- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Most Suitable Online Money Transfer Method? Consider Fees, Exchange Rates, and Security

Image Source: pexels

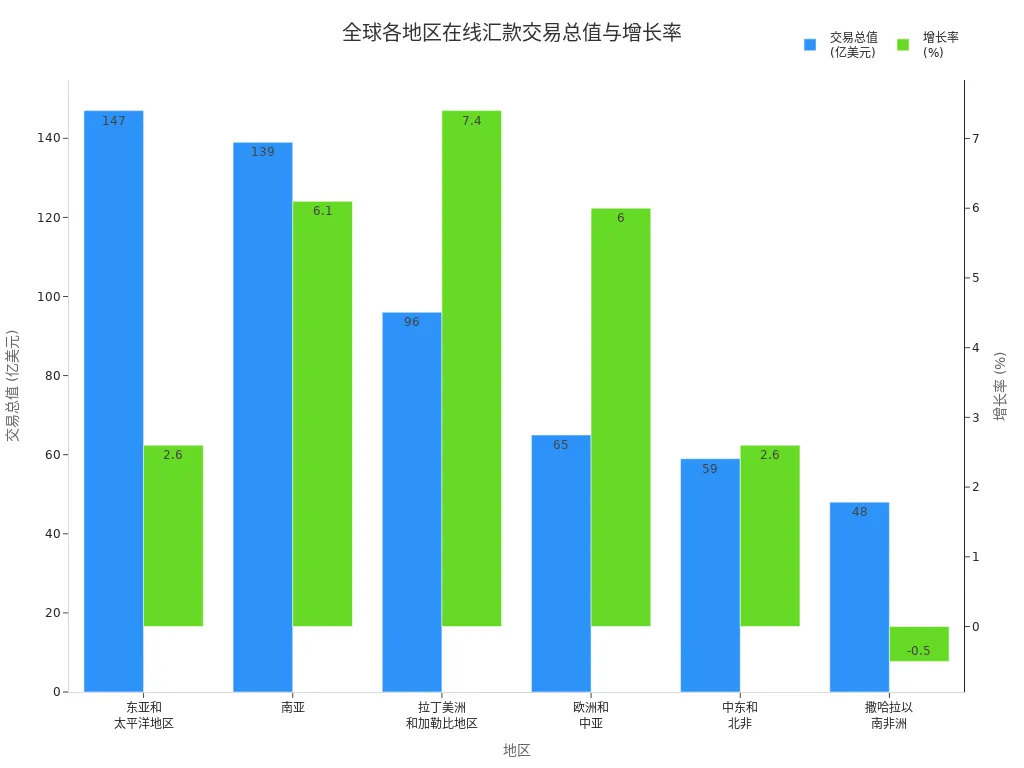

When choosing an online remittance method, you should prioritize fees, exchange rates, security, and transfer speed. You can compare the service fees and exchange rate transparency of different platforms to determine which option best suits your actual needs. The total value of global online remittance transactions continues to grow, with significant regional differences. The chart below shows the transaction values and growth rates by region, helping you understand the market scale:

You can also refer to user reviews to choose platforms with a good reputation, enhancing your remittance experience.

Key Points

- When choosing an online remittance method, first focus on the fee structure, compare the service fees of different platforms, and select the most cost-effective option.

- Exchange rate transparency directly affects the amount received, so prioritize platforms offering real-time exchange rates and transparent fees to avoid hidden costs.

- Security is a crucial factor in choosing a remittance platform; ensure the platform uses multiple encryption and compliance measures to protect personal information and funds.

- Choose transfer speed based on your actual needs; for urgent remittances, opt for real-time payments or wire transfers to ensure funds arrive promptly.

- Check user reviews to understand the platform’s actual performance and choose services with a good reputation to improve the remittance experience.

Criteria for Choosing an Online Remittance Method

Fees

When choosing an online remittance method, you should first focus on the fee structure. Service fees vary significantly across platforms and banks. The table below shows the fee structures of mainstream platforms (priced in USD):

| Platform | Fee Structure |

|---|---|

| MoneyGram | Fees for direct bank-to-bank transfers start at $1.89. |

| PayPal | No fees for both sender and receiver when sending funds within the U.S. |

| Xoom | 1% fee for transactions under $999, and $10 for transactions of $1,000 or more. |

You will find that online remittance services are generally more cost-effective than traditional banks. Bank international remittance fees typically range from $15 to $50, with possible additional charges. If you use the same financial institution, bank transfers may sometimes be free. Independent remittance service providers offer lower fees, suitable for users who remit frequently. By comparing fees across platforms, you can choose the most suitable online remittance method.

