- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Most Suitable Way to Send Money from the US to Turkey?

Image Source: pexels

When working or living in the US, you may need to send money to Turkey. You can choose from bank wire transfers, international money transfer companies, online transfer platforms, or cryptocurrencies. Each method has its own characteristics, and you need to select the most suitable one based on your needs and the recipient’s situation. Security, speed, fees, and convenience are key factors to consider.

Key Points

- When choosing a transfer method, focus on transfer costs, exchange rates, speed, security, and recipient preferences.

- Security is critical; bank wire transfers and international money transfer companies typically use multiple layers of encryption and identity verification to ensure fund safety.

- Transfer speeds vary; bank wire transfers usually take 1-5 business days, while some online platforms and cryptocurrencies can deliver funds in minutes.

- Fees vary significantly; traditional bank wire transfers have higher fees, while international money transfer companies and online platforms offer more transparent fees, suitable for small transfers.

- Communicate with the recipient in advance to understand their needs and preferences, which can enhance the transfer experience and reduce unnecessary issues.

Key Factors in Choosing the Best Method

When selecting the best way to send money from the US to Turkey, you should focus on the following key factors:

- Transfer Costs

- Exchange Rates

- Delivery Speed

- Security Measures

- Recipient Preferences

You need to consider these factors in combination with your actual needs and the recipient’s situation to choose the most suitable method.

Security

Security is one of the most important factors to consider. Different transfer methods employ various security technologies. For example, banks and wire transfers use secure banking protocols, multi-factor authentication, and encryption to prevent fraud. Digital wallets and mobile payments protect transactions through encryption, identity verification, and biometric authentication. Cryptocurrencies rely on blockchain technology to ensure transaction integrity. The table below shows the main security features of various payment methods:

| Payment Method | Security Features |

|---|---|

| On-site Card Payment | Dynamic and Two-Factor Authentication, Chip Technology, Encrypted EMV Terminals |

| Digital Wallet Transactions | Encryption and Identity Verification |

| Online Purchases | SSL/TLS Encrypted Payment Gateways |

| Mobile Payments | Biometric Authentication and Tokenization |

| Bank and Wire Transfers | Secure Banking Protocols, Multi-Factor Authentication, and Encryption |

| Cryptocurrencies | Decentralized Blockchain Technology |

You can also focus on security measures like encryption, tokenization, identity verification, and transaction monitoring, which effectively prevent information leaks and fund theft.

Speed

Transfer speed directly affects whether the recipient can access funds in a timely manner. Bank account transfers are typically completed within 0-1 business days, while international wire transfers may take 1-5 business days. Some online transfer platforms and cryptocurrencies can deliver funds in minutes. You can choose the most suitable method based on the urgency of the funds. The table below shows the processing times for major transfer methods:

| Transfer Method | Processing Time |

|---|---|

| Bank Account Transfer | 0-1 Business Days |

| International Wire Transfer | 1-5 Business Days |

For example, online platforms funded by debit cards or cash can deliver funds in minutes, making them ideal for urgent scenarios.

