- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

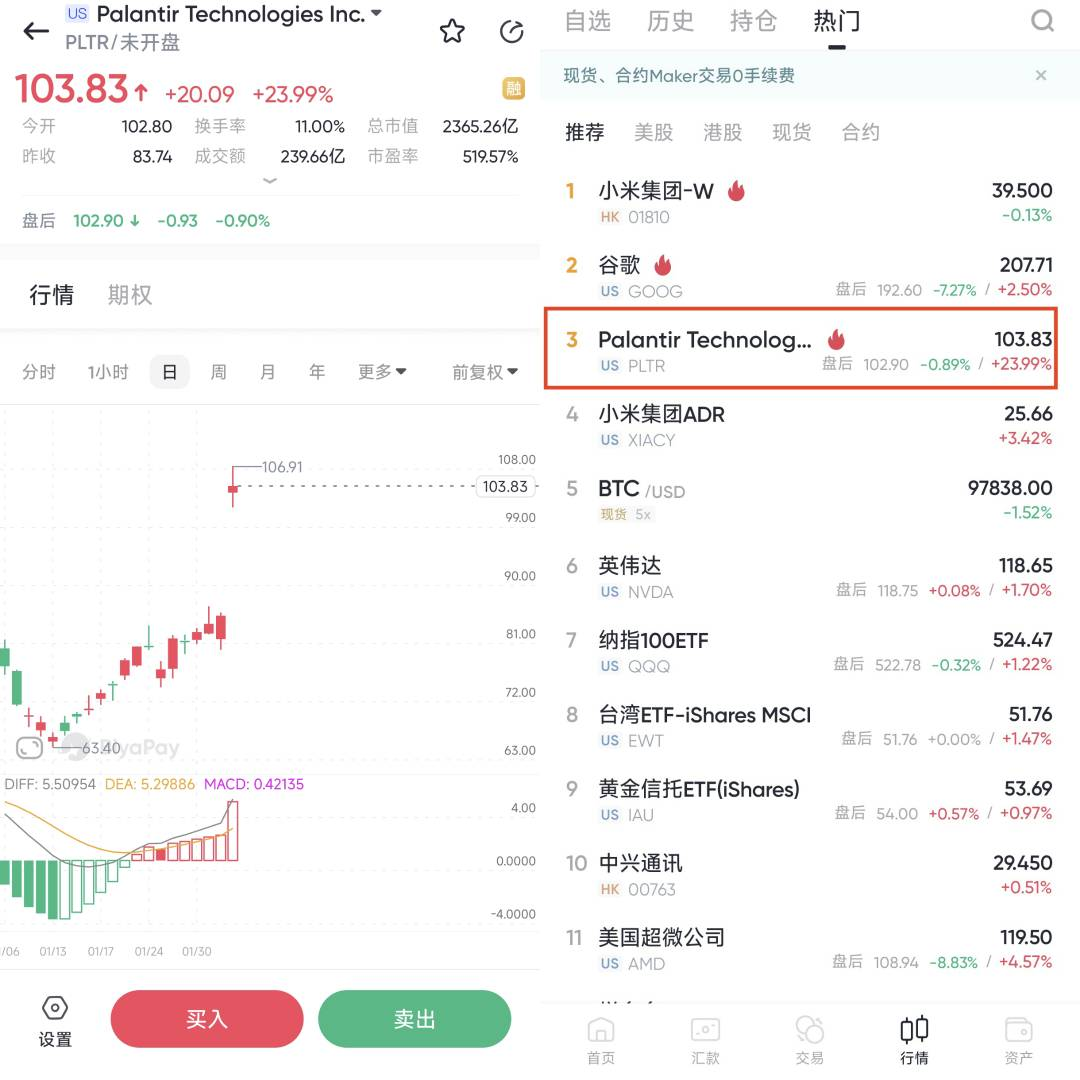

Palantir's performance and stock price hit new highs, DeepSeek sparks a new wave of AI, and software giants are fully exploding?

