- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Ways to Send Money to the UK: A Comparison of Bank Wire Transfers, International Money Transfer Companies, and Digital Apps

Image Source: unsplash

When you send money to the UK through remittance, you typically focus on fees, transfer speed, and fund security. Each method has its pros and cons, but based on actual statistics and user feedback, choosing the best method that suits your needs is most important. The table below shows the proportion of remittance inflows to GDP in the UK in recent years:

| Year | Remittance Inflows to GDP Ratio |

|---|---|

| 2020 | 0.11782 |

| 2019 | 0.14642 |

| 2018 | 0.15133 |

| 2017 | 0.15955 |

| 2016 | 0.16829 |

When you operate in practice, common considerations include:

- For large amounts, you prioritize security.

- You compare the fees of various methods, including transfer fees and exchange rate differences.

- For urgent transfers, you focus on the time it takes to arrive.

When choosing the best method, you need to combine your transfer amount and urgency to make a flexible judgment.

Key Points

- When choosing a remittance method, consider fees, transfer speed, and security. Different methods suit different needs.

- Bank transfers are suitable for large remittances, with high security but higher fees and longer processing times.

- International money transfer companies have lower fees and faster speeds, suitable for small to medium remittances and frequent transfers.

- Digital apps offer convenience and fast processing, with transparent fees, suitable for daily small transfers and urgent remittances.

- Cryptocurrency transfers are fast and low-cost but require attention to security and compliance risks.

Method Overview

Image Source: unsplash

When sending money to the UK, you can choose from multiple methods. Each method suits different needs and user groups. The table below helps you quickly understand the core features of four mainstream remittance methods:

| Feature | Bank Transfer (e.g., Licensed Hong Kong Banks) | International Money Transfer Companies | Digital Apps | Cryptocurrency |

|---|---|---|---|---|

| Currency | Single currency/currency conversion | Multi-currency support | Multi-currency support | Multi-currency support |

| Speed | Usually completed within the same day (China Mainland to Hong Kong or UK may take 1-3 days) | Varies by company (generally 1-3 days) | Varies by app (fastest in minutes) | Varies by platform (fastest in minutes) |

| Cost | Higher international transfer fees (usually USD20-50 per transaction) | Varies (USD5-30 per transaction) | Varies (some as low as USD2 per transaction) | Low transaction fees (some platforms below USD1 per transaction) |

| Regulatory Requirements | Complies with China/Mainland China and Hong Kong regulations | Complies with international regulations | Varies by app | Varies by platform |

Bank Transfers

When you choose bank transfers, you usually prioritize security. Bank transfers are suitable for large remittances and users with high regulatory requirements. You need to provide detailed recipient information and bank account details. Bank transfers are widely used between China/Mainland China, Hong Kong, and the UK. You will find that bank transfers have higher fees but strong fund security. You are suitable for choosing bank transfers in scenarios requiring stability and compliance.

International Money Transfer Companies

If you want to save costs, you can consider international money transfer companies. These companies support multiple currencies and are suitable for users with frequent cross-border transfers. You only need to provide recipient information, and some companies also support cash withdrawals. You will find that international money transfer companies vary greatly in speed and fees. You are suitable for choosing them for small to medium remittances and scenarios with certain speed requirements.

Digital Apps

If you prioritize convenience and fast processing, you can choose digital apps. Digital apps support mobile operations, with some completing transfers in minutes. You only need to link a bank card or e-wallet, and the operation is simple. Digital apps are suitable for daily small transfers and younger users. You will find that digital apps have lower fees, and some support real-time exchange rate inquiries. You are suitable for choosing digital apps for daily life and urgent transfer scenarios.

Cryptocurrency

If you focus on innovation and low costs, you can try cryptocurrency. Cryptocurrency supports global transfers, with some platforms having extremely low fees. You need a digital wallet and basic operational knowledge. Cryptocurrency is suitable for users dissatisfied with traditional financial channels. You will find that cryptocurrency transfers are fast, but you need to assess security and compliance risks yourself. You are suitable for choosing cryptocurrency in scenarios highly sensitive to speed and cost, but you need to be cautious of risks.

You can choose the best method based on your needs, combining fees, speed, and security.

