- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

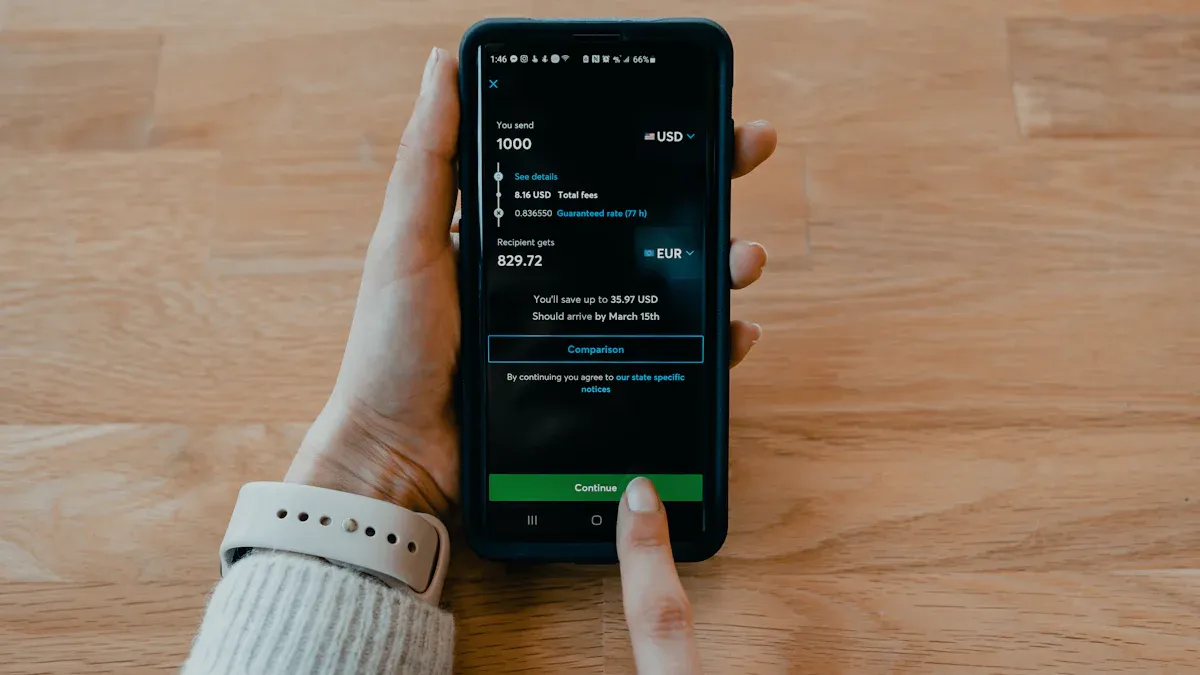

How to Transfer Funds to a Bank Account via Discover: Safe and Convenient Methods of Fund Transfer

Image Source: pexels

You can use Discover to transfer funds safely and conveniently to a bank account. To do so, you need to link your bank account to your Discover account in advance to ensure a smooth transfer. Please note that the transfer process involves practical considerations such as account information, fees, and limits, so it’s recommended to carefully verify each step to ensure the security of your funds.

Key Points

- Before initiating a Discover transfer, you must link your bank account to your Discover account, ensuring all information is accurate.

- Choose the appropriate bank account type, as savings and checking accounts each have their advantages and disadvantages, depending on your needs.

- The transfer amount must be within the specified limits, with a daily maximum of $250,000 for savings accounts and $10,000 for checking accounts.

- Ensure a secure network environment and avoid conducting transfers in public places to protect personal information.

- If a transfer fails, promptly verify account information and balance, and contact Discover customer service for assistance if necessary.

Feasibility of Discover Transfers

Supported Account Types

You can transfer funds from Discover to various bank accounts. Common account types include savings accounts and checking accounts. Savings accounts are suitable for holding idle funds and typically offer higher interest rates. Checking accounts are better suited for daily spending and payments, allowing easy access to funds. These accounts, opened at licensed banks in mainland China or Hong Kong, can serve as target accounts for Discover transfers. You need to confirm that the target account supports Automated Clearing House (ACH) transfers to ensure a smooth fund transfer. Support for account types may vary slightly between banks, so you can consult your bank’s customer service in advance to confirm that your account meets Discover’s transfer requirements.