Palantir released its Q4 2024 results after the close of trading on February 3rd Eastern Time. Its stock price rose sharply in after-hours trading on the US stock market, with an increase of over 24%, setting a new historical high.

The reason for this stock price increase is that the latest performance data and full-year sales forecast released by the software giant exceeded the expectations of Wall Street analysts. According to CEO Alex Karp, this is due to the “wild endogenous growth trend” in demand for artificial intelligence software.

The more crucial factor for the stock price prospects of the world’s top software companies is that Wall Street analysts and strategists from top asset management institutions generally expect that with the rapid spread of the “new paradigm of low-cost computing power” led by DeepSeek worldwide, the cost of AI training and application inference will continue to decrease.

At the same time, this will comprehensively promote the accelerated penetration of AI applications into various industries worldwide. Software giants such as Palantir , Salesforce, and ServiceNow may experience exponential growth in their AI revenue data and overall profits. Under the influence of the global popularity of DeepSeek and the “DeepSeek low computing cost shock wave”, they are likely to become the biggest winners.

What is Palantir’s background?

Palantir is a US Big Data software company co-founded by billionaire Peter Thiel in 2003, headquartered in Denver. The company is known for its deep cooperation with the US government and military, especially in the key role of intelligence analysis and military artificial intelligence. Palantir’s technology is widely used by several important branches of the US military and provides data support in difficult missions such as hunting down bin Laden, making the company famous.

In recent years, Palantir has not only continued to provide core services to the US government, but also established long-term cooperative relationships with many well-known global enterprises, such as General Mills and Panasonic. In 2023, Palantir launched its artificial intelligence platform (AIP), which not only helps enterprises analyze big data through generative AI, but also simplifies the data call process, enabling customers to efficiently use its core functions with low technical barriers.

The AIP platform has a wide range of applications, including logistics optimization, predictive maintenance, threat detection, etc., and has been adopted by more than 100 organizations worldwide. The company is also in talks with more than 300 additional companies.

It is understood that Palantir’s artificial intelligence Data Analysis software ecosystem has now been fully applied to all US military departments and is used by US allies such as Ukraine and Israel. Palantir recently expanded its contract with the US Army to 2028, with a total amount of up to $619 million, and expanded its AI cooperation with the US Special Operations Command.

Due to its unique position and rapid growth in the AI field, Palantir’s stock price rose sharply in 2024 and became one of the important AI software companies in the market. At the same time, Palantir is also expanding its cooperation with other technology companies, such as AI startup Anthropic, to introduce its large language model into US intelligence and defense operations, further consolidating its leadership position in defense-related science and technology.

Palantir’s fourth quarter financial report

Revenue growth remains strong and not ideal compared to past growth. But growth continues. Total revenue increased 36% year-over-year to $828 million, $46 million higher than expected.

