- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money from the US to Poland: A Comprehensive Comparison of Wire Transfer, MoneyGram, and PayPal Remittance Methods

Image Source: unsplash

You can choose from multiple methods to send money from the US to Poland, such as wire transfers, MoneyGram, PayPal, or Wise. Each method suits different scenarios; for example, wire transfers are ideal for large transfers, PayPal is suitable for small, quick remittances, and Wise is known for low fees and transparent exchange rates. When sending money, you should consider fees, transfer speed, and security. Ensure the recipient’s information is accurate, including IBAN and SWIFT codes, to avoid common risks.

Key Takeaways

- When choosing a remittance method, consider fees, transfer speed, and security. Wire transfers are suitable for large transfers, MoneyGram and PayPal are ideal for small, quick remittances, and Wise is known for low fees and transparent exchange rates.

- Ensure recipient information is accurate, including IBAN and SWIFT codes, to avoid delays or failures. Any errors may result in funds being returned.

- Wise’s fees start at 0.33% with no hidden charges, making it ideal for cost-conscious users. Wire transfer fees are higher, typically ranging from $25 to $65.

- PayPal and MoneyGram generally offer faster transfers, with PayPal arriving in minutes and Wise completing most transfers within a day, suitable for urgent needs.

- Before sending money, verify recipient details to ensure accuracy. Use official channels to prevent information leaks and fraud risks.

Overview of Remittance Options from the US to Poland

When sending money from the US to Poland, you can choose from several mainstream methods. Each method varies in fees, speed, and security. You need to select the most suitable channel based on your needs.

Wire Transfers

Wire transfers are a traditional international remittance method. You can send US dollars directly to a Polish recipient’s account through a bank. Wire transfers are suitable for large fund transfers, with funds typically arriving in 1-3 business days. Fees are higher, and some banks charge intermediary bank fees. You need to provide the recipient’s IBAN and SWIFT codes, ensuring accuracy. Wire transfers are highly secure, ideal for scenarios requiring stable delivery.

