- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What are the conditions for canceling a MoneyGram money transfer? And how to avoid transaction failures?

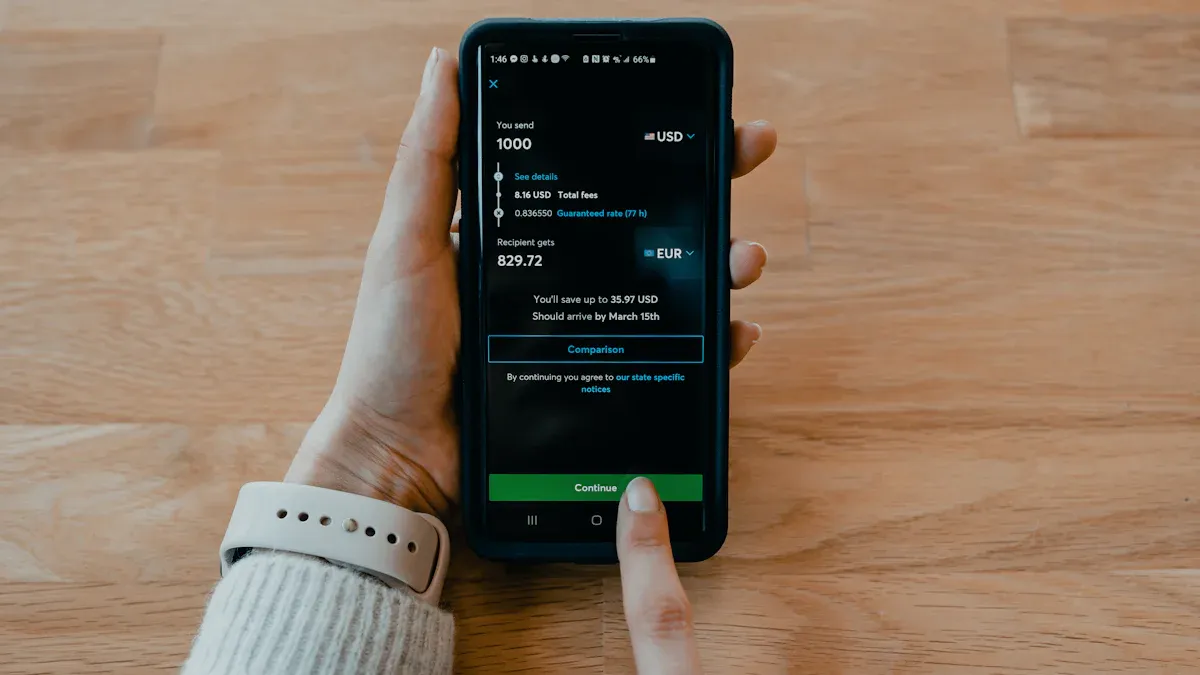

Image Source: unsplash

When you use MoneyGram for remittance, common reasons for failure include incorrect information entry, remittance timeout, failure to pass compliance checks, abnormal recipient accounts, and exceeding amount limits. Financial regulatory authorities have noted that anti-money laundering compliance issues and violations of consumer protection laws can lead to transaction cancellations. The table below outlines some typical scenarios:

| Evidence Type | Description |

|---|---|

| Anti-Money Laundering Compliance Issues | MoneyGram failed to effectively supervise agents, resulting in unprocessed suspicious transactions. |

| Consumer Protection Law Violations | MoneyGram failed to transfer or refund funds on time, affecting customer fund safety. |

By carefully verifying all information before remitting, you can effectively avoid transaction failures due to conditions for canceling a remittance.

Key Points

- Ensure the recipient’s information is accurate to avoid transaction failure due to spelling errors.

- Complete the payment promptly, as unpaid orders will be automatically canceled if they exceed the validity period.

- Understand and comply with remittance amount limits in different countries to avoid cancellations due to exceeding limits.

- Confirm the recipient account’s status before remitting to ensure it is operational and avoid failures due to account abnormalities.

- Choose a payment method supported by MoneyGram to ensure smooth transactions and reduce the risk of cancellation due to unsupported payment methods.

Conditions for Canceling a Remittance

When using MoneyGram for international remittances, you must understand the conditions for canceling a remittance. Only by mastering these conditions can you effectively avoid transaction failures. Below is a detailed explanation of each common situation.

