- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Simple Process and Selection Guide for Sending Money to Canada

Image Source: unsplash

You can choose from multiple methods to send funds from mainland China to Canada. Mainstream options include bank transfers, digital payment platforms, and cash remittance services. Data shows that the digital transfer market is valued at $2.8 billion, making it the dominant method. During the process, you can experience advantages like simplicity, high security, and transparent fees. The remittance process typically involves filling in recipient information, selecting the amount, and choosing a payment method. Many platforms use encryption technology and two-factor authentication to ensure the safety of funds and information.

| Remittance Method | Estimated Market Value (2024, USD) | Notes |

|---|---|---|

| Digital Transfers | 2,800,000,000 | Dominant market |

| Traditional (Non-Digital) | 2,400,000,000 | Smaller market share |

Key Points

- When choosing a remittance method, consider speed, fees, and security. Digital payment platforms are suitable for small amounts, while bank transfers are ideal for large amounts.

- Ensure the recipient’s information is accurate. Incorrect information may lead to failed or delayed remittances.

- Understand the fees and delivery times of each remittance method. Digital platforms generally have lower fees and faster delivery, while bank transfers have higher fees.

- Monitor exchange rate changes. Choosing the right timing for remittance can optimize fund transfer outcomes.

- Use reputable service providers and enable two-factor authentication to ensure fund security and prevent fraud and information leaks.

Remittance Methods

Image Source: unsplash

Bank Transfers

You can choose to send international remittances through licensed banks in mainland China or Hong Kong. Bank transfers are suitable for large fund transfers with high security. You need to provide the recipient’s name, address, account number, and bank identification code. Bank wire transfers typically take 1 to 5 business days to arrive, with fees ranging from 15 to 80 USD. The table below outlines the main features of different bank transfer methods:

| Feature | Wire Transfer | Bank Transfer (Interac, EFT, ACH) |

|---|---|---|

| Speed | 1 to 5 business days | Some methods deliver in minutes |

| Cost | 15-80 USD per transaction | Some methods are free |

| Best Use | Large transfers | Daily payments |

Bank transfers are suitable for scenarios where you need to send large amounts at once or have high security requirements.

Digital Payment Platforms

You can use digital payment platforms like TransferWise, Xoom, or Remitly. These platforms support multiple currencies, offer transparent fees, and provide fast delivery. You only need to fill in the recipient’s information and select a payment method. Digital platforms are ideal for frequent small remittances or when fast delivery is needed. You can complete payments via credit card, debit card, or digital wallet. The following platforms perform strongly in the U.S. market:

- Support multi-currency payments: Transfi, PayPal, Stripe, Square

- Transparent fees and exchange rates, high security

- Responsive customer support, suitable for cross-border e-commerce and personal remittances

