- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding Remitly's US Dollar Exchange Rate: How to Use Real - time Exchange Rates and the Lock - in Feature for Efficient Remittances

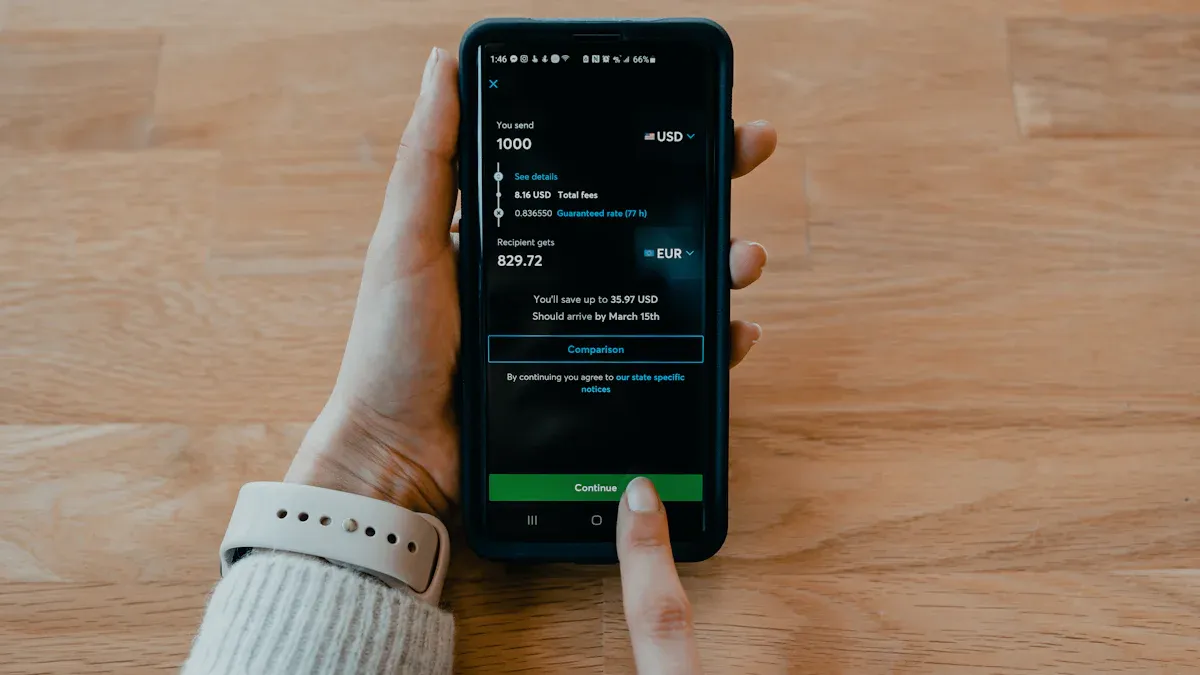

Image Source: unsplash

When using Remitly USD exchange rates for remittance, you can directly impact the cost of each transfer. Through real-time exchange rate viewing, you can stay updated with the latest market changes. The rate-locking feature allows you to lock in a favorable rate, effectively avoiding losses due to exchange rate fluctuations. You can also set rate alerts to seize the best timing for remittances. For your first transfer, Remitly waives the transaction fee, helping you save more.

Key Points

- Real-time viewing of Remitly USD exchange rates helps you stay informed about market dynamics and choose the best transfer timing.

- Utilizing the rate-locking feature ensures you lock in a favorable rate, avoiding losses from exchange rate fluctuations.

- Setting rate alerts automatically notifies you of changes in your target exchange rate, reducing the hassle of manual checks.

- For your first transfer, Remitly waives the transaction fee, helping you save more funds.

- Comparing exchange rates and fees across different remittance services allows you to choose the most cost-effective solution, enhancing transfer efficiency.

Remitly USD Exchange Rate Queries

Image Source: pexels

Real-Time Exchange Rate Viewing

You can check the latest USD exchange rates on the Remitly platform at any time. Remitly USD exchange rates are updated multiple times daily based on global forex market changes. This allows you to stay informed about market dynamics in real-time and choose a more suitable transfer timing. The platform displays the current USD-to-target-currency exchange rate directly on the remittance page, making it easy for you to compare and make decisions.

The table below shows the update frequency of Remitly USD exchange rates:

| Rate Update Frequency | Description |

|---|---|

| Multiple Times Daily | Remitly frequently updates USD-to-other-currency exchange rates based on global forex market fluctuations. |

When choosing a remittance service, besides focusing on the exchange rate itself, you can compare the actual received amounts across different platforms. Below is a comparison of Remitly with another major digital remittance service:

| Service Provider | Exchange Rate (1 USD) | Received Amount (MXN) |

|---|---|---|

| Remitly | 19.52 MXN | 19520 MXN |

| Xoom | 19.7246 MXN | 19725 MXN |

You can see that exchange rates and received amounts vary across platforms. Before sending, it’s recommended to compare multiple options to choose the best solution.