Fee Comparison

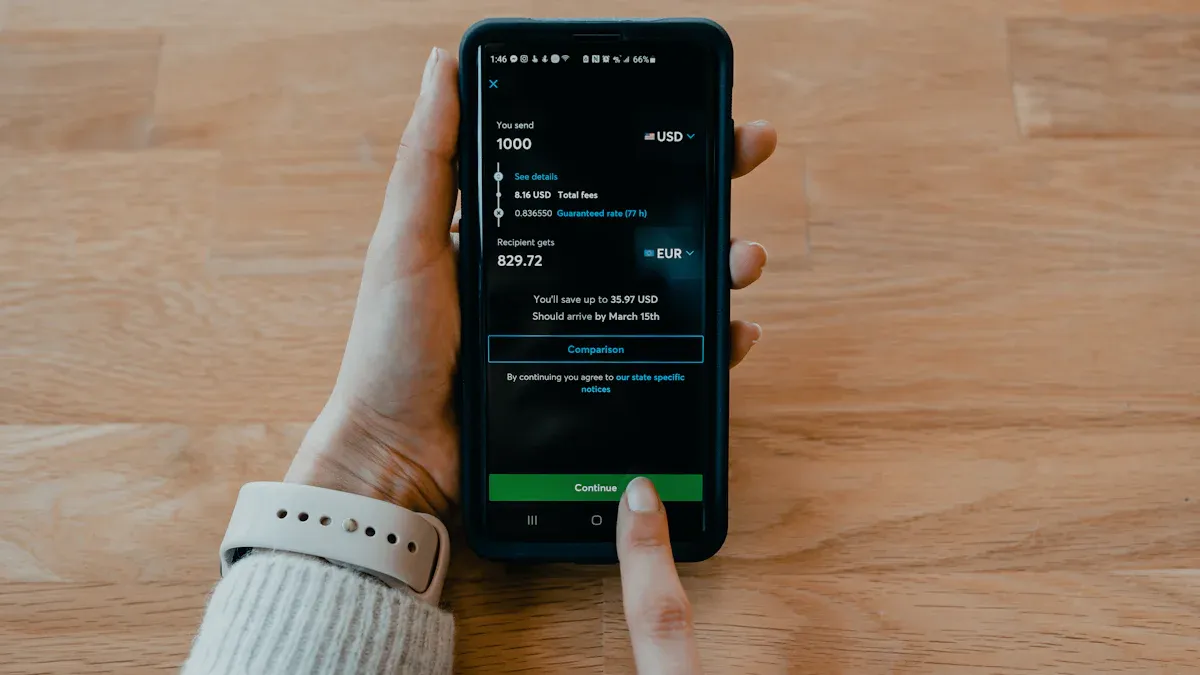

Image Source: pexels

Bank Transfer Fees

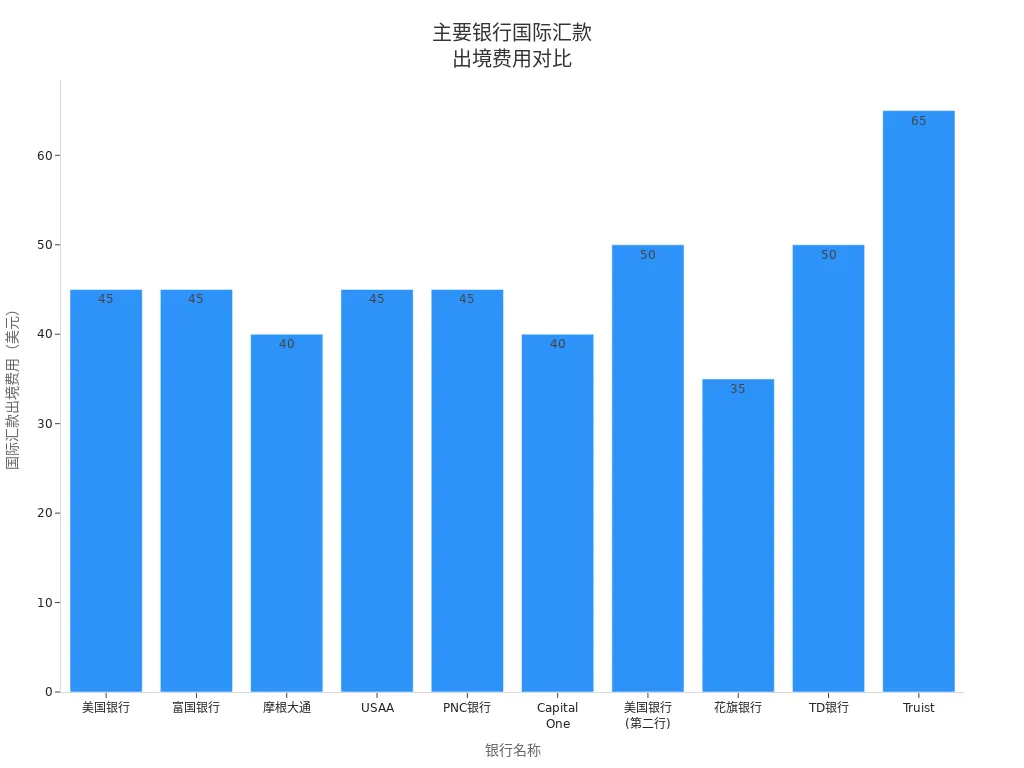

When you use bank transfers to send money to the UK, you usually find the fees to be higher. The fee structure for bank transfers includes transfer handling fees and possible intermediary bank fees. For example, with licensed Hong Kong banks, international transfer fees are generally between USD20-50. The table below shows international remittance fees for major U.S. banks, which you can reference to judge the cost of bank transfers:

| Bank Name | International Outbound Transfer Fee (USD) |

|---|---|

| Bank of America | 45 |

| Wells Fargo | 45 |

| JPMorgan Chase | 40 |

| USAA | 45 |

| PNC Bank | 40-45 |

| Capital One | 40 |

| Citibank | 35 |

| TD Bank | 50 |

| Truist | 65 |

You will find that bank transfer fees are significantly higher than other methods. Banks charge high fees mainly due to technical limitations and high operational costs.

International Money Transfer Company Fees

If you choose international money transfer companies, you can usually save a significant amount on fees. Companies like Wise, OFX, and others use local account networks to reduce intermediary fees. Generally, their fees range between USD5-30, with some companies charging even less. You can refer to the table below:

| Transfer Company | International Transfer Fee (USD) |

|---|---|

| Wise | 5-10 |

| OFX | 0-15 |

| Western Union | 10-30 |

When you operate in practice, you find that international money transfer companies have lower fees than banks, making them suitable for frequent cross-border transfers. Some companies also adjust fees based on the transfer amount and destination.

Tip: If you are transferring a larger amount, you can prioritize international money transfer companies as the best method, saving costs while ensuring transfer speed.

Digital App Fees

When you use digital apps (such as PayPal, Revolut, etc.) for remittances, the fees are usually lower. The handling fees for digital apps generally range between USD2-15, with some apps even free. The table below shows the fee structure for common digital apps:

| App Name | Fee (USD) | Remarks |

|---|---|---|

| PayPal | 2-10 | Charged based on amount |

| Revolut | 0-5 | Some transfers free |

| Wise | 5-10 | Real-time exchange rate |

You only need to operate on your phone, with transparent fees, suitable for daily small transfers. Some banks’ digital channels also offer free services, but urgent transfers may incur additional fees.

Cryptocurrency Fees

If you choose cryptocurrency for remittances, the fees are usually very low. Mainstream cryptocurrency platforms like USDT, BTC, etc., have transfer fees generally below USD1. You need a digital wallet and basic operational knowledge. Cryptocurrency is suitable for users extremely sensitive to costs, but you need to be cautious of platform security and compliance risks.

Note: Although cryptocurrency has low fees, you need to bear the risks of exchange rate fluctuations and regulatory compliance.

When choosing a remittance method, you can comprehensively consider fees, speed, and security to find the best method for yourself.

Speed Comparison

Bank Transfer Speed

When you use bank transfers, you usually need to wait longer. International bank transfers generally take one to five business days. If you send money from China/Mainland China or Hong Kong to the UK, the arrival speed is affected by the banking system and intermediary banks. In practice, you find that bank transfers are suitable for large fund transfers that are not urgent.

- International bank transfers usually take one to five business days to process.

- Generally, international bank transfers will arrive within one to five business days. Bank transfers are secure but not the fastest option.

International Money Transfer Company Speed

If you choose international money transfer companies, the arrival speed is faster. Speeds vary significantly by company. The table below shows the estimated arrival times for mainstream international money transfer companies:

| Service Provider | Estimated Arrival Time |

|---|---|

| Bank (SWIFT) | 1-5 business days |

| Wise | Seconds to 2 business days |

| Western Union | Minutes to 5 business days (bank transfer); minutes to 4 business days (cash withdrawal) |

| MoneyGram | 1 hour to the next business day |

| WorldRemit | Usually within minutes |

| Xoom | Bank transfers in hours; cash withdrawals in minutes |

| XE | 1 to 4 business days |

| Remitly | Express in minutes (with extra fees); Economy 3-5 business days |

You can choose faster arrival methods based on the transfer company and service type. International money transfer companies are suitable for scenarios requiring speed.

Digital App Speed

When you use digital apps, you can usually experience faster arrival speeds. Apps like PayPal, Revolut, etc., support real-time transfers or complete transfers within minutes. You only need to operate on your phone, and funds can quickly reach the recipient’s account in the UK. Digital apps are suitable for daily small transfers and urgent remittances. If you need to send money quickly, digital apps are one of the best methods.

