- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Cebuana Remittance Guide: How to Cancel Transactions, Check Status, and Analyze Fees

Image Source: pexels

When conducting cross-border remittances, you often encounter issues such as canceling transactions, checking progress, or calculating fees. Mastering the correct procedures can help you save time and avoid unnecessary losses. You need to pay attention to transaction deadlines, document accuracy, and fee structures. The Cebu remittance guide provides practical advice to help you efficiently handle various real-world scenarios.

Key Points

- Apply to cancel a transaction within 30 minutes of initiating it to avoid losses.

- Use online tools or call the customer service hotline to check remittance status, and have your transaction reference number ready to improve efficiency.

- Understand the remittance fee structure and choose the right service provider and method to avoid unnecessary expenses.

- Carefully verify remittance details to ensure accuracy and reduce the risk of transaction failure.

- Stay calm when encountering issues, contact customer service promptly for assistance, and ensure problems are resolved smoothly.

Cebu Remittance Guide: Canceling Transactions

Image Source: pexels

Eligibility Conditions

You can apply to cancel a transaction within 30 minutes of initiation. Beyond this time, the transaction cannot be canceled. The Cebu remittance guide reminds you that a refund can only be requested if the recipient has not yet collected the funds. If you need to cancel, you must personally visit the branch where the transaction was initiated. You will also need to bring a valid ID and a refund request letter.

- Canceling a transaction is only possible within 30 minutes of initiation.

- A refund can only be requested if the funds have not been collected.

- You need to visit the original branch to submit the request.

Procedure

The Cebu remittance guide suggests following these steps when deciding to cancel a transaction:

- Act within 30 minutes of the transaction to avoid missing the deadline.

- Prepare the original receipt and a valid government-issued ID.

- Be aware that canceling a transaction may incur a handling fee, which varies based on the remittance amount and branch location, typically settled in USD.

- Notify the recipient promptly to avoid confusion about the transaction status.

- Visit the branch where the transaction was initiated and fill out a cancellation form. If visiting in person is inconvenient, you can also call the customer service hotline for assistance.

Tip: The Cebu remittance guide suggests preparing all required documents in advance to save time during the cancellation process.

Required Documents

You need to prepare the following documents to successfully cancel a transaction:

- A valid ID (e.g., passport or government-issued ID).

- The original transaction receipt.

- A refund request letter (if the funds have not been collected).

- Visit the original branch to submit the application in person.

Notes

The Cebu remittance guide reminds you to pay attention to the following when canceling a transaction:

- The sender has the right to request cancellation within 30 minutes of payment, and the branch will indicate your cancellation rights on the receipt.

- You can authorize an agent to submit the cancellation request, and it will be considered received by the branch once submitted.

- After cancellation, the branch will review the request to ensure the funds have not been collected.

- Refunds can be issued in cash, credited back to the original card, or by check, depending on the original payment method.

- Ensure all documents are accurate and valid to avoid cancellation failure due to discrepancies.

Refund Details

After completing the cancellation, the branch will process the refund based on the review results. The refund amount will deduct a handling fee, settled in USD, with the fee varying by branch and country.

- The refund amount may deduct a processing fee.

- The refund method matches the original payment method, such as cash, credit card, or check.

- If you are handling the process in mainland China, consult the branch in advance to understand the specific refund process and fee standards.

Note: The Cebu remittance guide suggests thoroughly understanding the handling fees and refund methods before applying for a refund to avoid losses due to unclear information.

Checking Remittance Status

Online Inquiry

You can quickly check remittance status using various online tools. Commonly used platforms include e-Money Service of Cebuana Lhuillier and Quikz App. These platforms support sending and real-time tracking of transaction progress. Simply log in to the website or app, enter the transaction reference number, and view the current status. The table below shows commonly used online inquiry tools and their main functions:

| Tool Name | Function |

|---|---|

| e-Money Service of Cebuana Lhuillier | Send and check transaction status |

| Quikz App | Conveniently send money to the Philippines and check transaction status |

When using these tools, prepare your transaction reference number and personal information in advance to ensure a smooth inquiry.

Customer Service Inquiry

If online tools are inconvenient, you can call the customer service hotline to check the status. Provide the transaction reference number, sender’s name, and recipient’s information to the customer service representative. They will verify the remittance status based on the information provided. In case of system issues or special problems, customer service can offer further guidance.

Tip: Prepare all relevant information before calling customer service to improve inquiry efficiency.

