- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Does Uber support prepaid card payments? What about other services?

Image Source: unsplash

When using Uber in mainland China, the option to use prepaid cards is not available. You can choose Uber gift cards or cash payments (only for Uber Xiaohuang) or use digital wallets. Uber’s common payment methods include Apple Pay, Google Pay, PIX, and UPI, as shown in the table below:

| Payment Method |

|---|

| Apple Pay |

| Google Pay |

| PIX |

| UPI |

When performing operations, you should pay attention to the applicable scope of payment methods and the platform’s latest policies to avoid payment failures affecting your travel experience.

Key Highlights

- Uber does not support prepaid card payments in mainland China, primarily accepting credit cards, debit cards, and digital wallets.

- When using Uber gift cards, you need to note their applicable scope and restrictions to ensure they are used in the correct country and currency.

- DiDi Chuxing in mainland China also does not support prepaid cards; it’s recommended to use mainstream local payment methods.

- In international markets, platforms like Lyft and Grab support prepaid cards, but you should be aware of their respective restrictions and requirements.

- When managing prepaid card balances, regularly check the card’s status and validity to avoid payment issues due to insufficient funds.

Uber’s Prepaid Card Policy

Image Source: unsplash

Payment Policy

When using Uber in mainland China, the option to use prepaid cards is not available. You cannot directly use prepaid cards to pay for trips. Uber primarily supports credit cards, debit cards, and digital wallets (such as Apple Pay and Google Pay). You can add these payment methods to your Uber Wallet for convenient daily travel. Uber’s prepaid card policy varies by country and region. In some markets like the U.S., you may find that certain prepaid cards can be linked, but in mainland China, the prepaid card support function is not available. When choosing payment methods, it’s recommended to prioritize credit or debit cards to avoid trip disruptions due to payment failures.

Gift Cards and Cash

You can choose Uber gift cards as a payment method. Uber gift cards are applicable in some countries and regions, but you need to note the following:

- Gift cards can only be used in countries that accept the same currency as the original issuance.

- Gift card amounts cannot be used for family profiles, scheduled trips, or university campus card trips.

- Other important restrictions apply to Uber gift cards.

When using Uber in mainland China, cash payments are only available for Uber Xiaohuang services. When using cash payments, you need to ensure the driver can provide change. The Uber Wallet feature can help you manage gift card balances and cash payment records. In the U.S. market, Uber gift cards have a broader applicable scope, but you still need to be aware of currency and regional restrictions.

Prepaid Card Restrictions

Uber’s prepaid card policy has several restrictions. You cannot use prepaid cards for the Instant Pay (instant withdrawal) feature. Uber does not set a minimum balance requirement for prepaid cards, but a fee is charged for withdrawals. You can refer to the table below for related restrictions:

| Evidence Type | Description |

|---|---|

| Prepaid Card Restrictions | Uber does not support prepaid cards for Instant Pay, and no minimum balance requirement is mentioned. |

| Transaction Fees | Uber charges a $0.85 fee for each withdrawal to a personal debit card, and frequent withdrawals can lead to accumulated fees. |

| Transaction Limits | Up to six Instant Pay transactions are allowed daily, with fees reaching up to $5.10 if the limit is reached. |

When linking payment methods, Uber’s support for prepaid cards is limited, and some services cannot use prepaid card balances. When using Uber gift cards, you also need to pay attention to their applicable scope and restrictions. In the U.S. market, some prepaid cards may support linking, but in mainland China, Uber’s prepaid card policy is relatively strict.

Other Ride-Sharing Services

Image Source: unsplash

DiDi Chuxing

When using DiDi Chuxing in mainland China, the platform primarily supports credit cards, debit cards, WeChat Pay, and Alipay. DiDi Chuxing in mainland China does not currently offer prepaid card payment options. If you use DiDi Chuxing in overseas markets like Mexico, you can choose prepaid cards as a payment method. When linking a prepaid card, you need to ensure the card has sufficient balance to avoid payment failures due to insufficient funds. DiDi Chuxing’s support for prepaid cards is limited, and it’s recommended to prioritize mainstream local payment methods.