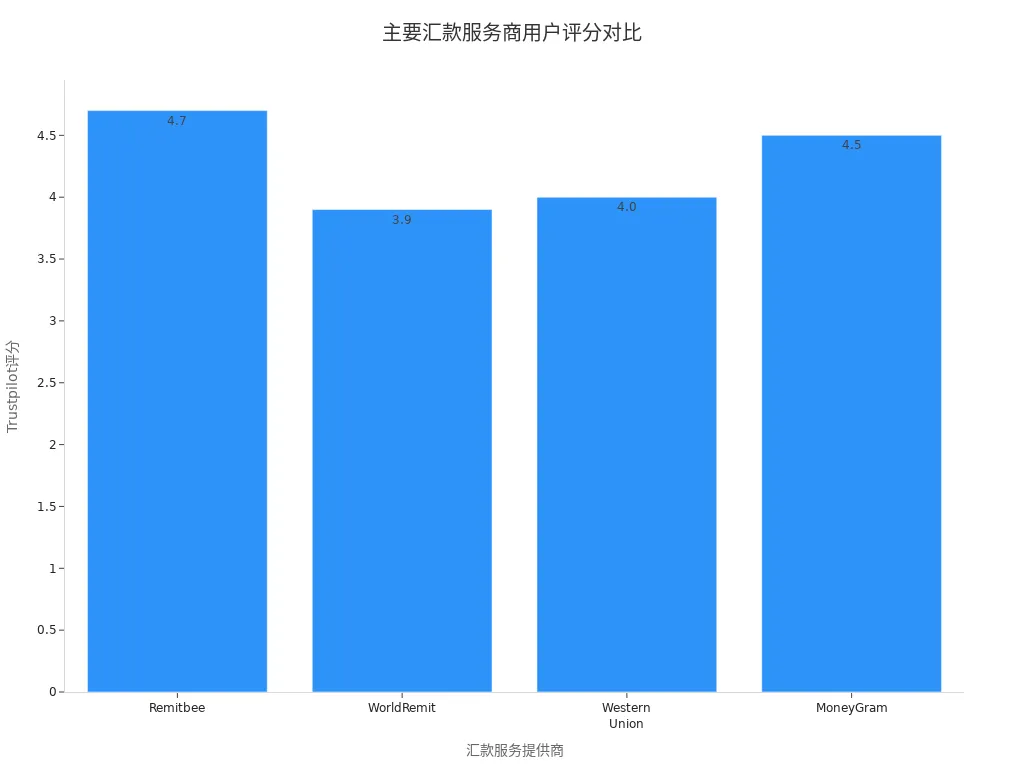

The chart below shows user satisfaction ratings for major remittance providers in Canada:

Cash Remittance Services

You can choose cash remittance services like Western Union or MoneyGram. These are suitable when you don’t have a bank account or need urgent remittances. You simply visit a service location, fill in the recipient’s information, and pay in cash. Cash remittances are fast, often arriving in minutes, but fees are higher. The table below compares user satisfaction for major providers:

| Remittance Provider | Trustpilot Rating | Main Advantages | Main Disadvantages |

|---|---|---|---|

| Western Union | 4.0/5 | Fast transfers, global coverage | High fees, hidden costs |

| MoneyGram | 4.5/5 | High usability, fast | Account closures, delays |

Cash remittances are suitable for scenarios requiring quick, flexible transfers but where higher fees are acceptable.

Remittance Process

When sending money to Canada, you can choose from different remittance processes. Each method has unique steps and considerations. You can select the most suitable process based on your needs and circumstances.

Bank Transfer Process

The bank transfer process is ideal for secure, standardized transfers. You can complete it through a licensed bank counter, online banking, or mobile app in Hong Kong. Below are the steps for a typical bank transfer process:

- Open or log into your digital bank account. You can refer to the bank’s mobile app or online banking guide to set up your account.

- Register for international remittance services, such as Interac e-Transfer. You can complete registration via online banking or the mobile app.

- Add recipient information. You need to enter the recipient’s name, address, bank account number, and bank identification code.

- Check remittance limits. You can view daily or per-transaction limits in the bank’s system.

- Enter the remittance amount (USD), confirm fees, and check the exchange rate.

- Submit the remittance request. You can choose immediate delivery or schedule a delivery time.

- Set up automatic deposit. If the recipient enables auto-deposit, funds will go directly to their account without needing to answer security questions each time.

Tip: When processing at a bank counter, bring a valid ID. Online banking and mobile apps are more convenient, allowing you to complete the process anytime, anywhere.

