- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Make Large - amount Remittances via Apple Pay and Understand Apple Pay Limits and Restrictions

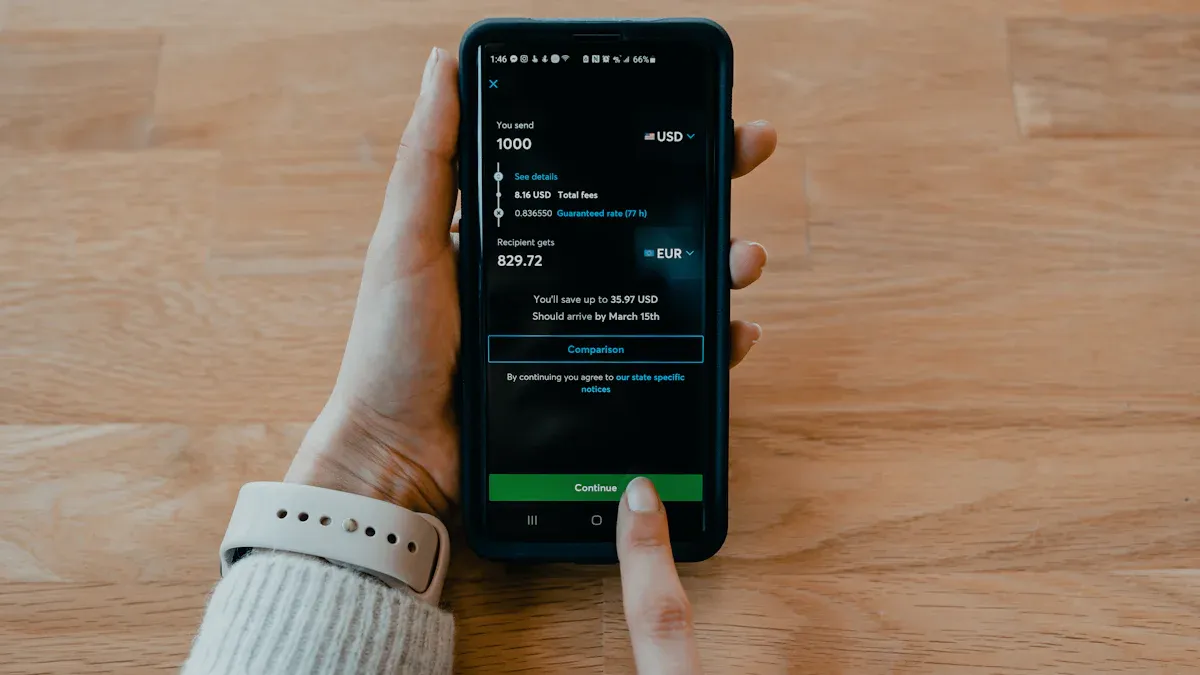

Image Source: unsplash

You can use Apple Pay to complete large transfers, but actual operations are affected by limits set by different countries and banks. For example, in France, Apple Pay contactless transactions typically have a $50 single-transaction cap, and some high-value transactions require a physical card. Specific limits in the United States and China/Mainland China may vary. Apple Pay offers fast transfer speeds, a user-friendly interface, and real-time tracking, making it more convenient than traditional bank transfers. However, Apple Pay requires both you and the recipient to have Apple Pay accounts, and there are daily sending limits. Currently, Apple Pay does not support direct international transfers.

Key Points

- Apple Pay supports various large transfer scenarios, including peer-to-peer transfers and online shopping, but you should note the differences in limits across countries.

- Before making large transfers with Apple Pay, ensure you have added a valid credit or debit card and completed identity verification.

- Apple Pay’s single transaction limit can reach up to 10,000 USD, and daily and monthly transaction limits also need attention.

- If you encounter limit issues, you can opt for split transfers or contact your bank to request a limit increase to meet large transfer needs.

- Verify the recipient’s information and account balance before transferring to avoid transaction failures due to incorrect details.

