- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why Choose Online Money Transfer Services to Send Money to Ghana? Understand the Process, Fees, and Best Options

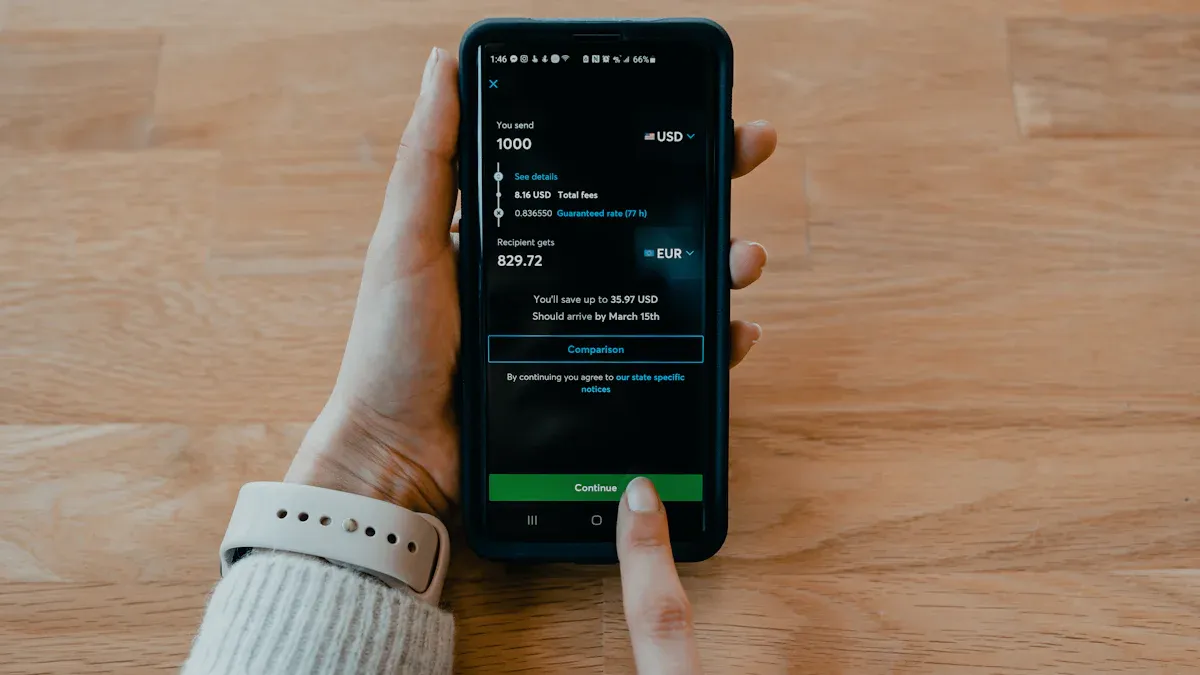

Image Source: unsplash

You can easily experience the efficiency and security of online remittance services. The registration process is simple and can be completed in just a few minutes. You only need to enter basic information on the platform to start remitting money. Many users find that digital remittances are not only convenient but also fast, often arriving on the same day. Compared to traditional banks, the fees are lower, and the exchange rates are better. Digital remittances can also help you and your family in Ghana save and manage funds more effectively, enhancing financial inclusion and access to more digital financial services.

Key Takeaways

- Online remittance services have a simple registration process that can be completed in minutes, allowing users to send money anytime, anywhere.

- Using online remittance services can significantly reduce costs, with fees typically 41% lower than traditional banks, along with better exchange rates.

- Funds usually arrive within a day, and many platforms support same-day delivery, improving cash flow efficiency.

- Choose platforms with transparent fees to avoid hidden costs, ensuring the actual cost of each remittance is clear.

- Prepare recipient information in advance to ensure accuracy and avoid remittance failures or delays.

Advantages of Online Remittance Services

Convenience and Simple Registration

You can quickly experience the convenience of online remittance services. Most platforms require only a few steps to complete registration. You just need to prepare basic identity information, follow the prompts to fill in the details, and create an account within minutes.

Many users find the entire process very intuitive, requiring no complicated operations. You can initiate remittances anytime, anywhere from your phone or computer without visiting a physical branch.

- Most online remittance platforms to Ghana complete transfers typically within a day or less.

- You can easily add recipient information, select the remittance amount, and complete the operation quickly.