Account Linking Requirements

Before making a Discover transfer, you must first link your external bank account to your Discover account. This process typically takes a few days. You need to follow the platform’s prompts to enter your bank account information. The system will verify the account through a series of small ACH deposits. You must check these small deposits in your bank account and enter the exact amounts on the Discover platform to complete the verification. Once linked successfully, you can proceed with fund transfers. Future transfers may take a few hours to a few days to arrive, depending on the bank and account type.

Tip: When linking a bank account, always verify the account information to avoid transfer failures due to errors. It’s recommended to choose a commonly used and secure bank account to increase the success rate of fund transfers.

- You need to link an external bank account to your Discover account to initiate transfers.

- The linking process may take a few days to complete.

- The system will verify the account through small ACH deposits.

- Future transfer processing times range from a few hours to a few days, depending on the account type.

Discover Transfer Process

Image Source: unsplash

You can follow the steps below to complete a Discover transfer, securely moving funds to a bank account. Each step is critical, and it’s recommended to refer to the official guide to ensure a smooth process.

Log In to Your Account

You need to log in to your Discover account first. Follow the official process, with detailed steps as follows:

- Log in to your Discover account online.

- Click “Card Services” in the menu and select “Balance Transfer.”

- Access the balance transfer page to view available balance transfer offers (if any).

- Choose the offer that best suits you and click “Select This Offer.”

- Enter the details of the balance you wish to transfer, including the target account number and transfer amount.

Tip: Ensure a secure network environment when logging in, and avoid operating in public places or on insecure devices.

Select Payment Options

After logging in, you will see various payment and transfer options. The Discover online interface typically offers the following options:

- Online bill payments

- Easy transfers

- Transfers using Zelle

You can select “Easy Transfers” or another suitable method based on your needs. Different options have varying processing speeds and procedures. It’s recommended to prioritize the officially recommended transfer method to ensure fund security.

Add a Bank Account

For your first Discover transfer, you need to add an external bank account. The system will require you to submit relevant verification documents. Common requirements are listed in the table below:

| Verification Type | Description |

|---|---|

| Tax Identification Number | The document must include your tax identification number and full name. |

| Date of Birth | The document must include your date of birth and full name. |

| Address | The document must include your address and full name. |

| Lease or Mortgage Agreement | The document must be an official and current agreement, signed within the past 6 months, and include your signature, full name, and address. |

You need to upload the required documents as prompted, ensuring the information is accurate and valid. The system will verify account information through instant verification, real-time verification, or trial deposit verification. Details of verification methods are as follows:

| Verification Step | Description |

|---|---|

| Instant Verification | Provide the external account’s name, account number, and ABA routing number, and Discover will verify and process the transfer. |

| Real-Time Verification | Provide the name, account number, ABA routing number, and online login credentials, and Discover will verify and process the transfer. |

| Trial Deposit Verification | Discover will send two small deposits to the external account, which you must confirm to complete verification (deposits will be withdrawn). |

Note: When adding a bank account, it’s recommended to prioritize accounts from licensed banks in Hong Kong to ensure support for ACH transfers.

Enter the Amount

After account verification, you can enter the transfer amount. Discover has clear limits on transfer amounts, as follows:

| Transfer Type | Limit |

|---|---|

| Daily Minimum Limit | $25 |

| Daily Maximum Limit | $250,000 |

You need to enter an amount based on your funding needs. The system will automatically check if the amount is within the allowed range. After entering the amount, it’s recommended to double-check the account information and amount to avoid transfer failures due to errors.

Confirm and Submit

The final step is to confirm and submit the transfer request. The system will verify account information again to ensure fund security. Discover transfer processing times vary by method, as follows:

| Transfer Method | Processing Time |

|---|---|

| Discover Online Banking | 2 to 3 days |

| Third-Party Services | Instant transfers |

After submission, you can track the transfer progress on your account page. In most cases, funds will arrive within 2 to 3 days. If you choose third-party services, some transfers may be instant.

