- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What are the Cheapest Ways to Remit Money to the Philippines? These Money - Saving Tips You Need to Know

Image Source: unsplash

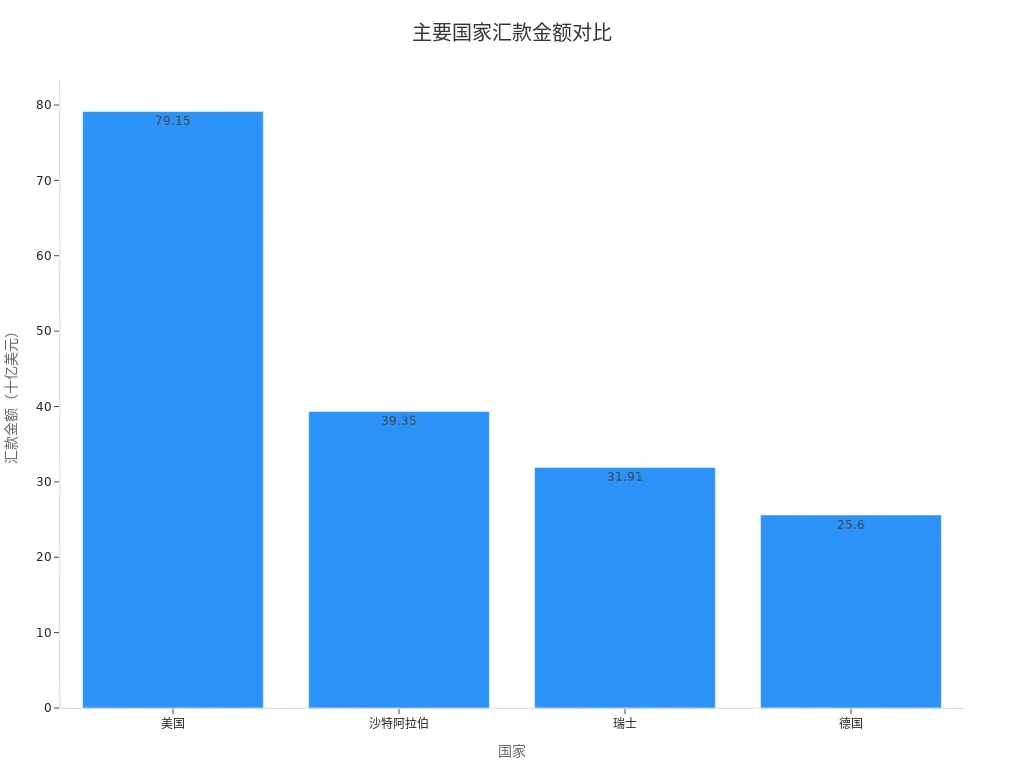

Are you looking for the cheapest way to send money? Mainstream channels include money transfer operators, online platforms, and traditional cash services. The United States sends USD 79.15 billion annually to the Philippines, far surpassing other countries.

Key Takeaways

- Choosing online remittance platforms and mobile payment apps often allows you to enjoy lower fees and faster delivery times, helping you save on remittance costs.

- Focus on platforms with transparent exchange rates; real-time exchange rates can maximize the recipient’s amount, avoiding increased costs due to exchange rate markups.

- Utilizing promotions and discount codes can further reduce remittance fees; make sure to check the latest promotional information before sending money.

Overview of the Cheapest Ways to Send Money

Image Source: unsplash

When choosing a remittance channel, your main concerns are likely fees and delivery speed. Below, I will detail several of the cheapest ways to send money, helping you quickly identify the most suitable option for your needs.

