- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use Apple Pay for International Transactions? A Detailed Explanation of Convenience, Security, and Payment Experience

Image Source: pexels

You can use Apple Pay for international transactions in many countries and regions worldwide, whether in malls, supermarkets, or online shopping. Apple Pay supports multiple international bank card types, including Visa and Mastercard. According to data, Apple Pay has the largest international transaction volume, surpassing Google Pay and Samsung Pay:

| Mobile Payment Platform | International Transaction Volume |

|---|---|

| Apple Pay | Largest |

| Google Pay | Second Largest |

| Samsung Pay | Smallest |

You will find in actual use that Apple Pay is not only convenient but also allows you to easily manage different currencies and multiple bank cards.

Key Points

- Apple Pay supports international transactions in 97 countries and regions, making global shopping convenient for users.

- Users can add multiple international bank cards to Apple Pay to meet various payment needs.

- Apple Pay uses encryption and tokenization technology to ensure transaction security and protect user privacy.

- Using Apple Pay offers a fast and convenient payment experience, with transaction speeds 63% faster than traditional card payments.

- When using Apple Pay, you should be aware of foreign transaction fees and regional restrictions, confirming card compatibility in advance.

Apple Pay International Transaction Support

Supported Countries and Regions

You can use Apple Pay for international transactions globally. Apple Pay currently supports international transaction services in 97 countries and regions, with at least one issuer supporting compatible cards in each region. You can experience the convenience of Apple Pay in major markets such as China/Mainland China, Hong Kong, the United States, the United Kingdom, France, and Japan. The table below shows the coverage of Apple Pay international transactions:

| Number of Supported Countries and Regions | Example Major Markets |

|---|---|

| 97 | China/Mainland China, Hong Kong, United States, United Kingdom, France, Japan |

When traveling abroad or shopping cross-border, you can confidently use Apple Pay for international transactions without worrying about regional restrictions. Apple Pay’s global expansion is rapid, with support for 11,000 banks and over 785,000,000 global users. Last year, the user count was 744,000,000, showing clear growth.

| Number of Banks Supporting Apple Pay | Global Apple Pay Users |

|---|---|

| 11,000 | 785,000,000 |

| Previous Year’s User Count | 744,000,000 |

Bank Card Types

You can add multiple international bank cards to Apple Pay. The most common card types include Visa, Mastercard, and American Express. Some regions do not yet support American Express, DC Card, or JCB Cards. In China/Mainland China or Hong Kong, you can typically use Visa and Mastercard, and some American Express cards issued by licensed Hong Kong banks are also supported. The table below shows the supported and excluded card types:

| Supported Card Types | Excluded Card Types |

|---|---|

| Visa | American Express (in some regions) |

| Mastercard | DC Card, JCB Cards |

| American Express | American Express (in some regions) |

You can manage multiple credit cards in Apple Pay to meet payment needs in different countries and regions. Apple Pay allows you to add multiple cards to your wallet, making it easy to choose the appropriate payment method for different scenarios. You used to be able to register credit cards from different countries, but now you need to ensure the issuing bank’s country matches your Apple ID’s country/region.

Tip: When adding international bank cards, it’s recommended to prioritize cards that support contactless payments and confirm that the bank has enabled Apple Pay services.

Applicable Scenarios

You can use Apple Pay for international transactions in various scenarios. Common use cases include:

- In-store shopping: At malls, supermarkets, restaurants, and other retail stores, you can complete payments by holding your device near a POS terminal.

- Online transactions: When shopping on e-commerce platforms or in apps, you can select Apple Pay at checkout, eliminating the need to enter card details.

- Public transportation payments: You can use Apple Pay for quick entry and exit in city transit systems like New York’s MTA subway and bus lines, London’s TfL public transport, San Francisco Bay Area’s Clipper card, and Hong Kong’s Octopus card.

Apple Pay international transactions support multi-currency payments. You can use Apple Pay at any international location with contactless payment terminals, greatly facilitating cross-border travel and consumption. You can flexibly switch between different bank cards to manage multi-currency bills without carrying multiple physical cards.

