- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Trump publicly issues coins, TRUMP coin skyrocketed 160 times! US President personally enters the field, what does it bring to the currency circle? Can Bitcoin 200,000?

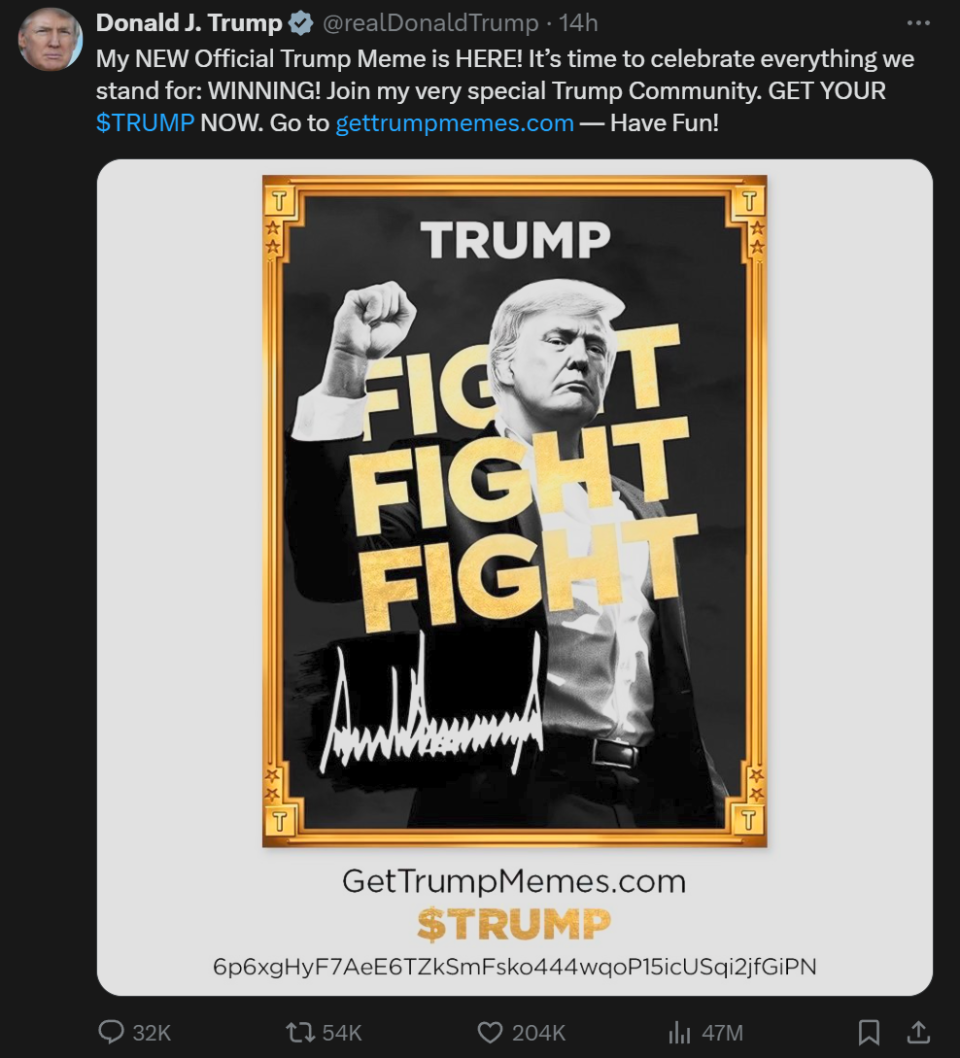

On Friday evening, January 17th at 6pm US time, Trump officially announced the publication of TRUMP coin through a tweet on his personal official X account. The tweet was full of provocation, with the words “Now is the time for us to celebrate our victory, join the special Trump community and celebrate together!” These highly infectious words called on everyone to participate.

Once the news was released, it quickly spread like wildfire. In the field of cryptocurrency, where information spreads quickly and investor sentiment is easily ignited, this tweet instantly attracted a huge amount of attention. In just 15 hours, the price of TRUMP coin showed an almost crazy soaring trend, with an increase of up to 160 times. According to the maximum publishing volume 1 billion claimed on its official website, the full circulation market value of TRUMP coin skyrocketed from zero to $30 billion.