Online Remittance Platforms

Online remittance platforms are among the most popular methods for sending money. You can operate them directly from a computer or phone without visiting a physical location. Many platforms offer low fees, sometimes even waiving fees during promotions. Some platforms also support real-time exchange rates with transparent fee structures, allowing you to clearly understand every charge.

| Platform | Fee Structure | Service Type |

|---|---|---|

| Western Union | Competitive exchange rates and fast processing times | Online and in-person transfers |

| Wise | Transparent fees and real-time exchange rates | Trackable transfers |

| ACE Money Transfer | Reasonable fees, offering multiple services | Bank transfers, cash pickup, mobile wallet transfers |

| MoneyGram | Low fees and fast receipt | Mobile wallet, cash pickup |

| PayPal | Possible additional fees and exchange rate conversion fees | Online transfers |

As you can see, Wise and MoneyGram are favored for their low fees and transparent structures. Western Union is known for its global network and fast delivery. ACE Money Transfer and PayPal also offer diverse services, but PayPal may incur additional fees.

Tip: Choosing a platform that supports real-time exchange rates can effectively reduce exchange rate losses, further lowering total costs.

Stablecoin payments (such as USDC) are an emerging remittance method. You can enjoy fees below 1%, with funds arriving in minutes, available 24/7, and every transaction is trackable. Compared to traditional remittance methods, stablecoin payments offer advantages in both fees and speed.

| Feature | Stablecoin Payments (e.g., USDC) | Traditional Remittance Methods |

|---|---|---|

| Fees | Below 1% | 8-12% |

| Transaction Speed | A few minutes | Several days |

| Availability | 24/7 | Dependent on bank hours |

| Transparency | Trackable | Opaque |

Mobile Payment Apps

Mobile payment apps allow you to complete remittances anytime, anywhere. You simply download the app, register an account, link a bank card or credit card, and initiate a transfer. Many apps offer low fees, real-time delivery, and multiple receipt methods. Some apps also support zero exchange rate differences and no hidden fees, truly helping you save money.

| App Name | Fee Type | Features |

|---|---|---|

| Instarem | Low fees, zero exchange rate difference | Real-time remittances, no hidden fees, supports multiple payment and withdrawal options. |

| Pangea | Fixed transfer fees | Fast transfers, supports cash pickup, offers referral rewards. |

| Pomelo | Zero transfer fees | Send via credit card, supports global use, competitive exchange rates. |

| Wise | Low fees | Supports multiple currencies, transparent fees, no hidden fees, real-time exchange rates. |

| XE Money | Transparent fees | Supports multiple currencies, user-friendly platform, fast delivery. |

| Remitly | Transparent fees | Offers multiple transfer methods, user-friendly app, supports cash pickup and mobile wallet. |

When choosing an app, prioritize products with low fees, fast delivery, and multiple receipt methods. Some apps periodically offer promotions or discount codes to further reduce remittance costs.

Security is also a key consideration. Mainstream mobile payment apps typically employ end-to-end encryption, two-factor authentication, and transaction monitoring to ensure your funds’ safety.

| Security Measure | Description |

|---|---|

| End-to-End Encryption | Ensures secure data transmission between sender and recipient. |

| Two-Factor Authentication | Requires users to verify identity through additional steps (e.g., SMS code), enhancing account security. |

| Transaction Monitoring | Monitors suspicious transactions, freezing accounts immediately in case of anomalies to prevent potential fraud. |

Government Incentives

The Philippine government offers several incentives for overseas workers to help reduce remittance costs. You can apply for official migrant worker benefits, including training, insurance, and loans. The government also issues Visa cards to official workers, facilitating remittance operations. In recent years, the government has actively pushed private banks to lower remittance fees, allowing you to enjoy lower service charges.

| Policy/Incentive | Description |

|---|---|

| Subsidized Benefits | Benefits available to official migrant workers, including training, insurance, and loans. |

| Visa Card | Visa cards issued by OWWA to all official workers for convenient remittances. |

| Reduced Remittance Fees | Government efforts to lower remittance costs through private banks. |

If you are an official Philippine migrant worker, you can prioritize these policies to enjoy exclusive benefits and lower fees.

