- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why Choose M Lhuillier Remittance Service? A Fast, Secure, and Economical Option for International Transfers

In today’s globalized world, international remittance has become an indispensable part of people’s daily lives. Whether it’s sending money to relatives and friends or paying cross - border bills, choosing a remittance platform that is fast, secure, and cost - effective is of great importance. M Lhuillierr remittance service, with its efficient fund transfer, low remittance fees, and user - friendly platform design, has become the first choice for many users.

This article will delve into the advantages of M Lhuillier to help you better understand how it provides convenient remittance and payment services for users.

How Does M Lhuillier Remittance Service Provide Fast and Secure Fund Transfers?

M Lhuillierr remittance service has won the trust of users with its efficient and rapid fund transfers. Compared with many traditional bank remittance methods, remittances provided by M Lhuillier can usually be completed within a few minutes, and users can easily withdraw funds. This service is especially suitable for those in urgent need of funds. For example, when remitting money to family members or paying bills quickly, the convenience and speed offered by M Lhuillier are undoubtedly a major advantage.

In terms of security, M Lhuillier’s remittance system protects users’ funds and personal information through multiple encryption technologies. All transactions are monitored in real - time by a professional team to ensure that every link in the remittance process meets security standards. At the same time, M Lhuillier also provides real - time remittance tracking services, allowing users to know the transfer status of funds at any time and ensuring that the funds arrive safely.

Whether you remit through M Lhuillier’s physical outlets or use its online platform for transfer, you can experience a convenient and secure fund transfer service. The platform supports multiple payment methods to meet the needs of different users, providing you with more diverse options for international remittances.

What about the Fees of M Lhuillier Remittance Service? Whose Needs Does It Suit?

M Lhuillier sets reasonable remittance fees, which are especially suitable for users who pursue cost - effectiveness. Compared with the remittance fees of some other traditional banks, M Lhuillier’s fees are lower, making it the first choice for many people to conduct international remittances. Users can remit funds to different countries and regions through M Lhuillier at a lower cost without incurring an economic burden due to high handling fees.

For people who often need to remit, M Lhuillier also provides some preferential measures. Users can choose a fee plan that suits them according to their own needs, and these plans usually offer high cost - performance. M Lhuillier also provides discounts and loyalty rewards for some long - term customers, such as reducing transaction fees or providing additional bonus points.

It should be noted that although M Lhuillier’s international remittance fees are low, different payment methods and remittance destinations may affect the fees. For example, the handling fees in some regions may be slightly higher, and some payment methods may require an additional payment of certain handling fees. Overall, the low - fee service provided by M Lhuillier makes it stand out among many international remittance platforms.

How to Easily Pay Bills through M Lhuillier?

In addition to remittance, M Lhuillier also provides users with a convenient bill - paying service. Customers can use M Lhuillier to pay various daily living expenses such as utility bills, phone bills, and credit card bills. M Lhuillier supports multiple payment methods, including cash payment and bank card payment, and customers can choose the most suitable method according to their needs.

When using M Lhuillier to pay bills, users only need to provide the relevant bills and necessary information, and the system will automatically process and confirm the transaction. Paying bills through M Lhuillier is not only time - saving and labor - saving but also simple to operate. Users don’t need to worry about complex payment processes. M Lhuillier also provides a text message notification service to ensure that users receive confirmation information as soon as they pay the bill, which is convenient for tracking and managing transactions.

M Lhuillier’s bill - paying service is especially suitable for busy modern people, especially those who often need to pay cross - border bills. Through M Lhuillier, users can easily handle bill - related matters worldwide, without having to queue up. They can complete the payment directly through the online platform or physical outlets, greatly improving the efficiency of life.

What Are the Usage Requirements of M Lhuillier Remittance Service?

