- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

500 billion Stargate plan: Can Oracle achieve new breakthroughs with this project?

Recently, Trump announced a shocking news - the official launch of the Stargate AI infrastructure project. The launch of this project is not only a major step for the US government to promote the development of AI technology, but also has led to a surge in Oracle’s stock. The Stargate project brings together tech giants such as OpenAI, SoftBank, Oracle, and MGX, with the goal of maintaining the US’s leading position in the global AI competition.

If you pay attention to Oracle’s stock market performance, the recent rise is not surprising. Behind all of this is the impact brought by the Stargate project. As one of the important participants in the project, Oracle’s role is becoming more prominent. This is not only a cooperation of technology and resources, but also an important layout of Oracle in the field of Cloud Services and AI infrastructure. Whether it is capital investment, data center construction, or expansion in future AI applications, Stargate will become a key opportunity for Oracle to seize market share and enhance brand influence.

Stargate Project Overview: The “Super Alliance” of US AI Infrastructure

The release of the Stargate project is undoubtedly an important milestone in US AI infrastructure investment. This is not just an ordinary cooperation, but an unprecedented cross-border and cross-industry “super alliance”. The four-party alliance composed of OpenAI, SoftBank, Oracle, and MGX intends to jointly build an infrastructure platform that can compete with the development of AI in countries such as China.

We need to know that AI technology is rapidly changing the world. Whoever can gain an advantage in this global competition will dominate the future wave of technological innovation. The core goal of the Stargate project is to ensure that the US always stays one step ahead in this competition. This is not only about technology and market share, but also about reshaping the global technology competition landscape.

This is also one of the reasons why Oracle participated in the Stargate project. Through cooperation with OpenAI and SoftBank, Oracle can not only gain more voice over in the Cloud Service and AI infrastructure fields, but also take this opportunity to further enhance its competitiveness in the global market. Especially with the rapid development of AI technology, Oracle is striving to occupy a place in this rapidly growing field through the Stargate project.

Oracle’s role in Stargate: a huge investment opportunity

In the Stargate project, Oracle’s role is crucial. Although Oracle’s equity stake investment is relatively small, far less than SoftBank and OpenAI’s investment, as a partner in this project, it will still have a huge strategic opportunity. Oracle’s investment is $7 billion, although this amount is relatively low, considering the overall scale of the project, this investment provides Oracle with a unique opportunity to expand in the AI infrastructure field.

One of the cores of Stargate is to build a large number of data centers in the next few years. It is reported that Oracle will be responsible for the construction of 10 data centers, which may increase to 20 in the future. Data centers are not only the infrastructure that supports AI computing, but also the core platform for Oracle’s future business expansion. These facilities will help Oracle enhance its competitiveness in the Cloud Service infrastructure field, especially to gain a larger share in the IaaS market.

Oracle’s advantages are not only reflected in capital investment, but also in its rich experience in Cloud Service and Data center construction. As one of the world’s leading Cloud as a Service providers, Oracle has strong technical and operational capabilities, which is one of the key reasons why the Stargate project chose Oracle as a partner. By participating in the Stargate project, Oracle can not only establish a foothold in the AI field, but also take this opportunity to further enhance its brand influence and help it better compete with other competitors such as Amazon AWS and Microsoft Azure in the global market.

Stargate’s Funding and Risk: Challenges and Opportunities

The Stargate project is undoubtedly a heavyweight investment in the Cloud Service field, attracting top investors such as SoftBank, OpenAI, and Oracle. However, with large-scale capital investment, Stargate also faces significant risks and challenges. The funds injected by SoftBank and OpenAI have provided initial growth momentum for Stargate, but ensuring that investment translates into sustained profitability remains a key challenge for the future.

SoftBank, as a globally renowned investment giant, has provided strong support for Stargate with its strong capital strength and global layout. OpenAI, as a leading artificial intelligence company, also contributes greatly to Stargate’s technological innovation and market influence. However, the injection of funds has also brought market return pressure. How Stargate converts these capital investments into actual profits will be the key to its long-term success.