A large amount of funds, like sharks smelling blood, flooded into the TRUMP coin market. The number of independent blockchain addresses participating in TRUMP coin transactions exceeded 107,000 in a very short period of time. Among them, the trading operations of some addresses were extremely dramatic. Some investors seemed to have the ability to predict the future, and almost at the same time as Trump’s tweet, they decisively bought in large quantities. These lucky ones harvested astonishing returns of more than 150 times in less than 15 hours, successfully achieving a gorgeous transformation from millions of dollars to hundreds of millions of dollars in wealth. For example, there are addresses that invested $1 million in TRUMP coin when it was just published, and then the market value rose all the way, and it has now reached $164 million; there are also addresses that purchased $31.20 million, not only quickly profited $29.80 million, but the remaining position market value is still as high as $184 million.

In-depth analysis: The logic and motivation behind Trump’s currency issuance

From the perspective of timing, Trump will officially take office at noon on January 20th Eastern Time, and he announced the issuance of currency three days before his inauguration, which can be described as killing two birds with one stone. On the one hand, he has not yet officially become the US president in theory, so he can cleverly avoid a series of legal restrictions faced by the incumbent president. As we all know, every move of the incumbent president is strictly constrained by many legal provisions, especially in the financial field. Trump successfully bypassed these potential legal obstacles by issuing currency at this special node. On the other hand, he fully utilized the high popularity brought by the identity of the incoming president. Trump has a huge fan base and high attention in the US and even globally. His identity as the incoming president has made him the focus of attention. Announcing the issuance of the currency at this time undoubtedly attracts a large number of investors’ attention and creates an excellent speculative environment for TRUMP coin.

Trump expressed strong interest and support for cryptocurrency during his campaign. He explicitly proposed to use Bitcoin as a strategic asset reserve in the US, which caused a strong reaction in the cryptocurrency field and gave many cryptocurrency enthusiasts hope for broader development space in the US. From a political perspective, this issuance may be aimed at further promoting the development of cryptocurrency in the US, fulfilling campaign promises, and gaining sustained support from cryptocurrency supporters. In today’s political environment, voter support is crucial. By taking active action in the cryptocurrency field, Trump can consolidate the support of this group of voters and lay a solid foundation for future political activities.

From an economic perspective, it cannot be ruled out that there are commercial interests behind it. The cryptocurrency market has developed rapidly in recent years and contains huge commercial potential. Trump has attracted widespread attention in the market by issuing coins, attracting a large amount of capital inflows, which may achieve economic benefits for individuals or related interest groups. The popularity of the TRUMP coin has made it possible for all parties involved, including project developers, early investors, etc., to get a share of this wealth feast, and Trump and the forces behind him may also expect economic returns from it.

Chain reaction: multidimensional impact on the cryptocurrency circle

Market sentiment and capital flows

The hot performance of TRUMP coin is like toppling the first domino, triggering a violent fluctuation in the overall sentiment of the cryptocurrency circle. The FOMO (fear of missing out) sentiment of investors is infinitely magnified. Driven by this sentiment, a large number of investors blindly follow the trend and invest their funds in the trading of TRUMP coin regardless of everything. This not only led to a surge in the transaction amount of TRUMP coin on the Solana blockchain platform, with a transaction amount exceeding $11.40 billion in the past 24 hours, far exceeding the sum of other major blockchain platforms during the same period, but also had a profound impact on the flow of funds in the entire cryptocurrency circle.

Funds that were originally stable in other currencies and projects have been tempted by the high returns of TRUMP coin and have withdrawn one after another. Some mainstream currencies and potential projects that were originally highly concerned and had good development prospects are facing huge price fluctuations due to capital outflows. For example, some small cryptocurrency projects have experienced significant price fluctuations due to a large amount of capital withdrawal, which has hindered the development progress of the project and caused a significant drop in the currency price. The disorderly flow of funds has seriously disrupted the original market capital layout, posing a great challenge to the stability of the cryptocurrency market.

