- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Conduct a Safe and Efficient Remittance from Canada to the US?

Image Source: unsplash

When transferring money from Canada to the US through remittance, choosing a regulated remittance company or bank is critical. This ensures the safety of your funds and effectively prevents information leaks. Market data shows that digital transfer methods had a market value of USD 2.8 billion in 2024, gradually surpassing traditional methods. The table below shows the market value changes of mainstream remittance methods:

| Remittance Method | 2024 Market Value (USD Billion) | 2035 Market Value (USD Billion) |

|---|---|---|

| Digital Transfer | 2.8 | 4.2 |

| Traditional (Non-Digital) | 2.4 | 3.5 |

You also need to pay attention to the compliance of the remittance company, such as whether it adheres to new consumption tax regulations and the Bank Secrecy Act. Choosing legitimate channels and using bank SWIFT codes can help you achieve secure remittances.

Key Points

- Choose regulated remittance companies or banks to ensure fund safety and prevent information leaks.

- Bank wire transfers are suitable for large-amount transfers with high security but longer processing times, typically 1-5 business days.

- Online platforms like Wise and Revolut offer low fees and fast delivery, ideal for frequent small-amount remittances.

- Cryptocurrency transfers are fast but involve price volatility and cybersecurity risks, making it crucial to choose compliant platforms.

- Verify all recipient information before remitting to avoid delays or financial losses due to errors.

Remittance Methods

Image Source: unsplash

You can choose multiple methods to transfer funds from Canada to the US. Each method has different processes, fees, and security measures. Below is a detailed introduction to mainstream remittance methods and their applicable scenarios.

Bank Wire Transfer

Bank wire transfer is a traditional and widely used cross-border remittance method. You need to visit a bank branch or submit a remittance request through online banking. The bank will transfer funds to the US recipient’s account via the SWIFT system. Bank wire transfers are suitable for users who need to transfer large amounts or have high requirements for secure remittances.

Bank wire transfer processes are typically strict, requiring detailed recipient information and identity verification. Canadian banks use encryption protocols and two-factor authentication to ensure the safety of your funds. All depositors can enjoy the protection of the Canada Deposit Insurance Corporation (CDIC).

