- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Citibank Global Transfer Service Fees and Usage Guide: Handling Fees, Exchange Rates, Promotions, and Remittance Optimization

Image Source: unsplash

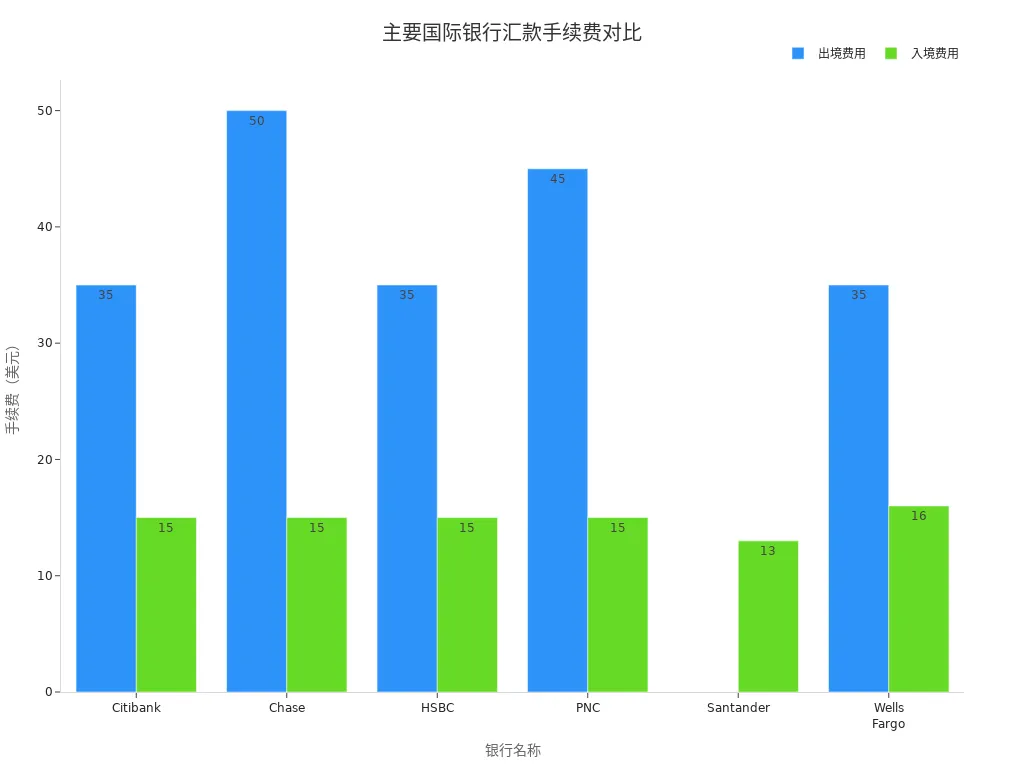

You can easily conduct international remittances through the Global Remittance Service. Transfers between Citibank accounts are typically free of fees, while standard SWIFT remittance fees are $35. Premium account types, such as Citigold® Private Client, enjoy free transfers. The table below shows a comparison of fees among major international banks, helping you clearly understand the actual costs:

| Bank | Outgoing Fees | Incoming Fees |

|---|---|---|

| Citibank | $35 | Usually waived, up to $15 |

| Chase | $40-50 | $15 |

| HSBC | $35 | $15 |

| PNC | $45 | $15 |

| Santander | $0 | $13 (USD), no fees for foreign currency |

| Wells Fargo | $35 | $16 |

Key Points

- When using Citibank’s Global Remittance Service, Citigold accounts enjoy fee-free international remittances, while fees for other accounts are relatively low.

- Before remitting, be sure to check exchange rates and fees in real time to ensure the best timing and method, maximizing financial efficiency.

- Utilize the exchange rate lock function to set rates in advance, reducing risks from market fluctuations and ensuring fund security.

- Initiating remittances through online channels often comes with fee waivers; prioritize using Citi Online or Citi Mobile.

- Pay attention to the validity period of promotional activities and stay updated on fee waiver information to take advantage of discounts at the right time.

Global Remittance Service Fees

Image Source: pexels

Fee Structure

When using the Global Remittance Service, the fee structure is likely your primary concern. Citibank has established clear fee standards based on different account types and remittance methods. You can refer to the table below to understand the remittance fees for major account types:

| Account Type | Sending Fees | Receiving Fees |

|---|---|---|

| Citigold / Citigold Private Client | $0 | $0 |

| Citi Priority | $25 | $0 |

| Other Accounts | $35 | $15 |

| Intermediary Bank Fees | $20-$50 | N/A |

When conducting international remittances via SWIFT, the standard fee is $35, which is mid-range in the U.S. market. The table below compares the average international remittance fees of major U.S. banks:

| Type | Average Fees |

|---|---|

| Domestic Remittance | $27 |

| International Remittance | $44 |

You can see that Citibank’s Global Remittance Service fees are slightly below the U.S. market average for international remittances. You only need to pay a fixed fee as the sender, and the recipient incurs no additional fees, ensuring the full amount is received.