Low Fees and Favorable Exchange Rates

By choosing online remittance services, you can significantly reduce transfer costs. Traditional bank transfers to Ghana may have fees as high as $50 and take longer to arrive. Online remittance services have fees that are, on average, 41% lower, with faster delivery.

| Method | Fee Range | Speed |

|---|---|---|

| Traditional Bank Transfer | Up to $50 | Several Days |

| Online Remittance Service | 41% Lower on Average | Faster |

You can also enjoy more transparent exchange rates. Many online remittance services use mid-market exchange rates without hidden markups, offering transparent fees.

| Service Type | Exchange Rate Type | Notes |

|---|---|---|

| Online Remittance Service | Mid-Market Exchange Rate | No hidden fees, transparent pricing |

| Banks and Other Institutions | Hidden Markups | Exchange rates often below mid-market, possible additional fees |

You can check exchange rates in real-time on the platform, clearly understanding each fee and the actual amount received.

Fast Delivery and Security

When you use online remittance services, funds typically arrive within a day. Many platforms, such as Paysend, support same-day delivery, significantly improving cash flow efficiency.

You can track the progress of your remittance at any time, with platforms providing real-time status updates, allowing you to wait with peace of mind.

In terms of security, mainstream platforms employ multiple security measures to protect your funds and information.

- Dedicated teams monitor fund security around the clock, promptly stopping suspicious activities.

- Transparent fund tracking features allow users to check the status of funds at any time.

- The latest digital security methods are used to ensure 100% fund safety.

- Dual verification mechanisms reduce the likelihood of errors.

- Encrypted payment methods and biometric verification ensure transaction security.

- All data is transmitted encrypted to protect sensitive information.

- Identity verification is conducted to prevent fraud, ensuring the identities of senders and recipients.

- Fraud detection systems monitor suspicious transactions.

You can confidently use online remittance services for personal remittances or family support, enjoying an efficient and secure experience.

Online Remittance Service Process

Image Source: unsplash

You can easily complete the entire process of sending money to Ghana through online remittance services. Each step is clear and straightforward, suitable for users of all ages. Below is a detailed breakdown of the standard process:

Create an Account

You need to register an account on the platform first. During registration, the platform will require you to upload valid identification, such as a Ghana Card, non-citizen card, passport, or driver’s license. You also need to provide proof of address, such as a recent utility bill or lease agreement. For business customers, you’ll need to submit business registration documents and a tax identification number. Some platforms may require additional information about the source of funds or beneficiary details.

The registration process is very intuitive, with platforms guiding you step-by-step to complete all information and document uploads.

Add a Recipient

You can add recipient information in the account dashboard. The recipient can be a bank account holder in Ghana or a mobile wallet user. You need to enter the recipient’s name, bank account number, or mobile wallet number. Some platforms support cash pickup services, suitable for recipients without bank accounts.

- When adding a recipient, it’s recommended to double-check the information to ensure smooth delivery.

Choose Amount and Currency

You can freely choose the remittance amount and currency. Most platforms support major currencies like USD and GBP, with recipients able to receive funds in Ghanaian Cedi (GHS) or other currencies.

| Sending Currency | Receiving Currency | Fee and Exchange Rate Impact |

|---|---|---|

| USD | GHS | Low fees, favorable exchange rates, with specific fees and rates varying by platform and amount. |

You can view exchange rates and fees in real-time on the platform, clearly understanding the actual cost of each remittance.

Payment and Submission

You can choose from various payment methods to complete the remittance, including bank accounts, debit cards, credit cards, or mobile wallets.

| Platform | Payment Methods | Processing Time |

|---|---|---|

| Paysend | Bank Account, MoMo, Vodafone | Within Minutes |

| MoneyGram | Debit Card, Credit Card, Cash | Fast, Secure |

You simply need to confirm the information is correct, submit the remittance request, and the platform will process your transfer immediately.

Track Progress

You can track the remittance progress at any time on the platform’s website or app track remittance progress. Many platforms offer email and SMS notifications to keep you updated on the remittance status in real-time.

- You’ll receive a transfer reference number for easy tracking and verification.

- Status updates are typically provided every few minutes, allowing you to wait with confidence.

The entire process is transparent and simple, requiring only account registration to start remitting. Whether for personal or business use, you can enjoy an efficient and secure fund transfer experience.

