- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Right Way to Remit Money to the Philippines? Understand Fees, Speed, and Security

Image Source: unsplash

When you remit to the Philippines, you should focus on fees, transfer speed, and security. The Philippines remittance market is continuously expanding, with a market size of $0.68 billion in 2022, projected to grow to $1.84 billion by 2030. Different people choose suitable methods based on factors such as remittance amount, urgency, and whether the recipient has a bank account. You can weigh speed, cost, and convenience based on your needs to make a more informed decision.

| Year | Remittance Market Size (USD Billion) | Expected Growth Rate |

|---|---|---|

| 2021 | 0.63 | N/A |

| 2022 | 0.68 | N/A |

| 2030 | 1.84 | 13.3% |

Key Points

- When choosing a remittance method, focus on fees, transfer speed, and security to ensure you select the most suitable channel.

- Digital wallets are suitable for small, frequent remittances, typically with low fees and fast transfers, convenient for daily use.

- For large remittances or high-security needs, choose licensed Hong Kong banks or internationally renowned platforms to ensure fund safety.

- For urgent remittances, prioritize services with fast transfer speeds, such as digital wallets or specific remittance services, to ensure timely delivery.

- Regularly compare fees and services of different channels and adjust your remittance method flexibly to save costs and enhance the experience.

Fee Comparison

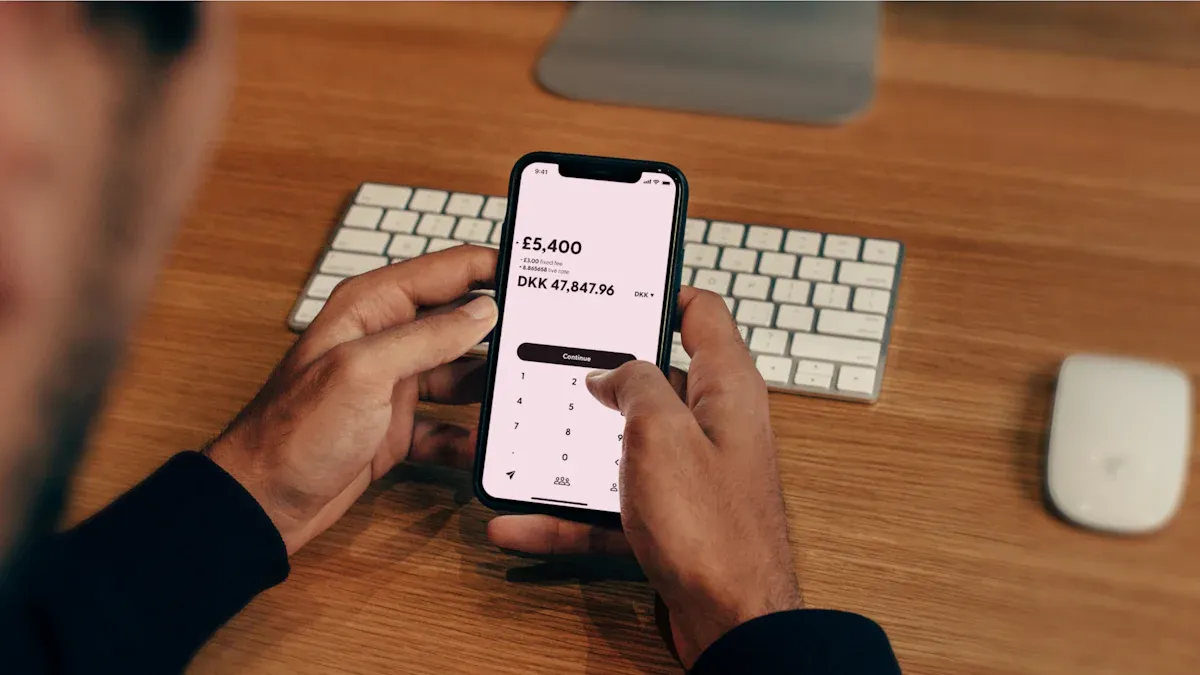

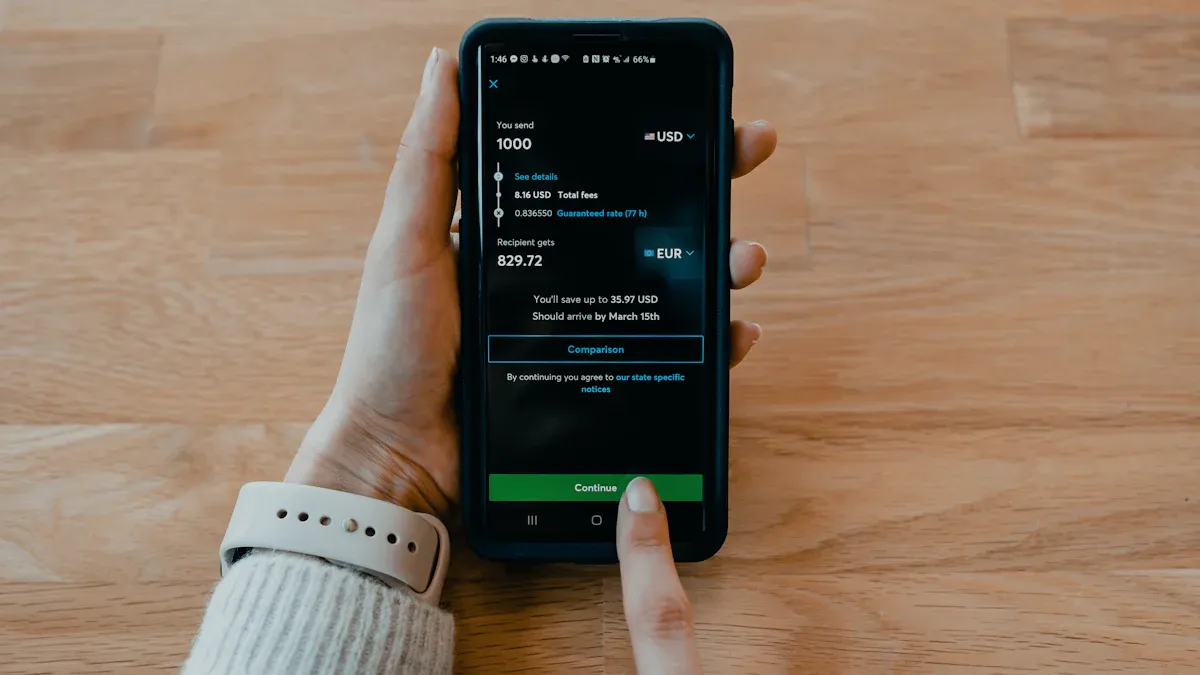

Image Source: pexels

Bank Transfer Fees