In your actual experience, you will find that Apple Pay international transactions not only improve payment efficiency but also provide a secure and convenient payment experience worldwide.

Operation Process

Image Source: pexels

Account Setup

To use Apple Pay for international transactions, you first need a compatible device. Apple Pay supports various devices, including iPhone, Apple Watch, iPad, Mac, and Apple Vision Pro. You can use these devices for contactless payments in multiple countries and regions, such as China/Mainland China, Hong Kong, and the United States. You can experience the convenience of Apple Pay in stores, apps, and Safari browsers.

Tip: When traveling, you may encounter service fees from local banks or device compatibility restrictions in some regions. It’s advisable to check the destination’s policies in advance.

You need to ensure your device is updated to the latest operating system version. You also need a valid Apple ID and must be signed in to your device. This way, you can smoothly add bank cards and conduct international transactions.

Adding an International Bank Card

You can follow these steps to add an international bank card to Apple Pay:

- Open the “Wallet & Apple Pay” app on your device.

- Tap the “Add Card” button.

- Hold the bank card near your iPhone, and the system will automatically recognize the card information. If it cannot be recognized, you can place the card in the viewfinder to scan it.

- If scanning fails, you can manually enter the card number, expiration date, and security code.

- Follow the on-screen prompts to fill in the required personal information.

- The system may require additional verification via SMS, email, or a customer service call. You need to enter the verification code sent by the bank or card issuer to complete identity verification.

- Once verified, the bank card will be added to your wallet.

You can add credit, debit, or prepaid cards from participating banks and card issuers. When using Apple Pay in China/Mainland China or Hong Kong, it’s recommended to prioritize cards that support contactless payments. You can also manage multiple bank cards simultaneously, making it convenient to switch between them in different countries and regions.

Note: Some banks may require you to download a dedicated app or provide additional information. Before adding a card, it’s best to consult the issuing bank for specific requirements.

Payment Steps

After completing account setup and adding a bank card, you can start using Apple Pay for international transactions. The payment process is very simple:

- When shopping in-store, simply hold your iPhone or Apple Watch near an NFC-enabled POS terminal. The system will automatically display the payment interface.

- You can authenticate using Face ID, Touch ID, or your device passcode. Biometric authentication ensures only you can complete the payment, greatly enhancing security.

- For in-app or Safari browser purchases, select Apple Pay as the checkout method and follow the prompts to complete authentication.

- Each transaction is protected by tokenization technology, ensuring the payment process is secure and reliable.

When conducting international transactions, some merchants may charge foreign transaction fees. For example, when using Apple Cash for international payments, 3% of the transaction amount is charged as a foreign transaction fee. You may also encounter currency conversion, with specific fees and exchange rates determined by the merchant and payment network, typically settled in USD.

In your actual experience, you will find that Apple Pay not only makes payments faster but also integrates with your contacts, making it easy to transfer money to friends or family without entering complex bank details.

You can switch between different bank cards in your wallet at any time to manage multi-currency bills without carrying physical cards. Apple Pay international transactions allow you to enjoy an efficient and secure payment experience worldwide.

Security Measures

Image Source: unsplash

Encryption and Tokenization

When using Apple Pay for international transactions, the system automatically employs multiple security technologies to protect your funds and information. Apple Pay uses tokenization technology to replace your real card number with a unique token. Merchants cannot access your actual credit card number, effectively preventing payment fraud. During the transaction process, the system encrypts payment data to ensure your personal information is not leaked. When using Apple Pay in China/Mainland China or Hong Kong, whether with Visa or Mastercard issued by licensed Hong Kong banks, you can enjoy the same security standards. The table below shows the main security technologies used by Apple Pay and their effects:

| Technology | Description | Effect |

|---|---|---|

| Tokenization | Replaces sensitive card information with a unique token, preventing merchants from accessing actual credit card numbers. | Enhances security, complies with PCI DSS standards, and reduces the risk of payment fraud. |

| Encryption | Protects payment data during transactions, ensuring merchants cannot access customers’ personal information. | Ensures transaction security and prevents data breaches. |

| Touch ID Authentication | Uses biometric technology for identity verification, increasing transaction security. | Provides an additional security layer, ensuring only authorized users can conduct transactions. |

When making actual payments, you don’t need to worry about card number leaks or data interception. Apple Pay’s encryption and tokenization technologies meet international industry standards.