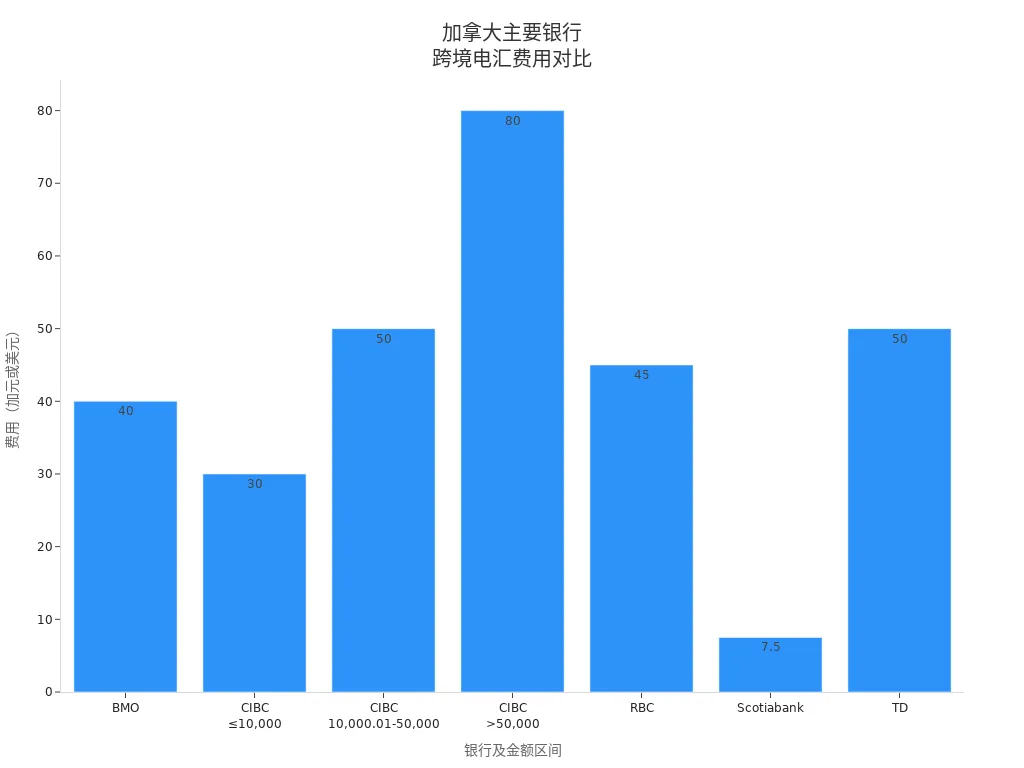

The table below shows the processing times and fees for cross-border wire transfers from major Canadian banks (in USD):

| Bank | Estimated Processing Time | Fees (USD) |

|---|---|---|

| BMO | Same-day processing | Approx. 30 |

| CIBC | 1-3 business days | Approx. 22-60 |

| RBC | Up to 2 business days | Approx. 33 and up |

| Scotiabank | Up to 2 business days | Approx. 5.5 |

| TD | 3-5 business days | Approx. 37 and up |

Online Platforms

You can choose regulated online platforms like Wise, Revolut, or Remitly for remittances. These platforms are regulated by the U.S. Financial Crimes Enforcement Network (FinCEN) and Canada’s Financial Transactions and Reports Analysis Centre (FINTRAC), ensuring compliance and fund safety. Online platforms are suitable for users seeking low fees and fast delivery. You only need to register an account, enter recipient information, and the platform will automatically handle currency conversion and fund transfers.

Wise and Revolut are known for transparent fees and high efficiency, ideal for frequent small-amount remittances.

| Platform | Regulatory Authority | Description |

|---|---|---|

| Wise | FinCEN, FINTRAC | Transparent fees, fast delivery |

| Western Union | FinCEN | Traditional remittance, wide coverage |

| MoneyGram | FinCEN | Multi-channel services |

Third-Party Payment

Third-party payment services like PayPal and RBC Cross-Border Banking provide convenient cross-border transfer options. PayPal is ideal for small, fast transfers between individuals, while RBC supports unlimited free fund transfers.

These services adopt strict anti-money laundering (AML) compliance measures, including customer identity verification and risk management frameworks, to ensure transaction safety. You can easily operate via mobile or computer, suitable for scenarios requiring instant delivery.

| Payment Service | Transaction Security Description |

|---|---|

| RBC Cross-Border Banking | Free fund transfers, fast delivery, secure |

| PayPal | Instant transfers, identity verification, secure protocols |

Cryptocurrency

Cryptocurrency offers a new cross-border remittance method. You can convert funds to Bitcoin or Ethereum through a cryptocurrency exchange and transfer them to a US recipient. Cryptocurrency exchanges must be registered in Canada and the US and comply with requirements, including customer identity verification and anti-money laundering measures.

The advantage of cryptocurrency remittances lies in low fees and fast delivery, but there are risks of price volatility and cybersecurity. You need to choose compliant trading platforms to protect personal information and achieve secure remittances.

- Cryptocurrency exchanges must follow FATF travel rules to ensure transparency of transaction party information.

- Canadian virtual asset service providers must register with FINTRAC and implement identity verification.

- You can enjoy faster processing speeds but need to be aware of price volatility and regulatory risks.

Method Comparison

When choosing a remittance method from Canada to the US, you need to comprehensively compare four aspects: security, delivery speed, fees, and applicable scenarios. Each method has its pros and cons, and only by combining your needs can you achieve secure and efficient remittances.

Secure Remittance

Your top concern is fund safety. Bank wire transfers and EFT payments are highly secure methods. Bank wire transfers use encryption protocols, protecting information during transmission. EFT payments, due to their typically small amounts, have lower risks and are easier to monitor for abnormal activities.

