- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Amazon 2025: How to achieve new heights through the dual engines of Cloud Service and Retail?

Amazon performed quite well in 2024, with its stock price soaring by 45%. You should know that this is a company with a market value of $2.30 trillion, and it is not easy to stand out in the overall environment. Behind this surge in 2024, it cannot be separated from the dual promotion of US GDP growth and Cloud Service transformation. Especially AWS, its growth momentum is getting stronger and has become an important engine supporting the company’s overall performance.

However, despite the astonishing stock price increase this year, we may see more moderate growth in 2025. The expected stock price will fluctuate between 15% and 30%, with a year-end target of around $270. Although the growth rate is not as crazy, it is still an opportunity worth paying attention to from a long-term investment perspective. Next, we will talk about Amazon’s core business and see how it continues to improve revenue and profitability.

Revenue and profitability capacity enhancement: Amazon’s core business

As soon as the Q3 2024 financial report was released, Amazon’s performance was impressive. The company’s total revenue reached $158.90 billion, with an annual growth rate of 11%. This is quite impressive for a company with a market value of $2.30 trillion, especially as both retail and Cloud Service businesses are steadily advancing. Although the growth rate of the retail business has relatively slowed down, AWS’s continued expansion, especially its strong performance in high-margin areas, has provided strong profit support for Amazon.

Speaking of AWS, it is undoubtedly Amazon’s golden egg. In Q3 2024, AWS’s revenue increased by 19% YoY, continuing to be Amazon’s profit core. As more and more companies begin to migrate their businesses to the cloud, AWS has considerable potential for market share and profit margins. In terms of retail business, Amazon has significantly improved Operational Efficiency by optimizing logistics and reducing unnecessary capital expenditures. The performance in the North American market is particularly outstanding, with the operating profit margin of the North American retail department reaching a historical high of 6%, an increase of 2 percentage points compared to last year. These optimization measures and scale effects not only make Amazon’s retail business more efficient, but also lay a solid foundation for future profit growth.

The synergy effect of AWS and retail business

Speaking of Amazon, the synergy effect between AWS and retail business is a highlight that cannot be ignored. Although AWS is Amazon’s high-margin business, its collaboration with retail business is far more than that. With the continuous deepening of AI and Cloud Service technologies, AWS not only helps Amazon improve its own Operational Efficiency, but also promotes digital transformation in various industries worldwide. When enterprises use AWS, they usually pair it with smarter Data Analysis and Machine Learning tools, which in turn drives the demand for more Cloud as a Service from Amazon. It can be said that the growth of AWS is not only independent development, but also forms a virtuous cycle with retail business to some extent.

In terms of retail business, Amazon is further improving cost-effectiveness by reducing capital expenditures and optimizing warehousing. In the past few years, Amazon has invested heavily in logistics and warehousing, especially in North America and international markets. However, as the retail market gradually becomes saturated, Amazon has begun to focus on how to reduce expenses through efficiency improvements, especially in warehousing and logistics networks. For example, while reducing warehouse expansion, Amazon has also strengthened the automation level of existing warehouses. As a result, although new investments have decreased, Operational Efficiency has greatly improved, further enhancing the profitability of the retail business.

In the coming years, as these optimization measures continue to advance, we have reason to believe that Amazon’s retail business will continue to grow, especially in North America and some international markets. Coupled with the strong growth of AWS and the support of AI technology, Amazon’s overall revenue and profits have stronger upward potential.

Amazon’s long-term growth potential

Looking to the future, Amazon still has huge growth potential. Although it may face a more complex market environment in 2025, Amazon’s diversified business structure and increasingly optimized operating model make it still attractive in the coming years. Especially with the increasing uncertainty of the global economy, the Cloud Service and retail businesses that Amazon relies on will continue to be important sources of stable revenue.

Firstly, the growth prospects of AWS remain strong. As more and more enterprises turn to the cloud, AWS will not only continue to benefit from the expansion of the Cloud Service industry, but also gain more growth momentum from the combination of AI technology. Amazon is accelerating the application of its AI technology in AWS, especially in the deep integration of Machine Learning, Data Analysis and other fields, which will further enhance its competitiveness. In the next few years, AWS will no longer be just an “infrastructure provider”, but will become the core platform for more and more enterprises’ digital transformation.

Secondly, the optimization of Amazon’s retail business globally is also a key driving force. Although the growth space of the retail market is gradually decreasing, Amazon can still achieve stable profit growth in relatively mature markets by improving Operational Efficiency, reducing capital expenditures, and further automating warehousing. Especially in the North American market, with Amazon’s more refined operations, it is expected that its retail business will continue to contribute considerable revenue and profits in the coming years.

However, the biggest challenge Amazon may face in 2025 is the changing global economic environment, especially the high interest rate environment, which may put pressure on the valuation of growth-oriented companies. Nevertheless, Amazon’s strong business foundation and continuous innovation ability enable it to maintain relative resilience in market fluctuations.