Exchange Rates

Exchange rates directly impact the amount received. Some online remittance methods offer mid-market exchange rates, but most platforms add a 2% to 4% markup. For example, Wise’s exchange rate markup ranges from 2.35% to 3.34%, while Monito’s digital transfers in Thailand have a markup of 1.28% to 1.96%. The table below illustrates the importance of exchange rate transparency:

| Source | Description |

|---|---|

| Wise | Banks and money transfer services use mid-market exchange rates when trading with each other but typically do not pass them on to consumers, instead marking up rates to earn extra profits. |

| Remit Analyst | The mid-market exchange rate is the midpoint between the buy and sell prices of two currencies, considered the fairest rate and often used as a benchmark for currency exchange. |

| Wise | Most providers add a profit margin to the mid-market rate without transparency, leaving consumers unaware of how much extra they are charged. |

When choosing a platform, prioritize those with high exchange rate transparency to avoid losses due to hidden rate markups.

Security

Security is a critical factor when choosing an online remittance method. Mainstream platforms use multiple security protocols to protect user funds and information:

- 3D Secure: Reduces transaction fraud through additional verification steps.

- Tokenization: Replaces sensitive payment information with random numbers to protect data.

- End-to-End Encryption (E2EE): Complex encryption algorithms ensure the security of sensitive data.

- Multi-Factor Authentication (MFA): Multiple identity verification steps enhance account security.

- KYC (Know Your Customer): Verifies customer identity to prevent money laundering and terrorist financing.

- Secure APIs and Zero Trust Framework: Multi-layered security measures with real-time monitoring of suspicious activity.

- AI Threat Detection: Real-time assessment and response to cyber threats.

You should note that the frequency of cyberattacks is increasing yearly. Cyberattacks rose by 38% in 2022, with an average data breach cost of approximately $4.45 million. Choosing platforms with strong security records and compliance can effectively reduce risks.

Speed

Transfer speed directly affects the efficiency of your fund usage. The processing times for different online remittance methods are as follows:

| Payment Method | Processing Time |

|---|---|

| Electronic Funds Transfer | Instant to three days |

| Credit Card | 1 to 3 days |

| ACH | 1 to 3 business days |

| Domestic Wire Transfer | 1 day |

| International Wire Transfer | 1 to 5 days |

If you need urgent remittances, you can choose real-time payments (RTP) or wire transfers, which are nearly instant. Global ACH is suitable for regular transactions but is slower, typically taking hours to days. You should choose the appropriate online remittance method based on your actual needs.

Convenience

Convenience is also an important consideration when choosing an online remittance method. Many platforms support mobile and desktop operations, allowing users to complete remittances anytime, anywhere. Mobile apps simplify the international remittance process; you only need to enter the recipient’s bank details to start a transfer. Some platforms also support batch payments and recurring payments, ideal for businesses or individuals with frequent remittances. You can choose a platform that is easy to use based on your habits and needs.

Tip: If you frequently need multiple remittances, prioritize platforms that support batch and recurring payment functions to save time and effort.

User Reviews

User reviews can help you assess a platform’s actual performance. Many users praise online remittance methods for competitive exchange rates, fast transfers, and ease of use. For example, Western Union is considered reliable and user-friendly, Taptap Send has a 4.3 rating on TrustPilot with users calling it “very fast and efficient,” and Wise is praised for transparent fees and multi-currency management. Remitly emphasizes ease of use and security, suitable for users needing quick remittances.

However, you should also be aware of common complaint types:

| Complaint Type | Details |

|---|---|

| Transfer Delays | Users express dissatisfaction with transfer delays, especially for urgent remittance needs, which can reduce trust. |

| Hidden Fees | Customers are confused by unclear fees and exchange rates, emphasizing the importance of transparency. |

| Poor Customer Service | Complaints include slow response times and unhelpful support, leading to user disappointment. |

| Account Verification Issues | Users complain about lengthy verification processes or sudden account freezes, affecting remittance capabilities. |

By reviewing user feedback, you can understand a platform’s strengths and weaknesses, choose a reputable online remittance method, and enhance your remittance experience.