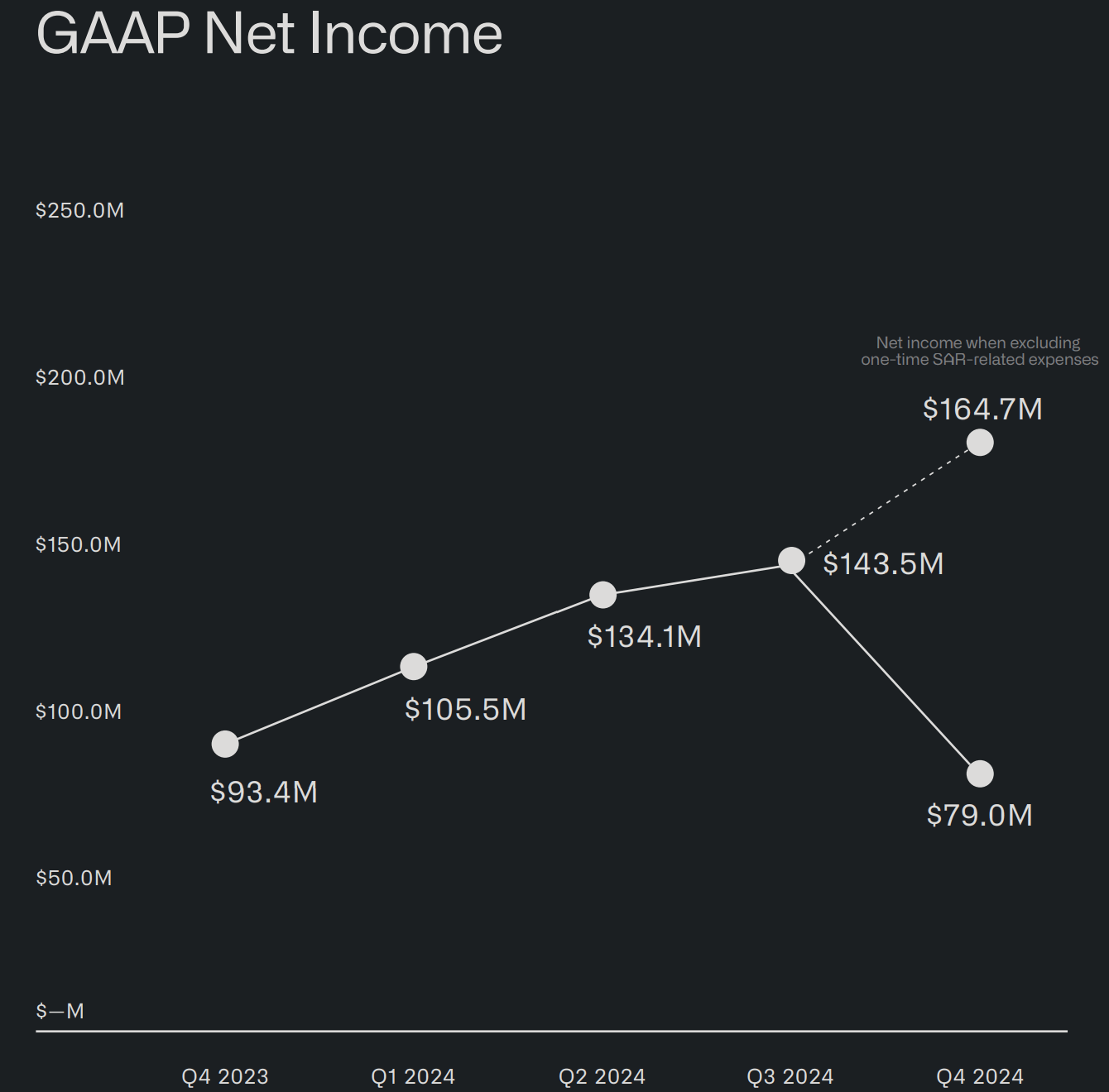

Compared to valuation, Palantir’s earnings per share are still unsatisfactory, but this is not new as investors are playing Persistent Challenge. The adjusted earnings per share are $0.14. Although expensive, Palantir can develop to this valuation. Moreover, the growth is indeed impressive, and the earnings trend is the same.

Strong guidance, countering doubts.

Everyone now knows that Palantir’s valuation is already quite high. What if you want it to not rise in the short term? It’s simple, as long as the expected growth slows down significantly or does not meet everyone’s expectations. So why is the growth expectation given by PLTR management so important? There are mainly two reasons:

On the one hand, the market is not very familiar with the AIP business that is still in its early stages of development.

On the other hand, their services are highly customized, making it difficult to accurately estimate how much money they can earn.

That is to say, there are not many competitors in the market now. How much Palantir can grow in the short term mainly depends on how many new customers it can attract, which requires expanding the team, such as adding personnel responsible for sales and developing customized plans. This leads to a gap between the market’s original expectations and the actual situation, and everyone is accustomed to making judgments based on the expectations given by the management.

