- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use Cebuana's Online Remittance? Understand the Process, Fees, and Limits

Image Source: unsplash

You can experience efficiency and security through Cebuana online remittance. All transactions use advanced encryption technology, and accounts are protected by passwords and two-factor authentication. You can complete a transfer in just a few minutes, with the system supporting direct remittances to bank accounts or specific recipients. The table below outlines the main security measures and convenience features:

| Security Measures | Convenience Features |

|---|---|

| Advanced encryption technology | Fast transfers |

| 24/7 customer service support | Direct transfers to bank accounts or recipients |

| Password-protected accounts | Complete transfers in just a few minutes |

| Two-factor authentication | Easy to use |

| Strict compliance with anti-money laundering laws |

Key Points

-

Registering a Cebuana online remittance account is quick and simple, requiring only personal information and email confirmation.

-

Ensure you upload valid identification documents; the system will approve them before you can use the remittance service.

-

When entering recipient information, carefully check the name and contact details to avoid delays due to errors.

-

Choose an appropriate payout method, such as cash pickup or bank transfer, to ensure the recipient can conveniently access the funds.

-

Understand remittance fees and exchange rates to plan ahead and avoid unnecessary expenses.

Cebuana Online Remittance Process

Image Source: unsplash

Registration

You can easily complete registration through the Cebuana online remittance platform. First, visit the Cebuana official website and click the “Register” button. The system will prompt you to fill out a registration form, including your full name, email address, and phone number. You need to create a username and password, which will be used for future logins. After registration, the system will send a confirmation email to your inbox. Simply click the link in the email to activate your account. The entire process is straightforward and can be completed in a few minutes.

- Visit the Cebuana website and click the “Register” button.

- Fill out the registration form with personal information.

- Create a username and password.

- Confirm registration via email.

Verification

After registration, you need to complete identity verification. Cebuana online remittance requires you to upload valid identification documents. You can choose any of the following official documents:

| Required Identification Documents |

|---|

| Passport |

| Driver’s License |

| Professional Regulation Commission (PRC) ID |

| National Bureau of Investigation (NBI) Clearance |

| Police Clearance |

| Postal ID |

| Voter’s ID |

| Philippine Identification (PhilID) |

| Social Security System (SSS) Card / Unified Multi-Purpose ID (UMID) |

| Barangay Certification |

| Government Service Insurance System (GSIS) e-Card |

| Senior Citizen ID |

| Overseas Workers Welfare Administration (OWWA) ID |

| OFW ID |

| Seaman’s Book |

| Alien Certificate of Registration / Immigrant Certificate of Registration |

| Government Office and GOCC ID, e.g., Armed Forces of the Philippines (AFP) ID |

| Home Development Mutual Fund (HDMF) ID |

| National Council on Disability Affairs (NCWDP) Certification |

| Department of Social Welfare and Development (DSWD) Certification |

| Integrated Bar of the Philippines (IBP) ID |

| Company IDs issued by private entities or institutions (registered or regulated) |

| ID issued by the National Council on Disability Affairs (NCDA) |

Ensure the uploaded documents are clear, authentic, and valid. The system will automatically review your identity information, and once approved, you can start using the Cebuana online remittance service.

Recipient Information

When entering recipient information, you must ensure all details are accurate. The Cebuana online remittance platform will prompt you to input the recipient’s full name and contact details. Carefully check each piece of information to avoid delays or issues with fund collection. The platform recommends reviewing all details again after completion to ensure accuracy.

- Carefully check the recipient’s name and contact details to reduce the risk of errors.

- Review all information to ensure smooth transactions.

- Accurate information helps the recipient collect funds promptly.

Payout Method

You can choose a suitable payout method based on the recipient’s needs. Cebuana online remittance supports cash pickup and bank transfer options. Cash pickup is ideal for recipients who can visit designated locations to collect funds, while bank transfer is suitable for direct deposits into the recipient’s bank account. You need to clearly select the payout method when filling out the information and ensure the recipient can access the funds smoothly.