You should prioritize regulated remittance companies or banks and ensure the use of SWIFT codes for cross-border transfers. This can effectively prevent information leaks and fund losses.

| Remittance Method | Security Description | Anti-Fraud Measures Description |

|---|---|---|

| EFT Payment | Due to frequent small-amount transfers, EFT payments have lower risks and are easier to track and monitor for abnormal activities. | Canadian banks and payment systems implement encryption and anti-fraud measures. |

| Wire Transfer | Wire transfers are considered very secure, but international transfers have higher fraud risks and are typically irreversible once sent. | Transfers through trusted remittance services are usually encrypted, ensuring sensitive information is protected during transactions. |

- Wire transfers are a secure and reliable cross-border remittance method.

- Financial institutions implement strict security measures to protect you and the recipient.

- Choosing a reputable remittance service provider is key to secure remittances.

When using online platforms and third-party payments, you should also verify whether the platform is licensed by Canadian and US financial regulators. Cryptocurrency, while fast, has higher price volatility and cybersecurity risks, so it’s recommended to operate only on familiar, compliant platforms.

Speed

Delivery speed directly affects the efficiency of your fund usage. The average transfer times for different methods are as follows:

| Transfer Method | Average Transfer Time |

|---|---|

| Bank Wire Transfer | 1-5 business days |

| Online Platforms | Possibly same-day processing |

| Third-Party Payment | Possibly same-day processing |

| Cryptocurrency Remittance | Depends on blockchain network, typically minutes to 1 hour |

If you need funds to arrive quickly, prioritize online platforms or third-party payments, which can usually complete transfers on the same day. Bank wire transfers, while secure, take longer and are suitable for non-urgent scenarios. Cryptocurrency transfers are fast but depend on network congestion and platform reviews.

Tip: In emergencies, choosing regulated online remittance services or third-party payments can significantly shorten delivery time.

Fees

When remitting, you need to pay attention to transaction fees and potential hidden fees. Fee standards vary significantly across banks and platforms. Below are the wire transfer fees for some major banks (in USD):

| Bank/Platform | Outbound Wire Fee | Inbound Wire Fee | Notes |

|---|---|---|---|

| Online Platforms | $5-$15 | $0-$10 | Transparent fees, some platforms have no hidden fees |

| Third-Party Payment | $0-$10 | $0-$10 | Suitable for small-amount transfers |

When choosing, carefully read the fee details and beware of additional fees that intermediary banks may charge. Online platforms and third-party payments typically have lower fees, suitable for frequent small-amount remittances. Bank wire transfers are suitable for large amounts but have higher fees.

Applicable Scenarios

Different remittance methods suit different needs. You can choose the best option based on your situation:

| Scenario | Best Remittance Method | Description |

|---|---|---|

| Urgent Transfer | Online Remittance Services, Third-Party Payment | These services usually offer fast transfers, arriving within minutes or available for cash pickup. |

| Large-Amount Transfer | Bank Wire Transfer | Bank wire transfers have high limits, suitable for large fund movements with strong security. |

| Low-Cost Needs | Online Remittance Platforms, Third-Party Payment | These platforms have low fees and transparent exchange rates, ideal for frequent small-amount remittances. |

| Digital Asset Transfer | Cryptocurrency | Suitable for users familiar with digital currency operations, fast but with price volatility risks. |

When operating, combine your needs and prioritize regulated channels to ensure secure remittances and efficient delivery.

Operating Procedures

Bank Wire Transfer Steps

When using a bank wire transfer, follow these steps to ensure funds are safely and smoothly transferred to the US:

- Visit a bank branch or log into online banking and select the “international remittance” service.

- Enter recipient information, including the recipient’s full name, US bank account number, SWIFT code, bank address, and routing number.

- Enter the remittance amount (USD) and choose the payment method (e.g., bank account or cash).

- Carefully verify all information, especially the recipient’s name, account number, and bank routing information. Errors may lead to delays or returns.

