- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tesla's future blueprint: From electric vehicles to energy storage, how to seize opportunities and respond to challenges?

In recent years, Tesla’s performance has undoubtedly excited investors. As a leading company in the global electric vehicle industry, Tesla’s innovation and growth have always been a hot topic in Capital Markets. As a result, the stock price has soared, especially in the past few years, with breakthroughs in production scale, technological innovation, and global market penetration, investors’ confidence has significantly increased. Tesla has not only achieved success in the traditional electric vehicle field, but also begun to expand into multiple emerging fields such as energy storage, autonomous driving, and robotics, with huge potential for future growth.

Currently, Tesla is in a critical stage of further expansion. In 2025, Tesla plans to launch some strategically significant products and projects, including the anticipated affordable electric car priced at $25,000 and autonomous driving taxis (robotaxis). These innovations are expected to be key factors driving the company’s continued growth and may also bring further market share increase.

However, as the company’s market value continues to rise, the market’s expectations for Tesla’s future performance are also increasing. Investors not only see huge growth potential, but also face possible risks and challenges. How to avoid potential risks while being full of opportunities is a problem that every investor needs to consider carefully.

Production Leap: Tesla’s Delivery Growth and Expansion Potential

Tesla has shown amazing production and delivery growth in the past few years. From 365,000 vehicles in 2019 to 1.846 million vehicles delivered in 2023, Tesla’s success is not accidental. This achievement is due to its leading technological innovation, large-scale production, and precise grasp of global market demand.

Tesla not only improves production efficiency by optimizing production processes, but also further expands production capacity through global production bases. For example, Tesla’s Shanghai Gigafactory has become one of the most important production centers in the world, promoting Tesla’s strong expansion in the Asian market. At the same time, with the gradual improvement of production facilities and continuous breakthroughs in technology, Tesla has also made significant progress in cost control. All of this has led to Tesla’s delivery volume constantly breaking records, meeting the growing demand for electric vehicles worldwide.

Looking ahead to 2025, although the company may experience short-term production adjustments, from the overall trend, Tesla’s production potential is still strong. In fact, this adjustment is more like preparing for more efficient and intelligent production. For example, Tesla is further improving the production and delivery efficiency of each model by continuously upgrading production lines and expanding production capacity. Even if the production scale is slightly adjusted in the short term, in the long run, Tesla still has strong expansion capabilities.

Among them, scale effect is one of the key factors for Tesla’s future growth. With the increase in production, the cost per vehicle will also be further reduced, which can not only improve gross profit margin, but also enhance its competitiveness in the market. In addition, Tesla continues to increase investment in innovation, such as optimizing battery technology and accelerating automated production, further laying the foundation for future large-scale production.

Tesla’s production and delivery capabilities will continue to exert its market competitiveness. Against the backdrop of global market expansion, Tesla will not only continuously increase its market share, but also is expected to become the “pricing king” of the electric vehicle industry, driving the overall development of the industry.

