- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Micron's pullback does not mean disappointment. The potential of AI and Data Center cannot be ignored. Seize the opportunity in time!

Micron’s recent pullback has attracted the attention of many investors, especially considering the rapid development of AI technology and data centers. This company, which occupies an important position in the storage chip field, is standing at the forefront of the technology trend. From Big Data to Cloud Services, AI is constantly driving the transformation of various industries around the world. The expansion of data centers has also brought huge market opportunities to semiconductor companies like Micron.

With the increasing global demand for AI and data processing, Micron’s storage chip products are playing an increasingly important role. Investment opportunities in this field, especially with Micron’s technological accumulation and innovation advantages, are particularly attractive. The adjustment of the stock price may provide a good entry point for investors who are prepared for long-term investment.

Financial soundness and technological innovation drive growth

Micron, as a leader in the global memory chip industry, has accumulated deep technological and market advantages in the semiconductor field. The company not only continuously consolidates its market position with strong technological strength, but also provides strong support for its future development with its stable financial performance.

Based on the latest financial report, Micron’s revenue and profits remain strong. Despite the challenges of the global economy and short-term uncertainties, the company’s overall revenue has maintained steady growth. This indicates that Micron not only continues to lead in technology, but also can steadily advance in complex market environments.

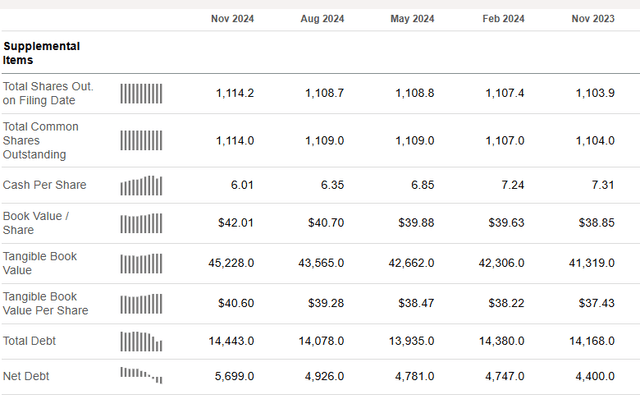

Micron’s cash flow position is also very healthy. The company reported that as of the latest financial report period, the cash balance reached $7.60 billion, while the total debt was only $14.40 billion, accounting for about 13% of the market value. This means that Micron’s financial leverage is very low. The low debt level and strong cash reserves give Micron sufficient financial flexibility in the face of external pressures to support its continuous investment in research and development and capital expenditures.

It is worth mentioning that Micron’s investment in technological innovation has never stopped. The company’s R & D budget has reached a historical high, which not only demonstrates Micron’s ambition for future technological development, but also demonstrates its layout in emerging fields, especially in AI and data center innovation. With the rapid expansion of the data center and AI markets, Micron will undoubtedly become the main beneficiary in these fields.

Standing out in the AI and Data center wave

With the explosion of AI technology, the demand for global data centers is showing unprecedented growth. As a leader in the storage chip industry, Micron happens to occupy a favorable position in this rapidly expanding market. AI and data centers are not only hotspots for technological innovation, but also the focus of global investment in the coming years.

According to Gartner’s forecast, global spending on Public Cloud services will reach $723.40 billion by 2025, a 21% increase from $595.70 billion in 2024. This growth is driven by the sharp rise in demand for Cloud Services and data storage, and Micron is the core beneficiary in this field. Especially driven by AI, the demand for high-speed storage chips in data centers is also increasing. The computing demand of AI far exceeds that of traditional computing, requiring larger-scale storage solutions and faster processing speeds, which is the embodiment of Micron’s technological advantages.

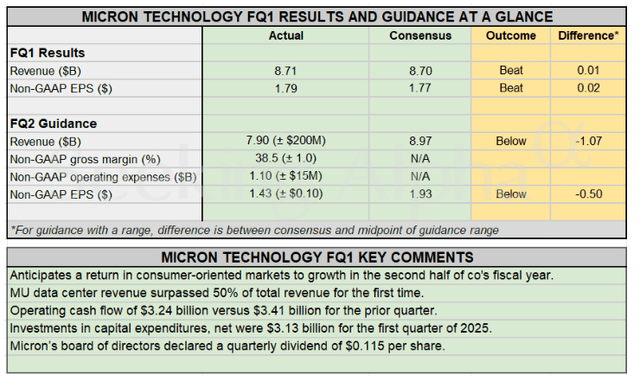

Micron’s market share in Data Center is also constantly increasing. In the past quarter, the revenue of Data Center business exceeded 50% of the company’s total revenue for the first time. This indicates that Micron has firmly grasped the key share of this market, and in the next few years, with the further popularization of AI technology, its growth potential in this field is still huge.