Recommendation: Before confirming submission, double-check all information, including the account, amount, and documents. If you encounter any issues, contact Discover customer service or refer to the official help documentation.

Account Type Details

Savings Account

You can choose a savings account as the target for Discover transfers. Savings accounts are suitable for holding long-term funds and typically offer higher interest rates. Savings accounts opened at licensed banks in mainland China or Hong Kong support Discover transfers. When using a savings account, pay attention to transfer limits and processing times. The table below outlines the main transfer rules for savings accounts:

| Account Type | 30-Day Incoming Limit | Processing Time |

|---|---|---|

| Savings/Money Market Account | $250,000 | Internal transfers: Instant |

| External transfers: Up to 4-5 business days |

You can transfer up to $250,000 USD every 30 days. Internal transfers are typically instant, while external transfers may take 4 to 5 business days. For large transfers, plan ahead to avoid delays affecting fund availability.

Tip: For external transfers, choose a bank account that supports ACH transfers and verify account information to ensure fund security.

Checking Account

You can also use a checking account for Discover transfers. Checking accounts are ideal for daily spending and payments, offering strong liquidity. Checking accounts opened at licensed banks in mainland China or Hong Kong support Discover transfers, but you should note limits and fee changes. Since March 2022, checking account incoming limits have been adjusted. The table below outlines the relevant regulations:

| Account Type | 30-Day Incoming Limit | Outgoing Transfer Fee | Other Fees |

|---|---|---|---|

| Checking Account (Before March 2022) | $250,000 | $30 | No monthly or overdraft fees |

| Checking Account (After March 2022) | $10,000 | $30 | No monthly or overdraft fees |

When transferring to a checking account, you can transfer up to $10,000 USD every 30 days (post-March 2022). Each outgoing transfer incurs a $30 USD fee. You don’t need to worry about monthly or overdraft fees.

Note: When choosing a checking account for transfers, plan amounts carefully to avoid liquidity issues due to insufficient limits. Check bank policies in advance to select the best account type for your needs.

Discover Transfer Security

Image Source: pexels

Information Protection

When conducting Discover transfers, you must prioritize the security of your personal and account information. Discover employs multiple international security protocols to protect your funds and data. The table below outlines the main security measures during transfers:

| Security Protocol Type | Description |

|---|---|

| PCI Compliance | Discover adheres to the Payment Card Industry Data Security Standard (PCI DSS), ensuring all merchants and service providers handling Discover card data meet security requirements. |

| PIN Security Requirements | Merchants accepting PIN inputs must comply with Payment Card Industry PIN security requirements to protect users’ PIN information. |

| Mobile Payment Standards | Discover requires all mobile payment solutions to comply with MPoC, CPoC, and SPoC standards to ensure secure transaction processing. |

During operations, it’s recommended to enable two-factor authentication to further enhance account security. You should also regularly update your password and avoid using overly simple ones. When operating in public places, avoid connecting to insecure Wi-Fi networks. After completing a transfer, log out of your account promptly to prevent unauthorized access.

Tip: When adding or modifying bank account information, verify all details carefully to prevent fund risks due to information leaks.

Risk Prevention

When using Discover transfers, you may encounter various risks. Common risks include:

- ACH Fraud: Fraudsters may initiate fraudulent transfers after obtaining bank account information.

- Phishing Attacks: Scammers may use emails or texts to trick you into revealing sensitive bank information, leading to unauthorized payments.

- Insider Threats: Internal personnel may abuse privileges to conduct unauthorized fund operations.

You can take the following measures to reduce risks:

- Attend security training to learn how to identify common scams.

- Always verify recipient information during payments to protect sensitive data.

- Enable account security alerts to detect unusual activity promptly.

If you encounter suspicious information, contact Discover customer service or your bank’s official channels immediately. Avoid clicking on unfamiliar links or sharing verification codes and passwords. These measures can effectively mitigate security risks during transfers and ensure fund safety.