Compared to this, Oracle has adopted a more cautious strategy in capital investment. Although Oracle plays an important role in Stargate, it avoids excessive reliance on external funds through relatively conservative fundraising methods. This not only ensures Oracle’s financial health, but also ensures its control in the project, demonstrating its mature fund management strategy.

In terms of fundraising, Stargate not only relies on equity stake financing, but also adopts debt financing. This strategy can avoid diluting Shareholders’ Equity, but it also means that Stargate needs to bear certain repayment pressure. How to balance debt financing and equity stake financing will be the key to future development.

In addition, Stargate is actively seeking other partners to enhance its financial strength. The addition of potential investors such as Qatar Investment Authority and JPMorgan Chase will further expand its funding sources and help Stargate expand its influence in the global market. Through flexible financing methods and strategic cooperation, Stargate is expected to occupy a place in the fiercely competitive Cloud Service market.

Overall, Stargate’s funding and risk coexist. Despite strong financial support, how to balance risk and return under pressure will determine whether it can achieve long-term stable growth.

Oracle’s Differentiation from Competitors: Positioning in the IaaS Market

In the Cloud Service market, there are significant differences in strategies between Oracle and competitors such as Microsoft. Especially in the IaaS field, Oracle has demonstrated a competitive advantage different from other companies through its unique Market Positioning, driving its future growth.

The strategic differences between Oracle and Microsoft in AI and Cloud Services are particularly prominent. Microsoft’s Azure platform focuses on comprehensiveness, aiming to provide a wide range of Cloud as a Service through deep integration of AI technology to meet the diverse needs of different enterprises. Microsoft’s strategy focuses on large-scale service integration and flexibility to capture more application scenarios in the market. Oracle, on the other hand, focuses on providing customized solutions for enterprises, especially in the IaaS field. Oracle does not simply pursue the diversification of Cloud as a Service, but focuses on using its powerful database technology and enterprise-level software to help customers efficiently manage infrastructure. This gives Oracle a unique advantage in high performance and enterprise-level data processing, in sharp contrast to Microsoft’s extensive layout.

In the IaaS field, Oracle’s focus is considered the key to its future growth. IaaS provides basic services such as computing, storage, and networking, and is a core component of Cloud Services. Oracle has established a competitive advantage in this field with its powerful database and data management technology. Compared with AWS and Azure, Oracle’s leading position in database technology enables its IaaS services to better meet the needs of enterprises that need to process large amounts of data. More importantly, Oracle has significant advantages in cost control, making its services both efficient and effectively helping enterprises reduce operating costs by optimizing architecture and flexible pricing models. Especially for enterprises in industries such as finance, healthcare, and retail, Oracle’s services have become an important choice when facing complex data processing and high-performance computing needs.

Therefore, by focusing on the IaaS field, Oracle not only occupies a unique position in the Cloud Service market, but also lays a solid foundation for its future growth. By further strengthening its technological advantages and focusing on the enterprise market, Oracle is expected to gain a larger market share in the coming years.

Overall, Oracle has great potential for growth. If you are also optimistic about Oracle and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Oracle’s financial condition and market valuation: opportunities provided by undervaluation