Fees

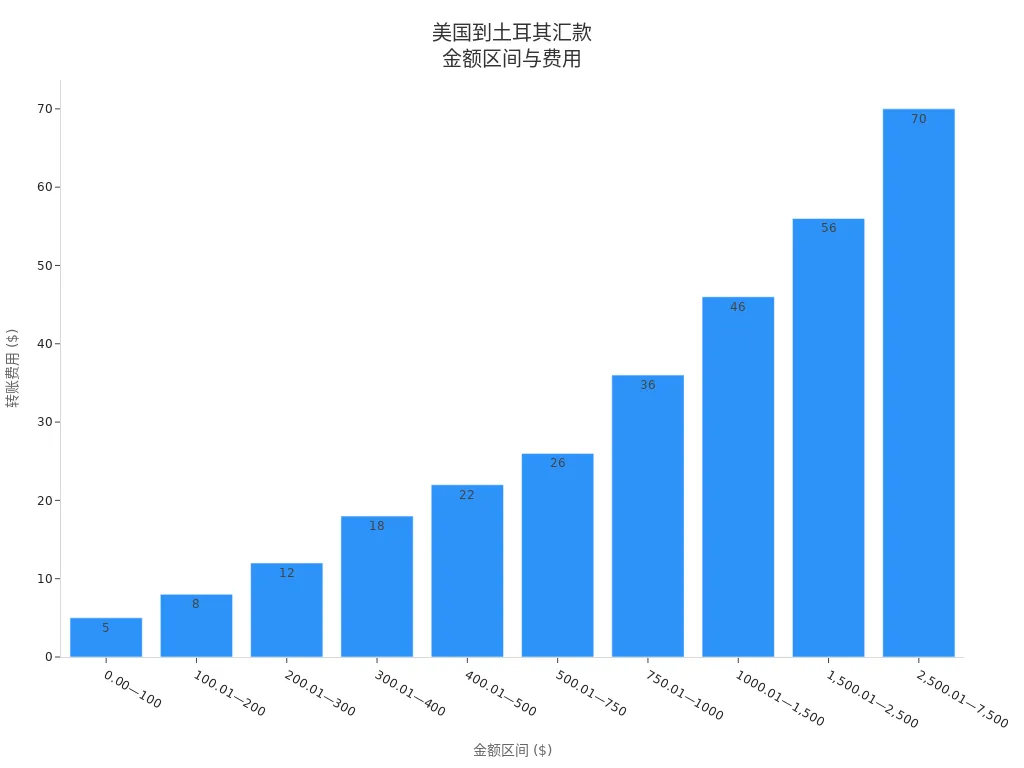

Fees are a critical factor when choosing the best transfer method. Fees vary significantly depending on the transfer amount. The table below shows the transfer fees for different amount ranges from the US to Turkey (in USD):

| Amount ($) | Transfer Fee ($) |

|---|---|

| 0.00 — 100 | 5 |

| 100.01 — 200 | 8 |

| 200.01 — 300 | 12 |

| 300.01 — 400 | 18 |

| 400.01 — 500 | 22 |

| 500.01 — 750 | 26 |

| 750.01 — 1000 | 36 |

| 1000.01 — 1,500 | 46 |

| 1,500.01 — 2,500 | 56 |

| 2,500.01 — 7,500 | 70 |

You can choose the most suitable method based on the transfer amount and fees to avoid unnecessary costs.

Convenience

Convenience determines the ease of operation for you and the recipient. Platforms like Remitly and Western Union support multiple payment methods, making them suitable for first-time users and those without bank accounts. Payoneer is ideal for freelancers and businesses, available globally. Cryptocurrency transfers are fast and low-cost but require a crypto wallet or trading platform, which may be challenging for beginners. You can choose the most suitable method based on the recipient’s situation and your operational preferences.

Tip: When choosing the best method, it’s recommended to communicate with the recipient in advance to understand their preferences and needs, which can enhance the transfer experience and reduce unnecessary issues.

Mainstream Transfer Methods

Image Source: pexels

Bank Wire Transfers

You can send money from the US to Turkey via bank wire transfers. The process is standardized and suitable for large transfers or users with high security requirements. Follow these steps:

- Register for wire transfer services and add the recipient.

- Select the “Payments and Transfers” function.

- Go to the “Wire Transfers and Global Transfers” page.

- Read and accept the relevant terms.

- Enter the recipient’s country, bank, and account information.

- Confirm the information and add the recipient.

Bank wire transfers typically take 1-3 business days to arrive. You can check specific transfer limits on the bank’s website or mobile app. The table below shows the main features of bank wire transfers:

| Item | Details |

|---|---|

| Processing Time | 1-3 Business Days |

| Transfer Limits | Check with the bank’s system |

Bank wire transfers are suitable for scenarios requiring high security and compliance, but fees are typically high, and the process can be cumbersome.

International Money Transfer Companies

You can use international money transfer companies for cross-border transfers. Major companies like MoneyGram and Xe offer multiple sending options and lower fees. Simply register an account, enter recipient details, and choose a payment method to complete the transfer. Some companies support delivery in minutes, ideal for urgent needs. The table below compares the fees and speed of two major companies:

| Company | Fees | Transfer Time |

|---|---|---|

| Xe | 0.00 USD | Minutes to 3 Business Days |

| MoneyGram | Low Fees | Fast and Secure |

These companies strictly comply with anti-money laundering regulations, requiring identity verification and monitoring suspicious transactions. When choosing the best method, prioritize international money transfer companies, especially for speed and convenience.

Online Transfer Platforms

Online transfer platforms like Paysend and Remitly offer flexible remittance options. You can transfer funds directly to the recipient’s bank card or account. Paysend charges a $1.99 fee, while Remitly’s fees vary by amount and payment method. The table below shows the fees and delivery options of major platforms:

| Platform | Transaction Fees | Delivery Options |

|---|---|---|

| Paysend | $1.99 | Direct to Bank Card or Account |

| Remitly | Varies | Multiple Delivery Options, Depending on Payment Method |

These platforms perform well in user ratings. For example, Wise has a Trustpilot rating of 4.3, Remitly 4.6, and Paysend between 4.2-4.5. You can choose flexibly based on the recipient’s needs and platform service quality.