Apple Pay Large Transfer Support

Image Source: pexels

Supported Scenarios

You can use Apple Pay to complete large transfers in various scenarios. Apple Pay is not only suitable for daily spending but also supports higher-amount fund transfers. Here are common large transfer use cases:

- Peer-to-peer transfers: You can directly transfer funds from your account to a friend or family member’s account via Apple Pay. This method is suitable for large personal transfer needs.

- In-store transactions: In retail stores that support Apple Pay, you can use it to pay for high-value goods or services.

- Online shopping: Many websites support Apple Pay, allowing you to purchase high-value items and complete large transfers online.

- Bank transfers: You can transfer funds to a linked bank account via Apple Pay, enabling large transfers to banks.

- Cash withdrawals: Some ATMs that support Apple Pay allow you to withdraw cash to meet special large fund needs.

Tip: Apple Pay support scenarios may vary slightly by country and region. When using it in China/Mainland China, the United States, or other regions, it’s recommended to consult your bank or Apple’s official support in advance to confirm supported transfer methods and limits.

Eligibility Conditions

When using Apple Pay for large transfers, you must meet certain eligibility conditions. First, you must add a credit or debit card to Apple Pay and complete the relevant verification. The verification process includes entering card details, billing address, contact information, and security code to ensure your transactions are secure and reliable.

You can also increase the total large transfer amount by adding multiple cards. For example, if you have two cards with a daily limit of $500 USD each, you can send a total of $1,000 USD. Each time you add a new card, the system will require you to verify the card information to ensure account security.

Here are the basic steps to add a new card:

- Open the Wallet app.

- Tap the plus sign in the top right corner and select Add New Card.

- Enter card details and complete verification.

- Fill in the billing address and contact information, ensuring accuracy.

- Enter the security code and agree to the terms.

When using Apple Pay in China/Mainland China, some banks may impose stricter review processes for large transfers. You should check your bank’s policies in advance to ensure smooth fund transfers.

Note: Only verified cards can be used for large transfers. During the process, ensure all information is accurate and valid to avoid transaction failures due to incorrect details.

Limit Details

Image Source: pexels

Single Transaction Limit

When using Apple Pay for large transfers, the single transaction limit is a key concern. Apple Pay’s official guidelines and major partner banks typically set a cap for single transactions. You can refer to the following common rules:

- Apple Pay supports single transaction amounts up to 10,000 USD. After identity verification, you can complete large transfers.

- If the transaction amount is below 100 USD, you only need to hold your device near a contactless reader and authorize via Touch ID or device passcode to complete the payment.

- For transactions exceeding 100 USD, some retailers may require you to enter the card’s PIN at the terminal to ensure transaction security.

- You can combine the single transaction limits of multiple cards by adding them to achieve a higher total for large transfers.

Tip: When using Apple Pay in China/Mainland China or Hong Kong, banks may adjust single transaction limits based on their risk control policies. It’s recommended to consult your bank’s customer service before transferring to confirm the current limit standards.

