- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Google Future Engine: Can AI and Cloud Services Drive the Next Wave of Growth?

In today’s rapidly changing technology industry, Google’s parent company Alphabet, as a global tech giant, has always been at the forefront of innovation, especially in fields such as AI and Cloud Services, demonstrating strong development potential. Faced with the rise of emerging competitors such as ChatGPT and the legal risks brought by Anti-Trust litigation, Google still maintains its competitive advantage in the global market with its stable market position and diversified revenue sources.

Since 2019, Google has risen by more than 196%. This achievement not only reflects the company’s continued growth in existing businesses, but also demonstrates its deep accumulation in future technology fields. By deeply laying out high-growth markets such as AI, autonomous driving, and Cloud Services, Google is accelerating its transformation and moving towards a more diversified future.

Google’s Competitive Analysis: How to Maintain Market Leadership

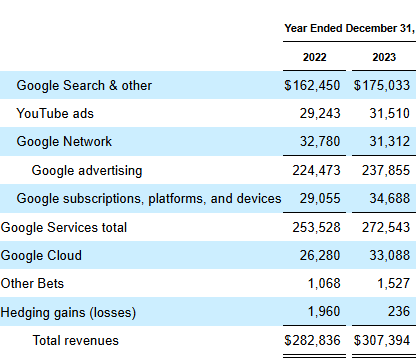

Google remains an undeniable giant in the global technology industry, especially in the search engine market. In the 2023 fiscal year, Google search contributed 56.94% of the company’s total revenue, continuing to be the leader in the global search engine market.

Despite facing pressure from emerging competitors, especially the rise of AI tools like ChatGPT, Google still firmly grasps the market dominance with its strong technological advantages and huge user base.

Google’s core competitiveness comes from its advanced search algorithms and strong technical accumulation. For example, PageRank and BERT algorithms continuously optimize search results, enabling Google to provide accurate and efficient information search services for global users. In addition to technology, Google’s unique user ecosystem is also a key factor in its competitiveness. Whether it is search on personal devices, intelligent assistants, or its extensive ad platforms and application services, Google maintains strong user stickiness through these channels, which in turn promotes its continued leadership in the search engine field.

Although AI tools like ChatGPT have shown strong competitiveness in some application scenarios, Google does not believe that they will replace its dominant position in the search engine market in the short term. On the contrary, Google has been integrating AI technology into its search engine to improve the relevance and intelligence of search results. For example, Google has used AI technology in search to provide more personalized recommendations and more accurate answers, further enhancing User Experience. With strong brand effect, technological innovation, and continuously improving Customer Satisfaction Score, Google will still have a place in future competition.

No matter what kind of market competition it faces, Google can maintain its leading position in the industry through continuous innovation and technological investment. With its absolute advantage in the search engine market, coupled with its layout in Cloud Services and artificial intelligence, Google’s long-term growth potential is still worth looking forward to.

Google’s Growth Engine: The Potential of AI and Cloud Services

Google’s future growth cannot be separated from its deep cultivation in the fields of artificial intelligence (AI) and Cloud Services. In the past few years, Google has invested a lot of resources in these two high-growth areas and made significant progress.

Firstly, investment in artificial intelligence has become the core driving force for Google’s future development. The company has invested about $100 billion in AI research and development, accounting for one-third of its total revenue in 2023. These investments are not only used to strengthen the intelligence of existing businesses, but also to expand into new business areas. Taking Waymo as an example, Google’s autonomous driving technology has made significant progress. Waymo is now one of the world’s leading unmanned taxi services and is expected to occupy a larger market share in the coming years. With the maturity of AI technology, Google’s application scenarios in multiple industries will become more and more extensive, driving further growth of the company’s overall business.

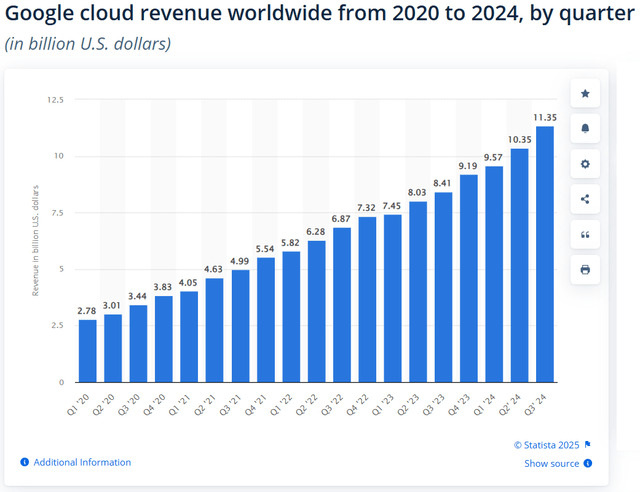

Besides AI, Google’s performance in the Cloud Service field is also remarkable. Google Cloud has become an important player in the global Cloud Service market. Since 2020, Google Cloud’s revenue has grown significantly, from $2.78 billion in Quarter 1 of 2020 to $11.35 billion in Q3 of 2024, showing strong growth momentum.

Cloud Service not only provides Google with a stable and highly profitable source of revenue, but also provides a solid foundation for the implementation of its AI technology. With the increasing demand for AI-driven solutions by enterprises, the market prospects of Google Cloud are very broad, and it is expected to continue to maintain high-speed growth in the coming years.

Combining AI and Cloud Service as two growth engines, Google can not only enhance its own technological competitiveness, but also achieve cross-industry expansion through innovative business models. This “dual-wheel drive” strategy will bring Google more diversified sources of revenue and put it in a favorable position in future competition.