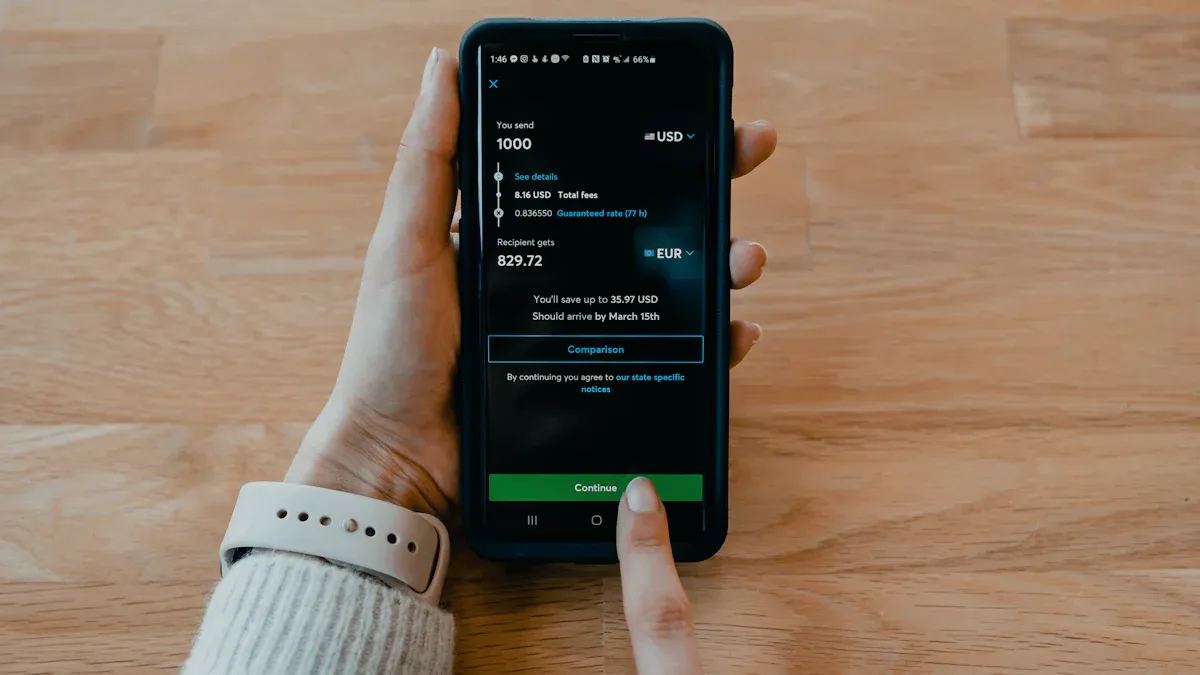

Online Platform Remittance Process

Digital payment platforms offer a faster remittance process. You can use platforms like Remitly, TransferWise, or Xoom to easily complete cross-border transfers. Below is the typical online platform remittance process:

- Log into your platform account. New users can register with an email or phone number.

- Enter the amount to send (USD).

- Fill in the recipient’s name, address, and phone number. You can choose to send funds directly to a Canadian bank account or a cash pickup point.

- Select a payment method. You can pay with a bank account, credit card, debit card, or digital wallet.

- Review fees and real-time exchange rates. The platform will display all fees and estimated delivery times.

- Confirm and submit the remittance. You can track the remittance status in real-time on the platform.

Note: When using digital platforms, ensure the recipient’s information is accurate. Some platforms support auto-deposits and transfer cancellations for added flexibility.

Cash Remittance Process

The cash remittance process is suitable when you don’t have a bank account or need urgent transfers. You can choose providers like Western Union or MoneyGram. Below are the main steps for cash remittances:

- Visit a service location and fill in the recipient’s information, including name, address, and contact number.

- Select the remittance amount (USD) and pay in cash along with the fees.

- Choose a receiving method. You can have the recipient pick up cash at a designated location in Canada or deposit it directly into their bank account.

- Obtain a remittance receipt and reference number. Share the reference number with the recipient for fund pickup.

- Track the remittance status. Some providers offer online tracking of delivery progress.

Tip: Cash remittances have higher fees. Check each provider’s fees and delivery times in advance to avoid unnecessary costs.

When choosing a remittance process, you can combine factors like fund size, delivery speed, and operational preferences to select the most suitable method. Bank transfers are ideal for large amounts and security needs, digital platforms suit frequent small transfers, and cash remittances are best for urgent or no-account scenarios.

Fees and Delivery Time

Image Source: unsplash

Fees

When choosing a remittance method, fees are a key consideration. Bank transfers typically have higher fees, ranging from 15 to 80 USD per transaction, especially for large remittances through licensed Hong Kong banks. Digital payment platforms like TransferWise, Remitly, and WorldRemit offer transparent fees, often lower than traditional banks, with some charging a percentage, making them suitable for small or frequent remittances. Cash remittance services like Western Union and MoneyGram have higher fees, ideal for urgent or no-account scenarios. You can review fee details during the remittance process to avoid unexpected costs.

