- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Options for Sending Money to Bangladesh: Understanding Remittance Limits, Fees, and Transfer Methods

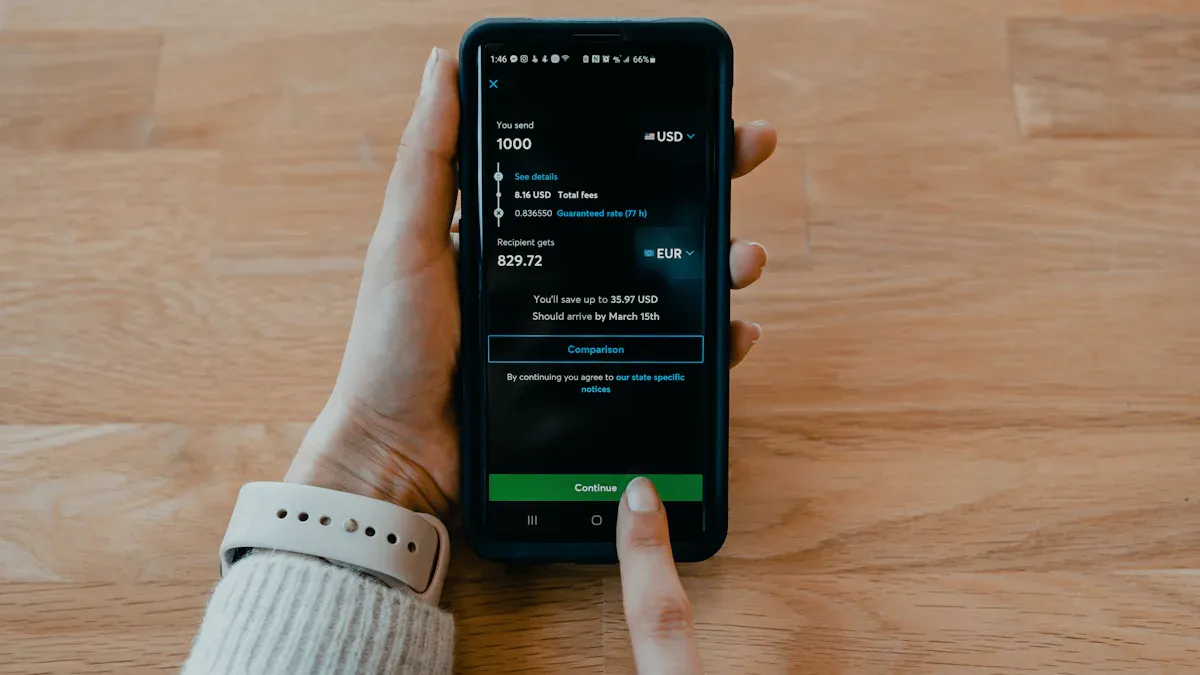

Image Source: unsplash

When sending money to Bangladesh through remittance, you often consider safety, speed, and cost. Different methods have their pros and cons; some are fast but expensive, while others are simple but have limits. You need to focus on fees, transfer time, recipient convenience, and remittance restrictions. The demand for remittances to Bangladesh continues to grow, with the total transaction value expected to rise significantly over the next five years:

| Year | Transaction Value (USD Billion) | Annual Growth Rate (CAGR) |

|---|---|---|

| 2025 | 25.27 | 12.93% |

| 2030 | 46.41 | 12.93% |

Choosing the best option can save you time and money.

Key Takeaways

- When choosing a remittance method, consider fees, transfer speed, and recipient convenience. Different methods suit different needs.

- Wise and bKash are fast and low-cost options, ideal for small transfers. Bank wire transfers are suitable for large amounts with high security.

- Always verify each provider’s remittance limits and legal compliance requirements to ensure smooth fund delivery.

- Watch out for hidden fees and unfavorable exchange rates, and choose transparent platforms to avoid unnecessary expenses.

- Ensure recipient information is accurate to prevent delays or transaction failures.

Overview of Remittance Methods

Image Source: pexels

In Bangladesh, remittance methods are mainly divided into inbound and outbound remittances. You can choose different channels based on your needs. Below are several mainstream methods:

Bank Wire Transfer

Bank wire transfers are suitable for large remittances. You can process them through licensed Hong Kong banks, offering high security and transparent fund flows. Bank wire transfers require detailed information and involve more complex procedures. The transfer time is longer, typically taking 2-5 business days. For scenarios requiring formal documentation and large funds, bank wire transfers are a common choice.

Wise

Wise is a digital remittance platform ideal for users seeking low costs and fast transfers. You can operate it directly from your phone or computer, with simple procedures. Wise typically delivers funds within seconds to hours, with transparent fees. For those needing frequent small remittances, Wise is one of the best options.