MoneyGram

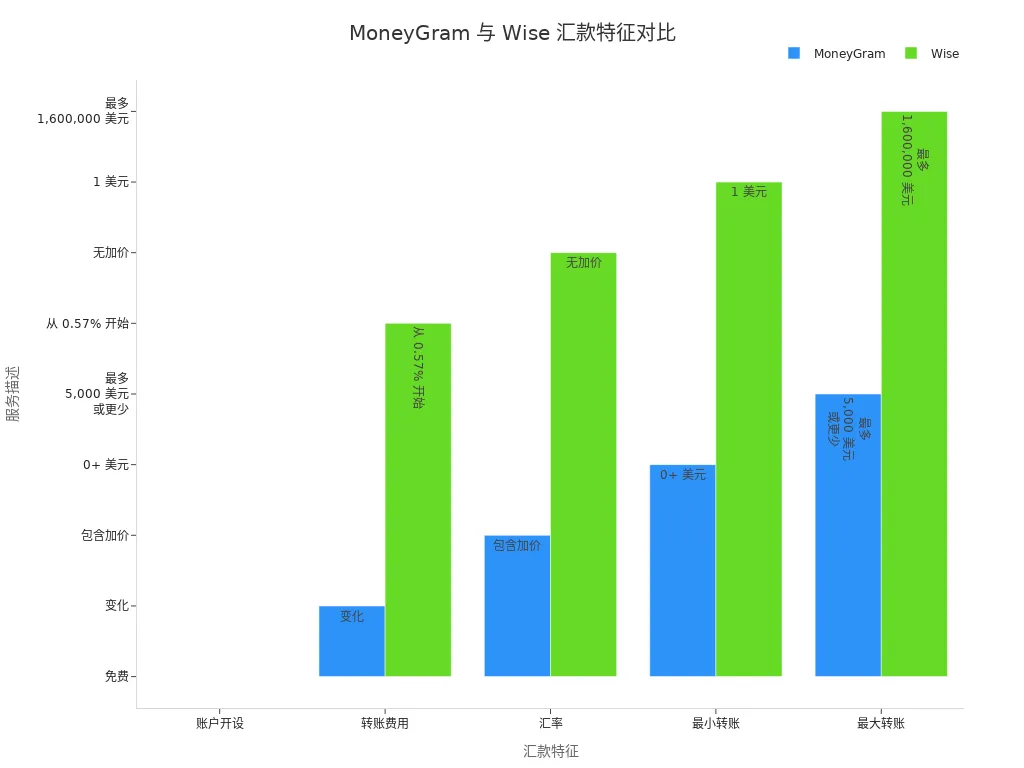

MoneyGram is suitable for situations requiring quick transfers. You can operate online or at physical locations, with funds typically arriving within hours. Opening a MoneyGram account is free, and transfer fees vary based on the amount and destination. Exchange rates include a markup, reducing the actual amount received. The maximum transfer amount is $5,000 or less. MoneyGram performs well in security, but you should remain vigilant against fraud risks.

- Most MoneyGram transfers are completed within hours.

- Account opening is free, suitable for temporary remittance needs.

PayPal

PayPal is suitable for small, convenient remittances from the US to Poland. You only need the recipient’s email to complete the transaction. PayPal has higher fees and exchange rate markups, with funds arriving in minutes to a day. The maximum transfer amount is limited, making it suitable for daily or small payments. PayPal is highly secure, supporting transaction disputes and fund protection.

Wise

Wise is known for low fees and transparent exchange rates. You can operate online, with 64% of transfers arriving within 20 seconds and 95% within a day. Opening a Wise account is free, with fees starting at 0.57% and no exchange rate markups. The maximum transfer amount is up to $1,600,000, suitable for large and frequent remittances. Wise uses multiple encryption technologies to ensure fund safety.

| Feature | MoneyGram | Wise |

|---|---|---|

| Account Opening | Free | Free |

| Transfer Fees | Varies | From 0.57% |

| Exchange Rate | Includes Markup | No Markup |

| Maximum Transfer Amount | $5,000 or less | $1,600,000 |

You can compare the amounts received and transfer speeds of different providers. For example, OFX and Venstar support remittances from the US to Poland, with transfers taking 1-3 days and no fees. The actual amount received varies due to exchange rate fluctuations, so compare real-time exchange rates and fees before sending.

Wire Transfers

Process

When sending money from the US to Poland, you can choose wire transfers. You need to prepare the recipient’s details, including SWIFT/BIC code, IBAN number (up to 34 characters), beneficiary’s full name and address, receiving bank name and address, and the purpose of payment. At a licensed Hong Kong bank counter or online banking platform, fill out the relevant forms with this information, and the bank will process your remittance request.

Tip: Ensure all information is accurate to avoid delays or failures due to errors.

- You need to provide the following information:

- SWIFT/BIC code

- IBAN number

- Beneficiary name and address

- Bank name and address

- Purpose of payment

Fees

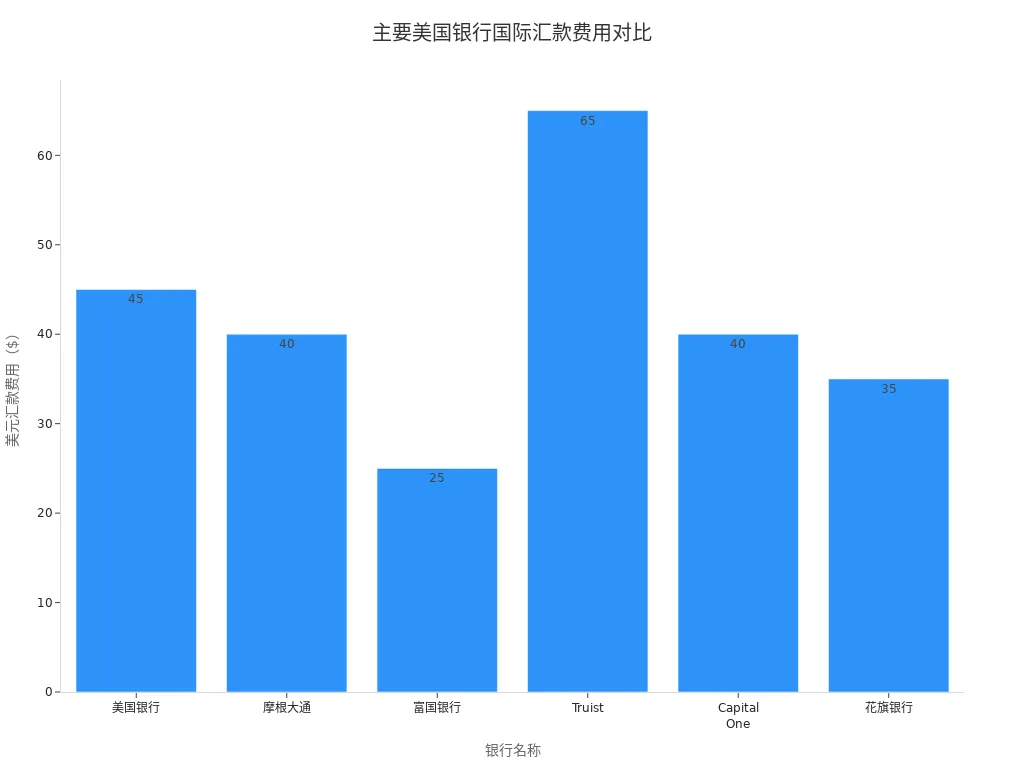

International wire transfer fees vary significantly across banks. When using a licensed Hong Kong bank, fees typically range from USD25 to USD65. Some banks offer discounts for foreign currency transfers, with higher fees for USD transfers.

Transfer Time

When sending money to Poland via wire transfer, funds typically arrive within 1 to 5 business days. In most cases, transfers are completed in 2 business days, but holidays or bank system differences may extend the time.

- International wire transfers generally take 1-5 business days.

Exchange Rates

Banks typically use exchange rates slightly below the mid-market rate for wire transfers. The actual amount received in Polish złoty will be reduced due to exchange rate differences. The table below compares amounts received at different exchange rates:

| Provider | Exchange Rate | Transfer Fee | Recipient Receives |

|---|---|---|---|

| Mid-Market Rate | 3.60555 PLN | USD10.76 | 3,566.75 PLN |

| Other Banks | 3.51641 PLN | USD0.00 | 3,516.41 PLN |

Limits

When using a licensed Hong Kong bank for wire transfers, the maximum single transfer limit is typically USD50,000. Some online banking channels have lower limits, around USD4,000. Cash pickup limits are USD5,000.

| Service Type | Maximum Transfer Limit | Minimum Transfer Limit |

|---|---|---|

| Bank Transfer | USD50,000 | N/A |

| Cash Pickup | USD5,000 | N/A |

| Online Bank Transfer | USD4,000 | N/A |

Security

When choosing wire transfers, banks use encryption and authentication protocols to ensure fund safety. Licensed Hong Kong banks comply with international regulations to prevent fraud and money laundering. Choose trusted banks to ensure a secure and reliable transfer process.

- Bank transfers are highly secure, using encryption and authentication.

- Choosing well-known financial institutions further ensures fund safety.

Pros and Cons

The table below summarizes the main advantages and disadvantages of wire transfers:

| Advantages | Disadvantages |

|---|---|

| Convenience | High fees |

| Security | Long processing time |

| Reliability | Complexity |

| International transfers | Limited availability |

When sending money from the US to Poland, wire transfers are suitable for large fund transfers with high security but have higher fees and longer transfer times. Choose based on your specific needs.

MoneyGram

Image Source: unsplash

Process

You can easily send money from the US to Poland using MoneyGram. The steps are straightforward:

- Register or log in to your MoneyGram account.

- Enter the recipient’s details.

- Input the amount you want to send.

- Choose the delivery method, such as bank transfer or cash pickup.

- Select a payment method, such as a debit card.

- Review all information, fees, and exchange rates, then click “Send.”