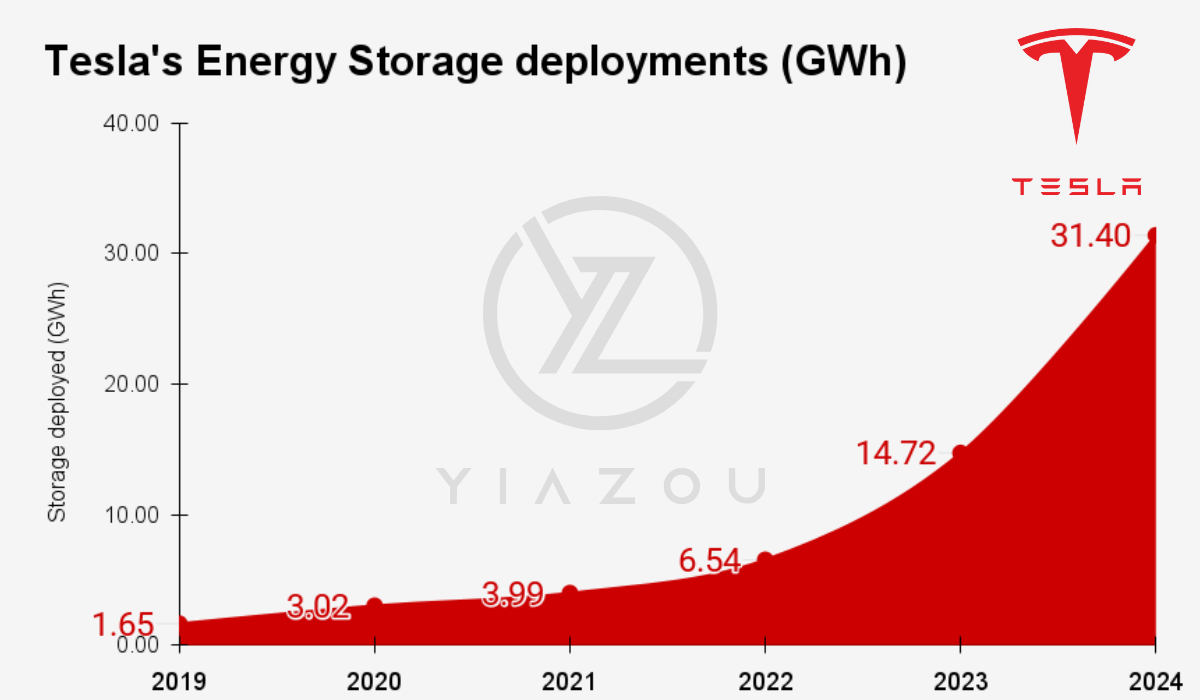

Energy Storage Business: The Rise of Tesla’s New Engine

Although Tesla has always been known for its electric vehicles, its energy storage business is quietly rising and becoming another highlight of the company’s growth. When we talk about Tesla, we usually think of Model 3 or Cybertruck, but it cannot be ignored that Tesla also has strong market potential in the energy storage field.

Tesla’s energy storage solutions, including Megapack and Powerwall, are accelerating their development, especially in the context of the global promotion of Renewable Energy, where demand is rising sharply. Megapack, as a large-scale battery energy storage solution, is helping the grid achieve better energy scheduling, especially during high-demand periods. Powerwall provides households with smarter energy management methods, allowing them to be self-sufficient through solar panels and storing excess electricity through battery energy storage technology for use when needed.

In California, US, Tesla’s energy storage products have become the first choice for households and businesses, and are expanding to more markets worldwide. Tesla’s annual production at its Lathrop factory has reached 40 GWh, and this production is expected to further expand by 2025. With the surge in global demand for Renewable Energy, Tesla’s position in the energy storage field will only become more and more important.

More broadly, energy storage solutions are not just for meeting the needs of individuals and businesses, they also contribute to the stability of the global power system. With governments around the world paying more attention to the transformation of Renewable Energy, energy storage has become one of the key technologies for achieving energy independence and reducing carbon emissions. Tesla is at the forefront of this trend, and its energy storage business has enormous growth potential in both providing global power system stability and promoting global energy transformation.

If Tesla can successfully expand its market share in energy storage products, this business is expected to become an important engine supporting its continued growth after electric vehicles.

Tesla’s innovation strategy: from electric vehicles to robotics

Tesla has always relied on innovation to drive its expansion in electric vehicles and other cutting-edge technologies. In the coming years, Tesla’s multiple new products and technologies will bring new growth opportunities.

One of the most notable innovations is Tesla’s plan to launch an affordable electric vehicle priced at $25,000 in 2025. Currently, although Model 3 provides consumers with a more affordable option, the high price of electric vehicles still discourages many people. By launching more competitively priced electric vehicles, Tesla hopes to break down this barrier and attract more potential customers, especially in rapidly growing markets such as China. This move will also help Tesla further consolidate its global market leadership position.

In addition to electric vehicles, Tesla’s layout in autonomous driving and robotics technology is also worth paying attention to. The Optimus humanoid robot project is an important initiative of Tesla in the field of artificial intelligence and automation. Although it is still in its early stages, if successful, it may not only serve factory production, but also enter family life and become a daily assistant. In addition, Tesla’s autonomous driving taxi (robotaxi) project is also under development. If successful, it may change the traditional travel mode, become a new source of income for Tesla, and further expand its business boundaries.

In terms of battery technology, Tesla’s 4680 battery being developed will help reduce the production cost of electric vehicles and provide longer range. By producing this new type of battery, Tesla can not only reduce its dependence on external suppliers, but also increase its gross profit margin and enhance its market competitiveness. This move will enable Tesla to maintain its leading position in the electric vehicle market.