MoneyGram and Western Union

MoneyGram and Western Union have extensive global networks, ideal for recipients without bank accounts. You can send money at local agent locations, and recipients can collect cash with an ID. According to TrustPilot ratings, MoneyGram scores 4.1/5, and Western Union scores 3.6/5, indicating high service quality. You can choose these methods based on recipient convenience.

| Service | TrustPilot Rating | Positive Review Rate | Negative Review Rate |

|---|---|---|---|

| Western Union | 3.6/5 | 64% | 10% |

| MoneyGram | 4.1/5 | 56% | 24% |

bKash and Cash Points

bKash is Bangladesh’s most popular digital wallet, especially suitable for rural and low-income households. You can transfer funds directly to the recipient’s mobile account via bKash. With agents widespread in urban and rural areas, bKash greatly enhances accessibility in rural regions. Many rural households own mobile phones, making bKash very convenient. bKash dominates Bangladesh’s digital remittance platforms, with annual inflows reaching $24 billion.

Tip: While informal channels like hundi offer better exchange rates, they carry risks of money laundering and fraud. Formal channels, though more procedural and costly, are safer and more reliable. You should weigh safety and convenience when choosing the best option.

Fees and Transfer Speed

Image Source: unsplash

Fees

When choosing a remittance method, fees are the most direct factor affecting costs. Different channels have varying fee structures. Bank wire transfers typically charge a fixed fee of about 20 USD per transaction, suitable for large remittances. Wise is known for low costs, with fees ranging from 1% to 2% of the transfer amount. MoneyGram and Western Union fees range from 1% to 3%, suitable for small to medium transfers. bKash international remittance fees are higher and vary by agent and provider. Refer to the table below for a quick overview of fee ranges for major services:

| Service Provider | Fee Range |

|---|---|

| Wise | 1% - 2% |

| MoneyGram | 1% - 3% |

| Western Union | 1% - 3% |

| bKash | N/A |

If you want to save on costs, Wise and MoneyGram are usually the best choices. Bank wire transfers, while secure, have higher fees and are better for larger amounts.

Transfer Speed

Transfer speed directly impacts the recipient’s ability to use funds. Bank wire transfers typically take 1 to 2 business days, suitable for non-urgent situations. Wise and mobile wallets like bKash offer extremely fast transfers, completing in seconds to minutes. MoneyGram and Western Union’s cash pickup services are also rapid, allowing recipients to collect funds within minutes. Refer to the table below for transfer times of different methods:

| Transfer Method | Processing Time |

|---|---|

| Bank Transfer | Usually arrives within 1-2 business days |

| Cash Pickup | Usually available within minutes |

| Mobile Wallet | Instant or within minutes |

During the remittance process, you may encounter delays. Common reasons include:

- Economic stagnation

- Governance challenges

- Prevalence of informal remittance channels, exacerbated by corruption and bureaucratic inefficiencies

If you need funds to arrive quickly, consider digital channels like Wise or bKash. When choosing the best option, balance fees and transfer speed to ensure funds arrive safely and on time.

Remittance Limits

Amount Limits

When sending money to Bangladesh, you must consider each provider’s amount restrictions. Different channels have clear rules on maximum and minimum transfer amounts. Refer to the table below for the limits of major providers:

| Service Provider | Maximum Limit | Minimum Limit | Notes |

|---|---|---|---|

| Wise | 995,000 BDT | N/A | Daily limit 250,000 BDT, monthly limit 450,000 BDT (bKash and Nagad) |

| SBI California | $50,000 | N/A | Online transfers limited to $25,000 daily, no limit for in-branch transfers |

If you need to send large amounts, consider bank wire transfers or in-branch processing. For small and frequent remittances, Wise and bKash are more flexible. Always check the latest limit policies to ensure smooth transfers.

Legal and Compliance Requirements

During the remittance process, you must comply with relevant legal and regulatory requirements. Countries have strict oversight of international remittances, especially the US, UK, and Middle Eastern nations. You should note the following:

- International remittances exceeding $10,000 must be reported to the IRS.

- US international remittances are regulated by the Consumer Financial Protection Bureau (CFPB).

- All electronic payments are subject to the Electronic Fund Transfer Act (EFTA).

- The Foreign Account Tax Compliance Act (FATCA) requires US taxpayers to report foreign bank accounts.

- Banks may require proof of funds’ source and recipient identity.

When using licensed Hong Kong banks or digital platforms, providers conduct customer due diligence (CDD/KYC) and monitor transactions to prevent money laundering. Financial institutions must retain transaction records for at least 5 years and report large or suspicious transactions to regulators. To choose the best option, prioritize compliance and safety.

Recipient Requirements

Before sending money, ensure the recipient has the necessary identity and account information. Different channels have varying requirements. Refer to the following checklist:

- Valid identification, such as a passport, driver’s license, or national ID.

- Recipient’s bank account details, including account number, bank name, and branch code.

- Recipient’s full name and address.

- Purpose of the transfer, such as personal use, investment, or business purposes.

- Transaction details, including amount sent, currency, and transfer fees.

If you choose bKash or cash pickup services, recipients only need a phone number and ID to collect funds. When filling out remittance information, ensure accuracy to avoid delays or failures.