Cryptocurrencies

Cryptocurrencies offer another cross-border transfer option. Stablecoins like USDT are increasingly used for cross-border payments in Turkey. Cryptocurrency transaction fees are typically lower than traditional banks. For example, Litecoin’s fees are around $0.02-$0.03, ideal for frequent small transfers. However, Bitcoin’s fees can be higher, averaging $23 in February 2021. Cryptocurrencies have high volatility and face regulatory challenges and fraud risks. When choosing the best method, weigh fees, speed, and risks to ensure fund safety.

Method Comparison and Selection Advice

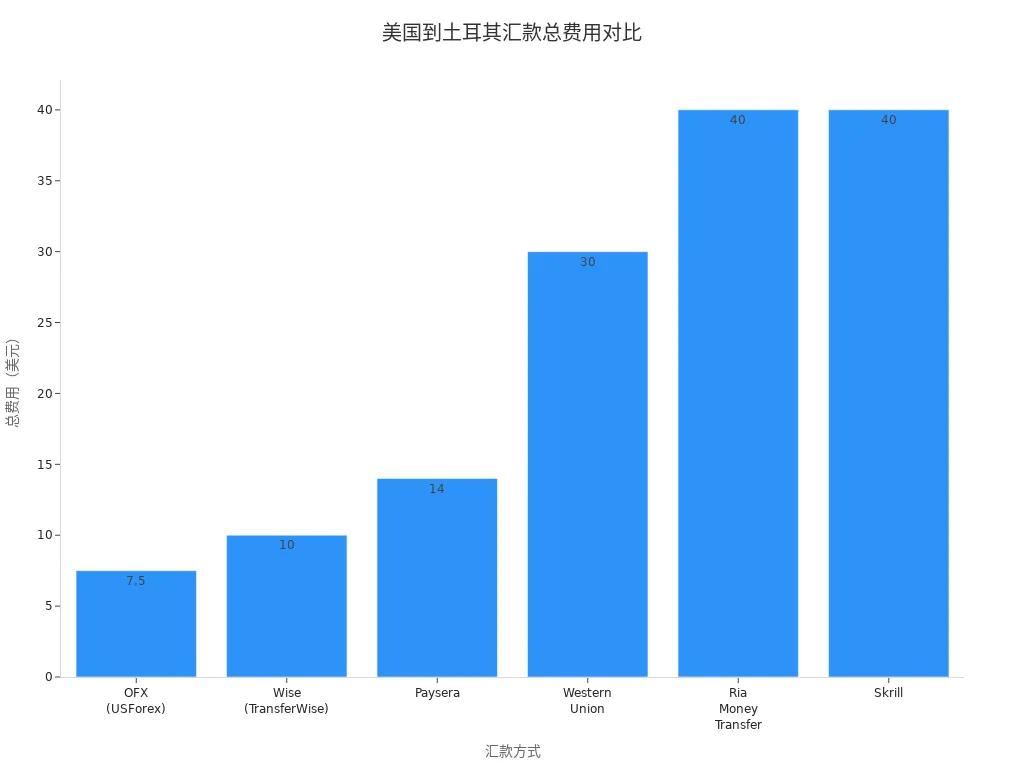

Fee Comparison

Fees are often the most direct consideration when choosing the best method. Different transfer methods have significant fee variations. Traditional bank wire transfers often require multiple bank intermediaries, with high fees, typically $25-$45 for outbound wire transfers, and some banks charge up to $85. Receiving banks may also charge additional fees. In contrast, international money transfer companies and online platforms have more transparent fees, with platforms like Wise and Paysera charging $4-$14 per transfer, though some have hidden exchange costs. Cryptocurrency transfers have the lowest fees, typically under $5, and do not require bank networks.

The table below shows the total fees and delivery times for sending $1000 to Turkey:

| Transfer Method | Fees for Sending $1000 | Hidden Exchange Costs | Total Fees | Transfer Arrival Time |

|---|---|---|---|---|

| Bank Wire Transfer | $15-$85 | $0-$15 | $15-$100 | 1-5 Days |

| Wise | $10 | $0 | $10 | 1-2 Days |

| Paysera | $4 | $10 | $14 | 1-3 Days |

| Western Union | $5 | $25 | $30 | 3-5 Days |

| Ria Money Transfer | $5 | $35 | $40 | 3-5 Days |

| Skrill | $39 | $1 | $40 | 3-5 Days |

| Cryptocurrency | <$5 | Varies by Coin Volatility | <$5 | Minutes to 1 Day |

Tip: When choosing a transfer method, besides focusing on explicit fees, pay attention to exchange rate differences and hidden costs, as these affect the final amount received.

