- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Key Issues in Sending Money to Spain: Taxes, Exchange Rates, and the Best Transfer Methods

Image Source: unsplash

When you remit money to Spain through a remittance, the three key issues you need to focus on are taxes, exchange rates, and transfer methods. These factors directly affect the actual amount your family or friends receive and determine whether you can complete the remittance smoothly and compliantly. According to the latest statistics, the amount of international remittances received by Spain varies significantly each year:

| Time | Remittance Amount (EUR Million) |

|---|---|

| Q4 2024 | 5853 |

| Q1 2025 | 7480 |

| Average | 2542.36 |

| Historical High | 7480.00 |

| Historical Low | 888.00 |

You need to understand the following points:

- Personal income tax, gift tax, and inheritance tax affect large remittances, especially when exceeding specific thresholds.

- Exchange rate fluctuations and fees from different transfer methods can cause significant differences in the received amount.

- Choosing a platform with transparent fees can reduce unnecessary losses.

Key Points

- When remitting to Spain, you need to focus on taxes, exchange rates, and transfer methods, as these factors directly affect the received amount.

- International remittances exceeding $10,800 must be declared to the Spanish Tax Agency and require submission of the S1 form to ensure the legality of the funds’ source.

- Choosing a platform with transparent fees can reduce hidden costs, ensuring the recipient receives more local currency.

- Exchange rate fluctuations affect the received amount, so you must confirm the exchange rate and fees before remitting to avoid exchange rate traps.

- Prepare identity proof, address proof, and proof of funds’ source to ensure a smooth and compliant remittance.

Taxes on Remittances to Spain

Image Source: unsplash

Spanish Tax Requirements

When you remit money to Spain, you must understand the Spanish Tax Agency’s declaration requirements for international transfers. Spain has clear declaration thresholds for received international remittances. The main declaration standards are as follows:

| Transaction Type | Declaration Threshold (USD) |

|---|---|

| Cash Transactions (€500 notes) | No declaration required |

| Cash Payments or Transfers | $3,240 |

| Credit Line | $6,480 |

| Total Transaction Amount | $10,800 |

If you receive a one-time international remittance exceeding $10,800, you must declare it to the Spanish Tax Agency and submit the S1 form. If the source of funds is unclear, the tax authorities may request additional explanations. You need to ensure that all funds’ sources are legal and documented, or it may trigger a tax investigation.

- International transfers exceeding $10,800 require declaration.

- The S1 form must be filled out during declaration.

- Unclear fund sources may trigger tax obligations.

Declarations in the Sending Country

When you remit money to Spain from mainland China, the United States, or other major sending countries, you must also comply with local tax declaration regulations. For example, in the U.S., banks, credit unions, or remittance service providers automatically collect a remittance tax during eligible transfers and report the information to the IRS. You need to report the total remittance tax paid on your annual federal income tax return and provide detailed personal information, including your Social Security Number (SSN).

- The remittance tax is automatically collected by financial institutions and reported to the IRS.

- You need to declare the total remittance tax on your annual tax return.

- Detailed personal information is required when applying for tax credits.

- The new Section 4475 imposes a new excise tax on cross-border remittances initiated in the U.S., requiring businesses and individuals to comply with new withholding and remittance requirements.

If you use a non-eligible remittance service provider, you may not be eligible for tax deductions. U.S. citizens and financial institutions must also complete additional identity verification and reporting processes. When declaring, you need to prepare relevant documents, including Forms 3210 and 795/795A, to ensure all materials are complete to avoid delays due to incomplete documentation.

