- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Citibank Global Remittance Service: Fees, Exchange Rates, Arrival Time and Money - Saving Strategies

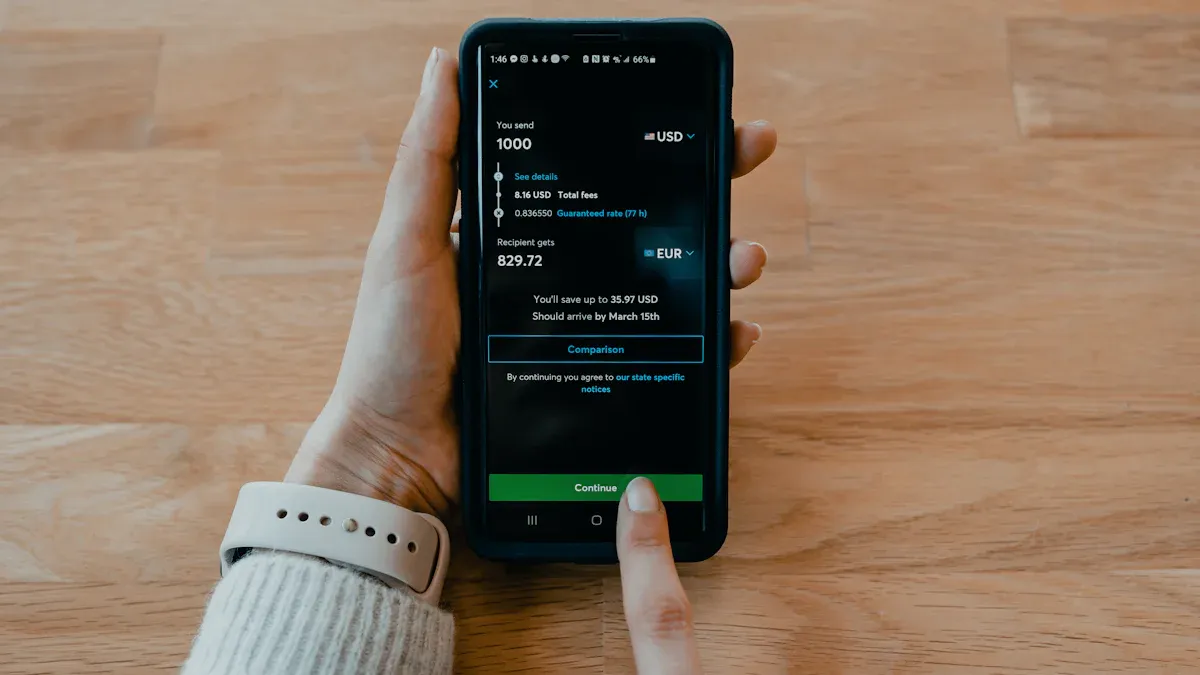

Image Source: pexels

Are you planning to use Citibank for global remittance services? Fees vary depending on the account type. Citigold® and Citi Alliance accounts typically enjoy free international transfers, while Citi Priority and Citi International Personal accounts incur charges ranging from $17.50-$35.

The bank sets its own exchange rates, and the actual cost may be 4-6% higher than the market rate. Choosing Citibank Global Transfers offers faster processing, typically within 2 days, while traditional wire transfers may take 1-5 business days. Selecting the right channel and timing can effectively save costs.

Key Points

- Choosing the right account type can save on international transfer fees. Premium accounts like Citigold often provide free transfers.

- Bank exchange rates are usually higher than market rates, and understanding the difference can help reduce additional expenses.

- Transfer times vary depending on the method; online platforms are generally faster, while traditional wire transfers may take 1-5 business days.

- Before transferring, always verify recipient information to ensure accuracy and avoid failed transfers.

- Using third-party services like Wise can offer more transparent fees and better exchange rates, helping you save costs.

Global Remittance Service Fees

Image Source: unsplash

Handling Fees

When choosing a global remittance service, the first thing to focus on is handling fees. Fees vary significantly depending on the account type and transfer method.

The table below summarizes international transfer fees for common account types:

| Account Type | Sending Fee | Receiving Fee | Notes |

|---|---|---|---|

| Citigold / Citigold Private Client | Free | Free | No fees |

| Citi Priority | $25 | Free | |

| Other Accounts | $35 | $15 | Additional intermediary fees may apply |

If you use Citibank Global Transfers, some premium accounts can enjoy free services. Standard accounts incur international sending fees of $25-$35, with receiving fees typically at $15.

