- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

From GPUs to physical AI, how can NVIDIA seize future growth opportunities?

NVIDIA is not only the leader in the graphics card field, but also occupies an important position in a bunch of future technology fields such as artificial intelligence, robotics, and Cloud Services. It can be said to be a core player in the future trend. Although the current valuation of NVIDIA is not low, its potential is still very great from the perspective of long-term growth.

To put it simply, NVIDIA is not only “making graphics cards”, but also paving the way for the entire AI era. The development of fields such as AI, robotics, and autonomous driving cannot be separated from its technical support, which are the core technologies that almost all industries will rely on in the future. NVIDIA’s layout in these fields means that it has huge growth potential in the future.

Next, we will talk about how NVIDIA continues to drive its growth through technological innovation and industry leadership from several aspects. At the same time, we will also take a look at some of the challenges and risks it faces to help everyone clarify how far its future path is.

NVIDIA’s technological advantages and future growth potential

One of the core reasons why NVIDIA has achieved such rapid growth in just a few years is its strong technological advantage. In the past few years, with the explosive development of AI, NVIDIA has achieved undisputed leadership in the market with its GPU, especially in the fields of AI training and Deep learning. Whether it is large data centers, autonomous cars, or artificial intelligence applications, NVIDIA’s hardware has almost become the industry standard.

From the perspective of financial performance, NVIDIA’s gross profit margin and net profit margin have always maintained a high level in the industry, which directly reflects the strong competitiveness of its products and technologies. Specifically, NVIDIA has launched multiple market-leading GPUs through continuous product innovation, and gradually optimized its product structure, making high-end GPUs contribute most of the company’s profits. For example, NVIDIA’s high-end graphics cards are not only unparalleled in the gaming and professional creation fields, but also demonstrate their powerful computing capabilities in AI, data center and other fields, which is one of the reasons why NVIDIA can obtain high gross profit.

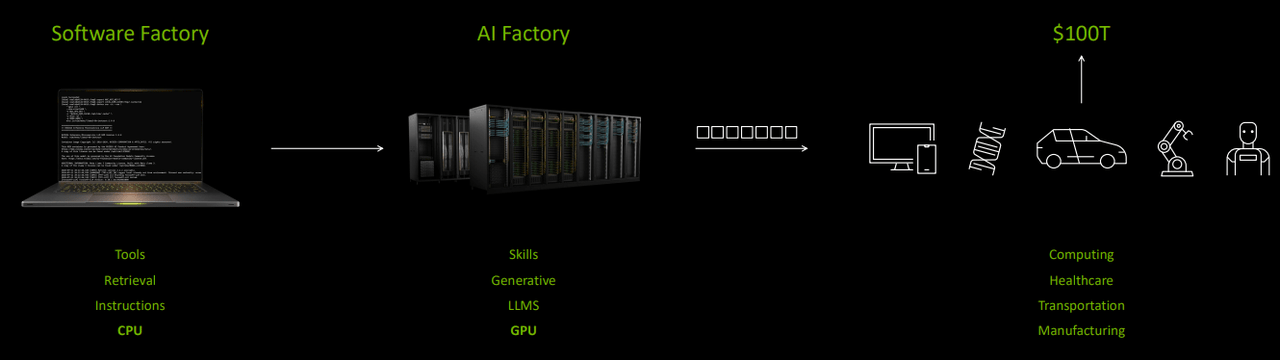

In addition, NVIDIA’s transformation has been quite successful, especially in terms of software revenue growth. In recent years, NVIDIA has not only relied on hardware, but also further expanded its revenue sources by launching AI software platforms (such as AI Enterprise) and other products. More importantly, NVIDIA’s market layout is not limited to traditional gaming and GPU businesses. It has targeted broader markets, such as healthcare, robotics, and industrial automation. According to NVIDIA’s strategic plan, the total market size of these areas is expected to reach $100 trillion, which provides huge potential for the company’s future growth.

If we look further ahead, NVIDIA is laying a solid foundation for future growth through technology and industry chain extension. Whether it is entering the medical field or promoting robotics technology, NVIDIA has strong technological accumulation and forward-looking layout. Especially in the AI field, NVIDIA’s products and technologies have become important infrastructure supporting the entire industry, so its share in these Emerging Markets will gradually increase in the future.