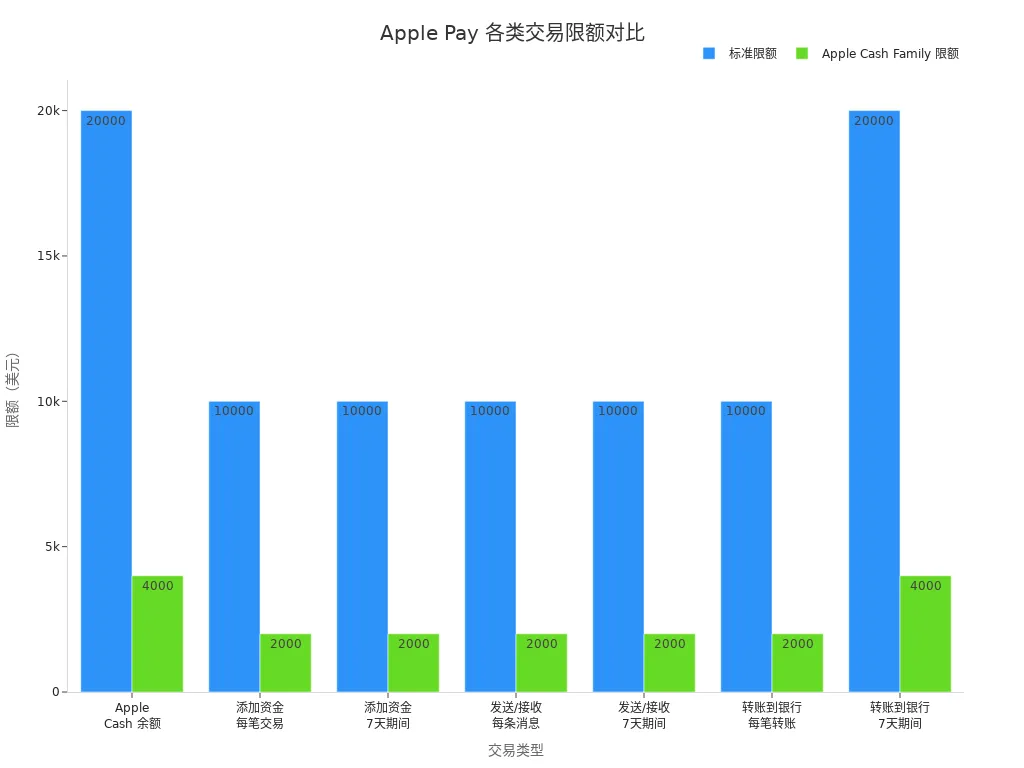

Daily/Monthly Limits

Apple Pay not only sets limits on single transactions but also restricts cumulative transaction amounts daily and monthly. You can refer to the table below for standard limits across different transaction types:

| Transaction Type | Standard Limit (USD) | Apple Cash Family Limit (USD) | Tap to Cash Limit (USD) |

|---|---|---|---|

| Apple Cash Balance | 20,000 (after identity verification) | 4,000 (participants) | |

| Add Funds (per transaction) | 10 - 10,000 | 10 - 2,000 | |

| Add Funds (7-day period) | 10,000 | 2,000 | |

| Send/Receive (per message) | 1 - 10,000 | 1 - 2,000 | 1 - 2,000 |

| Send/Receive (7-day period) | 10,000 | 2,000 | 2,000 |

| Transfer to Bank (per transaction) | 1 - 10,000 | 1 - 2,000 | |

| Transfer to Bank (7-day period) | 20,000 | 4,000 |

You can see that Apple Pay’s standard limits are significantly higher than traditional contactless payment methods. In the U.S. market, after identity verification, the single transaction limit can reach 10,000 USD, with a 7-day cumulative limit of up to 20,000 USD. Apple Cash Family accounts and Tap to Cash functions have lower limits, suitable for family members or small-scale fund management.

Note: When using Apple Pay in China/Mainland China or Hong Kong, banks set daily and monthly limits based on local policies and compliance requirements. Some banks allow you to request a limit increase, and the specific process requires consulting bank customer service.

Bank and Regional Differences

Apple Pay limits vary by bank and region. When using it in different countries or regions, limit standards may differ significantly. Here are a few typical examples:

| Country/Region | Single Transaction Limit (USD) |

|---|---|

| United Kingdom | Approx. 125 |

| Canada | Approx. 75 |

| Saudi Arabia | Approx. 80 |

When using Apple Pay in the UK, the traditional contactless payment limit is about 125 USD, but Apple Pay supports higher payment amounts. In Canada and Saudi Arabia, contactless payment limits are approximately 75 USD and 80 USD, respectively. You can increase transaction limits in some markets using the Consumer Device Cardholder Verification Method (CDCVM) to enable large transfers.

- Licensed banks in Hong Kong typically adjust Apple Pay limits flexibly based on customer identity verification. You can proactively contact the bank to request an increase in credit or debit card limits, which will also raise Apple Pay limits.

- If you encounter limit issues while using Apple Pay, it’s recommended to contact bank customer service directly, explain your large transfer needs, and the bank will provide solutions based on your account status and compliance requirements.

Friendly Reminder: When applying for a limit increase, banks may require additional identity verification documents. Ensure your account information is accurate and valid to avoid application failures due to incomplete documentation.