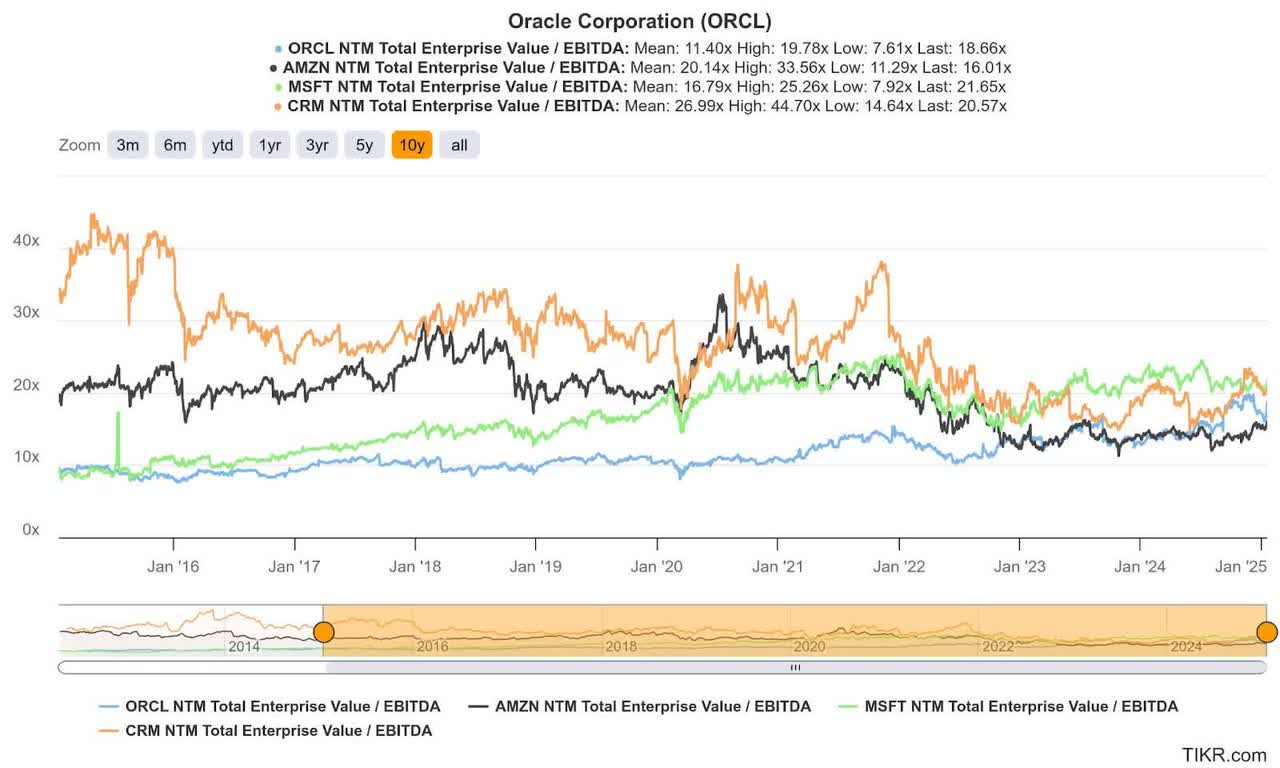

Oracle’s financial situation and market valuation have always been the focus of investors’ attention, especially in the current stock market environment. Oracle’s undervaluation provides unique opportunities for investors. Compared with competitors such as Microsoft and Salesforce, Oracle’s valuation appears relatively low, which not only reveals the opportunity for its stock price to correct, but also implies the potential for future upside.

Currently, Oracle’s Price-To-Earnings Ratio is significantly lower than Microsoft and Salesforce, making its stock more attractive under similar growth expectations. Although Microsoft’s diversified layout in Cloud Services and AI and Salesforce’s strong position in the CRM market have brought them significant market valuation premiums, Oracle’s stock price reflects its unique corporate strategy and market positioning. Oracle’s undervaluation is partly due to investors’ cautious attitude towards its long-term growth potential, especially in competition with Microsoft and AWS, where Oracle has not shown the same broad market share as these companies. However, Oracle’s focus on efficient IaaS services and enterprise-level solutions provides important support for its future growth.

