- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why Choose a Remitly Account for Cross - border Money Transfers? Understand the Transfer Steps, Fees, and Advantages

Image Source: unsplash

By choosing a Remitly account, you can enjoy secure data encryption and a transparent fee structure. New users get their first transfer fee-free, and promotional exchange rates make your transfers more cost-effective. You will find the transfer process simple and the service reliable. Remitly has broad coverage, supporting over 170 countries and regions, offering multiple delivery methods:

| Number of Supported Countries | Delivery Methods |

|---|---|

| Over 170 countries | Bank transfer, mobile wallet, cash pickup |

You can easily meet various cross-border transfer needs.

Key Takeaways

- Choosing a Remitly account ensures secure data encryption and transparent fee structures, protecting your funds and personal information.

- New users enjoy a fee-free first transfer with promotional exchange rates, saving more on transfer costs.

- Remitly supports over 170 countries with multiple receiving methods, meeting diverse cross-border transfer needs.

- The registration process is simple, with quick identity verification, allowing you to start transferring within minutes.

- Real-time transfer tracking ensures every transaction is transparent and secure, enhancing user experience.

Reasons to Choose a Remitly Account

Image Source: pexels

Security and Reliability

When making cross-border transfers, your primary concern is the safety of your funds and personal information. By choosing a Remitly account, you gain multiple security assurances. Remitly uses advanced data encryption technology to protect every transfer.

- Remitly’s mobile app and website use Transport Layer Security (TLS), ensuring data is not intercepted during transmission.

- The system supports modern encryption protocols, including AES256 and 2048-bit RSA, providing strong protection for sensitive data.

- All sensitive information is encrypted during transmission and at rest, with critical data regularly backed up and securely stored.

- Remitly strictly complies with data protection regulations worldwide, safeguarding your privacy rights.

You can also rest assured that Remitly is regulated by multiple authoritative bodies globally. The table below shows some regions’ regulatory details:

| State/Province | License Number | Regulatory Body |

|---|---|---|

| California | #2451 | Department of Financial Protection and Innovation |

| Canada | M15481516 | Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) |

| Florida | FT230000068 | Office of Financial Regulation |

| Illinois | #MT.0000226 | Department of Financial Institutions |

| Hong Kong | N/A | Regulated by licensed banks in Hong Kong (when receiving via bank) |

When using a Remitly account, you can be confident that your funds and personal information are under strict regulation and protection.

Convenient Experience

You want a simple and efficient transfer process, and Remitly delivers an exceptional user experience.

- Remitly supports multilingual services, allowing you to use the Chinese website and app to complete operations easily.

- The mobile app is designed to be clear and straightforward, enabling you to send funds and track transaction progress anytime, anywhere.

- You can quickly check exchange rates and send funds to over 50 countries, meeting diverse needs.

Remitly’s partnership with Visa further enhances transfer efficiency. You only need to enter the recipient’s name and 16-digit Visa debit card number to send funds directly to their account, covering over 100 regions.

The table below summarizes the benefits of the Visa partnership:

| Evidence Point | Description |

|---|---|

| Direct Transfers | Funds can be sent directly to Visa debit cards and bank accounts, covering 100+ regions |

| Transparency | You can track transfers in real-time via the Remitly app, ensuring transparent and secure transactions |

| Extended Partnership | Remitly and Visa’s partnership extended for five years, continuously optimizing global fund flows |

When choosing a Remitly account, you also enjoy exclusive benefits for new users.

- The first transfer is fee-free, and promotional exchange rates make your transfers more cost-effective.

- Offer details vary by location and destination country, so review the terms during registration to ensure eligibility.

- Remitly’s fee-free first transfer policy is highly competitive among similar platforms, with more predictable exchange rates and transparent fee structures.

If you need to send money to China/Mainland China, the US, or other countries, a Remitly account offers a secure, convenient, and cost-effective service experience. By choosing a Remitly account, you can easily handle various cross-border transfer scenarios, whether for family support, tuition payments, or business transfers, enjoying efficiency and peace of mind.

Supported Countries and Receiving Methods

Coverage

When making cross-border transfers, your main concern is whether the service covers your target country. With a Remitly account, you can easily send money to over 170 countries and regions worldwide. Whether you need to transfer to China/Mainland China, the US, Hong Kong, or other regions, Remitly meets your needs.

Remitly’s transaction volume continues to grow in countries like Mexico, India, and the Philippines, demonstrating its strong global market influence. The table below shows transaction volume growth in some regions:

| Country | Transaction Volume Growth Rate |

|---|---|

| Mexico | N/A |

| India | N/A |

| Philippines | N/A |

| Other Countries | 45% |

You can rest assured that Remitly’s broad service coverage ensures an efficient cross-border transfer experience, no matter where you are.