Cryptocurrency Speed

If you choose cryptocurrency for cross-border remittances, the speed is very fast. Cryptocurrency transactions are usually completed within minutes. You don’t need to wait for bank clearing or worry about holiday delays.

- Cryptocurrency transactions are usually completed within minutes, especially for cross-border transfers.

- Real-time payment networks allow instant fund transfers, typically completed within seconds and operating 24/7. When you pursue extreme speed, you can consider cryptocurrency, but you need to be cautious of platform security and compliance.

Security Analysis

Bank Transfer Security

When you use bank transfers, banks take multiple security measures to protect your funds. Banks comply with anti-money laundering (AML) regulations, capable of detecting and preventing criminals from disguising illegal funds as legitimate income. Each fund transfer must include sender and recipient information, increasing transparency and helping banks detect and prevent money laundering or terrorist financing activities. Banks also collect detailed personal information, including name, address, date of birth, occupation, nationality, and country of residence. In case of suspicious transactions, banks are legally obligated to report promptly.

If you choose licensed Hong Kong banks for transfers, the fund security is high, suitable for large remittances and scenarios with strict compliance requirements. Bank transfers perform reliably in terms of security, making them the best method for many users.

International Money Transfer Company Security

When you use international money transfer companies, fund security is also protected by multiple safeguards. The table below shows main regulatory measures and institutions:

| Regulatory Body/Measure | Description |

|---|---|

| DFID | Regulates remittance channels through the UK Remittances Working Group to ensure fund security |

| JMLSG | Assists in identifying criminal risks and provides compliance guidance |

| FSCS | Offers up to USD85,000 in fund protection for customers |

| PIs and EMIs | Customer funds are separated from company funds, protected by FCA |

You can rest assured that international money transfer companies reduce risks by separating customer and company funds and undergoing multiple regulatory oversights. FSCS also provides up to USD85,000 in compensation protection. If you choose international money transfer companies, security is institutionally guaranteed, suitable for small to medium remittances.

Digital App Security

When you use digital apps for international remittances, security primarily relies on technical measures. You should choose secure websites and apps, ensuring the URL starts with “https://” and displays a lock icon in the address bar. You can enable two-factor authentication (2FA), requiring a one-time verification code for each login or transfer. You should also use trusted payment gateways for transactions.

Digital apps protect your account and funds through encryption and multi-factor authentication. If you value operational convenience and real-time transfers, digital apps are a relatively secure choice.

Cryptocurrency Security

If you choose cryptocurrency for remittances, you need to pay special attention to security risks. Cryptocurrencies have high volatility, and market misuse is common, with higher financial crime risks. Many retail consumers have limited understanding of crypto assets, and the legitimate demand for investing in these products is unclear.

- Cryptocurrency transfers are fast, but you need to be cautious of platform security and regulatory compliance.

- When using cryptocurrency, you need to assess risks yourself and choose trading platforms carefully. Cryptocurrency is suitable for users highly sensitive to speed and cost, but you need to manage security and compliance risks yourself.

Convenience Comparison

Bank Transfer Convenience

When you use bank transfers, you usually need to visit a bank branch or operate through online banking. Licensed Hong Kong banks offer multiple channels, including online banking and mobile banking. You can manage multiple currencies through a Wise business account with low fees and mid-market exchange rates, making fund management simpler. This account also supports invoice processing and large payments, enhancing your operational convenience. Bank fast fund transfer services help you pay suppliers and employees on time, ensuring business continuity. Although bank transfers involve more procedures, they remain the preferred choice for large and highly regulated scenarios.

- You can initiate transfers through online banking or mobile banking.

- Wise business accounts support multi-currency management and invoice processing.

- Bank services ensure timely fund arrivals, maintaining business relationships.

International Money Transfer Company Convenience

If you choose international money transfer companies, the operation process is simpler. Many companies offer real-time tracking, user-friendly interfaces, and multiple payment methods. The table below shows key features of international money transfer companies that enhance convenience:

| Feature | Description |

|---|---|

| Tracking Options | Users can track transfer status in real time. |

| Multiple Payment Methods | Offers various funding methods, including online and mobile apps. |

| User-Friendly Interface | Simple interface design for easy operation. |

You can check exchange rates anytime, enjoy faster repeat transfers, and locate the nearest Ria location. Transfers are typically completed within 15 minutes to a few hours, with low fees allowing you to send money easily from mobile devices or desktops. Competitive exchange rates ensure more funds reach the recipient. International money transfer companies are suitable for frequent transfers and users with high convenience requirements.