Comparison of Mainstream Online Remittance Methods

Image Source: unsplash

Third-Party Payment Platforms

You can choose third-party payment platforms for international remittances. Platforms like Wise and Paysend typically offer lower fees and more transparent exchange rates. You can operate them via mobile or desktop, with a simple process. These platforms display real-time exchange rates, letting you know exactly how much will be received. In terms of security, they use multiple encryption and identity verification methods to ensure your funds are safe. User reviews generally indicate that third-party payment platforms are fast and suitable for users needing efficient transfers.

Tip: When using third-party payment platforms, you can check fees and exchange rates in advance to avoid losses due to rate fluctuations.

Bank Transfers

You can also use banks for international remittances. Licensed banks in Hong Kong typically charge fixed fees ranging from USD 15 to USD 50. Bank exchange rate policies often include a markup, meaning the actual amount received may be lower than expected. Bank transfers are highly secure and compliant, suitable for users with high fund security requirements. However, transfer speeds are slower, usually taking 1 to 5 business days. When using bank transfers in mainland China, you should understand relevant policies and procedures in advance.

| Remittance Method | Fee Type | Exchange Rate Policy |

|---|---|---|

| Traditional Banks | Fixed Fees | Possible exchange rate markup |

| International Remittance Companies | Fixed fees or exchange rate markup | Potentially more competitive rates |

| No-Fee Providers | No fees | Possibly less favorable exchange rates |

Cryptocurrency Remittances

You can try cryptocurrencies for cross-border remittances. Cryptocurrency remittances typically have no traditional fees and offer fast transfer speeds, often nearly instant. Platforms convert based on market prices, but exchange rate fluctuations can be significant. Security relies on blockchain technology, but you need to pay attention to the platform’s compliance and regulatory status. Cryptocurrency remittances are suitable for users sensitive to speed and cost but come with higher risks.

Emerging Remittance Tools

Emerging remittance tools, such as mobile apps and social platform payments, are transforming online remittance methods. You can use these tools for small, fast transfers with low or no fees. Exchange rate policies vary; some platforms offer competitive rates, while others rely on fees. Security depends on the platform’s technology and regulation. In terms of user experience, emerging tools are user-friendly, ideal for younger users and frequent small remittances.

You can choose the most suitable online remittance method based on your needs, considering fees, exchange rates, security, and transfer speed.

Methods for Comparing Fees and Exchange Rates

Fee Inquiry

When choosing an online remittance method, you should first learn how to check fees. Most platforms display fee amounts directly on the transfer page. You can find detailed fee structures on the platform’s fee explanation page. Some platforms automatically calculate fees based on the remittance amount, payment method, and receiving method. By comparing multiple platforms, you can choose the channel with the lowest fees.

Tip: When using licensed Hong Kong banks for international remittances, you’ll typically see fixed fees (e.g., USD 15-50), but some platforms charge fees based on a percentage of the amount.

Exchange Rate Transparency

Exchange rate transparency directly affects the amount received. Modern online remittance methods usually display real-time exchange rates before the transfer, letting you know exactly how much the recipient will receive. You can assess a platform’s exchange rate transparency using the following methods:

| Method | Description |

|---|---|

| Real-Time Rate Display | Platforms provide real-time exchange rates, ensuring you know the amount the recipient will receive before transferring. |

| Competitive Pricing | Platforms partner with financial institutions to offer more competitive rates than traditional banks. |

| Rate Locking | Some platforms allow you to lock in exchange rates for a short period to avoid losses from market fluctuations. |

| Technical Updates | Advanced platforms use technology and data analysis to ensure timely and accurate rate updates. |

You can see all fees and rate markups before transferring. Transparent rate displays allow you to compare platforms and choose the most favorable option. As industry transparency improves, consumers can access fairer prices.

Identifying Hidden Fees

When remitting, you should pay special attention to hidden fees. Many platforms advertise “$0” or “no fees,” but they may charge extra costs through exchange rate markups or payment method fees. Common hidden fees include:

- Exchange Rate Differences: Platforms add a markup to the mid-market rate, causing you to pay more.

- Transfer Fees: Some companies charge fees based on a percentage of the amount, which may not be clearly indicated on the homepage.

- Payment Method Fees: Using credit or debit cards may incur additional fees.

- Hidden Taxes: Some transactions may include unclear taxes or regulatory fees.

| Fee Type | Impact Description |

|---|---|

| Transfer Fees | Directly increase your expenses |

| Exchange Rate Markup | May result in paying more than expected |

| Payment Method Fees | Additional costs may increase the total unknowingly |

| Receiving Method Fees | May cause the recipient to receive less than expected |

You should carefully read the platform’s fee descriptions to avoid increased costs due to hidden fees. Choosing an online remittance method with a transparent fee structure can effectively save money.