Tip: When choosing a payout method, it’s recommended to communicate with the recipient in advance to confirm the most convenient option.

Reference Number

After completing the remittance, the system will generate a unique reference number, also known as a remittance control number. You can retrieve this number through the Cebuana Lhuillier mobile app or via SMS. The reference number is used to identify and track your remittance transaction. The recipient must provide this number and valid identification to collect the funds. You should securely store the reference number to avoid losing it.

- The reference number is automatically generated by the system for easy transaction tracking.

- The recipient must provide the reference number and identification to collect funds.

- It’s recommended to record the reference number in a secure location to prevent forgetting it.

The Cebuana online remittance process is simple and efficient; just follow the steps above to complete your remittance smoothly. Prepare your personal information and identification documents, ensure recipient details are accurate, choose an appropriate payout method, and securely store the reference number to make the remittance process safer and more convenient.

Fee Details

Image Source: unsplash

When using Cebuana online remittance, you need to understand the fee structure. Different remittance amounts, destinations, and payout methods affect the final fees. The following content helps you clearly understand how each fee is calculated and key considerations.

Service Fees

You will pay a service fee when making a remittance. Cebuana online remittance charges varying fees based on the transaction amount. The table below outlines the main service fee standards (in USD):

| Transaction Amount Range | Service Fee (USD) |

|---|---|

| Up to 2,000 PHP | 0.24 USD |

| 2,001 - 10,000 PHP | 0.50 USD |

| Over 10,000 PHP | 0.40 USD/1,000 PHP |

| Fixed Fee | 2.20 USD |

You can quickly calculate the required service fee based on your remittance amount. The service fee will be automatically displayed when you submit your remittance request. You don’t need to calculate it manually; the system will provide a complete fee breakdown.

Tip: Before remitting, compare service fees for different amounts to choose the most cost-effective method and avoid unnecessary expenses.

Exchange Rates

When making cross-border remittances, the exchange rate directly affects the amount the recipient receives. Cebuana online remittance uses real-time exchange rates, and the system will display the current rate when you submit your remittance. You can check exchange rate changes at any time to plan your remittance timing effectively.

- Exchange rates fluctuate daily based on international market conditions.

- You can check the current exchange rate before remitting to ensure the recipient gets the maximum benefit.

- Exchange rate information is clearly displayed on the remittance page for easy decision-making.

If you choose bank transfer, licensed banks in Hong Kong typically use international standard exchange rates. You can use the service confidently without worrying about non-transparent rates.

Other Fees

In addition to service fees and exchange rates, other fees may apply in some cases. When remitting, consider the following:

- Avoiding hidden fees is one of the main ways to save on remittance costs.

- Many fees may only be mentioned in the fine print, leading to unexpected expenses.

- It’s recommended to compare different remittance centers to ensure reasonable fees.

When using Cebuana online remittance, the system will inform you of all possible fees in advance. Carefully review the fee details to avoid additional costs due to overlooked information.

Note: Before remitting, thoroughly understand all fee terms to ensure every charge is clear.

Limits and Regulations

Amount Limits

When using Cebuana online remittance, you need to be aware of the amount limits per transaction. Different remittance methods have different maximum amounts. The table below shows the amount limits for the main transaction types:

| Transaction Type | Maximum Amount (PHP) | Maximum Amount (USD, Approx.) |

|---|---|---|

| 24k Card or 24k Plus Card | 100,000 | Approx. 1,800 |

| Cash Pickup Transfer | 50,000 | Approx. 900 |

Exchange rates fluctuate with the market; the specific USD amount depends on the real-time rate. The system will automatically convert and display the final amount when you submit your remittance.