Digital App Convenience

When you use digital apps, you experience high convenience. Apps like Currencycloud allow access to multi-currency accounts and international payment functions. UK SMEs can leverage 15 additional local payment channels to transfer funds to over 180 countries easily. These features significantly reduce management and cost burdens. Digital apps let you send and receive funds quickly and easily, often cheaper than traditional banks or remittance services. You can choose peer-to-peer apps, apps directly connected to banks, or international transfer apps. Instant payment features allow transactions to complete in seconds, reducing payment processing costs and enhancing the mobile experience. Digital apps are the best method for many users’ daily transfers.

- You can access multi-currency accounts and international payment functions.

- Fund transfers cover the globe with low management costs.

- Instant payments improve operational efficiency.

Cryptocurrency Convenience

If you choose cryptocurrency for remittances, you will find both convenience and challenges. The digital pound, as a central bank digital currency, aims to provide a secure and efficient payment method, adapting to the decline in cash usage. Widespread use of the digital pound can stimulate domestic market innovation, including leasing and e-commerce. However, you may encounter challenges, such as financial stability and privacy risks, and phone loss or network interruptions may affect fund security. The Bank of England and HM Treasury are advancing the digital pound’s design phase, expected to continue until 2025/2026. When choosing cryptocurrency, you need to balance convenience and security, suitable for users with high demands for innovation and low costs.

- The digital pound provides an efficient payment experience, adapting to the trend of reduced cash usage.

- Widespread adoption can promote market innovation.

- You need to be cautious of financial stability, privacy, and device security issues during use.

Exchange Rates and Hidden Costs

Bank Transfer Exchange Rates

When you use bank transfers to send money to the UK, banks typically do not directly adopt the mid-market exchange rate. Licensed Hong Kong banks and other international banks add a markup to the actual exchange rate. You can refer to the table below to understand the difference between bank exchange rates and the mid-market rate:

| Bank | Mid-Market Rate | Bank Rate | Difference (%) |

|---|---|---|---|

| Certain International Bank | 1.1641 | 1.1239 | 3.55% |

| 0.7843 | 0.7572 | 3.55% |

The exchange rate you receive is usually 3% to 4% lower than the market rate. Banks may also charge currency conversion fees and intermediary bank fees. You need to be cautious during remittances, as these hidden costs directly affect the amount the recipient actually receives.

Hidden costs of bank transfers include exchange rate markups, currency conversion fees, intermediary bank fees, and recipient bank fees. These fees may not be obvious initially but will reduce the total amount received by the recipient.

International Money Transfer Company Exchange Rates

If you choose international money transfer companies, the exchange rates are usually more competitive than banks. Many companies advertise low handling fees, but the actual exchange rate may include a 1% to 4% markup over the mid-market rate. By understanding how these fees work, you can choose the right service to control your finances. The table below shows common hidden fees:

| Hidden Fee | Meaning |

|---|---|

| Exchange Rate Markup | The exchange rate you receive is worse than the actual market rate |

| Currency Conversion Fee | Additional fees for converting USD or GBP to other currencies |

| Intermediary Bank Fee | Intermediary banks in the SWIFT network may deduct small fees |

| Recipient Bank Fee | Some foreign banks charge fees for accepting international transfers |

You need to be cautious during remittances, as although international money transfer companies have low handling fees, exchange rate markups and other hidden fees will also affect the final amount received.

Digital App Exchange Rates

When you use digital apps for remittances, some apps like Wise use the mid-market exchange rate directly, with no markup and transparent fees. Other apps like Remitly add a 1% to 4% markup on the mid-market rate and charge fixed handling fees. The table below helps you compare the exchange rates and fee structures of different digital apps:

| App | Rate Type | Fixed Fee | Hidden Fees |

|---|---|---|---|

| Paysend | Competitive rate, close to mid-market | USD2 | No hidden fees |

| Remitly | Mid-market rate plus 1-4% | USD1.49-3.99 | Exchange rate markup not always clearly disclosed |

| Wise | Actual mid-market rate | From 0.1% | N/A |

When choosing digital apps, you can prioritize services with transparent exchange rates and low fees to reduce hidden costs.

Cryptocurrency Exchange Rates

If you use cryptocurrency for remittances, exchange rates and transaction costs are influenced by multiple factors. Smaller remittance amounts usually face higher fees, sometimes accounting for 10% to 20% of the transfer amount. You can reduce transaction costs by choosing platforms with fixed fees and increasing market competition. Factors affecting cryptocurrency exchange rates and costs include:

- Smaller transfer amounts have higher fee proportions

- Fixed-fee platforms help reduce costs

- Increased market competition leads to lower prices

When using cryptocurrency, you need to pay attention to platform exchange rates and fee structures, choosing remittance channels reasonably to avoid unnecessary hidden costs.