Lyft

When using Lyft in the U.S. market, you can use prepaid cards through the Lyft Cash feature. Lyft Cash allows you to top up your account with a prepaid card balance for daily ride expenses. When using Lyft Cash, you need to note the following:

- Lyft Cash cannot be used for all fees. For example, membership fees, driver fees, gift cards, and fees outside the U.S. cannot be paid with Lyft Cash.

- You must always link a valid backup payment method (such as a credit or debit card) in case the prepaid card balance is insufficient.

- Lyft’s support for prepaid cards has certain restrictions, and some services cannot use prepaid card balances.

When performing operations, it’s recommended to regularly check your account balance to avoid travel disruptions due to insufficient funds.

Grab

When using Grab in Southeast Asian countries, you can choose prepaid cards as a payment method. Grab supports multiple payment methods, including credit cards, debit cards, digital wallets, and prepaid cards. When linking a prepaid card, you need to ensure the card information is valid. Grab’s support for prepaid cards is relatively broad, but some promotional activities or special services may not support prepaid card payments. When using Grab, it’s recommended to understand local payment policies in advance to ensure smooth payments.

Other Services

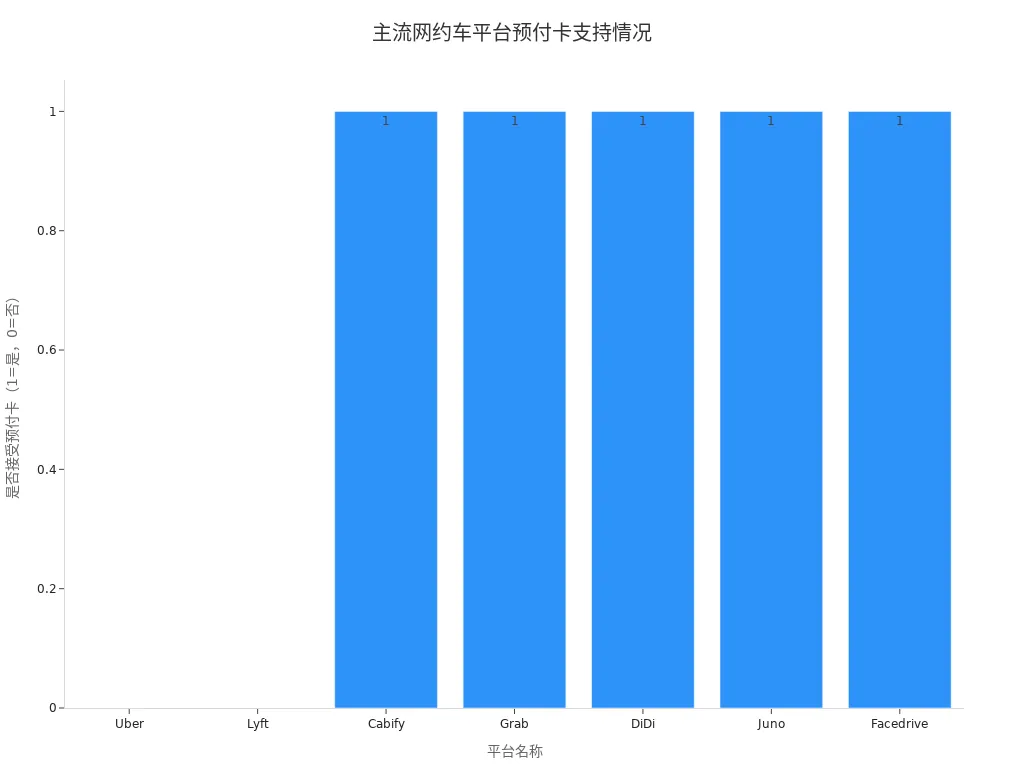

When choosing other ride-sharing services, you can refer to the table below to understand each platform’s support for prepaid cards:

| Platform | Accepts Prepaid Cards | Notes |

|---|---|---|

| Uber | No | Offers Uber Cash as an alternative |

| Lyft | No | Offers Lyft Cash as an alternative |

| Cabify | Yes | Available in multiple countries |

| Grab | Yes | Operates in Southeast Asia |

| DiDi | Yes | Available in multiple cities in Mexico |

| Juno | Yes | Operates in New York City |

| Facedrive | Yes | Provides services in Canada |

You can visually understand each major platform’s support for prepaid cards through the bar chart below:

When using prepaid cards for payment, some platforms may reserve funds for tips or additional fees, reducing the actual available balance. You should understand the platform’s specific policies in advance and manage your prepaid card balance reasonably. Uber’s prepaid card policy is relatively strict, and other platforms also have varying degrees of restrictions. When choosing payment methods, it’s recommended to prioritize credit or debit cards to ensure smooth payments.

E-Commerce Platforms

Mainstream E-Commerce

When shopping in mainland China, mainstream e-commerce platforms typically support multiple payment methods. You can choose Alipay, WeChat Pay, or UnionPay for checkout. These payment methods cover both online and offline scenarios, making daily shopping convenient. When using Alipay, you can experience a fast and secure payment process. WeChat Pay combines social and e-commerce functions, making shopping more convenient. UnionPay, as the national bank card network, is suitable for high-value purchases and cross-border transactions.

When shopping in mainland China, cash is rarely used anymore. Alipay and WeChat Pay have become the most popular choices. UnionPay still plays a significant role in traditional banking systems, providing the foundation for card and ATM transactions.

International E-Commerce

When shopping in the U.S. market, international e-commerce platforms like Amazon and eBay typically accept credit cards, debit cards, and some prepaid cards. When shopping on eBay, you can use a Visa gift card as a payment method. You simply select “Credit/Debit Card” at checkout and enter the card information. If the Visa gift card balance is insufficient, you can combine other payment methods to complete the transaction. When shopping on Amazon, some prepaid cards can also be used for checkout, but you need to pay attention to the platform’s specific policies. When using prepaid cards, it’s recommended to check the card balance in advance to avoid transaction failures due to insufficient funds.

Prepaid Card Restrictions

When shopping online, prepaid card usage has some common restrictions. You cannot use prepaid cards for subscriptions or free trial services, as these typically require recurring payments. When making large transactions, prepaid cards may not meet the demand. Most prepaid card providers set a maximum load value, and transactions exceeding this limit cannot be completed.

- Prepaid cards are not suitable for subscriptions and free trial services.

- Prepaid cards cannot complete large transactions exceeding the maximum load value.

When choosing payment methods, it’s recommended to prioritize credit or debit cards to ensure smooth transactions. When managing prepaid card balances, you should regularly check the card’s status to avoid shopping disruptions due to restrictions.

Food Delivery Services

Domestic Food Delivery

When using food delivery platforms in mainland China, platforms typically support multiple payment methods, including bank cards, digital wallets, and some prepaid cards. If you choose prepaid card payments, you need to pay attention to the platform’s specific requirements for prepaid cards. Some platforms require you to activate the card before use. You can only use prepaid cards to pay for orders placed on the platform, not for other purposes. You also need to ensure the card balance matches the order amount exactly; otherwise, the payment may fail. The table below summarizes common prepaid card usage restrictions:

| Requirement/Restriction | Description |

|---|---|

| Card Activation | Users must activate the prepaid card before use. |

| Usage Restriction | Can only be used to pay for platform orders. |

| Amount Restriction | Can only pay the exact order amount. |

When using a prepaid Visa card in the U.S. market, you can pay on all food delivery platforms that accept Visa debit cards, whether online or offline.

International Food Delivery

When ordering on international food delivery platforms, prepaid cards offer more flexibility. Virtual prepaid cards can simplify cross-border transactions, helping you avoid high fees and delays. By preloading funds, you can reduce additional costs due to exchange rate fluctuations. Prepaid cards also enhance payment security, reducing fraud risks. When managing subscriptions and recurring payments, you also gain more options. However, international platforms have some common restrictions for prepaid cards:

- Some prepaid cards may be rejected due to regional or currency restrictions.

- Certain prepaid cards are only allowed for use in the country of purchase, and international payments may fail.

- Currency mismatches can cause transactions to be blocked, such as when the card balance is in USD, but the order is settled in GBP.