Frequency

You can use Cebuana online remittance multiple times daily, but the system imposes clear limits on daily transaction frequency and total amounts. Refer to the table below:

| Frequency | Transaction Limits |

|---|---|

| Daily Transaction Frequency | Up to 5 times |

| Per Transaction Limit | Up to PHP 5,000 (Approx. 90 USD) |

| Daily Total Limit | Up to PHP 25,000 (Approx. 450 USD) |

You need to plan your remittances carefully to avoid transaction failures due to exceeding frequency or amount limits. The system will automatically check for limit violations when you submit a remittance.

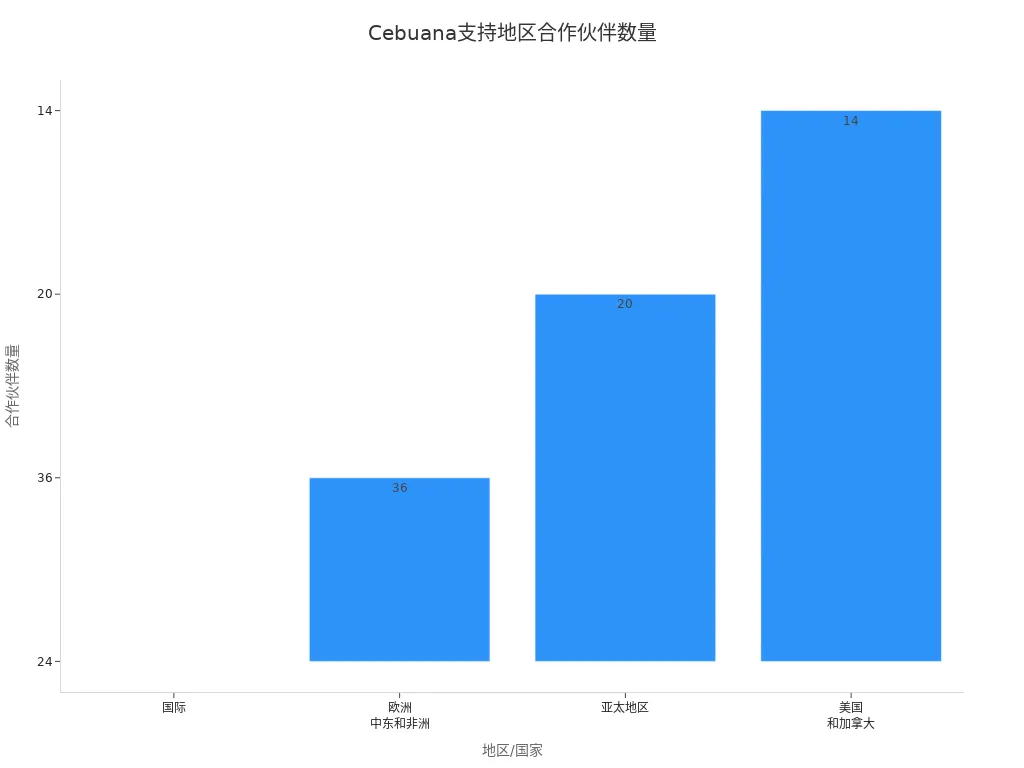

Regions

Cebuana online remittance services cover multiple regions globally. You can send money to the United States, Canada, Asia-Pacific, Europe, the Middle East, and Africa. The table below lists some key partners:

| Region/Country | Partners (Partial List) |

|---|---|

| International | Multiple international banks and financial institutions |

| Europe, Middle East, and Africa | Multiple local and international remittance companies |

| Asia-Pacific | Multiple regional financial service institutions |

| United States and Canada | Multiple remittance and financial service companies |

When choosing a remittance destination, you can check supported countries and partner institutions through the platform to ensure funds arrive smoothly.

Compliance Requirement: According to the Bangko Sentral ng Pilipinas, you must present at least one valid photo ID original and a clear copy for your first financial transaction. Prepare the required documents in advance to ensure a smooth remittance process.