Traditional wire transfers have higher fees, usually $50 or more. Online transfer fees are approximately $15. Major U.S. banks (such as Bank of America and JPMorgan Chase) follow a similar structure.

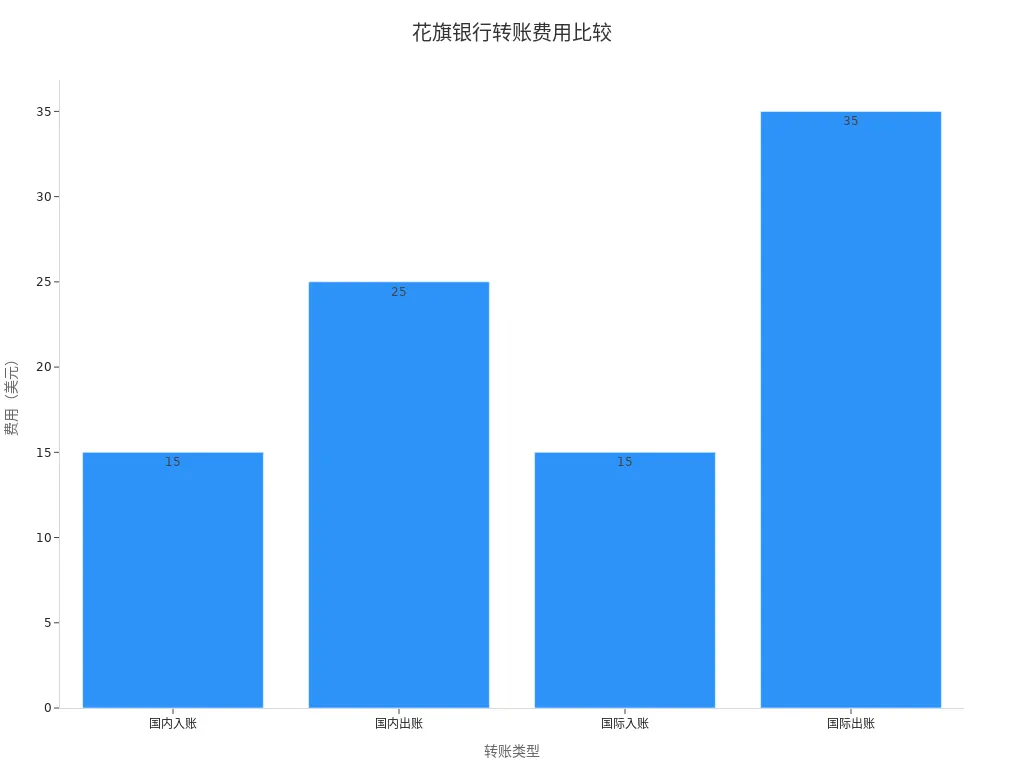

The chart below shows a comparison of fees for different transfer types:

When transferring currencies other than USD, some channels may waive handling fees, but you should be aware of subsequent exchange rate costs.

Hidden Costs

In addition to explicit handling fees, global remittance services involve various hidden costs.

The most common hidden costs include:

- Intermediary bank fees: If you choose SHA or BEN modes, the recipient or intermediary bank will deduct fees from the received amount.

- Exchange rate markup: Banks typically do not use the market mid-rate and instead add a certain percentage, with actual costs potentially 4-6% higher than the market rate.

- Other processing fees: In some cases, the receiving bank may charge additional incoming fees.

The table below shows the differences in fee-sharing methods:

| Fee Type | Details |

|---|---|

| OUR | The sender pays all fees, including intermediary bank fees. The recipient receives the full amount you sent. |

| BEN | The recipient pays all fees. All processing fees, including intermediary bank fees, are deducted from the amount they receive. |

| SHA | The sender pays their bank’s fees, while the recipient pays intermediary and receiving bank fees. This is the most common option. |

When transferring foreign currencies, banks use Visa or MasterCard exchange rates and add fees on top of the mid-market rate, directly affecting the total amount you pay.

Optimization Tips

You can reduce the total cost of global remittance services with the following methods:

- Choose the right account type. If you have a premium account like Citigold, prioritize using free transfer services.

