- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Two major impacts in a week: DeepSeek's explosive popularity and Meta and Microsoft's huge investment. What is the fate of NVIDIA?

The past week can be called a week of “completely changing NVIDIA’s fundamentals”.

From the news perspective, two events occurred last week that had a significant impact on NVIDIA’s stock price.

First, the Chinese artificial intelligence company DeepSeek has released the latest AI open source model, which is more cost-efective than ChatGPT and directly shocked the entire Silicon Valley and Wall Street.

The emergence of DeepSeek not only made Silicon Valley giants restless, but also caused a storm in Capital Markets. DeepSeek’s AI assistant topped the app store rankings in both China and the United States in just a few days, an unprecedented feat. It should be noted that applications that can conquer both markets are rare. What is even more shocking is that DeepSeek claims that the ability of its AI model can rival the latest version of OpenAI, but the research and development cost is only a drop in the bucket.

This news was like a bombshell, causing NVIDIA’s stock price to plummet by about 17% and its market value to evaporate by $589 billion, setting one of the largest single-day market value losses in the history of the US stock market. On the same day, other semiconductor companies such as AMD and Broadcom were also impacted, with their stock prices falling by 6% and 17% respectively. DeepSeek single-handedly crushed the global stock market!

The second thing is that Meta and Microsoft respectively disclosed in their latest financial reports that Microsoft plans to invest $80 billion to build an AI Data Center in the future, and Meta will spend $65 billion on AI research and development. Although the news did not cause a storm in the short-term market like DeepSeek, as investors, we all know that these two companies are NVIDIA’s two largest customers, and their expenses are NVIDIA’s revenue. Therefore, their impact on NVIDIA’s stock price in the long run is probably even greater than that of DeepSeek.

After such a turbulent week, I’m sure everyone must be asking not only whether the volatility has ended, but also whether now is a good time to bottom fish NVIDIA. If I say that the DeepSeek incident has far-reaching impact and its impact has not yet fully fermented, would you believe it? And what information does Meta and Microsoft’s capital expenditure reveal, and what signals do they give about the future trend of NVIDIA’s stock price?

Let’s take a look at how NVIDIA will perform in the future, from DeepSeek’s sudden success to Microsoft and Meta’s future capital expenditures in the AI field.

First, we need to understand the impact of ChatGPT on NVIDIA

To understand the impact of DeepSeek on NVIDIA’s stock price, we must first understand the impact of ChatGPT on NVIDIA and see how ChatGPT pushed NVIDIA to the top three in global market value within two years.

Time goes back to 2022. For most of 2022, NVIDIA’s stock price was tormented by the global decline in consumer electronics demand. The stock price fell from a high of around $30 at the beginning of the year to $12 in the fourth quarter, with an overall decline of nearly 2/3. The turning point occurred on November 30, 2022, when OpenAI released ChatGPT. On the day of the release, NVIDIA’s stock price rose by 8.2%. With the market’s unanimous optimism about ChatGPT, NVIDIA’s stock price also sounded the horn of counterattack, and we already know what happened afterwards.

Looking back from today, what has ChatGPT changed about NVIDIA? In fact, nothing has changed internally, NVIDIA is still the same NVIDIA. ChatGPT has changed the external market environment, specifically the total demand for NVIDIA chips and the urgency of the demand. These two points can be well confirmed in NVIDIA’s financial report.