Change in currency pattern

Ripple XRP has always been closely related to the SEC lawsuit, and its price trend seems to be controlled by this lawsuit. Every time there is good news in the lawsuit, XRP is injected with a shot in the arm, and the price will experience a significant increase. The market expects that the encryption reform initiated by the new SEC leadership of Trump may have a positive impact on the review of related cases, which will once again benefit XRP. According to market analysis and prediction, its popularity is expected to remain until around January 20th.

However, from the perspective of market value, the current development of XRP is worrying. Its total market value has soared to 330 billion, which is not only huge, but also means that the profit-taking is extremely huge. In this case, market risks continue to accumulate. Once the market sentiment reverses, XRP is likely to face the risk of a significant pullback.

In contrast, Solana and ADA, which are both “made in the US” concepts and favored by American investors, have now entered the investors’ field of vision. As market funds are always seeking new speculative targets and potential high-yield opportunities, Solana and ADA, with their unique advantages, have begun to attract the attention of funds.

Solana has several significant advantages. It has a large number of users and a broad user base worldwide, which provides solid support for its development. At the same time, Solana’s more decentralized characteristics, which are in line with the core value concept of cryptocurrency, also make it highly praised in the market. Against the backdrop of cryptocurrency reform, the probability of Solana being approved for ETF is relatively high. In addition, there are many favorable factors for Solana this year, such as futures and spot ETF expectations, FireDancer upgrades, and counterfeit products season, which have added a lot of imagination space for its future development.

From the perspective of its token mechanism, the total number of Solana tokens is 590 million, of which only 480 million (82%) are unlocked. Among these 480 million tokens, 390 million are in the state of staking to earn coins and are firmly locked, and only 90 million are actually circulating in the market. More importantly, at least half of these 90 million are locked in various Defi and various pools. This means that in the total amount of 590 million tokens, the number of tokens that can truly be freely bought and sold may only be about 50 million. The scarcity of tradable tokens makes it easy for Solana to experience a significant price increase driven by market funds. We started fishing Sol at 80 and have added positions multiple times since then, with an average price of 100. We have held it for one year.

From its actual trend, after completing the FireDancer upgrade, Sol surged by 20% the next day. This time, due to Trump’s issuance of coins on the Sol chain, it rose again by 15%. All signs indicate its huge potential. It is expected that there is a good chance of rising to 400-500 u by the end of the year.

Ethereum is expected to have a staking function due to its approval of ETFs. The launch of this function will significantly increase its returns. Based on market expectations, Wall Street asset management giants such as BlackRock are likely to submit relevant applications a few weeks after the new SEC takes office. Once the application is successful, Ethereum may directly experience a 20% increase. The implementation of the staking function will further enhance the investment attractiveness of Ethereum, not only attracting more investors to enter, but also possibly changing its competition landscape in the cryptocurrency market, giving it a more advantageous position in competition with other currencies.

Changes in regulatory expectations

The unprecedented event of Trump’s coin issuance is like a bombshell, causing a huge uproar among regulatory agencies. The cryptocurrency market has long been in a regulatory gray area, lacking clear and unified regulatory rules, which has led to market chaos and difficulty in effectively protecting investor rights. The Trump coin issuance incident undoubtedly sounded the alarm for regulatory agencies and is likely to accelerate the improvement and implementation of regulatory policies.

In the future, the regulatory direction is expected to pay more attention to investor protection, market compliance, and preventing financial risks. In terms of investor protection, regulatory agencies may introduce a series of measures to require cryptocurrency project parties to fully disclose project information, improve market transparency, and prevent investors from suffering losses due to information asymmetry. Regarding market compliance, regulatory agencies will strengthen the review of various links such as cryptocurrency trading platforms and project publishing, and crack down on illegal transactions and fraudulent activities. In terms of preventing financial risks, regulatory agencies may strictly monitor the leverage use and capital flow in the cryptocurrency market to prevent systemic risks in the market.