Diverse Receiving Options

When choosing a transfer platform, the variety of receiving methods is crucial. Remitly offers multiple receiving options, allowing you and the recipient to flexibly choose the most suitable method.

You can receive transfers through the following methods:

- Bank Deposit: Funds are sent directly to the recipient’s bank account, compatible with various bank types, including licensed banks in Hong Kong.

- Cash Pickup: Recipients can collect cash directly at designated locations, offering convenience and speed.

- Debit or Credit Card Payments: Such as Visa and MasterCard, funds can be transferred directly to the recipient’s card account, ideal for scenarios requiring fast delivery.

You can choose the most appropriate receiving method based on the recipient’s needs. Remitly’s diverse receiving channels make your cross-border transfers more convenient and efficient.

Transfer Process

Image Source: pexels

Registration and Verification

When choosing a Remitly account, you first need to complete registration and identity verification. The process is very simple, making it easy for new users to get started.

- Visit the Remitly official website and fill in basic registration information, including email and password.

- Upload a government-issued photo ID, such as a passport, national ID, or driver’s license.

- For larger transfer amounts, you may need to provide proof of address, such as a utility bill or bank statement.

- Ensure uploaded images are clear and readable to avoid delays in verification.

- Follow the platform’s prompts to complete all verification steps, after which you can start international transfers.

Tip: Prepare your documents in advance to improve registration efficiency. Remitly strictly protects your personal information to ensure privacy and security.

Common identity verification documents include:

- Government-issued ID (e.g., passport, driver’s license)

- Proof of address (e.g., bank statement)

Entering Information

When filling in transfer details, ensure the recipient’s information is accurate.

- Enter the recipient’s full name, address, and phone number.

- If choosing a bank transfer, provide the recipient’s bank account details. Licensed bank accounts in Hong Kong can also be used as a receiving target.

- Remitly uses advanced security protocols to protect all recipient information from leaks.

- Before confirming the transfer, double-check all details. If errors are found, contact Remitly customer service promptly to assist with corrections or cancellations.

Reminder: Accurate recipient information prevents delays or loss of funds.

Payment and Confirmation

You can choose from multiple payment methods to fund your transfer. The table below shows common payment options:

| Payment Method | Description |

|---|---|

| Debit or Credit Card | Use a debit or credit card for transfers, requiring the card’s expiry date, name, and CVV/CVC. |

After completing payment, Remitly will send a confirmation email with a reference number. You can check the transfer status in real-time on the website or mobile app. The platform will notify you of progress via email or SMS at each step.

Processing times vary by receiving method:

| Transfer Method | Processing Time |

|---|---|

| Online Transfer Service | 1 to 5 business days |

| Digital Wallet Transfer | Within minutes |

| Cash Pickup Service | Available within minutes or hours |

You can select the most suitable payment and receiving methods based on your needs, enjoying an efficient and secure cross-border transfer experience.

Fees and Exchange Rates

Fees

When choosing a cross-border transfer platform, you care most about transparent fees. Remitly’s fee structure is clear, with no hidden charges. You can see the exact cost of each transfer before proceeding.

The table below shows transfer fees for some popular destinations (in USD):

| Destination | Fee (USD) |

|---|---|

| UK | 3.99 |

| Mexico | 1.99 |

| Eurozone | 1.49 |

When using Remitly, you don’t need to worry about additional hidden charges. The platform clearly displays all fees, including exchange rate conversion costs, on the transfer page.

Remitly promises no hidden fees, but you still need to pay exchange rate fees for converting USD to foreign currencies. The platform will clearly show all costs before you confirm the transfer.

For new users, Remitly offers a fee-free first transfer. You can enjoy this benefit by entering a promotional code.

- Remitly provides a fee-free first transfer for new users, requiring a promotional code.

- Fee-free transfers typically range from $500 to $2,999, depending on the destination and account verification level.

- This offer is limited to first-time customers, one use per person, and cannot be applied to subsequent transfers.

- Enter the promotional code during registration or the first transfer, and the system will automatically apply the discount.

You can take advantage of the fee-free first transfer policy to experience Remitly’s service and exchange rate benefits.

Exchange Rates

When making cross-border transfers, exchange rates directly impact the amount received. Remitly provides real-time updated exchange rates, and promotional rates are often better than those of traditional banks.

- Foreign exchange market volatility affects rates, with pairs like USD to INR or USD to PHP fluctuating daily.

- Transfer methods and delivery speeds may impact rates, with faster delivery potentially having slightly lower rates.

- Seasonal demand and global economic events (e.g., holidays or crises) can lead to rate adjustments.