When you choose a licensed Hong Kong bank for Philippines remittance, you typically encounter two types of fees: transfer handling fees and exchange rate margins. Most banks offer competitive international remittance fees. The transfer time generally takes 1 to 5 business days. You can refer to the table below to understand the fee structures of different service types:

| Service Type | Fee Structure Description |

|---|---|

| Bank Transfer | Licensed Hong Kong banks usually charge a fixed handling fee, with some banks offering free transfers under specific conditions. |

| Remittance Service | Online platforms have transparent fees, with some providers charging a percentage of the amount. |

| Digital Wallet | Digital wallet transfers have lower fees and are convenient. |

Bank transfer fee structures are relatively clear, but you also need to pay attention to exchange rate margins. Exchange rate margins are the largest cost component in international remittances. With global remittances exceeding $650 billion annually, exchange rate margins can lead to significant losses for you and the recipient. You can use real-time exchange rate data to choose a suitable provider and reduce costs.

Remittance Service Fees

When you use mainstream remittance services, the fee structures vary. Some platforms charge a fixed fee, such as $3.99 per transaction, regardless of the amount. Others charge a percentage fee, such as 2% for a $100 remittance, which is $2. Payment methods and transfer speed also affect fees. The table below shows common fee types:

| Fee Type | Example |

|---|---|

| Fixed Fee | $3.99 per transaction |

| Percentage Fee | 2% per transaction |

| Payment Method Impacting Fees | Credit card payments may incur higher fees |

| Delivery Speed Impacting Fees | Faster delivery services have higher fees |

When choosing, you should compare the fees and exchange rates of different platforms to ensure the best value.