The implementation of this series of regulatory measures means higher compliance costs and stricter review standards for cryptocurrency projects. Some non-compliant projects may face the fate of being eliminated due to their inability to meet regulatory requirements. Those compliant high-quality projects are expected to have a healthier development environment in a more standardized market environment. Once regulatory policies are implemented, projects that perform well in technical strength, team background, project planning, and meet regulatory requirements will gain more trust and financial support from investors, stand out in the market, and promote the entire cryptocurrency market towards a healthier and more orderly direction.

Bitcoin Trend: Association with Trump’s Coin Issuance and Future Outlook

As a core indicator of the cryptocurrency market, the price trend of Bitcoin is closely related to the Trump coin issuance event. Trump’s positive statements on cryptocurrency during and after the election have injected strong confidence into the Bitcoin market. The market expects Trump to implement policies favorable to the development of cryptocurrency after taking office, and this optimistic sentiment has driven the continuous rise of Bitcoin prices.

After Trump launched the TRUMP coin, the overall active level of the cryptocurrency market increased significantly, and Bitcoin was also driven. Bitcoin rose sharply from around $97,000 to break through $105,000. This shows Trump’s influence in the cryptocurrency field and the high sensitivity of the market to his related actions.

From a macroeconomic perspective, Trump claimed to list Bitcoin as a national strategic reserve asset and use it to repay part of the US national debt. If this idea is realized, the status and value of Bitcoin will be greatly enhanced, which will inevitably attract more institutions and investors to enter the market and further push up the price of Bitcoin. At the same time, it is expected that Trump will adopt cryptocurrency-friendly policies after taking office, which will reduce the regulatory uncertainty faced by Bitcoin, promote the development of the entire industry, and provide strong support for the price of Bitcoin.

However, the price trend of Bitcoin is not always upward. Currently, the Nasdaq index is showing a downward wedge shape and is at a critical critical point. There is a close linkage between Bitcoin and the US stock market. If the Nasdaq index successfully breaks through the resistance level, it will open a new round of bull market, and Bitcoin is expected to benefit, with the price possibly rising to $12-140,000. Conversely, even if the Nasdaq index fails to break through, the market may experience a washing out, and then it will still develop towards an upward trend, with at most another week of consolidation.

Looking back at the trend of Bitcoin last year, from the end of October to the beginning of December, it rose from 25,000 to nearly 50,000, and this time it rose from 50,000 to 100,000, doubling the increase. After two rises, there were significant pullbacks and consolidations, and there were cases of false falls and takeoffs in early January. When the ETF was approved in mid-January last year, Bitcoin hit a new high, and the inauguration of Trump may also become an opportunity for the price of Bitcoin to rise. However, historical experience shows that after a significant rise, Bitcoin may experience a similar pullback to last year, which was 20% last year and lasted for about two weeks. Investors need to be vigilant about the same situation this time.

From a more macroscopic market cycle perspective, the price fluctuations of Bitcoin are often closely related to the overall supply and demand of the market, investor sentiment, and changes in the macroeconomic environment. The Trump coin issuance incident undoubtedly exacerbates market uncertainty, making the factors affecting the price trend of Bitcoin more complex. On the one hand, Trump’s supportive attitude may attract more long-term investors to enter the market. They are optimistic about the potential value of Bitcoin in the future economic pattern and regard it as a long-term value storage means, thus providing stable support for the price of Bitcoin. On the other hand, short-term speculators may follow the trend and speculate on Bitcoin due to the popularity of TRUMP coin, exacerbating the short-term fluctuations of Bitcoin price.

In the coming period of time, the price trend of Bitcoin will also be affected by the global economic situation. If the global economic recovery is good and investors’ risk appetite increases, funds may flow to more potential emerging asset areas, and Bitcoin is expected to benefit from it. Conversely, if the global economy faces downward pressure, investors may turn to more traditional safe-haven assets, and the price trend of Bitcoin may face certain pressure.

Impact on Investors - What Should Investors Do?

