- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

AI chip new era: How Broadcom seizes the opportunity after DeepSeek's popularity?

Broadcom’s recent performance has attracted many investors, especially those who value high-speed growth. Its growth momentum mainly comes from the surge in demand for customized AI acceleration chips. With the rapid development of AI technology, many large companies need stronger processing capabilities, which is Broadcom’s strength. It is expected that Broadcom’s growth rate will reach about 30% by 2027, which is undoubtedly a great attraction for investors pursuing high returns.

However, the recent emergence of DeepSeek has caused some market fluctuations. Although the training cost of this AI model is much lower than that of Google and Microsoft’s congeneric products, the market’s reaction has been too intense, leading to a pullback in Broadcom’s stock price. Although there is some short-term pressure, in the long run, Broadcom’s potential is still strong, especially in the field of customized ASIC chips.

Broadcom’s core growth driver: custom ASIC chips

As mentioned earlier, the key to Broadcom’s growth lies in customized ASIC chips, which is also an important driving force for the company’s performance growth. Compared to standard GPUs, these chips are more targeted and can optimize computing power, energy efficiency ratio, and cost according to customers’ specific needs. Therefore, they are increasingly favored by tech giants.

Currently, Hyperscalers are accelerating the transition from general AI chips to customized ASIC chips to improve the efficiency of AI training and inference. Broadcom is an important player in this market, maintaining close cooperation with companies such as Google, Meta, and Amazon to provide them with customized AI chip solutions. This long-term cooperation not only ensures a stable order flow, but also enables Broadcom to continuously optimize its ASIC products and enhance market competitiveness.

In addition, Broadcom’s management has proposed a long-term growth target of 30%, and the custom ASIC business is a key support point for this growth expectation. From the current industry trend, the capital expenditures of major Cloud Service companies are still increasing, and Broadcom’s ASIC business is expected to continue to benefit. Even if the market fluctuates in the short term, the demand in this field remains strong in the long run.

Recently, due to the market volatility caused by DeepSeek’s news, some investors have doubts about Broadcom’s growth prospects. However, from a fundamental perspective, this adjustment may be overinterpreted by the market, as the core demand for AI computing has not changed and customized ASICs are still an important trend in the future.

Custom ASIC Market: The Driving Force of Super Cycle

As tech giants continue to invest in AI infrastructure, Cloud Services is entering a “super cycle”. Against this backdrop, the importance of custom ASIC chips is becoming increasingly prominent, and Broadcom is the core beneficiary of this market.

Currently, Cloud Service giants such as Google, Meta, and Amazon are seeking more efficient and cost-effective computing solutions, driving a surge in demand for custom ASIC chips. Compared to general-purpose GPUs, ASIC chips have higher energy efficiency in specific tasks, which makes Hyperscalers willing to invest resources in chip customization to optimize AI training and inference performance. Broadcom has established deep partnerships with these technology companies based on years of ASIC design experience and is laying out in the 3nm process.

It is worth noting that TSMC has played an indispensable role in this process. As Broadcom’s core foundry partner, TSMC’s advanced process capabilities directly determine the performance and delivery schedule of ASIC chips. With the gradual maturity of the 3nm process, Broadcom’s next-generation ASIC chips will be further optimized in terms of energy efficiency, computing speed, and cost control, thereby strengthening its market competitiveness.

From an overall trend perspective, the continued advancement of Cloud Supercycle not only means an increase in Cloud Service spending, but also indicates the long-term growth potential of the custom ASIC market. For Broadcom, this is an extremely attractive track, and its ASIC business will continue to benefit from this trend and become an important engine driving the company’s future growth.

The efficiency improvement of AI chips: the transition from NVIDIA to custom ASICs

In the past few years, NVIDIA has almost dominated the AI computing market, and its GPUs have become the preferred choice for AI training due to their powerful parallel computing capabilities. However, with the explosive demand for generative AI, Cloud Service giants are beginning to look for more efficient and cost-effective solutions, which is driving the industry to shift from general-purpose GPUs to customized ASIC chips.