- Complete identity verification; banks typically require valid identification.

- Pay the transaction fee; the bank will display all fee details.

- After submitting the remittance request, the bank will generate a transaction receipt and tracking number, allowing you to check the remittance status in real time.

Tip: Before remitting, always verify account, branch, and institution numbers. It’s recommended to enable bank auto-alert functions to receive timely notifications of large transactions or suspicious activities. For large-amount transfers, consider using bank drafts or checks to enhance security.

Common errors include:

- Sending incorrect bank information (e.g., account or routing numbers).

- Forgetting to verify the recipient’s full name or address, leading to payment returns or delays.

- Cyber fraud risks, where scammers may insert incorrect account information.

Online Platform Procedures

You can use online platforms like Wise or Remitly for fast and secure remittances. The specific steps are as follows:

- Register and log into the platform account, linking your Canadian bank account or credit card.

- Enter recipient information, including the US bank account number, branch number, SWIFT/BIC code, and recipient bank address.

- Select the remittance amount (USD); the platform will automatically display the real-time exchange rate and fees.

- Complete multi-factor identity verification; some platforms require uploading government-issued ID documents.

- Confirm all information is correct before submitting the remittance request.

- The platform ensures transaction security through encrypted communication and provides a tracking number for real-time monitoring of remittance status.

It’s recommended to choose reputable remittance services with strong security features and encryption protection. Never share personal or financial information through unsecured channels and always operate on secure websites.

When using mobile apps (e.g., PayPal, Wise), you can experience convenient international remittance services. Platforms typically require the recipient’s full name, complete bank account information, and branch number. SWIFT/BIC codes and bank addresses are also mandatory. Platforms use encrypted communication and multi-factor verification to ensure secure remittances.

Third-Party Payment Guidelines

Third-party payment services (e.g., PayPal, RBC Cross-Border Banking) offer flexible cross-border transfer options. The steps are as follows:

- Log into the third-party payment platform and link your Canadian bank account or credit card.

- Enter recipient information, including the US bank account or PayPal email.

- Select the remittance amount (USD); the platform will display fees and exchange rates.

- Complete identity verification; some platforms require a verification code or facial recognition.

- Confirm all information is correct before submitting the transfer request.

- The platform will generate a transaction receipt, allowing you to check the delivery status at any time.

When using third-party payments, pay attention to platform security. Cyber theft and fraud are major challenges in cross-border payments. Choose platforms with robust security measures and regularly learn cybersecurity best practices.

Data shows that 59% of users worry about security during remittances, and 75% of Gen Z stop cross-border payments due to fraud risks. You can enhance secure remittance experiences through platform compliance tools and AI-driven suspicious transaction detection.

Cryptocurrency Procedures

If you choose cryptocurrency for cross-border remittances, follow these steps:

- Set up a secure wallet to store cryptocurrencies (e.g., Bitcoin or Ethereum).

- Purchase cryptocurrency via Interac e-Transfer or wire transfer; the platform will require identity verification and uploading government-issued ID documents.

- Enter the recipient’s wallet address and select the transfer amount (USD equivalent in cryptocurrency).

- Confirm all information is correct before submitting the transfer request.

- The platform processes the transaction via the blockchain network, typically completing in minutes to an hour.

- You will receive a confirmation notification upon transaction completion.

Canadian cryptocurrency service providers must register with FINTRAC, and all transactions over $10,000 must be reported. Platforms verify sender and recipient identities to ensure legal compliance. Be mindful of price volatility and cybersecurity risks during operations.

Cryptocurrency MSBs must maintain transaction records and report suspicious or terrorism-related transactions. Before remitting, assess whether the recipient is a politically exposed person (PEP) to ensure compliance.

Precautions

When conducting any cross-border remittance, follow these safety measures:

- Choose reputable remittance services that are legally compliant in China/Mainland China and the US.

- Verify the recipient’s identity before remitting, especially when dealing with unfamiliar individuals or businesses.

- Avoid sharing personal or financial information through unsecured channels and always operate on secure websites.