When using international food delivery platforms, it’s recommended to check the card’s policies in advance to avoid payment failures.

Payment Considerations

When choosing prepaid cards to pay for food delivery orders, you should note the following:

- You need to ensure the card is activated and has sufficient balance.

- You should verify that the order amount matches the card balance to avoid payment failures due to insufficient funds.

- For cross-border payments, you need to pay attention to the platform’s currency and regional restrictions, as some platforms may not support international prepaid cards.

- You can prioritize credit or debit cards as backup payment methods to ensure smooth order completion.

Tip: When managing prepaid cards, it’s recommended to regularly check the balance and validity to avoid disruptions to your dining experience due to card expiration.

Streaming Services

Domestic Streaming

When using streaming services in mainland China, platforms typically support multiple payment methods. You can choose bank cards, digital wallets, or some prepaid cards for top-ups. Mainstream platforms like video, music, and reading apps support subscriptions through bank cards issued by licensed Hong Kong banks. When linking a prepaid card, you need to confirm the card is activated and has sufficient balance. Some platforms allow you to use prepaid cards to purchase short-term memberships, but long-term subscriptions may not support prepaid cards. During top-ups, the platform displays prices in USD, making it easy to understand actual expenses.

Tip: When using prepaid cards for payments, it’s recommended to check the platform’s policies in advance to avoid payment failures due to incompatible card types.

International Streaming

When using international streaming services in the U.S. market, platforms like Netflix, Spotify, and Disney+ typically accept credit cards, debit cards, and some prepaid cards. You can enter prepaid card information on the checkout page to complete subscriptions. Some platforms support virtual prepaid cards, enhancing payment security. When linking a prepaid card, you need to ensure the card balance exceeds the subscription fee. For example, Netflix’s standard subscription fee is USD 15.99/month. When using a prepaid card for payment, the platform automatically deducts the corresponding amount. Some international platforms have regional and currency restrictions for prepaid cards, so it’s recommended to understand the relevant policies in advance.

| Platform | Supports Prepaid Cards | Subscription Fee (USD/Month) |

|---|---|---|

| Netflix | Yes | 15.99 |

| Spotify | Yes | 10.99 |

| Disney+ | Yes | 13.99 |

Subscription Restrictions

When using prepaid cards to subscribe to streaming services, you need to note the following restrictions:

- Prepaid cards typically do not support automatic renewals. You need to manually top up or re-link the card each month.

- Some platforms require the card balance to exceed the subscription fee to avoid service interruptions due to insufficient funds.

- You cannot use prepaid cards to purchase family plans or premium memberships, as some features are exclusive to credit or debit card users.

- Prepaid cards are not applicable for free trials or first-month discount promotions, as platforms require a payment method that supports automatic deductions.

It’s recommended to carefully read the platform’s payment policies before subscribing and plan your prepaid card balance reasonably to ensure continuous access to streaming services.

Educational Apps

Domestic Educational Platforms

When using educational apps in mainland China, platforms typically support multiple payment methods. You can choose bank cards, digital wallets, or some prepaid cards for tuition and course payments. Many platforms allow you to top up using bank cards issued by licensed Hong Kong banks. When linking a prepaid card, you need to confirm the card is activated and has sufficient balance. Some educational platforms support tuition payments, but their support for prepaid cards is limited. During payments, the platform displays prices in USD, making it easy to understand actual expenses. The table below shows the payment methods for some educational platforms:

| Educational Platform | Payment Methods |

|---|---|

| Multiple International Educational Institutions | Support UnionPay mobile payment services |

| Over 5,000 Educational Providers | Support tuition payments |

When choosing payment methods, it’s recommended to prioritize bank cards or digital wallets to ensure smooth payments.

International Educational Platforms

When using international educational platforms in the U.S. market, platforms typically accept credit cards, debit cards, and some prepaid cards. You can enter prepaid card information on the checkout page to complete course purchases or tuition payments. Some international platforms support UnionPay mobile payment services, enhancing payment flexibility. When linking a prepaid card, you need to ensure the card balance exceeds the course fee. For example, some course fees are USD 99. When using a prepaid card for payment, the platform automatically deducts the corresponding amount. Some international platforms have regional and currency restrictions for prepaid cards, so it’s recommended to understand the relevant policies in advance.