Overall, although the stock market is facing uncertainty, Amazon is still a long-term growth stock worth paying attention to. With its continued development in Cloud Services, AI, and retail, it is expected that Amazon’s stock price will reach $270 by the end of 2025, demonstrating decent return potential.

Valuation analysis: The attractiveness of Amazon stock

Speaking of investment, valuation is undoubtedly one of the key factors determining whether it is worth buying a stock. Although Amazon’s stock price has experienced many fluctuations in recent years, it still has relative attractiveness from the current valuation. Especially compared to the historical valuation of the past 15 years, Amazon’s stock price seems to show signs of undervaluation in some aspects.

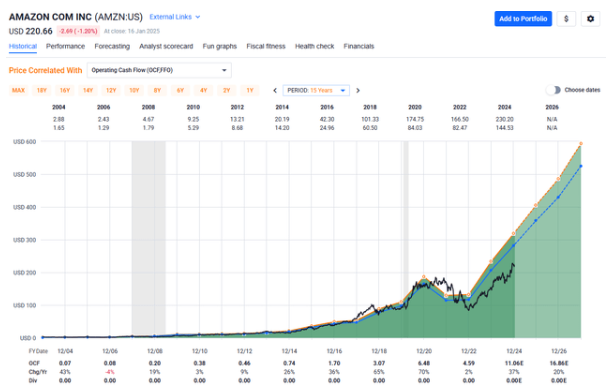

We can analyze it through the valuation model of price-to-operating cash flow ratio (P/OCF). P/OCF is an important indicator for measuring the health of a company’s cash flow, especially for expanding companies like Amazon. Unlike the traditional Price-to-Earnings Ratio (P/E), P/OCF focuses more on the company’s cash flow situation and can more accurately reflect the future profit potential of high-growth companies like Amazon.

According to the data, Amazon’s average P/OCF over the past 15 years has been about 25.5 times, while its current P/OCF is about 19.8 times. This means that compared to historical levels, Amazon’s stock price is currently at a discount of about 22%, which is a pretty good buying opportunity for long-term investors. Although the current P/OCF may still be higher than some traditional retail companies, this valuation is still attractive for a company that occupies a leading position in Cloud Services, AI, and global retail.

Furthermore, analysts predict that Amazon will continue to maintain strong cash flow growth in the next few years. According to market forecasts, Amazon’s operating cash flow is expected to grow by 27% in 2025, 20% in 2026, and 22% in 2027. Even if the growth slows down slightly, we can still see an annualized return of 25% in the next few years if we follow a conservative valuation range (i.e. P/OCF of 20-22 times). This is still very attractive for investors who hope to obtain sustained and stable returns.

Although Amazon’s current stock price is no longer as cheap as it was in 2022, it is still a stock worth holding from a long-term return perspective. Especially driven by efficient integration and innovation in the global retail and Cloud Service industries, Amazon will continue to create value for investors.

If you want to seize the investment opportunity in Amazon, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting transactions of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Investor Outlook: Reasons to Choose High-Quality Growth Stocks

In the current economic environment, with rising interest rates and sustained inflationary pressures, many investors may be concerned about the future performance of growth stocks. Especially for overvalued technology stocks, stock price volatility has increased in the face of interest rate hikes and high inflation. However, even so, Amazon is still a high-quality stock worth paying attention to.

Firstly, although we are facing a higher interest rate environment, Amazon’s business model and diversified revenue sources enable it to maintain strong competitiveness in such a macro environment. Amazon not only relies on US consumer spending, but also its AWS (Amazon Cloud as a Service) and international market expansion provide the company with huge growth potential. Especially with the combination of Cloud Service and artificial intelligence, AWS’s revenue growth and market share are expected to continue to rise, providing strong support for the company’s overall performance.

Secondly, Amazon’s financial situation is very stable. In the past few years, the company’s profitability has gradually increased, and its operating cash flow has steadily increased. This enables Amazon to continue to reinvest and innovate in the face of market pressure, driving more long-term growth. For example, Amazon is reducing capital expenditures in low-profit retail and increasing investment in high-margin AWS and advertising businesses. The optimized allocation of these resources will continue to improve the company’s overall efficiency and profitability.

Finally, from the perspective of investment return, despite facing higher interest rates and more intense market competition, Amazon still has very strong long-term growth potential. If the expected operating cash flow growth is achieved, Amazon is expected to achieve stable annualized returns in the next few years. Especially the deep integration of Cloud Service business and AI will bring new revenue growth points to Amazon, further driving its stock price up.

In summary, Amazon’s strong performance, stable financial situation, and innovative potential in Cloud Services and AI make it an ideal long-term investment target. Despite the challenging market environment, as the company continues to improve Operational Efficiency and expand market share, it is expected that Amazon’s stock price will reach $270 by the end of 2025. This is still a very attractive choice for investors seeking long-term stable growth.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.