- Send a small test amount to establish trust before making large transfers.

- Stay vigilant about the latest scam tactics and regularly learn cybersecurity knowledge.

- Carefully read all fee details and beware of hidden fees and exchange rate risks.

- Use auto-alert functions to receive timely notifications of account anomalies or large transactions.

- During the remittance process, verify all recipient information to avoid delays or returns due to errors.

In any remittance process, prioritize secure remittances. Only by protecting personal information and verifying every detail can you ensure funds arrive smoothly.

Risk Prevention

Image Source: pexels

Secure Remittance Precautions

When transferring money from Canada to the US, common risks include scams, information leaks, and account theft. Common types of cross-border remittance scams include:

- Foreign lottery scams

- Nigerian money transfer proposals

- Check overpayment scams

Be cautious of unsolicited prize notifications or fund transfer requests from strangers. Do not respond to emails claiming you need to assist with transfers. Protect your bank account and credit card information and avoid disclosing it casually. Choose legitimate channels for secure remittances, set complex security questions, and regularly update passwords. Before each remittance, verify the recipient’s identity and account information to avoid financial losses due to errors.

Tip: You can send a small test amount to confirm delivery before making large transfers for added safety.

Identifying Hidden Fees

When choosing remittance services, hidden fees may affect the actual amount received. You can take the following measures to identify and avoid these fees:

- Compare different international remittance services and choose the option with the best fees and exchange rates.

- Select service providers with transparent fee structures to avoid unexpected costs.

- Pay attention to exchange rate markups and ensure the rate used is close to the mid-market rate.

- Use digital transfer platforms like Wise, PayPal, and Revolut, which typically have lower and more transparent fees.

Before remitting, carefully read the fee details to avoid losses due to intermediary banks or platform charges.

Exchange Rate Risks

Exchange rate fluctuations directly affect the USD amount received in the US. The table below shows the main factors affecting exchange rates and coping strategies:

| Influencing Factor | Description |

|---|---|

| Canadian Dollar Depreciation | When the Canadian dollar depreciates, the same CAD remittance results in fewer USD received. |

| Interest Rate Differences | Policy interest rate differences between Canada and the US affect exchange rate fluctuations. |

| Foreign Exchange Risk Premium | Risk premiums in the forex market also cause exchange rate volatility. |

| Risk Management Strategies | You can use financial tools like forward contracts to lock in exchange rates and reduce adverse fluctuation impacts. |

You can combine multiple tools to manage currency risks and maximize remittance amounts.

Fund Tracking

Tracking fund status in real time after remittance is crucial. You can track funds through the following methods:

- Enter the tracking number on the company’s website or mobile app to check transfer status at any time.

- Track in real time via the bank or remittance service provider’s official website or app.

- Use unique reference numbers to identify transactions.

- Receive email or SMS notifications for fund delivery or anomalies.

- Contact official customer support channels for verification if you have any questions.

Most reliable remittance companies provide online tracking tools to help you monitor fund movements and enhance security.

Selection Advice

Matching User Needs

When choosing a remittance method from Canada to the US, match it to your actual needs. Different platforms have distinct features in fees, speed, and transfer limits. The table below helps you quickly understand the basics of mainstream platforms:

| Application | Fees | Speed | Transfer Limit |

|---|---|---|---|

| Wise | Low fees | Fast | Up to $10,000 |

| PayPal | Higher fees | Fast | Up to $10,000 |

| Remitly | Moderate fees | High-speed | Up to $5,000 |

| Xoom | Moderate fees | Fast | Up to $5,000 |

If you prioritize low costs, consider Wise first. For fast transfer speeds, Remitly and Xoom meet your needs. PayPal is suitable for convenience and broad application scenarios. For large-amount transfers, opt for bank wire transfers or cross-border services from licensed Hong Kong banks for higher security.

Pros and Cons Summary

When choosing a remittance method, refer to the following pros and cons:

- Wise offers low fees and excellent exchange rates, ideal for cost-conscious users.