Incorrect Information Entry

When filling in the recipient’s name, account number, or address, if there are spelling errors or inconsistencies, the MoneyGram system will automatically identify and cancel the remittance. For example, if the recipient’s name does not match the bank account registration information, the system will flag it as a high-risk transaction. You need to ensure all information is accurate to avoid transaction failure due to minor errors.

Remittance Timeout

If you fail to complete the payment for a remittance order within a prolonged period, the system will automatically cancel the order. MoneyGram typically sets a validity period for each remittance. If payment is not made within the specified time, the order becomes invalid. You should complete the payment as soon as possible after placing the order to prevent funds from failing to arrive due to a timeout.

Failure to Pass Compliance Checks

MoneyGram conducts compliance checks on every remittance. If you involve sensitive countries, suspicious fund sources, or violate anti-money laundering regulations, the system will directly cancel the remittance. Financial regulatory authorities require MoneyGram to strictly enforce anti-money laundering policies. When remitting, you must ensure the funds’ source is legitimate to avoid interception due to compliance issues.

Abnormal Recipient Account

If the recipient’s account is frozen, closed, or has abnormal transaction records, MoneyGram will reject the remittance. You should confirm the account’s status with the recipient before remitting to ensure it is in normal use. An abnormal account is one of the conditions for canceling a remittance and is often overlooked.

Exceeding Amount Limits

MoneyGram imposes strict limits on remittance amounts for different countries and regions. If your remittance amount exceeds the limit, the system will automatically cancel the order. For example, international transfers have a maximum of 10,000 USD per transaction, U.S. domestic transfers have a maximum of 15,000 USD, and Chile has a maximum of 5,000 USD. Refer to the table below:

| Transfer Method | Per Transaction Limit | 30-Day Limit |

|---|---|---|

| International Transfer | Up to 10,000 USD | Up to 10,000 USD |

| U.S. Domestic Transfer | Up to 15,000 USD | Up to 15,000 USD |

| Chile | Up to 5,000 USD | N/A |

You should check the destination’s amount limits in advance to avoid cancellations due to exceeding limits.

Unsupported Payment Method

MoneyGram supports multiple payment methods, but some countries or regions may not support certain payment channels. If you choose an unsupported payment method, the system will display an error and cancel the remittance. You should follow MoneyGram’s platform prompts to select an appropriate payment method to ensure smooth transaction completion.

User-Initiated Cancellation

If you discover errors in the information or the recipient is temporarily unable to collect the funds after remitting, you can actively request a cancellation. As long as the recipient has not yet collected the funds, you can apply for cancellation through the MoneyGram platform or customer service. User-initiated cancellation is also one of the conditions for canceling a remittance, applicable when you need to correct information or change plans.

Friendly Reminder: Before proceeding, carefully verify all information and understand the conditions for canceling a remittance. This can significantly reduce the risk of transaction failure.

Common Reasons

Image Source: pexels

Incorrect Information Case

When filling in recipient information, if the name is misspelled or the account number is incorrect, the system will directly cancel the remittance. For example, if the recipient’s name does not match the bank’s registered information, MoneyGram will flag it as a high-risk transaction. When remitting from mainland China to the U.S., if the recipient’s address is entered incorrectly, the funds cannot be successfully transferred. This is one of the conditions for canceling a remittance, and you should double-check all information before submission.

Timeout Non-Payment Case

If you fail to complete payment within the specified time after placing an order, MoneyGram will automatically cancel it. For instance, if you choose bank transfer but the payment is delayed due to bank system maintenance, the order may be canceled after exceeding the validity period. When using a licensed Hong Kong bank for transfers from mainland China, delays due to holidays or cross-border clearing may also cause timeouts. You should complete payment promptly to avoid transaction failure.

Compliance Issue Case

During the remittance process, if sensitive countries or unclear fund sources are involved, MoneyGram will cancel the remittance due to failure to pass compliance checks. Real cases show that some users faced transaction termination because they failed to provide timely remittance transfers to designated recipients or failed to process refunds promptly. You may also encounter cancellations due to inaccurate disclosure of remittance transfer availability dates. MoneyGram strictly adheres to anti-money laundering policies to ensure every transaction is compliant.