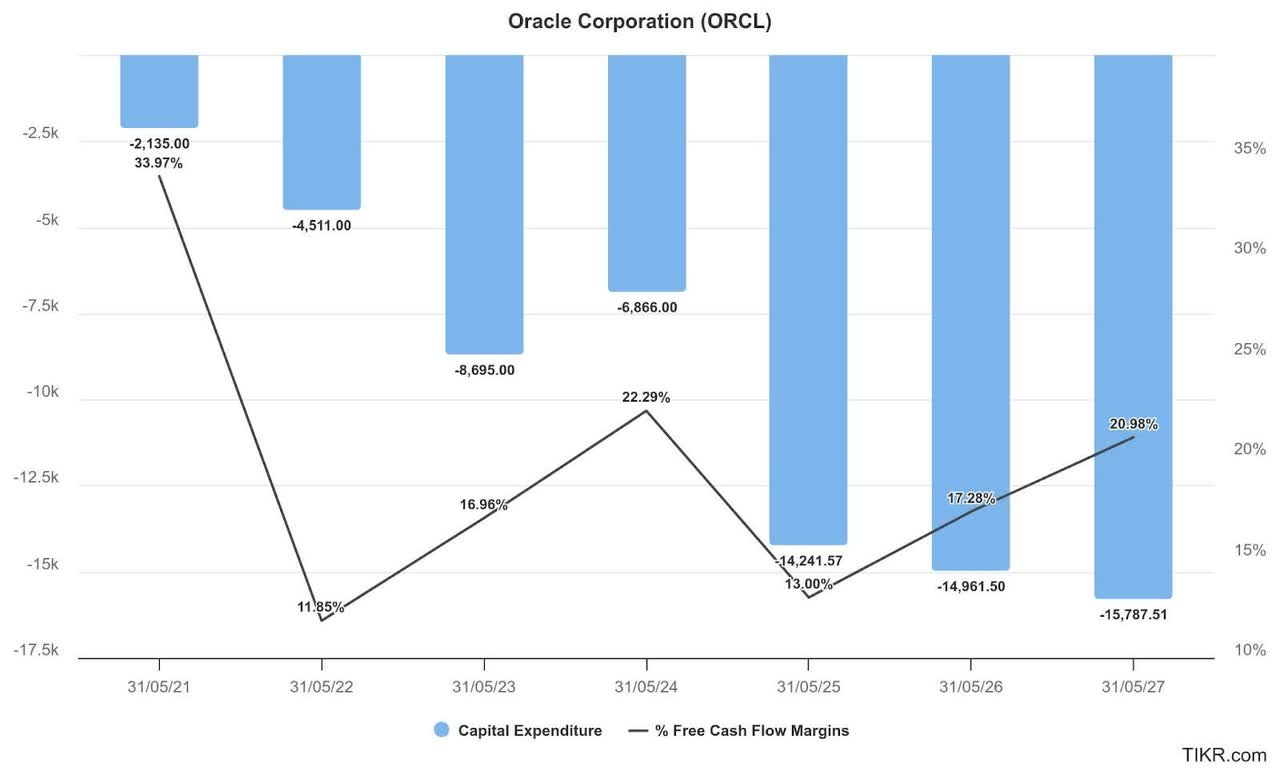

How should investors view the current stock price correction of Oracle? Firstly, the stock price correction of Oracle provides an opportunity for those who are optimistic about its long-term development to buy at a low price. Oracle’s unique positioning in the IaaS field and its powerful database technology have gradually increased its competitiveness in the Cloud Service market. With the increasing demand for data management by enterprises, Oracle is expected to experience strong performance growth. Secondly, Oracle’s financial condition is healthy, its cash flow is stable, and it performs well in debt management, which provides strong financial support for the company’s future investment and expansion. Therefore, although the stock price correction may make some investors worried, in the long run, Oracle’s fundamentals are still solid, and its future upward potential is worth paying attention to.

In summary, Oracle’s current undervaluation provides investors with a rare opportunity. Compared to Microsoft and Salesforce, although Oracle’s valuation is lower, its technological advantages and market positioning in specific areas give it strong momentum for future growth. Investors should pay attention to Oracle’s continued expansion in the Cloud Service and IaaS fields, seize investment opportunities after its stock price correction, and enjoy potential long-term returns.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.