Traditional Banks and Cash Services

Traditional banks and cash services remain popular remittance channels for many. You can process wire transfers through licensed Hong Kong banks or opt for cash remittance services. Bank wire transfers typically have higher fees and longer delivery times but offer strong reliability. Cash remittance services are known for low fees and fast delivery, ideal for users needing urgent transfers.

| Service Provider | Fees (USD) |

|---|---|

| DBP Branches (selected) | 5.00 |

| M. Lhuillier/Kwarta Padala | 5.00 |

| Credit to Other Bank USD account | 8.00 |

| PNB (Credit to PNB or Other Bank USD account) | 8.00 |

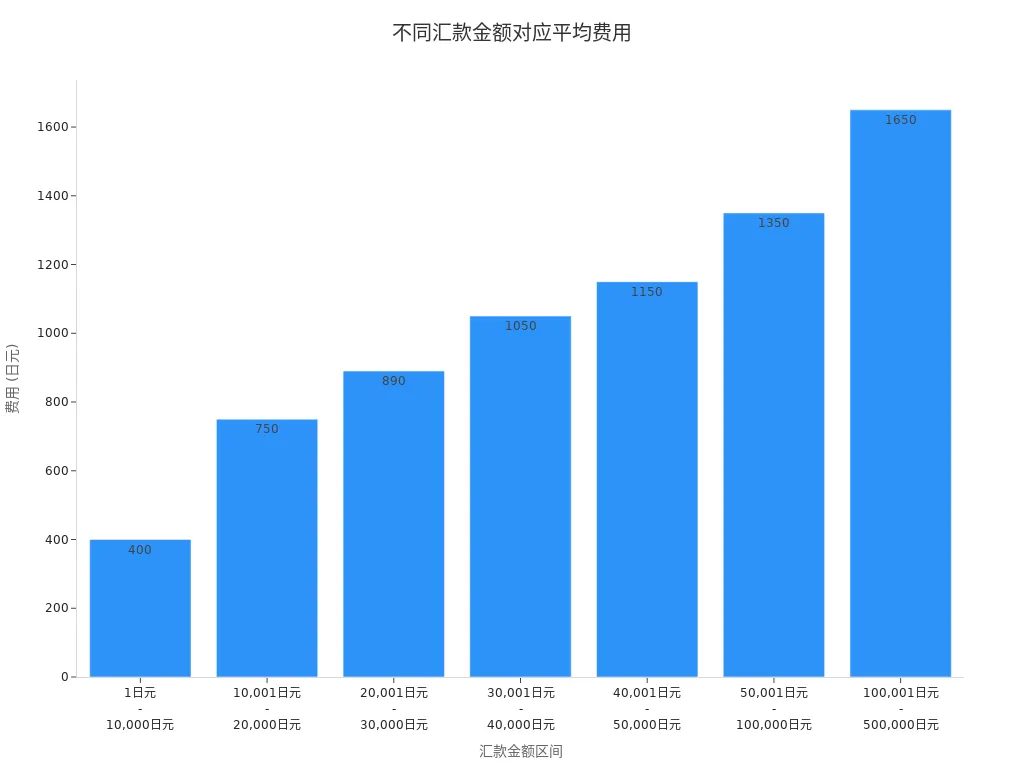

You can choose different services based on the remittance amount, with fee ranges as follows:

| Remittance Amount | Fees (JPY) |

|---|---|

| 1 JPY - 10,000 JPY | 400 JPY |

| 10,001 JPY - 20,000 JPY | 750 JPY |

| 20,001 JPY - 30,000 JPY | 890 JPY |

| 30,001 JPY - 40,000 JPY | 1,050 JPY |

| 40,001 JPY - 50,000 JPY | 1,150 JPY |

| 50,001 JPY - 100,000 JPY | 1,350 JPY |

| 100,001 JPY - 500,000 JPY | 1,650 JPY |

Cash remittance services are known for their speed and competitive fees, ideal for users needing quick transfers. Bank wire transfers, while reliable, typically have higher fees and slower processing times. When choosing, you can weigh speed and cost based on your needs.