Biometric Authentication

Each time you make a payment, the system requires authentication via Face ID or Touch ID. Only you can complete the transaction, significantly reducing the risk of remote fraud. Apple Pay stores biometric data and encryption keys in the device’s secure enclave. Even if the device is lost, others cannot access your sensitive information. The table below summarizes the security advantages of biometric authentication:

| Evidence Point | Description |

|---|---|

| Physical Presence Requirement | Face ID and Touch ID ensure only authenticated users can initiate transactions, significantly reducing the risk of remote fraud. |

| Secure Enclave | The secure enclave handles sensitive operations like key management and biometric matching, ensuring biometric data and encryption keys are not intercepted or tampered with. |

When using Apple Pay in China/Mainland China or Hong Kong, every transaction requires biometric authentication, greatly enhancing security.

Privacy Protection

When using Apple Pay for international transactions, the system strictly protects your privacy. Apple Pay uses encryption and tokenization technology to ensure sensitive data is not accessed by merchants or third parties. Compared to other mobile payment platforms, Apple Pay does not collect your transaction details or spending habits. The table below compares the privacy protection measures of mainstream platforms:

| Platform | Privacy Protection Measures |

|---|---|

| Apple Pay | Uses encryption and tokenization to protect sensitive data. |

| Google Pay | Uses encryption and anonymization to protect user information, but its data-driven business model raises privacy concerns. |

When making cross-border payments, you don’t need to worry about your personal information being misused. Apple Pay prioritizes user privacy, ensuring secure and reliable international transactions.

Payment Experience

Speed and Convenience

When using Apple Pay for international transactions, you will notice a significant improvement in payment speed. According to data, Apple Pay’s transaction speed is 63% faster than traditional card payments. You simply hold your phone or smartwatch near a POS terminal, and the system completes the payment automatically without inserting a card or signing. The table below compares the speed of different payment methods:

| Payment Method | Speed |

|---|---|

| Apple Pay | 63% Faster |

| Traditional Card Payment | - |

Apple Pay’s contactless payment experience makes global travel more convenient. You don’t need to carry large amounts of cash or worry about currency exchange issues. You can complete payments directly with your smart device, especially in countries and regions supporting contactless payments, where this method is highly practical. When shopping in China/Mainland China, Hong Kong, or the U.S., you can quickly complete checkout, saving time.

Fees and Exchange Rates

When conducting Apple Pay international transactions, you need to be aware of related fees and exchange rates. Most banks charge foreign transaction fees, typically around 3% of the transaction amount, subject to the issuing bank’s policies. Some cards issued by licensed Hong Kong banks may have different policies. The table below summarizes common fee structures:

| Fee Type | Amount (USD) |

|---|---|

| Foreign Transaction Fee | Typically 3% of the transaction amount |

| Exchange Rate Markup | Based on network rates, may include a markup |

| Interest | Unpaid credit card balances incur interest and late fees |

If you use an Apple Card for international purchases, you can enjoy a more transparent fee policy. Apple Card does not charge any foreign transaction fees, and the exchange rate uses Mastercard’s real-time rates, updated daily. When paying in local currency, you receive wholesale market exchange rates, avoiding retail markups.

- Apple Card does not charge foreign transaction fees.

- Exchange rates are based on Mastercard’s real-time rates, with transparent information.

- When paying in local currency, you receive wholesale market exchange rates.

User Feedback

You may encounter some issues in your actual experience. According to user surveys, 59% of Apple Pay users reported dissatisfaction, 66% experienced checkout issues, and 52% noted that cashiers lacked knowledge about Apple Pay. The table below shows related statistics:

| Statistic | Result |

|---|---|

| Dissatisfaction Rate | 59% |

| Checkout Issue Rate | 66% |

| Cashier Knowledge Gap Rate | 52% |

Despite this, Apple Pay international transactions still improve payment conversion rates. Data shows that Apple Pay’s payment conversion rate increased by 22.3%, with revenue growth of 22.5%. When shopping in Europe or the U.S., mobile payments have become the preferred method. You don’t need to carry physical cards, better protecting personal information and reducing the risk of credit card and identity theft.