- Monitor exchange rate changes. Transfer when rates are favorable to minimize losses from rate markups.

- Understand fee-sharing methods. When choosing OUR mode, although you bear all fees, the recipient receives the full amount, suitable for large or critical transfers.

- Ensure sufficient account balance. Make sure your account has enough funds to cover all fees to avoid additional charges or delays due to insufficient balance.

- Review bank policies carefully. Understand the relevant policies before transferring to avoid unnecessary losses due to unfamiliar rules.

Tip: When choosing a global remittance service, consider handling fees, exchange rates, and transfer times comprehensively to flexibly select the most suitable option.

Exchange Rates and Money-Saving Tips

Exchange Rate Calculation

When using Citibank’s global remittance service, the exchange rate is a key factor determining the actual received amount. Citibank typically adds a percentage markup to the market exchange rate. You should note that the average rate markup is approximately 1.75%, meaning the actual amount you pay will be higher than the market mid-rate. Additionally, the bank charges a fixed fee, such as $35 per international transfer.

- Citibank’s exchange rates include a conversion service commission, making the actual cost higher than the market rate.

- Third-party services like Wise use the market mid-rate, offering more transparent fees.

- Before transferring, compare exchange rates and fees across different channels to choose the best option.

Real-Time Queries

You can use various tools to check exchange rates and fees in real time to make more informed decisions. The table below summarizes common features and descriptions:

| Feature | Description |

|---|---|

| Real-Time Exchange Rates | Provides real-time rates and transaction alerts |

| Order Monitoring | Set target rates for automatic transaction execution |

| Forex Trading | Easily conduct forex trading, supporting multiple currencies |

| Remittance Service | Hassle-free transfers to Citi accounts worldwide |

| Analysis Tools | Provides market analysis and technical indicators |

You can check the latest exchange rates on Citibank’s online banking platform at any time. Foreign exchange rates are updated every four minutes, and you need to retrieve new rates afterward. Foreign currency wire transfers cannot be scheduled in advance due to rate fluctuations, so you must confirm the rate at the time of the transaction.

| Update Frequency | Description |

|---|---|

| Every Four Minutes | Forex rates are valid for four minutes, after which new rates must be retrieved |

| Cannot Schedule in Advance | Foreign currency wire transfers cannot be pre-arranged due to rate fluctuations |

Money-Saving Tips

You can effectively reduce the cost of global remittance services with the following methods:

- Use Wise for international transfers, which offers transparent and usually cheaper fees than banks.

- Wise uses the mid-market exchange rate, avoiding bank markups.

- If you want to avoid transfer fees, opt for Citibank Global Transfers, though the transfer time may be longer.

- Consult Citibank before transferring to confirm the required time and fees.

- Compare exchange rates and fees across different services to choose the most suitable channel.

The table below compares Citibank and Wise in terms of exchange rates and fee transparency:

| Citibank | Wise | |

|---|---|---|

| Exchange Rate | Citibank’s rates include a conversion service commission | Wise uses the actual mid-market exchange rate |

Wise offers lower fees, and users can clearly see all fees before transferring. When choosing a global remittance service, prioritize channels with high transparency and low costs.

Global Remittance Service Transfer Times

Mainstream Region Timelines

When using global remittance services, transfer times typically range from 1 to 5 business days. In most cases, funds to mainstream regions like the U.S., U.K., Canada, and Singapore can arrive within 1-2 business days. Some banks offer “fast transfer” services that can complete transfers on the same day or the next day. If you transfer to remote or less-developed banking systems, you may need to wait longer. For large transfers, banks may conduct additional reviews, which could extend the transfer time.

Influencing Factors

During the remittance process, you’ll find that transfer speed is affected by multiple factors:

- Specific international transaction processing: Different banks and payment institutions have their own processing workflows, with varying speeds.

- Payment method: Electronic funds transfers are faster than checks or drafts.

- Currency conversion: Transfers involving currency exchange may take longer for certain currencies.

- Time zones: Differences in bank operating hours and business days can cause delays.

- Intermediary banks: Cross-border transfers may pass through multiple intermediary institutions, each with different processing times.

- Weekends and holidays: Bank holidays and weekends in the sender’s or recipient’s country can affect transfer speed.

- Destination country: Developed countries with robust banking systems process transfers faster, while remote regions may experience delays.