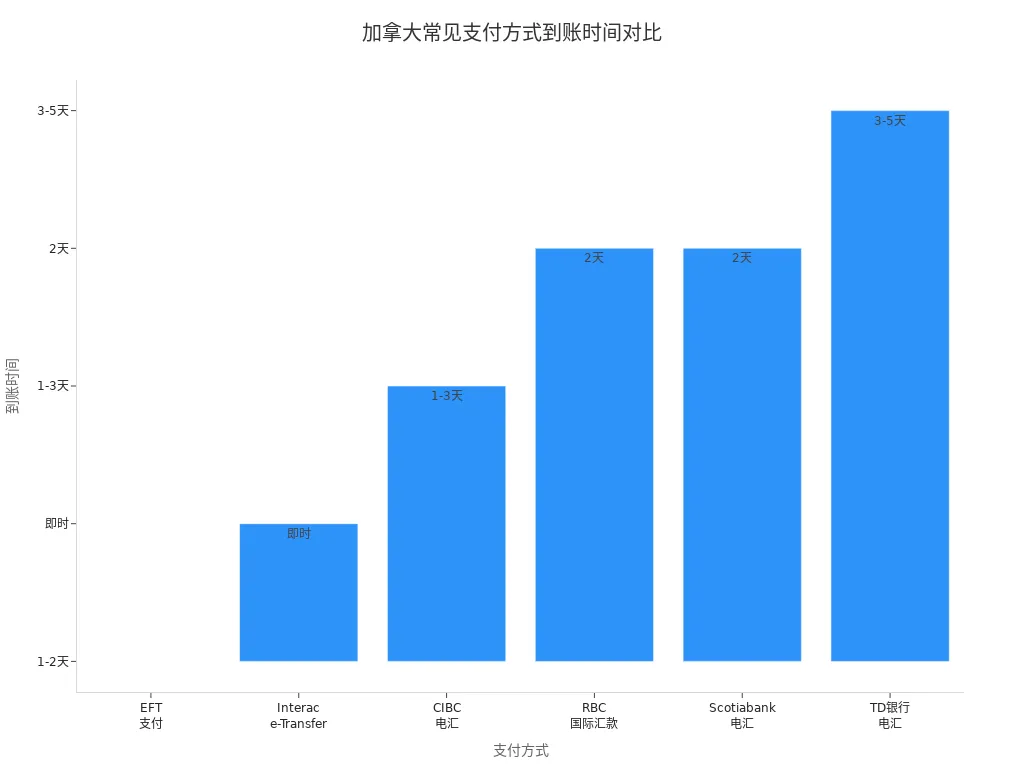

Delivery Time

Delivery time directly affects the recipient’s ability to use funds. Different methods vary significantly in speed. Refer to the table below for processing times of common payment methods:

| Payment Method | Processing Time |

|---|---|

| EFT Payment | Typically processed within 1-2 business days |

| Interac e-Transfer | Nearly instant |

| CIBC Wire Transfer | Arrives within 1-3 business days |

| RBC International Transfer | Arrives within 2 business days |

| Scotiabank Wire Transfer | Arrives within 2 business days |

| TD Bank Wire Transfer | Arrives within 3-5 business days |

When using digital payment platforms, PayPal balances and instant transfers can achieve near-real-time delivery. Cash remittance services typically complete within 1-3 business days, with some providers offering minute-level delivery. The chart below compares delivery times for different payment methods:

Exchange Rate Impact

During the remittance process, you also need to consider exchange rates. The exchange rate determines how much USD you send converts to CAD in Canada.

- If the USD-to-CAD exchange rate is high, the recipient gets more CAD.

- Exchange rate fluctuations affect the recipient’s purchasing power, especially for those relying on remittances long-term.

- Monitor exchange rates to choose the best timing for remittances and optimize transfer outcomes.

- Digital payment platforms often offer near-market real-time exchange rates, reducing losses.

When choosing a remittance method, consider fees, delivery time, and exchange rates to select the most suitable channel for your needs.

Security and Considerations

Information Accuracy

When filling in recipient information, you must ensure high accuracy. Errors can lead to failed or delayed remittances. Common mistakes include:

- Not carefully checking recipient information

- Providing incorrect or incomplete information

- Recipient’s address not matching their registered location

You can reduce errors by:

- Verifying the recipient’s full name and spelling

- Checking the correct account and routing numbers

- Ensuring the address matches the recipient’s registered location

Tip: Double-check all information before each remittance. Both bank counters and digital platforms require detailed information, and any oversight could prevent funds from arriving.

Compliance and Taxes

When sending money to Canada, you need to understand compliance and tax requirements. Funds themselves are typically not taxed, but recipients may need to report income based on the nature of the funds. If the transfer is a gift, the recipient generally doesn’t pay taxes, but if you exceed the annual tax-free limit ($17,000 USD per recipient in 2025), you may need to file a gift tax return. If the funds are considered income (e.g., wages or business profits), the recipient must report to the Canada Revenue Agency and may need to pay taxes.

- Most remittance services have a $10,000 USD transfer threshold, below which no additional paperwork is typically required

- Transfers exceeding $10,000 USD may require additional forms, such as the U.S. FinCEN Form 105

- Remittance services may have hidden fees, like exchange rate markups or processing fees

Choose reputable providers with transparent pricing to avoid hidden fees. When using licensed Hong Kong banks or digital platforms, consult compliance requirements in advance to ensure smooth remittances.