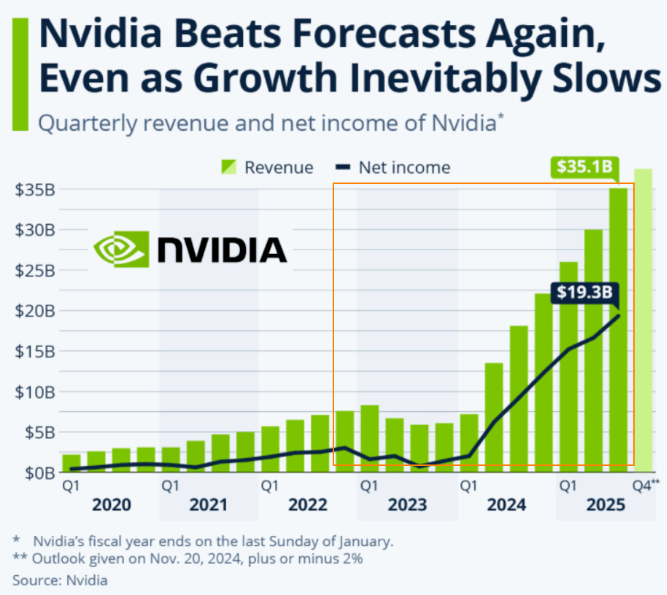

Starting from the second quarter of 2023, the revenue of NVIDIA’s financial report has entered a takeoff mode. From 6 billion, to 7 billion, 13.50 billion, 18 billion, 22 billion, 26 billion, 30 billion, 35 billion, sales are generally not turning back. Behind these revenue figures, it represents the market situation where NVIDIA’s high-end chips are in short supply.

What makes investors even more pleased is that along with the growth in sales, NVIDIA’s gross profit margin has also been soaring. From 43% in the first quarter of 2022 to 53%, 63%, 70%, 74%, and the highest to 78%, until the recent two-quarter financial report returned to around 75%. From the historical trend, it can be seen that this gross profit margin level has far exceeded the normal gross profit margin range in NVIDIA’s history. If we compare the lowest gross profit margin of 43% and the highest gross profit margin of 78% during the time period, we will find that the values have more than doubled, which means that in just one year, NVIDIA can charge the same customers twice the price of a year ago for the same product, and even so, it is still in short supply.

There is a well-known concept in the stock market called “Davis Double Click”, which describes the process of investors obtaining considerable returns through the dual growth of earnings per share (EPS) and company valuation (PE). In the past two years, it can also be said that NVIDIA’s stock price has been stimulated by the “double click” of revenue growth and gross profit margin growth, which has led to a surge in stock price. “High revenue” and “high gross profit” have become the two legs supporting NVIDIA’s stock price.

After understanding the impact of ChatGPT on NVIDIA’s stock price, let’s take a look at the impact of DeepSeek

Firstly, due to the existence of the Scaling law, I believe that the demand for chips in the US may not experience significant fluctuations in the short term.

We all know the Jevons Paradox, which refers to the situation where technological progress improves the efficiency of resource use, but cost reduction leads to increased demand, resulting in an increase in the speed of resource consumption rather than a decrease.

In the long run, due to the existence of the Jevons Paradox, the emergence of DeepSeek may not only not have an inhibitory effect on the demand for GPUs in the whole society, but may even promote the increase in the demand for GPUs in the whole society due to the popularization of AI. Just like in the 19th century, the improvement of steam engine efficiency enabled more power to be generated per unit of coal, which instead pushed up the overall demand for coal in the whole society.

Secondly, whether people like it or not, the motivation for big tech to rush to buy NVIDIA chips in the short term has probably been greatly reduced by Deepseek. The best evidence to support this conclusion is the internal disclosure of Meta employees after Deepseek became popular. The entire Meta artificial intelligence development team entered a panic mode, and everyone was seeking a reasonable explanation for their own cost.

In the short term, the shortage of GPU demand will be alleviated by big tech companies through engineering optimization. At the same time, it can be expected that during the supplier negotiation process, the pressure will be passed on to NVIDIA, forcing it to make concessions on procurement prices. More importantly, since Deepseek can quickly catch up with OpenAI through model “distillation”, Meta, Microsoft, Google, and other US big tech companies can also take the initiative and optimize their own engineering after others make better models, achieving overtaking through engineering optimization. In this way, the urgent demand for NVIDIA GPUs in the short term will also greatly slow down.

In short, for the two legs that support NVIDIA’s high stock price, the “high gross profit” leg is likely to be the first to be hurt by Deepseek. As for sales, given that the scaling law is still valid, it will still be in a situation of “making one and selling one”, but it will be difficult to sell at such a high price.

So in this case, how will NVIDIA’s stock price be affected?