Best Method Comparison

When choosing a method to send money to the UK, you often weigh fees, transfer speed, security, convenience, and exchange rates. Each method has unique advantages and limitations. You can quickly understand the comprehensive performance of four mainstream methods through the table below:

| Aspect | Bank Transfer | International Money Transfer Companies | Digital Apps | Cryptocurrency |

|---|---|---|---|---|

| Fees | Higher fees | Moderate fees | Lower fees | Unstable fees |

| Speed | 1-3 business days | 1-2 business days | Real-time | Real-time |

| Security | High | Medium | Medium | Low |

| Convenience | Medium | High | High | Medium |

| Exchange Rate | Medium | Medium | High | Low |

If you choose bank transfers, you usually get the highest security. Licensed Hong Kong banks strictly comply with regulatory requirements, suitable for sending large funds. You need to bear higher handling fees and exchange rate markups, with transfer times generally taking 1-3 business days. Bank transfers are suitable for scenarios with compliance needs or high emphasis on fund security in China/Mainland China.

If you choose international money transfer companies, you can balance fees and speed. Most companies like Wise, Western Union, etc., support multiple currencies, with moderate fees and faster speeds. You can operate via mobile or computer, enjoying high convenience. International money transfer companies are suitable for frequent cross-border transfers or small to medium remittances.

If you pursue extreme convenience and real-time transfers, you can choose digital apps. You only need a few steps, and funds can reach the recipient’s account in the UK. Apps like Wise, PayPal, etc., have low fees and transparent exchange rates, suitable for daily small or urgent remittances. When using digital apps, you experience efficiency and flexibility, but security is slightly lower than bank transfers.

If you focus on innovation and cost, you can try cryptocurrency. You can achieve global real-time transfers, with some platforms having extremely low fees. You need a digital wallet and basic operational knowledge. Cryptocurrency is suitable for scenarios highly sensitive to speed and cost, but you need to assess security and compliance risks yourself.

When making a practical choice, it’s recommended to prioritize your remittance amount, speed requirements, and security needs. You can further understand the performance of specific services through the table below:

| Service | Fee Structure | Transfer Speed | User Satisfaction |

|---|---|---|---|

| Wise | Transparent fee structure, competitive exchange rates | Most transfers completed within minutes | High, trusted by users |

| PayPal | Less transparent fees, possible additional charges | Payments almost instant but may have delays | Low, Trustpilot rating of 1.3 |

If you choose Wise, you can enjoy transparent fees and real-time exchange rates, with fast transfer speeds and high user satisfaction. If you choose PayPal, although the transfer speed is fast, the fee structure is less transparent, and user reviews are lower. When choosing digital apps, it’s recommended to prioritize fee and exchange rate transparency.

After comprehensively considering fees, speed, security, convenience, and exchange rates, you can find the best method for yourself. If you are transferring a larger amount, it’s recommended to choose bank transfers or international money transfer companies. If you prioritize speed and convenience, digital apps are a better choice. If you are willing to take risks, cryptocurrency can also serve as an alternative channel.

Scenarios and Best Methods

Large Remittances

When you need to send large funds to the UK, security and compliance are the primary considerations. International bank transfers are the preferred choice for many users, especially through licensed banks in China/Mainland China or Hong Kong. Although bank transfers have higher fees, they provide stable fund protection and strict regulatory processes. You can choose from the following methods:

- International Wire Transfer: Conducted through banks, suitable for large funds with high security, but handling fees are typically between USD20-50.

- Online Remittance Services: Such as Wise, PayPal, and Revolut, with lower fees and fast speeds, suitable for some large transfer needs.

- Forex Brokers: For example, Currencies Direct or XE, offering better exchange rates and personalized services, suitable for large fund transfers.

- Mobile Payment Services: Western Union and MoneyGram support direct transfers to recipient bank accounts or mobile wallets, convenient to operate.

- Traditional Methods: Such as drafts or checks, with high security but longer processing times, suitable for scenarios with low speed requirements.

When choosing the best method, you can prioritize bank transfers and forex brokers. If you are more concerned about speed and cost, online remittance services are also a good choice. Bank channels and trusted financial institutions are generally considered the safest options. Digital payment platforms like PayPal, Revolut, and Wise also use encryption technology to secure your financial data.

Tip: When sending large funds, it’s recommended to consult banks or professional institutions in advance to ensure compliance and fund security.