Risk Prevention

During the remittance process, stay vigilant against fraud and information leaks. Research shows nearly 40,000 fraud reports were filed in Canada in 2020, with remittance scams being significant. Common risks include impersonation scams, wire transfer fraud, phishing emails, and social engineering attacks. You can protect funds by:

- Verifying the recipient’s identity, especially for unusual or urgent requests

- Using secure payment methods, choosing reputable remittance services and banks

- Enabling two-factor authentication to enhance online account security

- Staying cautious of communications requesting personal or financial information

Note: Bank counter transactions have lower risks but require vigilance against information leaks. Online remittances are convenient but more vulnerable to cyberattacks. Regularly update passwords and avoid processing remittances on public networks.

Restrictions and Regulations

Amount and Frequency Limits

When sending money to Canada, there are typically no strict limits on amounts or frequency. Canada imposes no specific amount restrictions on personal or business remittances. However, if a single or cumulative remittance exceeds $10,000 USD, financial institutions must report to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). The table below summarizes key amount limits and reporting requirements:

| Transaction Type | Amount Limit | Reporting Requirement |

|---|---|---|

| Sending to Canada | No specific limit | Over $10,000 requires FINTRAC reporting |

| Sending from Canada | No specific limit | Over $10,000 requires FINTRAC reporting |

| Receiving from Overseas | No specific limit | Over $10,000 requires FINTRAC reporting |

When sending international remittances from mainland China through licensed Hong Kong banks, you must also comply with China’s foreign exchange regulations. Each individual has an annual foreign exchange purchase limit of $50,000 USD, with amounts exceeding this requiring additional approval. Frequent large remittances may trigger compliance reviews by banks and regulators.

Foreign Currency and Exchange Rates

When sending money from mainland China, you must comply with strict foreign exchange controls. Funds cannot move freely in or out, and all foreign currency exchanges and cross-border transfers must go through compliant channels. The State Administration of Foreign Exchange (SAFE) and the People’s Bank of China (PBOC) oversee foreign exchange flows. When processing remittances, monitor real-time exchange rate changes. Some digital payment platforms offer near-market rates, reducing losses. Foreign-invested enterprises also face debt-to-equity ratio requirements and complex processes for fund repatriation.

| Regulatory Requirement | Description |

|---|---|

| Foreign Exchange Controls | In China, enterprises, banks, and individuals must comply with a “closed” capital account policy, with strict rules for fund movement. |

| Main Regulators | SAFE and PBOC oversee foreign exchange flows. |

| Foreign-Invested Enterprise Requirements | FIEs must comply with debt-to-equity ratio requirements, with capital repatriation subject to multiple government checks. |

Regulatory Requirements

When choosing a remittance channel, ensure all operations are compliant. Both China and Canada have strict anti-money laundering and anti-terrorist financing requirements. Financial institutions monitor large or unusual transactions. Failure to comply with regulations may result in criminal charges or administrative fines. The table below outlines common penalty types:

| Penalty Type | Description |

|---|---|

| Criminal Charges | Non-compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act may lead to criminal charges. |

| Administrative Fines | FINTRAC can impose fines on non-compliant reporting entities. |

Before sending money, thoroughly understand relevant policies to ensure funds are secure and compliant, avoiding unnecessary legal risks.

Issue Resolution

Delayed Processing

When sending money to Canada, you may encounter account delays. Common reasons include:

- Bank holidays causing extended processing times

- System errors affecting transfer progress

- Inaccurate recipient information

You can reduce delays by:

- Choosing remittance services known for speed and efficiency

- Understanding each platform’s transfer process and setting realistic delivery expectations

- Double-checking all information before sending to ensure accuracy

Reminder: Remittances around holidays may take longer. Plan ahead to avoid urgent situations.

Information Correction

Incorrect information is a primary cause of remittance failures. Common errors include:

- Entering incorrect recipient account or routing numbers

- Forgetting to verify the recipient’s full name or address

- Recipient information not matching bank records

You can address this by:

- Always verifying the recipient’s account number, name, and other details

- Contacting the remittance provider immediately if errors are found

- Choosing platforms that support information corrections or transfer cancellations for added flexibility

Customer Support Channels

For remittance issues, you can contact major providers through:

| Method | Details |

|---|---|

| Phone | 1-809-200-7380 or 802-532-7382; for fraud, call 1-800-448-1492 |

| Online Chat | Communicate with customer service representatives via the official website for instant help |

| Complaint Channels | Submit issues via the provider’s complaint page, e.g., Western Union offers an online complaint form |

| Locate Agent | Find the nearest agent location on the provider’s website for in-person assistance |

For delays, errors, or failed remittances, contact the provider through official channels and keep remittance receipts for follow-up queries.