Fee-Free Scenarios

If you hold a Citi checking or savings account, you can initiate Global Remittance Service through Citi Online or Citi Mobile to enjoy fee-free transfers between accounts. Specific fee-free conditions include:

- You hold an eligible Citi account.

- You initiate the remittance through Citi Online or Mobile.

- The remittance amount is credited in the recipient’s primary account currency.

- When sending and receiving via Global Remittance Service, the bank does not charge fees, but exchange rate conversions may include a commission.

When using the Global Remittance Service in Taiwan, fees are fully waived, with the current promotion lasting until the end of the year. As the sender, you bear all fees, ensuring the recipient receives the full amount without deductions.

Tip: Before remitting, check fees and exchange rates in real time via Citibank’s website or mobile app to stay informed about the latest policies and promotions.

Account Type Benefits

Choosing different account types allows you to enjoy varying levels of fee waivers. Premium accounts like Citigold Private Client and Citigold offer full fee exemptions for Global Remittance Services. If you are a Citi Priority customer, international remittance fees are $25, with receiving fees waived. Standard accounts incur $35 for sending and $15 for receiving.

You can also gain additional fee waivers by meeting conditions such as account balance or regular deposits. For example:

- As a Citigold customer, you automatically enjoy fee waivers for domestic and international remittances.

- Initiating remittances via Citi Online or Citi Mobile may qualify certain account types for fee waivers.

- If you hold a Regular Checking or Access Checking account with $250 or more in monthly direct deposits, monthly service fees may be waived.

- If you hold a Citi Savings or Citi Accelerate Savings account with an average monthly balance of $500 or more, or also hold a Regular Checking/Access Checking account, monthly service fees may be waived.

When choosing account types and remittance methods, consider your cash flow and remittance needs to plan effectively and minimize the actual costs of the Global Remittance Service.

Exchange Rates and Locking Service

Image Source: unsplash

Exchange Rate Mechanism

When using the Global Remittance Service, exchange rates are likely your top concern. Banks typically use the mid-market exchange rate as the basis for currency conversion. During actual remittances, banks add a hidden fee to this rate, reflected in the difference between the bank’s quoted rate and the mid-market rate. You may not notice these hidden fees, but they directly affect the final amount remitted.

Citibank’s exchange rates are typically higher than those of specialized remittance services. If you use traditional banks for international remittances, the recipient may receive a reduced amount. Before remitting, compare exchange rate quotes from different providers to maximize your funds.

Tip: Check current exchange rates via the bank’s website or mobile app to avoid unnecessary losses due to rate differences.

Exchange Rate Locking Function

When remitting, you may worry about risks from exchange rate fluctuations. The foreign exchange market changes daily, and rate fluctuations may lead to principal losses during currency conversion. The Global Remittance Service offers an exchange rate locking function. You can book an exchange rate for up to 30 days in advance, setting your desired conversion price. When the market rate reaches your target, the system automatically executes the transaction. This helps you avoid losses from rate fluctuations, ensuring funds reach the recipient’s account securely.

- Advantages of exchange rate locking:

- You can plan remittance costs in advance.

- You can reduce risks from market fluctuations.

- You can ensure the recipient receives a more stable amount.

For large remittances, prioritize using the exchange rate locking function to complete transactions at favorable rates, reducing overall costs.

Real-Time Query Methods

Before remitting, you should check exchange rates and related fees in real time. Citibank offers multiple query methods:

- Log in to Citibank’s website, visit the Global Remittance Service section, and view the latest exchange rate and fee information.

- Use the Citibank mobile app to check real-time exchange rates and simulate remittance amounts.

- Call the bank’s customer service hotline for professional exchange rate consultation and remittance advice.

| Query Method | Advantages | Applicable Scenarios |

|---|---|---|

| Website | Comprehensive information, timely updates | Computer operations |

| Mobile App | Convenient, anytime access | Mobile users |

| Customer Service Hotline | Professional answers, personalized advice | Complex issue inquiries |

Before remitting, compare rates and fees across multiple channels to choose the optimal timing, minimizing costs and improving efficiency.

Promotional Activities

Promotion Types

When using the Global Remittance Service, you can enjoy various promotional offers. Citibank currently offers remittance fee waivers and investment account fee waivers. International remittances initiated via Citi Online or Citi Mobile incur no fees. Upgrading to Citi Priority, Citigold, or Citigold Private Client also waives annual fees for Citi Personal Wealth Management investment accounts. The table below summarizes the main promotion types:

| Promotion Type | Details |

|---|---|

| Remittance Fee Waiver | International remittances initiated via Citi Online or Citi Mobile are fee-free. Remittances assisted by branches or bankers still incur fees. |

| Investment Account Fee Waiver | Annual fees for investment accounts are waived for Citi Priority, Citigold, and Citigold Private Clients. |

You can choose the most suitable promotion based on your account type and remittance needs.