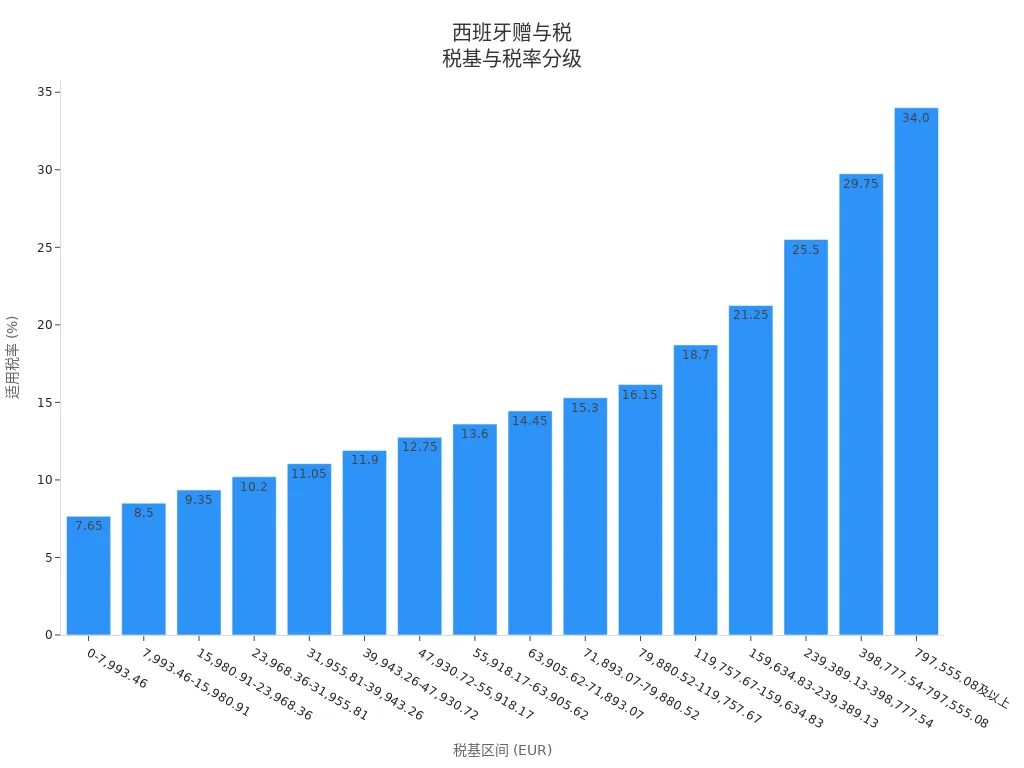

Gift Tax and Large Declarations

When you remit money to Spain as a gift, regardless of the amount, you need to pay a gift tax. The Spanish Civil Code does not specify a minimum amount for gifts, and the recipient must declare the gift within one month and pay the corresponding tax. Banks have no reporting obligation for cash transactions below $3,240, but you still need to pay taxes as required by law.

The following is the tiered tax rate table for Spain’s gift tax:

| Tax Base (USD) | Tax Liability (USD) | Remaining Tax Base (USD) | Applicable Tax Rate (%) |

|---|---|---|---|

| 0 | 8,630 | 8.65 | 7.65 |

| 8,630 | 660 | 8,620 | 8.50 |

| 17,260 | 1,390 | 8,620 | 9.35 |

| 25,890 | 2,200 | 8,620 | 10.20 |

| 34,520 | 3,080 | 8,620 | 11.05 |

| 43,150 | 4,030 | 8,620 | 11.90 |

| 51,780 | 5,060 | 8,620 | 12.75 |

| 60,410 | 6,170 | 8,620 | 13.60 |

| 69,040 | 7,360 | 8,620 | 14.45 |

| 77,670 | 8,630 | 8,620 | 15.30 |

| 86,300 | 10,000 | 43,080 | 16.15 |

| 129,380 | 17,040 | 43,080 | 18.70 |

| 172,460 | 25,180 | 86,160 | 21.25 |

| 258,620 | 43,700 | 172,320 | 25.50 |

| 431,240 | 88,200 | 431,240 | 29.75 |

| 862,480 | 218,000 | and above | 34.00 |

When declaring large remittances, you need to follow these steps:

- Choose an appropriate transfer method, such as a licensed Hong Kong bank, online platform, or remittance service.

- Understand the fees and exchange rates for each method and calculate the total cost (in USD).

- Prepare necessary documents, including proof of funds’ source and transfer purpose.

- Fill out and submit the S1 or 720 form (if applicable).

Compliance Recommendations

To avoid fines or investigations due to non-compliance, you should follow these recommendations:

- Familiarize yourself with Spain’s Modelo 720 overseas asset reporting requirements, as non-compliance may lead to severe penalties.

- Retain all relevant documents, including proof of income, expenses, and deductions.