Discover Transfer Fees and Limits

Fees

When making Discover transfers, you need to be aware of different types of fees. Discover’s balance transfer fees vary based on your card type and current promotions. For example, in May 2024, some customers using the Discover it Cash Back Card enjoyed a 3% promotional transfer fee. After the promotional period, the fee typically reverts to 5%. Additionally, interest on transferred balances will be calculated based on your card’s standard purchase APR. Before proceeding, carefully review the fee details to avoid higher costs due to overlooked promotional terms.

Tip: Check the current fees and promotional policies on the Discover website or account page. Understanding the fee structure helps you plan transfers and reduce unnecessary expenses.

Transfer Limits

Discover imposes clear limits on daily and monthly transfer amounts. The system will automatically verify if the amount is within the allowed range. The table below summarizes common transfer limits:

| Transfer Type | Daily Minimum Limit | Daily Maximum Limit | 30-Day Maximum Limit |

|---|---|---|---|

| Savings Account | $25 | $250,000 | $250,000 |

| Checking Account | $25 | $10,000 | $10,000 |

Accounts opened at licensed banks in mainland China or Hong Kong generally adhere to these limits. Choose the appropriate account type based on your needs. For large transfers, consider splitting them into smaller amounts to avoid failures due to exceeding limits.

Note: When planning transfers, verify account limits and fees. Properly managing transfer frequency and amounts can enhance fund management efficiency.

Common Issues and Recommendations

Handling Transfer Failures

You may encounter transfer failures when using Discover. Common reasons include:

- Cross-Border Transactions: International transfers, especially those involving different currencies, may face strict bank scrutiny, causing delays.

- New or Unusual Transactions: If your transfer behavior differs from past activity, the bank may temporarily block the transfer for security verification.

- Technical or System Issues: Bank system maintenance or software problems may cause transfer delays.

- Insufficient Funds: Inadequate account balance will result in transfer rejection.

- Incorrect Account Information: Entering wrong account or routing numbers will affect transfer progress.

- Bank Security and Fraud Prevention Systems: Banks use fraud prevention systems to protect funds, which may sometimes delay transfers.