Like many remittance platforms, M Lhuillier remittance service requires users to be over 18 years old and provide valid identification. To ensure the legality and security of remittance transactions, M Lhuillier will require users to provide identification documents such as passports, identity cards, or other legal certificates when using its services. This measure helps prevent fraud and improper behavior, thus safeguarding the security of users’ funds.

In addition, M Lhuillier has launched special offers and reward programs for loyal customers. Through this program, users who have used M Lhuillier for a long time can enjoy transaction fee discounts and even have the opportunity to apply for a credit card provided by M Lhuillier. These reward measures not only enhance the customer’s usage experience but also increase user loyalty, bringing more benefits to them.

What Are the Transaction Limits and Document Requirements of M Lhuillier?

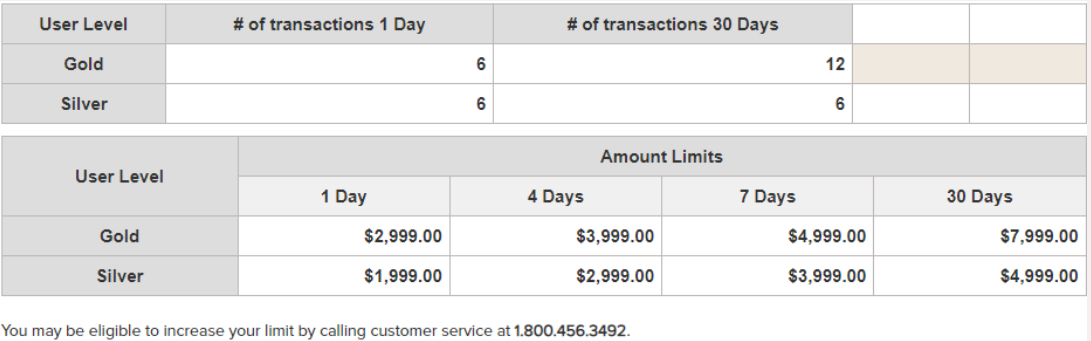

The amount of each M Lhuillier remittance is subject to certain limits. Depending on different payment methods and your account type, the remittance limits are as shown in the figure.

For small - value remittances, users can complete the transfer very conveniently. For larger - value remittances, more supporting documents may be required.

Especially for international remittances, users need to submit some additional documents, such as proof of identity, proof of source of income, etc., to ensure the smooth progress of the remittance. These additional document requirements are to ensure the security and compliance of the transaction and avoid the occurrence of money laundering and other illegal activities. Therefore, when making large - value remittances, users should prepare the relevant documents in advance to ensure that the remittance can be completed smoothly.

How Does M Lhuillier Ensure the Security of Remittance Service?

The security of M Lhuillier has always been one of the most valued aspects by its users. To ensure the security of each transaction, M Lhuillier has taken strict security measures, including data encryption technology, real - time transaction monitoring, and full - process supervision by a professional team. Users’ personal information and funds are protected by multiple layers to ensure that no information is leaked.

In addition, every transaction of M Lhuillier is recorded in detail, and users can track the status of fund transfers in real - time through the platform. This not only improves the transparency of the transaction but also allows users to keep track of the funds’ dynamics throughout the remittance process, ensuring the safety of funds.

M Lhuillier also has a 24 - hour customer service, and users can seek help through the phone or online platform when they encounter any problems. Whether it’s a question about remittance or other issues, M Lhuillier can provide timely and effective assistance to ensure the user experience.

Conclusion

Overall, M Lhuillier remittance service, with its fast, secure, and low - cost features, has become a preferred platform for many people when making cross - border remittances and paying bills. Its secure and reliable remittance system, convenient bill - paying methods, and flexible remittance limits have enabled it to occupy an important position in the market.

Whether you are making daily remittances, paying bills, or need to make large - value transfers, M Lhuillier can provide you with an ideal service. And if you are looking for a more efficient and flexible remittance method, BiyaPay’s remittance function without limit, as well as its local remittance service covering most countries and regions in the world, will bring you more choices and convenience for fund transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.