You can also download the MoneyGram online remittance app, create a profile, follow prompts to enter recipient details and amount, select payment and delivery methods, and complete the transfer. For offline operations, visit a nearby MoneyGram agent, fill out the transfer form, and submit cash.

Fees

MoneyGram’s fees vary based on transfer amount, payment method, and delivery method. Refer to the table below for key factors affecting fees:

| Fee Variables | Description |

|---|---|

| Transfer Amount | Fees vary based on the amount transferred. |

| Payment Method | Using a credit card may incur slightly higher fees. |

| Delivery Method | Different delivery methods may affect fees. |

You can estimate specific fees on MoneyGram’s website or app before proceeding.

Transfer Time

When sending money from the US to Poland via MoneyGram, it typically takes about 3 days to arrive. In some cases, cash pickup may be faster.

Tip: Holidays or special periods may delay delivery.

Exchange Rates

MoneyGram typically includes a markup on exchange rates. The actual amount received in Polish złoty will vary due to exchange rate differences. Compared to platforms like Wise, MoneyGram’s rates may be less transparent, resulting in slightly lower received amounts.

Limits

When using MoneyGram for international transfers, the maximum single transfer limit is USD10,000, with a cumulative limit of USD10,000 within 30 days.

| Transfer Type | Limit (USD) |

|---|---|

| International Transfer | 10,000 per transaction, 10,000 within 30 days |

Security

MoneyGram uses robust data protection protocols to ensure your transaction information is secure. Each fund transfer requires valid identification to prevent fraud and identity theft. For transactions exceeding USD15,000, additional verification steps further enhance security.

Pros and Cons

The table below summarizes MoneyGram’s main advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Covers over 200 countries with 400,000 agents globally; funds can be sent online, via app, or in person | Exchange rate markups; fees vary by destination, payment method, and amount; not all services available in all destinations; may not be the cheapest option |

When choosing MoneyGram, weigh the fees, speed, and convenience based on your needs.

PayPal

Image Source: unsplash

Process

You can easily send money from the US to Poland using PayPal. The steps are as follows:

- Open the PayPal app and go to the “Send & Request” page.

- Enter the recipient’s name, email address, or Polish phone number, or provide a bank account or card number.

- Select the amount to send and set the currency to Polish złoty (PLN).

- Choose your preferred payment method, such as a credit card or bank account.

- Review all information and click “Send.”

You need to meet the following conditions for a smooth transfer:

- Valid email address

- Government-issued ID (e.g., passport or national ID)

- Proof of address (e.g., utility bill or bank statement)

- Polish phone number

- Bank account or credit/debit card

Fees

PayPal’s international transfer fees are higher, with a complex fee structure. Refer to the table below for main fee types:

| Fee Type | PayPal Fee |

|---|---|

| Standard Commercial Transaction | Approx. 2.99% or 3.49% + $0.49 |

| Additional International Transaction Fee | Approx. 1.5% |

| Currency Conversion Fee | 3% |

| Other Commercial Transactions | 3.49% + fixed fee |

Fees vary based on transaction type and amount. The currency conversion fee is typically 3% of the transaction amount.

Transfer Time

When using PayPal, funds typically arrive within minutes. The actual time may vary depending on the delivery method and bank processing speed. PayPal is a reliable and fast option for US-to-Poland transfers.

Tip: In some cases, delivery time may be extended; communicate with the recipient in advance.

Exchange Rates

PayPal’s exchange rates are typically lower than platforms like Wise. The actual amount received in Polish złoty will be reduced due to exchange rate differences. The table below compares exchange rates and amounts received across providers:

| Provider | Exchange Rate | Transfer Fee | Recipient Receives |

|---|---|---|---|

| Wise | 3.60555 | $10.76 | 3,566.75 PLN |

| PayPal | 3.45807 | $4.99 | 3,440.82 PLN |

When choosing a platform, check real-time exchange rates and fees to ensure the recipient receives the maximum amount.