- Declare all income, including income from mainland China and abroad.

- Use electronic methods to file declarations, ensuring completion before the tax authority’s deadline.

- Provide accurate information, ensuring the data aligns with economic reality.

- If you discover errors or omissions in your declaration, voluntarily correct them by submitting a supplementary declaration before the tax authority’s request to avoid penalties.

- Seek professional assistance to identify potential errors and optimize your tax situation.

Tip: When remitting to Spain, you must understand the declaration process and tax policies in advance, plan the fund transfer route rationally, and ensure compliance and security. This can effectively avoid tax risks due to untimely declarations or incomplete documentation.

Exchange Rate Impact

Image Source: unsplash

Exchange Rate Calculation

When you remit money to Spain, you must pay attention to the exchange rate fluctuations of the euro, Spain’s official currency. Exchange rates change daily, directly affecting the amount the recipient receives in Spain. Below is a set of recent euro-to-CNY exchange rate data:

| Date | EUR to CNY Exchange Rate | Change |

|---|---|---|

| 2025-09-17 | 8.4458 | -0.366% |

| 2025-09-22 | 8.34319 | |

| 2025-09-25 | 8.38848 | +0.452% |

You can see that although exchange rate fluctuations may seem small, they can cause significant differences in large remittances. Exchange rate changes directly affect the amount of local currency received. Exchange rate fluctuations can cause variations in the received amount, impacting the overall value of the remittance. Transfer costs and timing further affect the net amount received.

Exchange Rate Traps

When choosing a remittance method, you may encounter exchange rate traps. Many platforms advertise “zero fees” or “free transfers,” but their exchange rates are higher than the interbank rate, hiding markup costs. You need to be aware of the following common issues:

- Assuming all platforms use the same exchange rate may lead to losses, so confirm the exchange rate and fees before sending.

- Entering incorrect information may delay funds and cause unnecessary stress.

- Exchanging currency at local Spanish banks may incur high fees, especially if you are not their customer.

- Using ATMs to withdraw cash is generally cheaper than currency exchangers, but fees may still apply.

- When using a credit card, always ask the merchant to settle in the local currency to avoid high exchange rate fees.

- Exchanging currency at small shops in tourist areas often incurs higher fees and less favorable rates.

- Using unknown apps or unauthorized platforms may lead to funds being stolen or lost.

Tip: When remitting, always keep receipts and tracking codes to facilitate inquiries if issues arise.

Platform Selection

When choosing a remittance platform, you should prioritize platforms with transparent exchange rates. The exchange rates and fee structures vary significantly across platforms. The table below compares the transparency and fees of several major platforms:

| Platform | Transparent Exchange Rate Features | Fee Structure |

|---|---|---|

| Vance | Google exchange rate, no markup | Fixed $3 transfer fee, no hidden fees |

| Wise | Mid-market exchange rate | Transfer fees typically $0.50 to $2 |

| CurrencyFair | Close to mid-market exchange rate | Transfer fee around $3 |

| XE | Competitive exchange rate | Most transfers start at $2 |

| OFX | No fees for large transfers | Offers better exchange rates |

You can use the following criteria to evaluate a platform’s exchange rate transparency:

| Criterion | Description |

|---|---|

| Consumer Understanding | Whether the platform’s design and disclosed information are easy to understand |

| Comparison Capability | Whether it’s convenient to compare different remittance products |

| Channel Adaptability | Whether it suits your preferred remittance channels |

| Fees and Exchange Rates | Whether fees and exchange rates clearly show their combined impact on the received amount |

When remitting to Spain, choosing a platform with transparent exchange rates can effectively reduce hidden fees, ensuring the recipient receives more local currency. Studies show that remittance costs can account for 15% of the total value. If Spain reduces remittance costs by 1 percentage point, developing countries could receive an additional 28.9 million euros. If costs are reduced by 56%, low-income countries could receive an extra 243 million euros annually.

Remittance Methods to Spain

When choosing a method to remit to Spain, you need to consider fees, transfer speed, and security comprehensively. Different methods suit different needs, especially for large remittances, where choosing a low-fee, high-exchange-rate platform can maximize the recipient’s funds. Below are four common methods with their pros and cons.

