numbers to prevent loss or exposure.

- Only use Ria’s official channels for transfers and queries, avoiding third-party platforms.

By adopting industry-standard measures during operations, you can effectively reduce risks and ensure fund safety.

Fraud Prevention

During the remittance process, stay vigilant against various fraud risks. Ria proactively educates customers to help you identify and prevent risks. The company regularly trains employees to enhance their ability to detect phishing and fake emails.

Follow these steps to prevent fraud:

- Learn information security best practices to improve cybersecurity awareness.

- Understand Ria’s wire transfer confirmation process, requiring verbal confirmation for all wire requests.

- Establish a “secret word” with Ria to verify the authenticity of transfer requests.

- Regularly review official safety tips and update prevention measures.

- Stay vigilant and contact Ria customer service immediately if you encounter suspicious activity.

By proactively verifying each step during transfers, you can effectively prevent fraud. If you notice anomalies, report them through official channels promptly to protect your rights.

You can use Ria’s real-time tracking system to monitor fund progress and promptly identify delays or anomalies.

- Real-time updates help reduce error risks, ensuring funds are delivered accurately.

- The customer support team addresses issues promptly, boosting your confidence.

- Securely store PIN codes and reference numbers to avoid exposure.

- Set a strong password for your account and avoid operating on public Wi-Fi.

- For cash pickups, the system provides a unique PIN to ensure funds are only released to the designated recipient.

If you have questions, contact official channels promptly to ensure fund safety.

FAQ

How Can I Recover a Lost PIN Code?

You can contact Ria’s official customer service, providing your personal information and remittance reference number. The support team will assist in verifying your identity to recover the PIN code. Securely store the new PIN to avoid losing it again.

What Should I Do If the Transfer Status Shows “Processing” for a Long Time?

First, verify if the recipient information is correct. If accurate, contact Ria customer service. They will help identify the issue and provide a solution.

Can I Cancel a Submitted Transfer?

You can request cancellation before the funds arrive. Log into your Ria account, select the relevant order, and click “Cancel.” For special cases, contact customer service promptly.

How Long Does It Take for a Transfer to a U.S. Bank Account?

With bank transfers, funds typically arrive within 1 to 4 business days. Actual times depend on U.S. bank processing speeds and holidays. You can track progress online at any time.

How Can I Ensure the Security of Transfer Information?

Operate only on Ria’s website or app, avoiding public networks for sensitive information. Ria uses encryption to protect data. Regularly change your password to prevent leaks.

Tracking your Ria remittance is essential for ensuring your funds reach their destination safely. By entering the PIN code on the website or app, you gain real-time visibility into every stage of the transfer process, from initiation to final delivery. Understanding processing times, verifying recipient details, and knowing how to contact support when issues arise all contribute to a secure and reliable experience.

When evaluating remittance options, however, reliable tracking is just one factor. Cost, speed, and what happens to the money after it arrives also matter. BiyaPay offers an alternative approach: fees as low as 0.5%, transfers with same-day availability—send and receive on the same day, and full transparency.Users can check the exact cost beforehand using the real-time exchange rate calculator. Beyond sending money, funds can be directly used to invest in stocks, eliminating the need for complex international accounts and enabling seamless cross-border payments and global investing.

For those looking for a more efficient, transparent, and feature-rich solution, this could be a compelling choice. Learn more at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.