In practice, it’s recommended to prioritize online remittance platforms and mobile payment apps, as these are typically the cheapest ways to send money. Government incentives and cash services are also worth considering to further save on fees.

Fee Comparison

Transaction Fees

When choosing a remittance channel, the first thing to focus on is transaction fees. Fees vary significantly among service providers. Online remittance platforms and mobile payment apps generally offer lower transaction fees, with some platforms waiving fees for first-time transactions or during promotions. Traditional banks, especially licensed Hong Kong banks, charge higher fees for international remittances, typically ranging from USD 5-8 per transaction. Cash services have relatively transparent fees, suitable for small, quick transfers. By comparing transaction fees across channels, you can find the cheapest way to send money.

Exchange Rates

Exchange rates directly affect the final amount received by the recipient. You’ll notice significant differences in exchange rates offered by different remittance providers.

- Remitly typically offers more competitive exchange rates than traditional banks, significantly impacting the amount received by the recipient.

- Compared to other remittance services (like Western Union and Xoom), Remitly generally provides better exchange rates for online transfers.

- Hidden foreign exchange fees can lead to higher costs during transfers, affecting the final amount received.

- According to Wise’s research, Filipinos lost PHP 83.7 billion in 2023 due to hidden foreign exchange fees.

- Many remittance providers impose undisclosed markups on exchange rates, causing you to pay more than expected. For example, a USD 10,000 international transfer might incur an additional PHP 21,187 due to a 3.6% markup.

When choosing a service, prioritize platforms with transparent exchange rates to avoid increased costs due to markups.

Hidden Fees

In addition to transaction fees and exchange rates, you need to be aware of various hidden fees. Common hidden fees include:

- Transfer fees

- Exchange rate differences

- Additional charges (e.g., service fees, recipient fees, withdrawal fees, inactive account fees)

Some online services may offer lower fees for first-time transactions or discounts for large transfers. Before sending money, carefully review the fee disclosure to understand all potential charges. This helps avoid unexpected expenses when receiving funds in the Philippines. By comparing the fee structures of different services, you can better control remittance costs and improve fund utilization efficiency.

Pros and Cons and Use Cases

Online Platforms

You can choose online platforms for remittances, which are highly convenient. You only need to operate via computer or phone without visiting a physical location. Online platforms typically offer fast transaction speeds, low fees, real-time exchange rates, and high transparency. You can track transaction progress at any time.

| Pros | Cons |

|---|---|

| Convenience and accessibility | Dependence on internet connection and digital infrastructure |

| Faster transaction processing | Potential security issues and fraud risks |

| Lower fees and exchange rates | |

| Enhanced financial inclusion | |

| Transparency and transaction tracking |

If you work in mainland China or the United States, online platforms allow you to easily send money to the Philippines, but you need to ensure a stable network environment and pay attention to account security.

App Remittances

Mobile payment apps allow you to complete remittances anytime, anywhere. You can enjoy low fees and real-time delivery. Apps typically support multiple receipt methods and have user-friendly interfaces, making them suitable for younger users. When using them, protect your personal information and avoid operating in unsafe network environments. Some apps also periodically offer promotions to help you save further.

Tip: Prioritize apps that support two-factor authentication and end-to-end encryption to enhance fund security.

Bank Wire Transfers

Bank wire transfers are suitable for users needing large remittances or prioritizing high security. You can process international remittances through licensed Hong Kong banks, enjoying global services and high security assurances. Bank wire transfers are fast but have higher fees and are irreversible. When operating, carefully verify recipient information to avoid fund loss due to errors.

| Pros | Cons |

|---|---|

| Convenience | High fees |

| Speed | Irreversibility |

| Global service | Attracts fraudsters |

| Security |

Bank wire transfers are suitable for businesses or scenarios requiring one-time large fund transfers.

Cash Services

Cash remittance services are ideal for users needing urgent transfers. You can handle them directly at service locations with transparent fees and fast delivery. Many overseas Filipino workers rely on cash remittances to support their families’ daily needs.