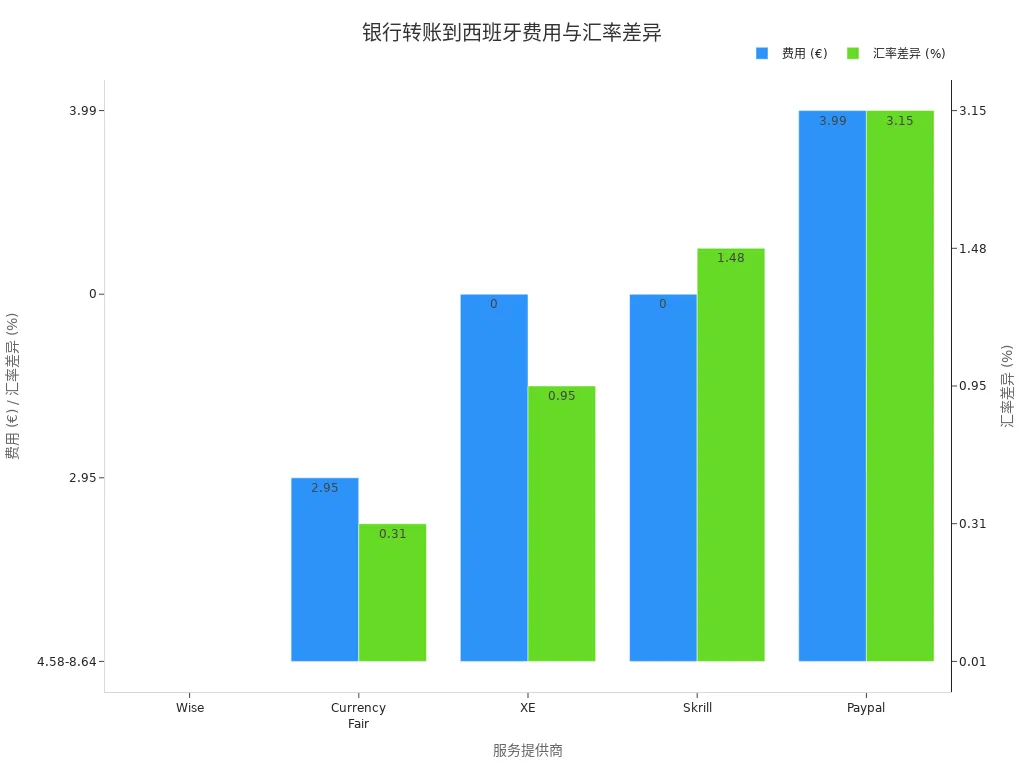

Bank Wire Transfer

Bank wire transfers are a traditional method for international remittances, suitable for large fund transfers. You can process them through a licensed Hong Kong bank, typically requiring the recipient’s name, account number, and SWIFT code. The advantages of bank wire transfers are high security, ideal for large and important transactions. The disadvantages are higher fees and longer processing times.

| Service Provider | Fees (USD) | Exchange Rate Difference |

|---|---|---|

| Wise | 4.58-8.64 | 0.01% worse than mid-market |

| Currency Fair | 2.95 | 0.31% worse than mid-market |

| XE | 0 | 0.95% worse than mid-market |

| Skrill | 0 | 1.48% worse than mid-market |

| Paypal | 3.99 | 3.15% worse than mid-market |

You can see that fees and exchange rate differences vary significantly among service providers. Bank wire transfers within the SEPA zone typically take 1-3 days, while intercontinental transfers may take longer. The chart below illustrates the fee and exchange rate differences among service providers:

Key features of bank wire transfers include:

- Suitable for large remittances with high security.

- Higher fees, typically 3-5%.

- Transfer speed of 1-3 days, with some banks offering same-day transfers.

- Requires detailed recipient information and compliance documents.

Tip: For large remittances, prioritize service providers with transparent fees and favorable exchange rates to effectively reduce costs.