NVIDIA’s GPU performs strongly in the field of AI training, but its energy efficiency and cost are not ideal in large-scale inference tasks. Especially for Hyperscaler, long-term reliance on NVIDIA not only means higher procurement costs, but also is subject to NVIDIA’s pricing power and supply chain control. Therefore, companies such as Google, Amazon, Meta, etc. are accelerating their own research and development or adopting customized AI accelerators to reduce their dependence on NVIDIA while optimizing the performance and cost of AI workloads.

Broadcom is a direct beneficiary of this trend. Its custom ASIC solution can accurately optimize the computing architecture according to customer needs, achieving higher computing efficiency and energy efficiency ratio on specific tasks. For example, custom AI chips such as Amazon’s Inferentia and Google’s TPU are designed with ASIC, and the power consumption of such products in inference tasks is much lower than that of traditional GPUs, while also being optimized for specific AI models.

In addition, Broadcom’s ASIC business also benefits from TSMC’s advanced process technology support. The application of 3nm process will further improve the computing efficiency of chips and provide more competitive customized solutions for Hyperscaler. With more and more enterprises adopting ASIC architecture, Broadcom can not only gain a larger market share in this transformation process, but also enhance its market position by binding customers through deep cooperation.

From the GPU era dominated by NVIDIA to the AI inference era dominated by ASIC, Broadcom is standing on the trend of industry transformation. With the continuous growth of AI computing demand, this trend will further accelerate in the next few years, providing strong support for Broadcom’s long-term growth.

If you are optimistic about Broadcom’s growth prospects and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Is Broadcom stock worth buying?

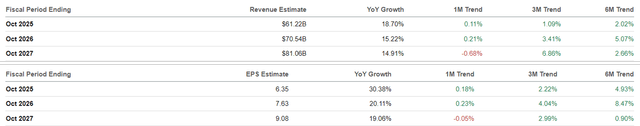

When looking forward to Broadcom’s future growth, the market is very optimistic about its prospects, especially driven by DeepSeek. Consensus forecasts show that Broadcom’s revenue and profits are expected to accelerate in fiscal year 2027, with compound annual growth rates (CAGR) of 16.3% and 23.1%, respectively. This forecast is significantly higher than the initial growth rates of 7.9% and 13.2%, reflecting Broadcom’s strong performance in the cloud super cycle and emerging new growth opportunities.

From historical data, Broadcom’s compound annual growth rate performance in the past few years has also been very impressive. The CAGRs for fiscal year 2019 and fiscal year 2024 were 17.9% and 18%, respectively. This indicates that Broadcom has the ability to continue expanding in a rapidly developing market environment, especially against the backdrop of increasing demand for AI and custom ASIC chips.

From the perspective of valuation, Broadcom’s forward-looking Price-To-Earnings Ratio (FWD P/E) has also experienced a significant upward adjustment. Its FWD P/E non-GAAP valuation has increased from a 1-year average of 29.09 times and a 5-year average of 20.11 times to 34.85 times, close to the competitive level with NVIDIA (NVIDIA’s FWD P/E is 40.66 times). Although Broadcom’s FWD PEG non-GAAP ratio is 1.69 times, lower than the industry median of 1.82 times, it still shows strong attractiveness compared to the 5-year average of 1.38 times, especially with the support of strong growth prospects.

The increase in this valuation level reflects the market’s confidence in Broadcom’s future growth. Although the current stock price may experience a moderate pullback, Broadcom remains an attractive choice from a long-term investment perspective.

Overall, although short-term market adjustments may bring some uncertainty, Broadcom is still a company worth investing in for the long term due to its strong competitiveness in the field of customized AI accelerators. For investors seeking stable growth opportunities, the current market correction may be a buying opportunity worth paying attention to.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.