Small Transfers

When you conduct daily small transfers, speed and fees become the main concerns. Digital apps and online transfer services provide efficient and convenient solutions. The table below helps you quickly compare the features of different methods:

| Transfer Method | Speed | Fees | Best Use |

|---|---|---|---|

| Online Transfer | Instant–2 days | Low | Daily, personal, and business |

| Mobile App | Instant–1 day | Low | Fast, small transfers |

You can complete transfers within minutes through mobile apps or online platforms. Digital apps like Wise, Revolut, etc., support real-time transfers with fees as low as USD2-10. In daily life, choosing digital apps as the best method can effectively save costs and time. Mobile payment services are also suitable for small transfers, with simple operations, ideal for young users and frequent cross-border remittance scenarios.

Tip: For small transfers, it’s recommended to prioritize digital apps with transparent fees and competitive exchange rates to avoid unnecessary hidden costs.

Urgent Remittances

When you face urgent situations, you need funds to arrive quickly. At this point, transfer speed and reliability become the deciding factors. You can choose from the following methods:

- Wise: Offers fast transfers and transparent arrival time estimates, suitable for urgent remittances.

- TorFx: Suitable for large urgent transfers, supporting UK recipients with efficient service.

- Zing: Focused on small transfers, with fast response times, suitable for temporary fund needs.

- Regency FX: Small team, flexible and efficient, able to meet special urgent scenarios.

For urgent remittances, digital apps and some international money transfer companies can achieve arrivals in minutes. Bank transfers, while secure, have longer processing times, making them unsuitable for urgent needs. You can choose the fastest and most cost-effective service based on your situation. Digital apps like Wise and Revolut provide real-time transfers and transparent fees, making them one of the best methods for urgent remittances.

Note: For urgent remittances, it’s recommended to verify recipient information in advance to ensure funds arrive safely and promptly.

Pros and Cons and Recommendations

Bank Transfer Pros and Cons

When you choose bank transfers, you can achieve high security. Bank transfers are suitable for scenarios requiring large remittances and strict compliance. Licensed Hong Kong banks typically follow strict regulatory requirements to ensure fund security. You can use bank transfers globally, supported in almost all countries and regions.

However, you will also find that bank transfers have higher handling fees, typically between USD20-50. The processing time is longer, generally requiring 1-3 business days. Banks also add markups to exchange rates, and the actual amount received may be lower than expected. You need to provide detailed recipient information, and the procedure is relatively cumbersome.

| Pros | Cons |

|---|---|

| High security | High handling fees |

| Globally available | Long processing time |

| Suitable for large remittances | Exchange rate markups |

| Strict regulation | Cumbersome operation process |

Bank transfers are a common choice for large fund transfers through licensed banks in China/Mainland China or Hong Kong, but you need to weigh costs and arrival speed.

International Money Transfer Company Pros and Cons

If you choose international money transfer companies, you can enjoy lower fees and faster arrival times. Many companies support multiple currencies, with simple operation processes. You can complete transfers easily via mobile or computer, and some companies support cash withdrawals, suitable for recipients without bank accounts.

However, the service coverage of international money transfer companies is limited, and some countries and regions may not be supported. You need to pay attention to the company’s qualifications and regulatory status when choosing. Some companies may experience delays during peak periods, and fee structures may vary based on amount and destination.

| Pros | Cons |

|---|---|

| Low fees, fast speed | Limited country availability |

| Convenient operation | Fee structure may be unclear |

| Supports multiple currencies | Some services require recipient bank accounts |

| Suitable for small to medium and urgent remittances | Possible delays during peak periods |

For frequent cross-border transfers or small to medium remittances, international money transfer companies offer flexible options, but you should pay attention to service coverage and fee details.

Digital App Pros and Cons

When you use digital apps, you can experience high convenience and lower fees. Apps like Wise, Revolut, etc., support real-time transfers with transparent fees. You only need a few steps, and funds can reach the recipient’s account in the UK. Digital apps are suitable for daily small transfers and urgent remittances.

However, you need to note that some digital apps only support specific countries or regions. Recipients typically need a bank account or e-wallet. Poor network conditions may limit operations. Some apps add markups to exchange rates, and you need to calculate the actual amount received in advance.

| Pros | Cons |

|---|---|

| Convenient operation, real-time transfers | Limited country and region availability |

| Low fees, transparent exchange rates | Recipients need bank accounts |

| Suitable for small and urgent transfers | Network conditions affect usage |

| Supports multiple currencies | Some apps have exchange rate markups |

In daily life and urgent scenarios, digital apps provide an efficient experience, but you should confirm recipient conditions and fee structures in advance.

Cryptocurrency Pros and Cons

If you choose cryptocurrency for remittances, you can enjoy extremely low handling fees and fast arrival times. Cryptocurrency is not restricted by traditional banking systems and is usable globally. You only need a digital wallet to complete transfers anytime, anywhere.