Overall, Tesla is not only consolidating its existing market share by continuously promoting innovation in electric vehicles, robots, autonomous driving, and battery technology, but also opening up new directions for future growth.

If you are optimistic about Tesla and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Challenges and risks: Can Tesla break through bottlenecks?

Although Tesla has shown strong growth potential, it also faces many challenges.

Firstly, high valuation is undoubtedly a major risk. Tesla’s market value is much higher than that of traditional car manufacturers, and its Price-To-Sales Ratio is also significantly ahead, reflecting the market’s extremely high expectations for its future growth.

Although the company is innovating and expanding in multiple areas, if it fails to meet these expectations, the stock price may face downward pressure, especially against the backdrop of increasing global economic uncertainty.

Secondly, the advancement of autonomous driving technology still faces many uncertainties. Tesla is at the forefront of the field of autonomous driving, but the maturity of technology and the adaptation of regulations are two major obstacles. Regulatory policies vary from country to country, and the safety of autonomous driving technology is still a sensitive topic. If Tesla cannot break through these technological and regulatory bottlenecks, its global promotion of autonomous driving may be affected.

Furthermore, capacity and supply chain issues cannot be ignored. Although Tesla continues to expand production capacity, the existing production facilities and service network may not be able to meet the rapidly growing demand in the future. Production delays and supply chain bottlenecks, especially in the case of raw material shortages, may affect delivery schedules, and insufficient service centers and charging infrastructure may limit User Experience when expanding globally.

Tesla’s future challenges mainly focus on high valuation, technical bottlenecks, and capacity. Investors need to closely monitor the impact of these risk factors on the company’s stock price and market performance.

Tesla’s future trend: bullish trend or bearish reversal?

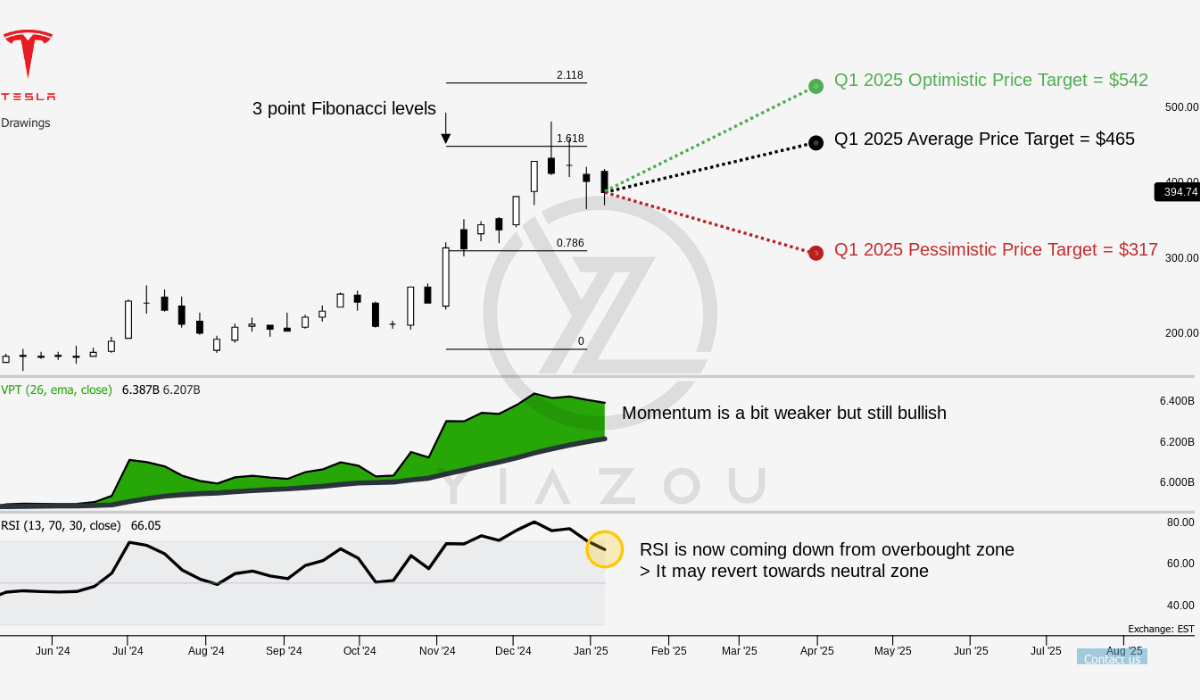

Tesla’s current trading price is $400, and investors are looking forward to its prospects for Quarter 1 in 2025. According to analysis, Tesla’s average target price is $465, close to the Fibonacci level of 1.618, indicating that the market sentiment is optimistic and the price may continue to rise. At the same time, the optimistic target price is $542, close to the Fibonacci level of 2.118. If this target price is achieved, it means that Tesla’s stock price still has the potential to rise strongly.