Before the financial report was released, those who were bullish on Palantir had a clear idea, no need to say more. The bears were mainly worried about whether Palantir could maintain high growth in 2025 and whether profits could increase as expected. The main bearish point was that they were worried that the US government’s spending on defense had reached its peak, and Palantir still had to face competition from OpenAI, enterprise SaaS platforms that use AI technology, and now DeepSeek.

Although these pessimistic people also admit that Palantir can still have good growth in the short term, compared to the current stock price, they think it may be reasonable to fall further.

The management’s expectations for Quarter 1 and the whole year of 2025 in the current quarterly report directly refute these doubts.

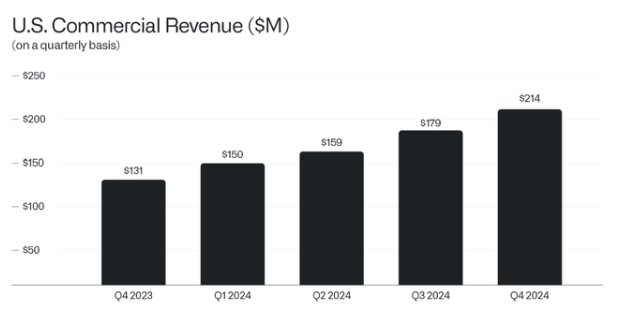

- Strong growth momentum: Quarter 1 is expected to grow by 36%, slightly higher than market expectations. Full-year revenue is expected to be between 3.74 billion and 3.76 billion, with an average growth of 30%. The revenue growth of the US commercial sector can reach at least 54%!

- Profit continues to improve: It is expected that the adjusted profit margin for Quarter 1 will reach 41%, which is almost 4 percentage points higher than the market expectation. The annual profit margin will average 42%, an increase of 3 percentage points from 2024.

Outstanding quarterly performance:

In addition to the great expectations given, Palantir’s actual performance in the fourth quarter of last year was also quite good. In the US, the main source of revenue, whether it is government business revenue or commercial business revenue, the growth rate has accelerated, mainly due to the strong market demand for Foundry and AIP products.