Micron’s innovation strategy has laid the foundation for its success in the data center and AI markets. The company has been committed to promoting the research and development of new generation storage technologies, especially in the fields of high-performance computing (HPC) and memory chips. Micron’s DDR5 memory modules and 3D NAND technology are one of the core technologies for data center and AI needs. With the increasing global investment in AI applications, Micron’s technologies will undoubtedly usher in a broader market space.

It is worth noting that data center investment is accelerating globally. Microsoft plans to invest $80 billion in data center construction by 2025, and Micron is one of the main beneficiaries of this huge investment. With the continuous increase in data storage demand, Micron’s storage solutions will gain more popularity worldwide, driving further expansion of the company’s business.

Stock price and valuation: 33% potential upside potential

Recently, Micron’s stock price has experienced a wave of decline, which also provides an attractive buying opportunity for potential investors. Although the company’s latest quarterly financial report exceeded expectations, the market overreacted to Micron’s conservative revenue guidance, resulting in a significant pullback in the stock price.

From the perspective of stock price trend, although Micron’s stock price correction is noteworthy, this adjustment may not necessarily represent a problem with the company’s fundamentals. In fact, the market’s reaction to Micron seems to be somewhat excessive, especially in the AI and data center fields, where the company’s prospects are still bright. To evaluate Micron’s investment value, we can use the intrinsic value evaluation method - discounted cash flow (DCF) model.

In the analysis, a conservative revenue growth assumption was adopted, assuming that Micron’s average annual revenue growth rate in the next few years is 10%, and the permanent growth rate was lowered from 4% to 3%. Under this conservative assumption, Micron’s intrinsic value per share is still about 33% higher than the current stock price. If Micron’s stock price rebounds to the target price of about $127, this means that investors can obtain relatively high potential returns.

In addition, the RSI indicator of technical analysis shows that the current stock price of Micron is in the “neutral” range (about 50), far below the overbought range of 70. This means that the stock price is not overheated at present and there is room for growth. If you are a long-term investor, now is a good time to buy.

Micron’s strong financial position and continuously growing AI market demand provide a solid foundation for the company’s future growth. Micron’s deep cultivation in the global data center and AI storage fields will bring long-term stable cash flow and revenue growth to the company, further driving up the stock price. Therefore, although market sentiment has temporarily depressed the stock price, from the perspective of fundamentals and Technical Fundamentals, Micron is still a stock worth looking forward to.

If you are also optimistic about Micron and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting US and Hong Kong stock and digital currency transactions.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Long-term growth potential stocks are worth paying attention to

In summary, Micron is undoubtedly an investment opportunity with long-term growth potential in the current semiconductor field. The current low stock price and short-term pullback caused by market mood swings provide an attractive buying opportunity. The company’s financial condition is healthy, relying on strong cash flow and low debt, and can continue to invest in technology research and innovation in the future, continuously consolidating its leading position in the storage chip and data center markets.

The explosive growth of AI and data centers will continue to drive Micron’s performance growth. It is expected that global data center investment will significantly increase by 2025, and giants such as Microsoft plan to increase investment in the data center field, which is undoubtedly a huge benefit for Micron, a storage chip supplier. Micron is actively expanding innovation in this field, continuously enhancing its technological strength, and capturing long-term growth opportunities. Micron’s data center business already accounts for more than 50% of the company’s total revenue. With the explosive growth of data traffic, this proportion will further increase in the future.

From the perspective of valuation, despite the short-term mood swing in the market, Micron’s intrinsic value is still much higher than the current stock price. According to conservative income growth assumptions, the current stock price has about 33% upside potential, indicating that it is still a relatively cheap investment target. Moreover, technical analysis shows that the stock price is still in the neutral zone and has not reached an overbought state in the short term, providing investors with sufficient upside potential.

Of course, investing in Micron also has certain risks. Firstly, the competition in the semiconductor industry is becoming increasingly fierce, especially in the fields of AI and data center storage. The technological progress of other major companies may put pressure on Micron. Secondly, the cyclical fluctuations in the technology industry may affect Micron’s short-term performance, especially in the case of slowing market demand or falling storage chip prices, which may affect its profitability. However, based on past performance, Micron has repeatedly demonstrated its strong resilience and successfully recovered in the industry turmoil.

Therefore, considering Micron’s fundamentals, financial situation, industry prospects, and stock price valuation, the author believes that Micron is a very worthwhile investment target to hold for the long term. Even if the short-term stock price fluctuates greatly, investors should patiently wait for the long-term benefits brought by its technological innovation and market expansion. If you are looking for a stock that is expected to benefit from the explosive growth of AI and data centers, Micron may be a good choice.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.