Best Options and Practical Tips

Selection Criteria

When choosing a remittance method for Bangladesh, consider fees, transfer speed, and recipient convenience. The best option varies by scenario. Refer to the table below for a quick comparison of remittance methods for small and large transfers:

| Remittance Method | Small Transfer Fees | Large Transfer Fees | Notes |

|---|---|---|---|

| Bank Transfer | Cheapest | Cheapest | Typically the lowest fees |

| Credit Card Transfer | Additional fees | Additional fees | Credit card companies may charge extra |

| Cash Remittance | Moderate fees | Moderate fees | Maximum remittance of $5,000 |

| Mobile Wallet Remittance | Moderate fees | Moderate fees | Maximum remittance of $2,500 |

For large transfers, such as over $5,000, bank transfers are usually the best choice, offering low fees and high security through licensed Hong Kong banks. For small transfers, mobile wallets and cash remittances are more flexible, ideal for urgent or daily expenses.

Transfer speed is another key factor. In emergencies, such as medical expenses or unexpected costs, fast delivery is critical. Mobile wallets and cash remittances can complete in minutes, ideal for urgent needs. Traditional bank transfers, while cheaper, take longer, often several days. If the recipient in Bangladesh lacks a bank account, mobile wallets or cash pickup services are more convenient.

You should also consider compliance and incentive policies. In 2024, the Bangladesh government strengthened oversight of remittance channels, encouraging formal methods. When you use banks or compliant platforms, recipients can receive a 2.5% cash incentive, automatically added to their account. Formal channels are not only safer but also provide more benefits for you and your family.

When choosing the best option, consider:

- Transfer amount

- Speed requirements

- Whether the recipient has a bank account

- Fee and exchange rate transparency

- Availability of incentive policies

- Provider’s customer support and tracking features

Avoiding Common Issues

During the remittance process, you may encounter common problems. Understanding and avoiding these can ensure safer and smoother transfers.

- Hidden Fees and Unfavorable Exchange Rates

Many banks and transfer services charge hidden fees or offer poor exchange rates for international remittances. Always review total costs and choose transparent platforms. - Transfer Delays

Traditional bank international transfers may take days, delaying urgent funds. For time-sensitive needs, opt for mobile wallets or cash remittances. - Limited Customer Support

Issues may arise during transfers. Choose platforms with responsive customer support for quick assistance. - Lack of Tracking Features

Inability to track remittance progress can cause anxiety. Choose services with real-time transaction tracking to monitor fund status. - Incorrect Recipient Information

Ensure the recipient’s name, address, and account details are accurate. Prepare valid ID, address proof, and bank details in advance, and double-check before sending to avoid delays or failures.

Tip: After each transfer, share the tracking number with the recipient promptly to help them check and collect funds.

By addressing these details and choosing the right method based on your needs and scenario, you can achieve safe, efficient, and cost-effective cross-border remittances. Whether you choose bank transfers, mobile wallets, or cash pickups, prioritize fund safety and recipient convenience to find the true best option.

When selecting a remittance method, refer to the table below for a quick overview of each channel’s pros and cons:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Credit Unions and Bank Transfers | Secure and reliable, suitable for large transfers | Higher fees, longer transfer times |

| Traditional Remittance Services | Many locations, ideal for urgent cash pickups | Inconsistent fees, limited pickup times |

| Online Transfer Platforms | Low fees, fast, and convenient | Recipients need a bank account, limited by amount restrictions |

You can weigh the following factors to find the best option:

- Online transfer platforms are ideal for those seeking low costs and fast transfers.

- Bank transfers suit non-urgent, large-amount scenarios.

- Mobile wallet services are best for instant transfers.

You should stay updated on the latest policies and service changes, choosing remittance channels rationally to ensure fund safety.

FAQ

How to Ensure Information Accuracy During Remittance?

You need to prepare the recipient’s name, address, and bank account details in advance. Double-check each item carefully during entry to avoid delays or failures due to errors.

How Long After Sending Can I Check the Transfer Status?

You can check the transfer progress in real-time on the service provider’s or bank’s website. Some channels provide a tracking number, which the recipient can use to check the status.

Are There Limits on Remittance Amounts?

Different channels impose amount limits. Bank wire transfers are suitable for large amounts, while Wise and bKash are better for small and frequent remittances. Check specific limits with the provider.

What to Do If a Remittance Fails?

Contact the provider’s customer service, providing the remittance receipt and recipient details. They will help identify the issue and resolve it, ensuring funds are returned or retransferred safely.

Is Proof of Fund Source Required for Remittances?

For large remittances, banks may require proof of the fund’s source. Prepare relevant documents, such as pay stubs or contracts, to complete the review smoothly.

When sending money to Bangladesh, are you choosing between Wise, bKash, and bank wire transfers? For a smarter, more cost-effective alternative, BiyaPay offers a better cross-border solution.

We enable seamless conversion between fiat and digital currencies like USDT, helping you bypass intermediary banks and reduce transfer costs. Enjoy fees as low as 0.5%—saving up to 90% compared to traditional services. Use our real-time exchange rate tool to lock in favorable rates and maximize your transfer value.

No overseas bank account? No problem. Sign up in under 3 minutes and send funds to most recipient channels in Bangladesh with same-day delivery. Plus, manage both U.S. and Hong Kong stocks from one integrated platform for greater financial control.

Start today on BiyaPay and experience faster, more affordable, and secure international money transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.