- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to MoneyGram e - transfer Service: A Fast and Secure Global Remittance Solution

Image Source: unsplash

You can use MoneyGram’s electronic transfer service to easily send funds from mainland China to anywhere in the world securely. The system employs high-standard encryption technology to protect every transaction’s information. A globally extensive agent network offers multiple receiving options, supporting bank accounts, cash pickup, and mobile wallets. The dedicated app allows you to operate anytime, anywhere, with clear and transparent fees. You can quickly complete a remittance, track progress in real-time, and have peace of mind.

Key Points

- MoneyGram supports remittances to over 200 countries and regions worldwide, with 450,000 agent locations, making it easy for users to find a service point anytime.

- Users can choose from multiple receiving methods, including bank accounts, cash pickup, and mobile wallets, flexibly meeting various needs.

- MoneyGram’s mobile app provides real-time tracking, allowing users to check remittance progress anytime, ensuring fund security.

- Joining the Plus Rewards program allows users to earn points and exclusive offers, enjoying more benefits.

- MoneyGram adopts high-standard security measures, including encryption technology and multi-factor authentication, to protect users’ funds and information.

Service Advantages

Global Coverage

You can use MoneyGram’s electronic transfer service to send funds to over 200 countries and regions worldwide. MoneyGram has a vast global agent network, covering 450,000 retail locations, supporting over 150 currencies. Whether you’re in mainland China or other regions, you can easily find a nearby service point. The table below shows the global coverage of MoneyGram’s electronic transfer service:

| Number of Operating Countries and Regions | Number of Retail Locations | Number of Supported Currencies |

|---|---|---|

| Over 200 | 450,000 | Over 150 |

You can use MoneyGram services in major markets such as the United States, Europe, Asia, and Africa, meeting remittance needs for different countries and regions.

Multiple Receiving Methods

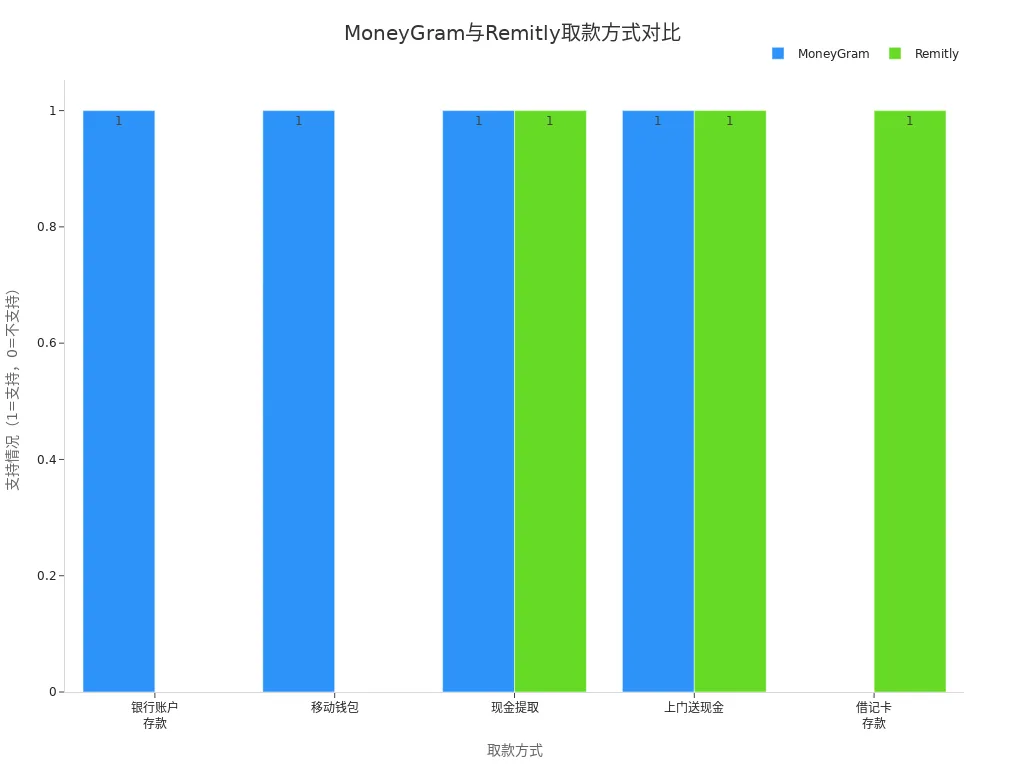

MoneyGram’s electronic transfer service offers diverse receiving options. You can choose bank account deposits, mobile wallets, cash pickup, or even home cash delivery in select regions. Compared to similar services, MoneyGram is more flexible in receiving methods. The table below compares MoneyGram and Remitly’s support for different withdrawal methods:

| Withdrawal Method | MoneyGram | Remitly |

|---|---|---|

| Bank Account Deposit | Yes | No |

| Mobile Wallet | Yes | No |

| Cash Pickup | Yes | Yes |

| Home Cash Delivery | Yes (select regions) | Yes |

| Debit Card Deposit | No | Yes |

You can flexibly choose the most suitable method based on the recipient’s actual needs.