Limits

PayPal has clear limits on transfer amounts. Refer to the table below:

| Transaction Type | Unverified Account | Verified Account | Notes |

|---|---|---|---|

| Single Transaction | $4,000 | Up to $60,000 (may be limited to $10,000) | Limits vary by currency or country |

| International Transfer | $4,000 | Up to $60,000 | International limits similar to domestic |

Confirm your account status and limits before sending to avoid transaction failures due to insufficient limits.

Security

PayPal provides multiple security measures for international transfers. The platform does not share sensitive card or bank information during transactions, effectively reducing fraud risks. All data is encrypted during transfers, ensuring fund safety.

- PayPal protects your account information, preventing leaks.

- International transfers include identity verification for enhanced security.

Pros and Cons

The table below summarizes PayPal’s main advantages and disadvantages for US-to-Poland transfers:

| Advantages | Disadvantages |

|---|---|

| Easy to use, feature-rich | Complex fees, high international costs |

| Widely accepted | Requires PayPal account to receive funds |

| Secure payment method | Often targeted by scams |

| Many domestic transactions free | Withdrawals to bank accounts take time |

When choosing PayPal, you can enjoy a convenient and secure transfer experience but should note the fees and exchange rate issues. Some users report that withdrawals to Polish bank accounts may take longer, and account limits can be unclear.

Wise

Process

You can easily send money from the US to Poland using Wise. Wise supports online and mobile app operations, with a simple process. Register a Wise account, select Poland as the destination, and enter the recipient’s details and amount. Wise displays the amount you’ll pay and the Polish złoty (PLN) the recipient will receive. Choose from payment methods like bank transfer, credit card, or debit card. Wise uses mid-market exchange rates, with transparent fees and no hidden costs.

Tip: Wise supports transfers to over 70 countries, with a user-friendly interface, ideal for frequent cross-border transfers.

- Register a Wise account

- Select destination country and amount

- Enter recipient details

- Choose payment method

- Confirm fees and exchange rate, then complete the transfer

Fees

Wise’s fees are highly transparent, starting at 0.33%. You can see all fees clearly before sending. Compared to licensed Hong Kong banks’ international wire transfers, Wise has no intermediary bank fees, making it more cost-effective.

Transfer Time

Wise offers fast transfer speeds. Most funds arrive instantly after completing the transfer. In some cases, it may take up to 5 business days. You can track transfer progress in real-time on the Wise platform to ensure timely delivery.

- Wise transfers typically arrive instantly

- Up to 5 business days for completion

Exchange Rates

Wise uses the mid-market exchange rate with no markups. You can see the exchange rate and actual amount received directly. Compared to traditional banks and other platforms, Wise offers better rates, maximizing the recipient’s funds. Check real-time exchange rates before sending to ensure optimal value.

Limits

Wise supports multiple payment methods, each with different maximum and minimum transfer limits. Refer to the table below:

| Payment Method | Maximum Transfer Limit | Minimum Transfer Limit |

|---|---|---|

| Wire Transfer | 1,000,000 USD | N/A |

| ACH Payment | 50,000 USD | 50,000 USD |

| Debit/Credit Card | 2,000 USD | 2,000 USD |

| SWIFT | 1,600,000 USD | N/A |

| USD Currency Top-Up | 6,000,000 USD | N/A |

Choose a payment method based on your needs for flexible transfer amounts.

Security

Wise uses multiple encryption technologies to protect your funds and personal information. All data is encrypted during transfers. Wise adheres to international financial regulatory standards to prevent fraud and money laundering. You can use Wise for US-to-Poland transfers with confidence.

Wise charges no hidden fees, and all transactions are recorded for easy tracking and disputes.

Pros and Cons

When choosing Wise, you can enjoy the following advantages:

- Low fees, transparent exchange rates

- Simple operation, fast delivery

- Supports large and small transfers

- High security with data encryption

However, Wise has some limitations:

- Some payment methods have lower limits

- Delivery may be delayed in rare cases

- Requires a Wise account

Weigh these pros and cons based on your needs to choose the best remittance method.