Digital Wallet Fees

Digital wallets typically offer lower transfer fees and more convenient services. You can refer to the following fee information:

- Traxion Pay, Inc.: $0.90 per transaction

- USSC Money Services, Inc.: Up to $1.35

- Paysend: Starting fee of $1.99

- TransferGo: Fixed fee of $1.25 for next-day transfers

- BOSS Money: Free handling fees for the first three transactions

Digital wallet remittance fees are generally lower than traditional banks and remittance services. Some platforms even offer zero-fee transfers during promotions. You can choose the most suitable service based on the transfer amount and speed.

Hidden Fees

During the remittance process, you need to be cautious of hidden fees. Common hidden fees include:

- Additional fees due to payment methods, such as credit card payments

- Currency exchange rate surcharges

- Fees charged by third-party receiving institutions

- Lower fees for economy transfers, higher fees for fast transfers or cash pickups

- Additional fees possibly charged by local banks or pickup points

You should choose reliable providers and carefully review all related fees, including remittance and recipient fees. Understanding exchange rates and their surcharges helps avoid unexpected fund reductions. Before completing a transaction, always check the total fees to ensure fund safety and transparency.

Transfer Speed

Image Source: unsplash

Bank Transfer Speed

When you choose a licensed Hong Kong bank for Philippines remittance, the transfer speed is usually slower. Interbank transfers typically take 1 to 2 business days, while ACH transfers may take 3 to 5 business days. You can refer to the table below to understand the processing times for different bank transfer types:

| Transfer Type | Average Processing Time |

|---|---|

| Interbank Transfer | 1-2 business days |

| ACH Transfer | 3-5 business days |

Bank transfers are suitable for non-urgent scenarios. If you need fast delivery, bank transfers may not be the best choice.

Remittance Service Speed

When you use mainstream remittance services, the transfer speed is usually faster. Some services like Xoom and Kabayan Remit can complete transfers within minutes to an hour. MoneyGram’s speed depends on the payment and receipt methods. The table below shows the transfer times for different remittance services:

| Service Name | Speed | Delivery Method |

|---|---|---|

| Xoom | Usually within minutes | Cash pickup, bank deposit, mobile wallet, doorstep delivery |

| Kabayan Remit | Most payment methods within an hour | Bank account credit, cash pickup, mobile e-wallet top-up |

| MoneyGram | Speed depends on payment and receipt methods | Cash transfer, mobile top-up |

You can choose the appropriate service based on the recipient’s needs to meet urgent remittance scenarios.

Digital Wallet Speed

Digital wallet remittances are the fastest. When you transfer via a digital wallet, funds are typically available within minutes. The table below shows the availability times for digital wallets:

| Transfer Method | Availability Time |

|---|---|

| Digital Wallet | Available within minutes |

Digital wallets are suitable for small, frequent, or urgent remittance needs. You can enjoy an efficient and convenient service experience.

Factors Affecting Transfer Speed

Transfer speed is influenced by various factors. When remitting, you should note the following:

- Global events, such as pandemics, geopolitical events, and natural disasters, may affect international bank transfer times.

- Bank holidays, including those in other countries, may cause transfer delays.

- Weekend transfers may not be processed until the next business day, depending on the recipient country’s workweek.

- Different time zones and bank cutoff times affect transfer processing speed.

- Bank transfers typically go through the SWIFT network, which may cause delays.

Additionally, bank processing times, intermediary banks, and compliance verifications can also affect transfer speed. When choosing a remittance method, you should consider your actual needs and the provider’s characteristics to reasonably arrange fund delivery time.

Security Analysis

Bank Transfer Security

When you choose a licensed Hong Kong bank for Philippines remittance, you benefit from multiple security safeguards. Banks use secure online platforms with encryption technology and multi-factor authentication to protect your account and funds. They also collaborate with international security agencies, implementing fraud detection systems to ensure every remittance complies with international banking standards and regulatory requirements. Philippine banks also follow strict regulatory requirements to ensure the legality and security of all international remittances. These measures not only prevent fund theft but also enhance the credibility of the Philippine financial market. Banks’ anti-fraud systems can effectively identify risks such as account takeover, synthetic identity, payment mule activities, social engineering scams, and cross-border money laundering. When using bank transfers, your funds and information are comprehensively protected.