Usage Recommendations

When making payments on educational apps, you should note the following:

- You need to ensure the prepaid card is activated and has sufficient balance.

- You should verify that the course or tuition amount matches the card balance to avoid payment failures due to insufficient funds.

- For cross-border payments, you need to pay attention to the platform’s currency and regional restrictions, as some platforms may not support international prepaid cards.

- You can prioritize bank cards or digital wallets as backup payment methods to ensure your learning plan proceeds smoothly.

Tip: When managing prepaid cards, it’s recommended to regularly check the balance and validity to avoid disruptions to your learning experience due to card expiration.

Prepaid Card FAQs

Tip Reservations

When using prepaid cards to pay restaurant bills, you often encounter tip reservation issues. Restaurants typically reserve an additional 20% of the bill amount. This amount is temporarily frozen in your prepaid card account and released after the tip is settled. If your card balance is insufficient, it may lead to payment failure. In the U.S. market, this temporary hold is especially common when using prepaid cards. The temporary hold period for prepaid cards is generally 1 to 8 days, sometimes longer, affecting your fund liquidity. When choosing payment methods, it’s recommended to understand the platform’s policies in advance. For example, Uber’s prepaid card policy has clear restrictions on tip reservations.

Balance Management

When using prepaid cards daily, managing your balance reasonably is crucial. You can check detailed transaction history anytime through mobile apps to understand each expense. You can also set real-time alerts to stay informed about account changes and avoid overspending. You need to be familiar with the prepaid card’s usage mechanism to ensure sufficient balance before each transaction. When using prepaid cards in mainland China, you should also regularly check the card’s validity and remaining balance to prevent payment disruptions due to insufficient funds.

Refunds and Security

When facing refund issues, the processing period for prepaid cards may be longer. Some platforms refund the amount to the card within 1 to 8 days. When requesting a refund, you need to keep transaction receipts for future reference. When using prepaid cards, you also need to pay attention to account security. You can avoid entering card information on insecure websites to prevent data leaks. When linking prepaid cards, it’s recommended to prioritize platforms with security certifications. When using prepaid cards in the U.S. market or mainland China, always pay attention to account security to protect personal funds.

When choosing payment methods, you should pay attention to each platform’s prepaid card support policies. Many services like Uber, Lyft, Amazon, and Netflix accept prepaid cards, but different platforms have restrictions. The table below summarizes key features:

| Platform/Feature | Supports Prepaid Cards | Fee Transparency | Fund Management | User Protection |

|---|---|---|---|---|

| Uber Pro Card | Yes | High | Strong | Strong |

| Lyft | Yes | High | Medium | Strong |

| Amazon | Yes | High | Medium | Strong |

| Netflix | Yes | High | Medium | Strong |

- You can improve fund management efficiency with prepaid cards and enjoy better fee transparency.

- When using prepaid cards, you need to regularly check the platform’s latest policies, ensure account security, and plan your balance reasonably.

FAQ

Can prepaid cards be used for automatic renewals?

You cannot use prepaid cards for automatic renewals. Most platforms require you to manually top up or re-link the card each month.

What should I do if a prepaid card payment fails?

You can first check the card balance and validity. Insufficient balance or an unactivated card can cause payment failures. You can contact the platform’s customer service for assistance.

How long is the refund period for prepaid cards?

You typically need to wait 1 to 8 days to receive a refund. The platform will return the refund amount to your prepaid card account.

Can prepaid cards be used for cross-border payments?

You can use prepaid cards on some international platforms. You need to pay attention to currency and regional restrictions, as some cards are limited to use in their country of issuance.

How do I manage prepaid card balances?

You can check your balance and transaction history anytime through mobile apps. It’s recommended to regularly check the card’s status to avoid payment disruptions due to insufficient balance.

In 2025’s projected $1+ trillion global mobility market, traditional ride-hailing platforms’ payment limits and fees can add inconvenience. For a cost-effective, seamless cross-border fund management solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.