Physical AI: NVIDIA’s potential growth path

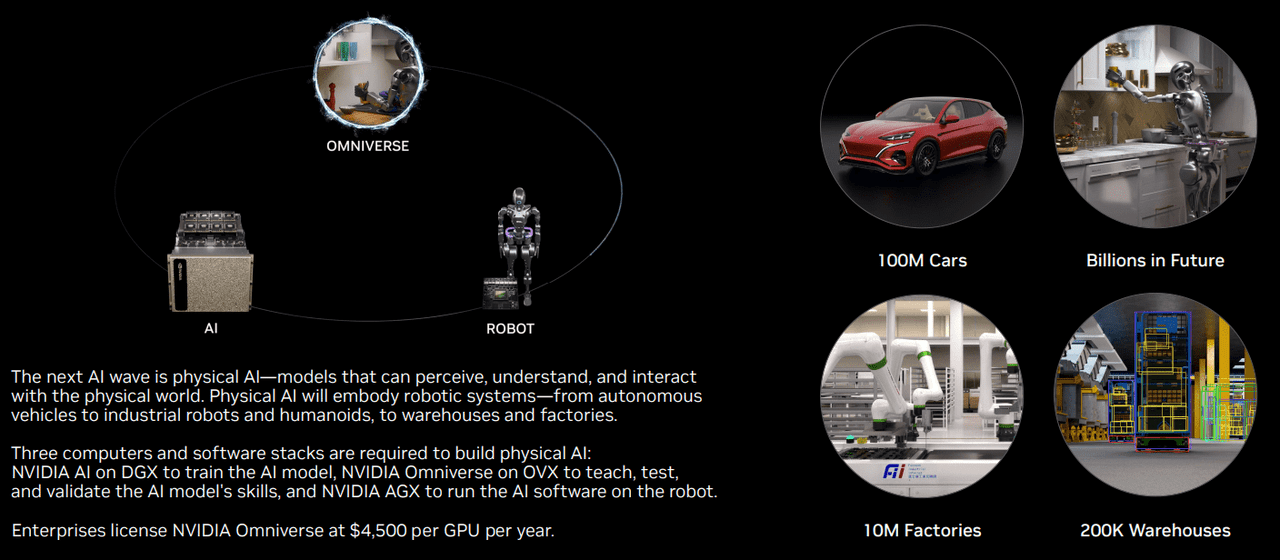

Speaking of physical AI, many people may feel unfamiliar with this concept, but simply put, it refers to the use of AI technology to promote the transformation of the physical world. For example, in fields such as robotics, autonomous driving, and logistics, the application of physical AI is gradually maturing. NVIDIA’s technical accumulation in this field is also very profound. It not only provides powerful hardware support, but also promotes the development of these applications through a series of software platforms.

NVIDIA’s high-performance GPU is the core of physical AI technology applications. For example, in the field of autonomous driving, NVIDIA’s Drive platform has been adopted by multiple car manufacturers, providing an autonomous driving computing platform and supporting AI training and inference. In the fields of robotics and logistics, NVIDIA’s Jetson module also plays an important role. The Jetson module can provide powerful computing power for various automation devices, enabling robots and automation systems to better perform complex tasks.

In addition, NVIDIA’s Omniverse platform also provides an important support for the application of physical AI. Omniverse is not only a tool for creating virtual worlds, but more importantly, it provides a platform for various industries to simulate the physical world and test AI applications. Through this platform, users can simulate various scenarios in the real world in a digital environment, conduct AI training and testing, which provides great help for the landing of AI applications in various industries.

From a longer-term perspective, the market for physical AI will become an important driving force for NVIDIA’s future growth. For example, with the gradual popularization of autonomous driving technology, NVIDIA’s technology will provide computing and data processing capabilities for millions of autonomous cars worldwide. In the field of robotics, as more companies begin to deploy automated production lines, NVIDIA’s hardware and software will help them achieve more efficient production and operations.