Fees and Exchange Rates

Image Source: unsplash

Fee Comparison

When choosing a remittance service, fees are often your primary concern. Fee structures vary significantly across platforms. Some platforms, like TapTap Send, charge no transfer fees but may adjust exchange rates slightly. Platforms like Wise are known for transparent, low fees, typically lower than traditional banks. The table below provides a quick overview of the fee structures and use cases for major platforms:

| Service Name | Transfer Time | Fee Structure | Best Use Case |

|---|---|---|---|

| TapTap Send | Near Instant | No transfer fees, slightly higher exchange rate | Fast mobile fund transfers |

| MoMo | Instant | Cheap for local transfers, higher fees for international | Recipients in Ghana |

| Pesa | Usually Same Day | Low transfer fees and competitive exchange rates | Cost-effective and fast remittances |

| Misan by Bamboo | Fast | Competitive, transparent fee structure | Young users combining remittances and investments |

| Wise | 1-2 Business Days | Transparent fees, typically lower than banks | Users prioritizing transparency |

You can see that some platforms are ideal for speed, while others focus on fee transparency and affordability. Platforms like Paysend often use fixed fees with fast delivery, suitable for users needing stable costs and high efficiency.

Exchange Rate Transparency

When remitting, you should pay attention to exchange rates in addition to fees. Some platforms, like Afriex, offer real exchange rates without hidden markups. You can understand different platforms’ exchange rate policies through the following points:

- Afriex provides real exchange rates with no hidden markups.

- Sendwave’s exchange rates are less competitive and may include additional fees.

- Many providers add markups to currency exchange rates, reducing the final amount received by the recipient.

When choosing a platform, prioritize those that offer transparent mid-market exchange rates with no hidden fees. This ensures you know exactly how much Ghanaian Cedi each dollar converts to, avoiding losses due to unclear exchange rates.

Delivery Time

Delivery speed directly affects your and the recipient’s experience. The table below shows the delivery times for different platforms:

| Remittance Service | Fund Delivery Time |

|---|---|

| GCB Xpress | Within Seconds |

| Western Union | Within Minutes |

When you choose online remittance services, transfers are typically completed within minutes to a day. Platforms like Paysend support same-day delivery, significantly improving cash flow efficiency. You can track progress in real-time to ensure funds arrive safely in the recipient’s account.

When comparing platforms, consider fees, exchange rates, and delivery times to choose the service that best suits your needs. This way, you can save costs while ensuring your family or partners receive funds promptly.

Service Provider Comparison

Pros and Cons of Major Platforms

When choosing an online remittance service, you’ll find that each platform has its own strengths and weaknesses. Understanding these can help you make a more informed choice.

- Increased convenience and accessibility: You can complete transfers anytime, anywhere via phone or computer without visiting a physical branch.

- Real-time and fast transactions: Most platforms support near-instant delivery, reducing wait times.

- Higher competition and lower fees: Market competition allows you to enjoy lower fees, saving on remittance costs.

- Enhanced data protection and security: Platforms use strict security measures to protect your funds and personal information.

- Integration with third-party services: You can access multiple financial services, such as bill payments or balance inquiries, on the same platform.

However, some platforms have limitations:

- Limited access for vulnerable groups: If you or your family lack stable internet or smart devices, using these services may be challenging.

- Privacy concerns: You need to upload personal information, which may worry some users about data breaches.

- Compliance and regulatory challenges: Smaller platforms may struggle to meet strict compliance requirements, affecting service stability.

When choosing, prioritize platforms with high security and transparent fees to ensure fund safety and delivery efficiency.

Use Cases

Different remittance needs suit different platforms. You can refer to the table below to choose the most suitable service based on your situation:

| User Scenario | Suitable Platform |

|---|---|

| Frequent Small Transfers | PayAngel |

| One-Time Large Transfers | NALA |

For example, if you frequently send small amounts to Ghana, PayAngel’s fast delivery and low fees are ideal. For one-time large transfers, NALA’s favorable exchange rates and no hidden fees can save you more costs.

You can combine your remittance frequency, amount, and delivery speed needs to flexibly choose platforms. This ensures you save on fees while allowing your family or partners to receive funds promptly, improving the overall experience.

Best Choice Recommendations

Large vs. Small Remittances

When choosing a remittance service, you need to consider the transfer amount. Small transfers are suitable for weekly family support or emergency funds, easier to manage within tight budgets, and helpful for unexpected situations.