Remitly regularly updates promotional exchange rates based on the destination country and transfer amount. You can view the exact rate before confirming the transfer.

- Remitly’s promotional rates vary by country and amount, with periodic adjustments to ensure competitive rates.

- You can check real-time exchange rates on the Remitly website or app, displaying the latest market-driven values.

When using Remitly, you can maximize the value of each transfer. The platform avoids hidden markups common in traditional banks, offering transparent exchange rate information and predictable received amounts.

The list below summarizes Remitly’s exchange rate advantages:

- Real-time updated rates ensure accurate market prices.

- Transparent rate information allows you to confirm the received amount before transferring.

- Promotional rates are often better than banks, helping you save more.

You can use the Remitly platform to check and compare exchange rates anytime, choosing the optimal transfer timing.

Limits and Delivery Times

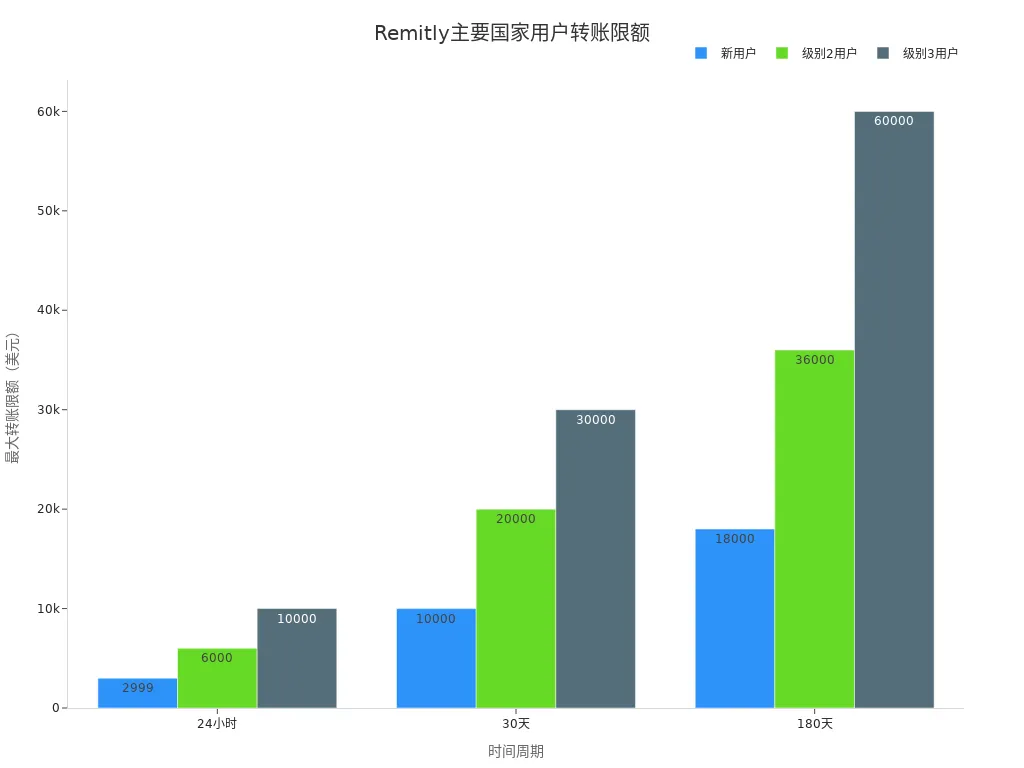

When making cross-border transfers, transfer limits and delivery times are equally important. Remitly sets different transfer limits based on user levels.

The table below shows transfer limits for US users (in USD):

| User Level | 24-Hour Limit | 30-Day Limit | 180-Day Limit |

|---|---|---|---|

| New User | $2,999 | $10,000 | $18,000 |

| Level 2 User | $6,000 | $20,000 | $36,000 |

| Level 3 User | $10,000 | $30,000 | $60,000 |

You can flexibly choose transfer amounts based on your needs and account verification level. For frequent senders, understanding monthly or six-month maximum transfer amounts is crucial. For example, as a Level 1 user, you can send up to $10,000 USD monthly and up to $18,000 USD over six months.

Regarding delivery times, Remitly offers flexible options based on receiving methods. Refer to the table below:

| Receiving Method | Estimated Delivery Time |

|---|---|

| Bank Account | 1-5 business days |

| Digital Wallet | Within minutes |

| Cash Pickup | Available within minutes or hours |

You can choose the fastest or most economical delivery method based on the recipient’s needs. For regions like China/Mainland China, the US, and Hong Kong, bank account transfers typically take 1-5 business days, while digital wallets and cash pickups are faster.

Before transferring, you can check limits and delivery times in real-time on the Remitly platform to ensure each transfer meets your needs.