Abnormal Account Case

If you fail to confirm the recipient account’s status before remitting and the account is frozen or closed, MoneyGram will reject the remittance. For example, when transferring to a U.S. recipient whose account is frozen due to abnormal transactions, the system will automatically cancel the order. You should communicate with the recipient in advance to ensure the account is normal.

Amount Limit Case

When remitting from mainland China to the U.S., if a single transaction exceeds 10,000 USD, the system will directly cancel the order. MoneyGram imposes strict amount limits for different countries and regions. If you fail to check the limits in advance, transactions may fail due to exceeding them. You should check the destination’s amount regulations before remitting.

Payment Method Case

If the payment method you choose is not supported by MoneyGram, the system will display an error and cancel the remittance. For example, if you select certain third-party payment channels in mainland China that are not recognized by MoneyGram, the order will be terminated. You should choose an appropriate payment method based on platform prompts to ensure smooth transaction completion.

How to Avoid Transaction Failure

Image Source: unsplash

Verify Remittance Information

When filling in remittance information, you must carefully verify each item. Entering incorrect information may lead to transaction delays or cancellations, and even the risk of unrecoverable funds. You should ensure the recipient’s name, address, and account information exactly match their identification documents.

- Before submitting a transfer through the MoneyGram app, double-check the recipient’s information and transfer amount.

- If in doubt, contact MoneyGram customer service for assistance.

- Verify all details with the recipient to avoid cancellations due to mismatched information.

Tip: Incorrect information can directly cause funds to fail to transfer. It’s recommended to double-check before each operation.

Complete Payment Promptly

You should complete payment as soon as possible after placing an order. MoneyGram sets a validity period for each remittance, and unpaid orders will be automatically canceled if they exceed this period. You can prepare the recipient’s full name, address, and contact information in advance to ensure a smooth payment process.

- Collect complete recipient information in advance.

- Verify all details before payment to avoid delays due to incomplete information.

- If encountering holidays or bank system maintenance, choose a faster payment method.

You can check the order status in real-time on the MoneyGram website or mobile app to ensure timely payment completion.

Comply with Regulatory Requirements

When remitting, ensure the funds’ source is legitimate and avoid involving sensitive countries or suspicious fund flows. MoneyGram conducts compliance checks on every transaction, and abnormalities will lead to cancellation.

- Use only legitimate funds for remittances.

- Avoid transferring to high-risk countries or regions.

- If required to provide additional materials, promptly cooperate with MoneyGram to submit relevant proof.

Compliance issues are one of the conditions for canceling a remittance. Compliant operations can effectively ensure fund safety.

Confirm Recipient Account Status

Before remitting, confirm the account status with the recipient. If the recipient’s account is frozen, closed, or has abnormal transactions, MoneyGram will reject the remittance.

- Actively contact the recipient to confirm the account is in normal use.

- Avoid remitting to accounts that have been inactive for long periods or have abnormal records.

- If the recipient’s account information changes, promptly update the remittance details.

Account abnormalities are often overlooked but are a significant cause of transaction failure.

Check Amount Limits in Advance

Before remitting, understand the amount limits for the destination country or region. MoneyGram imposes strict single-transaction and periodic limits for different regions.

| Topic | Details |

|---|---|

| Transfer Limits | Most countries (e.g., U.S., UK, Canada) have a 30-day international transfer limit of 10,000 USD. |

| Additional Transfer Methods | MoneyGram allows users to send additional funds in person through certain partner institutions. |

| Fee Structure | Fees vary based on the amount and payment method, with noticeable increases in the 500-1,000 USD range. |

| Fee Estimator Tool | You can obtain accurate fee estimates on MoneyGram’s homepage under the “Fees and Rates” tab. |

You can use MoneyGram’s official tools to check limits and fees in advance to avoid cancellations due to exceeding amount limits.

Choose an Appropriate Payment Method

You should select a payment method based on the channels supported by the MoneyGram platform. Different methods suit different needs:

- Debit or Credit Card: Suitable for quick, secure small transactions.

- Bank Transfer: Suitable for sending larger amounts.

- Cash Payment: Available at MoneyGram agent locations.

- Mobile Wallet and Digital Payment Systems: Suitable for tech-savvy users.

Choosing a supported payment method can effectively reduce the risk of transaction failure.

Use Transaction Tracking Features

You can use MoneyGram’s transaction tracking feature to monitor the remittance status in real-time.