Branch Inquiry

You can also visit a Cebu remittance branch for an in-person inquiry. Bring a valid ID, such as a passport, driver’s license, or Philippine ID (PhilID). Show the transaction reference number and ID to the staff, who will help you check the latest status.

- Keep the receipt and control number, as these are key for inquiries.

- During an in-person inquiry, the staff will verify your identity to ensure information security.

- Acceptable IDs include passports, driver’s licenses, PRC IDs, NBI clearances, police clearances, postal IDs, voter IDs, PhilIDs, SSS cards, UMIDs, etc.

Common Issues

When checking remittance status, you may encounter the following issues:

- Error messages during sending may occur due to exceeding daily or 30-day limits. Contact the official customer service hotline +1-844-611-2040 for assistance.

- For complaints or transfer issues with Quikz App or Pangea Money Transfer, contact Pangea’s customer service directly.

- If the system lags or the app is slow, check your network connection, close unnecessary programs, and clear cache and temporary files regularly.

- For hardware issues, try restarting the device or updating drivers.

The Cebu remittance guide suggests verifying all information carefully before inquiring to avoid failures due to incorrect details.

Cebu Remittance Guide: Fee Analysis

Image Source: unsplash

Fee Details

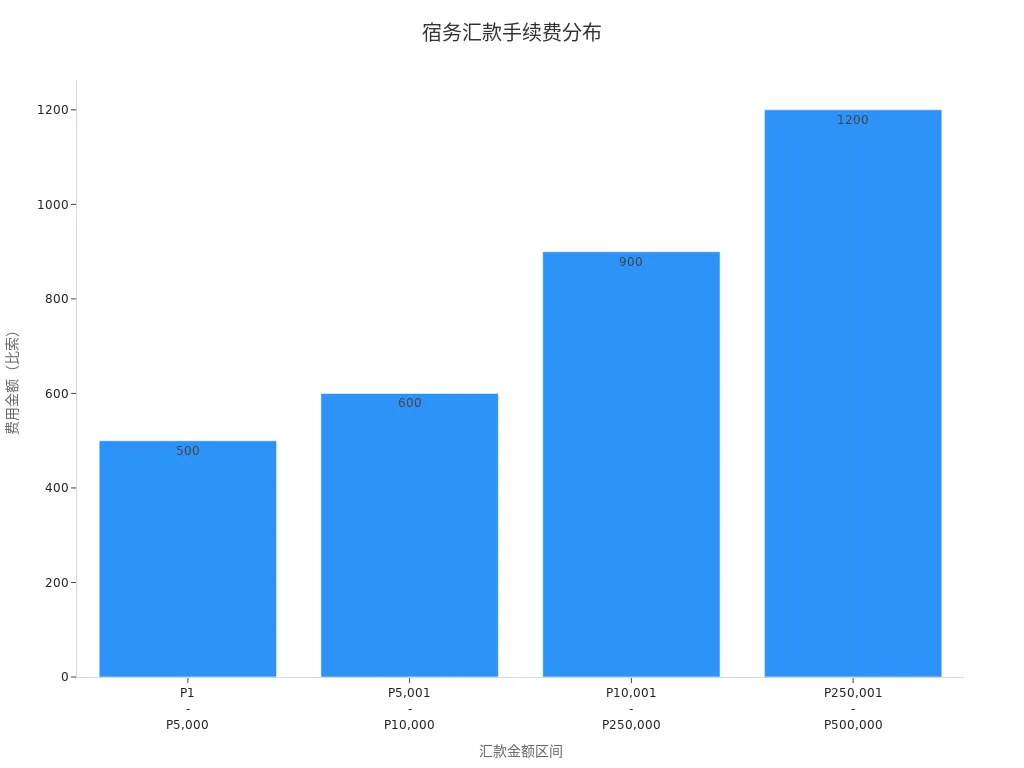

When conducting Cebu remittances, the fee structure is a primary concern. Different remittance amounts correspond to different service fees, typically settled in USD. The table below shows common remittance amount ranges and their corresponding fees (converted to USD based on the current exchange rate, with actual fees subject to the day’s rate):

| Remittance Amount Range (PHP) | Fee Amount (USD) |

|---|---|

| 1 – 5,000 | Approx. 9.00 |

| 5,001 – 10,000 | Approx. 10.80 |

| 10,001 – 250,000 | Approx. 16.20 |

| 250,001 – 500,000 | Approx. 21.60 |

You can refer to the chart below to visually understand fee changes across different amount ranges:

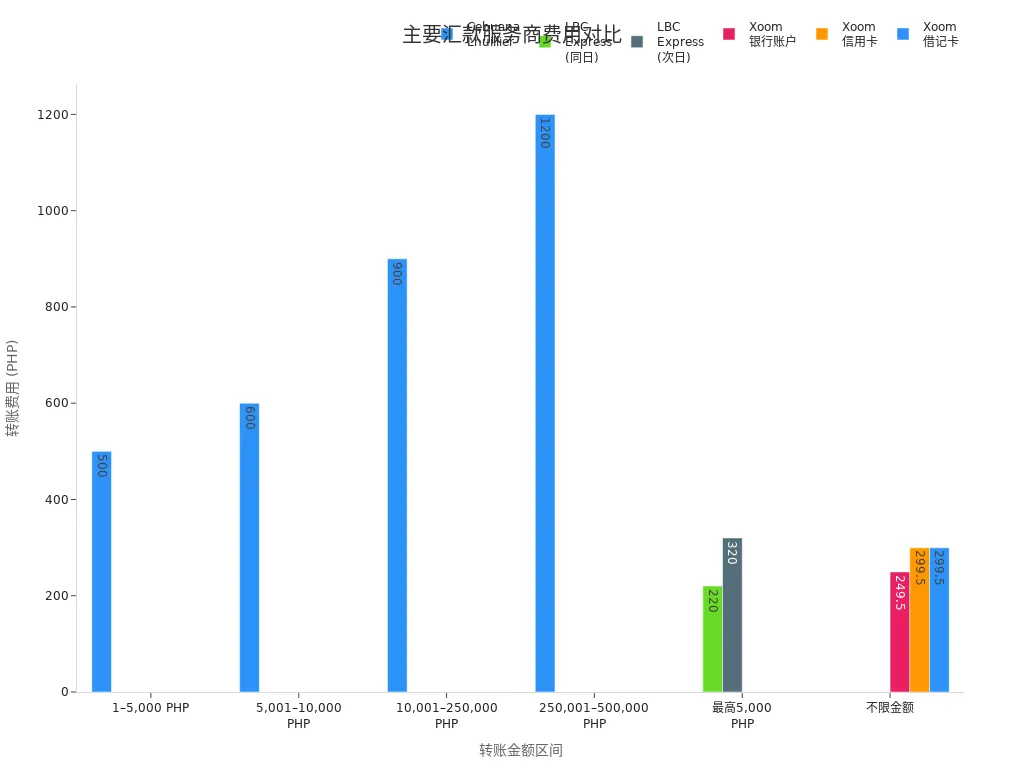

Additionally, fees vary across service providers. The table below compares Cebu remittance fees with other major providers:

| Service Provider | Transfer Amount (PHP) | Transfer Fee (USD) |

|---|---|---|

| Cebuana Lhuillier | 1 – 5,000 | Approx. 9.00 |

| LBC Express (same day) | up to 5,000 | Approx. 0.10 – 4.00 |

| Xoom (bank account) | Any amount | Approx Resorts |

| Xoom (credit/debit card) | Any amount | Approx. 5.40 |

You can refer to the fee comparison chart below:

Calculation Method

Before remitting, you need to understand how fees are calculated. Cebu remittance services typically charge a fixed service fee based on the remittance amount range. For example, for amounts up to 2,000 PHP, the fee is approximately 0.24 USD; for 2,001 to 10,000 PHP, it’s about 0.50 USD; for amounts over 10,000 PHP, the fee increases by approximately 0.40 USD per additional 1,000 PHP. You can estimate the total cost based on the actual remittance amount.

Tip: Use the fee calculator on the official website or app to input the amount and view the total fee, helping you plan your budget in advance.

Influencing Factors

You may notice that fees are influenced by multiple factors beyond the amount:

- Standard service fees vary by location and currency.

- Scheduling a remittance for a future date may incur additional setup fees.

- Different remittance methods (e.g., cash pickup or bank deposit) result in different fees.

- Exchange rate differences are a significant factor, as providers often add a markup to the market rate, reducing the actual amount received.

- Receiving and intermediary banks may charge additional processing fees, deducted from the received amount.

You should thoroughly understand all related fees and exchange rates before remitting to avoid unnecessary losses due to incomplete information.

Cost-Saving Tips

You can effectively save on remittance fees with the following methods:

- Choose reputable remittance services. Prioritize regulated licensed banks or well-known remittance providers to avoid extra fees due to non-standard services.