Security Assessment of Online Remittance Methods

Image Source: unsplash

Platform Security Record

When choosing an online remittance method, you should prioritize the platform’s security record. You can review the platform’s historical data to check for incidents of fund loss or data breaches. Many mainstream platforms publish security reports detailing the number and handling of security incidents over recent years. You can refer to user reviews to assess the platform’s response speed and resolution capabilities during issues. Platforms with strong security records typically use multiple encryption technologies and real-time monitoring systems to reduce risks. When remitting in mainland China, you can prioritize platforms with international compliance certifications for better fund security.

User Information Protection

When performing online remittances, user information protection is crucial. Platforms must use end-to-end encryption to ensure your personal and transaction data aren’t stolen by third parties. You can check if the platform supports multi-factor authentication, such as SMS verification or dynamic codes. Some platforms also use tokenization, converting sensitive information into random codes to enhance security. During registration and use, you should carefully read the platform’s privacy policy to understand data storage and usage practices. Platforms with robust information protection measures can effectively prevent identity theft and data breaches.

Tip: You can regularly change your account password and avoid using simple passwords to enhance account security.

Compliance

Compliance is also a key criterion when choosing an online remittance method. Compliant platforms adhere to financial regulatory requirements in various countries, undergoing regular audits and security assessments. You can check if the platform holds relevant financial licenses, such as those for international remittance services from licensed Hong Kong banks. Compliant platforms typically implement KYC (Know Your Customer) and AML (Anti-Money Laundering) policies to ensure every transaction is legal and compliant. When remitting in mainland China, you should choose platforms with clear compliance processes to avoid fund freezes or delays due to policy risks. Platforms with strong compliance offer a more stable and secure remittance experience.

| Assessment Dimension | Specific Measures | How You Can Evaluate |

|---|---|---|

| Security Record | Historical security incidents, user complaints | Review security reports and feedback |

| Information Protection | Encryption technology, multi-factor authentication, tokenization | Check privacy policies and technical descriptions |

| Compliance | Financial licenses, KYC, AML, audit reports | Verify platform credentials and compliance processes |

You can combine these dimensions to choose an online remittance method with high security and strong compliance to safeguard your funds and information.

Practical Selection Tips and Pitfalls to Avoid

Choosing Based on Needs

When choosing an online remittance method, you should make decisions based on your actual needs. Different remittance amounts, frequencies, and receiving methods will affect your best choice. You can consider the following aspects:

- Accurate Reporting of Transaction Amounts: You need to know the exact amount of each remittance to avoid increased fees due to unclear amounts.

- Impact of Transaction Fees: Pay attention to service fees and exchange rate markups, especially for large remittances, where fee differences are more significant.

- Exchange Rate Fluctuations: Choose platforms with transparent rates to minimize losses from rate changes.

- Remittance Frequency: If you remit frequently, prioritize platforms with low fees or batch payment functions.

- Income Levels of Sender and Receiver: Choose services based on both parties’ financial situations to avoid high fees impacting their livelihood.

- Proportion of Remittance in Total Income: If remittances account for a large portion of income, opt for low-fee, high-transparency platforms.

You should also consider the recipient’s needs. Different platforms support various receiving methods and transfer speeds. The table below shows the receiving methods, transfer speeds, and fee types of mainstream platforms:

| Platform | Payment Method | Transfer Speed | Fee Type |

|---|---|---|---|

| Flutterwave | Foreign currency bank deposit or cash withdrawal | Cash withdrawal typically within minutes | Transparent low-cost transfers |

| Interswitch | Foreign currency bank deposit or cash withdrawal | Cash withdrawal typically within minutes | Transparent low-cost transfers |

| PayPal | Foreign currency bank deposit or cash withdrawal | Cash withdrawal typically within minutes | Transparent low-cost transfers |

| Western Union | Foreign currency bank deposit or cash withdrawal | Cash withdrawal typically within minutes | Transparent low-cost transfers |

| Wise | Foreign currency bank deposit | 1-5 business days | Low fees |

| OFX | Foreign currency bank deposit | 1-5 business days | No transfer fees |

| Xoom | Foreign currency bank deposit or cash withdrawal | Cash withdrawal typically within minutes | Transparent low-cost transfers |

You can flexibly choose the most suitable platform based on whether the recipient needs cash withdrawal, transfer speed, and fee levels.