Large Transfer Process

Preparation

Before making large transfers, you need to prepare thoroughly. First, ensure your Apple Pay account is linked to a valid credit or debit card and has completed identity verification. You should check the card’s single transaction and daily limits in advance to avoid transaction failures due to insufficient limits. It’s recommended to verify your bank account balance to ensure sufficient funds for the transfer. You also need to confirm the recipient’s Apple Pay account information is correct, especially in China/Mainland China, where bank review processes may be stricter.

Tip: You can check the limits and status of linked cards in the Wallet app. If you plan multiple transfers, consider adding multiple cards in advance to increase the total limit.

Operation Steps

You can follow these steps to complete a large Apple Pay transfer:

- Open the Wallet app and select the bank card to use.

- Enter the recipient’s information, ensuring the name and account details are correct.

- Input the transfer amount (in USD) and verify it is within the limit.

- Complete identity verification, such as using Touch ID or Face ID.

- Confirm the transaction and wait for the system to indicate success.

If you need to make split transfers, you can repeat the above steps, using different cards to complete multiple transactions. In China/Mainland China, some banks may require additional verification or SMS confirmation.

| Step | Description |

|---|---|

| Select Bank Card | Confirm card limit and status |

| Enter Information | Recipient’s name and account details |

| Input Amount | In USD, verify within limit |

| Identity Verification | Use Touch ID or Face ID |

| Confirm Transaction | Wait for system confirmation of result |

Notes

During the large transfer process, you may encounter some common issues. Here are potential problems and solutions:

- Insufficient funds

- Network interruption

- Incorrect recipient information

- Payment method needs updating

- Identity verification issues

- Device configuration issues

- Incompatible payment method

- General service issues

If a payment fails, first check if the payment information is correct and confirm sufficient balance in your bank account or card. If the issue persists, contact Apple Support or bank customer service for further assistance. You can also check device settings or try switching payment methods. If the problem remains unresolved, contacting Apple Pay support is a wise choice.

Note: When using Apple Pay for large transfers in China/Mainland China, banks may have special review requirements. It’s recommended to understand the relevant policies in advance to ensure smooth transactions.

Usage Restrictions

Bank Restrictions

When using Apple Pay for large transfers, banks impose various restrictions. Policies may differ across banks and regions. You need to pay attention to daily spending limits, transaction verification methods, and account management features. The table below summarizes common bank restrictions:

| Restriction Type | Description |

|---|---|

| Spending Limits | Account owners can set daily or monthly spending caps for participants of shared Apple Card accounts. |

| Transaction Limits | Some countries and regions set caps on single or cumulative transaction amounts, with some high-value transactions requiring a PIN. |

| Verification Methods | Banks may require you to enter a PIN, sign a receipt, or use other methods to complete identity verification. |

| Notification Features | Account owners can receive notifications of Apple Card activities by participants for better fund management. |

| Contact Information | It’s recommended to contact the issuing bank or merchant for details when encountering limit issues. |

When using Apple Pay with licensed banks in Hong Kong, banks adjust limits flexibly based on your identity verification status. Similar practices apply in the U.S. market. You can proactively request an increase in credit or debit card limits to raise Apple Pay transfer limits.

Scenario Restrictions

Apple Pay is suitable for various consumption scenarios, but not all situations support large transfers. You can use Apple Pay to make payments at supermarkets, restaurants, retail stores, and some online shopping platforms. Certain ATMs also support Apple Pay withdrawals. In the U.S. and Hong Kong markets, some high-value transactions may require additional identity verification. Banks also restrict transaction frequency to prevent abnormal fund flows. For example, multiple consecutive large transfers may trigger risk control reviews.

Tip: When using Apple Pay in China/Mainland China, some banks may manually review large transactions. Understand bank policies in advance to avoid transaction restrictions.

Security Requirements

When making large transfers, you must meet strict security and compliance requirements. Apple Pay ensures fund security through multiple identity verifications and compliance processes:

- You need to complete identity verification to ensure the security of each large transaction.

- Apple requires you to provide personal information for verification before sending or receiving large funds via Apple Cash or linked bank accounts.

- The identity verification process helps prevent fraud and ensures transactions comply with financial regulations, particularly anti-money laundering (AML) laws.