- Compare fees and exchange rates across providers. Use online comparison tools to find providers with transparent fees and competitive rates.

- Plan and budget your remittances. Regular remittances with consolidated amounts can reduce transaction frequency and overall costs. Monitor exchange rate fluctuations and choose favorable times to remit.

Tip: Comparing and planning before remitting can significantly reduce overall costs.

Avoiding Extra Fees

You may encounter unexpected fees during the remittance process. You can take the following measures to avoid these extra costs:

| Fee Type | Description |

|---|---|

| Transfer Fees | Fees charged by the remittance provider, either fixed or percentage-based. |

| Exchange Rate Fees | Providers often offer rates higher than the market rate, reducing the actual amount received. |

| Receiving Bank Fees | The receiving bank may charge a processing fee, deducted from the received amount. |

| Intermediary Bank Fees | During international transfers, funds may pass through intermediary banks, each charging a fee. |

You can avoid these fees by:

- Avoiding postal services for sending funds and choosing legitimate channels.

- Monitoring foreign exchange rates and choosing favorable times for transactions.

- Using online transaction methods to reduce hidden fees from manual processes.

- Choosing well-known remittance centers for transparent fees and standardized services.

The Cebu remittance guide suggests thoroughly understanding the fee structure and transaction limits before remitting, and choosing the right provider and method to minimize costs.

Operational Tips and Common Issues

Avoiding Failures

You may experience transaction failures due to improper operations. Verify all details in advance to ensure accuracy. Check the recipient’s name, account number, and transaction amount. Pay attention to transaction deadlines, especially for cancellations or modifications. Use a fee calculator before remitting to estimate total costs and avoid failures due to insufficient funds. Avoid operating during unstable network conditions to reduce system lag risks.

Tip: Conduct remittances during banking hours to get timely assistance if issues arise.

Handling Exceptions

If you encounter system failures, delayed arrivals, or incorrect details, stay calm. Contact official customer service immediately and explain the issue. Prepare your transaction reference number and ID. The customer service team will assist with status checks or exception handling. If handling business in mainland China, prioritize official channels of Hong Kong-licensed banks. You can also visit a branch for direct assistance. Keep all transaction receipts for future reference.

Note: Stay patient and follow official procedures during exception handling to avoid further losses due to operational errors.

Filling Out Details

When filling out remittance details, ensure all information is accurate and complete. Use English for the recipient’s name to avoid spelling errors. Accurately enter the recipient’s account number and contact details. Verify the remittance amount and currency to match the actual requirements. Refer to the table below for key points on filling out details:

| Detail Type | Requirement |

|---|---|

| Name | Full English spelling, no abbreviations |

| Account Number | Accurate digits |

| Contact Details | Valid phone number or email |

| Amount | Enter in USD |

Double-check all information before submission to reduce transaction failures due to errors.

In Cebu remittance operations, focus on the following three points:

- Act promptly within transaction deadlines to avoid missing optimal cancellation or inquiry times.

- Verify all details carefully to ensure accuracy.

- Thoroughly understand the fee structure and choose the appropriate remittance method.

You can flexibly choose online or offline operations based on your needs, avoiding common pitfalls and enhancing the overall remittance experience.

FAQ

How can I check if a remittance has arrived?

You can log in to the Cebu website or app and enter the transaction reference number to check the status. Alternatively, call the customer service hotline and provide the relevant information for a quick status check.

Will funds be refunded if a remittance fails?

If a remittance fails, the funds will be refunded to the original payment method. Provide the transaction receipt and ID, and the branch will process the refund after review, with the amount settled in USD.

How long does it take to receive a refund after canceling a transaction?

After canceling a transaction, the branch typically processes the refund within 3-5 business days. You can choose cash, credit card, or check, with the exact time depending on the bank’s processing speed.

What should I do if I entered incorrect remittance details?

If you notice incorrect details, contact the branch or customer service immediately. Provide the correct information, and the staff will assist in making corrections to avoid transaction failure or delays.

How are remittance fees calculated?

Fees are charged based on the remittance amount range. Use the fee calculator on the official website or app to input the amount, and the system will display the total fee, all in USD.

Cebuana remittance guide highlights 30-minute cancellations (needing reference number and ID), status checks via reference, and fees from $9 (1,000-5,000 PHP $9 USD), but processing fees and reviews can raise costs, especially in 2025’s $80+ trillion remittance market, where traditional providers’ delays and limits create hassles. For a lower-cost, seamless alternative, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.