- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose Cebuana's Online Remittance Service? Understand Fees, Efficiency, and Transfer Methods

Image Source: pexels

When choosing a Cebuana remittance service, you often focus on the convenience and reliability of the service. Many users value Cebuana’s door-to-door delivery service, bank account credit options, and nationwide branch network. Cebuana has over 2,500 branches, ensuring funds reach their destination securely with transparent and reasonable fees. You can also benefit from excellent customer support and strict information security measures. It is recommended that you consider your remittance amount, frequency, and recipient’s preferred method to determine how to complete cross-border remittances efficiently and securely.

Key Points

- When choosing Cebuana remittance services, pay attention to service fees, exchange rates, and hidden costs to understand the actual cost of each remittance.

- Choose the appropriate delivery time, considering the speed of different transfer methods to ensure funds reach the recipient on time.

- Utilize Cebuana’s online channels, bank transfers, or cash pick-up options, selecting the transfer method flexibly based on the recipient’s needs.

- Before remitting, carefully verify recipient information and exchange rates to avoid common errors and ensure fund security.

- If issues arise, contact Cebuana customer service promptly for support and solutions to ensure a smooth remittance process.

Fees for Choosing Cebuana Remittance Services

Image Source: unsplash

When choosing Cebuana remittance services, fees are one of the primary factors influencing your decision. You need to consider service fees, exchange rates, hidden costs, and other aspects to fully understand the actual cost of each remittance.

Service Fees

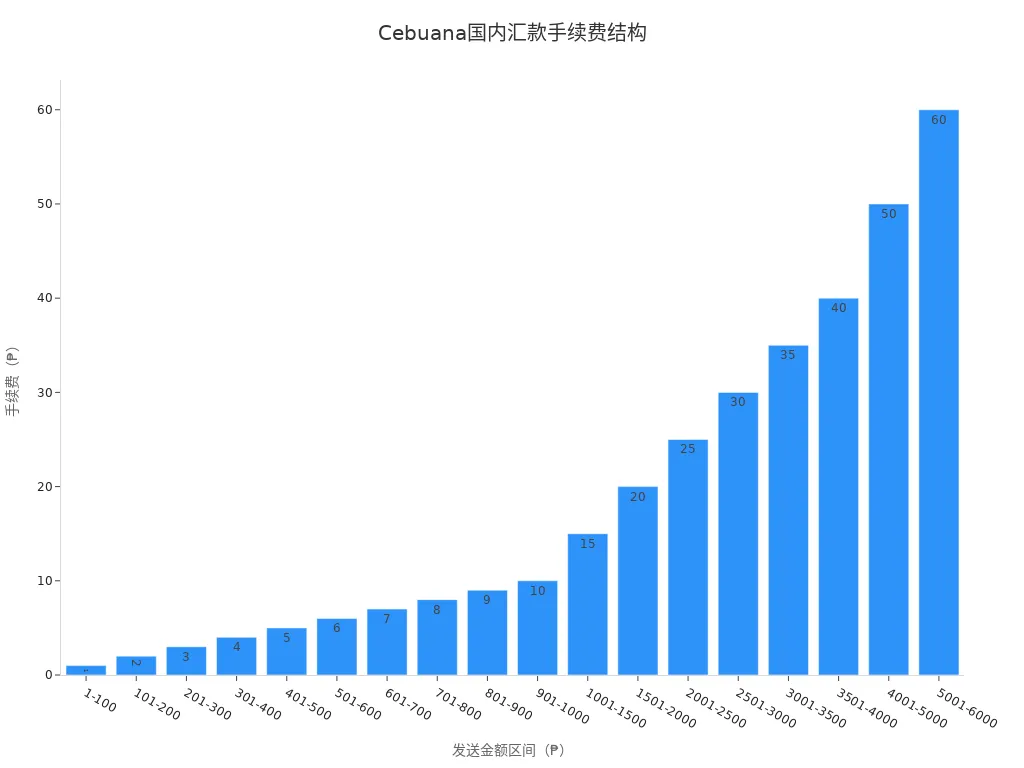

Cebuana’s fee structure is very clear. You can quickly check the corresponding service fee based on the remittance amount range. The table below shows the service fees for different amount ranges (in USD, based on the current exchange rate conversion, subject to the actual exchange rate):

| Remittance Amount Range (USD) | Service Fee (USD) |

|---|---|

| 0.01 - 450 | 9 |

| 451 - 900 | 11 |

| 901 - 1800 | 15 |

| 1801 - 2700 | 18 |

| 2701 and above | 22 |

You can visually understand the trend of service fees for different amounts through the chart below:

Exchange Rates

When choosing Cebuana remittance services, you should also pay attention to exchange rates. Cebuana typically adjusts rates based on market conditions, but the actual amount received may vary due to exchange rate fluctuations. You should check the platform’s real-time exchange rates before each remittance to avoid losses due to rate changes.

Tip: You can use an online exchange rate calculator to estimate the amount received, helping you make more informed decisions.

Hidden Fees

Cebuana is relatively transparent in its fee disclosures. During the process, the platform clearly displays all fees, including remittance service fees and related taxes. The table below summarizes common fee types:

| Fee Type | Range (USD) | Notes |

|---|---|---|

| Remittance Fee | $0.00-$9 | Includes tax, displayed during remittance |

You don’t need to worry about additional hidden fees, but it’s still recommended to carefully review all fee details before confirming payment.

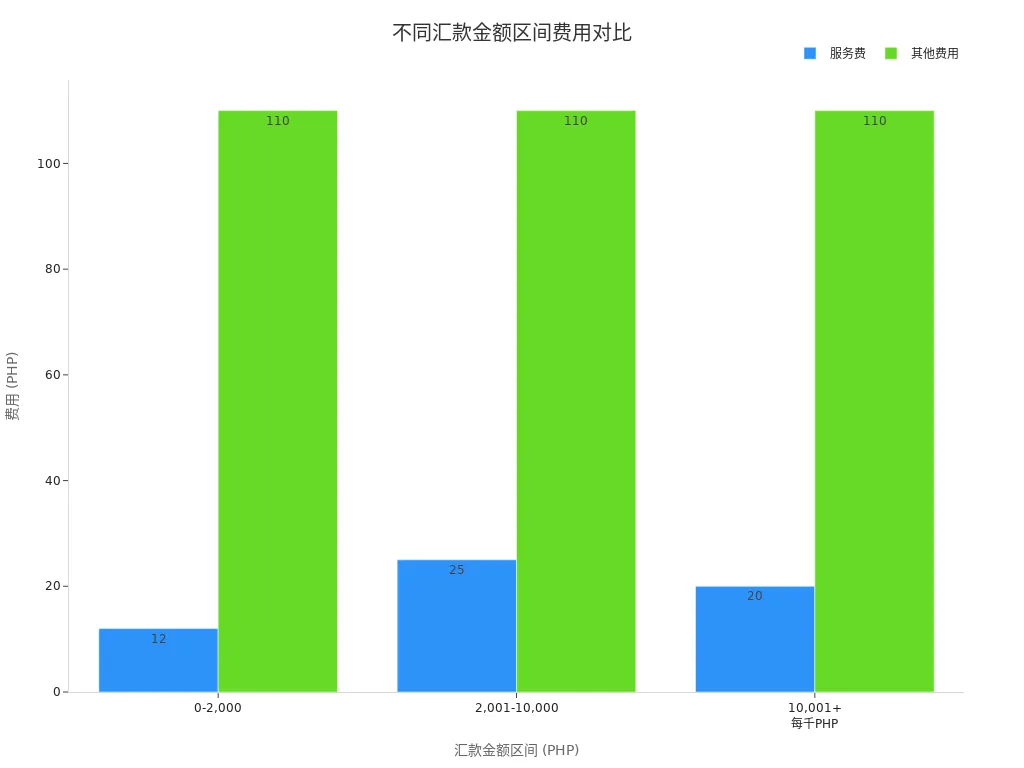

Fee Comparison

When choosing Cebuana remittance services, it’s best to compare them with other mainstream remittance channels. The table below shows the fee comparison for different services for the same remittance amounts (in USD):

| Remittance Amount (USD) | Cebuana Service Fee (USD) | Other Fees (USD) |

|---|---|---|

| 0 - 36 | 0.2 | 2 |

| 37 - 180 | 0.5 | 2 |

| 181 and above | 0.4/18 | 2 |

You can further understand the service fees and other costs for different amount ranges through the chart below:

Additionally, some emerging online remittance services offer lower fees and faster speeds for small, frequent transfers. For example, some platforms charge less than $1 per transaction with instant delivery, while traditional bank transfers have higher fees and longer delivery times. You can choose flexibly based on your needs.

| Service Type | Fees (USD) | Exchange Rate Advantage | Delivery Speed |

|---|---|---|---|

| Emerging Online Services | <1 | Highly competitive | Instant |

| Traditional Banks | High | Average | 2-3 days |

Cost Savings

You can effectively reduce remittance costs through the following methods:

- Avoid using postal services and opt for online channels.

- Monitor real-time exchange rates before each remittance and choose favorable timing.

- Utilize technical tools, such as automatic exchange rate alerts and fee calculators.

- Choose reputable, compliant remittance centers to ensure fund security.

It is recommended that you combine your remittance amount, frequency, and recipient’s preferred method when choosing Cebuana remittance services, compare fees comprehensively, and adjust your remittance strategy to maximize cost savings.

Efficiency of Choosing Cebuana Remittance Services

Delivery Time

When choosing Cebuana remittance services, delivery time is an important measure of efficiency. Different transfer methods and destinations affect how quickly funds reach the recipient. The following summarizes common delivery times:

- Transactions within mainland China or local transactions are typically completed within minutes.

- Remittances to neighboring countries like Indonesia or Malaysia generally arrive within one day.

- Remittances to other countries may take 2-3 business days.

- International transactions vary from a few hours to several days, depending on the destination country and the processing speed of partner banks.

You can choose the most suitable delivery time based on the recipient’s needs. For urgent remittances, prioritize fast channels for local or neighboring countries.

Factors Affecting Speed

Many factors affect the delivery speed of Cebuana remittances. You can improve efficiency through the following aspects:

- Pre-transaction planning. Prepare all necessary information in advance to reduce operational errors.

- Pay attention to transaction fees. Some expedited services may incur additional fees, but they significantly increase delivery speed.

- Quality customer service experience. Contacting customer service promptly can speed up issue resolution.

- Reputation of the remittance center. Choosing a reputable and compliant service provider can effectively reduce delay risks.

During actual operations, it’s recommended to understand the processes and requirements in advance to avoid delays due to incomplete or incorrect information.

Fast Service Options

Cebuana offers various fast remittance services to meet urgent needs in different scenarios. You can choose real-time transaction services like Pera Padala for a fast delivery experience. This service covers the Philippines and international markets, with over 2,000 branches and partners. You only need to fill out a form and provide valid identification to complete the remittance. The process is simple and efficient, ideal for users needing quick fund turnover.

Fees for some expedited services vary by service type. You can check the platform’s published rate information before remitting to select the most cost-effective service. Although some services don’t explicitly indicate additional fees, you can obtain detailed information through official channels.

Tip: If you need to remit during holidays or weekends, consult customer service in advance to confirm the availability and fee standards for expedited services.

Handling Delays

You may encounter processing delays during the remittance process. Common reasons for delays are shown in the table below:

| Delay Reason | Explanation |

|---|---|

| Compliance Checks | Strict compliance checks may cause delays, requiring verification processes to detect potential suspicious transactions. |

| Incorrect or Insufficient Payment Details | Input errors may lead to mismatched information, causing delays or even transfer rejections. |

| Destination Country | Remittances to politically or economically unstable regions may face delays due to enhanced scrutiny. |

| Currency Conversion | Less commonly used currencies require cross-conversion, increasing complexity and delays. |

| Bank Relationships | Intermediary banks connecting the sender and recipient may cause delays. |

| Bank Holidays and Weekends | Bank holidays and weekends affect the timeliness of international transfers. |

| Different Time Zones | Differences in working hours among the sender, recipient, and intermediary banks affect delivery speed. |

You can reduce delay risks by verifying recipient information in advance, choosing commonly used currencies, and avoiding bank holidays. In some cases, network issues or bank operating hours may also affect delivery speed. Generally, remittances can be completed within a few hours or 24 hours, but fund availability and partner processing workflows may also have an impact.