Rate Alert Settings

Remitly offers a rate alert feature for you. You can set a target exchange rate on the platform. When the Remitly USD exchange rate reaches your set target, the system will automatically notify you. This way, you don’t need to frequently check rates manually and can complete transfers at the optimal time.

Many users have the following common concerns when using Remitly USD exchange rates:

- Users are concerned about the reasons for exchange rate fluctuations, including the impact of supply and demand changes and economic turbulence.

- Users believe comparing exchange rates and fees across services is important to ensure they get the best remittance amount.

- Users are concerned about the impact of high fees on the overall remittance amount, especially when choosing a remittance service.

By setting rate alerts and combining them with real-time exchange rate queries, you can proactively manage market changes, improve remittance efficiency, and reduce costs.

Rate Locking Feature

Image Source: unsplash

Locking Exchange Rate Process

When using Remitly USD exchange rates for remittances, you can choose the rate-locking feature. This feature allows you to lock in a favorable rate when it’s suitable, ensuring your remittance is unaffected by market fluctuations. The process is very simple:

- First, you need to register and log in to your Remitly account.

- When initiating a transfer, the system displays the current USD exchange rate. You can select the “fixed rate” option to lock in the rate at that moment.

- After completing the remittance information, the system will prompt you to upload relevant documents, including:

- Identification documents

- Proof of address

- After submission, Remitly will lock the exchange rate for your transaction. Even if the market rate changes, the recipient will receive the amount based on the rate you locked.

This process ensures the stability of your remittance amount even in highly volatile exchange rate conditions. You don’t need to worry about sudden rate drops reducing the recipient’s actual received amount.

Lock Duration and Rules

The Remitly USD exchange rate locking feature allows you to lock the rate for up to 30 days after initiating a transfer. As long as you select the rate-locking option during the remittance process, the system will automatically retain the current rate for your transaction. Below are the main advantages of locking the exchange rate:

- When you initiate a transfer, the applicable exchange rate is locked. Even if the recipient hasn’t received the funds and the rate changes, they will still receive the amount based on the rate at the time of sending.

- Remitly’s “fixed rate” option allows you to transfer with confidence during market fluctuations. The amount you send will be converted to the recipient’s currency based on the locked rate, avoiding losses due to rate changes.

- This feature is particularly beneficial in markets with rapidly changing exchange rates. You can plan your remittance timing in advance and lock in the optimal rate.

When using the Remitly USD exchange rate locking feature, you can also enjoy a fee waiver for your first transfer. Remitly does not charge hidden fees, and all fees and exchange rate information are clearly displayed on the remittance page. Refer to the table below for Remitly’s performance in fee transparency:

| Fee Type | Description | Notes |

|---|---|---|

| Hidden Fees | Remitly’s main fees are embedded in the exchange rate. | Applies only to the rate for first-time customers. |

| Exchange Rate Transparency | Advertised rates do not reflect future rate usage. | Users should carefully review rates and received amounts. |

Before sending, it’s recommended to carefully verify the exchange rate and received amount to ensure maximum returns for each transfer. The Remitly USD exchange rate locking feature gives you more control, making your remittance process more reassuring and efficient.

Enhancing Remittance Efficiency

Cost-Saving Strategies

When using Remitly USD exchange rates for remittances, you can save costs through various methods. First, you can research and compare different remittance service providers. Specialized remittance platforms typically offer better exchange rates and lower fees than traditional banks. You can use rate comparison tools to access real-time rate and fee information from various platforms, choosing the most cost-effective solution.

- Research and compare providers, selecting platforms with reasonable fee structures.

- Use technology tools to stay updated on the latest rates and fees.

- Pay attention to market active periods and plan remittance timing accordingly.

You can also leverage Remitly USD exchange rate real-time monitoring and locking features. Real-time rates allow you to understand current market prices, while locking rates helps you secure a favorable rate to avoid losses from subsequent fluctuations. These features are especially important for large transfers or planning future payments, providing stability and transparency.

Tip: Before sending, verify the recipient’s information to avoid delays or fund losses due to errors. Save receipts and confirmation details for each transaction to facilitate future inquiries or claims.

Timing Selection Tips

When choosing remittance timing, you can refer to historical exchange rate fluctuations. Although Remitly does not directly provide historical rate data, you can analyze USD exchange rate trends through financial platforms like XE, OANDA, or Investing.com to determine when rates are more favorable.

- Avoid sending remittances on weekends or holidays, as these times may lead to extended processing.

- Understand transfer limits and plan remittance amounts to avoid delays due to exceeding limits.

- Monitor economic calendars and choose active market periods for remittances to secure better rates.