- Small Transfer Advantages:

- Flexible for daily needs

- Easy fund management

- Suitable for frequent remittances

- Small Transfer Disadvantages:

- Frequent transactions may increase overall fees

- Greater impact from exchange rate fluctuations

Large transfers are ideal for paying tuition, medical bills, or investment funds. You can reduce the number of transfers, lowering total fees.

- Large Transfer Advantages:

- Suitable for one-time large payments

- Lower overall fees

- Large Transfer Disadvantages:

- Requires advance fund planning

- Large transfers may face delivery delays

You can choose platforms with low fees and favorable exchange rates based on your needs. For frequent small transfers, opt for platforms with low fees and fast delivery. For large transfers, prioritize platforms with transparent exchange rates and strong security.

Urgent Delivery Needs

If you have urgent remittance needs, choose services with the fastest delivery. TransferGo supports near-instant delivery, typically within 2-3 minutes, with the first two transfers free and no hidden fees. Ria can complete transfers in 15 minutes with transparent fees and no extra charges.

| Service Name | Fastest Delivery Time | Fee Details |

|---|---|---|

| TransferGo | 2-3 Minutes | First two transfers free, no hidden fees |

| Ria | 15 Minutes | No extra fees, fees disclosed upfront |

In urgent situations, prioritize platforms like TransferGo or Ria to ensure funds arrive quickly and safely.

Business vs. Personal Use

Your needs for business and personal remittances may differ. Business users typically require large transfers, focusing on delivery speed and fund security. Personal users prioritize fees and exchange rates, preferring flexible and convenient platforms.

- Business Use:

- Choose platforms supporting large transfers, fund tracking, and compliance assurances

- Focus on delivery speed and fund security

- Personal Use:

- Choose platforms with low fees and favorable exchange rates

- Focus on ease of operation and delivery speed

You can evaluate platforms’ service types and fee structures based on your needs to choose the most suitable online remittance service. This ensures efficient and secure fund transfers for both family support and business operations.

Precautions

Required Information

When making online remittances, you need to prepare the recipient’s detailed information in advance. Platforms will require you to provide the recipient’s name, bank account number, or mobile wallet number. You also need to ensure all information is accurate to avoid remittance failures due to errors. Banks and remittance providers verify recipient information to meet anti-money laundering and counter-terrorism financing requirements. You should also note the purpose of the funds, ensuring funds in the settlement account are used only for paying beneficiaries. Platforms typically transfer funds to the beneficiary’s local settlement account within 24 hours of receiving the transfer. The table below summarizes the key required information and verification requirements:

| Required Information/Requirement | Description |

|---|---|

| Recipient Information | Banks must ensure all anti-money laundering/counter-terrorism financing requirements are met. |

| Fund Usage | Funds in the settlement account are used only for paying beneficiaries. |

| Transaction Time | Funds are transferred to the beneficiary’s local account within 24 hours of receipt. |

When filling out information, double-check each item to ensure accuracy and validity.

Security Precautions

You must prioritize security during the remittance process. Platforms use encryption to protect your personal information and funds. You can take the following measures to enhance security:

- Use strong passwords and change them regularly.

- Avoid conducting remittances on public networks.

- Be cautious of strangers requesting account information.

- Verify recipient information promptly to avoid sending funds to the wrong account.

Choose platforms with strong reputations and security measures to ensure every remittance arrives safely.

Common Pitfalls

When using online remittance services, you may encounter common pitfalls. Many users overlook the accuracy of recipient information, leading to remittance failures or delays. Some fail to check platform fees and exchange rates, resulting in lower-than-expected received amounts. Others choose unfamiliar platforms in emergencies, increasing fund risks. You can avoid these errors by noting the following:

- Do not carelessly fill in recipient information.

- Always check platform fees and exchange rates before remitting.

- In emergencies, prioritize fast and secure platforms.

By preparing in advance and carefully verifying each step, you can smoothly complete online remittances to Ghana.

How to Choose an Online Remittance Service

Needs Assessment

Before choosing an online remittance service, you need to clarify your remittance needs. Different purposes affect your service choice. The table below helps you quickly assess your situation:

| Assessment Criteria | Description |

|---|---|

| Remittance Purpose | Specify the purpose, such as education, healthcare, or housing. |

| Economic Impact | Evaluate the impact on household finances to ensure effective fund use. |

| Dependency Level | Determine the household’s reliance on remittances to choose the right service. |

You can select providers supporting specific purposes based on your needs. For frequent remittances, choose platforms with fast delivery and low fees. For occasional remittances, prioritize those with favorable exchange rates.