If you choose interbank transfers, they typically take 3-5 business days. Using online platforms like PayPal, some transactions can be completed in minutes to hours.

Acceleration Methods

You can speed up transfer times with the following methods:

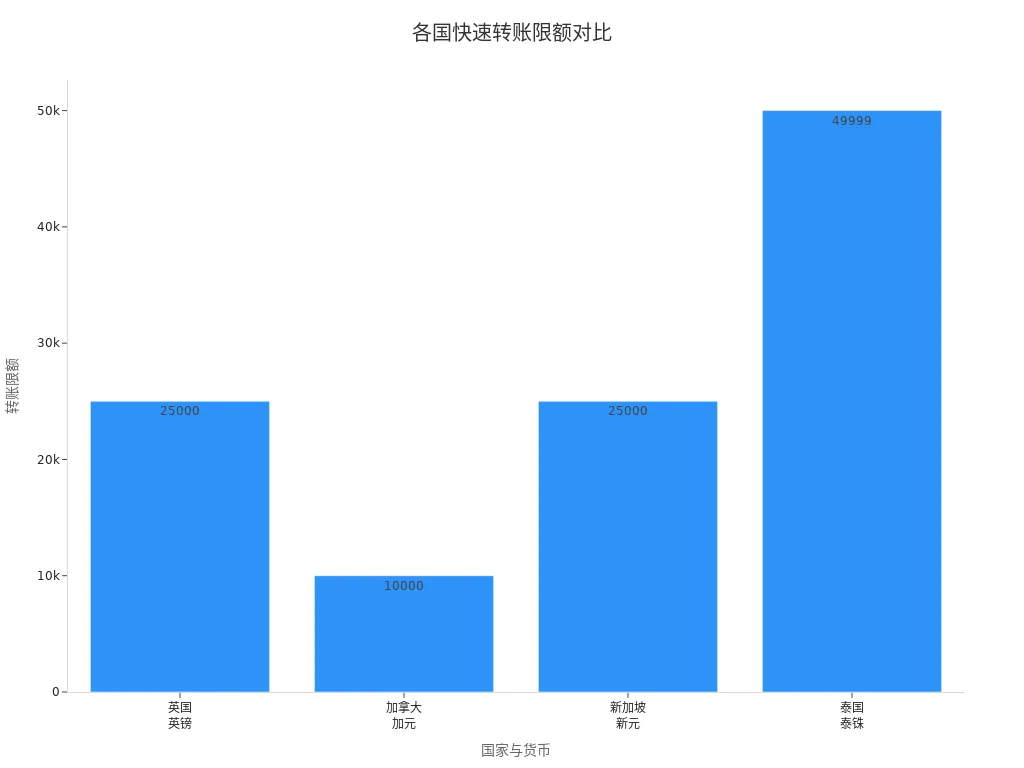

| Country | Currency | Fast Transfer Limit (USD) |

|---|---|---|

| U.K. | GBP | $25,000 |

| Canada | CAD | $10,000 |

| Singapore | SGD | $25,000 |

| Thailand | THB | $1,400 |

You can track transfer progress in real time on the online banking platform. Banks will notify you of transfer status via email or SMS. Simply provide the recipient’s email or phone number in the payment details, and the system will automatically send progress updates. Citi’s Global Beneficiary Service Payment Tracker provides real-time visibility, helping you monitor fund movements at any time.

Operation Process and Pitfalls to Avoid

Image Source: unsplash

Step-by-Step Guide

When making global remittances with Citibank, you can follow these steps:

- Gather necessary information. You need to prepare personal details, account numbers, and tax identification information.

- Obtain the form. You can download the WTRF0710E/S form from Citibank’s website or Hong Kong branch.

- Fill in personal information. Enter your name, address, and contact details in the designated fields.

- Provide account information. Accurately input your Citibank account number and related account details.

- Complete the tax information section. Enter your Tax Identification Number (TIN) or Social Security Number (if applicable).

- Verify information accuracy. Carefully review all entered information to ensure it is correct.

- Sign and date the form. Sign the form and include the submission date.

- Submit the form. Send the form to the relevant Citibank department or follow the provided instructions.

If operating through online banking, follow these steps:

- Obtain the recipient’s bank information, including full name, bank account number, and SWIFT code (e.g., CITIHKHX for Citibank Hong Kong).

- Log in to your online banking or mobile app and navigate to the international transfer page.