- You can use cash services to meet your family’s basic needs like food, clothing, and housing.

- The Philippines receives significant remittances annually, and cash services play an important role in the national economy.

- Cash remittances not only support families but also provide funds for business investments, promoting economic development.

When choosing cash services, you can flexibly arrange based on actual needs, especially for those without bank accounts or requiring fast delivery.

Money-Saving Tips and Precautions

Image Source: pexels

Promotions and Discounts

You can reduce remittance costs by participating in promotions and using discount codes. Many remittance providers offer first-time transfer discounts for new users. For example, some platforms provide exclusive discount codes for users in the United States and Canada, offering USD 10 to USD 40 discounts on first-time transfers. The table below shows common discount types and codes:

| Discount Type | Code | Description |

|---|---|---|

| First Transfer Discount | PNAA10USA | USD 10 discount on first transfer from the USA to the Philippines |

| First Transfer Discount | PNAA10CAN | USD 10 discount on first transfer from Canada to the Philippines |

| First Transfer Discount | None | Up to USD 20 discount on first transfer |

| First Transfer Discount | None | USD 15 discount with promotional code |

| First Transfer Discount | None | USD 40 discount for sending USD 100 or more |

Before sending money, check the service provider’s website or app for the latest promotions and use discount codes to choose the cheapest way to send money.

Exchange Rate Selection

When sending money, prioritize platforms with transparent exchange rates. Real-time exchange rates can help maximize the recipient’s amount. Some providers add markups to exchange rates, reducing the actual amount received. You can compare exchange rates across platforms and choose the most favorable timing for remittances. Exchange rate fluctuations and global market conditions affect the final amount, so it’s advisable to send money when rates are high.

Tip: Choosing platforms that support real-time exchange rates can effectively reduce exchange rate losses.

Fee Comparison

You can find the most cost-effective channel by comparing transaction fees across providers.

You can choose platforms with low fees and fast delivery based on your needs. Some mobile payment apps and online platforms periodically offer fee-free promotions, further reducing costs.

Avoiding Additional Fees

When sending money, be cautious of hidden fees and unfavorable exchange rates. Common additional fees include:

- Exchange rate fluctuations

- Global market conditions

- Service provider transparency

- Hidden fees

- Unfavorable exchange rates

- Bank transfer fees

- Foreign exchange transaction fees

- Remittance service fees

You can choose competitive providers and take advantage of discounts and promotions. Comparing exchange rates and fees across services helps maximize remittance value and avoid unnecessary expenses.

Practical Operation Guide

Online Platform Process

You can easily complete remittances through mainstream online platforms. Below are common steps:

- Create an account: Register with your email address and set a strong password.

- Start the transfer: Select the Philippines as the recipient country, enter the remittance amount, and choose the receipt method.

- Enter recipient information: Fill in the recipient’s details based on the receipt method.

- Pay fees: Choose bank transfer or use a debit/credit card to pay the transfer fees.

Tip: Ensure accurate information during registration and remittance to avoid transaction failures due to mismatched details.

App Operation Steps

You can download mobile payment apps to send money. The process is as follows:

- Register an account and complete identity verification, uploading valid identification.

- Select the remittance destination and amount, and fill in recipient information.

- Link a bank card or credit card and confirm payment.

- Wait for the system to process; the recipient can receive funds within minutes.

Financial institutions require you to provide proof of identity and source of funds to ensure compliance. You should regularly update account information, especially for high-risk accounts.

| Requirement Type | Description |

|---|---|

| KYC Requirements | Identity verification required, identifying high-value transactions |

| EDD May Be Required | Verification of fund sources, ongoing transaction monitoring |

Bank Process

You can process international remittances through licensed Hong Kong banks. The process is as follows:

- Visit a bank branch or use online banking services.

- Fill out an international remittance application form, providing the recipient’s bank account information.

- Submit valid identification and proof of fund source.

- Pay the remittance amount and fees (in USD) after bank review.

- The recipient typically receives funds within 1-3 business days after processing.