From the current market trend, Google’s layout in the AI and Cloud Service fields will undoubtedly become a strong support for its future growth. With continuous technological innovation and expanding market demand, Google’s long-term development potential will become increasingly apparent.

Google’s valuation: stock price potential and market expectations

When analyzing Google’s future potential, valuation is an important factor that cannot be ignored. Although Google’s strong performance in multiple fields has provided it with sustained growth momentum, does its current stock price reflect these potentials? Through the analysis of valuation models, we can see that Google’s stock price still has some upward potential.

Using the modified Ben Graham model for valuation, Google’s intrinsic value is estimated to be $275, while the current stock price is about $197. This means that Google’s stock price is undervalued by about 42% relative to its actual value. This valuation is based on Google’s earnings per share of $7.98 in fiscal year 2024 and assumes an average annual growth rate of 16.5% over the next decade. Considering Google’s expansion potential in AI and Cloud Services and the market’s confidence in its long-term growth, this growth expectation is completely reasonable.

In addition, Google’s diversified revenue sources also provide solid support for its valuation. As the world’s largest ad platform, Google has created sustainable cash flow through various channels such as search engines, YouTube, and AD Network. Although the advertising market may face certain competitive pressures, Google’s huge user base and strong advertising technology will still bring stable revenue. At the same time, emerging businesses such as AI and Cloud Services are also constantly expanding, further enhancing Google’s revenue growth expectations.

It is worth noting that Google’s high cash reserves and low debt burden give it strong financial flexibility in dealing with economic fluctuations. Even in the face of Anti-Trust cases or other potential legal risks, Google can still maintain strong resilience, which provides strong support for its long-term development.

Overall, from a valuation perspective, Google’s stock price has significant potential for growth. Considering its leading position in multiple fields such as AI, Cloud Services, and advertising, Google’s stock price will gradually approach its intrinsic value in the coming years, providing sustained investment returns.

If you also have confidence in Google and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

With it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Risk factors: Anti-Trust cases and economic uncertainty

Although Google’s strong position in multiple areas provides a solid market foundation, there are still some latent risk factors to pay attention to, especially in the context of Anti-Trust litigation and changes in the macroeconomic environment.

Firstly, the Anti-Trust case is an undeniable challenge for Google. As the world’s largest search engine and ad platform, Google’s dominant position in the market has attracted high attention from regulatory agencies. In recent years, especially in the US and Europe, Google has frequently faced Anti-Trust investigations, accusing it of abusing its market position to exclude competition. Although Google has been working hard to deal with these lawsuits and has taken multiple compliance measures to mitigate legal risks, the progress of these cases is still uncertain and may bring pressure to the company’s reputation and operations.

However, Google’s strong financial position and diversified business provide support for its response to these risks. Firstly, Google has strong cash reserves and relatively low debt, which enables the company to maintain financial health in the face of potential legal proceedings or regulatory penalties. Secondly, Google’s revenue sources are not only dependent on advertising business, but the rapid growth of emerging businesses such as AI and Cloud Services further enhances its risk resistance. Even in the face of pressure on advertising revenue, Google is still able to diversify its revenue through other Lines of Business.

In addition to the Anti-Trust issue, changes in the macroeconomic environment are also a key factor affecting Google’s future performance. The uncertainty of the global economy, inflationary pressures, and possible interest rate hikes may all have an impact on corporate advertising spending, indirectly affecting Google’s revenue. Although Google has a large share of the global advertising market, economic fluctuations may still bring some short-term uncertainties.

Q4 2024 Financial Report Expectations: Behind Steady Growth

Looking ahead to Q4 2024, Google expects a strong growth quarter. According to the guidance provided by the company, total revenue is expected to reach approximately $87.71 billion, a year-on-year increase of 14.37%. This growth rate not only reflects the company’s solid performance in advertising business, but also demonstrates significant progress in high-growth areas such as AI and Cloud Services.

In particular, the performance of Google Cloud Service is highly anticipated. Since the launch of Google Cloud, its revenue has continued to rise, and as more and more enterprises turn to AI-driven solutions, Google Cloud’s growth momentum is expected to continue to be strong. It is expected that Google Cloud’s revenue will continue to grow by more than 30% in the fourth quarter of 2024, a growth rate far higher than the industry average, fully demonstrating Google Cloud’s competitiveness and wide range of application scenarios in the market.

In terms of advertising business, despite facing some external challenges such as economic uncertainty and intensified competition, Google still maintains a strong market share. With the recovery of global advertising market demand, Google’s advertising performance is expected to continue to expand, especially in search ads and YouTube ads. With its strong user base and precise advertising delivery technology, the growth prospects of advertising business are still optimistic.

In addition, Google is expected to achieve moderate growth in gross profit margin, net profit margin, and EBIT profit margin, further reflecting the improvement of the macroeconomic environment and the improvement of the company’s Operational Efficiency. Google’s profitability remains at the industry-leading level, thanks to its advanced technology platform, low operating costs, and strong growth in advertising and Cloud Service businesses.

Overall, Google’s Q4 financial report expectations show that the company can still maintain steady growth in multiple core areas, especially with the support of Cloud Services and advertising revenue, and the overall performance is expected to achieve good growth. This also provides confidence for investors, indicating that Google still has strong profitability and market competitiveness in the coming quarters.

Overall, Google still shows strong growth momentum with its leadership position in search engines, advertising, and Cloud Services. Despite facing certain market challenges, its continued investment in AI and technological innovation undoubtedly provides a solid foundation for future growth. Whether it is short-term financial performance or long-term strategic layout, Google maintains strong competitiveness.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.