Comparison of Remittance Methods from the US to Poland

Fee Comparison

Fees are a key consideration when choosing a remittance method. Different channels have varying fee structures and hidden costs. The table below compares the main fees for wire transfers, MoneyGram, PayPal, and Wise:

| Remittance Method | Fees (USD) | Exchange Rate Markup | Other Fees |

|---|---|---|---|

| Wire Transfer | 25-65 | Yes | Possible intermediary bank fees |

| MoneyGram | Varies by amount and method | Yes | Varies by payment method |

| PayPal | 2.99%-3.49%+$0.49 | Yes | 3% currency conversion fee |

| Wise | From 0.33%, approx. 10.76 | No | No hidden fees |

Wise offers the lowest and most transparent fees. Wire transfers are suitable for large amounts but have higher fees. PayPal and MoneyGram are ideal for small or temporary transfers, but fees vary by amount and method.

Speed Comparison

Transfer speed directly affects the recipient’s experience. Refer to the table below for delivery times:

| Remittance Method | Delivery Time |

|---|---|

| Wire Transfer | 1-5 business days |

| MoneyGram | Hours to 3 days |

| PayPal | Minutes to 1 day |

| Wise | 20 seconds to 1 day, up to 5 days |

Wise and PayPal are typically the fastest, ideal for urgent transfers. Wire transfers and MoneyGram take longer, with potential delays during holidays.

Security Comparison

Security is a top priority for international transfers. Each platform uses encryption and authentication, but details vary:

- Wire Transfers: Operated by licensed Hong Kong banks, following international regulations, offering the highest security.

- MoneyGram: Uses data protection protocols and requires ID to prevent fraud.

- PayPal: Encrypts account information, supports transaction disputes, and protects funds.

- Wise: Multi-layer encryption, international compliance, and traceable transactions.

Choosing reputable financial institutions maximizes fund safety. Wise and wire transfers excel in security.

Convenience Comparison

Convenience determines ease of operation. Refer to the list below:

- Wire Transfers: Require detailed recipient information, complex process, suitable for users with bank accounts.

- MoneyGram: Supports online and offline operations, simple registration, ideal for temporary transfers.

- PayPal: Requires only recipient email or phone number, user-friendly, suitable for daily small payments.

- Wise: Online operation, intuitive interface, supports multiple payment methods, ideal for frequent cross-border transfers.

For ease of use, PayPal and Wise are great choices. Wire transfers suit experienced users.

Exchange Rates and Limits

Exchange rates and limits directly impact your and the recipient’s benefits. The table below compares exchange rates and maximum limits:

| Remittance Method | Exchange Rate Type | Maximum Limit (USD) |

|---|---|---|

| Wire Transfer | Bank rate | 50,000 (some channels 4,000) |

| MoneyGram | Marked-up rate | 10,000 per 30 days |

| PayPal | Marked-up rate | 4,000-60,000 |

| Wise | Mid-market rate | 1,600,000 |

Wise uses mid-market rates with no markups, maximizing received amounts. Wire transfers and Wise support large transfers, while PayPal and MoneyGram are better for smaller amounts.

Use Cases

Choose the best remittance method based on your needs:

- For large, stable transfers, wire transfers are ideal.

- For low fees and high exchange rates, Wise performs best.

- For temporary transfers or recipients without bank accounts, MoneyGram is convenient.

- For small, daily payments, PayPal is the most convenient.

Tip: When sending money from the US to Poland, compare real-time fees and exchange rates, considering speed and security, to choose the best method.

Recommendations

Speed Priority

If speed is your priority, choose PayPal or Wise. PayPal typically delivers in minutes, ideal for urgent transfers. Wise completes most transfers within a day, some in 20 seconds. MoneyGram can also deliver quickly but may take hours. Wire transfers take longer, typically 1-5 business days.

Tip: Delivery may be delayed during holidays or bank maintenance periods.