During the remittance process, it’s recommended to regularly monitor Remitly USD exchange rate changes and combine rate alerts and locking features to flexibly choose transfer timing. This way, you can maximize remittance efficiency and save costs.

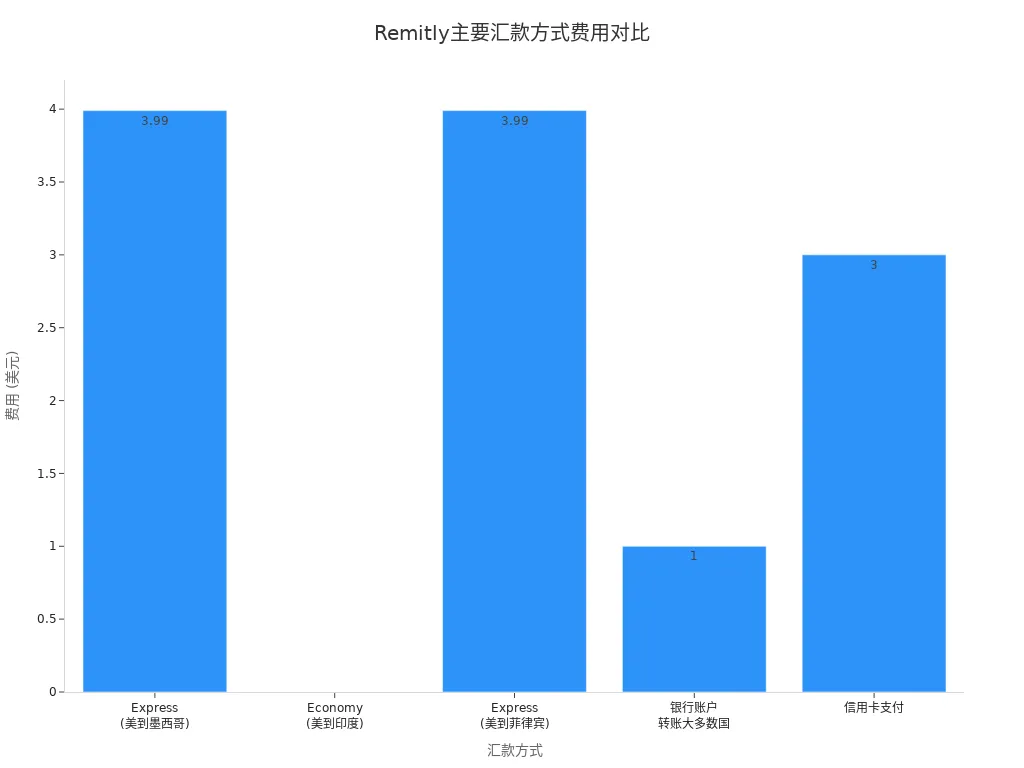

You can enhance remittance efficiency through Remitly USD exchange rate real-time queries and locking features. You can check rates and fees anytime on the app or website, choosing Express or Economy methods to flexibly control speed and cost. New customers can also enjoy promotional rates and a fee waiver for their first transfer. The table below shows fees for different remittance methods:

| Sending Method | Fees | Notes |

|---|---|---|

| Express (U.S. to Mexico) | ~$3.99 (debit card), ~$9.99 (credit card) | Faster transfer speed |

| Economy (U.S. to India) | $0 (bank account) | Slower transfer speed |

| Express (U.S. to Philippines) | ~$3.99 (debit card) | Faster transfer speed |

| Bank Account Transfer to Most Countries | Usually free or under $1 (economy speed) | Cost-effective |

| Credit Card Payment | Usually additional 3% or more | Higher fees |

| Exchange Rate Margin | Competitive, typically 1-2% below mid-market rate | Transparently displayed |

You can track transfer status at any time, monitor exchange rate changes, and choose optimal locking timing to ensure more funds reach the destination.

FAQ

How often are Remitly USD exchange rates updated?

You can see USD exchange rates updated multiple times daily on the Remitly platform. The platform automatically adjusts rates based on global forex market changes.

How do I set rate alerts?

You can select a target exchange rate in your account settings. The system will automatically notify you when the rate reaches your set value, eliminating the need for manual checks.

How long is a locked exchange rate valid?

After locking the exchange rate, it remains valid for up to 30 days. If you complete the transfer within this period, the recipient will receive the USD amount based on the locked rate.

Which banks in mainland China can receive remittances?

You can choose major banks in mainland China or licensed Hong Kong banks as receiving accounts. The platform displays a list of available banks for your selection.

Are there fee discounts for first-time remittances?

For your first remittance with Remitly, the platform waives the transaction fee. You can view detailed fee information on the remittance page.

Remitly boasts 1.49% average fees and transparent rates with real-time checks and locking (up to 30 days), but 1%-3% markups and payment variances can add costs, especially in 2025’s $80+ trillion remittance market, where traditional providers’ verifications slow transactions. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.