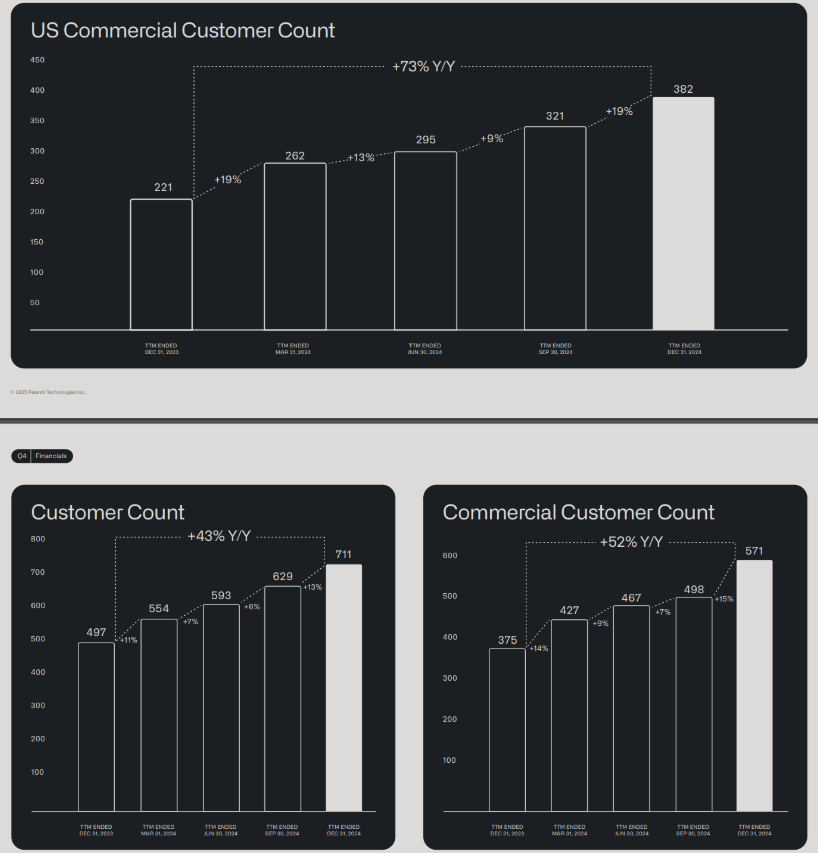

In the international market, the situation has improved mainly for government customers. The defense departments of countries such as the United Kingdom and Australia have signed new contracts with Palantir. The total number of customers has reached 711, an increase of 43%. At the same time, the number of commercial customers has increased by 52% compared to last year, reaching 571. This means that there are 140 customers in addition to commercial customers, so this is a number worth paying attention to. Government revenue has increased, but we should also pay attention to the quantity.

From the number of customers, it can also be seen that the number of Palantir customers increased significantly in the fourth quarter of last year, much better than the first three quarters. Among them, the number of new enterprise customers doubled, and the revenue expansion rate (NDR) of old customers further increased to 120%.

DeepSeek triggers “low computing cost storm”, software giants may become big winners

The DeepSeek R1 large model developed by the DeepSeek team topped the US hot search chart. Its application topped the free app download chart in the Apple App Store in China and the United States, surpassing ChatGPT and becoming a “milestone moment” for AI.

The DeepSeek team trained an open-source AI model with top-notch inference ability at a cost of less than 6 million dollars, using 2048 chips with performance lower than H100 and Blackwell’s H800 chips, with performance comparable to OpenAI o1. Compared with the training cost of Anthropic and OpenAI, which can easily reach 1 billion dollars, DeepSeek’s inference input and output tokens are priced extremely low.