Online Remittance Services

Online remittance services like Wise, PayPal, and CurrencyFair have become increasingly popular. You only need to register an account, link a bank card or credit card, and complete the remittance via a website or app. The advantages of online services include ease of use, fast transfer speeds, and transparent fee structures.

| Platform | Exchange Rate Markup | Additional Fees |

|---|---|---|

| CurrencyFair | 0.53% | $3 |

| Xe | 0.00% | 0.00 |

Platforms like Wise and CurrencyFair typically use mid-market exchange rates with low fees and no hidden costs. PayPal is convenient but has a high exchange rate markup of up to 3.15% and an additional $3.99 per transaction, suitable for small, urgent remittances. You should note:

- Wise: Transparent fees, exchange rates close to mid-market, fast transfers, suitable for large and frequent remittances.

- PayPal: Free registration, fast transfers, but high international fees, requiring the recipient to have an account, with a $10,000 per-transaction limit.

- CurrencyFair, XE: Favorable exchange rates, low fees, suitable for cost-sensitive users.

| Advantages | Disadvantages |

|---|---|

| Free account registration, near-instant fund transfers, can act as an intermediary without providing bank information, manageable via mobile apps | High international fees, exchange rate markups for foreign currency, recipients may need to create an account, transfers may be limited to $10,000 per transaction |

Note: Platforms like PayPal have higher fees and are suitable for small, urgent remittances. For large remittances, choose low-fee platforms like Wise or CurrencyFair.

Digital Banks

Digital banks offer a more flexible option for international remittances. You can transfer directly to a Spanish account via a digital bank app, enjoying low fees and real-time exchange rates. Digital banks typically use automated risk control and compliance measures to ensure fund security.

| Provider Name | Transfer Fee | Exchange Rate Margin | Minimum Transfer Amount | Maximum Transfer Amount |

|---|---|---|---|---|

| Wise | 0.4% – 0.6% | No markup | $1 | $6,000,000 |

| CurrencyFair | $3 | 0.45% | $7 | $10,000,000 |

| Revolut | 0 | 0.5% – 2% (weekends) | $1 | Varies by account type |

Advantages of digital banks include:

- Low fees, exchange rates close to mid-market.

- Support for large remittances, up to millions of dollars.

- Real-time transfers, some platforms complete in seconds.

- Robust security measures, including KYC, AI risk control, and real-time monitoring.

When using digital banks, security is equally important. Most digital banks use machine learning and AI to detect fraudulent transactions, implement KYC and KYB procedures, and monitor suspicious activities in real time. 90% of users expect stringent security measures, and payment tracking and recipient confirmation have become industry standards.

Recommendation: For large remittances, prioritize digital banks or low-fee platforms to save costs and ensure fund security.

Cryptocurrency

Cryptocurrency offers a new option for cross-border remittances. You can transfer funds to Spain using Bitcoin, Ethereum, or other digital currencies, with transactions completing in minutes and very low fees. The table below compares cryptocurrency with traditional remittances in terms of speed and fees:

| Method | Transaction Speed | Transaction Fees |

|---|---|---|

| Cryptocurrency | Seconds to minutes | A few cents (depending on the blockchain) |

| Traditional Remittance | 1-3 days | 6.4% (global average) |

However, you need to note that cryptocurrencies in Spain are considered assets, and all related activities must be declared. Whether exchanging to fiat, crypto-to-crypto trading, spending, or mining, you must pay capital gains tax, with tax rates ranging from 19% to 28%. The Spanish Tax Agency requires all cryptocurrency activities to be declared compliantly, or you may face penalties.

Tip: Cryptocurrency is suitable for users seeking speed and low costs, but compliance risks are high. You must thoroughly understand Spain’s tax policies and ensure legal declarations before using.

Operations and Compliance

Document Preparation

Before remitting to Spain, you need to prepare relevant documents in advance. Banks and remittance platforms typically require the following:

- Valid identity proof, such as a government-issued ID or passport

- Address proof, such as utility bills or bank statements

- Information on the purpose of the transfer

These documents help banks verify your identity and the flow of funds. When processing remittances through a licensed Hong Kong bank, complete documentation can expedite the review process and reduce unnecessary delays.