It is recommended that you combine delivery time, service type, and personal needs when choosing Cebuana remittance services, selecting the optimal solution to ensure funds reach the recipient efficiently and securely.

Transfer Methods

Image Source: pexels

Online Channels

You can easily complete remittances through Cebuana’s online channels. The eCebuana app offers remittance, micro-savings, bill payments, and e-recharge services. Simply download the app on your phone, register an account, and perform transfers anytime, anywhere. Online channels are ideal for users who want to save time and operate remotely.

- eCebuana app: Supports remittances, micro-savings, bill payments, and e-recharges.

Bank Transfers

Bank transfers are a preferred method for many users when choosing Cebuana remittance services. You can transfer funds directly to the recipient’s bank account, especially suitable for large transactions. In Hong Kong’s licensed bank scenarios, bank transfers are generally safer with clear fund trails. Note that delivery times may be longer, and fees may be higher.

| Type | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | Generally safer, suitable for large transactions. | May be slower, fees may be higher. |

Cash Pick-Up

Cash pick-up is ideal for recipients without bank accounts. You can choose to have the recipient collect cash directly at a Cebuana branch. Cebuana Lhuillier has 1,800 branches across the Philippines, with extensive coverage. Cash pick-up is fast, allowing recipients to access funds immediately, but transfer fees are typically higher, and exchange rates may be less favorable.

| Type | Advantages | Disadvantages |

|---|---|---|

| Cash Pick-Up | Convenient and fast, suitable for those without bank accounts. | Transfer fees are typically higher, exchange rates may be less favorable. |

| Institution Name | Number of Branches | Coverage |

|---|---|---|

| Cebuana Lhuillier | 1,800 | Nationwide in the Philippines |

E-Wallets

You can also choose e-wallets for remittances. Cebuana’s e-wallet uses advanced encryption to protect your information, implements multi-factor authentication, continuously monitors transactions, and has account protection policies. The customer service team is available to address security-related questions. E-wallets are suitable for users prioritizing information security and convenience.

- Uses advanced encryption to protect user information.

- Implements multi-factor authentication to enhance account security.

- Continuously monitors transactions to identify suspicious activities.

- Has account protection policies.

- Customer service team is available to address security concerns.

Choosing a Method

When choosing Cebuana remittance services, you can flexibly select the transfer method based on the recipient’s needs and your operational preferences. Data shows that pawnshop cash pick-up is the most popular method, accounting for about 29%. Bank transfers are suitable for large amounts and security needs, while e-wallets are ideal for users seeking convenience and information security. You can combine fees, efficiency, and recipient preferences to choose the best transfer channel.

| Transfer Method | Popularity |

|---|---|

| Pawnshop | 29% |

| Bank | N/A |

| Others | N/A |

You can flexibly choose the most suitable remittance method based on whether the recipient has a bank account, their requirements for delivery speed, and security needs.

Operational Process

Registration Process

You can follow these steps to register for a Cebuana online remittance account:

- Visit 24konline.com.ph.

- Click the “Register” button.

- Fill out the registration form, ensuring the information matches the Customer Information Sheet (CIS).

- Read and agree to the terms and conditions, checking the consent box.

- Click “Register” to submit the application.

- The system will send an email containing an activation link, which you need to use to complete the registration.

It is recommended that you carefully verify information during registration to avoid failure due to mismatched details.

Remittance Steps

After registering, you can follow these steps to remit:

- Log in to your account.

- Select the “Remittance” service.

- Enter recipient information, including name, contact details, and preferred receiving method.

- Enter the remittance amount (in USD), confirm the exchange rate and fees.

- Verify all information is correct and submit the remittance request.

- The system will generate a transaction number, which you can save for future reference.

Progress Tracking

You can track remittance progress through the following methods:

- Log in to your account, go to the “Transaction History” page, and check the latest remittance status.

- Use the transaction number to check progress on the platform.