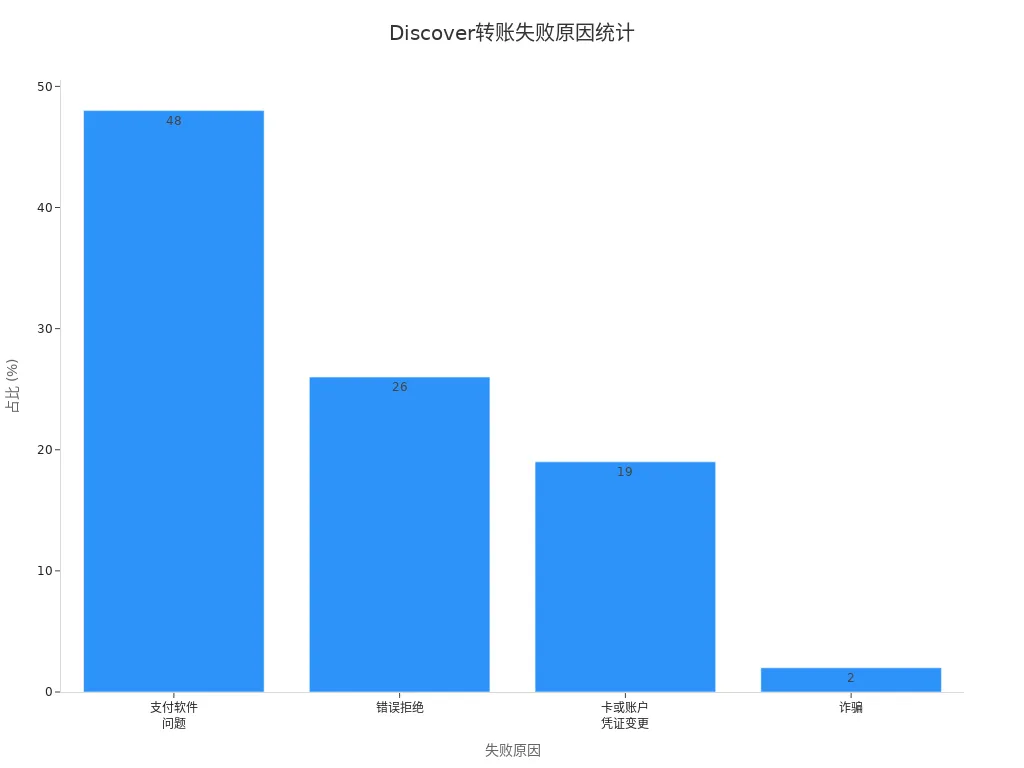

The table below outlines the main reasons for Discover transfer failures and their percentages:

| Reason | Percentage |

|---|---|

| Payment Software Issues | 48% |

| Erroneous Rejections | 26% |

| Card or Account Credential Changes | 19% |

| Fraud | 2% |

If a transfer fails, first verify account information and balance. If the issue persists, contact bank customer service or Discover’s official channels for further assistance.

Customer Service Channels

If you encounter transfer issues, you can contact Discover customer service through various methods. The table below lists commonly used contact methods:

| Contact Method Type | Number or Link |

|---|---|

| Customer Service Phone | 1-800-DISCOVER (1-800-347-2683) |

| International Customer Service Phone | 1-224-888-7777 |

| Hearing-Impaired Service | Dial 711 (Relay Service) |

| Online Messaging Service | Discover Card Help Center |

Choose the phone or online method based on your needs. Have your account information and transfer records ready to help customer service resolve issues quickly.

Improving Success Rates

You can improve the success rate of Discover transfers to bank accounts by:

- Confirming your bank account supports external transfers, especially for accounts at licensed Hong Kong banks.

- Carefully checking all entered information, ensuring account numbers, routing numbers, and names are correct.

- Maintaining sufficient account balance to avoid failures due to insufficient funds.

- Submitting transfer requests promptly to avoid delays from system maintenance or peak periods.

- Regularly monitoring bank and Discover notifications for updates on policies and limits.

Before each operation, double-check all details to minimize the risk of transfer failures and ensure funds arrive smoothly.

Choosing Discover for bank account transfers offers the following benefits:

- No account fees, reducing transfer costs.

- Up to 1% cashback monthly, increasing returns.

- Direct deposits can arrive two days early, enhancing liquidity.

- Savings account interest rates above the national average, supporting fund growth.

Before transferring, pay attention to the following details:

- Verify recipient information for accuracy.

- Understand relevant fees and limits, and plan transfer amounts (USD) accordingly.

- Ensure sufficient account funds to avoid failures.

- Contact the recipient’s bank to confirm all information.

- Request written confirmation for added security.

By choosing the appropriate method based on your needs and referring to common issues, you can enhance your transfer experience and ensure fund security.

FAQ

How long does it take for a Discover transfer to arrive?

You will typically receive funds within 2 to 3 business days. If you use third-party services, some transfers may be instant. The exact time depends on the bank’s processing speed.

Can I cancel a submitted Discover transfer?

Once a transfer is submitted, it typically cannot be canceled directly. If you detect an error, contact Discover customer service or your bank as soon as possible for assistance.

What should I do if I enter incorrect information during a transfer?

Stop the operation immediately and review all information. If an error is found, contact Discover customer service or your bank promptly to explain the situation and avoid fund loss.

Which currencies does Discover support for transfers?

You can only use USD for Discover transfers. When receiving funds at licensed banks in mainland China or Hong Kong, the bank will automatically convert to the local currency based on the exchange rate.

Will funds be refunded if a transfer fails?

If a transfer fails, funds are generally refunded to your Discover account within 3 to 5 business days. You can check the refund progress on your account page.

Discover transfers support $250,000/30-day limits for savings and instant internal moves, but external ACH takes 2-3 days, with 3%-5% balance transfer fees adding costs, especially in 2025’s $80+ trillion remittance market, where traditional banks’ reviews slow transactions. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.