Speed Comparison

Transfer speed directly impacts whether the recipient can access funds promptly. Bank wire transfers, due to multiple bank processing steps, typically take 1-5 business days, with potential delays during weekends or US/Turkey bank holidays. International money transfer companies and online platforms like Wise and Paysera usually deliver in 1-3 days. Some platforms, like Western Union, support delivery in minutes, ideal for emergencies. Cryptocurrency transfers are the fastest, completing in minutes and unaffected by bank hours.

| Transfer Method | Processing Time | Notes |

|---|---|---|

| Bank Wire Transfer | 1-5 Days | Delays on Holidays or Weekends |

| International Money Transfer Companies | Minutes to 3 Days | Depends on Service Type and Payment Method |

| Online Transfer Platforms | 1-3 Days | Some Platforms Support Instant Delivery |

| Cryptocurrencies | Minutes to 1 Day | Slight Delays During Network Congestion |

Note: Bank-related transfer methods may be delayed during US or Turkey bank holidays or weekends. For urgent needs, prioritize cryptocurrencies or international money transfer companies with instant delivery.

Security Comparison

Security is a critical factor when choosing the best method. Bank wire transfers and major international money transfer companies are strictly regulated in the US and Turkey, using multiple encryption and identity verification measures to ensure fund safety. The US Dodd-Frank Act provides clear consumer protection for cross-border transfers, ensuring you receive necessary information and protections. Turkey’s laws allow free transfer of profits and capital but impose some restrictions on foreign exchange transactions to stabilize its currency.

Cryptocurrencies rely on blockchain technology, offering transparent and low-cost transactions but with high volatility and risks of theft or fraud due to limited regulation in some platforms. When using cryptocurrencies, choose reputable platforms and protect private keys and wallet information.

| Method | Regulatory and Security Measures | Risk Points |

|---|---|---|

| Bank Wire Transfer | Multiple Encryption, Identity Verification, Compliance Regulation | High Fees, Slow Processing |

| International Money Transfer Companies | Anti-Money Laundering Monitoring, Identity Verification, Compliance Regulation | Risk of Information Leaks |

| Online Transfer Platforms | SSL Encryption, User Authentication, Compliance Regulation | Varying Platform Security |

| Cryptocurrencies | Decentralized Blockchain, Transparent Transactions | Price Volatility, Platform Security, Limited Regulation |

Advice: For high fund security requirements, prioritize bank wire transfers or large international money transfer companies. If you’re familiar with cryptocurrencies and can ensure proper security measures, consider them for small or urgent transfers.

Applicable Scenarios

Different transfer methods suit different needs. Choose the best method based on your situation and the recipient’s needs:

- Large Transfers: Bank wire transfers are ideal for large amounts, offering high security and compliance but with higher fees and slower delivery.

- Small or Regular Transfers: Online platforms like Wise and Paysera have low fees and fast delivery, suitable for frequent small transfers.

- Urgent Needs: International money transfer companies like Western Union support delivery in minutes, perfect for emergencies.

- Cryptocurrency-Savvy Users: Cryptocurrencies suit users familiar with blockchain, offering low fees and fast delivery but requiring attention to price volatility and platform security.

| Method | Best Scenarios | Main Advantages | Main Disadvantages |

|---|---|---|---|

| Bank Wire Transfer | Large, Formal Transfers | Secure, Compliant | High Fees, Slow |

| International Money Transfer Companies | Urgent, Cash Pickup | Fast, Many Locations | Variable Fees |

| Online Transfer Platforms | Small, Regular Transfers | Low Fees, Convenient | Requires Network and Accounts |

| Cryptocurrencies | Cryptocurrency Users | Low Fees, Fast | Price Volatility, Limited Regulation |

When choosing the best method, consider transfer amount, speed, security, and recipient needs. Communicate with the recipient in advance to confirm their channels and preferences for a better transfer experience.

Transfer Information and Precautions

Image Source: pexels

Required Information

When sending money from the US to Turkey, prepare the necessary information in advance. Requirements vary slightly by method. Common required information includes:

- Your valid ID, such as a US driver’s license, passport, or government-issued ID.

- Recipient’s full name, date of birth, detailed address, and bank account information (e.g., International Bank Account Number IBAN).