- Check transfer progress anytime via the MoneyGram website or mobile app.

- Set up notifications to receive status updates promptly.

- Contact MoneyGram customer service immediately if any abnormalities are detected.

The transaction tracking feature helps you identify and resolve issues promptly, further reducing the likelihood of remittance failure.

Handling a Canceled Remittance

Refund Process

When your MoneyGram remittance is canceled, you can apply for a refund through the following steps:

- Log in to the MoneyGram website or mobile app, go to the “My Orders” page, and select the canceled remittance record.

- Submit a refund request online, where the system will require you to provide relevant information, including the order reference number and personal identification.

- After submitting the request, you will receive an email containing the reference number. You can use this reference number and valid ID to collect the refund at a designated MoneyGram location.

- MoneyGram will charge a handling fee when processing refunds, with the specific amount based on the actual order.

Tip: When applying for a refund, be sure to keep the order reference number and related documents for subsequent inquiries and collection.

Refund Timeline

After submitting a refund request, MoneyGram typically processes the refund within seven to ten business days. If you paid using a credit card, debit card, or bank account, MoneyGram will transfer the refund back to the issuing institution within ten business days. The actual arrival time may vary due to differences in bank processing speeds. If you cancel a transfer at an agent location, you can usually collect a cash refund on-site.

- Online Refunds: Processing takes approximately seven to ten business days, with actual arrival depending on the bank or issuing institution.

- Agent Location Refunds: You can collect cash on-site with the reference number and ID.

Note: Refund arrival times may be delayed during holidays or bank system maintenance. Be patient and monitor account changes.

Customer Service Contact Methods

If you encounter issues during the refund process, you can contact MoneyGram customer service through the following methods:

- Call the customer service number listed on the MoneyGram website for live assistance.

- Submit inquiries through the online customer service system on the official website for real-time responses.

- Email MoneyGram’s official customer service address, detailing your order information and issues.

It’s recommended to prepare your order reference number and personal identification documents in advance when contacting customer service for quick verification and processing.

Account Information Verification

Before applying for a refund, recheck your account information to ensure accuracy. Incorrect account details may lead to refund delays or failures. You can follow these steps for self-verification:

- Confirm that the bank account name, number, and bank details match your identification documents.

- Check the validity and status of your credit or debit card to ensure it can receive refunds.

- If account information has changed, promptly update your MoneyGram account details.

Accurate account information is critical to ensuring a smooth refund. Verify carefully before proceeding to avoid unnecessary losses.

When using MoneyGram for remittances, pay close attention to accurate information entry, amount limits, recipient account status, and compliance requirements. You can verify all details in advance, choose an appropriate payment method, and use the transaction tracking feature to monitor progress in real-time. If issues arise, contact MoneyGram customer service promptly. Standardized operations and proactive communication can effectively reduce the risk of transaction failure and ensure the safety of your funds.

FAQ

Will funds be automatically refunded after a MoneyGram remittance fails?

After a remittance fails, MoneyGram will automatically initiate the refund process. You can check the order status on the MoneyGram platform to confirm refund progress. Funds are typically returned to the original payment account.

What payment methods can you use in mainland China?

You can choose bank transfers, debit cards, credit cards, or cash payments. Some licensed Hong Kong banks support MoneyGram remittances. You should select an appropriate method based on platform prompts.

Does MoneyGram have minimum and maximum amount limits?

When remitting from mainland China to the U.S., the maximum limit per transaction is 10,000 USD. The minimum amount is typically 1 USD. You should check MoneyGram’s official website for specific amount regulations.

How can you check the remittance status?

You can log in to the MoneyGram website or mobile app, enter the order reference number, and view the remittance progress in real-time. MoneyGram will notify you of status updates via SMS or email.

How long does a MoneyGram refund take?

After submitting a refund request, MoneyGram generally processes it within seven to ten business days. The actual arrival time depends on the bank or issuing institution’s processing speed.

MoneyGram cancellations require self-service portal requests before recipient pickup (needing reference number, sender’s last name/birthdate, and recipient’s last name), with refunds in 3-10 business days, but fees ($25-40 USD) and irreversible picked-up transfers add hurdles, especially in 2025’s $80+ trillion remittance market, where traditional providers’ delays and limits cause transaction failures. For a cost-effective, seamless alternative, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.