The high volatility and speculative nature of TRUMP coin pose huge risks to investors. Meme coin usually lacks actual value support, and its price trend often does not depend on the fundamentals of the project itself, but is highly susceptible to market sentiment. As a type of Meme coin, TRUMP coin is highly likely to experience a sharp drop in price once the market heat subsides after achieving a surge with the influence of Trump. In the trading of TRUMP coin, many investors are tempted by short-term high returns and blindly follow the trend with the mentality of making a profit and running away. However, this speculative behavior often ignores market risks. Once the market turns and prices fall rapidly, these investors are likely to be deeply trapped due to their inability to sell their TRUMP coins in a timely manner, resulting in a significant reduction in funds.

In addition, the overall market volatility caused by Trump’s currency issuance has greatly increased the difficulty of investment decisions. In this turbulent market environment, it is difficult for investors to accurately judge market trends. Various information in the market is mixed with good and bad, and it is difficult to distinguish between true and false. Investors may make wrong investment decisions due to misjudging the market situation, resulting in losses.

Therefore, if investors have made a profit in this wave of market, they must learn to exit in time before the risk comes to protect their profits. However, there is another issue that is easily overlooked If you have already made a lot of money on paper, the next step is how to “legally” convert this digital wealth into disposable real money? Many people have had their bank cards frozen and their funds cannot be withdrawn due to the use of insecure C2C channels for withdrawals.

Don’t worry, that’s why you need an effective withdrawal channel - this is where the multi-asset trading wallet BiyaPay comes in. As one of the safest withdrawal platforms currently available, BiyaPay provides a smooth path for your USDT legal withdrawal. The specific operation plan is actually not difficult.

First, transfer the USDT from the exchange to BiyaPay.

Then exchange 1:1 in BiyaPay for USD or other fiat currency.

Then withdraw these funds to Internationalization bank accounts such as Wise or OCBC.

Finally, these legitimate accounts will transfer the funds back to domestic bank cards, Alipay or WeChat.

Yes, there will be certain handling fees and exchange rate losses during this process, but this is precisely the “compliance toll” from intangible to tangible, from digital assets to real fiat currency. After learning this compliance withdrawal path, your ROI can be considered truly stable, and you no longer have to worry about currency exchange and fund security issues. You should know that in this thrilling crypto world, only those who can safely cash out the earned money can be considered real winners.

Of course, for keen and prepared investors, market fluctuations also bring opportunities. For example, in Solana-related investments, investors who laid out in advance have gained substantial profits due to Solana’s upgrade and potential benefits. Events such as Solana’s FireDancer upgrade and Trump’s issuance of coins on the Sol chain have created profit opportunities for investors. If investors can accurately grasp the market trend and bottom fish reasonably during the Bitcoin pullback, they are also expected to profit from the subsequent rise. When the Bitcoin price fell to 89,000, I suggested that everyone firmly bottom fishing and hold on, and then Bitcoin rose to 90,000 8, steadily gaining a profit of 10,000 points. This shows that as long as investors have keen market insight and decisive decision-making ability, they can seize opportunities in market fluctuations.

In addition, with the continuous development of the crypto market, compliant high-quality projects may have more investment value due to improved regulation. In a strictly regulated environment, projects that focus on technological innovation and have practical application scenarios can highlight their advantages. These projects usually have stable technical teams, clear development plans, and good market reputation, which can better adapt to regulatory requirements and bring stable returns to investors. If investors can conduct in-depth research on the market and explore such projects, they will gain long-term benefits. For example, some blockchain projects that are committed to solving practical financial problems and improving transaction efficiency can develop in a standardized manner under the guidance of regulatory policies, gradually becoming mainstream investment targets in the market and creating sustained wealth growth for investors.

Summary

The turmoil in the cryptocurrency market caused by Trump’s public issuance of coins has brought unprecedented investment opportunities as well as huge risks. Investors need to remain rational, conduct in-depth research on the market, pay attention to policy dynamics, and allocate assets reasonably in order to steadily move forward in the complex and ever-changing cryptocurrency market. Before making investment decisions, investors should fully understand the background, technical strength, market prospects and other factors of the project, and combine their own risk tolerance and investment goals to develop a scientific and reasonable investment plan. Only in this way can they seize opportunities to achieve wealth appreciation in the cryptocurrency market wave, effectively prevent risks, and protect their own asset security.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.