Mobile App Features

MoneyGram’s mobile app lets you manage electronic transfer services anytime, anywhere. You can send remittances to over 200 countries and regions through the app and track transfer progress in real-time. The app uses two-factor authentication and encryption technology to ensure the security of your account and funds. You can also use mobile wallets like Apple Pay and Google Pay for a convenient payment experience. The app has a simple, user-friendly interface, suitable for users of all ages.

Tip: Using the app for electronic transfer services saves queuing time and improves remittance efficiency.

Rewards Program

When using MoneyGram’s electronic transfer service, you can also join the Plus Rewards program. You can register through the following methods:

| Registration Method | Description |

|---|---|

| Visit Website | Visit the Plus Rewards page and select Join Plus Rewards |

| Create Profile | Select the registration option when creating an online profile |

| Log into Profile | Log into your online profile and select Register Now |

| Agent Registration | Ask a MoneyGram agent to register you for the Plus Rewards program in-store |

After joining the rewards program, you can earn points, exclusive offers, and more benefits, making every remittance more rewarding.

Electronic Transfer Service Process

Image Source: pexels

Registration and Verification

To use the electronic transfer service, you first need to register and complete identity verification. The process is straightforward:

- If you already have a MoneyGram profile, simply provide the remaining personal information to complete identity verification.

- If you don’t have a profile, you need to provide your full name, residential address (not a P.O. box), phone number, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and date of birth.

- You also need to upload a valid, unexpired government-issued ID.

- New users can download the MoneyGram app, click register, and create a profile.

- After registration, you can proceed to register your account and debit card.

You can use various IDs for verification, including U.S. driver’s licenses, passports, state IDs, U.S. military IDs, resident alien IDs, welfare IDs, or employment authorization cards. As long as the ID is valid and unexpired, the system can recognize it smoothly.

Tip: Ensure the information you provide is accurate to speed up verification and avoid issues with future remittances.

Choosing a Receiving Method

After registration, you can choose a suitable receiving method based on the recipient’s needs. The electronic transfer service supports multiple payment and receiving methods, with the following requirements:

| Payment Method | Requirements |

|---|---|

| Debit Card | Supports Visa and MasterCard. |

| Online Transfer | Available with credit or debit cards (Visa, MasterCard), options vary by country. |

| Bank Account Payment | Funds can be sent directly from U.S. checking or savings accounts, requiring a secure Plaid connection for new accounts. |

| Bank Account Processing Time | Standard ACH payments typically take 3 business days to clear; transfers are sent after bank confirmation. |

You can flexibly choose the most suitable method based on the recipient’s country and needs. If the recipient prefers USD directly, you can choose bank account deposit. If the recipient needs cash pickup, you can opt for cash.

Filling in Information

After selecting a receiving method, you need to fill in the relevant information. The system will require you to enter the recipient’s name, bank details, or pickup location details. To ensure security and compliance, the electronic transfer service requires you to upload a valid ID. Common ID types include U.S. driver’s licenses, passports, state IDs, military IDs, etc.. If your transfer exceeds $15,000, the system will require additional information to ensure fund security.

| Required Information | Description |

|---|---|

| ID | A valid ID is required to verify identity and prevent fraud. Acceptable IDs include U.S. driver’s licenses, passports, state IDs, military IDs, etc. |

| Additional Information | Transfers exceeding $15,000 require more information. |

| Data Protection | The system uses encryption to protect your personal information, ensuring data security during storage, transmission, and sharing. |

Note: Double-check all entered information to avoid transfer failures or delays due to errors.

Payment and Fees

After filling in all information, you need to select a payment method and confirm fees. The electronic transfer service supports multiple payment methods, including credit cards, debit cards, and bank accounts. Fees vary by payment method:

| Payment Method | Fee Description |

|---|---|

| Direct Transfer to Debit Card | Lowest fees |

| Cash Pickup | Significantly higher fees |

| Credit Card Payment | Slightly higher fees, may include cash advance fees and interest |

| Transfer Amount | Fees typically increase significantly between $500 and $1,000, potentially doubling |

You can use Visa or MasterCard credit or debit cards for payment. Some countries also support other payment options. You can use MoneyGram’s fee estimator tool to check fees for different payment methods and amounts in advance.