Fee Priority

To save on fees, prioritize Wise. Wise’s fees start at 0.33% with no hidden charges. Wire transfer fees are higher, ranging from USD25 to USD65. PayPal and MoneyGram fees vary by amount and payment method, with noticeable exchange rate markups. The table below compares fees:

| Remittance Method | Fees (USD) | Exchange Rate Markup |

|---|---|---|

| Wise | Approx. 10.76 | No |

| Wire Transfer | 25-65 | Yes |

| PayPal | 2.99%-3.49%+0.49 | Yes |

| MoneyGram | Varies by amount | Yes |

Convenience Priority

For ease of operation, choose PayPal or Wise. PayPal requires only the recipient’s email or phone number, with a user-friendly interface, ideal for small daily payments. Wise offers simple online and app operations, supporting multiple payment methods, suitable for frequent cross-border transfers. MoneyGram supports online and offline operations with straightforward registration. Wire transfers require detailed recipient information, making them more complex, suitable for users with bank accounts.

- PayPal: Simple, ideal for small transfers

- Wise: Intuitive interface, supports multiple payment methods

- MoneyGram: Online and offline, suitable for temporary transfers

- Wire Transfer: Complex process, suitable for large fund transfers

Security Priority

For maximum fund safety, choose wire transfers or Wise. Wire transfers, operated by licensed Hong Kong banks, use encryption and authentication protocols, offering the highest security. Wise uses multi-layer encryption and complies with international standards, with traceable transactions. PayPal and MoneyGram have robust security but require vigilance against online scams and information leaks.

Choose reputable financial institutions for a secure transfer process. Contact platform support promptly for any issues.

Precautions

Before Sending

Before sending money, carefully verify recipient information. Ensure the recipient’s name, bank account number, IBAN, and SWIFT codes are accurate. Confirm the receiving bank’s name and address. Communicate with the recipient in advance to verify details. Record this information on paper or in a digital document to avoid errors.

Tip: Any incorrect information may cause transfer failure, delays, or funds being returned.

During Transfer

During the transfer process, guard against common risks. Avoid using unknown links or third-party platforms. Use official channels like licensed Hong Kong bank websites, MoneyGram, PayPal, or Wise’s official apps. Double-check amounts and recipient details to avoid losses due to errors. When uploading IDs or documents, ensure secure channels are used.

- Common risks include: information leaks, scam links, and fake customer service.

- Set transaction alerts to monitor fund movements.

After Transfer

After completing the transfer, save transaction receipts and screenshots. Track fund status in real-time via the platform’s “transaction history” feature. If funds don’t arrive on time, contact the remittance platform or bank customer service with the transaction ID and details for progress inquiries. For account freezes or issues, file a dispute promptly and submit required documents per platform guidelines.

Regularly check the recipient’s account to confirm receipt. Contact platform support for any concerns to ensure fund safety.

Choose the best remittance method based on your needs. Wise offers low fees and fast delivery, ideal for cost-conscious users. PayPal and MoneyGram suit small or temporary transfers. Wire transfers are best for large funds with high security. Pay attention to fees, transfer times, and exchange rates, and follow the precautions to ensure a safe and smooth transfer.

FAQ

How to Confirm Recipient Information is Correct?

Ask the recipient to provide official bank documents. Verify the name, IBAN, and SWIFT codes. Confirm all details with the recipient before sending.

How Long After Sending Can I Check the Status?

Check progress in real-time on the platform or bank’s “transaction history” page. Contact the recipient to confirm receipt.

Will Funds Be Returned if the Transfer Fails?

If a transfer fails, the bank or platform will return funds to your account. Monitor refund times, typically 3-7 business days.

How to Avoid Scams During Transfers?

Use only official channels. Avoid clicking unknown links. Verify recipient identity. Contact platform support for any suspicious activity.

Are There Limits on Transfer Amounts?

Transfer limits vary by platform. Wise supports up to USD1,600,000. PayPal and MoneyGram have lower limits. Check platform rules in advance.

For US-to-Poland remittances, Wise offers low 0.33%+ fees and mid-market rates, while PayPal and MoneyGram suit small, fast transfers, but wire transfers’ $25-65 fees and 1-5 day delays inflate costs, especially in 2025’s $80+ trillion remittance market, where traditional channels’ markups and limits reduce received amounts. For a cost-effective, seamless solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.