Remittance Service Security

When you use mainstream remittance services, providers must comply with the Philippines’ financial regulatory standards. The table below shows key compliance requirements:

| Regulation Type | Detailed Requirements |

|---|---|

| Customer Identification | Financial institutions must verify customer identity through official documents and establish robust identity verification systems. |

| Record Keeping | All transaction records must be kept for at least five years, and customer information must be retained for five years after account closure. |

| Reporting Covered Transactions | Financial institutions must report all covered transactions to the Anti-Money Laundering Council within five business days. |

| Right to Inquire Deposits | The Anti-Money Laundering Council can inquire about bank deposits in cases of suspected illegality. |

Remittance services use encryption technology and anti-fraud measures, employing trusted payment gateways to ensure the safety of your funds and personal information. Two-factor authentication (2FA) adds a security layer to transfers, ensuring only authorized personnel can access sensitive data. The Philippines’ data privacy laws also provide strict guidance for cross-border data processing, protecting your information from leaks.

Digital Wallet Security

When you choose digital wallets for Philippines remittance, you can enjoy high-level security protection. Digital wallets use advanced encryption technology to protect your financial information, reducing the risk of data breaches. Many platforms offer two-factor authentication (2FA), and some support biometric authentication, further enhancing security. The table below summarizes common security technologies used by digital wallets:

| Technology Type | Description |

|---|---|

| Advanced Encryption Technology | Protects user financial information, reducing data breach risks. |

| Two-Factor Authentication (2FA) | Adds a security layer to ensure user identity verification. |

| Fraud Detection Systems | Monitors transactions and quickly flags unauthorized activities. |

If you encounter a security incident, you should immediately contact the e-wallet provider, freeze the account, and report the issue. If necessary, you can file a complaint with the Bangko Sentral ng Pilipinas (BSP) or seek assistance from law enforcement. Collecting and preserving relevant evidence helps protect your rights.

User Precautions

When remitting, you can take the following measures to protect yourself from scams:

- Never share one-time passwords (OTP), credit card security codes (CVV), or personal identification numbers (PIN) with anyone.

- Do not click suspicious links; visit official websites directly.

- Enable two-factor authentication to enhance account security.

- Only remit to people or businesses you know and trust.

- Do not install “troubleshooting” software requested by others.

- Do not grant others remote access to your phone, computer, or account.

You can also check the provider’s reputation, read user reviews, and confirm that the provider uses encryption and security protocols and is regulated by financial authorities. Transparent fees and exchange rates, timely transfers, and clear tracking options are also important references for choosing legitimate channels.

Reminder: Before remitting, carefully read the service terms to understand all security measures and liability scopes. Choosing legitimate channels effectively prevents risks and ensures fund safety.

Choosing the Right Method

Small and Frequent Remittances

If you frequently need to remit small amounts to the Philippines, it’s recommended to prioritize digital wallets or mainstream remittance services. These channels typically have low fees and fast transfer speeds, suitable for daily life, family support, or small purchases. Digital wallets like Traxion Pay, Inc. and USSC Money Services, Inc. charge as low as $0.90-$1.35 per transaction, and some platforms offer fee-free promotions. You can operate anytime via mobile apps, which is convenient and fast. When choosing a suitable method, you should focus on handling fees and exchange rates to avoid cumulative costs from frequent remittances. Digital wallets support multiple payment methods, and recipients can receive funds quickly. You can periodically compare the fees and services of different platforms to find the most suitable channel.

Tip: For small remittances, prioritize platforms with fast transfers and low fees to avoid inefficiencies due to high handling fees.