- Payment methods include credit and debit cards (Visa, MasterCard).

- Other payment options may vary by country.

- Using the fee estimator tool helps you choose the best option.

Obtaining a Reference Number

After completing payment, the system generates a unique reference number. This number is crucial for you and the recipient to track the transfer status. You’ll find the reference number on the receipt or confirmation email. Keep it safe and do not share it with unrelated parties.

Reminder: The recipient needs the reference number to pick up cash at a location or check the transfer status. Send it to the recipient promptly.

Online Tracking

You can track remittance progress anytime using the electronic transfer service’s online tools. Simply provide the reference number, sender’s last name, and recipient’s name to check the transfer status on MoneyGram’s website or app. If you have a MoneyGram account, you can log in to view all historical transfer records.

- Visit MoneyGram’s tracking page, enter the reference number and relevant information to check.

- Track transfer progress in real-time via the app, which is convenient.

- The system encrypts your query information to ensure data security.

Tip: Regularly check transfer status to stay informed about fund movements and ensure security.

Fees and Delivery

Transparent Fees

When using MoneyGram’s electronic transfer service, you can clearly see the fees for each transaction. The system displays all fee details before you confirm the remittance. You can choose the most suitable payment and receiving method based on your needs. The following are key features of fee transparency:

- MoneyGram displays all fees on the transaction page in advance, helping you make informed choices.

- You can use the fee estimator tool to understand fees for different amounts and methods.

- The fee structure is open and transparent, with no hidden charges. Credit card processing fees and currency exchange differences are clearly stated during transaction setup.

- Carefully review fee details to avoid unexpected costs.

Reminder: Credit card payments typically have higher fees than debit card or bank account payments. Choose the best option based on your situation.

Exchange Rate Information

For cross-border remittances, the exchange rate directly affects the received amount. MoneyGram dynamically adjusts rates based on market fluctuations, operational costs, and regulatory requirements. You can view the current exchange rate on the transaction page. The table below shows exchange rate update information:

| Rate Update Frequency | Description |

|---|---|

| Not Fixed | MoneyGram adjusts exchange rates and fee structures based on market changes and policy requirements. |

- MoneyGram earns part of its profit through currency exchange, and rates and fees may change anytime.

- You can use the fee estimator to check the latest rates and fees before remitting.

- Rate changes do not require prior notice, so confirm the final rate before sending.

Tip: Monitor exchange rate changes and time your remittance to avoid losses due to fluctuations.

Delivery Time

After completing the remittance, delivery time is affected by various factors. MoneyGram offers a “minutes-to-delivery” service to help you complete transfers quickly. Common factors affecting delivery time include:

- Recipient’s location

- Local regulatory requirements

- Accuracy of provided information

You can shorten delivery time by:

- Choosing the “minutes-to-delivery” service

- Ensuring recipient information is accurate

- Contacting customer service promptly if issues arise

Note: Remittances from mainland China to the U.S. market typically arrive in minutes. Some regions may experience delays due to local policies or bank processing. Track remittance status to ensure fund security.

Security Measures

Image Source: pexels

Fund Security

When using MoneyGram’s electronic transfer service, the system provides multiple layers of security for your funds. MoneyGram uses advanced encryption technology to ensure every transaction is processed in a secure environment. During electronic transfers, the system uses multi-factor authentication to prevent unauthorized access. A real-time monitoring system detects and blocks suspicious transactions, protecting your funds.

| Security Measure | Description |

|---|---|

| Encryption Technology | MoneyGram uses advanced encryption to protect customer information and transaction data. |

| Multi-Factor Authentication | Adds an extra layer of security to prevent unauthorized access. |

| Real-Time Monitoring System | Detects and prevents suspicious transactions to ensure fund security. |

You can use MoneyGram’s electronic transfer service with confidence, as the system protects your funds throughout.

Information Protection

Your personal information submitted on the MoneyGram platform is strictly protected. MoneyGram uses industry-recognized database and network technologies to encrypt data stored in its systems. Data is also protected during transmission via secure networks. MoneyGram signs data processing agreements with third-party vendors to ensure data flow security. All personal data transfers comply with relevant legal requirements. You should also protect your login information and contact MoneyGram customer service promptly if you notice anything unusual.

- MoneyGram uses encryption to protect consumer data stored in databases.

- Data transmission uses secure networks to prevent leaks.

- MoneyGram maintains robust information security programs to comply with data protection standards.

- Data processing agreements with third-party vendors ensure data flow security.

- All data transfers comply with applicable data protection laws.

- Multiple physical, technical, and organizational measures prevent unauthorized access or data loss.