Identity Verification

Identity verification is a critical step in international remittances. You need to provide detailed personal information to the bank or platform. The table below outlines common identity verification requirements:

| Required Information | Description |

|---|---|

| Purpose of Payment | Explanation of the transfer’s purpose |

| Relationship Between Sender and Recipient | Description of the relationship between both parties |

| Date of Birth | Sender’s date of birth |

| Address | Sender’s address |

| Occupation and Business | Sender’s occupation information |

| Nationality and Residency | Sender’s nationality and residency |

| Bank Information | Sender’s bank account details |

| Source of Funds | Explanation of the funds’ source |

If you are a business user, you also need to submit contracts, invoices, shipping documents, and accounting materials. The identity verification process helps prevent money laundering and illegal fund flows.

Proof of Funds’ Source

When remitting, banks and the Spanish Tax Agency will require you to prove the source of funds. Common proof of funds’ source includes:

- Bank statements

- Pay stubs

- Tax returns

- Savings account statements

- Investment portfolios

- Client contracts

These documents prove that your funds are legal and compliant. When declaring large remittances, it’s recommended to prepare relevant documents in advance to ensure a smooth review process.

Fraud Prevention

When conducting international remittances, you must prioritize fraud prevention and information security. Banks and platforms employ multiple strategies to protect your funds. The table below summarizes common fraud prevention measures:

| Strategy | Description |

|---|---|

| Customer Communication | Banks use multiple channels to remind customers of risks |

| Timely Intervention | Banks quickly contact cardholders to verify suspicious transactions |

| Personalized Information | Banks send targeted information to increase customer vigilance and reduce fraud losses |

| Automated Processes | Automated communication reduces manual intervention, improves efficiency, and detects anomalies promptly |

You can further enhance security by:

- Using official channels and legitimate platforms for remittances

- Regularly checking account information and contacting the bank promptly if anomalies are found

- Avoiding clicking on unfamiliar links or downloading unknown apps

- Intervening promptly in suspicious situations on P2P apps or online banking

During the remittance process, staying vigilant and using the bank’s security tools can effectively reduce the risk of fraud and ensure fund safety.

When remitting to Spain, taxes, exchange rates, and transfer methods affect the received amount and compliance risks. You must prepare documents in advance, choose transparent platforms, and ensure timely declarations. The table below summarizes key compliance and security measures:

| Key Measure | Description |

|---|---|

| Comprehensive Transaction Reporting | All banks and payment institutions must report every account, regardless of balance or activity. |

| Stricter Identity Checks | Opening a bank account requires current photo ID and proof of funds’ source. |

| Legally Mandated Instant Free Transfers | All euro transfers must be processed instantly without bank fees. |

| International Transfer Scrutiny | Transfers exceeding USD10,800 must be declared in advance, and split transfers will be tracked. |

| Ownership Transparency | New rules require disclosure of all beneficial owners of joint accounts. |

| Tax Compliance | The Spanish Tax Agency directly receives all account information to ensure alignment with annual tax declarations. |

You should stay updated on policy changes, choose remittance methods rationally, and ensure fund security.

FAQ

Do I Need to Declare Remittances to Spain in Advance?

When remitting over USD10,800, you must declare in advance to the Spanish Tax Agency. You need to fill out the S1 form to ensure the funds’ source is legal and compliant.

How Do I Choose the Best Exchange Rate Platform for Remittances?

You can compare real-time exchange rates and service fees across platforms. Choosing a platform with transparent fees and rates close to the mid-market rate ensures the recipient receives more funds.

Is It Safe to Remit Through a Licensed Hong Kong Bank?

Remitting through a licensed Hong Kong bank is highly secure. Banks strictly verify identity and funds’ sources to ensure compliant and secure fund delivery.

How Long Does It Take for Funds to Arrive After Remitting?

Bank wire transfers typically take 1-3 days. Online remittance services and digital banks can achieve same-day transfers, depending on the platform and amount.

What Documents Are Required for Remittances?

You need to prepare identity proof, address proof, and proof of funds’ source. Banks or platforms will require specific documents based on the remittance amount and purpose.

Remitting to Spain requires S1 form declarations over $10,800 USD, 19%-28% gift taxes, and bank fees of $0-50 with 1-5 day wires, especially in 2025’s $80+ trillion remittance market, where traditional providers’ markups and compliance reviews erode received amounts. For a cheaper, faster alternative, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day processing, no lengthy verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.