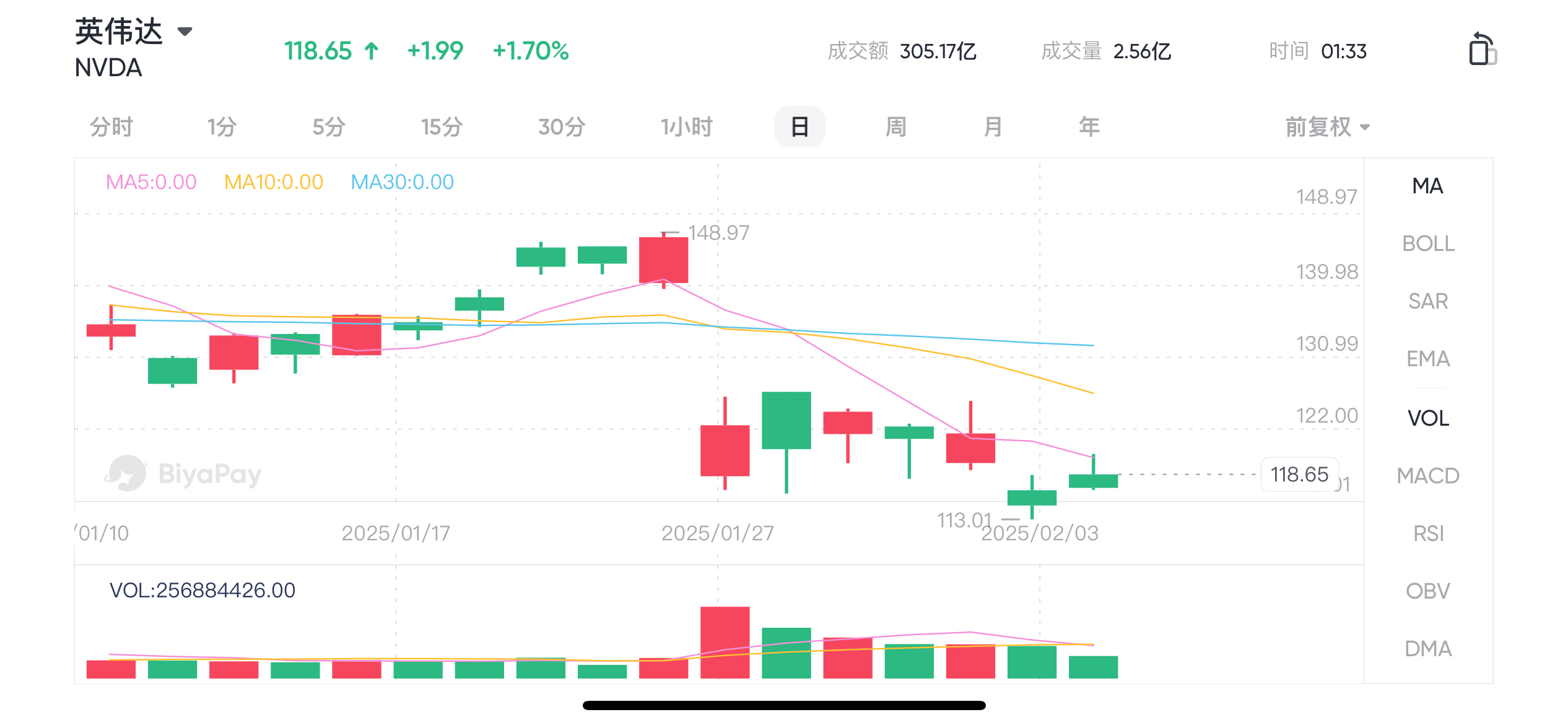

This “low computing cost storm” has made investors question the US tech giant’s AI money-burning plan. Last Monday, due to concerns about the “low-cost AI large model computing power paradigm” causing the tech giant to cut AI GPU orders, the stock price of “AI chip overlord” NVIDIA fell nearly 17%, and its market value evaporated by $589 billion in a single day, creating the largest single-day market value loss in the history of the US stock market.

However, DeepSeek software has been tested by global developers and is expected to accelerate the commercial application of advanced AI reasoning large models. Its “low computing power cost paradigm” is believed to promote the landing of generative AI and AI agent software.

Palantir’s future outlook

It is worth noting that the timing of Palantir’s financial report release is quite delicate. At this time, the market is still digesting the AI field shock caused by DeepSeek. Karp, the head of Palantir, responded, saying, “We must admit that technology itself is not necessarily good. But this requires us to accelerate the pace of development, mobilize all forces, and devote ourselves wholeheartedly to it.”

The outbreak of DeepSeek has great benefits for Palantir.

On the one hand, the “new paradigm of low-cost computing power” it brings accelerates the penetration of AI applications, and the market demand for AI application software has increased significantly. Palantir focuses on “AI + Data Analysis”, and business opportunities are expected to increase.

On the other hand, DeepSeek promotes the development of the AI industry, creates a good industrial atmosphere, and more companies are willing to cooperate with Palantir to enhance their competitiveness. At the same time, industry development brings more cooperation opportunities, and Palantir can complement the advantages of related companies to achieve technological innovation. In addition, Palantir’s business involves computing resources, and low computing costs may reduce its procurement costs and increase profit margins.

Therefore, interested friends can use the multi-asset wallet BiyaPay to buy and enter the market. The wallet provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

With DeepSeek’s significant reduction in AI training and inference costs, AI agents and generative AI software are expected to accelerate their penetration into various industries. This is also the reason why Wall Street is still optimistic about software stocks during the Nasdaq 100 index crash.

AI agents may become a major trend in AI applications before 2030, turning AI from an information-assisted tool into a productivity tool. It is predicted that the market size of artificial intelligence agents will surge from $5.10 billion to $47.10 billion from 2024 to 2030, with a compound annual growth rate of 44.8%.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.