Your personal information is fully protected when using MoneyGram services.

Compliance Measures

When conducting electronic transfers, MoneyGram strictly adheres to international anti-money laundering and anti-fraud standards. MoneyGram is committed to preventing its system from being used for illegal activities, protecting customers from risks like money laundering, fraud, and terrorist financing. All agents and partners must comply with relevant laws and MoneyGram’s policies. MoneyGram has an independent compliance and ethics committee to oversee compliance program execution. The company adopts global anti-money laundering standards, ensuring all agents meet U.S. market requirements.

- MoneyGram prevents its system from being used for illegal activities.

- Protects customers from risks of money laundering, fraud, and terrorist financing.

- Agents and partners must comply with laws and MoneyGram policies.

- Strictly enforces anti-money laundering and anti-fraud standards.

- An independent compliance committee oversees compliance programs.

- Adopts global anti-fraud and anti-money laundering standards to ensure agent compliance.

You can use MoneyGram’s electronic transfer service with peace of mind, as the system adheres to international compliance standards to protect your legal rights.

Practical Tips

Tracking Remittances

You can stay updated on the latest progress of your electronic transfer. MoneyGram provides convenient online tracking tools. Simply follow these steps:

- If you have a MoneyGram account, log into the official website to view your transaction history.

- If you don’t have an account, visit the MoneyGram website, click the “Track + Receive” tool, and enter your reference number and last name.

Ensure the information you enter is accurate, including the transfer reference number (found on the receipt or confirmation email) and the sender’s last name. This helps you quickly obtain remittance status and avoid unnecessary delays.

Reminder: Regularly track remittance progress to detect anomalies and ensure fund security.

Customer Support

If you encounter issues, you can contact MoneyGram’s customer service team through multiple channels. The table below lists common contact methods:

| Contact Method | Description |

|---|---|

| Phone | 2032238 |

| customerservice@moneygram.com | |

| Online Form | Submit requests by filling out a form |

| FAQs | Visit our FAQs for answers to common questions |

Choose the most suitable method to get help. The customer service team will assist with account, transfer, fee, and other issues.

Regulatory Information

When using MoneyGram’s electronic transfer service, you need to understand some cross-border remittance regulations. Different countries and regions have varying requirements for transfer amounts, identity verification, and documentation. The table below summarizes common restriction types:

| Restriction Type | Description |

|---|---|

| Transaction Limits | Most countries have a maximum of $10,000 USD per transaction, varying by destination country regulations. |

| Country Restrictions | Due to anti-money laundering laws, some countries may not support MoneyGram services; restrictions may change over time. |

| Additional Documentation | International transfers often require ID, especially for larger amounts. |

| Processing Delays | Some destination countries may require additional documents or approvals, potentially delaying fund receipt. |

When remitting, comply with the destination country’s local regulations and accurately provide the recipient’s name, location, and contact details. International transfers typically have higher fees than local ones. Understanding regulations in advance helps ensure smooth cross-border remittances.

You can experience global coverage, fast delivery, and diverse receiving options with MoneyGram’s electronic transfer service. Many transfers are completed in minutes, with multiple security measures protecting funds. The table below summarizes the main advantages:

| Advantage Type | Details |

|---|---|

| Global Coverage | Supports over 200 countries with over 430,000 agent locations |

| Speed | Most transfers arrive in minutes |

| Security | Transaction monitoring and identity verification ensure safety |

Choose the appropriate method based on your needs, and pay attention to fund security and compliance requirements.

FAQ

What receiving methods does MoneyGram’s electronic transfer service support?

You can choose bank accounts, cash pickup, or mobile wallets. Some regions also support home cash delivery. Select based on the recipient’s country and needs.

How can I check remittance progress?

Enter the reference number and recipient’s name on MoneyGram’s website or app. The system displays real-time remittance status, helping you track fund movements.

How long does it take for a remittance to arrive?

In most cases, funds arrive in minutes. Some regions may experience delays due to local regulations or bank processing. You can track progress anytime.

How much are the fees for remittances?

You can see all fee details before confirming the remittance. Fees vary by payment method and amount, typically in USD. Use the fee estimator tool for clarity.

Is using MoneyGram’s electronic transfer service safe?

The system uses encryption and multi-factor authentication. MoneyGram monitors transactions in real-time and adheres to international compliance standards. Your funds and information are fully protected.

MoneyGram’s electronic transfer service spans 200+ countries with 450,000 locations, offering minute-fast cash pickups and diverse receipt options, but fees ($1.99+) and limits ($10,000/transfer) can raise costs, especially in 2025’s $80+ trillion remittance market, where traditional providers’ verification delays hinder efficiency. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.