However, you need to bear higher risks. Cryptocurrency prices are highly volatile, and platform security varies. Some platforms lack regulation, making fund security difficult to guarantee. You also need certain cryptocurrency knowledge, and the operational threshold is higher. For small transfers, some platforms’ fixed fees may have a higher proportion.

| Pros | Cons |

|---|---|

| Extremely low fees, fast transfers | High price volatility, high risk |

| Globally available | Inconsistent platform security |

| Not restricted by banking systems | Lack of regulation, compliance risks |

| Suitable for innovation and low-cost needs | Higher operational threshold |

When pursuing speed and cost, cryptocurrency offers a new choice, but you need to carefully assess platform and personal risk tolerance.

Selection Recommendations

When choosing a remittance method, you can combine your needs and actual scenarios. The following recommendations help you find the best method:

- If you need large remittances, prioritize bank transfers or forex brokers. Bank transfers have high security, while forex brokers offer transparent fees and smaller exchange rate markups.

- If you pursue low fees and high efficiency, choose international money transfer companies or digital apps. P2P currency exchange platforms typically have lower fees, use real mid-market exchange rates, and offer high security.

- If you have a demand for innovation and extremely low costs, try cryptocurrency, but be cautious of platform security and compliance risks.

- Before remitting, it’s recommended to thoroughly understand all fees and exchange rates to avoid hidden costs affecting the actual amount received.

- When sending money between the US and the UK, relevant regulatory bodies will protect your funds. For example, the US Consumer Financial Protection Bureau (CFPB) oversees international remittances over USD15, ensuring you can see all fees before transferring.

Before sending any funds, it’s strongly recommended to consult a qualified tax professional to ensure compliance with US and UK laws.

You can flexibly choose the most suitable method based on remittance amount, speed requirements, and security factors. This way, you can find the true best method for different scenarios.

When choosing a remittance method, you need to focus on fees, speed, security, convenience, and exchange rates. Bank transfers are suitable for large amounts and high security needs, while international money transfer companies and digital apps are better for small and urgent scenarios. Although cryptocurrency has low costs, it carries higher risks. You should rationally judge the best method based on your situation to avoid losses due to overlooked details.

FAQ

What information is needed for bank transfers when sending money to the UK?

You need to provide the recipient’s name, bank account number, bank name, and SWIFT code. You also need to specify the purpose of the transfer. Licensed Hong Kong banks typically require you to verify all information to ensure fund security.

Are digital app remittances secure?

You can choose well-known digital apps for remittances. Most apps use encryption and two-factor authentication. You should ensure you download the official version and enable security settings. This effectively protects your funds and personal information.

How long does it take for a remittance to the UK to arrive?

When you choose bank transfers, it usually takes 1-3 business days. International money transfer companies and digital apps can arrive in minutes at the fastest. Cryptocurrency platforms can also achieve real-time transfers. You can choose the appropriate method based on urgency.

How are remittance fees calculated?

You need to pay attention to transaction fees, exchange rate markups, and potential intermediary bank charges. Bank wire transfers tend to have higher fees, typically ranging from USD 20 to 50. International money transfer companies and digital apps generally charge lower fees. You can check the detailed fee schedule in advance to avoid hidden costs.

Are there limits on remittance amounts?

When sending money from China/ Mainland China, banks and digital apps impose per-transaction or daily limits. Licensed Hong Kong banks have compliance requirements for large-value transfers. You should consult your bank or service provider in advance to ensure a smooth remittance process.

When sending money to the UK, your choice—whether it’s the security of a bank wire, the balance of an international money transfer company, or the immediacy of a digital app—is ultimately driven by efficiency, cost, and risk tolerance. As global digital finance evolves, the smartest decision is to find a platform that integrates these benefits and offers flexible access to global investment markets.

BiyaPay provides exactly this comprehensive solution. You can achieve zero-barrier global investment with our quick registration, completed in just 3 minutes without needing an overseas bank account. On the cost front, we offer remittance fees as low as 0.5%, providing savings of up to 90% compared to traditional banks. Furthermore, our real-time exchange rate inquiry and fiat conversion service ensure you constantly monitor rate dynamics to avoid hidden losses.

Crucially, BiyaPay connects your funds directly to global assets. We support the conversion between fiat and digital currencies (like USDT), ensuring quick funding by bypassing complex channels. A single account allows you to trade both US and Hong Kong stocks, enabling unified, quicker asset management without platform switching. For active traders, we offer zero commission for contract limit orders, a preferred method for low-cost position building. All transfers are supported by global remittance with same-day sending and arrival, meaning funds reach their destination the same day, so you never miss a critical trading window. Start exploring today to experience more efficient and transparent cross-border financial services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.