Recommended Remittance Methods

Small Remittances

For small remittances, you prioritize fees, delivery speed, and convenience. Fintech apps like Wise and Remitly typically offer lower fees and fast delivery, ideal for frequent transfers or temporary payments. Western Union has many locations but higher fees. Traditional bank channels are cumbersome and slower, less suitable for small, frequent needs. Refer to the table below for a quick comparison of different methods:

| Remittance Method | Fees | Speed | Convenience |

|---|---|---|---|

| Western Union | Higher | Moderate | Widely available |

| Fintech Apps | Lower | Fast | Flexible |

| Traditional Banks | Higher | Slower | Less flexible |

Recommendation: Prioritize digital payment platforms for lower fees and real-time delivery, ideal for daily expenses or small payments.

Large Remittances

For large fund transfers, security and compliance are paramount. International wire transfers through licensed Hong Kong banks offer strict identity verification and compliance assurance. Western Union and MoneyGram also support large cash remittances, suitable for in-person pickup scenarios. PayPal is convenient for mid-sized funds. Prepaid cards are flexible but have limited amounts. The table below outlines the pros and cons of different services:

| Remittance Service | Advantages | Use Cases |

|---|---|---|

| PayPal | Convenient, sent via email or phone number | Small to mid-sized remittances |

| Western Union | In-person pickup, widely available | Large remittances requiring cash payment |

| MoneyGram | In-person pickup, fast delivery | Large remittances requiring cash payment |

| Prepaid Card | Can be mailed or sent electronically, flexible | Funds for use in Canada |

Reminder: For large remittances, understand compliance requirements in advance and ensure the legitimacy of fund sources to avoid regulatory scrutiny due to high amounts.

Frequent Remittances

For frequent remittances to Canada, choose platforms with low fees and streamlined processes. Wise (formerly TransferWise) is known for real-time exchange rates and transparent fees, ideal for regular payments like tuition, living expenses, or family support. Remitly and licensed Hong Kong banks also offer multiple payment options for varying frequencies and amounts. Consider these common options:

- Wise supports multi-currency transfers with low fees, fast delivery, and a user-friendly interface

- Remitly offers economy and express speed options for flexibility

- Licensed Hong Kong banks are ideal for large, regular remittances with strong compliance

- Canadian banks like RBC and Scotiabank suit regular local recipients in Canada

For frequent remittances, prioritize platforms with transparent fees and fast delivery to reduce costs and improve fund management efficiency over time.

When choosing a method to send money to Canada, evaluate based on your needs:

- Assess speed, cost, and security to select the most suitable service

- Note differences in fees and exchange rates across services

- Choose trusted providers and understand relevant information in advance

Also, focus on process details and risk prevention:

- Choose reliable, well-known providers

- Ensure fee transparency and understand all related costs

- Use secure payment methods, like bank transfers or digital wallets

By combining your specific needs and carefully verifying information, you can complete remittances efficiently and securely.

FAQ

How do I choose the best method for sending money to Canada?

Choose based on the amount, delivery speed, and fees. For small remittances, use digital payment platforms. For large remittances, prioritize licensed Hong Kong banks. For urgent cases, opt for cash remittance services.

What should I do if a remittance fails?

Contact the remittance provider’s customer service immediately. Keep your remittance receipt. Most platforms support status tracking and information correction. Some allow cancellations or resending.

What basic information is needed for remittances to Canada?

You need the recipient’s full name, address, bank account number, and bank identification code. Digital platforms may also require the recipient’s phone number. Accurate information prevents delays or failures.

How can I ensure fund safety during remittances?

Choose reputable providers, enable two-factor authentication, avoid public networks, and regularly update passwords. Verify the recipient’s identity for suspicious or urgent requests.

Are there limits on remittance amounts?

Mainland China has an annual foreign exchange purchase limit of $50,000 USD per person. Single or cumulative remittances over $10,000 USD require reporting to Canadian regulators. Understand relevant policies in advance.

Remitting to Canada via Wise offers low fees and 1-2 business day delivery, while Pix enables near-instant, near-zero-fee transfers, but bank wires’ $15-80 fees and 5-day waits inflate costs, especially with 2025’s projected $80+ trillion remittance market, where traditional providers’ markups and limits erode received amounts. For a cheaper, faster alternative, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day processing, no lengthy verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.