However, pessimistic market sentiment also carries certain risks. According to technical analysis, the pessimistic target price of $317 corresponds to the 0.786 Fibonacci level. If the market trend weakens, the stock price may face significant downward pressure. The market’s mood swing and confidence in Tesla’s future will directly affect the rise and fall of its stock price.

From a technical perspective, Tesla’s Relative Strength Index is 66.05, close to the overbought zone, but there is no obvious bullish or bearish divergence. The slight downward trend of RSI suggests that the upward momentum of the stock price may weaken, which may slow down the pace of price increase.

At the same time, the trading volume price trend is 6.88B, still showing a horizontal movement state, indicating a lack of clear directionality in trading volume. Although the VPT line is higher than its Moving Average line (6.21B), it indicates that there is some accumulation in the market and no negative trend has been seen yet. If the trading volume breaks through the current horizontal pattern, it may provide clearer guidance for the direction of the stock price.

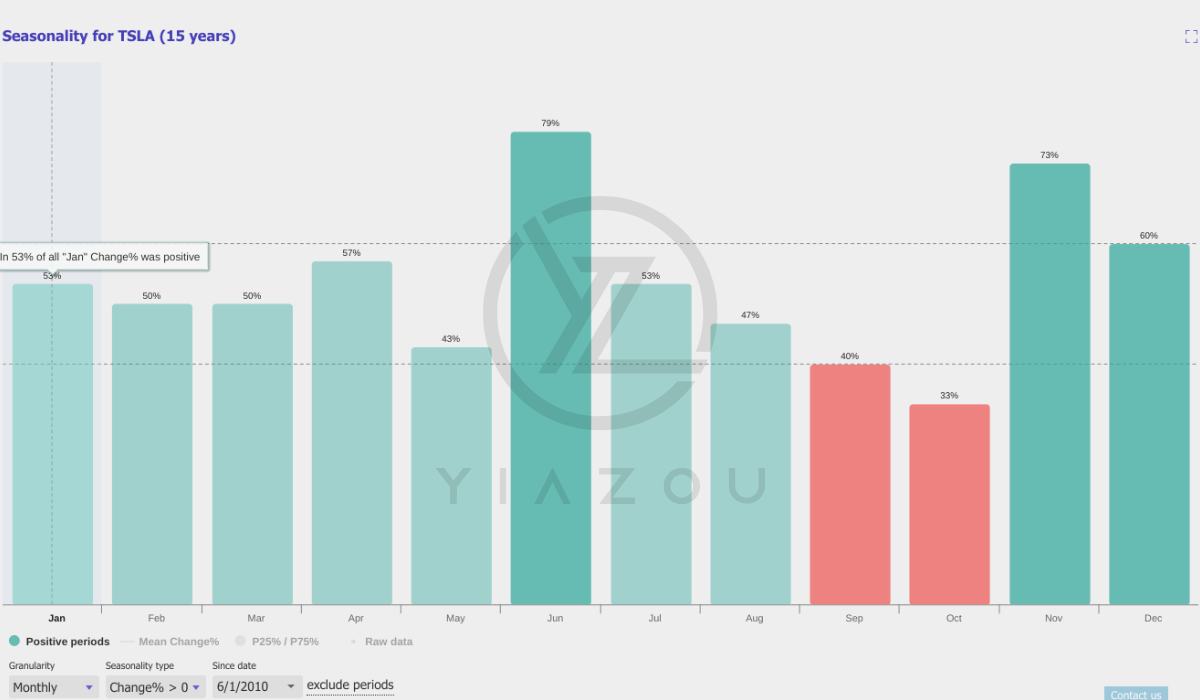

Finally, seasonal data shows that data from the past 15 years shows that the probability of a positive return for Tesla stock in January is 53%, indicating that the stock price may still be volatile in the short term.

Overall, Tesla’s stock price target is full of challenges and opportunities. Investors need to constantly pay attention to changes in market dynamics and technical indicators to capture possible trends.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.