- Mobile payments are the preferred method for international travel.

- Apple Pay improves payment conversion rates and reduces the need for physical cards.

- You can enjoy a more secure payment experience.

Restrictions and Considerations

Restricted Regions

When using Apple Pay for international transactions, you first need to be aware of regional restrictions. Apple Pay is not available in all countries and regions. You can use it smoothly in major markets like China/Mainland China, Hong Kong, and the United States, but some countries or regions have not yet enabled the service. You need to check Apple’s official website in advance to confirm whether the destination supports Apple Pay. Some banks or card issuers in certain regions may not have partnered with Apple, making it impossible to add or use related cards.

Tip: Before traveling abroad, it’s recommended to contact licensed Hong Kong banks or card issuers to confirm whether your card supports Apple Pay international transactions.

Compatibility

In actual use, you may encounter compatibility issues with devices or cards. Apple Pay requires specific hardware and software support, and some older devices or system versions may not support all features. You also need to ensure the bank card is issued by a participating issuer and has enabled Apple Pay services. The table below summarizes common compatibility issues:

| Compatibility Issue | Description |

|---|---|

| Device Compatibility | Requires specific hardware and the latest software; some features are unavailable in certain regions or languages. |

| Card Issuer Support | Only cards from participating issuers are supported; confirmation is needed in advance. |

| Regional Availability | Not available in all markets; check supported countries and regions for Apple Pay. |

During payment, transactions are routed to the card issuer for approval. If a card is declined, it’s advisable to contact the bank or issuer promptly to understand the reason. Unstable network connections, expired card information, or outdated devices may also cause transaction failures.

Transaction Limits

When using Apple Pay for international transactions, you need to be aware of transaction limits and fees. Apple Pay does not have a global uniform limit, with specific limits determined by the merchant, issuing bank, payment network, or country/region. Some merchants have no transaction limits, but they generally align with local contactless card payment limits. If the transaction amount exceeds the limit, the system may require a PIN or additional verification.

- Issuing bank policies determine whether a transaction is approved, and merchants may set transaction limits.

- Before conducting large transactions, you can try a few small transactions to reduce the risk of rejection.

- Apple Pay and Apple Cash are only available in the U.S. and cannot be used for international transfers.

- When using Apple Pay for international payments, banks or card issuers may charge foreign transaction fees, typically 3% of the transaction amount (in USD).

- In some countries like Japan and Costa Rica, foreign transaction fees may be higher, so it’s advisable to check policies in advance.

During the payment process, ensure a stable device network connection, accurate card information, and timely system updates to reduce the likelihood of transaction failures.

When using Apple Pay for international transactions, you can experience an efficient and secure payment process. Many users find the transaction speed fast, highly convenient, and secure. You can understand the actual experience and common misconceptions through the following points:

- You appreciate the speed and convenience of transactions.

- Apple Pay itself does not support direct cross-border transfers, but you can integrate third-party remittance services.

- Many users feel secure when making international transfers.

- You need to ensure the card used supports Apple Pay.

- Not all locations accept Apple Pay; look for the contactless payment symbol.

- Although Apple Pay does not charge foreign transaction fees, associated cards may charge 1% to 3% fees (in USD).

- Currency conversion fees may increase transaction costs, so pay attention to payment network exchange rates.