Security and Reputation

When choosing a remittance service, security and reputation are critical. You can learn about a platform’s performance through user reviews and third-party ratings.

- User reviews indicate that Samba Money Transfer offers fast, reliable service with low fees and competitive exchange rates.

- Most users are satisfied with Samba’s fund transfer services, though some mention delays in fund arrival.

- Reviewers find Samba’s transfer process simple, with an easy-to-use mobile app.

- In terms of customer service, users give positive feedback, indicating Samba performs well in support.

Prioritize platforms with robust security measures and high user ratings to reduce risks and enhance the remittance experience.

Cost-Effectiveness

When comparing platforms, focus on fees, exchange rates, and delivery speed. The table below shows the cost-effectiveness of major providers:

| Provider | Amount Received (USD) | Fees (USD) | Exchange Rate | Speed |

|---|---|---|---|---|

| Moneycorp | 3,213.83 | 0 | 16.0692 | 1-3 Days |

| Azimo | 3,271.01 | 0 | 16.3551 | 1-5 Days |

| WorldRemit | 3,257.71 | 0 | 16.2886 | Instant |

You can see that Azimo offers the highest received amount and best exchange rate but has slightly longer delivery times. WorldRemit is the fastest, ideal for urgent needs. Send App, designed for African diaspora, supports direct transfers to Ghanaian bank accounts and mobile wallets with competitive rates, fast delivery, and reliability.

Combine your budget and needs to choose the most cost-effective platform, ensuring secure fund delivery while saving costs.

Choosing online remittance services to send money to Ghana offers lower transaction costs, faster delivery, and higher fund security. Remittances are not only a vital part of household income in Ghana but also help low-income families improve their lives and support small business development. When selecting a provider, focus on the following factors:

| Core Advantage | Description |

|---|---|

| Fund Security | Platforms use multiple security measures to protect funds |

| Fees and Exchange Rates | Low fees, transparent exchange rates |

| Delivery Speed | Fast fund delivery, supporting urgent needs |

You can choose the most suitable remittance service based on your needs. For more practical information, check the FAQ.

FAQ

What basic information is needed for online remittances to Ghana?

You need to prepare the recipient’s name, bank account number, or mobile wallet number. You also need to provide your identification and contact information. Platforms will guide you to fill in this information step-by-step.

How long does it take for a remittance to arrive?

With mainstream online remittance services, funds typically arrive within minutes to a day. Delivery speed varies by platform and payment method.

What are the fees for online remittance services?

Most platforms charge a fixed fee, usually between 1-5 USD per transaction. Some platforms may adjust fees based on the remittance amount. You can check specific fee structures before sending.

What should I do if a remittance fails?

If a remittance fails, first verify the recipient’s information for accuracy. You can also contact the platform’s customer service for detailed guidance and refund processes.

What payment methods can be used for remittances?

You can use bank accounts, debit cards, credit cards, or mobile wallets for payment. Some platforms also support third-party payment tools. Choose the most convenient method based on your situation.

By exploring online remittance options to Ghana, you’ve grasped the importance of convenience, low fees, and speed—advantages that make digital services superior to traditional banks for personal and family transfers. However, true global financial efficiency extends beyond simple remittance; it’s about translating that transfer convenience into flexible worldwide asset management.

BiyaPay is designed to offer more than just remittance fees as low as 0.5% (saving you up to 90% compared to traditional banks) and global remittance that supports same-day sending and arrival (the fastest way to ensure funds are available the same day, so you don’t miss a market opportunity). We eliminate geographical hurdles: quick registration, requiring no overseas account, can be done in just 3 minutes, giving you zero-barrier entry to global investment.

You can utilize the real-time exchange rate tool and fiat conversion features to constantly monitor rate dynamics and avoid hidden losses. Crucially, we support seamless conversion between fiat and digital currencies like USDT, allowing for quick funding by bypassing complex channels. With a single account, you can access US and Hong Kong stocks trading, eliminating the need to switch platforms for unified, quicker asset management. For serious traders, our zero commission for contract limit orders is the preferred method for low-cost position building. Register now to elevate your global money movement and asset allocation strategy to a new level of efficiency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.