- PayPal is convenient with broad coverage but has relatively high fees.

- Remitly has fast transfer speeds, suitable for urgent needs.

- Xoom is simple and secure, ideal for users prioritizing transaction safety and compliance.

- Bank wire transfers are suitable for large amounts with high security but have higher fees and longer delivery times.

- Cryptocurrency transfers are fast and low-cost but have significant price volatility, suitable for users familiar with digital asset operations.

Practical Advice

When operating, first clarify your needs. For small and frequent transfers, choose online platforms with low fees and fast delivery. For large amounts or high security requirements, opt for bank wire transfers or cross-border services from licensed Hong Kong banks. When selecting a platform, check if it is regulated by Canadian and US authorities to ensure fund safety. Before remitting, verify all recipient information to avoid delays or losses due to errors. You can also send a small test amount to confirm delivery before making large transfers for added safety.

When transferring money from Canada to the US, choose services based on your needs. The table below summarizes the pros and cons of mainstream remittance methods:

| Service Name | Advantages | Disadvantages |

|---|---|---|

| Wise | Transparent and usually low fees | No cash pickup support |

| Skrill | Competitive fees and exchange rates | Non-transparent exchange rates |

| WorldRemit | Multiple sending and receiving methods | Potentially more expensive with more hidden fees |

| MoneyGram | Easy to use, wide coverage | Higher fees, non-transparent exchange rates |

| OFX | Good customer service, low fees | More expensive for small transfers |

Consider the following advice:

- Choose Wise or Skrill for low-fee transfers.

- For cash pickup needs, WorldRemit is suitable.

- For large-amount transfers, OFX is more appropriate.

Prioritize secure remittances and efficient delivery, verify information carefully, and mitigate risks. Combine your actual situation to choose the most suitable method.

FAQ

What basic information is needed to transfer money from Canada to the US?

You need the recipient’s full name, US bank account number, SWIFT code, and bank address. Licensed Hong Kong banks typically require you to provide this information to ensure funds arrive safely.

It’s recommended to verify all information in advance to avoid delays or returns due to errors.

How long does it take for a remittance to arrive?

Bank wire transfers typically take 1-5 business days. Online platforms and third-party payments can arrive as fast as the same day. Cryptocurrency transfers generally take minutes to an hour.

| Remittance Method | Estimated Delivery Time |

|---|---|

| Bank Wire Transfer | 1-5 business days |

| Online Platforms | Same day or next day |

| Cryptocurrency | Minutes to 1 hour |

What are the typical remittance fees?

Bank wire transfers have fees of about USD 20-60. Online platforms and third-party payments have lower fees, typically USD 5-15. Cryptocurrency platform fees vary based on network congestion.

Check the platform’s fee details before remitting to choose the most suitable method.

How to ensure remittance security?

Choose regulated remittance companies or licensed Hong Kong banks. Protect personal information and avoid operating on unsecured websites. Set complex passwords and update them regularly.

- Enable account alert functions to detect abnormal transactions promptly.

Do exchange rate changes affect the received amount?

Exchange rates directly impact the USD amount received. You can use rate-locking services to reduce losses from exchange rate fluctuations.

| Influencing Factor | Coping Method |

|---|---|

| Exchange Rate Fluctuations | Use rate-locking tools |

| Fee Markups | Choose transparent platforms |

Sending money from Canada to the U.S. shouldn’t come with high fees, hidden charges, or long wait times. If you’re looking for a smarter, more cost-effective way to transfer funds, BiyaPay offers a modern financial solution.

Enjoy real-time exchange rate tracking with our currency converter, and benefit from transfer fees as low as 0.5%. Our platform supports fast, secure cross-border payments with same-day sending and receiving—ideal for both urgent and large transactions.

Sign up in minutes and start sending money globally without needing a U.S. bank account. Plus, manage your investments seamlessly by trading stocks all in one place.

Join thousands of users who’ve switched to a more transparent, efficient way to move and grow their money. Get started today on BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.