Considering the current high market heat of NVIDIA, the market had already fully priced NVIDIA based on the optimal situation of “high revenue” and “high gross profit” before the Deepseekl incident occurred. This has led to the abnormal fragility of NVIDIA’s stock price, where even a small split could have a significant impact, let alone directly cutting off the “high gross profit” leg.

Based on the above analysis, it is inevitable that NVIDIA’s stock price will fluctuate. However, in the long run, is it possible that demand growth can offset the decline in gross profit margin? We can assume that in the long run, NVIDIA’s gross profit margin will return to the historical normal level, around 60% (Cisco’s gross profit margin also falls roughly into this range, which is a healthy gross profit margin for a hardware company with technical barriers to maintain good business relationships with customers, equivalent to hardware companies making money and customers not being “robbed”). This means that the company’s gross profit margin will decrease by about 20% from the current gross profit margin of 75%. Therefore, this question can be transformed into: Can future market demand increase by 20% to offset the pressure on this part of the gross profit margin? To answer this question, you can try to seek clues from the financial reports of Meta and Microsoft.

What signals do the financial reports of Meta and Microsoft give to the future trend of NVIDIA’s stock price?

Last week, Meta and Microsoft respectively disclosed their future plans at their latest financial reports. Microsoft plans to invest $80 billion to build an AI data center, while Meta plans to invest about $600 to $65 billion in server, data center, and network infrastructure expansion. Zuckerberg also mentioned that they expect to launch nearly 1GW of computing power this year. At the same time, they are building a 2GW or larger AI data center. Among them, AI servers are still a key investment direction. Although this does not directly mention Nvidia, these expansion measures mean that Meta will still rely on Nvidia’s AI chips, especially in large-scale AI training and inference tasks.

Overall, I think the AI strategies of these two companies have not been fundamentally affected by the DeepSeek incident. Big Tech’s attempt to break away from NVIDIA’s dependence is not something that happened in the past few days, but it is particularly prominent in this incident. The more likely scenario is that with the launch of self-developed chips by various companies, the chips used by Big Tech will become more diverse, and NVIDIA’s monopoly power will gradually weaken. This may have an impact on NVIDIA’s gross profit margin, but at the same time, NVIDIA itself is also making progress, and the entire AI cake is also getting bigger. Whether it will have an impact in the short term still needs to be observed. Personally, I think it is far from the right time. According to Anthropic CEO Amodi’s view, once algorithm innovation falls into a new bottleneck, the strategy of stacking computing power will make a comeback. At this time, NVIDIA is still one of the indispensable roles.

Is the sharp drop in NVIDIA’s stock price a crisis or an opportunity?

One of the huge values implied in NVIDIA’s stock price is the CUDA ecosystem. Now DeepSeek abandons CUDA and directly uses a language closer to hardware for development, that is, not based on CUDA but on PTX language for development optimization, which weakens NVIDIA’s CUDA barrier. This explains why AMD and Huawei are happy to see DeepSeek succeed.

After the launch of DeepSeek, Nvidia’s stock price plummeted. However, some investors believe that this is actually a good opportunity for bottom fishing Nvidia. Although the DeepSeek case has raised concerns about GPU demand in the market, the overall development trend of the AI market has not changed. With the continuous development and popularization of AI technology, the demand for infrastructure such as GPUs will continue to grow. In addition, the leading position and technological advantages of companies such as Nvidia in the AI field also provide strong guarantees for its future development. Therefore, for investors who are optimistic about the prospects of the AI market and hope to share Nvidia’s growth dividends, the current situation may be a rare buying opportunity.

If you also want to seize this opportunity, you can use the multi-asset trading wallet BiyaPay App. This platform not only allows real-time online trading of high-quality stocks such as NVIDIA, but also allows you to deposit digital currency (such as USDT) into the platform in real-time, and then withdraw fiat currency to invest in high-quality stocks such as NVIDIA in other securities. The withdrawal will be credited on the same day.

According to analysts’ predictions for 2025, the forward Price-To-Earnings Ratio (forward P/E) of NVIDIA’s stock is 27x, which is at the low percentile level of the past three years. Stocks with a P/E ratio below 0.85 are usually considered undervalued. For investors who have been waiting for a decline to buy NVIDIA, this is an opportunity.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.