If you need to send large amounts, you can increase your account level to access higher limits. Remitly provides a flexible, secure, and efficient cross-border transfer experience, meeting your needs for family support, tuition payments, or business transfers.

Key Benefits

Price Competitiveness

When choosing a cross-border transfer platform, price is a primary consideration. Remitly focuses on digital transfers, offering lower fees and more competitive exchange rates. The table below compares Remitly with other major platforms:

| Provider | Exchange Rate | Transfer Fee (USD) | Amount Received (PHP) |

|---|---|---|---|

| Wise | 57.0820 | 12.66 | 56,359.34 |

| Remitly | 55.4198 | 0.00 | 55,419.81 |

You can see that Remitly waives transfer fees, resulting in lower overall costs. By leveraging digital operations, Remitly reduces the cost pressures of traditional cash transfers. You benefit from the trend toward electronic payments and continued market growth, enjoying more affordable transfer services.

- Remitly focuses on digital transfers, reducing operational costs.

- Electronic payments make transfers more convenient and cost-effective.

- Market growth provides more cost-saving options.

User Experience

When using Remitly, you’ll find the process very straightforward. Remitly’s intuitive interface design is suitable for users with limited technical skills. You can complete transfers in just a few steps without complex operations. Many users report that Remitly offers fast transfers, low fees, easy-to-navigate apps and websites, and clear, transparent pricing information.

- Fast transfer speeds, with some transfers arriving within minutes.

- Lower fees compared to traditional banks and other platforms.

- User-friendly app and website with transparent information.

- Remitly provides 24/7 customer support to address urgent issues.

The table below shows user interface and customer support features of different platforms:

| Service Provider | User Interface Features | Customer Support Features |

|---|---|---|

| Remitly | Simple and user-friendly, real-time tracking | 24/7 support via phone, email, and chat |

| Western Union | Feature-rich, transaction history | Digital-first support, response speed varies by query type |

You can choose the most suitable service based on your needs. Remitly makes cross-border transfers easy, efficient, and convenient.

Security Measures

When transferring money, security is paramount. Remitly employs multiple security measures to protect your funds and information. You need to complete identity verification and two-factor authentication, and the platform monitors transactions in real-time to detect suspicious activity. Remitly has a dedicated team to handle unauthorized transactions, ensuring your account’s safety.

- Identity verification ensures account security.

- Two-factor authentication enhances protection levels.

- Transaction monitoring detects anomalies promptly.

- A professional team addresses risk issues.

Remitly uses advanced encryption technology, with all transactions protected at the highest level. The platform is regulated by authoritative bodies like the UK’s Financial Conduct Authority (FCA), adhering to strict compliance standards. You can confidently use Remitly for international transfers, enjoying a secure and compliant service experience.

By choosing a Remitly account, you gain secure data protection, a convenient user experience, transparent fee structures, and diverse service support. You can flexibly select transfer methods based on your actual needs.

Remitly makes it easy to meet cross-border transfer needs for China/Mainland China, the US, Hong Kong, and more. You can complete every international transfer with lower costs and higher efficiency.

FAQ

How do I register for a Remitly account?

You can visit the Remitly website or download the app. Fill in your email and password, and upload an identity document. The system will guide you through identity verification. The registration process is simple and can be completed in minutes.

What information is needed to send money to China/Mainland China?

You need the recipient’s full name, address, and phone number. If choosing a bank transfer, provide the account details for a licensed bank in Hong Kong. Ensure all information is accurate.

What payment methods does Remitly support?

You can use a debit card, credit card, or bank account for payments. The platform supports multiple mainstream payment methods, allowing you to choose based on your needs.

How long does it take for a transfer to arrive?

Bank account transfers typically take 1-5 business days. Digital wallet and cash pickup methods are faster, available within minutes or hours. You can track progress in real-time on the app.

Are there transfer amount limits?

Remitly sets limits based on account levels. New users can send up to $2,999 USD in 24 hours. You can increase your account level for higher limits to meet large transfer needs.

While services like Remitly offer convenience, they often come with hidden fees and less competitive exchange rates. For a smarter, more cost-effective way to manage cross-border transfers, consider BiyaPay.

We enable seamless conversion between fiat and digital currencies like USDT, helping you avoid costly intermediary charges. Enjoy transfer fees as low as 0.5%—a significant saving compared to traditional providers. Use our real-time exchange rate tool to lock in favorable rates and maximize your transfer value.

No overseas bank account? No problem. Register in under 3 minutes and send money to most countries worldwide with same-day delivery. Plus, manage both U.S. and Hong Kong stocks from one integrated platform for greater financial flexibility.

Start today on BiyaPay and discover a faster, more transparent way to send money and invest globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.