Avoiding Risks

When using online remittance methods, you must prioritize security risks. Common risks include data breaches, poor encryption, outdated security measures, phishing scams, and fake websites. You can take the following measures to reduce risks:

- Compare different remittance services to ensure you choose providers with transparent fees.

- Choose providers with clear fee structures to avoid hidden fees.

- Pay attention to exchange rate markups to ensure you get real rates.

- Use digital transfer platforms, which typically offer lower fees.

- Choose low- or no-fee providers and take advantage of promotional offers.

You can also enhance security with the following methods:

| Risk Type | Mitigation Strategy |

|---|---|

| Data Breach | Create strong passwords |

| Poor Encryption | Enable multi-factor authentication (MFA) |

| Outdated Security Measures | Avoid using public networks |

| Phishing Scams | Use common sense to identify potential scams |

You should regularly change passwords, enable multi-factor authentication, and avoid remitting on public networks. Stay vigilant when encountering suspicious websites or messages to prevent scams.

Tip: When choosing a platform, carefully read fee descriptions and terms of service to avoid increased costs due to unclear terms or hidden fees.

Enhancing User Experience

When choosing an online remittance method, user experience is equally important. In recent years, many remittance companies have gone digital, launching convenient mobile apps and web platforms. You can quickly and securely complete remittances via smartphone without visiting physical branches. The popularity of digital apps allows you to manage funds anytime, anywhere, improving the overall experience.

The table below summarizes improvements in user experience by mainstream platforms:

| Improvement Measure | Description |

|---|---|

| Digitization | Digital remittances are transforming the global financial sector, optimizing user experience. |

| Cost Reduction | Digital remittances reduce operational costs and processing times, improving user experience. |

| Security | Advanced systems ensure compliance with anti-fraud and anti-money laundering regulations, protecting global transactions. |

| Transparency | Users demand transparency and control over funds, driving demand for digital platforms. |

You can prioritize platforms supporting digital operations, saving time and gaining higher security. Data shows that over half of users prefer digital apps for remittances, finding them safer and more efficient.

Tip: When using online remittance methods in China/mainland China, choose platforms supporting multi-currency, real-time exchange rate displays, and batch payment functions to further enhance remittance efficiency and experience.

When choosing an online remittance method in China/mainland China, you should first compare transaction fees and exchange rates across platforms to ensure the lowest costs. Pay attention to transfer speed, especially choosing fast transfer services for urgent needs. You should also verify the platform’s security measures and compliance credentials to protect personal information. Check user reviews to understand the platform’s actual performance. By flexibly applying these methods, you can make secure and efficient remittance decisions.

- Evaluate fees and exchange rates to find the most cost-effective option.

- Choose secure and compliant platforms to ensure fund and information safety.

- Combine your needs to flexibly select transfer speed and receiving methods.

FAQ

How to Check Fees for Online Remittance Platforms?

You can check fees directly on the platform’s official website or app’s fee explanation page. Most platforms display the exact fee amount before the transfer, making it easy to compare and choose.

Do Exchange Rate Fluctuations Affect the Amount Received?

Exchange rates change daily. You should check the platform’s real-time exchange rates before remitting. Some platforms allow you to lock in rates to minimize losses.

Are Online Remittances Safe?

Choose platforms with strong security records and compliance credentials. Platforms using encryption and multi-factor authentication can effectively protect your funds and information.

Which Mainstream Online Remittance Methods Can Users in China/Mainland China Use?

You can choose third-party payment platforms, international remittance services from licensed Hong Kong banks, or cryptocurrency remittances. Different methods support multiple currencies and receiving options.

What to Do If a Remittance Fails?

If a remittance fails, contact the platform’s customer service promptly. Provide transaction details, and the platform will assist in identifying the cause and resolving the issue.

After evaluating online remittance options for fees, exchange rates, and security, you might still face challenges with high costs (like banks’ $15-$50 fees), hidden rate markups, or delayed transfers, which reduce efficiency and inflate expenses. BiyaPay offers a streamlined, transparent solution!

BiyaPay delivers fees as low as 0.5% and zero-cost contract orders, with real-time exchange rate queries to secure the best USD/CAD rates (currently around 1.36), minimizing volatility losses. Sign up quickly to send funds to most regions worldwide with same-day delivery.

Uniquely, BiyaPay supports US and Hong Kong stock trading on one platform, no overseas accounts needed, blending remittances with investing seamlessly. Backed by end-to-end encryption and strict compliance, it ensures security. Join BiyaPay now for fast, low-cost global transfers, breaking free from traditional platform constraints!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.