- If there’s a delay, contact online customer service for detailed processing information.

You should regularly monitor transaction status to ensure funds reach the recipient securely.

Common Pitfalls

Many users encounter these errors during the process:

- Providing incorrect recipient information, leading to failed deliveries.

- Not verifying the current exchange rate, affecting the amount received.

- Transacting with unauthorized agents or unverified remittance centers, increasing risks.

- Leaking transaction details to others, posing information security risks.

- Sending incorrect control numbers, affecting receipt.

You can avoid these issues by double-checking information, operating only through official channels, and protecting personal data. If in doubt, consult customer service promptly to ensure a smooth remittance process.

Precautions

Risk Prevention

When using Cebuana online remittance, you must pay attention to various security risks. Online transactions are prone to fraud. Common risks include:

- Someone posing as a buyer but actually a scammer trying to steal your funds.

- Scammers pretending to be immigration officials, demanding fake immigration fees and personal information.

- Someone posing as a relative, claiming an emergency to trick you into remitting money.

You can reduce fraud risks by confirming payment before shipping, verifying the other party’s identity, and refusing to disclose personal information.

Information Security

During the remittance process, protect your personal and account information. Cebuana uses multi-factor authentication and encryption to ensure data security. Avoid remitting on public networks to prevent information theft. It’s recommended to regularly change passwords and enable account protection features. If you encounter suspicious transactions, contact official customer service promptly to prevent fund losses.

Reminder: Only operate on official platforms and don’t trust links or requests from strangers.

Tips

You can follow these suggestions to enhance your remittance experience:

- Verify recipient information before each remittance to ensure accuracy.

- Monitor real-time exchange rates and fees to choose cost-effective timing.

- Save transaction numbers for easy tracking and inquiries.

- Operate only through official channels to avoid third-party platform risks.

These methods can help reduce errors and improve fund security.

Customer Support

If you encounter issues, you can contact Cebuana customer service through various methods. The table below lists main contact methods and service hours:

| Contact Method Type | Details |

|---|---|

| Phone Number | +63 956 234 6928, +632 759 9800 |

| help@quikz.com | |

| Service Hours | Monday to Friday 9am - 6pm CST, Saturday and Sunday 9am - 5pm CST |

You can choose phone or email support based on your situation. The customer service team will assist with remittance-related issues to ensure your funds are secure.

When choosing Cebuana online remittance services, focus on fees, delivery efficiency, and transfer methods. Combine your needs to reasonably compare different service options. Pay attention to remittance details and use official tools and customer support to ensure fund security. Feel free to share your remittance experiences or ask questions in the comments section to benefit more people.

FAQ

How can I check my remittance progress?

You can log in to your Cebuana online account, go to the “Transaction History” page, and view the latest status of each remittance. You can also use the transaction number to check progress on the platform.

Will funds be refunded if the remittance fails?

If the remittance fails, the system will automatically refund the funds to your account. You can check the refund status in your account balance. If you have questions, contact official customer service.

Which currencies can I use to remit to mainland China?

You can remit in USD. Cebuana will convert USD to RMB based on real-time exchange rates, ensuring the recipient receives the funds smoothly.

Is it safe to remit to a licensed bank account in Hong Kong?

Remitting to a licensed bank account in Hong Kong is secure with clear fund trails. Cebuana uses multiple encryption and identity verification measures to ensure your funds’ safety.

Are there limits on remittance amounts?

Cebuana imposes limits on single and daily remittance amounts. You can check the latest limit information on the platform before remitting to plan accordingly.

When using remittance services like Cebuana, factors such as transfer speed, fee transparency, and ease of use matter. For a faster, more cost-effective alternative, discover BiyaPay — a comprehensive platform combining global money transfers, currency exchange, and investment capabilities.

Access real-time exchange rates with our currency converter to lock in favorable rates and reduce costs. Enjoy transfer fees as low as 0.5% and same-day sending and receiving. Signing up takes just minutes, with no need for a foreign bank account.

Plus, trade global stocks directly on the same platform — ideal for growing your wealth across markets.

Start your journey with BiyaPay today and experience smarter, more secure cross-border finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.