Security and Support

Security Measures

When using Cebuana online remittance, you can benefit from multiple layers of security. Cebuana employs organizational, contractual, physical, procedural, and technical measures to protect your data and transaction security. The table below outlines the main security measure types and their descriptions:

| Security Measure Type | Description |

|---|---|

| Organizational Measures | Ensuring data security through organizational structure |

| Contractual Measures | Protecting user data through contractual agreements |

| Physical Measures | Protecting data storage with physical safeguards |

| Procedural Measures | Ensuring data security through procedural workflows |

| Technical Measures | Protecting user information with technical solutions |

Cebuana also collaborates with professional technology companies, using AI for identity verification and fraud risk assessment. You can further enhance account security by regularly changing your PIN. The digital process significantly reduces verification and processing times, minimizing risks.

Customer Support

If you encounter issues, you can seek help through multiple channels. Cebuana offers hotline, SMS, email, and social media support. The table below lists the main customer support channels and contact details:

| Channel | Contact Details |

|---|---|

| Hotline | 779.9800 (PLDT); 759.9800 (Globe) |

| SMS | GLOBE – 09178122737; SMART – 09188122737 |

| [email protected] | |

| Facebook Messenger | Cebuana Lhuillier Facebook |

| Phone | 8779.9800 (PLDT) or 7759.9800 (Globe) |

| U.S. Support | Email: help@quikz.com; Phone: +1-844-611-2040 |

You can choose the most convenient contact method based on your needs to receive prompt professional assistance.

Common Issues

You may encounter some common issues during the remittance process. Cebuana provides practical solutions:

| Issue | Solution |

|---|---|

| High Transaction Fees | Evaluate different services, choose better rates or discounted options |

| Exchange Rate Fluctuations | Monitor rate changes, remit during stable periods |

| Delayed Transfers | Choose efficient services, set realistic expectations based on process |

| Security Concerns | Enable two-factor authentication, protect personal data |

| Accessibility Challenges | Use mobile apps or local agents for convenient access in remote areas |

Before each transaction, consider foreign exchange rates, choose reputable remittance centers, and use technology to avoid queuing or mailing funds. This enhances remittance efficiency and ensures fund security.

When using Cebuana online remittance, simply provide valid ID and fill out the remittance form for a streamlined process with fast processing. You can check account balances and transaction history anytime via the eCebuana app to ensure fund security. It’s recommended to plan transactions in advance, monitor fees and exchange rates, and choose a suitable payout method. Securely store the reference number and contact customer service promptly if issues arise. With over 1,800 branches and certified partners nationwide, Cebuana makes remittance more convenient to meet various needs.

FAQ

How to Check Remittance Progress?

You can log in to the Cebuana online platform and visit the “Transaction History” page. The system will display the status of each remittance. If you need assistance, contact customer support.

What If Recipient Information Is Entered Incorrectly?

You should immediately contact Cebuana customer service. The support team will guide you to modify the information or cancel the transaction. Act quickly to avoid fund delays.

Will Funds Be Refunded If the Remittance Fails?

The system will automatically refund unsuccessful remittances. You can check the refund in your account balance. Refunds typically arrive within 1-3 business days.

Which Bank Accounts Can Be Used for Payout?

You can choose licensed bank accounts in Hong Kong for payout. The system supports multiple banks. Ensure the recipient’s account information is accurate.

What Documents Are Required for Remittance?

You need to upload valid identification documents, such as a passport or driver’s license. For the first remittance, the system requires clear photos of the documents.

While Cebuana offers reliable remittance services, its daily limits and traditional infrastructure can slow down your international transfers. For a faster, more flexible solution, consider BiyaPay.

We enable seamless fiat-to-crypto conversion (e.g., USDT), bypassing legacy networks for quicker settlements. Enjoy transfer fees as low as 0.5%—often lower than traditional providers. Use our real-time exchange rate tool to lock in favorable rates and maximize value.

No local bank account in the Philippines? No problem. Sign up in under 3 minutes and send money to the Philippines and beyond with same-day delivery. Plus, invest in U.S. and Hong Kong stocks from one unified platform.

Start today on BiyaPay and experience a smarter, more efficient way to send money and grow your wealth globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.