- Enter the recipient’s details, carefully verifying each item.

- Specify the transfer amount and currency (e.g., USD), ensuring the amount is correct.

- Review and confirm the transaction, checking for any discrepancies.

- After completing the transaction, use the bank’s tracking function to monitor the transfer status.

Friendly Reminder: Carefully verify information at each step to avoid transfer failures due to errors.

Common Issues

When using Citibank’s global remittance service, you may encounter the following issues:

- Banks respond slowly to digital demands, leading some customers to turn to fintech companies.

- Inadequate data security and anti-fraud measures, which may result in financial losses.

- Inadequate monitoring systems, with banks failing to promptly investigate fraud claims or respond to complaints.

- Unverified recipient information, leading to funds being sent to the wrong account.

- Transfer limit restrictions, requiring large amounts to be split into multiple transactions.

- Confusion between account numbers, routing numbers, and SWIFT codes, affecting transfer success rates.

You can seek help through CitiService. The table below summarizes CitiService’s advantages:

| CitiService Advantage | Description |

|---|---|

| One Phone Call | Fast and efficient service |

| Quick and Accurate Responses | Timely feedback on your inquiries |

| Regular Updates | Keeps you informed about inquiry status |

| Global Access | Contactable via local numbers |

| Easy Access to Experts | Direct contact with Citi experts |

| Product Knowledge and Technical Support | Ongoing support available |

When submitting complaints, include your name, address, phone number, email, nature of the complaint, relevant department or personnel, complaint date, and supporting documents.

Pitfall Avoidance Guide

You can avoid transfer failures and information errors with the following methods:

- Obtain complete recipient bank information, including full name, account number, and SWIFT code. When transferring to Hong Kong banks, ensure the correct SWIFT code is used (e.g., CITIHKHX).

- Carefully verify all entered information, especially account numbers and bank codes, to avoid confusion.

- Understand transfer limits and reasonably split large transfers to avoid transaction failures due to exceeding limits.

- Review all information multiple times before confirming the transaction to ensure accuracy.

- Use the bank’s tracking function to monitor transfer progress in real time and promptly identify anomalies.

- Contact CitiService or bank customer service for professional support if issues arise.

Tip: Preparing thoroughly and carefully verifying each piece of information before transferring can significantly reduce the risk of transfer failures and financial losses.

When using Citibank’s global remittance service, focus on the following key points:

| Key Point | Description |

|---|---|

| International Transfer Fees | Some accounts offer free international transfers; standard accounts incur fees of about $25-$35, with banks profiting from exchange rate spreads. |

| Exchange Rates | Bank rates include a commission, typically lower than actual market rates. |

| Transfer Time | Regular transfers take 3-5 business days; transfers between participating banks may be instant. |

| Daily Transfer Limit | Online transfers have a daily limit of $100,000, with specific limits varying by account. |

- You can choose the best channel based on your needs, paying attention to exchange rate changes and fee structures.

- Citi partners with Mastercard, supporting faster and more secure global payments, covering 14 markets with ongoing expansion.

- Regularly monitor bank policies and exchange rate updates to continuously optimize your remittance experience.

FAQ

How to Check Citibank’s Real-Time Exchange Rates?

You can log in to online banking or the mobile app, go to the forex section, and check the latest exchange rates at any time. Rates are updated every four minutes, so confirm again before transacting.

Will Funds Be Refunded If a Transfer Fails?

If you enter incorrect information or the bank’s review fails, funds are typically returned to the original account. Verify recipient information and retry the operation.

What Are the Transfer Limits?

You can transfer up to USD 100,000 daily. Some countries and currencies have per-transaction limits, such as USD 25,000 for Singapore and USD 10,000 for Canada.

How to Track Transfer Progress?

You can check transfer status on online banking. The bank will notify you of progress via SMS or email. You can also use the payment tracker to monitor fund movements in real time.

What Information Is Needed for Transfers to China/Mainland China?

You need the recipient’s name, bank account number, bank name, and SWIFT code. Carefully verify all information to avoid delays due to errors.

Citi’s Global Transfers offer free transfers for Citigold, $17.50-$35 for standard accounts, with 2-5 day delivery, but 4-6% rate markups and $20-$50 intermediary fees can raise costs, especially in 2025’s $80+ trillion remittance market, where bank reviews cause delays. For a cost-effective, seamless solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.