During operations, ensure device security and keep your system and Wallet app updated. Banks and Apple continuously monitor abnormal transactions to protect your account funds.

Limit Solutions

Split Transfers

If you find that Apple Pay’s single or daily limits cannot meet your large transfer needs, you can opt for split transfers. You can divide the total amount into multiple smaller transfers, each within Apple Pay’s allowed limit. For example, if you need to transfer 15,000 USD but the single transaction limit is 10,000 USD, you can first transfer 10,000 USD and then use the same or another verified card to transfer the remaining 5,000 USD. You can also use multiple bank cards to complete multiple transfers. This allows you to complete fund transfers without violating limit regulations.

Tip: When making split transfers, plan the amounts and timing in advance to avoid triggering bank risk control reviews due to frequent operations.

Increase Limits

You can proactively contact your issuing bank to request an increase in Apple Pay transfer limits. Banks typically evaluate based on your account history, credit status, and identity verification. If you have stable income and a good credit record, banks are more likely to approve your limit increase request. You need to prepare relevant identification documents and comply with the bank’s additional verification process. Some banks may also temporarily adjust single or daily limits based on your actual needs to facilitate large transfers.

Note: The approval time and requirements for limit increases vary by bank. Contact your bank in advance to understand the specific process and required documents.

Alternative Methods

When Apple Pay limits cannot meet your large transfer needs, you can consider other payment methods. Several options are available in the U.S. market:

- You can use dedicated remittance services, which typically offer better exchange rates and transparent fee structures.

- These services specialize in international transfers, enabling fast and secure fund transfers out of the U.S.

- Compared to traditional banks, remittance platforms usually complete fund transfers faster, suitable for urgent or high-frequency large transfer needs.

You can refer to the table below to understand fees and processing times for different payment methods:

| Payment Method | Fee Structure | Processing Time |

|---|---|---|

| Bank Transfer | Small international payments may have high fees and slow processing | Processing time depends on the transfer corridor, possibly slow |

| Domestic Bank Payment | Low or free fees in many markets | Real-time payment systems can process instantly |

| Digital Wallet (e.g., Apple Pay) | Usually card-based, may face similar issues | Processing time is generally fast |

When choosing a payment method, weigh your needs, fees, and transfer speed. For cross-border large transfers, dedicated remittance platforms often have advantages.

You can use Apple Pay for large transfers, but transaction restrictions affect feasibility. You need to transfer funds to Apple Cash first, which complicates the process. Apple Cash is suitable for domestic transactions in China/Mainland China and the U.S., but cross-border payments are not supported. You can make split transfers or request a limit increase. Leverage Apple Pay’s security features, such as fingerprint and tokenization technology, to protect fund security. Stay updated on bank and regional policy changes and choose the most suitable transfer method.

FAQ

Can Apple Pay be used for direct international transfers?

You cannot use Apple Pay for direct international transfers. You can only make local transfers in supported regions like China/Mainland China or the U.S. For international transfers, choose other payment methods.

How can I increase Apple Pay’s transfer limit?

You can contact your issuing bank to request a limit increase. The bank will evaluate based on your account status and identity verification documents. Prepare identification and relevant documents.

What should I do if an Apple Pay transfer fails?

First, check your bank card balance and recipient information. If the issue persists, contact bank customer service or Apple Pay support for assistance.

Can multiple bank cards combine transfer limits?

You can add multiple bank cards to Apple Pay. Each card’s limit can be used separately. You can make split transfers to increase the total limit.

What security measures are in place for using Apple Pay in China/Mainland China?

You need to complete identity verification. Apple Pay uses fingerprint, facial recognition, and tokenization technology to protect your funds. Banks monitor abnormal transactions to ensure account security.

MoneyGram spans 200+ countries with 400,000+ locations, offering transfers in minutes, but fees ($1.99+, up to $20.49 for credit cards) and exchange markups (e.g., USD/CNY 6.95 vs. market 6.99) inflate costs, especially in 2025’s $80+ trillion remittance market, where agent hours and verification delays cause hassles. For a cheaper, more convenient alternative, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay outperforms MoneyGram, maximizing recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no agent visits or lengthy checks needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current USD rates , optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.