- For transfers of $1,000 or more, some providers may require the recipient’s date of birth and proof of funds’ source.

- For online transfer platforms, you may need to provide credit card information, bank account numbers, and ID.

- Platforms like PayPal may require uploading ID and proof of funds’ source.

- Large transactions may require signatures from both sender and recipient.

The table below compares the main information required by different transfer methods:

| Transfer Method | Required Information |

|---|---|

| Bank Wire Transfer | Government-Issued Photo ID, Proof of Address, Recipient’s Full Name, and Bank Account Details |

| International Money Transfer Companies | ID, Recipient Information, Proof of Funds’ Source in Some Cases |

| Online Platforms | ID, Recipient Information, Varies by Platform |

| Cryptocurrencies | Usually No Traditional Documents, but Some Platforms Require ID Verification for Compliance |

Common Issues

During the transfer process, you may encounter operational issues. To avoid delays and errors, consider the following:

- Double-check all recipient information and amounts before confirming the transfer.

- Understand the fee structure and exchange rates of different providers to avoid reduced amounts due to hidden costs.

- Plan transfer times in advance, avoiding US and Turkey bank holidays to reduce delay risks.

- Choose trusted transfer services to ensure funds reach the recipient’s account safely.

Tip: Communicate with the recipient before the transfer to confirm their channels and information for improved efficiency.

Risk Prevention

Cross-border transfers carry certain risks. Take proactive measures to reduce fund loss and compliance risks:

- Exchange rate fluctuations may affect the received amount. You can lock in rates with banks or forex providers through forward contracts to minimize losses.

- Regulatory policies vary by country. Understand US and Turkey regulations to ensure compliance.

- Fund security risks are significant. Use only regulated platforms and protect personal and account information.

- For large transfers, note compliance requirements. In the US, transfers over $10,000 must be reported by banks, and those over $16,000 may require tax reporting.

| Regulation Type | Description |

|---|---|

| Tax Regulations | Transfers over $16,000 may be considered taxable gifts and reported to the IRS |

| Consumer Protection | International transfers over $15 are regulated by the CFPB for transparency and fairness |

| Electronic Funds Transfer Act | Electronic payments and transfers are regulated by the EFTA to protect consumer rights |

| Transfer Reporting | Banks must report transfers over $10,000 to prevent money laundering and illegal activities |

During operations, keep all transfer receipts and related documents. Contact the provider or bank promptly in case of issues to protect your rights.

You can choose the best transfer method based on your needs. The table below summarizes the pros and cons of three mainstream methods:

| Transfer Method | Advantages | Disadvantages |

|---|---|---|

| International Transfer Providers | Low Fees, Good Rates, Fast | Limited Amounts, Limited Currencies |

| P2P Payments | Convenient, Low Fees, Many Options | Low Merchant Acceptance, Not Suitable for Large Transactions |

| SWIFT Payments | Secure, Globally Accepted by Banks | High Fees, Slow Delivery |

For low fees and fast delivery, prioritize international transfer providers. For large or high-security transfers, SWIFT payments are more suitable. Before proceeding, double-check information and precautions to ensure a smooth transfer.

FAQ

How Long Does It Take for a Transfer to Arrive?

Different methods have different delivery times. Bank wire transfers take 1-5 days, international money transfer companies can deliver in minutes, and cryptocurrencies typically complete in minutes. Choose based on your needs.

What to Do If a Transfer Fails?

If a transfer fails, verify recipient information. Contact the provider’s customer service with transfer proof. Most platforms will assist in identifying the issue and refunding the funds.

Are There Limits on Transfer Amounts?

Bank wire transfers and international money transfer companies usually have per-transaction and daily limits. Check specific limits with the provider. Large transfers require additional identity verification.

How Are Exchange Rates Calculated?

During transfers, platforms display real-time exchange rates. Rates vary by platform. Compare in advance to choose the most favorable rate.

What Information Is Needed for a Transfer?

You need to provide ID, recipient’s name, and bank account information. Some platforms require the recipient’s address and date of birth. Large transfers need proof of funds’ source.

When sending money from the U.S. to Turkey, you’re likely weighing costs, speed, and convenience. For a smarter alternative, discover BiyaPay — a unified platform for global transfers, real-time currency exchange, and investment.

Check live rates with our currency converter to secure the best value. Enjoy transfer fees as low as 0.5%, with same-day sending and receiving. Sign up in minutes and start transferring securely.

Plus, trade U.S. and Hong Kong stocks directly on the same app—no overseas account needed.

Get started today on BiyaPay and experience seamless cross-border finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.