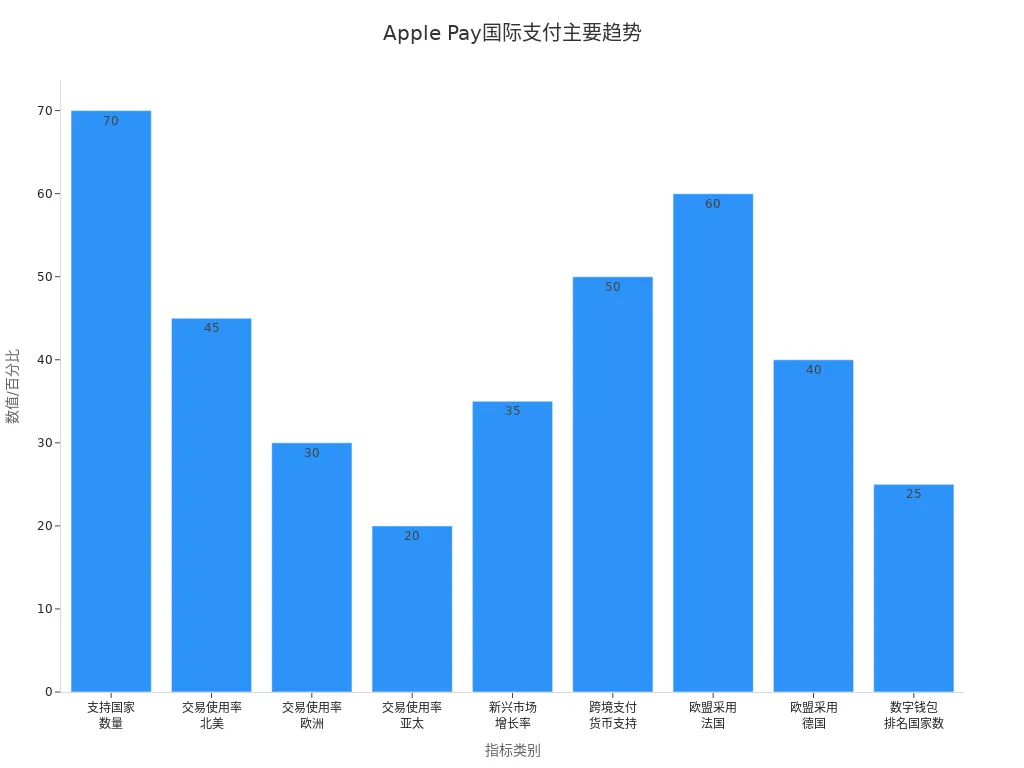

In the future, you can expect more countries and regions to support Apple Pay, with continuously optimized transaction experiences. The table below shows international trends:

| Evidence Type | Specific Data |

|---|---|

| Number of Supported Countries | Over 70 countries, including expansion to Colombia and Bahrain |

| Transaction Usage Rate | North America 45%, Europe 30%, Asia-Pacific 20% |

| Emerging Market Growth Rate | Adoption in India and Brazil increased by 35% |

| Cross-Border Payment Support | Supports over 50 currencies, suitable for international travelers |

| EU Adoption | 60% of iPhone users in France use Apple Pay, 40% in Germany |

| Digital Wallet Ranking | Ranks first in 25 countries, including the U.S., U.K., and Japan |

In actual use, it’s recommended to check the support status and fee policies of your destination in advance and choose cards issued by licensed Hong Kong banks wisely. In the future, Apple Pay will provide an even broader international payment experience.

FAQ

What devices are needed for Apple Pay international transactions?

You need an NFC-enabled iPhone, Apple Watch, iPad, or Mac. The device system must be updated to the latest version. You also need to sign in with a valid Apple ID.

How to add a bank card issued by a licensed Hong Kong bank?

You can select “Add Card” in “Wallet & Apple Pay.” Follow the prompts to scan or manually enter card information. Complete bank verification to use the card.

What fees are charged for Apple Pay international transactions?

You may be charged foreign transaction fees, typically 3% of the transaction amount (in USD). Specific fees depend on the issuing bank. Some cards may have different policies.

Are Apple Pay international transactions secure?

Each payment requires Face ID or Touch ID authentication. The system uses encryption and tokenization technology. Merchants cannot access your real card number, ensuring high security.

Can Apple Pay be used in China/Mainland China and Hong Kong?

You can use Apple Pay in China/Mainland China and Hong Kong. Some merchants and banks may not support it. You need to confirm card and terminal compatibility in advance.

Apple Pay spans 97 countries and 11,000 banks, with transactions 63% faster than traditional cards, but 3% foreign transaction fees and regional card compatibility issues persist, especially in 2025’s projected $10+ trillion digital payments market, where traditional methods add complexity. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.