Large and High-Security Needs

If you need to send a large amount at once or have high security requirements, it’s recommended to choose licensed Hong Kong banks or internationally renowned remittance services. Bank transfers offer high security, using multiple encryption and authentication measures to effectively prevent fraud and money laundering risks. You can also consider using international platforms like Wise or Western Union, which excel in security. The table below compares the security features of different remittance methods:

| Remittance Method | Security Features |

|---|---|

| Wise | Uses sophisticated security and anti-fraud measures, with funds protected under regulation. |

| Western Union | Ensures remittance safety through encryption and anti-fraud measures. |

When choosing a suitable method, prioritize the provider’s security credentials and regulatory background. Banks and international platforms typically offer fund tracking and customer service support, allowing you to address issues promptly. You can review each platform’s security policies in advance to ensure smooth fund delivery.

Urgent Remittance Scenarios

If you face an urgent situation requiring quick fund transfers to the Philippines, choose the fastest delivery channels. Digital wallets and some remittance services like Xoom and Kabayan Remit can complete transfers within minutes to an hour. You can operate via mobile or computer without waiting for bank processing cycles. When choosing a suitable method, focus on the provider’s real-time delivery capabilities and customer support. Some platforms offer 24-hour services, suitable for sudden needs. You can register and verify accounts in advance to ensure smooth remittances during emergencies.

Reminder: For urgent remittances, prioritize platforms supporting real-time transfers and familiarize yourself with the process in advance to avoid delays due to incomplete information or unactivated accounts.

Choosing Based on Actual Needs

When choosing a suitable method, you need to balance fees, speed, and security based on your actual needs. You can refer to the following suggestions:

- For small and frequent remittances, prioritize digital wallets or low-fee remittance services.

- For large remittances or high-security needs, choose licensed Hong Kong banks or internationally renowned platforms.

- For urgent transfers, select digital wallets or fast remittance services supporting real-time transfers.

- Periodically compare the fee structures and transfer speeds of different channels to adjust your remittance method flexibly.

During actual operations, you can list your needs, such as remittance amount, delivery time, and recipient account type, then compare the advantages of each channel. Choosing the right method not only saves costs but also enhances fund security and the remittance experience.

Before remitting, it’s recommended to thoroughly understand each platform’s service terms and fee details to ensure every fund safely and promptly reaches the Philippines.

When choosing a Philippines remittance method, you need to focus on fees, transfer speed, and security. Each channel has different advantages and disadvantages. You can:

- Compare the handling fees and exchange rates of each channel to choose a lower-cost method.

- Assess whether the transfer speed meets your urgency needs based on actual requirements.

- Prioritize platforms with robust security measures and regulatory oversight.

It’s recommended to regularly monitor policy and service changes and adjust your remittance method to ensure fund safety and efficient delivery.

FAQ

What are the mainstream methods for Philippines remittance?

You can choose licensed Hong Kong bank transfers, mainstream remittance service platforms, or digital wallets. Each method has different fees, speeds, and security levels. You can choose flexibly based on your actual needs.

What basic information is needed for remittance to the Philippines?

You need the recipient’s name, bank account or wallet number, receiving bank name, and SWIFT code. Some platforms also require the recipient’s phone number or ID number.

Reminder: Confirming recipient information in advance can prevent remittance failures.

Are there limits on remittance amounts?

Most platforms have limits on single transactions. Banks typically allow single remittances up to USD 10,000. Digital wallets and some remittance services have lower limits, ranging from USD 2,000 to USD 5,000.

What to do if a remittance fails?

You can first contact the provider’s customer service to verify information and transaction status. Banks and mainstream platforms generally support refunds or reprocessing. Keeping transaction records helps resolve issues quickly.

How to check remittance progress?

You can log into the service platform or bank website and enter the transaction number to check progress. Some platforms offer SMS or email notifications. Banks typically provide online tracking features.

When sending money to the Philippines, you want a solution that’s fast, affordable, and secure. BiyaPay offers a modern financial platform designed to meet your cross-border needs.

Enjoy transparent pricing with fees as low as 0.5% and access real-time exchange rates via our currency converter. Transfers can be sent and received on the same day, making it ideal for both urgent and regular remittances.

Plus, manage your investments seamlessly by trading U.S. and Hong Kong stocks — all from one integrated platform.

Start today on BiyaPay and experience smarter, more efficient global finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.