Participation Methods

To participate in these promotions, simply meet basic conditions. You need a valid Citibank account and must initiate remittances via Citi Online or Citi Mobile. To enjoy investment account fee waivers, consider upgrading to Citi Priority or higher-tier accounts. Upon upgrading, the bank automatically activates relevant promotions without additional applications. Before remitting, check the current promotion details on the bank’s website or app.

Tip: Operating through online channels often makes it easier to receive fee waivers. Contact customer service if you have questions.

Validity and Scope

Pay attention to the validity period and scope of promotional activities. The current remittance fee waiver applies in mainland China, Taiwan, Hong Kong, and other regions. Taiwan’s fee waiver promotion will continue until the end of the year. In mainland China, online remittances via the Global Remittance Service are also fee-free. Investment account fee waivers apply to Citi Priority and above clients, covering the U.S. market and select Asian markets. Before participating, check the bank’s announcements for deadlines and applicable regions.

Remittance Optimization Tips

Optimal Timing

When choosing remittance timing, consider mid-month weekdays, especially Monday to Wednesday. During these periods, banks process remittances more efficiently, and exchange rate fluctuations are smaller. Avoid peak times at the beginning and end of the month, when banks and transfer services are busiest, potentially causing delays and unfavorable rates. Operating during regular banking hours ensures smooth completion of the Global Remittance Service, reducing unnecessary delays.

Cost Reduction Techniques

You can reduce remittance costs in several ways:

- Consolidate multiple small remittances into one large transfer, as many banks charge lower fees for larger transfers.

- Choose fee-free online channels, as some account types qualify for fee waivers.

- Flexibly select remittance timing to avoid peak periods for better exchange rates.

- Contact the bank to negotiate more favorable rates, especially for large remittances.

- Prioritize online transfers, which are typically cheaper than counter transactions.

Security Enhancements

When using the Global Remittance Service, prioritize account security. Although the bank uses SWIFT codes (e.g., CITIIE2X) to encrypt sensitive data, ensuring secure international remittances, remain vigilant against account theft. Recent lawsuits indicate that some banks failed to promptly identify unauthorized devices or unusual logins, leading to customer fund losses. Regularly update passwords, enable two-factor authentication, and avoid operating remittances on public networks.

| Security Measure Type | Description |

|---|---|

| SWIFT Encryption | Ensures secure data transmission, reducing errors and fraud |

| Account Monitoring | Timely detection of unusual logins and device changes |

Common Pitfalls to Avoid

When remitting, you may overlook the following pitfalls:

- Focusing only on fees while ignoring exchange rate differences, which may lead to higher actual costs.

- Assuming all banks automatically detect risks, when you need to actively monitor account security.

- Ignoring promotion validity periods, missing fee waiver opportunities.

To maximize fund security and cost efficiency, thoroughly understand the fees, exchange rates, and security measures of the Global Remittance Service, and choose the optimal remittance method and timing.

When using the Global Remittance Service, focus on fees, exchange rate locking, and promotional activities. Selecting the right account type and remittance timing can help reduce costs. Many users value remittance speed and security. Technological advancements have made remittances faster, but user experience still has room for improvement. Fintech companies are driving service innovation, helping you make more informed decisions.

FAQ

Which currencies does Citibank’s Global Remittance Service support?

You can remit major currencies such as USD, EUR, GBP, and HKD through the Global Remittance Service. In mainland China, Hong Kong, or the U.S., you can select the target currency, with specific options subject to the bank’s real-time information on its website.

Before remitting, check the latest currency list to ensure a smooth transaction.

How long does it take for a remittance to arrive?

Remittances via Citibank’s Global Remittance Service typically arrive within 1-3 business days. SWIFT cross-border transfers may take longer. You can track remittance progress in real time via the bank’s app.

| Remittance Method | Estimated Arrival Time |

|---|---|

| Global Remittance | 1-3 business days |

| SWIFT | 2-5 business days |

Are there limits on remittance amounts?

In mainland China, the Global Remittance Service has a single transaction limit of USD 50,000. For large remittances, contact customer service in advance to understand the approval process and required documents.

How can I check the status of a remittance?

You can log in to Citibank’s website or mobile app, visit the “Remittance Records” page, and check the status anytime. For anomalies, call the customer service hotline for real-time assistance.

Save remittance receipts for easy future reference and verification.

What should I do if a remittance fails?

If a remittance fails, the bank will automatically refund the funds to your account. Check the recipient’s information for accuracy or contact customer service to resolve the issue. Before resending, verify all details.

Citi Global Transfers offer fee waivers (Citigold $0, standard $35) and SWIFT 1-3 business day delivery, but intermediary fees $20-50 and rate markups can raise costs, especially in 2025’s $80+ trillion remittance market, where traditional providers’ reviews cause delays. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.