Therefore, from a market perspective, physical AI is not only a potential growth point for NVIDIA in the short term, but also a key area for the company’s long-term development. As these technologies gradually mature, NVIDIA’s share in the physical AI market may further expand, bringing sustainable growth momentum to the company.

Consumer GPUs and Data centers: Sustained market share

Although the growth of the Data Center business is crucial for NVIDIA, we cannot ignore the important position of consumer-grade GPUs in the company’s overall revenue. In fact, the demand for high-performance GPUs in fields such as gaming, professional creation, and personal workstations is still strong. Especially with the increasing requirements for 4K and 8K video editing and game graphics, the market for consumer-grade GPUs is still a promising field.

However, as NVIDIA increases its investment in the data center market, the contribution of consumer-grade GPUs to revenue has declined. Nevertheless, consumer-grade GPUs are still one of NVIDIA’s stable sources of revenue and profit, and with the continuous advancement of technology, there is still room for growth in demand for consumer-grade GPUs. Especially as AI technology gradually penetrates into personal workstations and creator tools, consumer-grade GPUs are not only exclusive tools for gamers, but also gradually becoming a part of data processing and AI training.

Speaking of the data center market, it is undoubtedly the most promising area for NVIDIA’s growth. In recent years, with the rapid development of AI, Cloud Services, and Big data, the demand for data center GPUs has increased significantly worldwide. Especially in the fields of AI computing and Deep learning, NVIDIA’s GPUs have almost become the industry standard, and behind all of this is the rapid expansion of the data center business.

According to market research, the data center GPU market is expected to grow at a rate of 28.5% per year, and with more and more large enterprises entering the field, NVIDIA’s position in it will become more and more solid. With its technological advantages in the GPU field, NVIDIA will continue to dominate this market, providing strong support for the company’s future growth.

Risk factors and challenges

Although NVIDIA’s future prospects are very bright, we cannot ignore the various risks and challenges it faces. Firstly, although Yingda’s business is diversified, it still highly relies on the growth of specific areas, such as AI and data center. If there are fluctuations in market demand in these areas, it may affect NVIDIA’s overall revenue. In addition, NVIDIA’s revenue also depends on a few large customers, so customer expense adjustments or strategic changes may also bring some uncertainty.

Another major challenge is the fierce competition faced by NVIDIA. Although NVIDIA is almost unmatched in the GPU field, its competitor AMD is increasing its technological innovation and market penetration, especially in the consumer GPU market. Although NVIDIA still maintains its lead in the high-end market, if AMD catches up in technology, it may affect NVIDIA’s market share and pricing power.

In addition, risks that cannot be ignored include global macroeconomic uncertainty, policy changes, supply chain issues, and geopolitics. These factors will have potential impacts on NVIDIA’s operations and performance. For example, a global economic slowdown may affect investment in AI infrastructure, or semiconductor shortages in the supply chain may put pressure on NVIDIA.

NVIDIA’s return on investment and potential upside potential

Although NVIDIA’s valuation is already high, it still has considerable upside potential. Firstly, NVIDIA maintains strong financial performance, especially high gross and net profit margins, indicating that the company not only leads in technology, but also has strong profitability. With the diversification of business structure, especially the increase in software and service revenue, the company’s adaptability to market fluctuations has increased.

NVIDIA’s market share in AI, Cloud Services, and Data centers continues to expand. With the further development of AI technology, NVIDIA’s hardware and platform solutions will play a core role in multiple industries, bringing sustained revenue growth. Especially in the fields of AI and autonomous driving, NVIDIA is expected to continue to maintain its leading advantage and benefit from it.

Despite the intensifying market competition, NVIDIA still has great growth potential considering its leading position in multiple technology fields, especially against the backdrop of increasing global demand for high-performance computing.

If you are also optimistic about NVIDIA and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting US and Hong Kong stock and digital currency transactions.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Overall, NVIDIA is still a company worth long-term attention. Although the current stock price valuation is high, the company’s technological advantages in fields such as AI and data center, as well as its broad prospects in the future technology field, make it have strong long-term growth potential.

NVIDIA’s technological advantages and market leadership make it an ideal choice for participating in cutting-edge technology investments. Despite some external risks such as market fluctuations and policy changes, NVIDIA remains an attractive investment target in the long run.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.