Banks periodically review transactions to identify and report suspicious activities, ensuring fund safety.

Cash Remittance Process

You can choose cash remittance services, suitable for those without bank accounts or needing urgent transfers. The common process is as follows:

- Visit a service location, such as Cebuana Lhuillier international partners.

- Fill out a remittance form and submit valid identification.

- Pay the remittance amount and fees (in USD) to the staff.

- Receive a confirmation number or receipt and provide it to the recipient.

- The recipient can collect cash at a local branch with the confirmation number.

| Feature | Cash Remittance | Digital Methods |

|---|---|---|

| Convenience | Requires physical travel, less convenient | Fast and efficient |

| Security | Lower sense of security | Widely considered the safest method |

| User Satisfaction | Low | High |

| Fees | High fees are a major complaint | Competitive exchange rates and lower convenience fees |

You can choose the most suitable remittance method based on your needs to enhance efficiency and security.

Channel Comparison

Cost

When choosing a remittance channel, cost is a key consideration. Online platforms and mobile payment apps typically offer lower transaction fees, with some platforms waiving fees during promotions. Stablecoin payments have fees below 1%, far lower than the 8-12% of traditional banks. Licensed Hong Kong banks charge around USD 5-8 per international remittance. Cash remittance services have transparent fees, suitable for small, quick transfers. By comparing fee structures across channels, you can find the most cost-effective solution.

Speed

If you want funds to arrive quickly, prioritize online platforms and mobile payment apps. These channels typically complete transfers within minutes, allowing recipients to receive funds in real time. Stablecoin payments also offer fast delivery and are available 24/7. Traditional bank wire transfers take longer, usually 1-3 business days. Cash remittance services excel in urgent situations, allowing recipients to collect cash instantly at branches. You can choose the appropriate channel based on the urgency of the funds.

Convenience

Remittance channels in the Philippines vary significantly in convenience. You can enhance your remittance experience through the following methods:

- Mobile remittance services like GCash and PayMaya allow you to send funds anytime, anywhere via phone, greatly improving convenience.

- You only need to link a bank account or load a mobile wallet to complete transfers easily, saving time and effort.

- Convenience stores like 7-Eleven and Ministop have wide coverage, becoming mainstream channels for bill payments, especially in semi-urban and rural areas.

- Urban users prefer payment centers and banks, while informal providers are more popular in rural areas.

- When choosing a service, you can flexibly adjust channels based on the transfer amount and recipient’s location.

If you prioritize efficiency and convenience, mobile and online platforms are recommended, as they have grown rapidly over the past five years and become mainstream choices.

You can choose low-fee channels, flexibly utilize promotions and real-time exchange rates, and improve remittance efficiency. Keep the following suggestions in mind:

- Use reputable services, prioritizing licensed Hong Kong banks or licensed remittance platforms.

- Verify recipient information to avoid misdirected transfers.

- Protect account security and regularly monitor funds.

- Plan remittance timing to reduce transaction fees.

By avoiding common mistakes, you can ensure fund safety and save costs.

FAQ

How Fast Can Money Be Sent to the Philippines?

Using online platforms or mobile payment apps, funds can arrive in as little as a few minutes. Bank wire transfers generally take 1-3 business days.

What Security Measures Are in Place for Sending Money to the Philippines?

When choosing a reputable platform, the system uses end-to-end encryption and two-factor authentication to ensure your funds’ safety.

Are There Limits on Remittance Amounts?

When sending money through different platforms, minimum and maximum amounts vary. Check the service terms in advance to avoid exceeding or falling short of limits.

Remitting to the Philippines via platforms like Remitly offers 1.49% average fees and minutes-fast delivery, while stablecoin options under 1% fees shine, but bank wires’ $15-80 costs and 1-3 business day waits inflate expenses, especially in 2025’s $80+ trillion remittance market, where traditional providers’ markups and limits erode received amounts. For a cheaper, faster alternative, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day processing, no lengthy verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.